Professional Documents

Culture Documents

02 Manila Electric Co. Vs El Auditor General

02 Manila Electric Co. Vs El Auditor General

Uploaded by

Justine GalandinesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Manila Electric Co. Vs El Auditor General

02 Manila Electric Co. Vs El Auditor General

Uploaded by

Justine GalandinesCopyright:

Available Formats

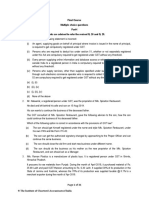

MANILA ELECTRIC CO.

vs El Auditor General is necessary for the public health, morals, or safety the legislature

may provide that such inspection or supervision shall be performed

FACTS: at the expense of the persons engaging in the occupation or

The Public Services Commission, based on the provisions of Article performing the act, and that no one shall engage in the occupation

40 CA 146, required the Complainant to pay a certain amount for the or perform that act until a fee or charge sufficient to cover the cost

rights of supervision and regulation of its electricity service. of the inspection or supervision has been paid.

Petitioner filed an appeal with the Auditor-General for the Similarly when an occupation is of such a character that lack of skill

reimbursment of such fees but such request was denied. and proficiency on the part of those who engaged in it will be a

The “rights” or “fees” collected by the PSC is supposedly for the menace to the public health or safety, an examination may be

recovery of the expenses it incurred for the work entailed by required of those who seek to engage in it, and the cost of such

exercising its power of supervision and regulation of the operations examination may be met by fees imposed upon those who take it.

and activities of the complainant’s business. PSC distuinguished The money thus raised, though paid into the treasury, is

these collections from taxes; appropriated in advance to the use provided by the statute, and

PSC: Taxes are an enforced contribution of money or other property does not go to the general support of the government. A statute

assessed in accordance with some reasonable rule of imposing such a charge, is not the levy of a tax, but a regulation, and

apportionment by authority of a sovereign state, on persons or the fee is a mere incident of the regulation, and in levying it the

property within its jurisdiction, for the purpose of defraying the legislature is not subject to the limitations which surround the

public expenses. Rights or fees are a reward or compensation taxing power.

allowed by law to an officer for specific services performed by him If revenue is the primary purpose and regulation is merely

in the discharge of his official duties; a sum certain given for a incidental the imposition is a tax, while if regulation is the primary

particular service; the sum prescribed by law as charge for services purpose the mere fact that incidentally a revenue is also obtained

rendered by public officers does not make the imposition a tax.

Inspection fees are not taxes, but are imposed under the

principle that they are compensation for services rendered in and

about making such inspection, which is presumably beneficial to

ISSUE: W/N the fees collected by PSC partake of the nature of taxes?NO

those on whom the fees are imposed, and they do not fall within a

RATIO: constitutional limitation concerning the imposition of a local

burden by way of taxation.

There is another form of pecuniary charge which is not a tax but an

incident of the power of regulation, but which, unlike the imposts

discussed in the previous paragraphs, may be imposed upon the

performance of an act which the legislature can neither tax not

hamper by any other pecuniary burden of a revenue producing

character. When an occupation or an act is of such a character that

a reasonable amount of inspection or supervision by public officials

You might also like

- General PrinciplesDocument15 pagesGeneral PrinciplesattywithnocaseyetNo ratings yet

- Tax RemediesDocument14 pagesTax RemediesCha100% (3)

- Xfinity - Statement - 2022-12-03Document5 pagesXfinity - Statement - 2022-12-03alan benedetta100% (1)

- Reviewer On Taxation MamalateoDocument80 pagesReviewer On Taxation MamalateoKMBH100% (2)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Electric BillDocument1 pageElectric BillChloe AlinsonorinNo ratings yet

- Comparative Analysis 8424 and 10963Document31 pagesComparative Analysis 8424 and 10963Rizza Angela Mangalleno100% (2)

- Onecard Statement (20 Jul 2022 - 19 Aug 2022) : Firoz AlamDocument3 pagesOnecard Statement (20 Jul 2022 - 19 Aug 2022) : Firoz AlamFiroz KhanNo ratings yet

- Tax Midterm ReviewerDocument32 pagesTax Midterm ReviewerJunivenReyUmadhayNo ratings yet

- Progressive Devt v. Quezon City (1989) Case Digest - ArcadioDocument2 pagesProgressive Devt v. Quezon City (1989) Case Digest - ArcadioR.D.B. Arcadio100% (1)

- Gomez V CADocument1 pageGomez V CAJustine GalandinesNo ratings yet

- Barut Vs - CabacunganDocument1 pageBarut Vs - CabacunganJustine GalandinesNo ratings yet

- Barut Vs - CabacunganDocument1 pageBarut Vs - CabacunganJustine GalandinesNo ratings yet

- REPUBLIC V Manila ElectricDocument4 pagesREPUBLIC V Manila ElectricSean GalvezNo ratings yet

- Nature of The Power To TaxDocument4 pagesNature of The Power To TaxLuisito Moslares MaestreNo ratings yet

- TAX I NotesDocument17 pagesTAX I Notes0506sheltonNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- Vitug Reviewer PDFDocument5 pagesVitug Reviewer PDFDavid TanNo ratings yet

- Impact of GST On Hotel IndustryDocument14 pagesImpact of GST On Hotel IndustryDebika SinghNo ratings yet

- As May Be Necessary To Carry Out The Provisions of This Act, Through SuchDocument2 pagesAs May Be Necessary To Carry Out The Provisions of This Act, Through SuchJustine GalandinesNo ratings yet

- Lee Vs PeopleDocument1 pageLee Vs PeopleJustine GalandinesNo ratings yet

- Commissioner of Internal Revenue Vs CoaDocument4 pagesCommissioner of Internal Revenue Vs CoaAb Castil100% (1)

- TAX Reviewer Part1Document13 pagesTAX Reviewer Part1Maricor EstrellaNo ratings yet

- Calalang v. LorenzoDocument1 pageCalalang v. LorenzoJay-ar Rivera BadulisNo ratings yet

- 04 Maglasang Vs CabatinganDocument1 page04 Maglasang Vs CabatinganJustine GalandinesNo ratings yet

- Republic vs. MeralcoDocument2 pagesRepublic vs. MeralcoPaolo Adalem100% (3)

- PhilComSat Vs AlcuazDocument3 pagesPhilComSat Vs AlcuazSheila CorpuzNo ratings yet

- Tax Differentiated From Other TermsDocument2 pagesTax Differentiated From Other TermsMiguel Satuito100% (1)

- City of CDO vs. CEPALCO DigestDocument2 pagesCity of CDO vs. CEPALCO DigestAmielle Canillo75% (4)

- 04 Victorias Milling Co. Inc. vs. Municipality of VictoriasDocument2 pages04 Victorias Milling Co. Inc. vs. Municipality of VictoriasJamaica Cabildo ManaligodNo ratings yet

- Association of Southern Tagalog Electric Cooperatives, Inc. vs. Energy Regulatory CommissionDocument27 pagesAssociation of Southern Tagalog Electric Cooperatives, Inc. vs. Energy Regulatory CommissionLance Christian ZoletaNo ratings yet

- Concept and Purpose of TaxationDocument5 pagesConcept and Purpose of TaxationNaiza Mae R. Binayao100% (1)

- Barut Vs - CabacunganDocument2 pagesBarut Vs - CabacunganJustine GalandinesNo ratings yet

- 1-Utak Vs ComelecDocument1 page1-Utak Vs ComelecJustine GalandinesNo ratings yet

- 4 7 2 Cir Vs Coa LDocument13 pages4 7 2 Cir Vs Coa LKing BautistaNo ratings yet

- Philippine Communications Satellite Corporation Vs Alcuaz, 180 SCRA 218 Case Digest (Administrative Law)Document1 pagePhilippine Communications Satellite Corporation Vs Alcuaz, 180 SCRA 218 Case Digest (Administrative Law)AizaFerrerEbina100% (3)

- Philcomsat V AlcuazDocument2 pagesPhilcomsat V AlcuaziptrinidadNo ratings yet

- 15 Progressive Development V QCDocument11 pages15 Progressive Development V QCrgtan3No ratings yet

- GR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTADocument3 pagesGR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTAtanniebangbang882No ratings yet

- Notes Tax I Aug 14 Part 2Document6 pagesNotes Tax I Aug 14 Part 20506sheltonNo ratings yet

- Notes - Tax I - Aug 14 - Part 2Document6 pagesNotes - Tax I - Aug 14 - Part 20506sheltonNo ratings yet

- Taxation Power Distinguished From Police Power: Tax Vs License FeesDocument2 pagesTaxation Power Distinguished From Police Power: Tax Vs License FeesNikko AlelojoNo ratings yet

- Petitioner Respondents Rilloraza, Africa, de Ocampo & Africa Victor de La SernaDocument14 pagesPetitioner Respondents Rilloraza, Africa, de Ocampo & Africa Victor de La SernaEsther MozoNo ratings yet

- Progressive Development Corporation vs. Quezon City (1989)Document10 pagesProgressive Development Corporation vs. Quezon City (1989)Rad IsnaniNo ratings yet

- Tax1: Classification of Taxes: MVR Fees Are Both Tax and Regulatory ExactionsDocument16 pagesTax1: Classification of Taxes: MVR Fees Are Both Tax and Regulatory Exactionssarah_trinidad_11No ratings yet

- Third Division: Syllabus SyllabusDocument9 pagesThird Division: Syllabus SyllabusCamille CruzNo ratings yet

- Republic vs. Manila Electric CompanyDocument15 pagesRepublic vs. Manila Electric CompanyFrizie Jane Sacasac MagbualNo ratings yet

- Chapter 34Document10 pagesChapter 34Kaila Mae Tan DuNo ratings yet

- VAT Important DoctrinesDocument7 pagesVAT Important DoctrineskaiaceegeesNo ratings yet

- Cir vs. San Roque. Gr. No.187485 - 0ctober 8,2013Document23 pagesCir vs. San Roque. Gr. No.187485 - 0ctober 8,2013evelyn b t.No ratings yet

- Tep Notes: " With God, All Things Are Possible" Mt. 19:26Document8 pagesTep Notes: " With God, All Things Are Possible" Mt. 19:26Tep DomingoNo ratings yet

- Phil. Communications Satellite Corporation vs. AlcuazDocument19 pagesPhil. Communications Satellite Corporation vs. AlcuazRustom IbañezNo ratings yet

- The Commissioner Hindu Endowmnents.Document6 pagesThe Commissioner Hindu Endowmnents.Sanni KumarNo ratings yet

- Expense CasesDocument11 pagesExpense CasesJoshua AmahitNo ratings yet

- 003 Republic vs. Manila Electric CompanyDocument18 pages003 Republic vs. Manila Electric CompanyMoyna Ferina RafananNo ratings yet

- Tax DigestDocument25 pagesTax DigestAerwin AbesamisNo ratings yet

- Ra 8282: Social Security Law: Sss vs. Atlantic GulfDocument16 pagesRa 8282: Social Security Law: Sss vs. Atlantic GulfKarl SaysonNo ratings yet

- Both Statements Are False (4) The First Statement Is True and The Second Is FalseDocument4 pagesBoth Statements Are False (4) The First Statement Is True and The Second Is FalseNoreen NombsNo ratings yet

- Philippine - Communications - Satellite - Corp. - v. Alcuaz PDFDocument12 pagesPhilippine - Communications - Satellite - Corp. - v. Alcuaz PDFMark Jeson Lianza PuraNo ratings yet

- Progressive Dev't Corp. v. Quezon CityDocument4 pagesProgressive Dev't Corp. v. Quezon CityOne TwoNo ratings yet

- Taxes Are The Enforced Proportional Contribution From Persons and Property Levied byDocument3 pagesTaxes Are The Enforced Proportional Contribution From Persons and Property Levied byKenneth Abarca SisonNo ratings yet

- Case 1Document2 pagesCase 1Honeybeez TvNo ratings yet

- Charging Fees For Public Sector Goods and Services: Good Practice GuideDocument32 pagesCharging Fees For Public Sector Goods and Services: Good Practice GuideIndah ShofiyahNo ratings yet

- Limitations I Nthe Power To TaxDocument3 pagesLimitations I Nthe Power To TaxJoshua AmahitNo ratings yet

- PHILCOMSAT Vs AlcuazDocument16 pagesPHILCOMSAT Vs AlcuazPJ SLSRNo ratings yet

- Purpose:: Basic Principles of Taxationa. Taxation As An Inherent Power of The StateDocument1 pagePurpose:: Basic Principles of Taxationa. Taxation As An Inherent Power of The StateMark SorianoNo ratings yet

- Republic Vs MeralcoDocument2 pagesRepublic Vs MeralcoGraziella AndayaNo ratings yet

- Tax Midterms ReviewerDocument43 pagesTax Midterms ReviewerJM GuevarraNo ratings yet

- First Exam Taxation Law Review: General OverviewDocument55 pagesFirst Exam Taxation Law Review: General Overviewana100% (1)

- 01.04 Republic vs. Manila Electric CompanyDocument19 pages01.04 Republic vs. Manila Electric CompanyLloyd ReyesNo ratings yet

- 042 - Republic v. ICCDocument3 pages042 - Republic v. ICCjrvyeeNo ratings yet

- A. Concept, Underlying Basis, and Purpose: Part I - General PrinciplesDocument5 pagesA. Concept, Underlying Basis, and Purpose: Part I - General PrinciplesBadong SilvaNo ratings yet

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationFrom EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNo ratings yet

- 8 de La Llana Vs AlbaDocument2 pages8 de La Llana Vs AlbaJustine GalandinesNo ratings yet

- 13 - Sison v. Ancheta - SaleDocument2 pages13 - Sison v. Ancheta - SaleJustine GalandinesNo ratings yet

- 01 - Progressive Development Corp. v. Quezon CityDocument2 pages01 - Progressive Development Corp. v. Quezon CityJustine GalandinesNo ratings yet

- 06 - Honda Cars v. Honda UnionDocument2 pages06 - Honda Cars v. Honda UnionJustine GalandinesNo ratings yet

- 10 - Ferrer v. BautistaDocument1 page10 - Ferrer v. BautistaJustine GalandinesNo ratings yet

- Imbong Vs OchoaDocument2 pagesImbong Vs OchoaJustine GalandinesNo ratings yet

- NG Vs PeopleDocument1 pageNG Vs PeopleJustine GalandinesNo ratings yet

- Menciano Vs San JoseDocument2 pagesMenciano Vs San JoseJustine GalandinesNo ratings yet

- Limcoma Multipurpose Vs RepublicDocument2 pagesLimcoma Multipurpose Vs RepublicJustine Galandines100% (1)

- 04 Lonzanida Vs COMELECDocument2 pages04 Lonzanida Vs COMELECJustine GalandinesNo ratings yet

- Sale Was An Involuntary Error and That The Real Intention Was To Convey The Lot Identified As 535-ADocument1 pageSale Was An Involuntary Error and That The Real Intention Was To Convey The Lot Identified As 535-AJustine GalandinesNo ratings yet

- 01 Gojo V GoyalaDocument1 page01 Gojo V GoyalaJustine GalandinesNo ratings yet

- Service Quote SWQ000441Document1 pageService Quote SWQ000441WALTER KLISSMANNo ratings yet

- CBAM GutachtenDocument44 pagesCBAM GutachtenAnnhNo ratings yet

- 1043 Rose Oil Drop LabelDocument2 pages1043 Rose Oil Drop LabelAli MalekiNo ratings yet

- Ele - Bill JuneDocument1 pageEle - Bill Juneabcd12345poiNo ratings yet

- GSRTC Ticket-1Document1 pageGSRTC Ticket-1hamirNo ratings yet

- Toursim ApplicationDocument4 pagesToursim Applicationmanohar_mca10No ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowAoTR BSNL BHILWARANo ratings yet

- Example Withholding TaxDocument2 pagesExample Withholding TaxRaudhatun Nisa'No ratings yet

- Final Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Document31 pagesFinal Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Sanket Mhetre100% (1)

- Mathematical Literacy Grade 12 Term 1 Week 3 - 2021 1Document12 pagesMathematical Literacy Grade 12 Term 1 Week 3 - 2021 1Thato Moratuwa MoloantoaNo ratings yet

- Multiple Choice Questions: As-Level Economics - Test 1 NameDocument5 pagesMultiple Choice Questions: As-Level Economics - Test 1 NameRoshan Ismail0% (1)

- Khalid Mehmood S/O Muhammad Ramzan (Late) Adil Town Manga MandiDocument1 pageKhalid Mehmood S/O Muhammad Ramzan (Late) Adil Town Manga MandiAZIZ REHMANNo ratings yet

- Commercial Invoice - Dedi IrwanDocument1 pageCommercial Invoice - Dedi IrwandharmawanNo ratings yet

- 17027405959014095ASO1Document1 page17027405959014095ASO1thinklikebrilliantNo ratings yet

- INV212635826Document3 pagesINV212635826Carito SandiNo ratings yet

- Ch16 TaxationDocument17 pagesCh16 TaxationAhmed DanafNo ratings yet

- Introduction To Export MarketingDocument26 pagesIntroduction To Export Marketingsaniya lanjekarNo ratings yet

- Tariff Barriers Are Charges Imposed Upon Imports - So They Are A Form of Import TaxationDocument4 pagesTariff Barriers Are Charges Imposed Upon Imports - So They Are A Form of Import TaxationBalaji ChandrasekaranNo ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Confirmation - JAL International BookingDocument3 pagesConfirmation - JAL International Bookingshubhsharma15112010No ratings yet

- Ticket: At/Etkt 147 5087940785 For Doucoure/Fousseny MRDocument2 pagesTicket: At/Etkt 147 5087940785 For Doucoure/Fousseny MRBakaye DembeleNo ratings yet

- 3 BMW Motorrad Price Compressed 2021Document2 pages3 BMW Motorrad Price Compressed 2021Dhaval WaghelaNo ratings yet

- The Doha RoundDocument10 pagesThe Doha Roundchan_1016No ratings yet

- Federal Board of Revenue FBR McqsDocument10 pagesFederal Board of Revenue FBR McqsHassan Ali0% (3)

- UNIT-2 Public Revenue: An Overview of PRDocument67 pagesUNIT-2 Public Revenue: An Overview of PRmelaNo ratings yet