Professional Documents

Culture Documents

TOA - Preweek

Uploaded by

sunflower0 ratings0% found this document useful (0 votes)

97 views48 pagesaaa

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaaa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

97 views48 pagesTOA - Preweek

Uploaded by

sunfloweraaa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 48

eR

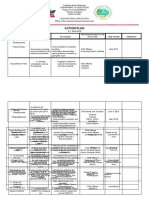

(9) ReSA- The Review School of Uccourtancy.» Theory of Uccounts

May 2016 Batch

TAPW - 311

ACCOUNTING

‘A primary objective of financial reporting isto

4 Assist investors in analyzing the economy

b. Assist investors in predicting prospective cash flows

©. Assist banks to determine an appropriate interest rate for their commercial loans

PRIMARY users: existing and potential investors, lenders and other creditors

® OTHER (secondary) users: erployees, customers

13. Under the

cotsisteney principle however reguires ta, stiould there he ny ch

1X, While only ‘going concern’ is mentioned us.an underlying as

imeritioned under the seetion on objectives of financial reporting in the new Framework

24. ENTITY theory (Assets = Liabilities + Equity) > emuphasis

PROPRIETARY theory (Assets'~ | Vquity) > eniphasis is om proper asset

RESIDUAL EQUITY theory (Assets ~Liabillies - Prefered Fquty ~ Common Eau)

26. IAS und IFRS are prineiples-based 5 «

31. Usual inistake is choice A. Instead of

ng

uppor trom practicing wecount

of professional members, représenting varions interested user groups.

38. ‘The Bureau of Internal Revemie (IR) is of directly involved in the stundard-setting process of fin

ng Standards Council, which

incial Reporting Standards (PFRS) are approved subject to

ions Commission (PRC) through the Board of Accountaney (BA)

are those that aflevt the entity and in which other entities participate, On the oth

ity are the usual examples of inter a! events

ctsing entries; however, prepaid expense

standards inthe country; instead, ISR is represented inthe. S-member

fs the standard-setting body of the

the concurrence ofthe Professo

40, External ev

events do not involve other entities’ participation. Protuction and e

50. Prepaid expense recorded under the asse? acthoal is not sibject to. res

‘coord under the expense method may be reversed.

464. Retrospective upplication assumes th th

7. Prospective application means thatthe change is effected fon the date oF change

77. Choice A is more commonly knows

79, While PAS 24 requires the disclosure of par

group transsetions, i€ does not req

eonsolidated FS,

ADDITIONAL QUESTIONS (with sugge rs)

1. Accounting concepts are NOT derived from which of the following?

Financial Repor

vars.

id subsi

c Experience Laws ofnature

b. Pragmatism ¢peneticality) Inductive reasoning,

Which of these qualitative charaeteristies or concepts are relates!?

A a Relevance and materiality 2 mice and understandability

b.- Understandability and comparability d ability ind comparability

Page 9 of 10 pages

ned fo the US FASB standards which are eonsidered rule

i i, standards are prepared.

tes the approval of accounting standards (PERS). The body is composed

TAPW-311

jovermicnts and their agencies, and the public

Conceptual Framework (2010), comparability is NOT unifirmity (je, accounting changes are allowed);

ssury divelosures must be

nption in the new Framework, ‘acerual Isis" is

made,

proper income determination/ineome:s/atement;

vba

val fe sheets

based.

neial reporting

hand, internal

new accounting policy had always been applied from the begining,

ividend in arrears,” which is required (o be disclosed in the noes to the FS,

relationship irrespective of any intereorapany,or intra

fe disclosure of transacyions which are normally eliminated in the, prepata

&

%

o

c

8 Which ig NOT'a key element of

3

KeSU- The Review School of GecoumFancg « Theory, of Gecommts’

‘May 2016 Batch

TAPW ~ 312

CASH AND. RECEIVABLES

Jf Alot the following would be regarded! as financial instruments, ENCERE

a Ca Notes payable © L

bo Rank overdraft C= 4 Equipment

2 Inender to be classified as a cash equivalent, on investmenit must have a mavurity’ period of:

4. Less than six months © Sixto twelve months

Three to six months Three months oF tess

PF Alvot the tollowing can be classified ws cash and cash equivalents. EXCEPT:

4 Bank dratts — ¢

bh equity investments

vies eld du for repayment in 90 dass

. Redsemable preference shares aquired and Jin 60.

AL Which of the following is generally classified as a1

wer ue

a, Postdated checks AC. €

hb. Bank overdratis. cue d

ent Hability_on the balance sheet?

lustomer NSF checks *&

2a Sha) sn ea a ea lang accuse NOTA

Sey key Velen ma areAR ie onion ea

Hid grey apap ucla MB ENEbutn ve eh es

i Shey nen be aise fe eal Suecas eae

$8) cash eisrl gysiem are tne mihi and procedfes el 8 ence!

That current obligations ane mt ¢ the saffguarding of cash

1 That excess gash does not ens dL. thar unised cash i invested

mal ono ear ho espeti opty eas

4, Separation of duties

E> Aealgtent oes fea

internat control ver eine neveiphe’?

Cash deposit on a regular basis

b. Daily entry ina yoycherregistee ~ dbwrvemenye

c.__ Daily recording of all eash receipts in the accounting records

4.) Immediate counting by the person opening the mail oF using the cash register

Proper authorization

imprest system

MX 4 Inreconctling the bank balance with the book cash balarve, which of the following would JOT cause the bank balance

shown in the bank statement to be Tower thar the unadjusted book hakanee’) an

4. Deposits intransi

b, Cash on hand atthe company

Interest credited to the account by the bank

NSF cheeks froma customer, 98 reporied un the bank stateinent

30 Accounts: receivable usually’ appear in the balance sheet,

a.” As current assets, combined with eash and cash equivalents

b, AS current assets, immedvately aller cash und Cash equivalents

&. Only ‘tthe balance sheet method oF estimating uncolletible accounts is used,

4.” Aveither current assets or noneiirent assets, depending on whether the allowance method or the dicect

‘write-off nethod is used! 1 a€count for uncollectible accounts

M4 A.orans tind receivables are fon-dlerivgtive nancial assets

With fixed or determinable payments that are quoted in an active market

b. With fixed or deferminable payments that are not quoted in ai active market

©. Without fixed or determinable paymgnts that are quoted in an active market

dd. Without fixed or determinable paynients that are not quoted in an active market

2B. Wien individual customers” accourit have credi7 balances of material amounts, these amou

a. May de shown as “credit balanges of customers’ accounts” in the current assets section

b. May be deducted fron the debit balance jn other customers’ accounts i she asset section

. Must be reported separately inthe liability secrich oF the balance sheet

4d, Should be omitted from the balance sheet

Page 1 of & pages

eS. the Review School of Cccowrdaney TAPW-312

PREWEE 17ATERIALS in THEORY of ACCOUNTS (May 2036 Bath) Page 2

D JS. Accounts receivable are classified as current assets:

EN aT veh ide itt task beyons ove Yea

Te nly eon bere rt eas wit 60 dys or soo

G32 Ol tba slofancs metho i seb eimai ineoletble aces

dk Whenever sceounts receivable arise from “normal” sales fo eistomers

less ofthe eredit terms

ples primarily supports the use of allowance for doubtful accounts?

LA: Which of the Foltowi

yecouinting pri

Continuity principle ©. Matching principle

» sure principle 4. Cost principle

CAF The allowance method of recognizing bad debt expense is generally considered a generally accepted accounting,

be met before the allowar

principle. What two conditions a ‘method ean be used?

Bad debts must be relevant and reliable

b, Bad debts must he expected and material

. Badlebts must be probabie anc! measurable

Xd, hid debis must be persistent over time andl the method used to estimate them is consistently applied

X6.-\ company, which has an adequate amount in its Allowance for Doubtful Aecounts, writes off as uncollectible an

‘account receivable from a bankrupt customer. ‘This aetion will:

a, Have no effect om total curent assets ¢. Reduce net income forthe period

be Reduce ota current assets 4. Reduce the amount of equity

© AF. WhichoF he fotlowing methods is NOT appropriate for estimating had debt expense?

a. Individual or collective assessment of outstanding re

b. Percentage of outstanding accounts receivable.

© Aging of accounts rece wable

uf

ables

renlaye of income

© AB Whicvisa veneraly accepted method of determining the amount ofthe adjustment wo bad debts expense?

a. A pereentage of sales adjusted forthe balance i the allowance

B.A percentage of abcounts receivable ot adjusted for the balance in the allowance

€ Anamoumt derived from aging accounts receivable adjusted forthe balance inthe allowance

4d. An-amount derived from aging accounts receivable not adjusted forthe halanee in the allowance

F) 49, Whieh of the following isan advantage of using the net price method for recording cash discounts on credit sales?

a. Iteases communication with customers about thie bal

BL uproperly reflects current period sales revenue

€._Itsimplifes recording of sts retuns and allowances

+k Tereqaire oss recordheeping efforts than the gross method

26. ABC Cyele Shop sels bicycle to. XYZ. a customer who uses Express Charge (a tational creditcard, but not issued by

a bank). In recording this sale. ABC Cycle Shop should record: = om

a. A cash receipt

b, An account receivable from NY

€ Amaccount receivable from Express Charge

4. Asmall increase inthe allowance for doubtful accounts

AAC When accounts eccivable ar factored aut eeeurse, what account des the transferor eet?

a, ccounts receivable ss Liability

Sales 4 Accounts receivable

Se 2% A nonintrestbearing note receivable

a, Catises no interest revenue to be recorded

Includes a specified principal amount phis specified imerest

© Includes a specified principal amount but an unspecified interest amount

4d, Ineludes an unspecified principal amount and an unspecified interest amount

beg 23: Shor-serm nnsinlenest beating notes reccivableiars usually réconded a ther

3. Present value Discounted value

b, Net tealizable value 4 Maturity value

4 2A. Asstiming that the ideal measure of short-term receivable in the balance shect isthe discounted value of the gash to be

received in the future, failure to follow this practice usually coes NOT make the balance shect mi

a. The amount of discount is not material

b. Most recefvables can be sold to a bank or factor

¢. Most short-term receivables are not interest-bearing

The allowance for uncollectible accounts includes discount element

Page 2 of 8 pages

@

ReSA - The Keriew School of Gecoudlomey TAPW-312

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Bateh) - Page 3

INVENTORIES

1Y-% 2. Which of the following is EXCLUDED jn the scope of PAS 2 on Inventories?

Inventories ofa service provider © Manufacturing supplies

6, Consituetion in progress 4 Raw materials

JF Acrvanntgcturing company: has whieh iree Basic types of inventory”?

‘4. Finished goods, work-in-process, snd ready-to-se!l- merchandise

b. Raw materials, work-in process, snd finished goods

©. Specific identification, FIFO, and average cost

4, Perpetual, periodic, and estimated

FA Which of the’ following should be inotuded in inventory?

a, Goods oat on consignment Gods held for pick-up by the buyer

Goods held on consignment 4. Goodsrin-transit purchased FOB destination

AB. What aré consigned goods?

31 Goods that are shipped but itl transfers to the receiver

b. Gouids that ate shipped bur ile remains with the shippet \

Goods that have heen Segregated for Shipment to a customer

4 Goods that are sod ut payment is wot required until the zoos are sold

BF Which ofthe following would NOT be included in he inycutory amotnt reported on a company’s balance sheet?

‘ents shipped cut on consignment to another company.

Items shipped today FOB shi 1 invoice had been niailed to the customer. comer

ems in the receiving deparment of the company: retuned hy the custome, invoice has been mailed.

{Eterm purchased from a supplier wod cn route directly tn a customer of the eompany: the term is FOB

destination: invoice recetved bat et Yet paid

Bt

lowet of cost or net tealiaabfe value (LONRW) fesults in theJeulese inventory account if applied to

a. Fach itt of inventories separately ¢ & Toga invemory

4) Groups of similar inven ies 4. Any of these

#:. Which ofthe following conversion costs C ANNO? be inclugedt in eos oF Inventory?

4. Cost of direct labor ©, Production rent and wtilities

b Salaries of sales sift Factory overhead based on normal capacity

3% Which may be included as part of the cost oF inseatories under PAS 2?

a. Selling costs

b, Administrative costs.

Costs of designing products for specitic

4. Abnormal amounts of wasted materials, labor or other production costs

3% Unider PAS 2, items of in

asset are Fequired to be:

gated into the ‘cos! oF yoo Sold” expense inthe period in whieh the tems are used

entory that are

used by business enterprise as components in 2, selfseonstructed property

b. _ Expensed directly into equity in the period in which the itemsvare used

oun

Added t0 a “property construct

. Capitalized and depreciated

provision ae

94. Where the et realizable vulue of inveniory fills below cost, PAS 2 requires tha

'2, The inventory continue io be carrie in the balance sheet a cost

|b. The itvemtory be writen down 1 nt realioabe value

© No adjsement bem, tthe diffrence betwecn net vealivable value and cost be disclosed in the

notes fo the financial statements:

4, The dilerence be added tthe carrying anount of th inventory

28. fan item of inventory that was written down 10 net reelizable ¥

4. - Previous amount ofthe write-down can he resarset

h. Carrying amount of the inventory cannot be ajasted

©. Value adjustment can be recognized immediately in equity

4. Adjustment must be secoginized in a “provision for fut

ue in 8 prior period subsequently recovers, then:

sntory write-downs? account

he specitic identification method ean be used only

a. In income tax returis

For financial reporting purposes but not in the income tax returns.

€. When the individual items in inventory ure similar in terms oF cost unction, and sales value

dd, When the actual acquisition costs of dividual units ean be determined from the aecounting records

Page 3 of 8 pages ay

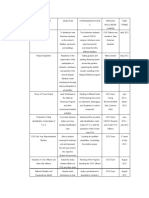

ReSU - The Review School of Ceccormtoney TAPW-312

PREWEFK MATERIALS in THEORY of ACCOUNTS (hay 2016 tateh) - Page 4

D

7. Whicl of these methods of measuring the cost of safes mont likely parallels the actual physicalflow of the woods?

a LIFO Average cost Soni

b. FIFO, Specific identification

JB. During a period of s sinje prices, whicl of the following methods of measuring the costs of goods sold is likely

fo resul in reporting the highest gross profi”

1. FIFO. Specie idemiitieation

bh LIFO 4. Average cost

D 40, The costing oF ventory mst be lias! until the ond of the acegumting period under whieh of the following method

‘of inventory valuation’,

2. LIPO perpetual Moving average

ib. EIFQ penpetuat S Weighted average

> a8 the seiehued avérage inventory Costing method is particularly suitable w inventory where:

a. Giads have distinc! use-by dates and the gooxls produced first must be sold earliest

t_Tho emily carries stosks of raw materials, work-in-progress and finshed goods

€._Dissimilar products are stored in separate locations

4. Homogeneous provlucts are mixed together

BSE 41. the specifi identification method ig more appropriate than an inventory cost flow assumption:

a, Fora larue inventory of identical low-priced items

by. Afeach tem inthe inventory is unique

€ ARpirehase costs ae fallin

purchase costs are ris

AX 42. Generally aeceptedsecounting principles require the selection of an inventory’ cost flow method which

i. Most closely approximaies lower of cost and net realizable value for the endit

bb. Most elearly reflects the periodic income

© Matches the physical flow of goods from inventory with sates revenue

Yields the most conservative amount of reported income

© se 43. Inventory: estimation will be required forall of the following, EXCEPT

a. When interim financial statements are prepared

When invemory is destroyed by typhoon oF fashfloods

€. As proofof reasonable accuracy of the physical inventory

Inthe determination of the énding inventory to be shown in the balance sheet

“fA ahee prose margin method of estimating ein inventory may be used fo lf oF he following, EXCEPT

2 Interalas well as externa interim reports

b.Intemals well as externa year-end reports

©. Fatimate of inventory destroyed by fre or other casialty

Routh test of the validity of an mventory eost determined under either period oF pempetua Sy

is NOT affected by the inventory valuation method used by a business?

‘a, Cost of goods sold

b. Net income of the business

&. Amounts owed for incomie taxes

‘d.Amounts paid to acquire merchandise

X46, When apes system is used:

a Fwwoenities must be made when 2oods are purchased

b. Contof yoods sold is residual umount, rather than an account

©. Ending. inventory is treated as an expense and hevinning inventory is treated as an asset

4. +Parchases’ account is not wsed: all inventory purchase erie ae debited to the inventory account

h Jf. twa pspemalinsentory system wo yes are normally made orc ah aes ansation

SEA eepDTs sales revenue andthe het recognizes cox ofthe goo sold

One ent records the pl naan he other ecords the sae,

Oe GREEN records the ost of gos and the ater reduces the balance inthe Inventory account

Si One ey updates the subsidiary ledger andthe oer updates the general led.

48> In a perpetual inv jem, recording a sale

Only Accounts Receivable

bb. Accounts Receivable and Inventory

‘&Accounts Receivable and Cost of Goods Sold

dd. Accouints Receivable and Cost of Goods Sold, and Inventory

Page 4 of 8 pages

| ReBU the Reren Rhaebof Gecourtemeg TAPW-312

PREWEEK MATERIALS in THEORY of ACCOUNTS {May 2016 Batch] Page 5

M_49. tna perpetual inventory system, recording z Sale omageount involves crediting which of the following accounts?

e Sono aa ae

nd Cost of Goods Sold oy

T-Rles Sever acon Goods Bal

8) 26 tna pemetuslinventary system, an javentory ow asimpion is Sed primarity for determining which costs to use in

a Recording sales revenue. ae

b.) Recording the cost of goods sold

¢, Recording purchases of inventory

J Foreeasts of future operating results, chat will be used as basis for the production budget,

A At: Ina manafocturing company, the *jusé-in-time” concept of inventory munagement is best illustraied by

a. Receiving deliveries of materials from suppliers just before the materials are used in the production

process.

1b Anautomated factory which reduces production time below that of other companies inthe industry

; © Completing the manufacturing process just before the deadline established by the customer.

4, Selling finished products before they go out ofsiyle.*

{BF Thewse of discount tost account implies that eat ofa purchased inventory item is the

a. List price of the iter

. tavoive price ofthe item

«©. ovoiee price les the purchase discount taken om dhe item

d, Invoice price less the purchase discount mot taken on the iter

75. K company divcovsred'a P20,000 Ovecstneiment ut 6 2015 ohedini inventory atler the’ financial statements for 2015

‘wore prepared, Tha eee of thiseror on the 2018 finial statements was

Carcass shee ited ad wis as dered

Th Corfeot eset were uted ad income was oversted

5. Coton saci vere Ovestaled td income was overated

d. Current assets were understated and income was understated

p dekicuitune

A; Which ofthe following is NOT dealt with by PAS 41 on “Agriwtiu

‘a. The accounting for biological asses

b. The processing of agricultural produce after harvesting

©. ‘The accounting treatment of government grants in expect to biological assets.

‘The intial measurement of auricultural produce harvested from the entity's biolagieal ussets.

si the accounting for Such products is dealt with by

4B. ‘where theres along aging ot maturation proces tet hu

& PASAL, Agricuimre © PAS 16, Properts; Plant and Equipment

b. PAS2,Imenany 4 2 PAS 40, bmvestmem Property

CAB Biological assets are

Living animals only © Roth living animals and fiving plants

b. Living planes only Neither living animals nor ving plants

Agriculuural activity. ©

et ae harvested product of the entity's biolowical asset

b. Is the detachinent of agricultural produce trom a biologieal asset or the cessation ofa biological

asset's life processes

Relates tothe processes of growth, degeneration, production and procreation that ean cause changes of

‘quantitative or qualitative nature sna biological asset

4 Is the management by an entity of the biological transformation of biological assets for sale, into.

‘agricultural produce. or iniy another biolog ical asset

4\ 58. Generally speaking. biological asses flatingto agricultural a

A fair velue approach

b. Historical cost

© Netrealizable value

d, Historical cost less depreciation tess impairment

ity should be meusured using

{7 A. Asricultural activity inchudesall of the following, EXCE MT :

a, Raising livestock © Ploriculture and aquacti

b. Anmual perennial croppi Ocean fishing

Page 5 of 8 pages

D

ReSU - The Review School of Vccountoney, TAPW-312

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 6

$6. Biological assets are measured at

a. Cost ©. Net realizable value

b, Lower of cost or net realizable value 4, Fair value less costs to sell

Lf. Which of the following costs are NOT included in costs fo sell?

a. Trausfer taxes and duties.

b. Levies by regulatory agencies.

© Commissions to brokers and dealers,

4d. Transport and other costs necessary to get the assets to a market

TiS Was le te ton) oF moacrcinen’ bas wie foc Vang biological apc, PAS

It Recep tt of eure cat

Reece the ee of present vale

Reda ies tren ct noe cot

Er isis several ve of onus

63. Which of the follosing values is UNLIKELY {0 be used in fair value measurement of biological asset?

4, Quoted price in a market

b. The most recent market transaction price

cc, The present value of the expected net cash flows from the

External independent valuation,

AA. A gain oF loss arising on the initial recognition of a biological asset and from a change in the fair value less estimated

costs to sell of a biological asset should be included

1. ‘The net profit or loss for the period

b. The statement of recognized wai and tosses

¢. A Separate revaluation reserve

d,Aceapital reserve within equity

_a6S. Yihere there is «production cycle of more than one year, PAS 41 encourages separate disclosure of the

2. Physical change only ¢. Total change in value

b. Price change only 4. Physical change and price ehange

$6. Where the fir Valve ofthe biological asset cannot be determined reliably, the biologleal asset should be measured at

2 Cost

Cost ess accumated depreciation,

Cost less accumulated depreciation and accumulated impairment losses.

Net realizable value:

67 Agricultural produce is measured at

a. Fair value

, Fait value less costs fo sell at the point of harvest

© Net realizable value

4, Net realizable value less normal profit mar

harvested, the harvest should be accounted for by asi

Sta

18 PAS 2, Inventories, or another

lard, For the purposes of that Standard. the cost a the date of harvest is

8, When agricultural produc

applicable Philippine Financial Reporting

deemed to be

8 Its far value fess cost to sell at point of harvest

The historical cost ofthe harvest

{© The historical cost less accumulated innpaiement losses

Market value

related fo agricultural activity is valued

a. AU fair value

b. Inaccordance with PAS 16, Property, Plant, and Eiuipment, ot PAS 40, Investment Property

©. At fie value in combination with the biologieal asset that is being grown on the land

d. At the fesale value separate from the biological asset that has been urown on the laid

7}. Which ofthe following CANNOT be resarded as an agriculture produce’

Cheddar cheese ©. Piglets

Racing Pony d: Calves

Page 6 of 8 pages

KOSA - The Review School of lecoumfanvey TAPW-312

/PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) Page?

SUGGESTED A

Dd Db al ol D

D dD 8 2. D

B » 43.0 63. D

B \ 42.8 oh A

B 8 452.0. 68. -D

: 41 % B 46. 8 6. ¢

D Eran) aA o7 8B

88 * OH age 68 A

Che 2» 8B 4,8 oo. 8

We Bick) a 0B 0. 8

WW B eB,

12. Cy 2° 0

13 3. b 53. i

“1. 8 MB

Is. is A 53. 2

16 6D 56, €

17, D0 57D

is ¢ BA BOA

oR MoD 9° OD

20 ¢ 40, D 0. D

RIPE ENP ANA HONS/CLARIFIEA TIONS TO SELECTED TFEMS

8. “Question is about cash receipts; avoucher is a written authorization to pastor disturse cash,

9. The hank statrment balance will show 3 higher amount than eash Idger halance for any interest credited to the bank

aaecount by the bank without the knowledge of the depwsitor.

13. Aceounts receivable from customers. is classified as current if realizable within one year oF normal operating ey

Whichever is longer

19. Net price method is preferred in aecouintine as it property retleets Current period sales revenue, net of any related cash

discount that may be availed bythe customer

20. For this type of eredt card fansnetion, ARK (seer) collects the amount fron ’xpress Charge (credit card! company):

then, Express Charge in turn collects the amount from XYZ (buyer)

22. Emphasizing substence over form, the note’s snspecified principal amount’ is its present or discounted value and te

“unspecified interest amount isthe discount, which is computed basedon the excess of face value over present vale.

Short-term non-interest bearing notes ceeivable are usually recon a their face value, which is incidentally equ to

the inaturty value for a non-interest bearing Hote

32, Under PAS 2 and Cost Accounting rules. costs of designing products for specifi customers may be included in the

inventory cost of @ product

Al, Specific idemificoyion is more appcopriate if each item i. the javentory ig uigue so thal the actual acquisition costs of

individual units can be determined fron the accounting records

42. Usual mistake is choice C, An entity must choose @ cost ow method which most clearly reflects the periodic income

through the ebst qr zoos sold.

48. Inventory valuation method (¢.z.. FIFO) affects cost oF yous sold. net income including related income taxes

The use of "discount lost” accouat implies that purchased inventories are recorded at nev amount; it also implies that

the purchase discount sat avaiied by the buyer so that it “lost

$4, PAS 41 is applied to auticalteral produce only at the point of harvest: the pro

harvesting is covered by PAS 2 or other anplicabi standards.

52. Choice A refers to agrieullural produce: choice B refers to harvest; choive C refers to biological transformation,

59. Uniler PAS 41. harvesting from unmanaged n 4 ocean fishihy and deforestation) is not an agricultural

activity, Aquaculture (svhich infuses fish farming), on the other hand, would fall under the detinition of asrieultural

activity

63, Exvernal independent valuation is not amine those listed as wsidetines in determining the fair value of a biological

asset in PAS 41, (See related seetion of pave 14 of the TA Lecture Notes)

ADDITIONAL QUESTIONS (wit

te,

sing of agricultural produce after

suggested answers)

A Wan entity incorreetly includes consignment ems in the ending inventory. the effect on the weve period's cost of

Bonds sold and net income is

B +a, Understatement, overstatement . Excess ofthe recoverable amount over the carrying amount of the asset

€._ Exeess ofthe earying amount over the recoverable amount of the asset

_Exeess ofthe earying amount over the discounted cashflows from the asset

26. The estimates of future cash flows in calculating wafue in use include all of the following, EXCEPT

a. Cast inflows from the continuing use of the assct

bb. _ Net cash flows from the disposal ofthe asset af the end of its useful ife

Future cash outflows that are expected to arise from improving or ecahaneing the asset's perfo

‘Cash outflows necessarily incured to generate the cash inflows from the continuing use.of the asset

v 26. When calculating estimates of future eash flows for value in use, which of these eash flows should NOT be included?

‘a. Cash lows from disposal

b. Income tax payments.

. Cash flows from the sale of assets produced by the asset

d. Cash outflows on the maintenance of the asset

24. Ifa plant asset is retined before itis fully depreciated and no salvage value is received,

‘a. Again on disposal occurs ¢. Hither a gain or a loss can occur

b. Aloss.on disposal occurs 4d, Neither a gain nor a oss occurs

Page 2 of 8 pages @

ReSU the Review School of Cccsweitamey TAPW-313

PRCWEEK MATERIALS in THEORY 51. Ta denen ets ara lotr Snr tae ity ae fo be

cicero se

herpes kage Or dela ta

>, Bae pees Noyce arene

2 38. Cash dividends declared out of current camings were distributed to an_ investor. How will the investor's investment

b

account be affveted by those dividends under euch of the following accounting methods?

d— aquity Method

a. No effect

b No fleet Decrease

© Decrease Decrease

4 No effect No effect

39, A firm purchased bonds to be classed as an investment in APS. The bonds were purchased at a premium. Assume the

market price of the bond is volatile. hereto

‘8. Cash interest reeeived each year

b. The ending valuation allowance »

cost.

«The ending valuation allowance account balance will depend on ending market value and original cost

adjusted for amortization of premium.

The premium is ignored because the bonds are not classified as held to maturity

Jess than the interest revenue recognized.

balance will depend on ending market value and original

D 40. A bond is purchased on January 1. ‘The investor's carrying value at the end of the first year would be highest iff the

bond was purchased ata

‘Discount and amortized by the stright-ltie method

b

and amortized by the straight-line method

n and amortized by the effective interest method

)) 41. Which of the following would NOT be reported as investn

‘a, Real estate held for an undetermined future uss

Property held by the entity to be leased out under,one oF more operating leases.

Property owned by the entity und leased out undler one or more operating leases.

4d. Property owned by the en

sat property?

48. 4 gain or loss arising from a cha

‘Be recognized in the protit or loss forthe périod in which it arises

bh. Be recognized directly to equity in the period in which it arises

© Be recognized as an adjustnient to retained earings atthe beginning ofthe year

4. Not be recognized in the accounts

vestment property’?

cash flows,

of the following generally provides the be

Discounted cash flow projections based on

'b. Recent prices on less active markets with adjust

€. Current prices for properties ofa different nature or subject to different conditions,

4. Current prices in an active market for similar property in the same location and condition,

44 Transfers from investment property to property, plant and eguipment are appropriate

‘When there is change of use.

Based on the entity's discretion,

‘Only when the entity adopts the fair value model under IAS 38,

4. The entity can never transfer property into another classification on the balance sh

classified as investment property.

A 4S. Derecognition of investn:

‘a. Itbecomes the subj

b. Mis sold

€. Itbecomes the subject ofa sale and feaseback deal

d. Itbecomes the subjeet of a finance lease:

once it is

L property will NOT be required when

of an operating lease.

Cor ag? Tt id Serle eros tate san invest plpet shal Ha

a. Te Vas of te property

5 STieefesertnll oF illo feise pyro’

The lomer of fle valoe ofthe propery and present value of inl lave pajnénts

2 STba pla fac veh of th pope pe pracen vlc Of ilar Jere pyrnend

C, 47. The cash surrender value ofan insurance poliey on the company president would be presented on the balance sheet as

a Cash > Longeterm investment

b. Marketable securities. Prepaid expense

Page 4 of 8 pages ea

ReSU - the Review School of Accourttamey TAPW-313

PREWEEK MATERIALS m THEORY of ACCOUNTS (ny 2016 Baten Popes

48. Under PFRS 9, which of the following is NOT a ealepory uf financiel ussets?

a, Financial assets at amotized cost

b. Financial asseis at fair value through profit ot loss

inancial fair value through accumalated profit or koss

inancial assets at fait value through other comprehensive ineome

INTANGIBLE ASSi:ts.

Identifabitity is seen as the characteristic that conceptually distinguishes other intangible assets from.

a Copyright © Goodwill

b. Franchise Patent

$0. The following expenditures should be expensed is incurred, EXCEPE

‘a, Expenditures on advertising and promotions] uctvities,

b, Payments for organization expense

Expenditures in relocating or reorganizing part or all of

d. Payment in advance of delivery of goods or services

$1, Which of the following items qualify ws an intangible asset under PAS 38

a. Advertising and promotion on the Iatnch of a huge product,

b. College tuition Rees paid to employees who decide to cnroll in an executive MBA program while

working withthe company, ‘

Operating losses during the inital stages ofthe project.

Legal costs paid to intellectual property lawyers to register a patent

52. Under PAS 38, intangible assets should be carried at

Cost less accumulated depreciation

b. ” Revalued amount less aeeumutated depreciation

© Cost plus a notional increase in fai value since the imangibte asset is acquired

de Cost Less accumulated amortization and/or accumulated impairment

AS Amortization of speci

a.

merprise

intangible assets results prinvrily from application of the

a Fulkdisclostre principle ‘Matching principle

b. Revenue principle a Cast principle

A Under PAS 38, which ofthe following methods of amortization is normally NOT recommended for intangible assets?

Units of production meth €. Pilective interest method

b, Declining balance method (Straight-line method

AS. A purchased patent has 9 remaining legal life of $ years. It should be

a. Expensed in the year of acquisition

b. Aniortized over a petiod of 10 or 20-years

©. Attiortized over its usefil fife, i'les¢ than ® years

de> Amortized over 8 years regardless of the useful life

JS, An intangible asset with an indefinite life is one where

8. There is no foreseeable limit on the period over which the asset will generute eash flows,

b. The length of tie is over 20 years.

The dircetors fee! thatthe intangible asset will not lose vahic in the foreseeable future

cd. There is a contractaal or legal arrangement tha ‘exeess of five years

57. An intangible asset

b. Amortized andl impairment test: asnually

. Amortized and tested for impairment if there is 4 “trigger event?

d. Amortized nad no impaimient test

3% Which of the following couters exclusive right to conduct business ina particular territory?

‘a. Pranchise Leasehold improvement

be Trademark d. Patentecopyright

mn

59, Which of these is expensed as incurred by the franchisee for & franchise-with un estimated useful fife often years?

Legal fees paid to the franchisce’s lawyers to ebtain the franchise

‘h. Periostic payments tothe franchisor hased on the franchisce’s revenues

©. Initial amount paid to the franchisor forthe franchise

4. Any inital direct costs incurred in obtaining the fronchise

BO. Costs incurred by a company that may develop its own goodwill internally should be:

8. Capitalized and amortized as the eonipany profits inereased.

b. Capitalized and mnortized over the useful life of te goodwill

. Expensed in the period incurred

4. Capitalized and amortized over « period not to execed 40 vears,

Page 5 of 8 pages ©

w

bp

RESO - The Review School of Cccowetoney, TAPW-313

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 6

A ioodil, when propery recognized, should be writin of

a, By systematic charges to expense over the period benefited, but not more than 20 years

b. Assoon as posible against retained caaings

©. _‘Assoon as possble as an ordinary item

When impalrment toss occurs

02. of the following is most likely NOT to be amortized over the periods of estimated benefit?

‘4, Development costs that resulted in a successful product,

Lease rights paid to owner of property for the usufruct

&. Costs incurred in organizing a corporation

d. Patent right purchased from an inventor

63. Goodwill should properly appear in the statement of financial position of « company whi

4. Has purchased an entity Consistently reports abo

b. Consistently operates profitably d Meets all of the conditions

normal profits

its finaneci

64. A newly set up dot-com entity has engaged you

highly publicized research and develops

made by one of its stakeholders. Which of the following statements is accurate?

‘8, Costs incurred during the “rescarch phase” can be capitalized.

b. Costs incurred during the “de\ nt phase” ean be ca

feasibility of the project being established are met.

‘e. Training eosts of technicians used in research can be capitalized,

4d. Designing the jigs and tools qualify as research activities

italized if criteria such as technical

{A computer software purchased as an operating system for the hardware oF as an integral part of a computer controlled

‘machine tool that cannot operate without the specific software shall be treated as

a, Intangible assets Inventory

b. Property, plant and equipment 4. Expense

“#6. Wich ofthe flowing cons related to cobnpe sofware capitalized to an intangible asset account?

a ee cs and kine Cor ae

1h Developmcal ets preceding chological feasibility

©, OBR ad tetng costs ncurel i tstclogla ea

mater

Ik, Com Et bemoan

iy but before completing the product

(87. The proper accounting treatment for the costs ineurre

48, To capitalize all costs until the software is sold

b. To charge research and development expense when incurred

established for the product.

&. To charge research and development expense only ifthe computer software has alternative future use

4. Toceapitalize all costs as incurred until a detailed program design or working model is ereated.

68. Which of the followit

g is correct statement eonceming research and development (R&D) costs?

a. AILR&D costs, without exception, must be charged to expense wher

b. R&D can only be amortized over a life of 40 years oF

‘6, Almost any treatment is acceptable for handling R&D costs

d. Notes to the financial statements must disclose total amount of R&D costs expensed during the period

AP Whi oe ong mos Hy na i rea an

“The total cost of a building (use li

research and development projeets

b. Depreciation in 2016 of the building used for research and development

© The cost incured in 2016 to ensure quality control for existing production processes

4d, The eost incurred in 2016 of research welvities performed by another firm: the project is expected to

bbe completed in 2017

opment expense in 20/6?

25 years, completed January 1, 2016) to be used in various

70. Which of the following note diselosures is NOT required by PAS 38?

. Usefil ives of the intangible assets.

b. Reconciliation of carrying amount atthe beginning and the end of the year.

‘Contractual commitments forthe acquisition of intangible asses

4d. Faie value of similar intangible assets used by competivors

Page 6 of 8 pages ©

advisor. The entity has recently completed one of its

ent projects and seeks your advice on the accuraey of the following statements.

RSA The Rewiew School of Cccowtanay TAPW-313°

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 7

oD c 4D 61. D

2D c aA 62. ¢

35: ie BOR 43. D B.A

48 4. OB 44. 8 6. B

Sith 25. 1D 45. 4 65. iB

6 oD 2A 46. © 66. ¢

D.C ake 47. C o7. 2B

& oD 2. D 48. C 68D

ea 2 D 49. C 0. 2B

10. B 30. B $0. -D 0. D

1h Ae 3G D

1A 32D D

B. OB 3. D 3. C

4. B 4B 4

1s. D 35. D 55. €

16. C 36. A 56. A

7. D 37. A 52 A

1B 38 B 8A

Ww ¢ 39. ¢ 32. OB

20. A 40. D 60. C

BRIEE EXPLANA LIONS/CLARIFICATIONS 10 SELLCTED ITEMS

23. Under BAS 36, the cash flows used fo measure the ‘value in use" of a property must be expressed hefore i.

39. The ending valuation allowance for AFS bond investments’ is based on the difference betwren fair value and

amortizedcas. FY AC :

40. Under the sffective imterest method (scientific method), the periodic amortization of premium is lowest in the first

41. A property leased in under finance (capitul) case and leased-out under opssating ease. quali

property. A property /eased out vind finance lease is not considered as an investment property.

|ONAL QUESTIONS (with suggested answers)

2 ‘Accounting for tangible operational assels is primarily in conformity with the:

v a. Matching principle intanstele

b. Historical cost principle

as an investment

2. An asset has a nine-year useful life and is 10 be depreciated under the sum of the years’ digits method. ‘The annual

‘depreciation expense would be the same ws that tinder the straight Tine method in the

B a. Third year ©. Seventh year

b. Fifth year 4 th year

3 Capitalization of construction period interest is based prinsarly upon the:

B ‘Comparability principle e

b. Matching principle 4.

‘Ateltionship characterized by the existence of a capacity

B A parent-subsidiary relationship ¢

B.A joint venture 4d. Asole proprictorship

5. ‘The panicular relationship between partés that signifies the existence ofa joint venture i:

d 2. Significant influence by one party over the other party

. Control over the operating policies of one party by another party

‘c. Shared influence by two parties over the activities of another party

4. Joint control by the parties over the activites of an operation

#C The party to a joint venture ve has joint cauteol over that venture

B

Investor Shareholder

b. Venturer Partner

7. ‘The party to a joint venture who does NOT have joint contro} over that venture,

A Investor ©. Shareholder

b. Venturer de Partner

_3¢ Which of following is NOT one ofthe forms of joint venture under PAS 312

b ‘& Jointly contolfed assets Jointly controlled operations

b. Jointly controtted emt

9% Iisa joint venta

5 4d. Jointly controlled management

that involves eslablishinent of « corporation, partnership or other entity in which each venturer has

an interest.

c 4. Jointly controlled operation ¢ Jointly eontrolied entity

b. Jointly controlled asset d. Jointly controlled business

Page 7 of 8 pages ©

KeSU - the Review School of lccoumtomey TAPW-313

[PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) -Page 8

¢

B

D

10, Under PAS 31, whats the comes treatment in accounting for an ines in jointly commolied ening?’ |

a Benchmark treatment: cost method; alternat wo

bb. Benchmark treatment: proportionate consolidation method; altemative method: cost method

© Benchmark treatment: proportionate consolidation method: alterna it ¥

4d. _ Benchmark treatment: equity metho; alternative method: cost method

JAE Uniler PPRS 11, what ate the two types of joint arrangements (i.¢, contraetusharrangement where two oF more parties

have joint controly?

‘Joint venture and joint agreement & Joint forves and joint venture

bh. _Toint venture and joint oper . Joint forces and joint agreement

12, Under PFRS 11, what is the method of accounting for investment in joint venture?

a Cost method ©. Fair value method

b. Equity method Consolidation method

13. On January 1, 2016, ABC Company capitalized cost for a new computer software product with an ceonomic life of

five years. Sales for 2016 were 30% of expected total sales of the software and the pattern of future sales CAN be

measured reliably. At December 31, 2016, the software had a net realizable value equal to 90% of the capitalized

cost, What pereentage ofthe original eapitalizedcost should be as the net amount on the Decetiber 31, 2016 balance

sheet?

% 10% 8%

b oT 90%

14, On January 1, 2016, ABC Co. capitalized cost for a new computer software product with an economic life of five

years. Sales for 2016 were 30% of expected total sales of the software, However, the pattern of future sales

CANNOT be measured relisbly. AL December 31, 2016, the software had a net realizable value equal to 90% of the

capitalized cost, What percentage of the original capitalized eost should be as the net amount on the December 31,

2016 balance sheet?

a. 70% © 8%

b 72% 4 906

15. Which of the following is NOT specifically excluded from the

‘4. Government assistance provided inthe form of tax bene

b. Government participation in ownership of the entity

© Govemument grant covered by PAS 41

<_Forgivable loan from the government

16, ‘These are government grants whose primary condition iy that an entity qualifying for them should purchase, construct,

‘or otherwise acquire long-term assets

4. Grants related to assets ©. Goverament gilt

b. Grants elated to income 4. Government appropriation

17. In the case of grants related 10 an assct, which of these treatments is prescribed by PAS 202

4. Record the grant at a nominal value in the frst year and write ic off in the subsequent year

1. Either setup the grant as deferred income or deduct i in ating atthe carrying amount of the asset

«. Record the grant at fair valu inthe frst year and take it to income in the subsequent year

dL Take it wo the income statement and dselose it as an extraordinary gain

18, Inthe ease of grants related ro income, which of these treatments is prescribed by PAS 20?

a. Credit the grant to “general reserve" under shareholders’ equi

bh. Present the grant in the income statement as ‘other income’ or asa separate fine item, or deduct it from

the related expenses

©. Credit the grant t ‘retuned earnings onthe balance sheet

4. Credit the grant to sales or other revenue from operations inthe income statement

19. In-ease of non-monetary grant, which ofthe following is prescribed by PAS 207

‘a. Record the grant at a value estimated by manageie

b. Record the asset at replacement cost and the grant at 3 nominal value

6 Record both the grant and the asset at fair value ofthe non-monetary asset

4. Record only the asset at fair value avd not recognize the fair value of the grant

20. ‘The internal sources of information indicating possible impairment inelude all of the following, EXCEPT

-w of PAS 20 on government grants’

a. Evidence of obsolescence or physical damage of the asset

b. Evidence that the economic performance of an asset will be worse than expected

© Significant change in the manner/extent in which the asset is used with an adverse effect on the entity

4. Significant decrease or decline in the market value of the asset

21. ‘The external sources of inforination indicating

4. Significant value in the technological

the asset is employed

'b. An increase in the interest rate oF market rate of retum on investment which will likely affect the

discount rate used in caleulating value in use

cc. The carrying amount of the net assets ofthe entity is more than its market capitalization

d. Significant dectine in budgeted net cash flows or significant increase in budgeted loss flowing. from

the asset

sible impairment include all ofthe following, EXCEPT

narket, legal or economic environment of the business in which

END

Page 8 of 8 pages

ReSU- The Review School of Oaconedtaney » Theory, of leconeite

Ma Batch

| TAPW-314

JABILITH

1. Which of the following is an essential charaéteristic ofa liability?

A a. Itmust be an obligation (o transfer assets or provide services in the future

b. The identity of the creditor must be known

€._Itmay be the result of future transactions

The exact amount due must be known

Which of the following is NOT an essential characteristic for an item to be reported as a liability on the balance sheet?

c ‘8. The lability isthe present obligation of a particular entity

b. The liability arises from past transactions or events

€- The lability is payable to a specifically identified payee

4. The settlement of the liability requires an outflow of resources embexlying economic benefits

3. Which of the following items would be EXCLUDED from current lia

D ‘4, A long-term liability callable or due on demand by the creditor e

indication that the debt will be called

‘Normal accounts payable which had been assigned by the ereditor to @ finance company

©. Long-term debt callable within one year or less because the debtor violated a debt provision

4d. A short-term debt which at the discretion of the entity can be rolled over at least twelve months after

the balance sheet date

4. Which of the following loss contingencies is usually NOT acerued?

< a. Product warranty obligations ©. Riskof loss from fire

b. Premium offer obligations 4. Non-colleetbility of receivables

5. Under PAS 37, for which of the following should a provision be recognized?

lity to replace specie detective television set already retumed to the manufacturer.

ity to pay pension benefits ifa specific employee lives to retirement.

to pay any adverse judgment for a product liability ease currently on appeal

10 pay for books received by the college bookstore; terms allow for the return for full

refund of any books not sold.

6. According to PAS 37, which TWO of the following best describe the sources of legal obligation?

‘A legal obligation is an obligation that derives from

n though the ereditor has

‘A—Legislation ‘C= A published policy

B~A contract D~ An established pattern of past practice

A a. AandB Cand D.

b. Nand ad BandD

7. Which of the following is within the scope of PAS 37 (Provisions, contingent liabilities and contingent assets)?

¢ 4 Financial instruments carried at fair value

b. Future payments under employment contracts

Future payments on vacant leasehold premises

d. An insurance company’s policy liability

8. According to PAS 37, for which of the following should a provision be recognized since it is NOT contingent?

G ‘4, Future operating losses ¢. Obligation for plant decommissioning costs

b. Obligations under insurance contracts Reduction in fair value of financial instruments

9 Gains or losses from the early extinguishment of debt, if material, should be

A ‘a, Recognized in income before taxes in the period of extinguishment

_b. Recognized as an extraordinary item in the period of extinguishment

©. Amortized over the remaining life of the extinguished issue

d. Amortized over the tile of the new issue

10. ‘The basic accounting issue for a lessor is

B .. Expense recognition during the lease term —¢. Computing depreciation over the lease term

Revenue recognition during the lease term determination of the cost of the leased asset

11. Ifthe lessor and lessee use different interest rat

e ‘a. The lessor will use different acc

b. Total expenses and revenues

€. Total expenses and revenue

4d, The lessee and lessor cannot use different interest rates

12, Inthe ease of a fease of land and building where title to the land is not transferred, the lease is gen

c ‘8, Both land and building are finance leases

b, Both land and building are operating leases

fc. Land is operating, lease; building is finance lease

ly treated as if

4, Land is finance lease; building is operating lease

13. ‘The lessor must classify a sale-and-leaschack arrangement as a(n)

D ‘8. Operating lease or a finance lease ‘¢. Direct financing lease or a sales-type lease

b. Operating lease or a sales-type lease 4. Direct financing lease or an operating lease

Page 1 of 8 pages

PASO STA Revtem Sabah o) Goce TAPW-314

‘PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 atch) - Page 2

14

20.

B

§. Which of the following is reported

‘One incentive for entering into a sale-and-leascback arrangement on substantially all of the market value of an-asset is

‘4. Tax implications are favorable for the lessor, compared with other lending arrangements

Improvement in cash flow for the lessor

. Improvement in cash flow for the lessee

Entire gain appears on lessee income statement in sale year

The vested benefits of an employee represent

a. Benefits to be paid to the retired employee in the current year

'b. Benefits to be paid to the retired employee in the subsequent year

Benefits accumulated in the hands of an independent trustee

4. Benefits that are not contingent on the employer's contin

If payment of employees’ compensation for future absences is probable

‘and the obligation relates to rights that vest or accumulate, the compensat

‘a. Accrued if attributable to employees’ services not yet rendered

b. Accrued if attributable to employees" services already rendered.

, Accrued if atributable to employees’ serviees whether or not already rendered

d. Recognized when paid

‘An entity maintains a defined benefit pensior

pension cost is measured using the

a, Projected benefit obligation ©. Unfunded vested benefit obligation

'b. Expected return on plan assets d. Unfunded accumulated benefit obligation

in the service of the employer

nd the amount can be reasonably estimated

should be

lan for its employees. The service cost component of the net periodic

interest expense?

a. Pension cost interest

Post retirement health eare benefit interest

cc. Imputed interest on non-interest-bearing note

dd, _ Interest incurred to finance construction of machinery for own use

Under PAS 19, plan assets include all of the following, except

a. Assets held by a long-term employee benefit fund

b. Qualifying insurance policies

cc. Assets that are available to be used only to pay furld employee benefits and are not available for

payments to creditors even in bankruptcy

dd, Non-transferable financial instruments issued by the reporting,

prise

Under PAS 26, investments held by retirement benefit plans should be stated at which of the following values in their

‘Statement of net asset

a. Net realizable value ‘6. Original cost less impairment

b. Fair value Value in'use

PAS 26 (Accounting and reporting by retirement benelit plan ¢ following?

a. The costs to companies of employee retirement ber

b. Reports to individuals of their future retirement be

¢. The financial statements relating to an actuarial bu

4. The general purpose fi r

According 10 PAS 26 (Accounting, an

disclosed in the financial report of a de

contribution plan’?

a. Government bonds held

bb. Actuarial present value of promised retirement benefits

©. Employee contributions

4d. Employer contribut

roporting by retirement benetit plans), which of the following may be

xed henet plan but would not be shown in the financial report of a defined

‘Which of the following is the best description of the current PERS approach to interperiod tax alloeat

a, An application of the matching concept ©. The enacted method

b. Partial allocation 4d. The asset-iability method

Which could NEVER be subject to interperiod tax allocation?

a. Rent revenue Estimated warranty expense

b. Depreciation expense on assets dd, Interest revenue on municipal bonds

‘A deferred tax liability uses

a. The current tax laws, regardless of expected or enacted future tax laws

b. Expected future tax law, regardless of whether those expected laws have been

©. Current tax laws, unless enacted future ta laws are different

4. Either current of expected future tax laws, reganiless of whether those expected laws have been

enacted

Which of the following differences would result in future taxable amounts?

Expenses or losses that are deductible after they are recognized n financial income

b. Revenues of gains that are taxable before they are recognized n financial income

. _ Expenses of losses that are deductible before they are recognize n financial income

4. Revenues of pains that are recognized in financial income hut ure never included in taxable it

ted

Page 2 of 8 pages

ReSU - the Reriew School of lecomedtamen, TAPW-314

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 2

27. ABC Company’s financial reporting basis of its plant assets exceeded the tux basis because it uses a different method

of reporting depreciation for financial reporting purposes and tax purposes. If there is no other temporary differences,

ABC should report a

D a. Clirment tax asset Deferred tax.

b. Current tax payable d. Deferred tax liability

28, Which of the following statements is correct regarding the provision for income taxes in the financial statements ofa

1¢ axes should be based on business income using individ

1b. ‘The provision for income taxes should be based on business income using corporate tax rates

©. The provision for income taxes should be based on the proprictor’s total taxable income, allocated to

the proprietorship at the percentage that business income bears to the proprietor’s total income

4. No provision for income taxes is required

Which of the following liabilities is @ financial liability?

a Deferred revenui

b. A warranty obligation

A constructive obligation

4. An obligation to deliver own shares worth a fixed amount of cash.

30. What is the principle of accounting for a compound instrument (e.g., an issued convertible debt instrument)?

B 4. The issuer shall classily a compound instrument as either a liability or equity based on an evaluation

of the predominant characteristics of the contractual arrangement

1b. ‘The issuer shall classify the ‘and equity components of a compound instrument separately as

financial liabilities, financial assets or equity instruments

The issuer shall classify a compound instruments as a liability in into entirety, until converted into,

equity, unless the equity components shall be presented separately

4d. The issuer shall classify a compound instrument as a liability in its entirety, until converted into equity

SHAREHOLDERS EQUITY & EARNINGS PER SHARE (EPS)

1. Major factors contributing to the growth of corporation-business includes all of the follow:

D ‘a. The facility to accumulate large amounts of resources,

b. Easy transferability of the share of ownership

imited fiability of the sharcholders

4d. The luck of government regulation

2. Its an equity instrument that is subordinate to all other classes of equity instrument

A a. Ordinary share © 0

b. Potential ordinary share 4. Warrants

3. Capital stock is said to be watered when

B a. Liabilities are overstated €. It is sold ata price in excess of book value

b. Assets are overstated dd. Tis issued for aysets other than cash

4. Common shares issued would exceed common shares outstanding as a result of

. ‘a, Declaration of stock spi ©. Purchase of treasury stock

b. Declaration of. sock dividend d. Payment in full of subscribed stock

‘A gain o Joss from one of the following transactions should NOT be included in determining income.

a. Receipt of interest from bank deposits Sale of plant and equipment

b. Sale of treasury shares d. Sale of products

6. When rights are issued to current shareholders, the number of rights to be issued per existing share will

c a. Be the number of rights needed to obtain one additional share multiplied by the number of shares

already held

b. Vary depending on the number per share already held, as determined and announced by the

corporation

©. Usually be only one right per share already held

4d. Depend on the number purchased by existing shareholders

7. Companies that earry no insurance against insurable casualty loss sometimes use an account called reserve for self

insurance. In preparing a balance shect, this account should be reported us

A a. Appropriated retained earings © Liability

b. Deferred a 4d. Unappropriated retained earnings

8. The peso amount of total shareholders’ equity remains the same when there is

c a, Issuance of preferred stock in exchange for convertible debentures

'b. Issuance of nonconvertible bonds with detachable stock purchase warrants

Declaration of a stock dividend,

dd. Declaration ofa cash dividend

9. Which best describes the net effect on retained earings of the purchase and subsequent sale of treasury stock?

A Retained earnings may never be increased but sometimes decreased

ined earnings may never be increased or decreased

ctuined eamings may never be decreased but sometimes increased

Retained earnings is always affected unless the reissue price is exactly equal to cost

Page 3 of 8 pages ©

RESO - The Review School of lccourtancry TAPW-314

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Bitch) -Page

10, Afler a quasi-reorganization where a deficit is removed, the balance of retained earings will

a a. Increase Remain the same

b Decrease 4 Fithor increase or deerease

1. What do an appropriation of reained eamings and « declaration of a eash dividend (for the same amount) have in

“ ‘4. Both increase the amount of appropriated retained earnings

b. Both have the same consequences for shareholders

‘c, Both result in decrease in unappropriated retained caring,

4. Both permanently reduce future ability wo pay dividends

12, ‘The type of share capital that normally carries the most rights is:

A ‘Ordinary shares ©. Cumulative preference shares (nonvoti

'. Convenible preference shares (nonvoting) _d._Partiipating preference shares (nonvoting)

13. Preference share that has the most restrictive features i:

¢ Fully participating, nonvoting €, Noncumulative, nonparticipating, nonvoting

b. Nonpartcipating, cumulative, nonvoting _d_ Noncumulative fully participating, nonvoting

14, In accordance with PFRS 2 (Share-based payment), how should an entity reeognize the change in the fair value ofthe

liability in respeet ofa eash-settled share-bosed payment transaction

c ‘a. Recognize inthe statement of changes in equity

b. Recognize in other comprehensive income

©. Recognize in profit or toss

d, Do not recognize in the financial statements but disclose in the notes thereto

15. Which of the following transactions involving the issuance of shares does NOT come within the definition of a ‘share~

based!” payment under PERS 2?

a, Employee share purchase plans

b, Employee share option plans

€. Share-hased payment relating to an acquisition of a subsidiary

4. Share appreciation rights

16, In what circumstances is compensation expense immediately ree!

c ‘a. Inall circumstances

'b. _ Incircumstances when options are exercisable within 2 years tor services rendered over the next 2 years

€. Incircumstances when options are granted for prior service, and the options are immediately exercisable

4d, Inno circumstances is compensation expense immediately recognized

17. In aceouinting for share-based compensation under PFRS 2, what interest rate is used to discount both the exereise

price of the option and the future dividend stre

c ‘8, The firm's known incremental borrowing rate

b. ‘The current market rate that firms in that particular industry use to discount eash flows

€. The risk-free interest rate

dd. Any rate that firms can justify as being reasonable

18, Which of the following would be most indicative of a simple capital structure?

c ‘a, Common stock, preferred stock, and convertible securities outstanding

1b. Eamings derived from one primary line of the business

‘c. Ownership interests consisting solely common stock

d._ Fequity represented materially by liquid assets

19, When EPS is computed, dividends on preferred stock are

c a. Added because they represent earnings to preferred shareholders

b. Reported separately on the income statement

©. Subtracted because they represent earings to prefered sh

<4. Ignored because so they do not pertain to the common stoc!

20. The weighted average number of shares outstanding during the period for all periods (other than conversion of

potential common shares) shall be adjusted for

A ‘a. Any change in the number of ordinary shares without a change in resources

b. Any prior-year adjustment

cc. Any new issue of shares for cash

d. Any convertible instrument settled in eash

ized under PERS 2?

olders,

ERROR CORRECTION, CASH BASIS vs. ACCRUAL BASIS, SINGL ENTRY SYSTEM

1

©. Cash borrowed on a short-term note

4d. Sale of operational asset for eash

2. Which of the following would NOT represent cash inflow nor outflow?

B a. Cash dividend paid ¢ hase of treasury shares

b. Share dividends declared andl issued 4. Ordinary shares issued

Incorrect accounting records using only a cash book is a characteristic of

c ‘a. Cash basis ¢. Single entry system

1b. Accrual basis, d. Double

Page 4 of 8 pages

ReSQ - the Review School of lccountarey, TAPW-314

PREWEEK MATERALSn THEORY of ACCOUNTS (ay 208 ath) ages

4, Accrual basis of accounting

b ‘4. Omits adjusting atthe end ofthe petiod

Leads tothe reporting of more complete information than does cash basfy accounting

©. Is not acceptable under GAAP

d. Results in higher income than cash basis accounting,

5. Compared to the accrual basis of accounting, the eash basis of cco

the accounting period of

b 4 Both accounts receivable and acerued expenses

bh. Accrued expenses but not of accounts receivable

©. Neither accounts receivable nor of accrued expenses

41. Accounts receivable but not of acerued expenses

6. Which of the following could result in overstatement of both current assets and shareholders’ equity?

Dd An understatement of acerued sales commission

}. Noncurrent note receivable principal is misclassified as current asset

©. Annual depreciation on manufacturing machinery i understated

Holiday pay expense for administrative employees is misclassified as factory overhead

7. Which among the following errors could cause an understatement of owiers” equity and overstatement of Hiabi

D ft, Failure to record interest accrued om i rote payable

b, Making the adjusting entry for depreciation expense twice

€. Failure to make the adjusting eniry 0 record revenue which had been carted but not yet billed to

customers

4. Failure t record the earned portion of fees received in advance

ting understates income by net decrease during

HED

Derivatives are financial instruments that derive their value from changes in a benchmark (“underlying”) based on any

of the following, EXCEPT:

c a. Stock prices © Discount on accounts receivable

b. Commodity prices 4. Mortgage and currency rates

2. Itis aright and NOT an obligation to purchase or sell an asset,

B a. Equity contracts Forward contracts

b. Option contracts 4. Swap contracts

3. What is the type of financial risk involved when entities have outstanding purchase commitments?

A a. Price risk ©. Interest rate risk

b. Credit risk d. Foreign currency risk

4. A derivative that usually requires alittle or small initial net investment as a protection against unfavorable movements

in price.

A Option c. Forward contract

b. Swap Future contract

5. Allofthe following are derivative financial instruments, EXCEPT

D a, Currency futures © Stock index futures

b. Interest rate swaps Treasury bills and notes

6. Which of the following, is NOT a derivative instrament?

D ‘a. Futures contracts Interest rate swaps

b. Credit indexed contracts 4. Variable annuity contracts

7. Derivatives are measured at

A a. Fair value Fair value tess cost to sell

b. Cost 4d. Hligher between fair value and cost

8. Changes in Fair value on « derivative instrument that is not designated as a hedging instrument are

B ‘a, Not recognized

Recognized in carnings immediately

€. Recognized in equity section of the balance sheet

4, Recognized in earnings only when realized through sale

9, An interest rate swap in which a company has a ixed rate of interest and pays a variable rate is called

B a. Cash flow hedge

b. Pair value hedge

©. Deferred hedge

dd. Hedge of forcign curreney exposure of net investment in foreign operations

10. Which of the following is NOT a distinguishing characteristic of a derivative instrument?

B a, Terms that require or permit net settlement

b. Must be“ highly effective” throughout its Tife

No initial net investment

d. One ot more underlyings and notional amounts

I. Hedge accounting is permitted for all of the following types of hedges, EXCEPT

A a. Trading securities ©. Available-for-sale securities

b. Unrecognized firm commitments 4d. Net investments in forcign operations

Page 5 of 8 pages

ReSU - the Review School of Gccountoncy, TAPW-314

[PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page ©

12, A hedge of the exposure (o changes in the fair value of a recognized asset or liability, oF an unrecognized firm

classified aa

A value hedue ©

curreney hedge

Cash flow hedge d. Underlying

1B 1c of a derivative instrument determined to be an effective fair value hedge shall

A a. Be recognized in profit or loss ©. Be included in retained earnings

b. Be recognized d

14, Changes in fair value ofa deri

tly in equity. d. Not be recognized

strument that is determined to be an effective cash flow hedge shall

iained earings

d. Not be recognized

features that separately meet the definition of a derivative instrument, These

B a. Be recognized in profit or loss ©. Bejincluded in

b. Be recognized directly in equi

&—Bibedded derivative instruments

6. Underlying

istrument duic to possible failure of another party to perform

according to terms of the contract

ce a. Offebalance-sheet risk Credit risk

bb. Market risk d. Investment risk

2. Which of the following types of inform from financial instruments is not required

tw be disclosed by PFRS 7?

« 8, Qualitative and quantitative information about market risk

bh. Qualitative and quantitative information about credit risk

© Qualitative and quantitative information about operational risk

ive und quantitative information about liquidity risk

on about expostres to risks arisi

veting obligations associated with financial liabi

ulty in disposing a financial asset due to lack of market liquidity

ulty in meeting cash flow needs due to cash flow problems,

«d.__anentity’s cash inflows will not be sufficient to meet the entity’s cash outflows,

4, In accordance with PERS 7 (Financial Instrument Disclosures), which of the following best deseribes the risk that

entity will encounter if t has diffu! ting obligations associated with its financial liabilities?

A a. Liquidity risk ©. Financial risk

b. Credit risk d Payment risk

Under PERS 7, credit risk refers

‘a. The risk that one party to a financial instrument will cause a financial loss for the other party by

{ailing (0 discharge an obligation

b, The risk that an entity will encounter difficulty inn

di with financial

ing! obligations assoc

of a financial instrument will fluctuate because of

rest rate risk and other price risk) ~ market risk

41> The fk eas hi exe ees dre eae UI ess operation

6, Under PERS 7 (Financial Instruments Disclosures), whieh two of the following are components of market risk?

B a. Credit risk and Currency risk Interest rate risk and Liquidity risk

b. Currency risk and interest rate risk a. sk und Liquidity risk

7. Which ofthe following types of information des PERS 7 NOT require 0 be disclosed about the significance of

inancial instruments?

dD a Fai ee oC Ee dace aura

'b. Information about the use of hedge accounting,

¢. Carrying amounts of categories of financial instruments

d, Information about financial instruments, contracts, and obligations under share-based payment transactions

8, (OLD) Which types of entities are required to apply PAS 30 (Disclosures in the FS of banks and

nstitutions)

c a. Allentities

1b. Banks, insurance companies and other financial institutions that are subject to prudential supervision by

regulators

Banks and similar financial institutions, one of whose principal activities is to take deposits and borrow with

the objective of lending and investing, and which are within the scope of banking or similar legistation

4, Internationally active banks and similar Financial in

9. (OLD) What information does PAS 30 require to he disclosed about the concentrat

D a. Concentration of credit risk

‘Concentration of liquidity risk

oft

of assets and liailitic

b,

&

items:

Page 6 of 8 pages

ReSO - the Review School of Cccowmntoney, TAPW-314

PREWEEK MATERIALS in THEORY of ACCOUNTS (May 2016 Batch) - Page 7