Professional Documents

Culture Documents

Tom and Jerry Are Joint Operators Sharing Profits and Losses Equally

Uploaded by

elsana philipOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tom and Jerry Are Joint Operators Sharing Profits and Losses Equally

Uploaded by

elsana philipCopyright:

Available Formats

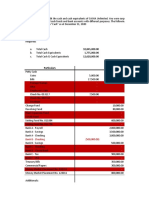

2. Tom and Jerry are joint operators sharing profits and losses equally.

The parties appoint Jerry as

the custodian of the joint operation’s assets. The joint operation’s transactions during the year are

as follows:

a. Jerry transfers inventory costing P 400 to the joint operation.

b. Tom contributes cash of P 500 to the joint operation, subject to liquidation by Jerry.

c. Jerry purchases additional inventory of P200 using the joint operation’s cash.

d. Jerry sells inventory costing for P 900 cash.

e. Jerry pays expenses of P100 using the joint operation’s funds.

f. Unsold inventory at year-end amounts to P 100.

Requirements:

Case # 1: No separate books

a. Prepare journal entries for transactions (a) to (e) above assuming no separate books are

maintained for the joint operation (the parties use the “joint operation” operation account to

record the joint operations transactions).

b. Compute for the profit or loss of the joint operation using the “joint operation” t-account.

c. If the joint operation is terminated at year-end, how much cash will be distributed to Tom and

Jerry, respectively? Assume Jerry takes the unsold inventory and Tom gets back the unused cash

of P 200 (P500 contribution – P 200 used for purchases – P100 paid for expenses). Reconcile the

cash distribution to the joint operators with the joint operation’s cash balance.

d. Provide the entries to (g) charge the unsold inventory to Jerry; (h) charge the unused cash

distribution to Tom; (i) record the joint operator’s respective shares in the profit; and (j) cash

distribution to the joint operators.

e. Provide T-account analyses on the closing of personal accounts, Joint operation account, and JO-

cash account.

Problem ccto

You might also like

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Practice Set - Cost BehaviorDocument2 pagesPractice Set - Cost BehaviorPotie RhymeszNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Chapter 17 Consolidated Fs Part 1 Afar Part 2Document23 pagesChapter 17 Consolidated Fs Part 1 Afar Part 2Kathrina RoxasNo ratings yet

- This Study Resource Was: SolutionDocument6 pagesThis Study Resource Was: SolutionChris Jay LatibanNo ratings yet

- Entity A Issues Convertible Bonds With Face Amount ofDocument1 pageEntity A Issues Convertible Bonds With Face Amount ofNicole AguinaldoNo ratings yet

- Prelim PartnershipFormationSampleProblemDocument4 pagesPrelim PartnershipFormationSampleProblemLee SuarezNo ratings yet

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- Midterm Exam PFRSDocument7 pagesMidterm Exam PFRSRoldan AzueloNo ratings yet

- Audit of Investments - Equity Securities Supplementary ProblemsDocument2 pagesAudit of Investments - Equity Securities Supplementary ProblemsNIMOTHI LASE0% (1)

- Solution Chapter 6 Joint ArrangementsDocument17 pagesSolution Chapter 6 Joint ArrangementsMariz QuintoNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- Acc 118 Week 4 ModuleDocument10 pagesAcc 118 Week 4 ModuleChristine Joy SonioNo ratings yet

- HOBA - General Procedures-DLSAUDocument25 pagesHOBA - General Procedures-DLSAUJasmine LimNo ratings yet

- Edoc - Pub Problems Solving Masdocx PDFDocument6 pagesEdoc - Pub Problems Solving Masdocx PDFReznakNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Partnership Q1Document3 pagesPartnership Q1Lorraine Mae RobridoNo ratings yet

- AFAR.3101 Partnership (Drill) : D. Advanced Financial AccountingDocument1 pageAFAR.3101 Partnership (Drill) : D. Advanced Financial Accountingvane rondinaNo ratings yet

- Business Policy Activity 2Document3 pagesBusiness Policy Activity 2Motopatz BrionesNo ratings yet

- Self-Test Partnership and Corporate LiquidationDocument6 pagesSelf-Test Partnership and Corporate Liquidationxara mizpahNo ratings yet

- Afar QuizDocument18 pagesAfar QuizCpa Cheap review materialsNo ratings yet

- Chapter 16 - Bus Com Part 3 - Afar Part 2Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2Emman ElagoNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Assignment: Assessment: Module 1: Banking and Other Financial InstitutionsDocument14 pagesAssignment: Assessment: Module 1: Banking and Other Financial InstitutionsMiredoNo ratings yet

- Chapter 3 Liquidation ValueDocument11 pagesChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- AE120 - Final Activity 1Document1 pageAE120 - Final Activity 1Krystal shaneNo ratings yet

- Quiz 2 AbcDocument15 pagesQuiz 2 AbcMa. Lou Erika BALITENo ratings yet

- Home Office, Branches and AgenciesDocument5 pagesHome Office, Branches and AgenciesBryan ReyesNo ratings yet

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Ix - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionDocument12 pagesIx - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionKirstine DelegenciaNo ratings yet

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocument3 pagesExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.No ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- Sycip Gorres Velayo & Co.: HistoryDocument5 pagesSycip Gorres Velayo & Co.: HistoryYonko ManotaNo ratings yet

- Corporation Liquidation Notes PDFDocument4 pagesCorporation Liquidation Notes PDFTk KimNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Sintos QuantiMethodsDocument3 pagesSintos QuantiMethodsDalla SintosNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Orca Share Media1554082908907Document2 pagesOrca Share Media1554082908907Joshua Tansengco Guitering100% (1)

- Home Office, Sales Agency and BranchDocument6 pagesHome Office, Sales Agency and BranchGelliza Mae Montalla0% (1)

- Baliwag Polytechnic College: Financial Accounting and Reporting A. AlmineDocument6 pagesBaliwag Polytechnic College: Financial Accounting and Reporting A. AlmineElaiza RegaladoNo ratings yet

- Assignment03 PDFDocument2 pagesAssignment03 PDFAilene MendozaNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- CE - Advanced Financial Accounting and ReportingDocument27 pagesCE - Advanced Financial Accounting and ReportingCristinaNo ratings yet

- CMPC131Document15 pagesCMPC131Nhel AlvaroNo ratings yet

- Problem Joint ArrangementsDocument1 pageProblem Joint Arrangementselsana philipNo ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument7 pagesUse The Following Information For The Next Two Questionselsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- Years Accounting 123Document7 pagesYears Accounting 123elsana philipNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitieselsana philipNo ratings yet

- Cash Received From Customers During The YearDocument5 pagesCash Received From Customers During The Yearelsana philipNo ratings yet

- Felicia Co Ae101 AccountingDocument4 pagesFelicia Co Ae101 Accountingelsana philipNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESelsana philipNo ratings yet

- Tweak Corporation Determined The Value in Use of The Unit To Be P535Document6 pagesTweak Corporation Determined The Value in Use of The Unit To Be P535elsana philipNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- Costs of Market Research Activities 75Document3 pagesCosts of Market Research Activities 75elsana philipNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- Accountinf 101675824567Document3 pagesAccountinf 101675824567elsana philipNo ratings yet

- On January 1 Accounintg ProlbemDocument3 pagesOn January 1 Accounintg Prolbemelsana philipNo ratings yet

- Illustration: Bonds Issued at Premium - With Transaction CostsDocument2 pagesIllustration: Bonds Issued at Premium - With Transaction Costselsana philipNo ratings yet

- The Immaterial Cost of The Leasehold Shall Be Amortized Over The LifeDocument3 pagesThe Immaterial Cost of The Leasehold Shall Be Amortized Over The Lifeelsana philipNo ratings yet

- When It Is Repayable On Demand and Form An Integral Part of An EntityDocument2 pagesWhen It Is Repayable On Demand and Form An Integral Part of An Entityelsana philipNo ratings yet

- Pra Acc Quizzer 2016Document5 pagesPra Acc Quizzer 2016Kim DavilloNo ratings yet

- On March 31 Accounting 101732636556Document3 pagesOn March 31 Accounting 101732636556elsana philipNo ratings yet

- Charis Marie F. Urgel Bsa - Iv "Cash and Cash Equivalents" PROBLEM NO. 1 - Composition of Cash and Cash EquivalentsDocument2 pagesCharis Marie F. Urgel Bsa - Iv "Cash and Cash Equivalents" PROBLEM NO. 1 - Composition of Cash and Cash Equivalentselsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- Pra Acc Quizzer 2016Document5 pagesPra Acc Quizzer 2016Kim DavilloNo ratings yet

- Solution Auditng ProblemsDocument1 pageSolution Auditng Problemselsana philipNo ratings yet

- D. $0.75 Per Client-Visit $19,826 Per MonthDocument2 pagesD. $0.75 Per Client-Visit $19,826 Per Monthelsana philipNo ratings yet

- Loan From BDO BankDocument2 pagesLoan From BDO Bankelsana philipNo ratings yet

- If The Company Sells 3Document2 pagesIf The Company Sells 3elsana philipNo ratings yet

- Insurance On Production EquipmentDocument2 pagesInsurance On Production Equipmentelsana philipNo ratings yet

- MAS Final ExamDocument1 pageMAS Final ExamMae CruzNo ratings yet

- Insurance On Production EquipmentDocument2 pagesInsurance On Production Equipmentelsana philipNo ratings yet