Professional Documents

Culture Documents

Loan Application Form

Uploaded by

ppat25679Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Application Form

Uploaded by

ppat25679Copyright:

Available Formats

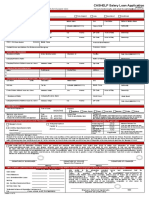

LAND BANK OF THE PHILIPPINES ANNEX C

LANDBANK SALARY LOAN APPLICATION/AGREEMENT FORM

(Please read the succeeding Promissory Note before filling up this form) Revised 12/2018

TO BE FILLED UP BY THE APPLICANT/BORROWER

Type of Loan: New Renewal

Type of Applicant: Pr Private Employee Government (CORP) Employee LGU Employee B Barangay Official

APPLICANT/BORROWER

First Name Middle Name Last Name

Address Tel No. Zip Code Mobile Number

Email Address Provincial Address

Tel No.

TIN SSS/GSIS No. Birthdate (MM/DD/YYYY) Age Gender Civil Status

Male Female Single Married Widow

SPOUSE INFORMATION

First Name Middle Name Last Name Birthdate (MM/DD/YYYY) Age

EMPLOYMENT DETAILS

Co. Employee ID No. Department Position Position Type End of Term (For Elected Only)

Rank & File Officer Elected (MM/DD/YYYY)

Years in Service Terms of Contract Gross Pay Net Pay Bank Account No.

P P

Name and Signature of Borrower

TO BE FILLED UP BY CO-MAKER

First Name Middle Name Last Name Name Key

Address Tel No. Zip Code Mobile Number

Email Address Provincial Address

Tel No.

TIN SSS/GSIS No. Birthdate (MM/DD/YYYY) Age Gender Civil Status

Male Female Single Married Widow

SPOUSE INFORMATION

First Name Middle Name Last Name Birthdate (MM/DD/YYYY) Age

EMPLOYMENT DETAILS

Co. Employee ID No. Department Position Position Type End of Term (For Elected Only)

Rank & File Officer Elected (MM/DD/YYYY)

Years in Service Terms of Contract Gross Pay Net Pay Bank Account No.

P P

Name and Signature of Co-Maker

PROMISSORY NOTE

FOR VALUE RECEIVED, I/We principal borrower and co-maker , promise to pay to the order of the LAND BANK OF THE

PHILIPPINES (the “Bank”) at its principal office located at Land Bank Plaza, 1598 M.H. del Pilar cor. Dtr. J. Quintos Streets, Malate, Manila or at any of its branches without need of notice or

demand, the sum of PESOS (P ) (the “Loan”), in equal monthly/semi-monthly amortizations on each day of the month, to start on

1

until fully paid. I/We further agree to pay interest on the Loan at a fixed rate of percent (8.5%)3 per annum, payable monthly/semi-monthly in arrears on the same day as

the monthly/semi-monthly amortizations; provided, however, that the payment of the interest first becoming due immediately after the release of the loan shall be made through automatic

deduction thereof by the Bank of an amount equivalent thereto from the loan proceeds upon release.

I/We hereby agree that the rate of interest fixed herein may be increased or decreased if during the term of the Loan or in any renewal or extension or restructuring thereof, there are

changes in the interest rate prescribed by law or the Monetary Board of the Bangko Sentral ng Pilipinas or there are changes in the Bank’s overall cost of funding/maintaining the Loan or

intermediation on account or as a result of any special reserve requirements, credit risk, collateral business, exchange rate fluctuations and changes in the financial market. I/We shall be notified

of the increase or decrease which shall take effect on the immediately succeeding amortization payment following such notice. Should I/we disagree with the interest adjustment, I/we shall so

inform the Bank in writing and, within thirty (30) days from receipt of the Bank’s notice of interest adjustment, prepay the Loan in full together with accrued interest and all other charges which

may be due thereon. If I/we fail to prepay the Loan as herein provided, the Bank may, at its option, consider the Loan as due and demandable, unless I/we advise the Bank in writing that I/we are

agreeable to the adjusted interest rate. My/Our failure to respond to the notice within thirty (30) days from receipt thereof shall constitute sufficient basis for the Bank to assume my/our

acquiescence to the adjusted rate of interest.

In case the principal amortization due to the Bank is not paid, I/we shall be charged with a penalty at the rate of three percent (3%) per month to accrue from the day immediately

after the due date thereof. It is understood that the basis for the computation of the penalty charges shall be the total principal amount due and unpaid.

In obtaining the Loan, I/we hereby represent and warrant the following:

(i) I/We am a regular/permanent employee/elected official/co-terminus/ appointed official of__________________________(Name of Agency)4

(ii) I/We have no past due outstanding with the Bank and/or with other creditor/s;

(iii) I/We have no pending application for retirement or I/we am not due for retirement during the term of the Loan;

(iv) I/We have no pending administrative or criminal case or electoral protest filed against me; and

(v) All information furnished to the Bank is full, complete and true.

I/We hereby agree that in the event (i) I/we fail to pay the Bank when due, any amount which I/we obligated to pay under this Note and other documents contemplated herein, or (ii)

any representation or warranty made hereunder or under any certifications, applications for loan or other documents given to the Bank in connection herewith is shown to have been incorrect and

misleading in any material respect, or (iii) failure to perform or violates any of the covenants and any provisions of this Note, or (iv) separation or termination from my present Employer/Agency,

then, the Bank may, at its option, declare the principal amount, including the accrued interest and other charges on the Loan, if any, (including those that may be due by acceleration, (the

“Obligations”) to be forthwith due and payable, without necessity of notice or demand. In view of this, The Bank may, at its option, apply the principle of compensation as a mode of

extinguishment of obligation. For this purpose, the Bank is hereby authorized to debit from my deposit and other accounts/credits/securities under the control or possession of the Bank, to be

applied as partial/full payment of the Obligations upon the occurrence of all requisites of compensation. The Bank has the option to apply the principle of compensation to the payment of any of

my obligations to the Bank (whenever I/We have several obligations to the Bank including, but not limited to my/our Obligations hereunder), whether or not any one of such obligations is more

onerous than the others. Further, I/we hereby authorize my/our Employer/Agency to deduct from my/our salaries, bonuses, separation, gratuity fee, retirement benefits and all other benefits due

to me/us, any amount to fully settle the Obligations.

I/We hereby agree that in case of my transfer of work station within the same agency, (a) my/our account shall be transferred to the Bank’s servicing branch nearest my new work

station (if necessary); (b) my/our servicing branch shall transfer the outstanding loan balance to new servicing branch; (c) my/our new servicing branch shall deduct the loan amortization from

my payroll account.

I/We may prepay, without penalty, all or part of the Loan; provided, that partial prepayment shall be applied in the next amortization due or in the inverse order (i.e. to the last

maturing amortization or instalment of principal).

I/We hereby undertake to shoulder all fees and charges relating to this Note such as, but not limited to, Credit Life Insurance (CLI) premium, documentary stamp tax and system

fees, which amount shall be automatically deducted from the loan proceeds thereof. I/We hereby agree that proceeds of the CLI shall be applied to the full satisfaction of my/our Obligations with

the Bank, excess if any, shall be payable to my/our beneficiary/ies reflected in my GSIS or SSS membership record. I/We hereby agree that the beneficiaries declared in my/our GSIS/SSS

insurance policy shall be the same beneficiaries of Group Credit Life Insurance applied for. I/We hereby understand that the insurance applied for will not become effective until the application

is approved by the Insurance Company at its Home Office.

The acceptance by the Bank of payment on the Loan or any portion thereof after due date shall not be considered as extending the time for payment thereof or a modification of any

of the conditions hereof. Any interest rate adjustment shall not deemed as a novation or amendment of my/our obligations under this Note or prejudice the Bank’s rights or remedies hereunder.

Should it be necessary to collect on this Note through an attorney, I/we hereby expressly agree to pay an amount equivalent to ten percent (10%) of the total amount due on this Note

as and for attorney’s fees, exclusive of all costs and fees allowed by law. I/We hereby expressly submit to the exclusive jurisdiction of the proper courts of Manila, Philippines, in the event of

litigation arising from this Note.

I/We hereby understand that the Bank, as a result of its evaluation or assessment of my online loan application, may change the loanable amount or the term of loan that I/we applied

for or may deny my/our mobile/online loan application without obligation on its part to notify me/us of the reasons of such denial.

I authorize LANDBANK, its agents, representatives, and outsourced service providers (“Bank”), to collect, process, use, update or disclose my personal information in accordance

with its Data Privacy Statement, the Data Privacy Act, and bank secrecy laws, to provide the products and/or services or implement the transactions which I have requested, to establish, confirm,

review or update my record, to manage my account, to market its products and services, to conduct customer risk, capacity and suitability assessment, audit, market research, and other

legitimate business purposes, and to comply with its reporting obligations under applicable laws, rules and regulations. I authorize the Bank to collect, process, disclose, or verify, my personal

information from any person or entity that the Bank may deem necessary including, but not limited to, credit bureaus, financial institutions, and government authorities. I agree to hold the

Bank and the persons or entities from whom it may obtain, or with whom it may disclose or verify my personal information free and harmless from any liability arising from the use of any

such information. The consent provided herein shall remain valid for the duration (from loan application to the settlement of my account), and even after the termination, of the products and

services availed by me, as may be required for legal, regulatory or legitimate business purpose. I confirm that I am aware that under the Data Privacy Act, I have (a) the right to withdraw the

consent hereby given or to object to the processing of my personal information provided there is no other legal ground or overriding legitimate interest for the processing thereof; (b) right to

reasonable access, (c) right to rectification , and (d) right to erasure or blocking of my personal information subject, however, to the conditions for the legitimate exercise of the said rights under

the Data Privacy Act and its Implementing Rules and Regulations, and subject further to the right of the Bank to terminate the product or service availed by me should I withdraw my consent or

request the removal of my personal information.

Signature Over Printed Name of Applicant/Borrower Signature Over Printed Name of Applicant/Borrower

(DATE) (DATE)

TO BE FILLED UP BY THE

EMPLOYER CERTIFICATION

Office: Date:

This Office certifies that:

(1) The above information and signature of applicant borrower and co-maker are authentic;

(2) The above applicant and co-maker;

□ are permanent/appointed employees of this Office and have in the service for at least one year except elected officials and are not on leave or absence

without pay;

□ have no pending administrative and/or criminal charges against them;

□ have no pending application for retirement or are not due for retirement within the term of the loan;

□ are up-to-date to the payment of their existing loans, if any;

□ are presently receiving a net-take-home-pay of not less than Php after statutory deducted net of all loan amortizations including the

livelihood loan applied for (except for Barangay Officials)

This Office certifies that the net-take-home-pay of the applicant/borrower as of amount to PESOS (Php ).

This Office agrees to collect the monthly instalment/amortization due on the loan of the borrower.

□ through automatic salary deduction by LANDBANK via DMVAL Facility; or

□ through automatic salary deduction and remit to LANDBANK not later than five (5) banking days after payroll date.

Name in Print Designation Signature of Authorized Signatory of the Employer

TO BE FILLED UP BY LANDBANK

EXISTING LOAN: Borrower EXISTING LOAN: Agency/Entity as of DOCUMENT CHECKLIST

Date Granted : Total Outstanding Balance Php ( ) Photocopy of Company ID

Amount Granted : Php Current Php ( ) Photocopy of Payslips

Outstanding Balance : Php Technical Past Due/Rate Php Certificates of:

Arrearages : Php % Actual Past Due/Rate Php % ( ) MNTHP ( ) Honorarium

Combined Past Due/Rate Php ( ) Nature of Appointment

% ( ) Others

Processed by: Reviewed by: Approved by:

SUBSCRIBED AND SWORN to before me on and at . Affiant exhibited to me his/her competent evidence of

identify as indicated below.

Borrower’s Name Government Issued ID No. Issuer/Expiry

Doc No.

Page No.

Book No.

Series of 20 NOTARY PUBLIC

You might also like

- Aub Salary Application FormDocument2 pagesAub Salary Application FormRaymund Platilla50% (2)

- Loan Application FormDocument1 pageLoan Application Formjdtmuyco100% (1)

- Home Loan Application FormDocument2 pagesHome Loan Application Formchin deguzmanNo ratings yet

- MC Application Form (Generic) FA 021517 LANDBANK CREDIT CARDDocument2 pagesMC Application Form (Generic) FA 021517 LANDBANK CREDIT CARDMariaAurora Fire StationNo ratings yet

- Home Loan Application FormDocument9 pagesHome Loan Application FormSachin KmNo ratings yet

- Apartment/Dormitory Census Form: Personal InformationDocument1 pageApartment/Dormitory Census Form: Personal Informationlazaruslipata06No ratings yet

- 2019 Safc Application FormDocument1 page2019 Safc Application FormSheredapple OrticioNo ratings yet

- Salary Loan/Advance - Application Form: Personal InformationDocument2 pagesSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- RBD - Common Retail Loan Application Form Co - ApplicantDocument2 pagesRBD - Common Retail Loan Application Form Co - Applicantr_awadhiyaNo ratings yet

- Credit InformationDocument2 pagesCredit InformationShivam BijjamwarNo ratings yet

- Common Retail Loan Application Form For GuarantorDocument2 pagesCommon Retail Loan Application Form For GuarantorNukamreddy Venkateswara ReddyNo ratings yet

- Aim Student Loan Application FormDocument3 pagesAim Student Loan Application FormCharles de belenNo ratings yet

- Client Information Sheet Ver092018 Front.Document1 pageClient Information Sheet Ver092018 Front.Lovely TanNo ratings yet

- Personal Loan Application Form 2019Document5 pagesPersonal Loan Application Form 2019bamarteNo ratings yet

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- TERC HR - Form 003 v1 - New Employee Information FormDocument1 pageTERC HR - Form 003 v1 - New Employee Information FormMaral Inocencio AltarNo ratings yet

- Cis 1 2 1Document2 pagesCis 1 2 1Rodgen VallesNo ratings yet

- CHECK OFF FORM FINAL 2022 FinalDocument4 pagesCHECK OFF FORM FINAL 2022 FinalTadei MaotoNo ratings yet

- Credit Card Application FormDocument4 pagesCredit Card Application FormPSC.CLAIMS1No ratings yet

- Loan Application FormDocument2 pagesLoan Application FormSarah Jane VallarNo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- China Bank Credit Card Application FormDocument2 pagesChina Bank Credit Card Application FormgregbaccayNo ratings yet

- Information Sheet: Personal Loan Number PersonalDocument1 pageInformation Sheet: Personal Loan Number PersonalRonald LamoNo ratings yet

- ALAT Account Customer Update FormDocument1 pageALAT Account Customer Update FormJamiu JabaruNo ratings yet

- No. of Years: For Individuals and Sole ProprietorshipsDocument2 pagesNo. of Years: For Individuals and Sole Proprietorshipsjunil rejanoNo ratings yet

- Business Credit Application: Legal Name: Date of Birth (For Individuals) : DbaDocument2 pagesBusiness Credit Application: Legal Name: Date of Birth (For Individuals) : DbaSorcerer NANo ratings yet

- Information Sheet: Card Number PersonalDocument1 pageInformation Sheet: Card Number PersonalAlven BactadNo ratings yet

- Gsis Lease With Option To Buy (Lwob) : Application InformationDocument2 pagesGsis Lease With Option To Buy (Lwob) : Application InformationOlivia Abac100% (1)

- JMT HR - Form 003 v1 - New Employee Information FormDocument1 pageJMT HR - Form 003 v1 - New Employee Information FormMaral Inocencio AltarNo ratings yet

- BKPloanapplicationDocument3 pagesBKPloanapplicationcunninghumNo ratings yet

- China Bank Credit Card Application Form PDFDocument2 pagesChina Bank Credit Card Application Form PDFJon SantiagoNo ratings yet

- Application Form - New Financial PlanDocument2 pagesApplication Form - New Financial PlanCamille FreoNo ratings yet

- Application Form - New Financial PlanDocument2 pagesApplication Form - New Financial PlanCamille FreoNo ratings yet

- Visa Purple Card: Application FormDocument2 pagesVisa Purple Card: Application FormNaajah PhillipsNo ratings yet

- Persoanl Account Opening Form English A1edbfb2bdDocument8 pagesPersoanl Account Opening Form English A1edbfb2bdsubhsarki4No ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMarco LagahitNo ratings yet

- Bdo bankBBG-CIR-Personal-09-06-2017 PDFDocument2 pagesBdo bankBBG-CIR-Personal-09-06-2017 PDFapollo degulaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMaria Elizabeth PonceNo ratings yet

- Bdo Infor Sheet Sample PDFDocument2 pagesBdo Infor Sheet Sample PDFLomiNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordErnesto G. Flores Jr.No ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKatyambotNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordLeslie Ann Cabasi TenioNo ratings yet

- BBG CIR Personal 09-06-2017Document2 pagesBBG CIR Personal 09-06-2017Catalina VianaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFIsagani AbonNo ratings yet

- Bdo Cir Form PDFDocument2 pagesBdo Cir Form PDFLeslie Ann Cabasi TenioNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFDianne B. BalderasNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFJohn Paul Pacheco LealNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFLomiNo ratings yet

- Real BDO Form PDFDocument2 pagesReal BDO Form PDFJehara AbdullahNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordAnonymous Pxq5M31No ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFHeaven San DiegoNo ratings yet

- Tenants Information FA PDFDocument2 pagesTenants Information FA PDFJonasNo ratings yet

- Reactivation Application Form 2Document4 pagesReactivation Application Form 2alina aguirre de la cruzNo ratings yet

- Revised Reservation FormDocument2 pagesRevised Reservation FormTed anadiloNo ratings yet

- BDO CirDocument2 pagesBDO CirCPANo ratings yet

- Application Form InternsDocument2 pagesApplication Form InternsShivam MishraNo ratings yet

- Disability Claim Form by Owner RSADocument7 pagesDisability Claim Form by Owner RSAQuinnCham Mia GiftNo ratings yet

- 2024-MQDocument4 pages2024-MQppat25679No ratings yet

- FTJA MONITORING FORMs - As of 08may2021Document18 pagesFTJA MONITORING FORMs - As of 08may2021ppat25679No ratings yet

- LC TEMPLATE For Non-Psych MDDocument2 pagesLC TEMPLATE For Non-Psych MDppat25679No ratings yet

- Guidelines - Formatted Templates LCDocument11 pagesGuidelines - Formatted Templates LCppat25679No ratings yet

- Local Media2836091836517252629Document62 pagesLocal Media2836091836517252629ppat25679No ratings yet

- ANS Benefits Brochure - NewDocument29 pagesANS Benefits Brochure - NewsasdadNo ratings yet

- Withholding Tax Card 2021-2022Document1 pageWithholding Tax Card 2021-2022muhammad bilalNo ratings yet

- The Kotak Mahindra Group An Overview: #DiscoverkliDocument6 pagesThe Kotak Mahindra Group An Overview: #DiscoverkliNalla ThambiNo ratings yet

- Assets, Liablites, Income and Expenditure All ListDocument6 pagesAssets, Liablites, Income and Expenditure All ListChandu BandreddiNo ratings yet

- Market Share of Top 5 Banks in IndiaDocument6 pagesMarket Share of Top 5 Banks in Indiamayank shridharNo ratings yet

- JK Insurance BrokerDocument23 pagesJK Insurance BrokerARKAJIT DEY-DMNo ratings yet

- Legal Mandates Related To Nutrition & Diet Therapy (Paulo Alfeche)Document5 pagesLegal Mandates Related To Nutrition & Diet Therapy (Paulo Alfeche)Faatoots FatsNo ratings yet

- Approximations of The Aggregate Loss DistributionDocument708 pagesApproximations of The Aggregate Loss DistributionArmai ZsoltNo ratings yet

- Lincoln MBA ProspectusDocument20 pagesLincoln MBA ProspectusPrasanth BrillianzNo ratings yet

- Kiplinger x27 S Personal Finance - January 2024Document76 pagesKiplinger x27 S Personal Finance - January 2024juandavidbc2008No ratings yet

- Reliance Retail Insurance Broking LimitedDocument43 pagesReliance Retail Insurance Broking LimitedShobhit JainNo ratings yet

- Edgard Mitchel Zuluaga Melgares-Success Int'l Private School Offer LetterDocument5 pagesEdgard Mitchel Zuluaga Melgares-Success Int'l Private School Offer LetterEdgard ZuluagaNo ratings yet

- HLM Takaful Care Rahmat: The Choice Is in Your HandDocument7 pagesHLM Takaful Care Rahmat: The Choice Is in Your HandAiza ANo ratings yet

- 6 Powerful Telephone ScriptsDocument23 pages6 Powerful Telephone ScriptsStephen WilliamsNo ratings yet

- PolicyDocument20 pagesPolicyPranay DasNo ratings yet

- Assignment 3 - Del MundoDocument5 pagesAssignment 3 - Del MundoAngel Alexa Del MundoNo ratings yet

- Axis NR CustomersDocument86 pagesAxis NR CustomersDeepak GoyalNo ratings yet

- Insight Into Basics of General InsuranceDocument50 pagesInsight Into Basics of General Insurancepiyushkumarjha12No ratings yet

- Insurance TrendsDocument19 pagesInsurance TrendsMaithili GuptaNo ratings yet

- CRASH COURSE - Summary 2006 PDFDocument36 pagesCRASH COURSE - Summary 2006 PDFYatte OmarNo ratings yet

- InvoiceDocument12 pagesInvoiceKenny XNo ratings yet

- Full Download Book Indian Financial System and Financial Market Operations PDFDocument41 pagesFull Download Book Indian Financial System and Financial Market Operations PDFtommy.peacock526100% (18)

- Drug Exception Application 04-14 EDocument3 pagesDrug Exception Application 04-14 Econtext-tines-0eNo ratings yet

- Insured & Vehicle Details: Product Code: 3001 UIN: IRDAN115P0017V01200102Document3 pagesInsured & Vehicle Details: Product Code: 3001 UIN: IRDAN115P0017V01200102patelsandip1989No ratings yet

- HDFC BankDocument34 pagesHDFC BankMichelle D'saNo ratings yet

- Claim Form - 1Document3 pagesClaim Form - 1asish sahooNo ratings yet

- Family SecureDocument8 pagesFamily SecureMärinël VëlmöntëNo ratings yet

- Suzuki Access InsuranceDocument2 pagesSuzuki Access InsuranceRaki GowdaNo ratings yet

- Ramada Murree AgreementDocument5 pagesRamada Murree Agreementsuhailsadiq97No ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet