Professional Documents

Culture Documents

MC Application Form (Generic) FA 021517 PDF

MC Application Form (Generic) FA 021517 PDF

Uploaded by

Joel LaguitaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MC Application Form (Generic) FA 021517 PDF

MC Application Form (Generic) FA 021517 PDF

Uploaded by

Joel LaguitaoCopyright:

Available Formats

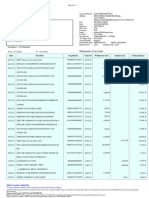

DEPOSIT ACCOUNTS

Bank Name and Branch Account Type Approximate Balance

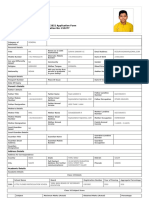

LANDBANK CREDIT CARD APPLICATION FORM

CREDIT EXPERIENCE

Before filling-out the application form, please read the agreement on the reverse side.

Please fill out application form properly, placing N/A for items not applicable. Bank / institution Type of Loan No of. Years to Pay Approximate Balance

Incomplete applications will not be processed.

FOR EMPLOYED INDIVIDUALS FOR SELF-EMPLOYED

Latest 1” X 1” ID picture Latest 1" X 1" ID picture

Latest Income Tax Return Registration Papers with DTI or SEC REQUEST FOR EXTENSION CARD

Certificate of Employment Accomplished Application Form

ATTACH PHOTOCOPY OF VALID ID OF EXTENSION

Accomplished Application Form Latest Audited Financial Statement

Payslips for the last three (3) months Latest Income Tax Return Last Name First Name Middle Name

Proof of Billing Address Proof of Billing Address

Valid ID Valid ID

Name to appear in the card if space is not sufficient

Application is for: Classic Gold Others: _____________

Referred by ___________________________________ Unit _______________ Birthdate (mm/dd/yyyy) Birthplace Age (must be atleast 13 years old)

Nationality TIN / ACR No.

PERSONAL DATA

GSIS / SSS No. Gender Civil Status

Last Name First Name Middle Name

Present Home Address ZIP Code Residing Since

Name to appear in the card if space is not sufficient Landline/s (include area code) Mobile Phone Number

Permanent Address ZIP Code Residing Since

Birthdate (mm/dd/yyyy) Birthplace Landline/s (include area code) Mobile Phone Number

Company Name and Address ZIP Code Employed Since

Nationality

Gender Number of Tax Identification No./ACR

ID PHOTO Dependents Nature of Business Position Annual Salary/Income

1X1 Civil Status GSIS / SSS No.

Mother’s Full Maiden Name Email Address Telephone Number

Present Home Address

Region ZIP Code Residing Since Employment Type Government Private Self-employed (Business)

Self-employed (Professional) Retired / Unemployed Others, pls. specify

Permanent Address ZIP Code Residing Since

Source of Funds: Salary/Honoraria Interest/Commission Business Pension

Previous Address ZIP Code

Overseas Filipino Remittance Other Remittance Other, pls. specify

Reason for Leaving

Landline/s (include area code) Mobile Phone Number

Other Source of Income Annual Amount

Mother’s Full Maiden Name Email Address Relationship to Principal Applicant Credit Limit

Company/Business Name and Address ZIP Code Telephone Number Name of School (If Student)

Position

School Address

Nature of Business Employed Since Annual Salary/Income

Name of Extension’s Spouse Birthdate (mm/dd/yyyy)

Occupation

Home Ownership (Check appropriate box)

Renting P________ /month Owned, without mortgage TIN

Owned, with mortgage P_________amortization/month Living with relatives

Cars owned Signature Over Printed Name Date

____ No./Fully Paid ____ No./with mortgage

LANDBANK REFERENCES

Source of Funds: Employment Type Employment Status Are you related If yes: Name of LANDBANKER

to a LANDBANK

Salary/Honoraria Government Permanent employee?

Rank Relationship

Interest/Commission Private Contractual

Yes No Non-officer Spouse Parent/In-law

Business Self-employed (Business) Consultant Officer Child/ In-law Sibling

Pension Self-employed (Professional) Others, pls. specify

Others, pls. specify

Overseas Filipino Remittance Retired / Unemployed

Other Remittance Others, pls. specify

Other, pls. specify DELIVERY INSTRUCTIONS

PLEASE DELIVER MY STATEMENT

Other Source of Income Annual Amount Home Office Email Address

AND CORRESPONDENCE TO:

Last School Attended Degree

Education I/WE CERTIFY THAT ALL THE ABOVE INFORMATION ARE TRUE AND CORRECT.

High School Some College College Post Graduate Others, pls. specify I/WE HEREBY AUTHORIZE LAND BANK OF THE PHILIPPINES TO VERIFY AND

INVESTIGATE SAID INFORMATION AND SUCH OTHER INFORMATION WHICH

LAND BANK OF THE PHILIPPINES MAY DEEM NECESSARY. I/WE ACKNOWLEDGE

Personal Reference (Nearest Relative Not Living with You) Relationship THAT I/WE HAVE READ AND UNDERSTOOD THE LAND BANK OF THE PHILIPPINES

CREDIT CARD AGREEMENT ON THE REVERSE SIDE THEREOF, AND HEREBY AGREE

Address TO BE BOUND BY THE SAME. IN CASE OF DISAPPROVAL OF MY/OUR

Contact No. APPLICATION, LAND BANK OF THE PHILIPPINES IS UNDER NO OBLIGATION TO

PROVIDE ME/US WITH THE REASON FOR SUCH A DECISION.

SPOUSE'S PERSONAL DATA

Last Name First Name Middle Name Signature Over Printed Name of Applicant Signature Over Printed Name of Spouse

Birthdate (mm/dd/yyyy) Company Name and Address

FOR LANDBANK USE ONLY

Employment Status

Permanent Contractual Consultant Others, pls. specify

Application ID Type of Card RCL CLBEP

Position Nature of Business

Prepared By Recommended for Approval Approving Authority

Annual Salary/Income Employed Since Telephone Number

TERMS AND CONDITIONS OF ISSUANCE AND USAGE OF THE LANDBANK CREDIT CARD

The cardholder agrees to be governed by the following terms and conditions upon signing of the application for the 11. LATE PAYMENT FEE - The CARDHOLDER shall pay late payment fees indicated in the attached Table of Fees and

issuance of his/her LANDBANK Credit Card. Charges, or at a rate determined by THE BANK if the amount paid is less than the minimum amount due or if the payment is

made after the payment due date. The late payment fees shall be based on the minimum amount due.

1. DEFINITION OF TERMS 12. ACCELERATION CLAUSE - Default or non-payment by the CARDHOLDER of the amount due shall render the

1.1 BANK/THE BANK - shall refer to Land Bank of the Philippines. CARDHOLDER’s obligations immediately due and payable without demand or notice of any kind.

1.2 LANDBANK CREDIT CARD - means any credit card issued by Land Bank of the Philippines. 13. OTHER APPLICABLE CREDIT CARD FEES - TThe CARDHOLDER agrees to pay the following related fees prescribed by

1.3 CARDHOLDER - refers to an individual to whom the bank issued a card, and thus bears the individual’s name; can THE BANK as provided for in the attached Table of Fees and Charges, such as:

either be principal or primary cardholder and/or extension/supplementary cardholder. - Cash Advance Service Fee - Card Replacement Fee

1.4 COMPANY - means a partnership/corporation/other entity which applies for a corporate credit card for the use of - Sales Slip Retrieval Fee - Returned Check Fee

its personnel. - Statement retrieval and delivery fees - Promo Charges

1.5 CREDIT CARD - means any card, plate, coupon book or other credit device existing for the purpose of obtaining money, - Monthly Maintenance Fee to be applied to cancelled accounts with outstanding credit balances.

property, labor or services on credit. 14. FOREIGN CURRENCY TRANSACTIONS - All transactions, charges and advances including those involving foreign

1.6 CREDIT CARD RECEIVABLES - represents the total outstanding balance of credit cardholders arising from currencies incurred in the Philippines, abroad or on-line through the use of the LANDBANK Credit Card shall be billed and

purchases of goods and services, cash advances, annual membership/renewal fees as well as interest, penalties, payable in Philippine currency, subject to 2% Assessment Fee and Service Fee on top of the Card Network’s foreign exchange

processing/service fees and other charges. rate on transaction posting date.

1.7 MINIMUM AMOUNT DUE OR MINIMUM PAYMENT REQUIRED - means the minimum amount that the credit 15. CASH ADVANCE FACILITY - Cash advance facility is available to the CARDHOLDER at an Automated Teller

cardholder needs to pay on or before the payment due date for a particular billing period/cycle as defined under the terms and Machine (ATM) bearing the card scheme logo. To use the service, a Personal ID Number (PIN) shall be issued and mailed at the

conditions or reminders stated in the statement of account/billing statement which may include: (1) total outstanding balance CARDHOLDER’s nominated billing address. The Cash Advance Limit is a percentage of the Credit Limit as determined by THE

multiplied by the required payment percentage or a fixed amount whichever is higher; (2) any amount which is part of any fixed BANK. A Cash Advance Fee and Service Charge shall be imposed on the amount drawn based on rates prescribed by THE BANK

monthly installment that is charged to the card; (3) any amount in excess of the credit line; and (4) all past due amounts, if any. and may be subject to change without prior notice.

1.8 CARD ACCOUNT - means the Credit Card Account opened by THE BANK for the purpose of entering all credits and debits 16. COMPLAINT/REQUEST HANDLING - The CARDHOLDER, at his/her option, may file a complaint/request via phone

received or incurred by the Primary Cardholder and the Supplementary Cardholder, if any, under these Terms and Conditions. through THE BANK’s 24 by 7 Customer Care Center Hotline at (632) 405-7000 or PLDT Domestic Toll Free Number 1-800-10-

1.9 CARD TRANSACTION - means the purchase of goods and/or service, benefits and reservations whether or not 4057000, or email at customercare@mail.landbank.com or by personally visiting any of THE BANK’s branches. THE BANK’s

utilized by the Cardholder and/or receiving Cash Advances by the use of the card number or in any other manner, regardless personnel handling the complaint shall acknowledge the same. The CARDHOLDER agrees that THE BANK while processing

of whether a sales slip or Cash Advance form or other voucher or form is signed by the Cardholder. the resolution of the complaint shall:

1.10 CASH ADVANCE - means any amount obtained by use of the Card, the card number, or in any manner authorized by - Record customer information to include but not limited to the CARDHOLDER’s full name and contact details; the details of

the Cardholder, from THE BANK or any other financial institutions for debit from the Card Account. the complaint and the actions expected to be taken to resolve the complaint;

1.11 CHARGES - means amount payable by the Cardholder arising from the use of the Card or the card numbers under these - Require the CARDHOLDER to provide additional documents or information necessary to resolve the complaint;

Terms and Conditions and include without limitation all Card Transactions, fees, Interest Charges, Late Payment Charges, - Provide CARDHOLDER with updates on the progress of the investigation to resolve the complaint;

additional expenses, damages, legal costs and disbursements, which will be debited from the Card Account and form part - Provide the CARDHOLDER with a timeframe in evaluating and resolving the complaint. In the event that the complaint

of the Current Balance. cannot be resolved within the timeframe provided, THE BANK shall inform the CARDHOLDER and provide the reason why

1.12 CREDIT LIMIT - means the maximum debit balance permitted by THE BANK of the Card Account for the PRINCIPAL/ the complaint cannot be resolved and provide additional time needed and the expected date of resolution;

Primary CARD and the EXTENSION/Supplementary Card, if any, and notified to the Primary Cardholder from time to time. - Inform the customer of the outcome of THE BANK’s investigation, evaluation and the final response to the complaint/request.

1.13 STATEMENT BALANCE or TOTAL OUTSTANDING BALANCE - means the total debit balance (inclusive of THE BANK shall not disclose to any third party any information obtained from the customer in all stages of the complaint,

all charges which shall be charged to the Card Account) outstanding on the Card Account payable to THE BANK according to except as may be required in the conduct of the investigation. No complaint/request shall be investigated by a Customer

THE BANK’s records as of the Statement Date. This may not include unbilled charges such as but not limited to any installment Assistance Officer of THE BANK who is involved in the matter which is the subject of the complaint.

availed or unbilled as of the statement cut-off date. 17. CUSTOMER SERVICE FACILITY - CARDHOLDER agrees that by using THE BANK’s customer service facility on

1.14 INTEREST CHARGES - means amount payable by the Cardholder representing cost for borrowing from or availing matters regarding CARDHOLDER’s Credit Card Account/s, THE BANK shall, at its sole option and discretion, record all the

of the credit card line. CARDHOLDER’s instructions. CARDHOLDER likewise understands and agrees that the recorded instructions may be used

1.15 LATE PAYMENT CHARGES - means the amount payable by the Cardholder representing penalty for not paying card by THE BANK against CARDHOLDER or any third party, for any purpose particularly, as evidence in any administrative or

usages and charges on Payment Due Date. judicial proceedings. Furthermore, CARDHOLDER authorizes THE BANK to communicate with CARDHOLDER through

1.16 MERCHANT AFFILIATES - means any corporate entity, person or other establishments supplying goods and/or electronic means such as SMS (short messaging systems), electronic mail, etc. at any permissible time under government rules and

services who accept the Card as a mode of payment or reservation by the Cardholder. regulations for whatever purpose related to the CARDHOLDER’s Card Account. Further, CARDHOLDER shall be responsible for

1.17 MONTH - means the calendar month. all electronic notifications sent by THE BANK and declares THE BANK free and harmless for any liability resulting from

1.18 PAYMENT DUE DATE - means the date specified in the Statement of Account by which date, payment of the Current unauthorized access to the information in the electronic notification by any means, by any person other than the CARDHOLDER.

Balance or any part thereof or the Minimum Amount is due to be made to THE BANK. 18. STATEMENT OF ACCOUNT (SOA) - The SOA shall be furnished to CARDHOLDER via registered mail, electronic

1.19 POSTING DATE - means the date by which a Card Transaction is posted onto the Card Account. mail, or private courier at the mailing information nominated by the CARDHOLDER.

1.20 PRINCIPAL CARDHOLDER - means a person other than an EXTENSION/ Supplementary CARDHOLDER who is 19. DISPUTED TRANSACTIONS - THE BANK shall furnish the CARDHOLDER with a Statement of Account (SOA)

issued a Primary Card and for whom the Card Account is first opened by THE BANK. showing the transactions and balances in relation to the CARD. The SOA shall be considered correct and binding if no error

1.21 STATEMENT DATE - means the date by which the Statement of Account is generated. is reported by the CARDHOLDER within thirty (30) calendar days from statement date. All written communications, requests

1.22 STATEMENT OF ACCOUNT - means THE BANK’s monthly or periodic statement sent to the Cardholder showing or reports on any error in the Statement of Account by the CARDHOLDER must be made in writing, duly signed by the

particulars of the Current Balance payable to THE BANK. CARDHOLDER and sent by registered mail, fax, electronic mail or courier delivery to THE BANK. It should contain, at a

1.23 EXTENSION CARDHOLDER - Any person who, upon application of the principal cardholder, is also issued a credit card. minimum, the following: a) CARDHOLDER’s complete name; b) Credit Card Number; c) Disputed amount; d) Details of the

1.24 TRANSACTION DATE - means the date by which a Card Transaction is completed. dispute; e) Supporting documents. THE BANK has no obligation to process the dispute if the CARDHOLDER fails to submit

1.25 ACCELERATION CLAUSE - means the provision in the contract between THE BANK and CARDHOLDER which the required documents

gives THE BANK the right to demand the obligation in full in case of default or non-payment of any amount due or for 20. DEFAULT, ATTORNEY’S FEES AND VENUE - If the CARDHOLDER fails to pay any amount less than the Minimum

whatever valid reason. Amount Due or Minimum Payment Required within two (2) billing cycle dates, in which case the Total Amount Due appearing in the

1.26 CARD NETWORK – Refers to MasterCard or any Associated Network. SOA for the particular billing period, CARDHOLDER shall be considered in default or delinquent. In case of default in the payment

2. THE LANDBANK CREDIT CARD - THE BANK is the sole owner of the card. The LANDBANK CREDIT CARD is of CARDHOLDER’s obligation, the right to use the LANDBANK Credit Card shall automatically be terminated and CARDHOLDER

not transferable. It is accepted worldwide and shall remain valid until the last day of the Month indicated therein unless it is shall refrain from further using such LANDBANK Credit Card and surrender the same to THE BANK on demand. In addition to

suspended, terminated by THE BANK or voluntarily cancelled by the CARDHOLDER. It shall automatically be replaced at the finance charges provided for under this agreement, the CARDHOLDER shall pay monthly late payment penalty service charge

discretion of THE BANK, one month before the expiration date. At THE BANK’s sole discretion, THE BANK reserves the right for the overdue amount at such rate as may be imposed by THE BANK. If the collection of account is referred to a collection

to suspend, terminate or cancel CARDHOLDER’s privileges anytime, for any reason whatsoever and without need for prior agency and/or through the intervention of a lawyer, CARDHOLDER agrees to pay the cost of collection or attorney’s fees to be

notice to CARDHOLDER. If THE BANK elects not to renew or replace the Card for any reason, the entire obligation shall be determined by THE BANK on the unpaid balance. An additional amount equivalent to 25% of the unpaid balance exclusive of

due and demandable. Without giving any reason or notice, and without prejudice to the other provisions hereof, THE BANK litigation expenses and judicial cost shall be charged to the CARDHOLDER as liquidated damages. Venue of all suits shall be in

shall have absolute discretion to refuse the approval of a proposed credit card application, to terminate all rights and privileges the court of proper jurisdiction of Manila, or any province or city where any of THE BANK’s branches is located, at the option of THE

under this agreement, disapprove any CARD transaction even if there is sufficient and available CREDIT LIMIT, to determine 21. BANK.ASSIGNABILITY OF RECEIVABLES -- Accounts receivables from CARDHOLDER may be sold by THE BANK

the CREDIT LIMIT, to decline renewal, re-issuance or replacement of the CARD and to change the terms and conditions in to any other party, without need of notice or consent of CARDHOLDER and shall be without recourse.

respect of or in connection with the Card account. 22. TERMINATION - In the event of the withdrawal of the principal or any extension, the CARDHOLDER’s privileges for whatever

3. MEMBERSHIP AND ANNUAL FEES - CARDHOLDER and EXTENSION CARDHOLDER shall pay an annual fee reason, including but not limited to the CARDHOLDER’s failure to comply with any of the terms and conditions herein provided,

in such amount as indicated in the attached Table of Fees and Charges, or to be determined by THE BANK. his death or insolvency (however evident), all privileges granted hereunder to the CARDHOLDER, including cost and attorney’s

4. CARDHOLDER’S RESPONSIBILITIES - The CARDHOLDER undertakes to: fee, shall immediately become due and demandable without the necessity of demand which CARDHOLDER hereof expressly

- Immediately notify THE BANK through any means of communications such as but not limited to electronic mail, regular waives. CARDHOLDER may, at any time, terminate the agreement under these Terms and Conditions by written notice to THE

mail, fax or phone of any changes in place of employment, business or residence stated in his application or credit card as BANK. Otherwise, the CARDHOLDER shall become liable to THE BANK for any and all fraudulent/unauthorized charges and

required by Republic Act No. 8484. transactions made on the CARD after the written notice or request for termination has been acted upon by THE BANK.

- Immediately notify THE BANK in case the card is lost and provide details and circumstances of such loss upon 23. RIGHT TO OFFSET - THE BANK at its sole discretion shall have the right, and the CARDHOLDER shall fully authorize

knowledge of the loss. All purchases and/or payments for services made/incurred by the CARDHOLDER and/or EXTENSION THE BANK to apply at any time, upon the termination of CARDHOLDER’s Card Account, the payment of the CARDHOLDER’s

CARDHOLDER arising from the use of the lost/stolen LANDBANK Credit Card before receipt by THE BANK of the written outstanding obligations, from any fund belonging to the CARDHOLDER maintained as deposit with THE BANK.

notice of loss shall be for the exclusive account of CARDHOLDER even if the signature of the CARDHOLDER and/or 24. COMPANY ACCOUNTS - A company which applies for LANDBANK Credit Card for the use of and in the name of

EXTENSION CARDHOLDER is forged. In the event that the CARDHOLDER may not be available to report in writing its personnel shall furnish THE BANK together with the application for membership, a board resolution authorizing (i) the

the loss of the LANDBANK Credit Card of EXTENSION CARDHOLDER, CARDHOLDER may authorize EXTENSION application for membership, (ii) the issuance of the LANDBANK Credit Card to such authorized personnel, (iii) the

CARDHOLDER to report in writing the loss of LANDBANK Credit Card. CARDHOLDER continues to be liable for all designation of an officer of the company to sign for and in behalf of the COMPANY, and (iv) Automatic Debit Arrangement from

obligations incurred through the use of the LANDBANK Credit Card until the expiration of 10 regular working days from the COMPANY’s deposit account at LANDBANK for payment of their LANDBANK Credit Card account.

the date of receipt of such written notice of loss. Should CARDHOLDER fail to report immediately in writing the loss of 25. LIMITATION OF LIABILITY - The CARDHOLDER agrees to hold THE BANK free and harmless from any liability in the

the LANDBANK Credit Card to THE BANK after discovery and to state the required information as to place, date and last event of any action arising from this Agreement or any incident thereto relative to the use or dishonor of the LANDBANK Credit

purchase made, it shall be deemed proof that CARDHOLDER fraudulently made use of the LANDBANK Credit Card, and Card which CARDHOLDER may file against THE BANK.

THE BANK or its affiliated merchants shall be rendered free and harmless from any and all liability arising out of the loss or 26. EXTENSION CREDIT CARD - Should an EXTENSION LANDBANK Credit Card be issued upon CARDHOLDER’s

theft of the LANDBANK Credit Card. request, the CARDHOLDER shall be responsible for all the charges, finance and service charges incurred through the use of

- Determine the amount due for the payment period. In the absence of a SOA resulting from delayed delivery, CARDHOLDER EXTENSION LANDBANK Credit Card. CARDHOLDER shall continue to be responsible for all such charges incurred through

must immediately inquire from THE BANK about the amount due which must be settled on or before the payment due the use of EXTENSION LANDBANK Credit Card unless CARDHOLDER requests in writing that the extension be cancelled

date. The CARDHOLDER’s responsibility to pay the outstanding balance on the payment due date is not dependent on or suspended. The principal CARDHOLDER and EXTENSION CARDHOLDER shall be jointly and severally liable for the

the receipt of the SOA. payment of the purchases incurred through the use of the EXTENSION LANDBANK Credit Card.

5. CARD DELIVERY - THE BANK shall deliver the Card at the address nominated by the CARDHOLDER. CARDHOLDER 27. WAIVER OF CONFIDENTIALITY/CARDHOLDER CONSENT TO DISCLOSURE - The CARDHOLDER

fully authorizes THE BANK or THE BANK’s official courier to release, in the CARDHOLDER’s absence the approved card waives his/her rights under applicable laws on bank secrecy and information security existing or may hereafter be enacted, such

to CARDHOLDER’s duly authorized representative upon presentation of an identification card with picture such as Driver’s as Republic Act (R.A.) No. 1405 (The Law on Secrecy of Bank Deposits), R.A. 6426 (Foreign Currency Deposit Act), R.A. 8791

License, Passport or SSS ID and authorization letter. The CARDHOLDER must sign the signature panel at the back of (The General Banking Law), R.A. 10173 (Data Privacy Act), and agrees/ permits/consents/authorizes THE BANK, its subsidiaries and

the card as soon as the card is received. The CARDHOLDER shall be liable for any card availment/s or usages thereafter affiliates to do the following: (i) make whatever credit investigations THE BANK may deem appropriate to ascertain CARDHOLDER’s

as a result of such delivery and hereby hold THE BANK free and harmless from any liability whatsoever for delivering the credit standing and financial capacity and capability; (ii) request consumer reporting or reference agencies for consumer reports

CARDHOLDER’s card as authorized herein. such as CARDHOLDER or LANDBANK Credit Card account information and reports as they may deem fit including but not

6. DISHONORED LANDBANK CREDIT CARD - THE CARDHOLDER shall hold THE BANK free from any liability limited to past due or litigation status of the LANDBANK Credit Card account, full payments or settlement of previously reported

if the LANDBANK Credit Card is not honored by affiliated merchants and for any defective product or service purchased LANDBANK Credit Card account and other LANDBANK Credit Card account updates to consumer reporting or reference

using the LANDBANK Credit Card. agencies, government regulatory bodies, and to other bank creditors, credit card companies, and financial institutions; (iii) submit,

7. CREDIT LIMIT - THE BANK shall have the sole right to determine the CARDHOLDER’s Credit Limit. The credit limit represents disclose, and transfer to any and all credit information service providers of any information relating to CARDHOLDER’s basic

maximum outstanding balance of the purchases and advances, expressed in local currency (Philippine Peso), inclusive of credit data with THE BANK as well as any updates or corrections thereof; and (iv) use or share with third parties the information

Cash Advance limit that CARDHOLDER, including EXTENSION CARDHOLDER, may be allowed at any given time. THE CARDHOLDER provided and or information derived from external sources for conducting surveys, marketing activities or

BANK reserves the right to deny authorization for any requested charges to CARDHOLDER’s account in case he/she exceeds promotional offers of THE BANK, its subsidiaries and affiliates, and/or to develop and make offers the CARDHOLDER may

his/her credit limit, otherwise, all charges shall become due and demandable without notice pending full settlement thereof. receive through mail, email, or other means of communication. Pursuant to R.A. 9510 (Credit Information System Act), the

8. PAYMENTS - THE BANK shall furnish CARDHOLDER a monthly statement of account and CARDHOLDER agrees to pay CARDHOLDER finally authorizes the submission of basic credit data in connection with any credit availment from the BANK to the Credit

all charges within the period as stated in the said statement. If the last day of payment falls on a weekend or a regular national Information Corporation (or its successor entity) and authorizes the latter to provide the same information to the BSP.

holiday, the payment due date is automatically moved to the next business day. The CARDHOLDER agrees to pay the interest 28. AMENDMENTS - Upon written notice to CARDHOLDER, THE BANK may, at any time and for whatever reason it may deem

at prevailing market rate per annum for late payments on all charges. Payments can be made in cash or check. All checks shall reasonable, amend, revise or modify this Agreement or CARDHOLDER’s credit limit and any such amendment shall bind

be made payable to LANDBANK Credit Card. Check payment becomes part of the available credit limit only after the funds are CARDHOLDER upon receipt of notice thereof unless the CARDHOLDER objects thereto by manifesting his/her intention to

cleared and shall be governed by existing banking regulations. The amount shall form part of the available credit limit on the terminate his/her membership in writing and surrendering the LANDBANK CREDIT CARD within 15 days from receipt of notice of

banking day following any cash payment provided that payment was made directly at any of THE BANK’s branches. Payments amendment. Failure to notify THE BANK of the CARDHOLDER’s intention to terminate his/her membership and/or the continued use of the

made shall be posted for a period of at least three (3) banking days. LANDBANK Credit Card by CARDHOLDER shall be construed as acceptance by CARDHOLDER of the amendments to this

9. MINIMUM AMOUNT DUE - Please refer to the attached Table of Fees and Charges. Agreement.

10. FINANCE CHARGES - If the CARDHOLDER settles only the minimum amount due or any amount less than the 29. SEPARABILITY CLAUSE - Should any provision of this Agreement be declared unconstitutional, invalid or unenforceable

outstanding balance on or before due date, finance charges as indicated in the attached Table of Fees and Charges by a court of competent jurisdiction, such declaration shall not affect in any manner whatsoever, the constitutionality, validity or

shall be applied. Finance charges shall be imposed on the unpaid balance stated in your previous SOA and on all new enforceability of the other provisions of this Agreement

transactions posted within the statement period computed from posting date until the current statement date. CARDHOLD-

ER hereby authorizes THE BANK to correspondingly increase or reduce the rates of such interest without advance notice

to the CARDHOLDER.

You might also like

- LANDBANK Credit Card Application Form - 2022Document3 pagesLANDBANK Credit Card Application Form - 2022shanelynmgNo ratings yet

- Blank Id Card TemplateDocument1 pageBlank Id Card TemplateSubiksha Financial ServicesNo ratings yet

- CC Verification FormDocument1 pageCC Verification FormSalman SajidNo ratings yet

- Small Business Loans Application FormDocument6 pagesSmall Business Loans Application Formchinmay patilNo ratings yet

- David Wilcock 23-10-2017Document94 pagesDavid Wilcock 23-10-2017Daniel EscobarNo ratings yet

- English Society 1580-1680Document229 pagesEnglish Society 1580-1680reditis100% (3)

- Multi-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Document2 pagesMulti-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Bev's AblaoNo ratings yet

- Restaurant Reservation CCADocument1 pageRestaurant Reservation CCAMohamed KamelNo ratings yet

- Cash Card Updating Form Legal Fillable 5 PagesDocument5 pagesCash Card Updating Form Legal Fillable 5 PagesAidonNo ratings yet

- Credit Card Transaction Using Face Recognition AuthenticationDocument7 pagesCredit Card Transaction Using Face Recognition AuthenticationRanjan BangeraNo ratings yet

- AsdfghjklDocument2 pagesAsdfghjklAdventurous FreakNo ratings yet

- AirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enDocument8 pagesAirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enCHOON ONN LIMNo ratings yet

- Mobile:: Role in Standard Chartered BankDocument3 pagesMobile:: Role in Standard Chartered BankVinu3012No ratings yet

- SIM Card Registration FormDocument1 pageSIM Card Registration FormSubi100% (2)

- Padre Valerio Malabanan Mem. School Avelino T. Amorao Jr. FEBRUARY 20-24, 2023 (WEEK 2)Document23 pagesPadre Valerio Malabanan Mem. School Avelino T. Amorao Jr. FEBRUARY 20-24, 2023 (WEEK 2)Jennifer Mayo0% (1)

- Home Loan Application FormDocument9 pagesHome Loan Application FormSachin KmNo ratings yet

- Payee Login ManualDocument17 pagesPayee Login Manualnareshjangra397No ratings yet

- Metrobank Branch Application Form No Cards With PEP 2Document2 pagesMetrobank Branch Application Form No Cards With PEP 2Gil Angelo Del ValleNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card Statementanshuman kumarNo ratings yet

- CC Authorization FormDocument1 pageCC Authorization FormgpnitaNo ratings yet

- Payroll Manager Accountant in Austin TX Resume Katherine PottsDocument3 pagesPayroll Manager Accountant in Austin TX Resume Katherine PottsKatherinePottsNo ratings yet

- Deposit Slip CertificateDocument1 pageDeposit Slip CertificateMalou AblazaNo ratings yet

- Credit Card Authorization Form Template 02Document2 pagesCredit Card Authorization Form Template 02Liza wongNo ratings yet

- Credit Card Payment Authorization Form: Company NameDocument2 pagesCredit Card Payment Authorization Form: Company NameAntwain UtleyNo ratings yet

- Insurance PolicyDocument3 pagesInsurance PolicyGlenn GalvezNo ratings yet

- Personal Information FormDocument2 pagesPersonal Information FormDanicaNo ratings yet

- Lesson-Elections and Party System-Philippine Politics and GovernanceDocument42 pagesLesson-Elections and Party System-Philippine Politics and GovernanceBrynn EnriquezNo ratings yet

- Ach FormDocument1 pageAch FormHimanshu Motiyani100% (1)

- Bautista - Tieza vs. Global-V Builders Co - Group 1Document3 pagesBautista - Tieza vs. Global-V Builders Co - Group 1John Robert Bautista100% (1)

- TD Ameritrade Individual Brokerage ApplicationDocument3 pagesTD Ameritrade Individual Brokerage ApplicationsananthvNo ratings yet

- CreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Document3 pagesCreditReport Piramal - Arjun Gupta - 2023 - 03 - 10 - 21 - 25 - 06.pdf 10-Mar-2023Rabbul RahmanNo ratings yet

- Rental Application 2021Document3 pagesRental Application 2021Viki HaroNo ratings yet

- ID Information SheetDocument1 pageID Information SheetRean Raphaelle Gonzales100% (1)

- Your Payment ReceiptDocument1 pageYour Payment ReceiptAniq AkmalNo ratings yet

- Landbank Iaccess Retail Internet Banking PDFDocument1 pageLandbank Iaccess Retail Internet Banking PDFMiriam DatinggalingNo ratings yet

- Example Agile Project Status ReportDocument6 pagesExample Agile Project Status ReportdlokNo ratings yet

- B.E / B.Tech 2021 Application Form Application No: 213277: Personal DetailsDocument3 pagesB.E / B.Tech 2021 Application Form Application No: 213277: Personal Detailsrajasekaran76No ratings yet

- 2.checklist of Training Topics For NABH Accreditation PreparationDocument5 pages2.checklist of Training Topics For NABH Accreditation PreparationSantosh JSE100% (1)

- Online Student Identity CardDocument1 pageOnline Student Identity CardEsha Anil JagtapNo ratings yet

- Wire Transfer GuideDocument2 pagesWire Transfer GuideMurdoko RagilNo ratings yet

- Configuration For Allowing Price Change in Service Entry SheetDocument4 pagesConfiguration For Allowing Price Change in Service Entry SheetBalanathan Virupasan100% (1)

- Dilg-Lgu Lupon: Statement of AccountDocument4 pagesDilg-Lgu Lupon: Statement of AccountDilg LuponNo ratings yet

- Services Marketing Christopher Lovelock Ppts CombinedDocument297 pagesServices Marketing Christopher Lovelock Ppts CombinedAnuja Falnikar100% (5)

- Application Form (Generic) FA 020420 LATESTDocument3 pagesApplication Form (Generic) FA 020420 LATESTmeninist27 ianNo ratings yet

- For Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelDocument5 pagesFor Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelKishore L NaikNo ratings yet

- Personalrecord - Umidcard - Form Balanay, RenanDocument2 pagesPersonalrecord - Umidcard - Form Balanay, RenanErica Jane SarsaleNo ratings yet

- 528 Cs PHP: ! Peso E Us Oollar !Document3 pages528 Cs PHP: ! Peso E Us Oollar !KIMBERLY BALISACANNo ratings yet

- Loan Agreement - 20200727 - 135718Document2 pagesLoan Agreement - 20200727 - 135718Arsee Hermidilla100% (2)

- Load Manna TutorialDocument35 pagesLoad Manna TutorialFred Astair Nieva Santelices100% (1)

- AccountsDocument6 pagesAccountsMunira PithawalaNo ratings yet

- Credit FormDocument2 pagesCredit Formyoeyar@gmail.comNo ratings yet

- Driving License LetterDocument1 pageDriving License LetterShiva KumarNo ratings yet

- Fee Receipt: Student InformationDocument1 pageFee Receipt: Student InformationAVNEESH SINGHANIA100% (1)

- For Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelDocument5 pagesFor Bank Use Only For Bank Use Only: EP000124865 Sourcing Channel EP000124865 Sourcing ChannelMUTHYALA NEERAJANo ratings yet

- Master Direction - Credit Card and Debit Card - Issuance and Conduct Directions, 2022Document26 pagesMaster Direction - Credit Card and Debit Card - Issuance and Conduct Directions, 2022Kumar SaurabhNo ratings yet

- Application For Schengen Visa: Photo This Application Form Is FreeDocument6 pagesApplication For Schengen Visa: Photo This Application Form Is Freeizal alfarizNo ratings yet

- Massachusetts AG Care - Com ComplaintsDocument168 pagesMassachusetts AG Care - Com ComplaintsBatman ResearchNo ratings yet

- Webviewe 1 PDFDocument2 pagesWebviewe 1 PDFRam RamNo ratings yet

- Jerlene Joy I. Bruan Bsacc-1Document4 pagesJerlene Joy I. Bruan Bsacc-1Jochelle SorianoNo ratings yet

- Co-Signer Statement For Surety BondDocument2 pagesCo-Signer Statement For Surety BondEda Esller Santos100% (1)

- KSFE Ecollection 035900002052 Payment ReceiptDocument1 pageKSFE Ecollection 035900002052 Payment ReceiptMelbinGeorgeNo ratings yet

- Order ReceiptDocument2 pagesOrder ReceiptkishanprasadNo ratings yet

- Personal Information Sheet 2017Document2 pagesPersonal Information Sheet 2017Chelsie Barbonio Onoya75% (4)

- Disbursement VoucherDocument9 pagesDisbursement VoucherADNAN USOPNo ratings yet

- Credit Card Authorization For Carnival Desiny 5/2/2011Document1 pageCredit Card Authorization For Carnival Desiny 5/2/2011WORNOUTMOMMYNo ratings yet

- WL WLDocument3 pagesWL WLsoumya pattanaikNo ratings yet

- TNC 280Document20 pagesTNC 280naveen.bitsgoa8303No ratings yet

- Credit Card ReconciliationDocument8 pagesCredit Card Reconciliationapi-456055243No ratings yet

- Loan Application FormDocument2 pagesLoan Application Formppat25679No ratings yet

- T MXONE 7.0 C1 IM - v1.2 - LabWorkbookDocument54 pagesT MXONE 7.0 C1 IM - v1.2 - LabWorkbook4seaupNo ratings yet

- Detail Section: Trough UrinalDocument1 pageDetail Section: Trough UrinalmarkeesNo ratings yet

- Gal Vallerius, Oxy Monster ComplaintDocument17 pagesGal Vallerius, Oxy Monster ComplaintChivis MartinezNo ratings yet

- Important Vocabulary Flashcards Meaning and Example Sentences With PDFDocument20 pagesImportant Vocabulary Flashcards Meaning and Example Sentences With PDFcxzczxNo ratings yet

- Lecture 4. Montreal Protocol - OzoneDocument6 pagesLecture 4. Montreal Protocol - OzoneKristine cheska AlmenanzaNo ratings yet

- Becamex Presentation - Full Version 4Document34 pagesBecamex Presentation - Full Version 4Trường Hoàng XuânNo ratings yet

- Assignment On HR ViolationDocument18 pagesAssignment On HR ViolationFahim IstiakNo ratings yet

- Vat Act-1991 (English Version)Document39 pagesVat Act-1991 (English Version)enamul100% (2)

- Sweet Lines Inc. Vs TevesDocument9 pagesSweet Lines Inc. Vs TevesElias IbarraNo ratings yet

- NALA Annual Report2008 - 0Document120 pagesNALA Annual Report2008 - 0nala_financeNo ratings yet

- Fuqua School of Business: Mbamission'S Insider'S GuideDocument71 pagesFuqua School of Business: Mbamission'S Insider'S GuidepnkNo ratings yet

- Full Download Test Bank For General Organic and Biological Chemistry Structures of Life 6th Edition Karen C Timberlake PDF Full ChapterDocument21 pagesFull Download Test Bank For General Organic and Biological Chemistry Structures of Life 6th Edition Karen C Timberlake PDF Full Chapterhastilyslockingdott0o100% (16)

- Defining, Conceptualising and Measuring The Digital Economy: September 2018Document27 pagesDefining, Conceptualising and Measuring The Digital Economy: September 2018NakNo ratings yet

- Data Analyst Test - AdvaRiskDocument13 pagesData Analyst Test - AdvaRiskwaghmareabhijeet89No ratings yet

- r600 13Document12 pagesr600 13Mark CheneyNo ratings yet

- 5 Manifestos Da ArteDocument3 pages5 Manifestos Da ArteCinthia MendonçaNo ratings yet

- This Study Resource Was: Chapter 8-Profitability QuizDocument5 pagesThis Study Resource Was: Chapter 8-Profitability Quizfatima mohamedNo ratings yet

- MotivationDocument11 pagesMotivationjurandirNo ratings yet

- Attendance Sheet Parents MeetingDocument2 pagesAttendance Sheet Parents MeetingAvis CastroNo ratings yet

- Dumlao v. ComelecDocument1 pageDumlao v. ComelecjiggerNo ratings yet

- Analysis of Financial StatementsDocument2 pagesAnalysis of Financial StatementsYasir RahimNo ratings yet