Professional Documents

Culture Documents

C Delgado

C Delgado

Uploaded by

Aiza DelgadoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C Delgado

C Delgado

Uploaded by

Aiza DelgadoCopyright:

Available Formats

Name: Delgado,Cresilda Q.

Date submitted: 12/10/2020

Time and schedule: 1:30- 3:00PM Score:

1. What do you mean by Behavioral Investor Type Framework? Explain further.

Behavioral Investor Type Framework it is about testing the personality of an investor and this is

the first in a series focusing on behavioral investor types. This series is intended to help advisors

strengthen their relationships with their clients by helping them better understanding clients'

financial personalities. It is important to know the background on how I developed behavioral

investor types. It is essential that we explore how personality tyros were developed.

2. Identify and explain the different types of Diagnostic Testing.

BIT Orientation Quiz and BIAS Identification Quiz. This different types of diagnostic testing it

should be said again that just because someone has one orientation it doesn't mean that they

won't have traits or characteristics of another orientation. It means that this is their dominant

orientation and needs to be accounted first. It is important to keep in mind that just because a

person is oriented toward or identified as one BIT versus another, it doesn't mean that they

won't have attributes of other types. For example, you might have a person that has a preserver

orientation but has independent characteristics as well.

3. Explain the general concept of the following:

a. upside/downside analysis,

b. bias analysis and

c. other biases.

The upside is that there are certain benefits that accrue to Preserver BITs. Since Preservers are

focus on preserving capital and avoiding losses, they take a somewhat conservative approach to

investing.The downside of the Preserver BIT has mainly to do with excessive focus on avoiding

losses. They are mainly emotional, which are hard to change or moderate, especially during

market upheavals. Bias analysis this preserver are dominated by emotion. Other biases, these

are the other biases that occur in preserver BIT with some regularity.

4. Explain the concept of the behavioral alpha process: a top down approach.

This method , which called behavioral alpha is a simpler and more efficient to approach to bias

identification, a top down approach make bias identification much easier. Behavioral alpha

process can maximize in a way of having realistic investment expectations, building reasonable

financial goals across realistic time horizons, establishing a personalized understanding of your

risk profile and sticking with the plan.

5. What do you think is the importance of knowing Behavioral Investor Type theory and

application? Explain base on your understanding and conceptualization about the chapter 6-8.

The importance of knowing behavioral investor type is that we can know what type of investors

are they and you should have a usable knowledge of BIT process that you can apply in practice.

To conceptualize, learning this topics we need to have a better understanding about this topic

on how important it is and we can apply it in a near future. It is also important to note that each

BIT also has positive elements that can should be leveraged to help attain financial goals. Learning

this topics we can prevent destructive behavior from limiting our ability to reach financial goals.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SAP Security SAP Security EssentialsDocument135 pagesSAP Security SAP Security EssentialsMahesh Gundu100% (3)

- Transformer Oil - DGA - From Sampling To AnalysisDocument47 pagesTransformer Oil - DGA - From Sampling To Analysislbk50100% (4)

- Dilip Kumar Behera - SPCBDocument31 pagesDilip Kumar Behera - SPCBTanmay SharmaNo ratings yet

- Borges-Tiago Et Al. (2020) - Online Users' Attitudes Toward Fake News - Implications For Brand ManagementDocument14 pagesBorges-Tiago Et Al. (2020) - Online Users' Attitudes Toward Fake News - Implications For Brand ManagementLiliana Alexandra ParaipanNo ratings yet

- Egg Drop ExperimentDocument4 pagesEgg Drop ExperimentalyannaxysabelleNo ratings yet

- MS 02 472Document128 pagesMS 02 472Meger ToolsNo ratings yet

- Assignment 3 Lump-Sump LiquidationDocument1 pageAssignment 3 Lump-Sump LiquidationchxrlttxNo ratings yet

- The ECM Software Buyer S GuideDocument31 pagesThe ECM Software Buyer S Guide2007brierNo ratings yet

- PARCO - Mid Country Refinery: Job Safety AnalysisDocument6 pagesPARCO - Mid Country Refinery: Job Safety AnalysisGyanendra Narayan NayakNo ratings yet

- NetReveal 360 For AML Compliance Brochure Dec2020 GlobalDocument7 pagesNetReveal 360 For AML Compliance Brochure Dec2020 GlobalMariem Ben ZouitineNo ratings yet

- Educational Planning PDFDocument7 pagesEducational Planning PDFRitchel Morales0% (1)

- QoS in The MPLS-DiffServ NetworkDocument4 pagesQoS in The MPLS-DiffServ Networkductdt09No ratings yet

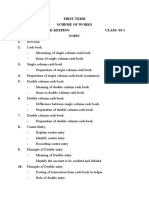

- Book KeepingDocument10 pagesBook KeepingOnyiNo ratings yet

- Maasai Agreement1904Document4 pagesMaasai Agreement1904Murigi KamandeNo ratings yet

- LEWA EcoflowTheInnovativeMeteringPumpsDocument16 pagesLEWA EcoflowTheInnovativeMeteringPumpsSrujana KandagatlaNo ratings yet

- DS 02995Document2 pagesDS 02995Giovanni ValentinoNo ratings yet

- PBL 2.oDocument40 pagesPBL 2.oFE-B-247 DIPESH KUMAR YADAVNo ratings yet

- HP 10BII Tutorial, Part 1: Initial SetupDocument17 pagesHP 10BII Tutorial, Part 1: Initial Setupeugene123No ratings yet

- Customer Satisfaction Towards Reliance Jio - 2017Document113 pagesCustomer Satisfaction Towards Reliance Jio - 2017Nishant Upadhayay0% (1)

- Automotive Precision Efuse Reference DesignDocument43 pagesAutomotive Precision Efuse Reference DesignAlbertoGonzálezNo ratings yet

- Everest Group Talent Availability For Auto Engineering ServicesDocument39 pagesEverest Group Talent Availability For Auto Engineering ServicesVivek SengarNo ratings yet

- Unit 4. My Neighbourhood: A. PhoneticsDocument5 pagesUnit 4. My Neighbourhood: A. PhoneticsLam BìnhNo ratings yet

- Placement - SAEC. - S.A. Engineering College (Autonomous)Document7 pagesPlacement - SAEC. - S.A. Engineering College (Autonomous)satheeshNo ratings yet

- Final Questions & AnswersDocument5 pagesFinal Questions & AnswersRija TahirNo ratings yet

- Peter DruckerDocument19 pagesPeter DruckerAjnie Saidali DimasangkayNo ratings yet

- Review - Government Procurement Reform ActDocument58 pagesReview - Government Procurement Reform ActiloilocityNo ratings yet

- Bahir Dar University: M.Sc. in Fashion Technology Web Enabled Product Data ManagementDocument13 pagesBahir Dar University: M.Sc. in Fashion Technology Web Enabled Product Data ManagementredietNo ratings yet

- Underline The Adverbs in The Following Sentences and State Their Kind. (G CH Chân Các TR NG T Trong Câu)Document2 pagesUnderline The Adverbs in The Following Sentences and State Their Kind. (G CH Chân Các TR NG T Trong Câu)Nguyễn QuỳnhNo ratings yet

- Chapter 6 To 7 - Rural Banks Government Non-Financial InstitutionsDocument45 pagesChapter 6 To 7 - Rural Banks Government Non-Financial InstitutionsJames DiazNo ratings yet

- Pwps / WPQ / Wopq Data SheetDocument14 pagesPwps / WPQ / Wopq Data SheetGurbir SinghNo ratings yet