Professional Documents

Culture Documents

Chapter 18 Intermediate Accounting 2e Gordon TB

Uploaded by

Chippu AnhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 18 Intermediate Accounting 2e Gordon TB

Uploaded by

Chippu AnhCopyright:

Available Formats

lOMoARcPSD|4810275

Gia02 tb chapter 18 - Intermediate Accounting 2E - Gordon -

TB

Intermediate Accounting I (Southern Methodist University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

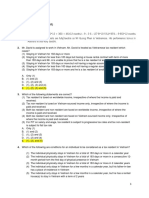

Intermediate Accounting, 2e (Gordon/Raedy/Sannella)

Chapter 18 Accounting for Leases

18.1 Leases: Overview

1) In general, the cost of an asset over the life of the lease is lower than if the lessee

purchased the asset.

Answer: FALSE

Diff: 1 Var: 1

Objective: 18.1

IFRS/GAAP: GAAP

AACSB: Reflective thinking

2) When a company purchases equipment by issuing a long-term note, the interest element

of the payment is tax deductible. However, if the company leases equipment, the entire

lease payment may be tax deductible.

Answer: TRUE

Diff: 1 Var: 1

Objective: 18.1

IFRS/GAAP: GAAP

AACSB: Reflective thinking

3) The concept of substance over form can be applied to leases. Which lease terms are most

important to understanding the economic substance of the lease contract?

Answer: The amount and timing of lease payments; the length of the lease; the economic

life of the leased asset; whether the lease transfers ownership of the leased asset to the

lessee at the end of the lease; and whether the lessee can, and is likely to, buy the leased

item at the end of the lease.

Diff: 1 Var: 1

Objective: 18.1

IFRS/GAAP: GAAP

AACSB: Reflective thinking

18.2 Lease Contracts, Lease Components, and Contract Consideration

1) After identifying a lease, both the lessee and the lessor are required to separate the

various lease and nonlease components and allocate consideration to these components.

Answer: TRUE

Diff: 1 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

2) When there are several assets as part of the lease, only some must be separately

identified.

Answer: FALSE

Diff: 1 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

1

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

3) Which of the following assets is always considered a separate lease component in a lease,

unless the impact on the financial statements of not separating it from the other asset(s) is

insignificant?

A) land

B) services associated with the lease

C) fully depreciated assets

D) All of the above

Answer: A

Diff: 2 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

4) In cases where the standalone price is highly variable or uncertain, the lessee may use

what type of method for determining standalone prices?

A) market method

B) residual method

C) component method

D) Both A and C are correct.

Answer: B

Diff: 2 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

5) Which of the following items are not examples of initial direct lease costs?

A) commissions

B) legal fees resulting from the execution of the lease

C) costs to prepare documents after the execution of the lease

D) All of the above are examples of indirect lease costs.

Answer: D

Diff: 1 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

6) In instances where there is not an observable standalone selling price, the lessor must

use an estimate of the standalone selling price and allocate it based on which of the

following methods?

A) adjusted market assessment approach

B) expected-cost-plus-a-margin approach

C) residual approach

D) any of the above approaches

Answer: D

Diff: 1 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

2

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

7) Alpha Company has three components in their lease agreement: the building, the

equipment and the maintenance service. Total consideration in the contract is $500,000 per

year. Alpha Company has identified the following standalone prices:

Component Standalone Price

Building $400,000

Equipment 100,000

Maintenance/Service 50,000

Total $550,000

Calculate the percentages and allocate the consideration to each component.

Answer: As the total consideration in the contract is not equal to the sum of the standalone

prices, Alpha Company uses the relative standalone prices to allocate the total consideration

to each component. The $500,000 total consideration is allocated as follows: (Round

percentages to two decimal places.)

Standalone Allocated

Component Price Percentage Consideration

Building $400,000 72.73% $363,650

Equipment 100,000 18.18% 90,900

Maintenance/Service 50,000 9.09% 45,450

Total $550,000 $500,000

Diff: 2 Var: 1

Objective: 18.2

IFRS/GAAP: GAAP

AACSB: Application of knowledge

18.3 Lease Classifications

1) Present value of lease payments + Present value of guaranteed or unguaranteed residual

asset = Fair value of leased asset + Deferred initial direct costs.

Answer: TRUE

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

2) The initial direct costs cannot be deferred and the lessor must expense initial direct costs

at the lease commencement.

Answer: FALSE

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

3

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

3) IFRS does not classify leases as operating and financing and does not distinguish two

types of leases. Rather, lessee accounting treatment is the same for all leases under IFRS.

Answer: TRUE

Diff: 1 Var: 1

Objective: 18.3

IFRS/GAAP: IFRS

AACSB: Application of knowledge

4) The Group II criteria seem like a simple way to achieve a reporting outcome. FASB wanted

lessors to recognize a profit at lease commencement from nonoperating lease treatment

due partly to a third-party residual value guarantee.

Answer: FALSE

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

5) The ________ date is when the lease agreement is signed. The ________ date is the date on

which the lessee is allowed to begin using the leased asset.

A) lease inception; lease commencement

B) lease consideration; lease commencement

C) lease inception; lease finalization

D) Both A and B are correct.

Answer: A

Diff: 1 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

6) If the lessor meets any one of the five Group I criteria, then the lessor classifies the lease

as a(n) ________. If the lessor meets both of the Group II criteria, but none of the Group I

criteria, then the lessor classifies the lease as a(n) ________. If the transaction does not meet

either the Group I or Group II criteria, then the lessor classifies the lease as a(n) ________.

A) operating lease; direct financing lease; sales-type lease

B) sales-type lease; direct financing lease; operating lease

C) standalone price lease; sales-type lease; direct financing lease

D) direct financing lease; operating lease; sales-type lease

Answer: B

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

4

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

7) Prior to 2019, lessees did not include the right-of-use asset and the lease liability for

operating leases on their balance sheets. Both FASB and IASB wrote new standards to

require that lessees nearly always report an asset and liability on their balance sheets when

they engage in a lease transaction. This accounting results in which of the following?

A) a more reliable estimation of the lease's value

B) a more faithful representation of the rights and obligations arising from leases

C) a better determination on whether the lessor held the risks and rewards of the leased

asset's ownership

D) All of the above

Answer: B

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP/IFRS

AACSB: Application of knowledge

8) Kataran Company enters into a 4-year lease transaction, with payments due at the

beginning of each year.

The lease payments are $78,000 per year.

The fair value of the leased asset is $290,000.

The lessor's deferred initial direct costs are equal to $24,000.

The lessor's estimate of the unguaranteed residual asset is $115,000.

Based on the above information, what is the implicit rate in the lease for Kataran?

A) 11.48%

B) 21.81%

C) 14.77%

D) 16.54%

Answer: D

Explanation: Kataran should apply time value of money concepts to identify the terms

needed to solve for the implicit rate. The present value, PV, is the present value of the lease

payments plus the expected residual value which equals the fair value of the leased asset

plus the deferred initial direct costs:

Present Value of Lease Payments + Present Value of Estimated Residual Value

= $290,000 Fair Value of Leased Asset + $24,000 Initial Direct Costs = $314,000

The number of periods, N, is 4 years. The payments each period, PMT, are $78,000. The

future value, FV, is the residual value of $115,000. Using the RATE function in Excel,

(=RATE(4,78000,-314000,115000,1)), the implicit rate in the lease is 16.54%.

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

5

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

9) Kataran Company enters into a 4-year lease transaction, with payments due at the

beginning of each year.

The lease payments are $68,000 per year.

The fair value of the leased asset is $280,000.

The lessor's deferred initial direct costs are equal to $14,000.

The lessor's estimate of the unguaranteed residual asset is $125,000.

Based on the information above, what is the implicit rate?

Answer: Kataran should apply time value of money concepts to identify the terms needed to

solve for the implicit rate. The present value, PV, is the present value of the lease payments

plus the expected residual value which equals the fair value of the leased asset plus the

deferred initial direct costs:

Present Value of Lease Payments + Present Value of Estimated Residual Value = $280,000

Fair Value of Leased Asset + $14,000 Initial Direct Costs = $294,000. The number of

periods, N, is 4 years. The payments each period, PMT, are $68,000. The future value, FV, is

the residual value of $125,000. Using the RATE function in Excel (=RATE(4,68000,-

294000,125000,1)), the implicit rate in the lease is 15.14%.

Diff: 3 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

10) Group I criteria provide guidance to operationalize the concept of ownership and control

of an asset. To meet the Group I criteria, a transaction only needs to meet one of the five

criteria. List those five criteria.

Answer:

1. The lease transfers ownership of the leased asset to the lessee at the end of the lease

term. If the lease transfers ownership, then the lessee firm has, in essence, purchased the

asset.

2. The lessee is given an option to purchase the asset that the lessee is reasonably certain

to exercise. For example, it might be reasonably certain that the lessee would exercise a

purchase option if the specified purchase price is well below the expected value of the

leased asset at the completion of the lease term.

3. The lease term is for a major part of the economic life of the asset. If the lease term

provides the lessee the use and control over substantially all of the asset's useful life, then

the agreement should be considered equivalent to purchasing the asset.

4. The present value of the sum of the lease payments and any residual value the lessee

guarantees to pay (that is not otherwise included in the lease payments) is equal to

substantially all of the asset's fair value. The present value computation includes lease

payments in the renewal periods, if any. Meeting this criterion implies that the lessee is

providing the lessor compensation that is equivalent to the purchase of the asset.

5. The leased asset is of a specialized nature. An asset with a specialized nature has no

alternative use to the lessor at the end of the lease term. Because the asset has no

alternative use to the lessor, its specialized nature implies that the lessor must have

transferred control over the asset to the lessee.

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: GAAP

AACSB: Application of knowledge

6

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

11) List the three additional indicators that IFRS recognizes individually or in combination

that could lead to classifying a lease as a finance lease.

Answer:

1. The lessee bears the lessor's losses if the lessee cancels the lease.

2. The lessee absorbs the gains or losses from fluctuations in the fair value of the residual

value of the asset.

3. The lessee may extend the lease for a secondary period at a rent substantially below the

market rent in a renewal option.

Diff: 2 Var: 1

Objective: 18.3

IFRS/GAAP: IFRS

AACSB: Application of knowledge

18.4 Accounting for Operating Leases: Lessee and Lessor

1) Measuring the right-of-use asset includes the following components: the lease liability

determined as the future value of the remaining lease payments, lease payments the lessee

makes to the lessor at or before the commencement date, a reduction for any lease

incentives the lessee receives and any initial direct costs the lessee incurs.

Answer: FALSE

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

2) For an operating lease, the lessee will record a(n) ________ and an associated lease

liability on the balance sheet.

A) intangible asset

B) capital adjustment

C) contra-liability account

D) right-of-use asset

Answer: D

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP/IFRS

AACSB: Application of knowledge

3) On the balance sheet, the lease liability is measured as ________.

A) the present value of the lease payments plus the present value of the guaranteed

residual value if the lessee guarantees it(if any)

B) the present value of the lease payments less the present value of the guaranteed residual

value (if any)

C) the future value of the lease payments plus the future value of the guaranteed residual

value (if any)

D) the present value of the lease payments plus the future value of the guaranteed residual

value (if any)

Answer: A

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

7

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

4) Which of the following statements is true?

A) The right-of-use asset is increased by prepaid lease payments, but reduced by lease

incentives and the lessee's initial direct costs.

B) The right-of-use asset is increased by prepaid lease payments and the lessee's initial

direct costs, but reduced by lease incentives.

C) The right-of-use asset is reduced by the lessee's initial direct costs, but increased by

lease incentives and prepaid lease payments.

D) The right-of-use asset is reduced by prepaid lease payments and the lessee's initial direct

costs, but increased by lease incentives.

Answer: B

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

5) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $77,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,900 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,900, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 7% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $1,200.

Assuming that this is classified as an operating lease, what is the amount of the lease

liability on January 1, 2019 before the lease payment?

A) $47,821

B) $45,892

C) $44,692

D) $64,200

Answer: A

Explanation: The lease liability is calculated as the present value of the future payments.

Using Excel, the present value of the future lease payments, based on a rate of 7%, 5

periods, and payments at the beginning of each period of $10,900, is $47,821. The Excel

formula: =PV(0.07,5,-10900,0,1) = $47,821.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

8

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

6) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $71,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,000 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,000, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $1,500.

Compute the present value of the lease payments in order to determine if the lease meets

the fourth Group I criterion. Calculate the present value of each payment individually.

Assuming that this is classified as an operating lease, what is the value of the right-of-use

asset at the lease's commencement?

A) $44,518

B) $46,018

C) $57,799

D) $47,799

Answer: C

Explanation: The right-of-use asset is valued as the initial measurement of the lease liability

(the present value of the future lease payments) plus prepayments plus initial direct costs.

Using Excel, the present value of the future lease payments, based on a rate of 4%, 5

periods, and payments at the beginning of each period of $10,000, is $46,299. The value of

the right-of-use asset is $46,299 + $10,000 + $1,500 = $57,799.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

7) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $77,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,900 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,900, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 6% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $1,100.

Assuming that this is classified as an operating lease, what is the annual lease expense

reported on the income statement?

A) $10,900

B) $13,300

C) $12,000

D) $11,120

Answer: B

Explanation: To calculate the annual lease expense, the first step is to calculate the total

payments over the life of the lease, which include prepaid payments, annual payments and

initial direct costs. Total payments are $10,900 + (5 × $10,900) + $1,100 = $66,500.

Annual lease expense is calculated by allocating this amount equally over the 5-year lease

life, $66,500 / 5 = $13,300.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

8) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $76,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

9

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,000 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,000, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 6% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $1,100.

In addition to the information provided above, assume that Bumble provided a $6,000

incentive. Assuming that this is classified as an operating lease, what is the annual lease

expense reported on the income statement?

A) $10,000

B) $12,220

C) $11,100

D) $11,020

Answer: D

Explanation: To calculate the annual lease expense, the first step is to calculate the total

payments over the life of the lease, which include prepaid and annual payments and initial

direct costs, less lease incentives. Total payments are $10,000 + (5 × $10,000) + $1,100 -

$6,000 = $55,100. Annual lease expense is calculated by allocating this amount equally

over the 5-year lease life, $55,100 / 5 = $11,020.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

9) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $78,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,700 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,700, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $2,000.

Assuming that this is classified as an operating lease, how much interest expense is

recorded in 2019?

A) $1,982

B) $0

C) $2,140

D) $1,554

Answer: D

Explanation: Interest for 2019 is calculated based on the lease liability reduced by the first

payment of $10,700 times the interest rate. The lease liability is calculated as the present

value of the future payments. Using Excel, the present value of the future lease payments,

based on a rate of 4%, 5 periods, and payments at the beginning of each period of $10,700,

is $49,540. ($49,540 - $10,700) × 4% = $1,554.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

10) Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $80,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,800 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,800, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase

10

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $1,100.

Assuming that this is classified as an operating lease, how much amortization is recorded on

the right-of-use asset in 2019?

A) $11,612

B) $0

C) $13,180

D) $1,568

Answer: A

Explanation: Amortization is the difference between the lease expense for the year and

interest for the year. To calculate the annual lease expense, the first step is to calculate the

total payments over the life of the lease, which include prepaid and annual payments and

initial direct costs. Total payments are $10,800 + (5 × $10,800) + $1,100 = $65,900.

Annual lease expense is calculated by allocating this amount equally over the 5-year lease

life, $65,900 / 5 = $13,180. Interest for 2019 is calculated based on the lease liability

reduced by the first payment of 5 times the interest rate. The lease liability is calculated as

the present value of the future payments. Using Excel, the present value of the future lease

payments, based on a rate of 4%, 5 periods, and payments at the beginning of each period

of $10,800, is $50,003. ($50,003 - $10,800) × 4% = $1,568. Therefore, amortization is

$13,180 - $1,568 = $11,612.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

11

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

11) Starboard Industries enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $73,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Starboard will return the automobile to Bumble

on December 31, 2023. The automobile has an estimated useful life of 7 years. Starboard

made a lease payment of $10,300 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,300, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 4% and is known by Starboard. Starboard guarantees

a residual value of $3,000 and incurs initial direct costs of $1,700.

Assuming that this is classified as an operating lease, what is the amount of the lease

liability on January 1, 2019 before the lease payment?

A) $47,688

B) $50,154

C) $45,854

D) $60,100

Answer: B

Explanation: The lease liability is calculated as the present value of the future payments.

Using Excel, the present value of the future lease payments, based on a rate of 4%, 5

periods, payments at the beginning of each period of $10,300, and a future value of $3,000

is $50,154. The Excel formula is =PV(0.04,5,-10300,-3000,1) = $50,154.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

12

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

12) Starboard Industries enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $73,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Starboard will return the automobile to Bumble

on December 31, 2023. The automobile has an estimated useful life of 7 years. Starboard

made a lease payment of $10,400 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,400, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 5% and is known by Starboard. Starboard guarantees

a residual value of $4,500 and incurs initial direct costs of $1,600.

Assuming that this is classified as an operating lease, what is the value of the right-of-use

asset at the lease's commencement?

A) $45,027

B) $46,627

C) $59,278

D) $62,804

Answer: D

Explanation:

Initial measurement of the lease liability $50,804

Payments lessee makes to the lessor prior to the lease

commencement date 10,400

Lease incentives received 0

Initial direct costs incurred by the lessee 1,600

Initial measurement of the right-of-use asset $62,804

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 5%, 5 periods, payments at

the beginning of each period of $10,400, and a future value of $4,500 is $50,804. The Excel

formula is =PV(0.05,5,-10400,-4500,1) = $50,804.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

13

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

Leewin Brokerage

Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile

with a fair value of $75,000 under a 5-year lease on December 20, 2018. The lease

commences on January 1, 2019, and Leewin will return the automobile to Bumble on

December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a

lease payment of $10,000 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,000, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 7% and is known by Leewin. There is no purchase

option, no lease incentives, no residual value guarantees, and no transfer of ownership.

Leewin incurs initial direct costs of $2,000.

13) Assuming that this is classified as an operating lease, what is the amount of the lease

liability at January 1, 2019 before the payment?

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 7%, 5 periods, and

payments at the beginning of each period of $10,000, is $43,872. The Excel formula is:

=PV(.07,5,-10000,0,1) = $43,872.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

14) Based on the above information, calculate the right-of-use asset on January 1, 2019.

Answer:

Initial measurement of the lease liability $43,872

Payments lessee makes to the lessor prior to the lease

commencement date 10,000

Lease incentives received 0

Initial direct costs incurred by the lessee 2,000

Initial measurement of the right-of-use asset $55,872

*The lease liability is found using the Excel formula: =PV(.07,5,-10000,0,1) = $43,872.

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

15) Based on the above information, what is the journal entry Leewin made to record the

initial payment of $10,000?

Answer:

Account December 20, 2018

Prepaid Lease Payment 10,000

Cash 10,000

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

14

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

16) Based on the above information, record the lessee's journal entry for the payment of

initial direct costs.

Answer:

Account January 1, 2019

Prepaid Initial Direct Costs 2,000

Cash 2,000

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

17) Assuming this is an operating lease, what journal entries does Leewin make on January

1, 2019?

Answer:

January 1, 2019

Account Debit Credit

Prepaid Initial Direct Costs 2,000

Cash 2,000

Account January 1, 2019

Right-of-Use Asset 55,872

Prepaid Lease Payment 10,000

Prepaid Initial Direct

Costs 2,000

Lease Liability 43,872

January 1, 2019

Account Debit Credit

Lease Liability 10,000

Cash 10,000

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 7%, 5 periods, and payments

at the beginning of each period of $10,000, is $43,872. The Excel formula is =PV(.07,5,-

10000,0,1) = $43,872.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

15

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

18) What journal entry does Leewin make on January 1, 2019 to record the annual lease

payment?

Answer:

Account January 1, 2019

Lease Liability 10,000

Cash 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

19) Assuming that this is classified as an operating lease, what is the annual lease expense

reported on the income statement?

Answer: To calculate the annual lease expense, the first step is to calculate the total

payments over the life of the lease, which include initial and annual payments and indirect

costs. Total payments are $10,000 + (5 × $10,000) + $2,000 = $62,000. Annual lease

expense is calculated by allocating this amount equally over the 5-year lease life, $62,000 /

5 = $12,400.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

20) Assuming that this is classified as an operating lease, create an amortization table for

periodic interest and reduction in the liability.

Periodic Interest and Reduction in the Liability

Reduction in

Payment Interest Lease Liability Balance

Lease commencement:

1/1/2019

1/1/2020

1/1/2021

1/1/2022

1/1/2023

Answer:

Periodic Interest and Reduction in the Liability

Payment Interest Reduction Balance

43,872

Lease commencement:

1/1/2019 10,000 10,000 33,872

1/1/2020 10,000 2,371 7,629 26,243

1/1/2021 10,000 1,837 8,163 18,080

1/1/2022 10,000 1,266 8,734 9,346

1/1/2023 10,000 654 9,346 (0)

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

21) Assuming that this is classified as an operating lease, create an amortization table for

the right-of-use asset.

16

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

Amortization of Right-of-Use Asset

Lease Amortization of

Expense Interest Right-of-Use Asset

12/31/2019

12/31/2020

12/31/2021

12/31/2022

12/31/2023

Total

Answer:

Amortization of Right-of-Use Asset

Lease Amortization of

Expense Interest Right-of-Use Asset

12/31/2019 12,400 2,371 10,029

12/31/2020 12,400 1,837 10,563

12/31/2021 12,400 1,266 11,134

12/31/2022 12,400 654 11,746

12/31/2023 12,400 0 12,400

Total 62,000 6,128 55,872

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

22) Prepare the journal entry required on December 31, 2019. Assume this is an operating

lease.

Answer:

Date Account Debit Credit

12/31/2019Lease Expense 12,400

Lease Liability 7,629

Accumulated Amortization–Right-of-Use

Asset 10,029

Accrued Lease Payable 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

17

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

Starboard Industries

Starboard Industries enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $75,000 under a 5-year lease on December 20, 2018. The

lease commences on January 1, 2019, and Starboard will return the automobile to Bumble

on December 31, 2023. The automobile has an estimated useful life of 7 years. Starboard

made a lease payment of $10,000 on December 20, 2018. In addition, the lease agreement

stipulates annual payments of $10,000, due on January 1 of 2019, 2020, 2021, 2022, and

2023. The implicit rate of the lease is 7% and is known by Starboard. Starboard guarantees

a residual value of $5,000 and incurs initial direct costs of $2,000.

23) Assuming that this is classified as an operating lease, what is the amount of the lease

liability on January 1, 2019 before the lease payment?

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 7%, 5 periods,

payments at the beginning of each period of $10,000, and a future value of $5,000 is

$47,437. The Excel formula is: =PV(.07,5,-10000,-5000,1) = $47,437.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

24) Based on the above information, calculate the right-of-use asset on January 1, 2019.

Answer:

Initial measurement of the lease liability $47,437*

Payments lessee makes to the lessor prior to the lease

commencement date 10,000

Lease incentives received 0

Initial direct costs incurred by the lessee 2,000

Initial measurement of the right-of-use asset $59,437

*Using Excel, =PV(.07,5,-10000,-5000,1) = $47,437

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

18

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

25) Assuming this is an operating lease, what journal entries does Starboard make on

January 1, 2019?

Answer:

January 1, 2019

Account Debit Credit

Prepaid Initial Direct Costs 2,000

Cash 2,000

Account January 1, 2019

Right-of-Use Asset 59,437

Prepaid Lease Payment 10,000

Prepaid Initial Direct Costs 2,000

Lease Liability 47,437

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 7%, 5 periods, payments at

the beginning of each period of $10,000, and a future value of $5,000 is $47,437.

January 1, 2019

Account Debit Credit

Lease Liability 10,000

Cash 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

Incentive Industries

Incentive Industries enters into a lease agreement with Bumble Motors to lease an

automobile with a fair value of $75,000 under a 5-year lease on December 20, 2018. Bumble

provides Incentive Industries with a lease incentive in the amount of $6,000 to terminate

another lease. The lease commences on January 1, 2019, and Incentive will return the

automobile to Bumble on December 31, 2023. The automobile has an estimated useful life

of 7 years. Incentive made a lease payment of $10,000 on December 20, 2018. In addition,

the lease agreement stipulates annual payments of $10,000, due on January 1 of 2019,

2020, 2021, 2022, and 2023. The implicit rate of the lease is 7% and is known by Incentive.

Incentive incurs initial direct costs of $2,000.

26) Assuming that this is classified as an operating lease, what is the amount of the lease

liability at on January 1, 2019 before the lease payment?

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 7%, 5 periods, and

payments at the beginning of each period of $10,000 = $43,872. The Excel formula is:

=PV(.07,5,-10000,0,1) = $43,872.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

19

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

27) Based on the above information, calculate the right-of-use asset on January 1, 2019.

Answer:

Initial measurement of the lease liability $43,872*

Payments lessee makes to the lessor prior to the lease

commencement date 10,000

Lease incentives received (6,000)

Initial direct costs incurred by the lessee 2,000

Initial measurement of the right-of-use asset $49,872

*The Excel formula is: =PV(.07,5,-10000,0,1) = $43,872.

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

28) What journal entries does Incentive make on January 1? Assume this is an operating

lease.

Answer:

January 1, 2019

Account Debit Credit

Prepaid Initial Direct Costs 2,000

Cash 2,000

Account January 1, 2019

Right-of-Use Asset 49,872

Liability for Lease Incentive 6,000

Prepaid Lease Payment 10,000

Prepaid Initial Direct Costs 2,000

Lease Liability 43,872

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 7%, 5 periods, and payments

at the beginning of each period of $10,000 = $43,872. The Excel formula is: =PV(.07,5,-

10000,0,1) = $43,872.

January 1, 2019

Account Debit Credit

Lease Liability 10,000

Cash 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

20

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

29) What journal entry does Incentive make on January 1, 2019 to record the annual lease

payment?

Answer:

Account January 1, 2019

Lease Liability 10,000

Cash 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

30) Assuming that this is classified as an operating lease, what is the annual lease expense

reported on the income statement?

Answer: To calculate the annual lease expense, the first step is to calculate the total

payments over the life of the lease, which include prepaid and annual payments and initial

direct costs, and reduced by the lease incentive. Total payments are $10,000 + (5 ×

$10,000) + $2,000 - $6,000 = $56,000. Annual lease expense is calculated by allocating this

amount equally over the 5-year lease life, $56,000 / 5 = $11,200.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

31) Assuming that this is classified as an operating lease, create an amortization table for

periodic interest and reduction in the liability.

Periodic Interest and Reduction in the Liability

Payment Interest Reduction Balance

Lease commencement:

1/1/2019

1/1/2020

1/1/2021

1/1/2022

1/1/2023

Answer: Periodic Interest and Reduction in the Liability

Payment Interest Reduction Balance

43,872

Lease commencement:

1/1/2019 10,000 10,000 33,872

1/1/2020 10,000 2,371 7,629 26,243

1/1/2021 10,000 1,837 8,163 18,080

1/1/2022 10,000 1,266 8,734 9,346

1/1/2023 10,000 654 9,346 (0)

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

21

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

32) Incentive Industries enters into a lease agreement with Bumble Motors to lease an

automobile with a fair

Assuming that this is classified as an operating lease, create an amortization table for the

right-of-use asset?

Amortization of Right-of-Use Asset

Lease Amortization of

Expense Interest Right-of-Use Asset

12/31/2019

12/31/2020

12/31/2021

12/31/2022

12/31/2023

Total

Answer:

Amortization of Right-of-Use Asset

Lease Amortization of

Expense Interest Right-of-Use Asset

12/31/2019 11,200 2,371 8,829

12/31/2020 11,200 1,837 9,363

12/31/2021 11,200 1,266 9,934

12/31/2022 11,200 654 10,546

12/31/2023 11,200 0 11,200

Total 56,000 6,128 49,872

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

33) Prepare the journal entry required on December 31, 2019. Assume this is an operating

lease.

Answer:

Date Account Debit Credit

12/31/2019Lease Expense 11,200

Lease Liability 7,629

Accumulated Amortization–Right-of-Use

Asset 8,829

Accrued Lease Payable 10,000

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

22

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

34) Lexus Company rents a copier from Heavenly Co on January 1, 2017. Under the terms of

the agreement, Lexus Company will pay rentals of $7,000 per month for a 6-month period.

Lexus Company will make these payments at the beginning of every month, beginning on

January 1, 2017. Lexus Company elects to apply the exemption for short-term leases. That

is, Lexus Company makes a policy election not to record the lease liability and the right-of-

use asset. What journal entry will Lexus Company make each month to record the rental

payments?

Answer: The monthly journal entry follows:

Account

Rent Expense 7,000

Cash 7,000

Diff: 1 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

23

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

35) On January 1, 2018, Jones AutoWorld, Inc. leases an SUV to Mains Company. The lease

term is 4 years with no renewal options and the economic life of the SUV is 7 years. The fair

value of the automobile is $65,000 and Jones' cost or carrying value is also $65,000. There

are no lease incentives. The lease calls for monthly payments of $800 at the end of each

month. Mains incurs initial direct costs of $2,400 on January 1, 2018. The implicit rate in the

lease is 5%. There is no transfer of ownership at the end of the lease term. Lease payment

collection is probable.

To determine whether Jones, the lessor, should classify the lease as operating, direct

financing, or sales-type, we assess both Group I and Group II criteria. Complete the below

table and draw a conclusion about how the lease should be classified.

Group I Criteria Met? Explanation

Transfer of ownership?

Purchase option likely to be exercised?

Lease term major part of economic life?

Present value substantial part of fair

value?

Asset is specialized?

Group II Criteria

Present value including third-party

guarantees substantially all of fair value?

Lease payment collection probable?

Answer: We have information to assess all of the criteria except for the fourth criterion of

Group I. The present value of an ordinary annuity of the 48 remaining lease payments of

$800 at a discount rate of 0.4167% per period (5%/12) is $34,738. The Excel formula is:

=PV(.004166667,48,-800) = $34,738.

Group I Criteria Met? Explanation

Transfer of ownership? No

Purchase option likely to be exercised? No

The lease term is 57% (4 yrs/7

Lease term major part of economic life? No yrs) of economic life

Present value substantial part of fair The PV of $34,738 is 53% of the

value? No $65,000 fair value.

Asset is specialized? No

Group II Criteria

Present value including third-party

guarantees substantially all of fair The PV of $34,738 is 53% of fair

value? No value.

Lease payment collection probable? Yes

The lease does not meet the Group I or both of the Group II criteria and thus it is an

operating lease.

Diff: 2 Var: 1

Objective: 18.4

IFRS/GAAP: GAAP

AACSB: Application of knowledge

24

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

18.5 Accounting for Finance Leases: Lessee

1) For both finance and operating leases, if the residual value is guaranteed by a third party

or is unguaranteed, then the residual value does not impact the lessee's accounting

treatment.

Answer: TRUE

Diff: 1 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

2) Each period of a finance lease, the lessee records a lease expense that includes which of

the following?

A) Interest expense on the lease liability, using the effective interest rate method and the

discount rate it used to compute the present value of the liability at the lease

commencement date; variable lease payments not included in the lease liability in the

period in which the obligation for the variable payments is incurred.

B) Interest expense on the lease liability, using the effective interest rate method and the

discount rate it used to compute the present value of the liability at the lease

commencement date; variable lease payments not included in the lease liability in the

period in which the obligation for the variable payments is incurred; and changes in variable

lease payments that depend on an index or rate.

C) Neither A nor B is correct.

D) Both A and B are correct.

Answer: B

Diff: 3 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

3) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $4,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 11%. Initial direct costs of $1,000 are incurred by the lessee

on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a

cost of $27,000. Collection of all lease payments is reasonably assured.

What is the proper classification of the lease to Nace?

A) Sales-type lease

B) Finance lease

C) Operating lease

D) Either A or B

Answer: B

Explanation: The lease is classified as a finance lease as the lease term is equal to the

asset's useful life and because the present value of the lease payments is 97% of the fair

value of the asset. Using Excel, the formula is =PV(.11,10,-4000,0,1) = $26,148. Calculation:

$26,148/$27,000 = 97%.

Diff: 3 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

25

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

4) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $8,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 6%. Initial direct costs of $1,400 are incurred by the lessee on

January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a cost

of $63,468. Collection of all lease payments is reasonably assured.

What is the amount of the lease liability recorded by Nace at the lease's commencement?

A) $58,881

B) $62,414

C) $63,468

D) $64,868

Answer: B

Explanation: The lease liability is calculated as the present value of the future payments.

Using Excel, the present value of the future lease payments, based on a rate of 6%, 10

periods, and payments at the beginning of each period of $8,000, is $62,414. Using Excel,

the formula is =PV(0.06,10,-8000,0,1) = $62,414.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

5) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $4,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 9%. Initial direct costs of $1,000 are incurred by the lessee on

January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a cost

of $29,035. Collection of all lease payments is reasonably assured.

What is the value of the right-of-use asset to Nace at the lease's commencement?

A) $30,035

B) $26,981

C) $26,671

D) $28,981

Answer: D

Explanation:

Initial measurement of the lease liability $27,981

Initial direct costs incurred by the lessee $1,000

Initial measurement of the right-of-use asset $28,981

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 9%, 10 periods, and

payments at the beginning of each period of $4,000, is $27,981. Using Excel, the formula is

=PV(0.09,10,-4000,0,1) = $27,981.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

26

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

6) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $6,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 10%. Initial direct costs of $1,100 are incurred by the lessee

on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a

cost of $41,608. Collection of all lease payments is reasonably assured.

What is the reduction in the lease liability recorded with the first and second lease

payments, respectively?

A) $6,000; $2,545

B) $4,165; $4,165

C) $36,499; $2,350

D) $4,055; $3,650

Answer: A

Explanation: The first payment is made on the commencement of the lease, so the entire

payment reduces the lease liability. See the following amortization table, using the effective

interest method:

Payment Interest Reduction Balance

Commencement 40,554

1-Jan-19 6,000 6,000 34,554

31-Dec-19 6,000 3,455 2,545 32,009

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

7) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $7,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 11%. Initial direct costs of $1,000 are incurred by the lessee

on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a

cost of $46,813. Collection of all lease payments is reasonably assured.

What is the amortization of the right-of-use asset recorded in 2019 and 2020, respectively?

A) $7,000; $2,737

B) $4,676; $4,676

C) $4,480; $2,520

D) $5,033; $4,480

Answer: B

Explanation: The right-of-use asset is amortized on a straight-line basis over the lease term.

Right-of-use asset = $45,759 + $1,000 = $46,759. $46,759 / 10 = $4,676. Using Excel, the

formula is =PV(0.11,10,-7000,0,1) = $45,759.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

27

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

8) Nice Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $9,500, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have a $2,000 residual value at the end of the lease term on

December 31, 2028, which is guaranteed by Nice. Nice's incremental borrowing rate is 7%.

Initial direct costs of $2,500 are incurred on January 1, 2019. Righteous Leasing acquired the

asset just prior to the lease term at a cost of $64,012. Collection of all lease payments is

reasonably assured.

What is the amount of the lease liability recorded by Nice at the lease's commencement?

A) $67,741

B) $72,412

C) $74,912

D) $22,500

Answer: B

Explanation: The lease liability is calculated as the present value of the future payments.

Using Excel, the present value of the future lease payments, based on a rate of 7%, 10

periods, payments at the beginning of each period of $9,500, and a $2,000 residual value is

$72,412. Using Excel, the formula is: =PV(0.07,10,-9500,-2000,1)=$72,412.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

9) Describe the accounting for a finance lease by the lessee if the lessee provides a residual

value guarantee.

Answer: If the lessee provides a residual value guarantee, the lessee includes the present

value of the residual value guarantee in the initial measurement of the lease liability. As is

the case with an operating lease, if the residual value is guaranteed by a third party or is

unguaranteed, then the residual value does not impact the lessee's accounting treatment.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

10) For a finance lease, what are the components of lease expense recorded by the lessee?

Answer:

1. Interest expense on the lease liability, using the effective interest rate method and the

discount rate it used to compute the present value of the liability at the lease

commencement date.

2. Variable lease payments not included in the lease liability in the period in which the

obligation for the variable payments is incurred.

3. Changes in variable lease payments that depend on an index or rate.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

28

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

11) Since IFRS makes an exception for leased assets that have low values, reporters may

account for leased assets with values of less than $5,000 as a rental agreement rather than

recognizing a right-of-use asset and a lease liability. For example, suppose a company

leases a $4,800 computer for 2.5 years. How does IFRS differ from how U.S. GAAP would

record this?

Answer: Under U.S. GAAP, the company records a right-of-use asset and a lease liability

because the lease term is greater than 1 year. Under IFRS, the company does not record the

right-of-use asset and a lease liability because the value of the leased asset is less than

$5,000, and it is a simple rental agreement.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

Nace Manufacturing Company

Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $4,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have no residual value at the end of the lease term. Nace's

incremental borrowing rate is 11%. Initial direct costs of $1,000 are incurred on January 1,

2019. Righteous Leasing acquired the asset just prior to the lease term at a cost of $27,000.

Collection of all lease payments is reasonably assured.

12) What is the proper classification of the lease to Nace?

Answer: The lease is classified as a finance lease as the lease term is equal to the asset's

useful life and because the present value of the lease payments is 97% of the fair value of

the asset. Using Excel, the formula is =PV(.11,10,-4000,0,1) = $26,148. Calculation:

$26,148/$27,000 = 97%.

Diff: 3 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

13) What is the amount of the lease liability recorded by Nace at the lease's

commencement?

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 11%, 10 periods,

and payments at the beginning of each period of $4,000, is $26,148. Using Excel, the

formula is =PV(.11,10,-4000,0,1) = $26,148.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

29

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

14) What is the value of the right-of-use asset to Nace at the lease's commencement?

Answer:

Initial measurement of the lease liability $26,148

Initial direct costs incurred by the lessee 1,000

Initial measurement of the right-of-use asset $27,148

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 11%, 10 periods, and

payments at the beginning of each period of $4,000, is $26,148. Using Excel, the formula is

=PV(.11,10,-4000,0,1) = $26,148.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

15) Based on the above information, prepare an amortization table for the Nace

Manufacturing's lease liability.

Payment Interest Reduction Balance

Commencement

1-Jan-19

31-Dec-19

31-Dec-20

31-Dec-21

31-Dec-22

31-Dec-23

31-Dec-24

31-Dec-25

31-Dec-26

31-Dec-27

Answer:

Payment Interest Reduction Balance

Commencement 26,148

1-Jan-19 4,000 4,000 22,148

31-Dec-19 4,000 2,436 1,564 20,584

31-Dec-20 4,000 2,264 1,736 18,848

31-Dec-21 4,000 2,073 1,927 16,921

31-Dec-22 4,000 1,861 2,139 14,782

31-Dec-23 4,000 1,626 2,374 12,408

31-Dec-24 4,000 1,365 2,635 9,773

31-Dec-25 4,000 1,075 2,925 6,848

31-Dec-26 4,000 753 3,247 3,601

31-Dec-27 4,000 399 3,601 (0)

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

16) Based on the above information, prepare Nace Manufacturing's journal entries at the

commencement of the lease, January 1 and December 31, 2019 payments, and amortization

of the right-of-use asset.

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 11%, 10 periods,

and payments at the beginning of each period of $4,000, is $26,148. Using Excel, the

30

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

formula is: =PV(.11,10,-4000,0,1) = $26,148.

The following entries are made by the lessee during the first year of the lease:

Lease commencement:

Account January 1, 2019

Prepaid Initial Direct

Costs 1,000

Cash 1,000

Account January 1, 2019

Right-of-Use Asset 27,148

Prepaid Initial Direct

Costs 1,000

Lease Liability 26,148

Initial payment:

Account January 1, 2019

Lease Liability 4,000

Cash 4,000

End of year payment:

Account December 31, 2019

Interest Expense 2,436

Lease Liability 1,564

Cash 4,000

**Interest Expense = 11% × ($26,148 - $4,000)

Amortization of right-of-use asset:

Account December 31, 2019

Amortization Expense–Right-of-Use Asset 2,715

Accumulated Amortization–Right-of-Use Asset 2,715

Right-of-use asset is amortized on a straight-line basis over the life of the asset. $27,148/10

= $2,715.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

Nice Manufacturing Company

Nice Manufacturing Company leased a piece of nonspecialized equipment for use in its

operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease

payments of $8,000, beginning on January 1, 2019, and at each December 31 thereafter

through 2027. The equipment is estimated to have a 10-year life, is depreciated on the

straight-line basis and will have a $5,000 residual value at the end of the lease term on

December 31, 2028, which is guaranteed by Nice. Nice's incremental borrowing rate is 9%.

Initial direct costs of $2,000 are incurred by the lessee on January 1, 2019. Righteous

Leasing acquired the asset just prior to the lease term at a cost of $27,000. Collection of all

lease payments is reasonably assured.

31

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

17) What is the amount of the lease liability recorded by Nice at the lease's

commencement?

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 9%, 10 periods,

payments at the beginning of each period of $8,000, and a $5,000 residual value is $58,074.

The Excel formula is: =PV(.09,10,-8000,-5000,1) = $58,074.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

18) What is the value of the right-of-use asset to Nice at the lease's commencement?

Answer:

Initial measurement of the lease liability $58,074

Initial direct costs incurred by the lessee 2,000

Initial measurement of the right-of-use asset $60,074

The lease liability is calculated as the present value of the future payments. Using Excel, the

present value of the future lease payments, based on a rate of 9%, 10 periods, payments at

the beginning of each period of $8,000, and a $5,000 residual value is $58,074. The Excel

formula is: =PV(.09,10,-8000,-5000,1) = $58,074.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

32

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

19) Based on the above information, prepare an amortization table for the Nice

Manufacturing's lease liability.

Payment Interest Reduction Balance

Commencement

1-Jan-19

31-Dec-19

31-Dec-20

31-Dec-21

31-Dec-22

31-Dec-23

31-Dec-24

31-Dec-25

31-Dec-26

31-Dec-27

31-Dec-28

Answer:

Payment Interest Reduction Balance

Commencement $ 58,074

1-Jan-19 $ 8,000 $ 8,000 $ 50,074

31-Dec-19 $ 8,000 $ 4,507 $ 3,493 $ 46,581

31-Dec-20 $ 8,000 $ 4,192 $ 3,808 $ 42,773

31-Dec-21 $ 8,000 $ 3,850 $ 4,150 $ 38,623

31-Dec-22 $ 8,000 $ 3,476 $ 4,524 $ 34,099

31-Dec-23 $ 8,000 $ 3,069 $ 4,931 $ 29,168

31-Dec-24 $ 8,000 $ 2,625 $ 5,375 $ 23,793

31-Dec-25 $ 8,000 $ 2,141 $ 5,859 $ 17,934

31-Dec-26 $ 8,000 $ 1,614 $ 6,386 $ 11,548

31-Dec-27 $ 8,000 $ 1,039 $ 6,961 $ 4,587

31-Dec-28 $ 5,000 $ 413 $ 4,587 $ (0)

The Excel formula is: =PV(.09,10,-8000,-5000,1) = $58,074.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

33

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

20) Based on the above information, prepare Nice Manufacturing's journal entries at the

commencement of the lease, January 1 and December 31, 2019 payments, and amortization

of the right-of-use asset.

Answer: The lease liability is calculated as the present value of the future payments. Using

Excel, the present value of the future lease payments, based on a rate of 9%, 10 periods,

payments at the beginning of each period of $8,000, and a $5,000 residual value is $58,074.

The Excel formula is: =PV(.09,10,-8000,-5000,1) = $58,074.

The following entries are made by the lessee during the first year of the lease:

Lease commencement:

Account January 1, 2019

Prepaid Initial Direct

Costs 1,000

Cash 1,000

Account January 1, 2019

Right-of-Use Asset 60,074

Prepaid Initial Direct

Costs 2,000

Lease Liability 58,074

Initial payment:

Account January 1, 2019

Lease Liability 8,000

Cash 8,000

End of year payment:

Account December 31, 2019

Interest Expense 4,507

Lease Liability 3,493

Cash 8,000

**Interest Expense = 9% × ($58,074 - $8,000)

Amortization of right-of-use asset:

Account December 31, 2019

Amortization Expense–Right-of-Use Asset 5,507

Accumulated Amortization–Right-of-Use Asset 5,507

Right-of-use asset is amortized on a straight-line basis (reduced by the guaranteed residual)

over the life of the asset. ($60,074 - $5,000) = $55,074. $55,074/10 = $5,507.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

21) Based on the information provided above, what are the journal entries on the lease

termination date of December 31, 2028, assuming that Nice must pay the guaranteed

residual value.

Answer:

34

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

Using the following amortization table:

Payment Interest Reduction Balance

Commencement $ 58,074

1-Jan-19 $ 8,000 $ 8,000 $ 50,074

31-Dec-19 $ 8,000 $ 4,507 $ 3,493 $ 46,581

31-Dec-20 $ 8,000 $ 4,192 $ 3,808 $ 42,773

31-Dec-21 $ 8,000 $ 3,850 $ 4,150 $ 38,623

31-Dec-22 $ 8,000 $ 3,476 $ 4,524 $ 34,099

31-Dec-23 $ 8,000 $ 3,069 $ 4,931 $ 29,168

31-Dec-24 $ 8,000 $ 2,625 $ 5,375 $ 23,793

31-Dec-25 $ 8,000 $ 2,141 $ 5,859 $ 17,934

31-Dec-26 $ 8,000 $ 1,614 $ 6,386 $ 11,548

31-Dec-27 $ 8,000 $ 1,039 $ 6,961 $ 4,587

31-Dec-28 $ 5,000 $ 413 $ 4,587 $ (0)

Amortization of right-of-use asset:

Account December 31, 2028

Amortization Expense–Right-of-Use Asset 5,507

Accumulated Amortization–Right-of-Use

Asset 5,507

Account December 31, 2028

Lease Liability 4,587

Interest Expense 413

Accumulated Amortization–Right-of-Use

Asset 55,074

Loss on Lease 5,000

Right-of-Use Asset 60,074

Cash 5,000

Right-of-use asset is amortized on a straight-line basis (reduced by the guaranteed residual)

over the life of the asset. ($60,074 - $5,000) = $55,074

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

35

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

22) Based on the information provided above, what are the journal entries on the lease

termination date of December 31, 2028, assuming that Nice does not have to pay the

guaranteed residual value.

Answer: Using the following amortization table:

Payment Interest Reduction Balance

Commencement $ 58,074

1-Jan-19 $ 8,000 $ 8,000 $ 50,074

31-Dec-19 $ 8,000 $ 4,507 $ 3,493 $ 46,581

31-Dec-20 $ 8,000 $ 4,192 $ 3,808 $ 42,773

31-Dec-21 $ 8,000 $ 3,850 $ 4,150 $ 38,623

31-Dec-22 $ 8,000 $ 3,476 $ 4,524 $ 34,099

31-Dec-23 $ 8,000 $ 3,069 $ 4,931 $ 29,168

31-Dec-24 $ 8,000 $ 2,625 $ 5,375 $ 23,793

31-Dec-25 $ 8,000 $ 2,141 $ 5,859 $ 17,934

31-Dec-26 $ 8,000 $ 1,614 $ 6,386 $ 11,548

31-Dec-27 $ 8,000 $ 1,039 $ 6,961 $ 4,587

31-Dec-28 $ 5,000 $ 413 $ 4,587 $ (0)

Amortization of right-of-use asset:

Account December 31, 2028

Amortization Expense–Right-of-Use Asset 5,507

Accumulated Amortization–Right-of-Use

Asset 5,507

Account December 31, 2028

Lease Liability 4,587

Interest Expense 413

Accumulated Amortization–Right-of-Use Asset 55,074

Right-of-Use Asset 60,074

Right-of-use asset is amortized on a straight-line basis (reduced by the guaranteed residual)

over the life of the asset. ($60,074 - $5,000) = $55,074.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP

AACSB: Application of knowledge

36

Copyright © 2019 Pearson Education, Inc.

Downloaded by Rosieanna Ann (linhdan0916@gmail.com)

lOMoARcPSD|4810275

23) With respect to lessees, how do IFRS and U.S. GAAP differ in the accounting treatment of

operating and finance leases?

Answer: The primary difference in IFRS and U.S. GAAP related to lessee accounting is that

IFRS does not distinguish operating from finance leases in the same way that U.S. GAAP

does. Under IFRS, lessees use the same accounting treatment for both types of leases.

Specifically, IFRS uses the U.S. GAAP accounting for finance leases for both operating and

finance leases. Thus, under IFRS, lessees report interest expense and amortization expense

on all leases.

In addition to the short-term policy election to account for a lease as a rental agreement,

IFRS makes an exception for leased assets that have low values. IFRS reporters may account

for leased assets with original costs of less than $5,000 as rental agreements.

Diff: 2 Var: 1

Objective: 18.5

IFRS/GAAP: GAAP/IFRS

AACSB: Application of knowledge