Professional Documents

Culture Documents

Midterm 2018 Solution Explanations

Uploaded by

Lyn LuongCopyright

Available Formats

Share this document

Did you find this document useful?

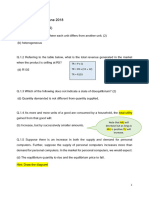

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm 2018 Solution Explanations

Uploaded by

Lyn LuongCopyright:

Available Formats

1. PART I (1.

0 point)

PART I

Multiple Choice Questions

Please choose the correct answer for each question. There are 20 multiple choice

questions worth 2 pts each, for a total of 40 pts.

2. MCh#001 (1.0 point)

Economic models

a. Are not very useful if they incorporate simplifying

assumptions.

b. Cannot be tested if they are based on assumptions.

*c. Allow managers to consider hypothetical situations.

d. None of the above.

3. MCh#002 (1.0 point)

Consider the market for gasoline in Metro Vancouver as shown in the following

diagram. Gasoline is a normal good. Which of the following events might have

caused the demand curve to shift to the left (from D1 to D2)?

a. An increase in the price of gasoline. No, this results in a

movement along the demand curve, not a shift of the curve.

b. An increase in consumer incomes. No, the question noted that

gasoline is a normal good, in which case the curve should have shifted out –

not in.

c. An increase in the price of hybrid cars (which use less

gasoline than other cars). No, a higher price for hybrid cars will decrease

the demand for hybrid cars, and thus increase the demand for gas guzzling

cars. This will shift the demand for gasoline out – not in.

*d. A decrease in the price of rapid transit. Yes, people will tend to

use more rapid transit and less driving, and this will cause the demand for

gasoline to shift in.

4. MCh#003 (1.0 point)

Thomas Malthus described the law of diminishing marginal returns and predicted

that, as land is in fixed supply, increases in population would cause increasing

undernourishment. Yet, in the past seventy years, population has risen substantially

but undernourishment has fallen. The most important reason is

a. Increases in the amount of agricultural land.

b. Increasing returns to scale in agriculture.

*c. Technological progress causing the production function Q(L)

to shift up.

d. All of the above.

5. MCh#004 (1.0 point)

The following diagram shows an estimated cost function.

a. The average cost curve is U-shaped. Yes, there are two conditions

necessary for an AC curve to be U shaped. One is the presence of fixed

costs to ensure that AC initially drops as Q increases. The second is the

presence of rising average variable cost to ensure that AC eventually

increases after AFC dies away. Both of these conditions are present.

b. Marginal cost is well-approximated by a quadratic function.

Yes, if you take the derivative of the cost function to get the marginal cost

function you will see that the marginal cost function is quadratic.

c. In the underlying data, factors other than quantity have

little effect on cost. Yes, with R2 at 0.99 we know that 99 percent of the

variation in cost is explained by the variation in Q. This means that only 1

percent of the variation in cost is explained by other factors.

*d. All of the above.

6. MCh#005 (1.0 point)

Figure 3.6 from the textbook illustrates the effect of different levels of advertising

expenditure A on quantity demanded. Two different regressions are illustrated.

a. The R2 statistic is smaller for the quadratic regression,

indicating a better fit to the data. No, the R2 is higher (not smaller)

for the better fitting model.

*b. We would expect that the coefficient on A2 in the quadratic

regression is statistically significant. Yes. We need the coefficient

on the A2 term to be negative and significant in order for the curve to bend to

fit the data in the way illustrated.

c. The linear regression line illustrates the saturation effect

of advertising. No, just the opposite. The linear regression shows that the

marginal benefit of advertising is constant at all levels of advertising – it is not

possible to have saturation.

d. All of the above.

7. MCh#006 (1.0 point)

Limited liability for the shareholders of publicly traded corporations:

a. Ensures that banks which lend money to these organizations

will always be fully repaid in the event of bankruptcy.

b. Allows the shareholders to pay income tax at the corporate

rate rather than at their own personal rate.

*c. Ensures that shareholders cannot lose more than the amount

they paid for their shares.

d. Allows these organizations to provide senior managers with

stock options.

8. MCh#007 (1.0 point)

Anne and Frank are CEOs of two publicly traded corporations. The two corporations

have the same revenue and cost functions, as illustrated in the diagram below.

Anne’s annual compensation is a base salary plus 3 percent of revenues, and

Frank’s compensation is a base salary plus 6 percent of profits. Assuming that Anne

and Frank have complete control over the choice of quantity, q, the theory of

managerial incentives tells us that:

Marginal Reveneue

Profit max q Rev max q

*a. Anne’s firm will have higher total cost than Frank’s firm.

Yes, Anne will choose q to maximize revenue whereas Frank will choose q to

maximize profits. The revenue maximizing q is higher than the profit

maximizing q. The diagram shows that costs are higher with the revenue

maximizing q.

b. Frank’s firm will have higher revenue than Anne’s firm. No, see

diagram.

c. The difference in output for the two firms will depend on the

difference in the base salary for Anne and Frank. No, the pair of qs

which maximize profits and revenues are independent of the base salary.

d. Neither CEO will choose the q that maximizes their company’s

stock price. No, maximizing stock price necessarily requires maximizing

profits. Thus, Frank will implicitly maximize stock price.

9. MCh#008 (1.0 point)

The cost function for a perfectly competitive firm is C(q) = 100 + 8q + 2q2. In the

short run the $100 fixed cost must be paid even if the firm shuts down. Let p* denote

the short-run shut-down price (i.e. the firm would shut down if p < p*).

a. Average variable cost is equal to marginal cost when p = p*.

Yes. MC = 8 + 4q and AVC = 8 + 2q. In the SR, the firm should keep

operating provided that P > AVC. We know that P = MC, and so the firm

should keep operating in the SR provided that MC >= AVC. This holds for

all q >= 0. When q = 0 we see MC = AVC = 8 = p*. This result is much

easier to see on a diagram.

MC

AC

AVC

8

Shut down point in SR

b. As price p falls toward p*, output q falls toward 0. Yes, the

previous diagram shows this.

c. p* = 8. Yes, see above.

*d. All of the above.

10. MCh#009 (1.0 point)

Which of the following is an accurate description of producer surplus?

*a. Revenue minus variable cost. Yes, in the diagram below the

rectangle implied by P and Q represents revenue. The area under MC

represents variable cost. Thus, PS = Revenue – Variable Cost.

b. Revenue minus variable cost minus sunk cost. No. Sunk cost never

shows up in our surplus diagrams.

c. Revenue minus consumer surplus. No, dumb!

d. The area between a downward sloping demand curve and an upward

sloping supply curve and to the left of the equilibrium quantity.

No, this is a measure of total surplus in a competitive market: CS + PS.

Supply MC

P

PS

Var Cost

11. MCh#010 (1.0 point)

A monopoly maximizes profit when output is chosen according to, where

where ε is the price elasticity of demand. This equation

demonstrates that:

a. A monopoly always sets price in the inelastic portion of its

demand curve. No if -1 < ε < 0 we see from the formula above that P < 0,

which does not make sense.

b. A decrease in a monopoly’s fixed cost results in an increase

in the monopoly’s profit maximizing quantity. No, the above formula

shows that fixed costs has no role in the setting of the optimal price.

c. The price elasticity ε remains constant if the firm changes

price in response to change in marginal cost. No, moving along a

demand curve in response to a change in MC always results in a change in

the elasticity (remember that elasticty varies between 0 and negative infinity

as we move from the bottom to the top of the demand curve.

*d. None of the above.

12. MCh#011 (1.0 point)

A profit-maximizing monopolist sells to 100 identical consumers, each of whom has

demand given by p = 100 – Q. Marginal cost is constant and equal to 40.

a. Uniform pricing is more profitable than two-part pricing. No,

when customers are identical, two-part pricing converts all CS and DWL into

profits. With uniform monopoly pricing there is both positive CS and DWL

which has not been converted into profits.

b. Nonlinear pricing with price equal to 80 for the first 20

units and price equal to 60 for all subsequent units maximizes

total surplus. No, the fact that the second block price of 60 is above MC of

40 implies that DWL remains with nonlinear pricing.

*c. Total surplus is maximized when Q = 60. Yes, surplus is maximized

when price is set competitively (i.e., P = MC). In this case we have p = 100 –

Q = 40. Solving this equation gives the competitive price Q* = 60.

d. All of the above.

13. MCh#012 (1.0 point)

Each student is willing to pay $3 for a first cup of coffee and $1.50 for a second cup.

Each faculty member is willing to pay $4 for a first cup of coffee and $3 for a second

cup. Nobody is willing to pay for more than two cups. The marginal cost of providing

coffee is $1 per cup. There is only one coffee shop in the relevant area.

a. If the coffee shop were able to charge different prices to

students and faculty, it would charge $1.50 to students and $3 to

faculty. No, if the student price is set at $3, the profit per student is (3 -1)*1

= 2. If instead the price is set at $1.50 then the profit per student is (1.50 –

1)*2 = 1. Therefore, profits are not maximized if the price for students is set at

$1.50.

b. Charging different prices to students and faculty is an

example of non-linear pricing. No. There is no block pricing since the

lower price is paid for both cups if two cups are ordered.

*c. A profit-maximizing two-part pricing system with different

monthly subscription fees for faculty and students would maximize

total surplus. Yes, suppose a student buys 20 times per month. Set the

price of coffee equal to MC = 1 and this will ensure the student will buy two

cups per visit. The student earns 3 – 1 = 2 units of surplus on the first cup,

and 1.50 – 1 – 0.50 units of surplus on the second cup for a total surplus of

$2.50 per visit. Based on 20 visits per month, set the monthly subscription fee

equal to 2.50*20 = $50. This will result in all surplus being extracted from

students. Now repeat these calculations for faculty. The monthly subscription

fee will be higher. By discriminating with respect to the subscription fee, the

surplus from both students and faculty can be fully extracted by the coffee

shop.

d. All of the above.

14. MCh#013 (1.0 point)

QuickieFood sells small fries (70g) for $2, large fries (150g) for $3, hamburgers for

$4, and a combination of large fries and a hamburger for $6.

a. QuickieFood uses a nonlinear pricing strategy. No, non-linear

pricing is used but it is not an exclusive strategy.

b. QuickieFood uses a mixed bundling strategy. No, mixed bundling is

used but it is not an exclusive strategy,

c. QuickieFood uses individual price discrimination. No, individual

price discrimination is when different individuals are charged different prices

but pricing falls short of perfect price discrimination. This is not what is

happening here.

*d. QuickieFood uses nonlinear pricing and mixed bundling. Yes,

there is non-linear price discrimination because the cost per gram is lower if

the large order of fries is purchased. There is also mixed bundling because

the fries and hamburger can be purchased individually or as a bundle.

15. MCh#014 (1.0 point)

This diagram compares perfect competition, perfect price discrimination, and uniform

monopoly pricing. Which statement is correct?

a. Under uniform monopoly pricing, consumer surplus is A + B + C.

No, the monopoly price is the upper price and thus CS = area A.

*b. Under perfect price discrimination, total surplus is A + B +

C + D + E. Yes, with perfect price discrimination all of the CS and DWL is

converted into profits, which means that profits equal the sum of CS and PS

with competition. This is given by area A + B + C + D + E.

c. Under perfect competition, producer surplus is zero. No, PS =

area D + E with competition.

d. Only perfect price discrimination eliminates deadweight loss.

No, two-part pricing with identical customers also eliminates DWL.

16. MCh#015 (1.0 point)

A car-sharing company charges an annual membership fee of $20 and a fee per

minute of $0.40. The marginal cost per minute (for gas, wear and tear, etc.) is $0.20.

*a. This pricing structure is an example of two-part pricing. Yes.

This should be obvious.

b. The pricing structure suggests consumers in this market are

close to identical. No, if customers were close to identical then we would

see the optimal fee per minute very close to MC. In fact the fee is twice as

high as MC.

c. Consumers who buy one or more hours for any given trip get a

discount on the per-minute price. This is best described as group

price discrimination. No, this is an example of non-linear price

discrimination.

d. None of the above.

17. MCh#016 (1.0 point)

Consider the Bertrand model with two firms producing identical products. Firm A’s

marginal cost of production is $5 while that of Firm B is $10. Neither firm has fixed

costs. The market demand for the product is given by Q = 60 – 2P. Assuming that

firms must charge prices that are whole numbers, what is the market equilibrium

quantity? Not covered on the 2020 midterm.

*a. Q = 42.

b. Q = 50.

c. Q = 60.

d. Q = 38.

18. MCh#017 (1.0 point)

Which of the following statements about cartel is TRUE?

Not covered on the 2020 midterm.

a. A cartel can be more successful when demand is more elastic.

*b. A cartel may fail when fringe firms (non-members) produce a

significant fraction of the market output.

c. When two firms each with marginal cost of production equal to

$2 collude and form a cartel, the MC of the cartel = $4.

d. Once two or more firms collude to form a cartel, there is no

incentive for cheating as the firms make higher profits in the

cartel than by acting independently.

19. MCh#018 (1.0 point)

Consider an airline route with only two firms: Sky Airlines (SL) and Fly Airlines (FL).

The two firms produce identical products and each firm has a marginal cost of $100.

There are no fixed costs. Not covered on the 2020 midterm.

a. The Bertrand-equilibrium profits are higher than Cournot-

equilibrium profits.

b. If the two firms collude and form a cartel, the profit-

maximizing cartel price is $100.

c. If SL’s marginal cost increases to $120 while FL’s marginal

cost remains $100, SL cannot earn positive profits in the Cournot

equilibrium.

*d. If SL’s marginal cost increases to $120 while FL’s marginal

cost remains $100, SL cannot earn positive profits in the

Bertrand equilibrium.

20. MCh#019 (1.0 point)

In the following payoff matrix, Coke and Pepsi have two choices available to them

regarding advertising. In each cell the number on the left is the profit of Coke and the

number on the right is the profit of Pepsi. Not covered on the 2020 midterm.

a. This is a prisoners’ dilemma game.

b. Neither firm has a dominant strategy.

*c. The Nash equilibrium is for both firms to advertise.

d. There are multiple Nash equilibria in this game.

21. MCh#020 (1.0 point) Not covered on the 2020 midterm.

Consider a monopolistically competitive market with symmetric firms. The following

diagram illustrates the current situation of a typical firm in the market.

a. The market is in long run equilibrium.

*b. In the long run, the demand curve for a typical firm

remaining in the market shifts to the right.

c. In the long run, the demand curve facing a typical firm

remaining in the market shift to the left.

d. The long run equilibrium price equals the minimum average cost

of production.

You might also like

- Midterm Solutions 2018Document13 pagesMidterm Solutions 2018Manan ShahNo ratings yet

- Solutions PepallDocument48 pagesSolutions PepallJoseph Guen67% (6)

- Man Kiw Chapter 15 Solutions ProblemsDocument10 pagesMan Kiw Chapter 15 Solutions ProblemsJosemariaSa100% (3)

- Tutorial For Students Economics BasicDocument5 pagesTutorial For Students Economics BasicasadullahqNo ratings yet

- Econ Quiz SolutionsDocument4 pagesEcon Quiz SolutionsMohamed Yousif HamadNo ratings yet

- BreakevenDocument14 pagesBreakevenkay_kleirNo ratings yet

- Midterm Answers 2017Document20 pagesMidterm Answers 2017Manan ShahNo ratings yet

- Assgnmt 5Document4 pagesAssgnmt 5Heap Ke XinNo ratings yet

- 20201221203332YWLEE003Perfect Compyp SolutionDocument19 pages20201221203332YWLEE003Perfect Compyp SolutionDương DươngNo ratings yet

- PS2 SolDocument4 pagesPS2 SolJOel Suárz RzNo ratings yet

- International Trade - Chapt 9 Imports Tariff/ Quotas For Imperfect MarketsDocument10 pagesInternational Trade - Chapt 9 Imports Tariff/ Quotas For Imperfect MarketsglenlcyNo ratings yet

- Chapter 7. Costs: 0. Economic Cost and Accounting CostDocument14 pagesChapter 7. Costs: 0. Economic Cost and Accounting CostLâmViênNo ratings yet

- Business Economics - Assignment SolutionDocument11 pagesBusiness Economics - Assignment SolutionGauthamNo ratings yet

- UoB PEAB Sample Exam Paper 2014Document11 pagesUoB PEAB Sample Exam Paper 2014Elliot BeagleyNo ratings yet

- Economics Quiz: MCQ Round DSM 2011-13Document6 pagesEconomics Quiz: MCQ Round DSM 2011-13Sachin ChawlaNo ratings yet

- Managerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Test Bank Full Chapter PDFDocument29 pagesManagerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Test Bank Full Chapter PDFJenniferPerrykisd100% (10)

- Introductin Fresh Final ExamDocument7 pagesIntroductin Fresh Final ExamTedi AbayNo ratings yet

- Practice Test For The Final ExamDocument10 pagesPractice Test For The Final ExamMeghna N MenonNo ratings yet

- Textbook Scan0001Document17 pagesTextbook Scan0001MoNa MatoutNo ratings yet

- MCQs - OligopolyDocument5 pagesMCQs - Oligopolypalak32No ratings yet

- Chapter 8Document11 pagesChapter 8Kalyani GogoiNo ratings yet

- Economics Department Model Exam Questions With AnswersDocument20 pagesEconomics Department Model Exam Questions With AnswersTeddy DerNo ratings yet

- Tute Sheet Post Mid TermDocument18 pagesTute Sheet Post Mid Termrajeshk_81No ratings yet

- Questions That Do Not Need A CalculatorDocument14 pagesQuestions That Do Not Need A Calculatorkidest mesfinNo ratings yet

- Advanced Microeconomics II Q & ADocument34 pagesAdvanced Microeconomics II Q & AZemichael SeltanNo ratings yet

- MicroEconomics Practice TestDocument7 pagesMicroEconomics Practice TestDavid BurfordNo ratings yet

- COST-BEHAVIOR - Mas 23Document12 pagesCOST-BEHAVIOR - Mas 23Daniel HarrisonNo ratings yet

- MA Economics 2010Document19 pagesMA Economics 2010Kiran KumarNo ratings yet

- Quiz 16Document7 pagesQuiz 16suranumiNo ratings yet

- RB CAGMAT REVIEW Microeconomics Q - ADocument32 pagesRB CAGMAT REVIEW Microeconomics Q - Amercy5sacrizNo ratings yet

- COST - Quizzer No. 1Document10 pagesCOST - Quizzer No. 1Ryan JulapongNo ratings yet

- Energy Economics (Peter M. Schwarz) (Z-Lib - Org) - Pages-69-75Document7 pagesEnergy Economics (Peter M. Schwarz) (Z-Lib - Org) - Pages-69-75ilia movasatianNo ratings yet

- PwS4: Cost Minimization, Market Structures, and DiscriminationDocument8 pagesPwS4: Cost Minimization, Market Structures, and DiscriminationAkshayNo ratings yet

- 8103-Managerial Economics - Executive MBA - Question PaperDocument4 pages8103-Managerial Economics - Executive MBA - Question Papergaurav jainNo ratings yet

- Mas - Activity Cost and CVP Analysis Part 1Document6 pagesMas - Activity Cost and CVP Analysis Part 1Ma Teresa B. CerezoNo ratings yet

- Ch. 07 Practice MCDocument11 pagesCh. 07 Practice MCjohannaNo ratings yet

- FinalExam 01dic2021Document2 pagesFinalExam 01dic2021Enzo MariacaNo ratings yet

- Latihan ud jawab pilganDocument4 pagesLatihan ud jawab pilganI Wayan Satria VirgantaraNo ratings yet

- Answer2 TaDocument13 pagesAnswer2 TaJohn BryanNo ratings yet

- Chap 13Document7 pagesChap 13Lê Trung AnhNo ratings yet

- Strategic Cost Management Final ExamDocument8 pagesStrategic Cost Management Final Examrizzamaybacarra.birNo ratings yet

- ECO401 Quiz 2 on Indifference Curves, Budget Lines & ProductionDocument2 pagesECO401 Quiz 2 on Indifference Curves, Budget Lines & Productionjunderwood93No ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCSoweirdNo ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCAhmadnur JulNo ratings yet

- Cost of Production Ch.5Document46 pagesCost of Production Ch.5Mahmoud KassemNo ratings yet

- FTCP Seminar 5 Answers (6) XSXSXSXDocument5 pagesFTCP Seminar 5 Answers (6) XSXSXSXLewis FergusonNo ratings yet

- Cpa Review School of The Philippines Manila Management Advisory Services Activity Cost and CVP Analysis TheoryDocument19 pagesCpa Review School of The Philippines Manila Management Advisory Services Activity Cost and CVP Analysis TheoryGennelyn Grace PenaredondoNo ratings yet

- Memo Exam Jun 2018Document12 pagesMemo Exam Jun 2018Nathan VieningsNo ratings yet

- Cubic Shaped TC CurveDocument4 pagesCubic Shaped TC CurveSEEMAL JAMILNo ratings yet

- Breakeven AnalysisDocument30 pagesBreakeven Analysistadesse geteNo ratings yet

- Midterm Examination: Cost AccountingDocument12 pagesMidterm Examination: Cost AccountingHardly Dare GonzalesNo ratings yet

- In Class Checkpoint Quiz ManaeconDocument17 pagesIn Class Checkpoint Quiz ManaeconDũng HoàngNo ratings yet

- Microeconomics Principles of Consumer ChoiceDocument18 pagesMicroeconomics Principles of Consumer ChoiceHashimRaza100% (2)

- Chapter 03 TestbankDocument108 pagesChapter 03 TestbankanukshaNo ratings yet

- Bep and CVP Analysis Ms. NaparotaDocument4 pagesBep and CVP Analysis Ms. Naparotarichelle ann rodriguezNo ratings yet

- 16 Appendix DDocument11 pages16 Appendix DRiswan RiswanNo ratings yet

- ME Problems PC MonopolyDocument7 pagesME Problems PC MonopolyDevan BhallaNo ratings yet

- PMIC02-5 Examination Overview 20-04-2023Document34 pagesPMIC02-5 Examination Overview 20-04-2023khahlisochabalalaNo ratings yet

- Module 1: Consumer Choice Theory & Behaviour Chapter 1: Demand ConceptsDocument26 pagesModule 1: Consumer Choice Theory & Behaviour Chapter 1: Demand Concepts049 Monil Kothari- BafNo ratings yet

- Karl MarxDocument44 pagesKarl MarxAkshay KumarNo ratings yet

- Cournot duopoly and game theory problemsDocument7 pagesCournot duopoly and game theory problemsBerk YAZAR100% (1)

- Chap 04Document87 pagesChap 04Tùng NguyễnNo ratings yet

- Market Failure and Government FailureDocument11 pagesMarket Failure and Government FailureNicoleVideñaNo ratings yet

- Concepts of Demand and SupplyDocument62 pagesConcepts of Demand and SupplyQuizMM MujNo ratings yet

- Demand, Supply and Producer's Surplus of Agri-Commodities: Nature and Determinants of Demand and Supply of Farm Products Demand & SupplyDocument8 pagesDemand, Supply and Producer's Surplus of Agri-Commodities: Nature and Determinants of Demand and Supply of Farm Products Demand & SupplyMamta VermaNo ratings yet

- ACLC College Tacloban Marketing PrinciplesDocument70 pagesACLC College Tacloban Marketing PrinciplesSherwin HidalgoNo ratings yet

- Business Confidence & Depression PreventionDocument8 pagesBusiness Confidence & Depression PreventionShriram DusaneNo ratings yet

- Lecture-2: Demand, Supply and Market Equilibrium: Abdul Quadir XlriDocument53 pagesLecture-2: Demand, Supply and Market Equilibrium: Abdul Quadir XlriAbhishek ShuklaNo ratings yet

- Market EquillibriumDocument14 pagesMarket EquillibriumEmeldinand Padilla MotasNo ratings yet

- NSS Exploring Economics 1 (3 Edition) : Revision NotesDocument4 pagesNSS Exploring Economics 1 (3 Edition) : Revision NotesadrianNo ratings yet

- Factor Endowment TheoryDocument64 pagesFactor Endowment TheoryIqraYounasNo ratings yet

- Atrianfar CVDocument2 pagesAtrianfar CVapi-432528250No ratings yet

- Ricardian Practice Problem Solution)Document7 pagesRicardian Practice Problem Solution)Genceci ChoiNo ratings yet

- Eco 104 Practice Questions For FinalDocument9 pagesEco 104 Practice Questions For FinalFariha FarjanaNo ratings yet

- EC202 Summer 2013 Exam Microeconomics QuestionsDocument7 pagesEC202 Summer 2013 Exam Microeconomics QuestionsFRRRRRRRTNo ratings yet

- 122 1004Document32 pages122 1004api-275486640% (1)

- Mock Test 3 - Paper 1 - EngDocument11 pagesMock Test 3 - Paper 1 - EngWasangLiNo ratings yet

- Chapter 18 Determination of Output and PriceDocument57 pagesChapter 18 Determination of Output and PriceJason Chung100% (1)

- Chapter 1 (The Scope and Method of Economics)Document4 pagesChapter 1 (The Scope and Method of Economics)jschmoe7No ratings yet

- Determination of Interest RateDocument35 pagesDetermination of Interest Rateznz17_78248No ratings yet

- 1 (Module Week 1)Document19 pages1 (Module Week 1)Edmon Jr UdarbeNo ratings yet

- Demand Curve: CharacteristicsDocument29 pagesDemand Curve: CharacteristicsAkhil VsNo ratings yet

- I Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Document28 pagesI Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Blaze MysticNo ratings yet

- Jamaican Youths On Their Way To Employment Stefanie WeckDocument99 pagesJamaican Youths On Their Way To Employment Stefanie WeckDante VirgilNo ratings yet

- Ebook Economics 11Th Edition Michael Parkin Solutions Manual Full Chapter PDFDocument39 pagesEbook Economics 11Th Edition Michael Parkin Solutions Manual Full Chapter PDFodilemelanie83au100% (10)

- University of California, San Diego Department of Economics ECON100A Practice Midterm Solutions Will Not Be PostedDocument12 pagesUniversity of California, San Diego Department of Economics ECON100A Practice Midterm Solutions Will Not Be PostedTylerNo ratings yet

- Microeconomics Question BankDocument3 pagesMicroeconomics Question BankGeneral DhruvNo ratings yet

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (17)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)

- How an Economy Grows and Why It Crashes: Collector's EditionFrom EverandHow an Economy Grows and Why It Crashes: Collector's EditionRating: 4.5 out of 5 stars4.5/5 (102)

- The Sovereign Individual: Mastering the Transition to the Information AgeFrom EverandThe Sovereign Individual: Mastering the Transition to the Information AgeRating: 4.5 out of 5 stars4.5/5 (89)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The Finance Curse: How Global Finance Is Making Us All PoorerFrom EverandThe Finance Curse: How Global Finance Is Making Us All PoorerRating: 4.5 out of 5 stars4.5/5 (18)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (3)