Professional Documents

Culture Documents

Payments From India - 07.03.19

Uploaded by

Ashirwad BehuraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payments From India - 07.03.19

Uploaded by

Ashirwad BehuraCopyright:

Available Formats

India

Indian Rupee (INR)

India is Flywire’s second largest market.

How does Flywire support Indian payers?

Flywire offers payors from India the opportunity to pay with local currency (INR) via the following payment

methods:

• Domestic Bank Transfer in Indian Rupees (INR)

• Domestic Bank Transfer of Less Than INR Equivalent of $5,000 USD

• Credit/Debit Card: VISA, Master Card

Common questions from Indian payers:

“My bank says I cannot pay through Flywire.”

Banks encourage students to pay directly through them in order to add high international exchange fees.

Banks want to see documentation (i.e., authorization letter) of the partnership between Flywire and the

institution. Remind your students to bring Flywire’s authorization letter with them they go to the bank to pay.

“I have a loan from a bank or financial institution in India. Can I use Flywire?”

Yes, loan holders can use Flywire to make tuition payments. After making your payment request, you will be

provided with an “Authorization Letter” along with the bank instructions from your Flywire student account

dashboard. The authorization letter will demonstrate that Flywire is acting as the only and official authorized

international payment processor and the end recipient of your payment is your educational institution.

Students receiving loans should provide the “Authorization Letter” to their banking institution and insist they

send the payment to our Flywire account in India without delay. If the loan company has any questions they can

contact support@flywire.com.

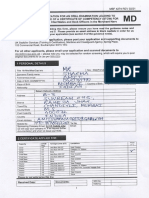

“How do I fill out a LRS Declaration (Liberalised Remittance Scheme) form?”

When booking a Domestic Bank Transfer in Indian Rupees (INR) on Flywire, Indian students will be provided

with a pre-filled form called an LRS Declaration once they initiate their payment. This form will include the

Sources of Income requirement of the Reserve Bank of India. Students can submit their LRS form to our collection

partner(s). Flywire will provide instructions on next steps in the payment experience.

“How do I send Flywire my funds from India?”

If you select the “Domestic Bank Transfer in India Rupees” option when booking your payment, you’ll be

provided with a pre-filled LRS Declaration form and you’ll be given access to our bank instructions.

Under the Liberalised Remittance Scheme (LRS), The Reserve Bank of India (RBI) now requires an LRS

Declaration form (fully titled “A2 cum LRS Declaration”) to transfer funds abroad. As a result, the A2 form has

been updated to fulfil this requirement.

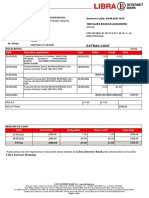

The bank instructions contain all of the details you’ll need to complete your payment. After creating an account,

you can retrieve the bank instructions at anytime through your Flywire dashboard or by contacting our customer

support.

You can send your payment through either National Electronic Fund Transfer (NEFT) or Real Time Gross

Settlement (RTGS). Once your payment is complete, you must also submit your LRS Declaration form to our

local partner in India via email—please note, this step is mandatory.

Instructions on how to submit your declaration form will be provided with the payment request. The sender of

the payment is required to fill out and send the form along with your payment and valid proof of national ID. Not

submitting the form could result in delays or cancellation of your payment. For detailed payment instructions,

please review this document.

NOTE: If your payment is a domestic bank transfer equalling the INR equivalent of $5,000 USD or less, you may select the “Domestic Bank

Transfer of Less Than INR Equivalent of $5,000 USD” option during the booking process. In this case, you do not have to fill out an LRS Declaration

form because this information is collected as part of the booking process. You do not need to submit a valid proof of national ID either, as your

Permanent Account Number (PAN) will be validated in real-time during the booking process.

“My bank is asking my for school’s account and routing number and a SWIFT code. What should I do?”

Flywire will provide the necessary bank details when booking a payment through the Flywire payment portal.

Download the payment Authorization Letter that is included with the payment instructions and provide this

letter to your bank.

What if a student doesn’t have a PAN?

The PAN is a 10-digit alphanumeric Permanent Account Number issued in India. Some students may have a PAN,

some may not. Students can use their parent’s number if they do not have their own PAN.

What if a student has a loan and the loan is in their name?

The student, as the payer, would use his/her own PAN. If they do not have a PAN, students can use their parents.

You might also like

- M2N12816457Document1 pageM2N12816457janacadNo ratings yet

- InternshipDocument28 pagesInternshipSowmiya SriniNo ratings yet

- Bank Challan For Us VisaDocument1 pageBank Challan For Us VisaKeshav ShahiNo ratings yet

- Unit 3 TybbaDocument11 pagesUnit 3 TybbaChaitanya FulariNo ratings yet

- Opening & Operating Deposit AccountsDocument11 pagesOpening & Operating Deposit AccountsBhagyesh ThakurNo ratings yet

- SABB Visa Direct FAQ money transfer service guideDocument3 pagesSABB Visa Direct FAQ money transfer service guideJavedNo ratings yet

- Online Inter Bank Fund Transfer Through NEFT: FAQ OnDocument3 pagesOnline Inter Bank Fund Transfer Through NEFT: FAQ Onarti guptaNo ratings yet

- Western Union PDFDocument40 pagesWestern Union PDFRobin Hoodxii100% (1)

- Bank Declaration Form PDFDocument18 pagesBank Declaration Form PDFJhalak BhartiNo ratings yet

- SIB Hello BookletDocument35 pagesSIB Hello BookletYogeshwaran .SNo ratings yet

- HDFC Bank Services GuideDocument9 pagesHDFC Bank Services GuideRajesh Maharajan50% (2)

- Fixed Deposit: Benefits of FDDocument9 pagesFixed Deposit: Benefits of FDPratik .BNo ratings yet

- What Is A Demand Draft?Document6 pagesWhat Is A Demand Draft?Mady StudioNo ratings yet

- This Is A Summarised and Simplified Version of The Reserve Bank of IndiaDocument338 pagesThis Is A Summarised and Simplified Version of The Reserve Bank of IndiaRohan VermaNo ratings yet

- Internship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchDocument4 pagesInternship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchUsman DudezNo ratings yet

- Internship ReportDocument14 pagesInternship ReportVanitha100% (1)

- PsbOnline R IDocument2 pagesPsbOnline R Igoyalpuneet007No ratings yet

- NBP Internship ReportDocument29 pagesNBP Internship ReportKashif SheikhNo ratings yet

- IPPB Final Terms Condition Digital Savings Account PDFDocument32 pagesIPPB Final Terms Condition Digital Savings Account PDFluvavi2No ratings yet

- A 2 B T & P T B S P B S B O I: Ssingment-Anking Heory Ractices Opic: Anking Ervices Rovided Y Tate ANK F NdiaDocument20 pagesA 2 B T & P T B S P B S B O I: Ssingment-Anking Heory Ractices Opic: Anking Ervices Rovided Y Tate ANK F NdiaarunanayarNo ratings yet

- Frequently Asked Questions: Banking Currency Foreign Exchange Government Securities Market Nbfcs Others Payment SystemsDocument2 pagesFrequently Asked Questions: Banking Currency Foreign Exchange Government Securities Market Nbfcs Others Payment SystemsNasim MunshiNo ratings yet

- HDFC Bank's Instant Account FAQ - Open a Bank Account Online in MinutesDocument4 pagesHDFC Bank's Instant Account FAQ - Open a Bank Account Online in Minutessom ghoshNo ratings yet

- Internet Banking FeaturesDocument7 pagesInternet Banking FeaturesDhrumi PatelNo ratings yet

- EFT Visa Payment India Bank AccountDocument2 pagesEFT Visa Payment India Bank AccountNazgulNo ratings yet

- Know Your Rupay Debit CardDocument9 pagesKnow Your Rupay Debit Cardwps gccNo ratings yet

- Report On Digital Banking NewDocument79 pagesReport On Digital Banking NewmanasutharNo ratings yet

- Commerce Topic 2Document16 pagesCommerce Topic 2Anonymous lVpFnX3No ratings yet

- Remittance Business: Money Transfer ServicesDocument2 pagesRemittance Business: Money Transfer ServicesPankaj NagarNo ratings yet

- PAYMETDocument1 pagePAYMETKilan KhnNo ratings yet

- Module 10 (Abhishek)Document12 pagesModule 10 (Abhishek)abhishek gautamNo ratings yet

- The Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountDocument6 pagesThe Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountEr Mosin ShaikhNo ratings yet

- Client Account MaintenanceDocument18 pagesClient Account MaintenanceNirajanNo ratings yet

- HSBCDocument18 pagesHSBCDarshan SejpalNo ratings yet

- FM 202 Finals3Document34 pagesFM 202 Finals3sudariodaisyre19No ratings yet

- Nri Savings Account Downgrade FormDocument2 pagesNri Savings Account Downgrade Formjksankar0% (1)

- RemittanceDocument2 pagesRemittanceAbhijit PhoenixNo ratings yet

- Mfa CH-3Document22 pagesMfa CH-320BBA29 DUBEY ADITYA ManasNo ratings yet

- Terms and Conditions For Customers 05042018Document10 pagesTerms and Conditions For Customers 05042018Naveen PrakashNo ratings yet

- Bank Account Basics: Types, Opening Process & Customer ServiceDocument30 pagesBank Account Basics: Types, Opening Process & Customer ServiceShaifaliChauhanNo ratings yet

- Major Changes Are Highlighted in RedDocument8 pagesMajor Changes Are Highlighted in RedR. B LaskarNo ratings yet

- IPPB Terms & ConditionsDocument37 pagesIPPB Terms & Conditionstrained thinkerNo ratings yet

- Sound Mind Leads To Safe BankingDocument16 pagesSound Mind Leads To Safe BankingsanketbshethNo ratings yet

- FAQ Member July2015 PDFDocument6 pagesFAQ Member July2015 PDFhiren_mistry55No ratings yet

- CHAPTER- 5 (OTHERS SERVICES OF BANK)Document8 pagesCHAPTER- 5 (OTHERS SERVICES OF BANK)kritik deswalNo ratings yet

- Where Can I Load My Cash App CardDocument52 pagesWhere Can I Load My Cash App CardHospitalityplusNo ratings yet

- What Are Prepaid Payment Instruments?Document5 pagesWhat Are Prepaid Payment Instruments?959 Prachi MiglaniNo ratings yet

- Commerce 1 GRD 12 ProjectDocument12 pagesCommerce 1 GRD 12 ProjectNeriaNo ratings yet

- Apply For A U.SDocument1 pageApply For A U.Sb_csrNo ratings yet

- FAQs FampayDocument4 pagesFAQs FampayManisha HinguNo ratings yet

- Electronic Fund Transfer HelpDocument11 pagesElectronic Fund Transfer Helpశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Axis Visa PrintDocument1 pageAxis Visa PrintCharan Kilari0% (1)

- Guide How To Add A Joint Holder To A NRE NRO AccountDocument2 pagesGuide How To Add A Joint Holder To A NRE NRO AccountHumaid ShaikhNo ratings yet

- Students Fee Payment System & Operations: Step by Step GuideDocument20 pagesStudents Fee Payment System & Operations: Step by Step GuidenitinNo ratings yet

- National Electronic Funds Transfer (NEFT)Document4 pagesNational Electronic Funds Transfer (NEFT)Arun NarayanaSamyNo ratings yet

- Student eVisa Requirements for IndiaDocument5 pagesStudent eVisa Requirements for IndiaMitesh ZalaNo ratings yet

- Consumers Preference Towards Plastic MoneDocument22 pagesConsumers Preference Towards Plastic Monecharujagwani50% (2)

- MICR: Magnetic Ink Char Acter Recognition: WebsiteDocument3 pagesMICR: Magnetic Ink Char Acter Recognition: Websitemaurya_reddyNo ratings yet

- Freelancers FAQsDocument2 pagesFreelancers FAQsPe WoxNo ratings yet

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Diphe Nautical ScienceDocument5 pagesDiphe Nautical ScienceAshirwad BehuraNo ratings yet

- Chief Vigilance Officers of Odisha Government DepartmentsDocument11 pagesChief Vigilance Officers of Odisha Government DepartmentsAshirwad BehuraNo ratings yet

- SQA Engine Application Exam Form - AUG 2019Document3 pagesSQA Engine Application Exam Form - AUG 2019Ashirwad BehuraNo ratings yet

- NoE SampleDocument5 pagesNoE SampleAshirwad BehuraNo ratings yet

- Loss Prevention Bulletin Vol.40 FullDocument88 pagesLoss Prevention Bulletin Vol.40 FullAshirwad BehuraNo ratings yet

- 21000 CBM Ethylene Carriers Form C Gas DetailsDocument16 pages21000 CBM Ethylene Carriers Form C Gas DetailsAshirwad BehuraNo ratings yet

- Tier 4 (General) Student Visa Application Guide: Last Updated: October 2014Document15 pagesTier 4 (General) Student Visa Application Guide: Last Updated: October 2014Ashirwad BehuraNo ratings yet

- UK Deck Officer Exam Timetable 2020-2021Document1 pageUK Deck Officer Exam Timetable 2020-2021Ashirwad BehuraNo ratings yet

- Mca Formula SheetDocument4 pagesMca Formula SheetBharatiyulamNo ratings yet

- COVID-19 Contingency Plan and GuidelinesDocument6 pagesCOVID-19 Contingency Plan and GuidelinesAshirwad BehuraNo ratings yet

- ML131220Document1 pageML131220Ashirwad BehuraNo ratings yet

- GT Writing Sample Scripts PDFDocument7 pagesGT Writing Sample Scripts PDFAshirwad BehuraNo ratings yet

- 2-Trim Stability BookletDocument16 pages2-Trim Stability BookletAshirwad BehuraNo ratings yet

- Oow Orals For UkDocument4 pagesOow Orals For UkAshirwad BehuraNo ratings yet

- MGN 69 (M) : Training and Certification Guidance - Part 11 Conduct of MCA Oral ExaminationsDocument24 pagesMGN 69 (M) : Training and Certification Guidance - Part 11 Conduct of MCA Oral Examinationsravi vermaNo ratings yet

- Instagram Account Password CrackerDocument5 pagesInstagram Account Password CrackerZeljko TomicNo ratings yet

- Print Student Visa - GOV - UKDocument19 pagesPrint Student Visa - GOV - UKAshirwad BehuraNo ratings yet

- CEC Accepted Countries 2020 All TaggedDocument1 pageCEC Accepted Countries 2020 All TaggedAshirwad BehuraNo ratings yet

- Boarding Pass Web Check-inDocument1 pageBoarding Pass Web Check-inAshirwad BehuraNo ratings yet

- Domestic Travel Guidelines PDFDocument1 pageDomestic Travel Guidelines PDFBalakumar GunaNo ratings yet

- 21funmathgames PDFDocument42 pages21funmathgames PDFAyush PatelNo ratings yet

- 02.04 Chapter 4Document53 pages02.04 Chapter 4NziouNo ratings yet

- Mumbai RPSL license details by numberDocument72 pagesMumbai RPSL license details by numberAshirwad BehuraNo ratings yet

- Naval Architectural Hydrostatic ValuesDocument53 pagesNaval Architectural Hydrostatic ValuesAshirwad BehuraNo ratings yet

- Mca Formula SheetDocument4 pagesMca Formula SheetBharatiyulamNo ratings yet

- Jacob Monkey PDFDocument14 pagesJacob Monkey PDFAshirwad BehuraNo ratings yet

- State Wise PolicyDocument107 pagesState Wise PolicyAshirwad BehuraNo ratings yet

- Safe working practices on board vesselsDocument43 pagesSafe working practices on board vesselsAshirwad BehuraNo ratings yet

- Sample PagesDocument10 pagesSample PagesjetamNo ratings yet

- Dispute Form - SERVICE and ERROR RELATED - Jofre Recososa For Ref 1-13404588837 or Ref 1-1340458840Document1 pageDispute Form - SERVICE and ERROR RELATED - Jofre Recososa For Ref 1-13404588837 or Ref 1-1340458840Ariel BajelotNo ratings yet

- Account StatementDocument6 pagesAccount StatementHussainNo ratings yet

- SLSP - Sadzobnik Obyvatelstvo 072011Document45 pagesSLSP - Sadzobnik Obyvatelstvo 072011Pixo Van UhričíkNo ratings yet

- E StatmentDocument2 pagesE StatmentShekhar BathawNo ratings yet

- PDFDocument3 pagesPDFkuldeep khannaNo ratings yet

- Statement VEP47885358Document1 pageStatement VEP47885358Eliza-Alexandra AntonNo ratings yet

- ECS Form PDFDocument1 pageECS Form PDFbharatstar100% (1)

- Dutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshDocument3 pagesDutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshNur NobiNo ratings yet

- Mr. POTLACHERU NAVEEN KUMAR account statement from Jan 2020 to Oct 2020Document8 pagesMr. POTLACHERU NAVEEN KUMAR account statement from Jan 2020 to Oct 2020P NAVEEN KUMARNo ratings yet

- A Study of Significant Characteristics of E-Payment Regime in IndiaDocument6 pagesA Study of Significant Characteristics of E-Payment Regime in IndiavandanadilipkamathNo ratings yet

- Transaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRDocument20 pagesTransaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRMOHAMMAD IQLASHNo ratings yet

- Cyber ch.4/1/2Document5 pagesCyber ch.4/1/2Suvarna LondheNo ratings yet

- Smart Money Technqiue PDF by DayTradingRauf UPDATEDDocument6 pagesSmart Money Technqiue PDF by DayTradingRauf UPDATEDMiguel16985No ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

- How Cryptocurrency Is Laundered Case Study of Coincheck Hacking IncidentDocument7 pagesHow Cryptocurrency Is Laundered Case Study of Coincheck Hacking Incidentarief webinarNo ratings yet

- Momo Statement ReportDocument2 pagesMomo Statement ReportHolybabyNo ratings yet

- Electronic Bill PaymentDocument2 pagesElectronic Bill PaymentHeikkiNo ratings yet

- Debit Mandate FormDocument1 pageDebit Mandate FormVermaNo ratings yet

- Laporan Donasi Dakwah SurauTV 2019-2020 PDFDocument153 pagesLaporan Donasi Dakwah SurauTV 2019-2020 PDFZeniana RahayuNo ratings yet

- Frequently Asked Questions: Getgo Prepaid CardsDocument1 pageFrequently Asked Questions: Getgo Prepaid Cardsgray casinilloNo ratings yet

- Excel FileDocument3 pagesExcel FilePawan YadavNo ratings yet

- Chase Bank Statement SummaryDocument2 pagesChase Bank Statement SummaryAn Šp0% (1)

- Your Financial Activities As of May 27, 2021Document3 pagesYour Financial Activities As of May 27, 2021Loan LoanNo ratings yet

- HDFC New ECS Mandate FormatDocument4 pagesHDFC New ECS Mandate FormatHafeezulla KhanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAarti PalNo ratings yet

- 2023 10 02 11 04 28jul 23 - 605009Document3 pages2023 10 02 11 04 28jul 23 - 605009prasannapharaohNo ratings yet

- R3mit - Io Business PlanDocument41 pagesR3mit - Io Business PlanHaitam SabahNo ratings yet

- IndusInd Bank Legend Credit Card Benefit GuideDocument34 pagesIndusInd Bank Legend Credit Card Benefit GuideRahul BhadoriaNo ratings yet

- Flow Bill Explanation (Papiamentu)Document2 pagesFlow Bill Explanation (Papiamentu)Shanon OsborneNo ratings yet

- Chapter 2: Payment InstrumentsDocument81 pagesChapter 2: Payment Instrumentsviet hoangNo ratings yet