Professional Documents

Culture Documents

Bep and CVP Analysis Ms. Naparota

Uploaded by

richelle ann rodriguezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bep and CVP Analysis Ms. Naparota

Uploaded by

richelle ann rodriguezCopyright:

Available Formats

BEP AND CVP ANALYSIS MS.

NAPAROTA

1. All of the following statements related to the use of break-even analysis are true except:

a. a change in fixed costs changes the break-even point but not the contribution margin figure.

b. a combined change in fixed and variable costs in the same direction causes a sharp change in the break-even point.

c. a change in fixed costs changes the contribution margin figure but not the break-even point.

d. a change in per-unit variable costs changes the contribution margin ratio.

e. a change in sales price changes the break-even point.

2. The costing method that lends itself most readily to the preparation of break-even analysis is:

a. weighted average costing

b. absorption costing

c. first-in, first-out costing

d. semivariable costing

e. direct costing

3. The break-even volume in units is found by dividing fixed expenses by the:

a. unit gross profit

b. total variable expenses

c. unit net profit

d. contribution margin ratio

e. unit contribution margin

4. A major assumption concerning cost and revenue behavior that is important to the development of break-even charts is

that:

a. all costs are variable

b. total costs are quadratic

c. costs and revenues are linear

d. the relevant range is greater than sales volume

e. costs will not exceed revenues

5. If the fixed cost attendant to a product increases while the variable cost and sales price remain constant, the

contribution margin and break-even point will:

Contribution Margin Break-Even Point

a. increase increase

b. not change increase

c. not change not change

d. increase decrease

e. decrease increase

6. When referring to the "margin of safety," an accountant would be thinking of:

a. the excess of sales revenue over variable costs

b. the excess of budgeted or actual sales over the contribution margin

c. the excess of budgeted or actual sales revenue over fixed costs

d. the excess of actual sales over budgeted sales

e. none of the above

7. A valid assumption for cost-volume-profit analysis is:

a. an increase in fixed costs will cause the break-even point to rise.

b. demand is constant regardless of price

c. a decrease in variable cost per unit will lower the break-even point

d. variable costs per unit are assumed to remain constant within the range of activity analyzed

e. all of the above are invalid assumptions

8. Based on the cost-volume-profit chart in for a manufacturing company, the correct statement is:

a. line b graphs total fixed costs

b. point c represents the point at which the marginal contribution per unit increases

c. line d graphs total costs

d. area e (between lines b and d) represents the contribution margin

e. area a represents the area of net loss

9. A result from lowering the

break-even point is:

a.an increase in the sales price per unit

b.an increase in the semivariable cost per unit

c.an increase in the variable cost per unit

d.a decrease in the contribution margin per unit

e.an increase in income tax rates

10. If current sales are P1, 000,000 and break-even sales are P600, 000, the margin of safety ratio is:

A. 6% C. 167% E. 40%

B. 60% D. 100%

11. Which of the following statements is true?

a. A shift in sales mix toward less profitable products will cause the over-all break-even point to fall.

b. One way to compute break-even point is to divide total sales by the cost margin ratio.

c. Once the break-even point has been reached, net income will increase by the unit contribution margin for each

additional unit sold.

d. As sales exceed the break-even point, a high contribution margin ratio will result in lower profit, rather than a low

contribution margin ratio.

12. Sats & Co. sells three products: Sim, Plu, and Corp. Sim is the most profitable product while Cop is the least

profitable. Which one of the following events will definitely decrease the firm’s over-all break-even point for the upcoming

accounting period?

a. An increase in the over-all market for Plu.

b. A decrease in Cop’s selling price.

c. An increase in anticipated sales of Sim relative to the sales of Plu and Cop.

d. An increase in Sim’s raw material cost.

13. Cost-volume-profit analysis is a key factor in many decisions including choice of product line, pricing of product,

marketing strategy, and utilization of productive facilities. A calculation used in a CVP analysis is the break-even point.

Once the break-even point has been reached, operating income will increase by the

a. sales price per unit for each additional unit sold.

b. contribution margin per unit for each additional unit sold.

c. fixed cost per unit for each additional unit sold.

d. gross margin per unit for each additional unit sold.

14. To reduce the break-even point, the company may

a. decrease both fixed cost and the contribution margin.

b. increase both fixed cost and the contribution margin.

c. decrease the fixed cost and increase the contribution margin.

d. increase the fixed cost and decrease the contribution margin.

15. If a company is earning a profit, its fixed costs

A. are less than total contribution margin.

B. are equal to total contribution margin.

C. are greater than total variable costs.

D. can be greater than or less than total contribution margin.

PROBLEM

Due to erratic sales of its sole product - a high-capacity battery for laptop computers, Salcedo Company has

been experiencing difficulty for some time. The company’s income statement for the most recent month is

given below:

Sales (19,500 units @ P300) P5, 850,000

Less variable expenses 4, 095,000

Contribution margin 1, 755,000

Less fixed expenses 1, 800,000

Net loss P (45,000)

1. The president believes that a P160, 000 increase in the monthly advertising budget, combined with an

intensified effort by the sales staff, will result in an P800, 000 increase in monthly sales. If the president is right,

what will be the effect on the company’s monthly net income or loss?

A. P120,000 increase C. P120,000 decrease

B. P 80,000 increase D. P 80,000 decrease

2. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price,

combined with an increase of P600, 000 in the monthly advertising budget, will cause unit sales to double.

What will the new profit or loss if these changes are adopted?

A. P 60,000 C. P 45,000

B. P(60,000) D. P(45,000)

3. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop

computer battery would help sales. The new package would increase packaging costs by P7.50 per unit.

Assuming no other changes, how many units would have to be sold each month to earn a profit of P97, 500?

A. 21,818 C. 25,450

B. 23,000 D. 28,000

4. Refer to the original data. By automating certain operations, the company could reduce variable costs by

P30 per unit. However, fixed costs would increase by P720, 000 each month.

How would the breakeven point in units change if the company automated the operations?

A. 1,000 units increase C. 3,000 units increase

B. 1,000 units decrease D. 3,000 units decrease

5. At what level of production would the automation of the production process be indifferent to the present

process?

A. 18,000 C. 24,000

B. 21,000 D. 28,000

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Managerial Economics - Midterm Assignment No. 1 (CVP Analysis)Document5 pagesManagerial Economics - Midterm Assignment No. 1 (CVP Analysis)Ronel CaagbayNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Strategic Cost Management Midterm ExamDocument6 pagesStrategic Cost Management Midterm Examrizzamaybacarra.birNo ratings yet

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- CVP AssignmentDocument5 pagesCVP AssignmentAccounting MaterialsNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro Davaovane rondinaNo ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChristian Blanza LlevaNo ratings yet

- Mas 3Document9 pagesMas 3Krishia GarciaNo ratings yet

- Module 3 Cost Volume Profit Analysis NA PDFDocument4 pagesModule 3 Cost Volume Profit Analysis NA PDFMadielyn Santarin Miranda50% (2)

- CVP analysis profit calculationsDocument9 pagesCVP analysis profit calculationsSherwin AuzaNo ratings yet

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- Mid TermDocument7 pagesMid Termpdmallari12No ratings yet

- Strategic Cost Management Coordinated Quiz 1Document7 pagesStrategic Cost Management Coordinated Quiz 1Kim TaehyungNo ratings yet

- Midterm - Set ADocument8 pagesMidterm - Set ACamille GarciaNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChris LlevaNo ratings yet

- Mas Midterm 2020Document5 pagesMas Midterm 2020rodell pabloNo ratings yet

- PrelimA2 - CVP AnalysisDocument8 pagesPrelimA2 - CVP AnalysishppddlNo ratings yet

- MAS 5 - CVPA ExercisesDocument4 pagesMAS 5 - CVPA ExercisesAngela Miles DizonNo ratings yet

- Cost Volume Profit AnalysisDocument9 pagesCost Volume Profit AnalysisIce Voltaire Buban GuiangNo ratings yet

- Cost Volume Profit AnalysisDocument6 pagesCost Volume Profit AnalysisCindy CrausNo ratings yet

- PrelimQ2 - CVP Analysis AnsKeyDocument7 pagesPrelimQ2 - CVP Analysis AnsKeyaira atonNo ratings yet

- Cost Volume Profit AnalysisDocument18 pagesCost Volume Profit AnalysisLea GaacNo ratings yet

- Mas.1416 Profit Planning and CVP AnalysisDocument24 pagesMas.1416 Profit Planning and CVP AnalysisCharry Ramos70% (10)

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Answer2 TaDocument13 pagesAnswer2 TaJohn BryanNo ratings yet

- Cost-Volume-Profit & Breakeven Analysis QuizDocument7 pagesCost-Volume-Profit & Breakeven Analysis QuizNaddieNo ratings yet

- Pre FinalDocument8 pagesPre Finalpdmallari12No ratings yet

- CVP ANALYSIS BREAK-EVEN POINTSDocument12 pagesCVP ANALYSIS BREAK-EVEN POINTSjayson86% (7)

- Strategic Cost Management Quiz No. 1Document5 pagesStrategic Cost Management Quiz No. 1Alexandra Nicole IsaacNo ratings yet

- Strategic Cost Management Midterm ExaminationDocument9 pagesStrategic Cost Management Midterm ExaminationJohn FloresNo ratings yet

- CVP Quiz - Bsa 2Document3 pagesCVP Quiz - Bsa 2Levi AckermanNo ratings yet

- CVP ANALYSIS QUIZ ASSESSMENTDocument12 pagesCVP ANALYSIS QUIZ ASSESSMENTBRYLL RODEL PONTINONo ratings yet

- 10Document2 pages10AlexNo ratings yet

- MasDocument4 pagesMasYaj CruzadaNo ratings yet

- Quizzer CVPDocument7 pagesQuizzer CVPReese KimNo ratings yet

- Acc 213 3e Q2Document6 pagesAcc 213 3e Q2Rogel Dolino67% (3)

- Finman Multiple Choice Reviewer - CompressDocument9 pagesFinman Multiple Choice Reviewer - CompressAerwyna AfarinNo ratings yet

- BreakevenDocument14 pagesBreakevenkay_kleirNo ratings yet

- Reviewer # 3Document5 pagesReviewer # 3christannaviktoriaNo ratings yet

- Module 3 - Do It YourselfDocument5 pagesModule 3 - Do It YourselfJudith DurensNo ratings yet

- AE22 ChapterTest 4 6 - AnswerKeyDocument6 pagesAE22 ChapterTest 4 6 - AnswerKeyElrey IncisoNo ratings yet

- Quiz1 - SET ADocument8 pagesQuiz1 - SET ACee Garcia100% (1)

- MIDTERM EXAMINATION SET B TRACING NO. MULTIPLE CHOICE QUESTIONSDocument7 pagesMIDTERM EXAMINATION SET B TRACING NO. MULTIPLE CHOICE QUESTIONSCamille Garcia100% (1)

- 03 Cost Volume Profit Analysis ANSWER KEYDocument2 pages03 Cost Volume Profit Analysis ANSWER KEYJemNo ratings yet

- MBA105 Managerial Accounting ExercisesDocument5 pagesMBA105 Managerial Accounting ExercisesTamieNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document8 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Instructions: Cpa Review School of The PhilippinesDocument17 pagesInstructions: Cpa Review School of The PhilippinesCyn ThiaNo ratings yet

- ACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisDocument3 pagesACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisJoyNo ratings yet

- MS-MidtermExam 5thyrABSA 2019 AnsDocument8 pagesMS-MidtermExam 5thyrABSA 2019 AnsKarla OñasNo ratings yet

- Quizzer - Cost Volume Profit AnalysisDocument8 pagesQuizzer - Cost Volume Profit AnalysisJethro Gutlay100% (3)

- Management Advisory Services: ABC, CVP, and Cost AnalysisDocument8 pagesManagement Advisory Services: ABC, CVP, and Cost AnalysisNicoleNo ratings yet

- Strategic Cost Management Final ExamDocument8 pagesStrategic Cost Management Final Examrizzamaybacarra.birNo ratings yet

- Final Exam - Strategic - OVILLODocument4 pagesFinal Exam - Strategic - OVILLOMaria Angelica100% (1)

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- Ace 202Document4 pagesAce 202bacad lyca jaynNo ratings yet

- FAR EASTERN UNIVERSITY MANAGEMENT EXAMDocument18 pagesFAR EASTERN UNIVERSITY MANAGEMENT EXAMErin CruzNo ratings yet

- CVP Multiple Choice Questions With AnswerDocument7 pagesCVP Multiple Choice Questions With AnswerCarla Garcia100% (4)

- MSQ-01 - Activity Cost & CVP Analysis (Final)Document11 pagesMSQ-01 - Activity Cost & CVP Analysis (Final)Mary Alcaflor40% (5)

- Negros Oriental State University Junior Philippine Institute of Accountants ACADEMIC YEAR 2021-2022Document2 pagesNegros Oriental State University Junior Philippine Institute of Accountants ACADEMIC YEAR 2021-2022richelle ann rodriguezNo ratings yet

- Psychosocial Perspective in Gender and Sexuality: Unit IIIDocument36 pagesPsychosocial Perspective in Gender and Sexuality: Unit IIIrichelle ann rodriguez67% (3)

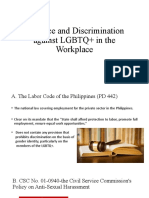

- Violence and Discrimination Against LGBTQ+ in The WorkplaceDocument6 pagesViolence and Discrimination Against LGBTQ+ in The Workplacerichelle ann rodriguezNo ratings yet

- Expenses Amount Electricity 1,500 Water 500 Internet 1,300 Gasoline 1,000 Total 4,300Document1 pageExpenses Amount Electricity 1,500 Water 500 Internet 1,300 Gasoline 1,000 Total 4,300richelle ann rodriguezNo ratings yet

- Jeremy Bentham UtilitarianismDocument12 pagesJeremy Bentham Utilitarianismrichelle ann rodriguezNo ratings yet

- Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocument26 pagesCost-Volume-Profit Analysis: Mcgraw-Hill/IrwinRoman Ali100% (1)

- Isv Managerial Accounting: Tools For Business Decision MakingDocument58 pagesIsv Managerial Accounting: Tools For Business Decision MakingMohd SuhailiNo ratings yet

- MAS Hilton Chap07Document30 pagesMAS Hilton Chap07YahiMicuaVillandaNo ratings yet

- HMCost2e SM Ch16Document35 pagesHMCost2e SM Ch16monsinNo ratings yet

- Cost Volume Profit Analysis Lecture NotesDocument34 pagesCost Volume Profit Analysis Lecture NotesAra Reyna D. Mamon-DuhaylungsodNo ratings yet

- Chapter One Cost-Volume-Profit (CVP) Analysis: Unit OutlineDocument14 pagesChapter One Cost-Volume-Profit (CVP) Analysis: Unit OutlineHussen AbdulkadirNo ratings yet

- If There Is An Increase In.... Then Profit Tends To......Document5 pagesIf There Is An Increase In.... Then Profit Tends To......glcpaNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Cost Volume PDFDocument29 pagesCost Volume PDFNOORUDDINNo ratings yet

- CVP ANALYSIS BREAK-EVEN POINTSDocument12 pagesCVP ANALYSIS BREAK-EVEN POINTSjayson86% (7)

- INTRODUCTION TO MANAGEMENT ADVISORY SERVICES COST CONCEPTSDocument6 pagesINTRODUCTION TO MANAGEMENT ADVISORY SERVICES COST CONCEPTSElaine Joyce GarciaNo ratings yet

- COST - VOLUME-PROFIT AnalysisDocument17 pagesCOST - VOLUME-PROFIT Analysisasa ravenNo ratings yet

- Cost Accounting: Sixteenth EditionDocument30 pagesCost Accounting: Sixteenth EditionHIMANSHU AGRAWALNo ratings yet

- Ch09: Break-Even Point & Cost-Volume-Profit Analysis: Presented byDocument49 pagesCh09: Break-Even Point & Cost-Volume-Profit Analysis: Presented byJason Vi LucasNo ratings yet

- CVP Analysis: Understanding Cost Behavior, Break-Even Point & ProfitabilityDocument35 pagesCVP Analysis: Understanding Cost Behavior, Break-Even Point & ProfitabilityChairul AnamNo ratings yet

- Hilton 13e SM Ch07Document72 pagesHilton 13e SM Ch07tttNo ratings yet

- Weyg - Man - 8e - Ch06 (Cost-Volume-Profit Analysis - Additional Issues) Accessibility DesignDocument74 pagesWeyg - Man - 8e - Ch06 (Cost-Volume-Profit Analysis - Additional Issues) Accessibility DesignAhmed AdamjeeNo ratings yet

- Fnce 413 Fin MGT (Stud May 2015)Document98 pagesFnce 413 Fin MGT (Stud May 2015)patrick kiruiNo ratings yet

- Managerial Accounting Homework 1 Comprehensive CVP AnalysisDocument3 pagesManagerial Accounting Homework 1 Comprehensive CVP AnalysisMK ZNo ratings yet

- Unit 2 Project ManagementDocument98 pagesUnit 2 Project ManagementSita RamNo ratings yet

- CH 16Document39 pagesCH 16Novi WulandariNo ratings yet

- BAC312 - Management Accounting ModuleDocument129 pagesBAC312 - Management Accounting ModuleBashi Taizya100% (1)

- Ms 3Document6 pagesMs 3KIM RAGANo ratings yet

- Cost Volume Profit CRDocument28 pagesCost Volume Profit CRMichiko Kyung-soonNo ratings yet

- CVP Analysis Guide: Cost-Volume-Profit Analysis ExplainedDocument16 pagesCVP Analysis Guide: Cost-Volume-Profit Analysis Explainedvaibhav guptaNo ratings yet

- Managerial Accounting - LemessaDocument112 pagesManagerial Accounting - Lemessaanteneh tesfaw100% (1)

- CVP Analysis QA AllDocument63 pagesCVP Analysis QA Allg8kd6r8np2No ratings yet

- ACN202-Lesson PlanDocument26 pagesACN202-Lesson PlanMaher Neger AneyNo ratings yet

- ACCOUNTING ENDTERM FinalDocument24 pagesACCOUNTING ENDTERM FinalHANNAH MAE MARAÑONNo ratings yet

- Assignment Group 4Document32 pagesAssignment Group 4Kevin NyasogoNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The Goal: A Process of Ongoing Improvement - 30th Aniversary EditionFrom EverandThe Goal: A Process of Ongoing Improvement - 30th Aniversary EditionRating: 4 out of 5 stars4/5 (684)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryFrom EverandThe Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryRating: 4.5 out of 5 stars4.5/5 (40)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Process!: How Discipline and Consistency Will Set You and Your Business FreeFrom EverandProcess!: How Discipline and Consistency Will Set You and Your Business FreeRating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Self-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeFrom EverandSelf-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeRating: 4.5 out of 5 stars4.5/5 (662)

- Working Backwards: Insights, Stories, and Secrets from Inside AmazonFrom EverandWorking Backwards: Insights, Stories, and Secrets from Inside AmazonRating: 4.5 out of 5 stars4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Kaizen: The Step-by-Step Guide to Success. Adopt a Winning Mindset and Learn Effective Strategies to Productivity Improvement.From EverandKaizen: The Step-by-Step Guide to Success. Adopt a Winning Mindset and Learn Effective Strategies to Productivity Improvement.No ratings yet

- Leading Product Development: The Senior Manager's Guide to Creating and ShapingFrom EverandLeading Product Development: The Senior Manager's Guide to Creating and ShapingRating: 5 out of 5 stars5/5 (1)

- Project Planning and SchedulingFrom EverandProject Planning and SchedulingRating: 5 out of 5 stars5/5 (6)