Professional Documents

Culture Documents

04B - Fort Bonifacio Development Corporation vs. CIR

Uploaded by

Renard EnrileOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04B - Fort Bonifacio Development Corporation vs. CIR

Uploaded by

Renard EnrileCopyright:

Available Formats

G.R. No.

173425 September 4, 2012

FORT BONIFACIO DEVELOPMENT CORPORATION, Petitioner,

vs.

COMMISSIONER OF INTERNAL REVENUE and REVENUE DISTRICT OFFICER, REVENUE

DISTRICT NO. 44, TAGUIG and PATEROS, BUREAU OF INTERNAL REVENUE, Respondents.

DEL CASTILLO, J.:

FACTS:

Petitioner was a real estate developer that bought from the national government a parcel of land that used

to be the Fort Bonifacio military reservation. At the time of the said sale there was as yet no VAT imposed

to real properties held primarily for sale so Petitioner did not pay any VAT on its purchase. Subsequently,

Petitioner sold two parcels of land to Metro Pacific Corp. In reporting the said sale for VAT purposes,

because the VAT had already been imposed in the interim, Petitioner claimed transitional input VAT

corresponding to its inventory of land. The BIR disallowed the claim of presumptive input VAT and

thereby assessed Petitioner for deficiency VAT.

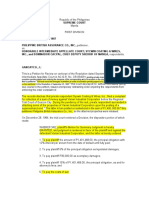

Respondents maintain that petitioner is not entitled to a transitional input tax credit because no taxes

were paid in the acquisition of the property.

Relevant Section 105 of the NIRC reads:

SEC. 105. Transitional input tax credits. – A person who becomes liable to value-added tax or

any person who elects to be a VAT-registered person shall, subject to the filing of an inventory as

prescribed by regulations, be allowed input tax on his beginning inventory of goods, materials and

supplies equivalent to 8% of the value of such inventory or the actual value-added tax paid on

such goods, materials and supplies, whichever is higher, which shall be creditable against the

output tax. (Emphasis supplied.)

ISSUE: Is Petitioner entitled to claim the transitional input VAT on its sale of real properties given its

nature as a real estate dealer applied on the value of the entire real property.

RULING: YES. Petitioner is entitled to claim transitional input VAT based on the value of the entire real

property. The provision on transitional input tax credit was enacted to benefit first time VAT taxpayers by

mitigating the impact of VAT on the taxpayer.

Obviously then, the purpose behind the transitional input tax credit is not confined to the transition from

sales tax to VAT. Further, amendments to the VAT law do not show any intention to make those in the

real estate business subject to a different treatment from those engaged in the sale of other goods or

properties or in any other commercial trade or business.

Petition is GRANTED.

You might also like

- South CotabatoDocument3 pagesSouth CotabatoGhee MoralesNo ratings yet

- 29 Orosa vs. Court of AppealsDocument3 pages29 Orosa vs. Court of AppealsHenry LNo ratings yet

- Legal Ethics Chapter I - Lawyer and Society - Philippine Law ReviewersDocument11 pagesLegal Ethics Chapter I - Lawyer and Society - Philippine Law ReviewersLuigy MontederamosNo ratings yet

- Germar vs. Legaspi (Full Text, Word Version)Document11 pagesGermar vs. Legaspi (Full Text, Word Version)Emir MendozaNo ratings yet

- De La Cruz v. Paras (1983)Document3 pagesDe La Cruz v. Paras (1983)Andre Philippe RamosNo ratings yet

- 21 G.R. No. 92299 - San Juan v. Civil Service CommissionDocument10 pages21 G.R. No. 92299 - San Juan v. Civil Service CommissionalfredNo ratings yet

- Notes and CommentsDocument10 pagesNotes and CommentsGracia SullanoNo ratings yet

- CM Hoskins & Co., Inc. Vs Cir GR No L-24059 November 28, 1969Document4 pagesCM Hoskins & Co., Inc. Vs Cir GR No L-24059 November 28, 1969Marianne Shen PetillaNo ratings yet

- $ Upre111e: 3republic of Tbe LlbilippinenDocument5 pages$ Upre111e: 3republic of Tbe LlbilippinenZymon GranadoNo ratings yet

- Bondoc Vs PinedaDocument15 pagesBondoc Vs PinedaPrincessAngelicaMoradoNo ratings yet

- Supreme Court of Canada C: Canada V. Glaxosmithkline Inc., 2012 SCC 52, (2012) 3 D: 20121018 D: 33874 B: Her Majesty The QueenDocument39 pagesSupreme Court of Canada C: Canada V. Glaxosmithkline Inc., 2012 SCC 52, (2012) 3 D: 20121018 D: 33874 B: Her Majesty The QueenJm CruzNo ratings yet

- The National Government, Which Historically Merely Delegated To Local Governments The Power To TaxDocument37 pagesThe National Government, Which Historically Merely Delegated To Local Governments The Power To Taxlleiryc7No ratings yet

- 4de Castro Vs JBCDocument37 pages4de Castro Vs JBCRai-chan Junior ÜNo ratings yet

- SALVADOR V RABAJADocument2 pagesSALVADOR V RABAJAJenin VillagraciaNo ratings yet

- Bayan - Muna - Vs - RomuloDocument2 pagesBayan - Muna - Vs - RomuloDan Ezekiel GustiloNo ratings yet

- Pobre v. Defensor-SantiagoDocument12 pagesPobre v. Defensor-SantiagoInna LadislaoNo ratings yet

- Lesson 8 - The Judicial BranchDocument31 pagesLesson 8 - The Judicial BranchFliss YvuseinNo ratings yet

- Batangas CATV Inc. Vs CA - 138810 - September 29, 2004 - JDocument14 pagesBatangas CATV Inc. Vs CA - 138810 - September 29, 2004 - JjonbelzaNo ratings yet

- Association of Small Landowners in The Philippines v. Honorable Secretary of Agrarian ReformDocument3 pagesAssociation of Small Landowners in The Philippines v. Honorable Secretary of Agrarian ReformHanabishi RekkaNo ratings yet

- Phil British Assurance Co. v. IACDocument6 pagesPhil British Assurance Co. v. IACDessa Ruth ReyesNo ratings yet

- DX - Engel Paul Aca v. Atty. Ronaldo Salvado, A.C. 10952, January 26, 2016.Document3 pagesDX - Engel Paul Aca v. Atty. Ronaldo Salvado, A.C. 10952, January 26, 2016.RenNo ratings yet

- Refined Digest PILDocument9 pagesRefined Digest PILptbattungNo ratings yet

- An Overview of The Changes To The Corporation Code of The PhilippinesDocument5 pagesAn Overview of The Changes To The Corporation Code of The Philippinesglenda e. calilaoNo ratings yet

- No, The Case of Anna, The Owner of A Drugstore Which Was Established by Her Ancestors Way BackDocument2 pagesNo, The Case of Anna, The Owner of A Drugstore Which Was Established by Her Ancestors Way BackkatNo ratings yet

- 027-Lutz v. Araneta, 98 Phil 148Document3 pages027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- Yabut, Jr. v. Office of The OmbudsmanDocument2 pagesYabut, Jr. v. Office of The OmbudsmanLance LagmanNo ratings yet

- Carlos Alonzo and Casimira ALONZO, Petitioners, Intermediate Appellate Court and Tecla Padua, RespondentsDocument8 pagesCarlos Alonzo and Casimira ALONZO, Petitioners, Intermediate Appellate Court and Tecla Padua, RespondentsAM CruzNo ratings yet

- LE. 1. Cayetano v. MonsodDocument39 pagesLE. 1. Cayetano v. MonsodDah RinNo ratings yet

- Association of Philippine Coconut Desiccators vs. Philippine Coconut Authority 286 SCRA 109, February 10, 1998Document13 pagesAssociation of Philippine Coconut Desiccators vs. Philippine Coconut Authority 286 SCRA 109, February 10, 1998CHENGNo ratings yet

- North Sea Continental Shelf Cases PDFDocument3 pagesNorth Sea Continental Shelf Cases PDFclaire HipolNo ratings yet

- Labor Standards SSS CasesDocument77 pagesLabor Standards SSS CasesCharenz Santiago SantiagoNo ratings yet

- Santos vs. Judge Lacurom (A.m. No. RTJ-04-1823, August 28, 2006)Document6 pagesSantos vs. Judge Lacurom (A.m. No. RTJ-04-1823, August 28, 2006)Sam Alberca100% (1)

- LAW Credits Finals 10 DigestsDocument10 pagesLAW Credits Finals 10 DigestsRae ManarNo ratings yet

- Be It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledHaydee Christine SisonNo ratings yet

- CivPro Case DigestsDocument28 pagesCivPro Case DigestsDaniel TolentinoNo ratings yet

- Classification of LawDocument7 pagesClassification of LawSyed Misbahul Islam100% (1)

- 6456347Document1 page6456347Kirstine Mae GilbuenaNo ratings yet

- Bpi Leasing Corp. v. CA, 416 Scra 4 (2003)Document19 pagesBpi Leasing Corp. v. CA, 416 Scra 4 (2003)inno KalNo ratings yet

- Polo V CIR DigestDocument1 pagePolo V CIR DigestKTNo ratings yet

- VI. Air Canada vs. CIRDocument21 pagesVI. Air Canada vs. CIRstefocsalev17No ratings yet

- Statcon - ReviewerDocument5 pagesStatcon - ReviewerHiezll Wynn R. RiveraNo ratings yet

- Deutsche Bank vs. CirDocument1 pageDeutsche Bank vs. CirDee WhyNo ratings yet

- G.R. No. L-63915Document10 pagesG.R. No. L-63915Julian DubaNo ratings yet

- Napocor vs. AngasDocument2 pagesNapocor vs. AngasJf ManejaNo ratings yet

- Magallona v. Ermita G.R. No. 187167, 16 August 2011, 655 SCRA 476 (2011)Document24 pagesMagallona v. Ermita G.R. No. 187167, 16 August 2011, 655 SCRA 476 (2011)Alex TimtimanNo ratings yet

- Zaldivar v. SandiganbayanDocument6 pagesZaldivar v. SandiganbayanLeizl A. VillapandoNo ratings yet

- Endencia v. DavidDocument21 pagesEndencia v. DavidbrownboomerangNo ratings yet

- StatCon First 20 Cases DigestsDocument10 pagesStatCon First 20 Cases DigestsKei GrrrNo ratings yet

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarKent Ugalde50% (2)

- Principle and State Policies CasesDocument290 pagesPrinciple and State Policies Casesmerwin cruzNo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs MacaraigcqpascuaNo ratings yet

- Corpocases Set1Document39 pagesCorpocases Set1Ryan Emmanuel MangulabnanNo ratings yet

- 4 CMS Logging VS CaDocument1 page4 CMS Logging VS Cak santosNo ratings yet

- 01 PubCorp - Local Autonomy PrinciplesDocument43 pages01 PubCorp - Local Autonomy PrinciplesJohn FerarenNo ratings yet

- City of Manila DigestDocument12 pagesCity of Manila DigestArthur John GarratonNo ratings yet

- CIR VS. TOKYO SHIPPING. LTD - G.R. No. L-68252 May 26, 1995Document2 pagesCIR VS. TOKYO SHIPPING. LTD - G.R. No. L-68252 May 26, 1995Rizalnino Noble100% (1)

- Letter of Atty. Cecilio ArevaloDocument6 pagesLetter of Atty. Cecilio ArevaloAppleSamsonNo ratings yet

- Pre-Trial Brief: Shiena Marie ConsingDocument3 pagesPre-Trial Brief: Shiena Marie ConsingArgie E. NACIONALNo ratings yet

- Tilted Justice: First Came the Flood, Then Came the Lawyers.From EverandTilted Justice: First Came the Flood, Then Came the Lawyers.No ratings yet

- Facts:: CIR vs. Magsaysay Lines GR No. 146984 Dated July 28, 2006Document6 pagesFacts:: CIR vs. Magsaysay Lines GR No. 146984 Dated July 28, 2006QuoleteNo ratings yet

- Rule 1.03 and 1.04 - Code of Professional ResponsibilityDocument2 pagesRule 1.03 and 1.04 - Code of Professional ResponsibilityRenard EnrileNo ratings yet

- Rule 1.01 and 1.02 - Code of Professional ResponsibilityDocument3 pagesRule 1.01 and 1.02 - Code of Professional ResponsibilityRenard EnrileNo ratings yet

- 09A - Ifurung vs. Carpio-MoralesDocument1 page09A - Ifurung vs. Carpio-MoralesRenard EnrileNo ratings yet

- G.R. No. 192821 March 21, 2011 People of The Philippines, Appellee, Sixto Padua Y Felomina, AppellantDocument1 pageG.R. No. 192821 March 21, 2011 People of The Philippines, Appellee, Sixto Padua Y Felomina, AppellantRenard EnrileNo ratings yet

- 69 - People vs. RellotaDocument2 pages69 - People vs. RellotaRenard EnrileNo ratings yet

- Canon 1 - Code of Professional ResponsibilityDocument4 pagesCanon 1 - Code of Professional ResponsibilityRenard EnrileNo ratings yet

- 74 - People V GarciaDocument2 pages74 - People V GarciaRenard EnrileNo ratings yet

- 08A - Plopenio vs. DARDocument1 page08A - Plopenio vs. DARRenard EnrileNo ratings yet

- 67 - Celino, Sr. vs. CADocument1 page67 - Celino, Sr. vs. CARenard EnrileNo ratings yet

- 08A - Amores vs. HRETDocument1 page08A - Amores vs. HRETRenard EnrileNo ratings yet

- 07A - J.R.A. Philippines, Inc. vs. CIRDocument1 page07A - J.R.A. Philippines, Inc. vs. CIRRenard EnrileNo ratings yet

- 17B - Manaloto vs. Veloso IIIDocument1 page17B - Manaloto vs. Veloso IIIRenard EnrileNo ratings yet

- 07B - UCPB vs. Spouses UyDocument1 page07B - UCPB vs. Spouses UyRenard Enrile100% (1)

- 17A - Dayao vs. ComelecDocument1 page17A - Dayao vs. ComelecRenard EnrileNo ratings yet

- 13B - Metrobank vs. LibertyDocument1 page13B - Metrobank vs. LibertyRenard EnrileNo ratings yet

- Rule 113, Sec. 5, Revised Rules of CourtDocument3 pagesRule 113, Sec. 5, Revised Rules of CourtRenard EnrileNo ratings yet

- People vs. Tomas, Sr.Document16 pagesPeople vs. Tomas, Sr.Renard EnrileNo ratings yet

- Republic of The Philippines Manila en Banc: One of The Seven Issues Discussed Is Illegal Possession of Fire ArmsDocument32 pagesRepublic of The Philippines Manila en Banc: One of The Seven Issues Discussed Is Illegal Possession of Fire ArmsRenard EnrileNo ratings yet

- US vs. CabanagDocument5 pagesUS vs. CabanagRenard EnrileNo ratings yet

- People vs. PenesaDocument4 pagesPeople vs. PenesaRenard EnrileNo ratings yet

- Rule 113, Sec. 5, Revised Rules of CourtDocument3 pagesRule 113, Sec. 5, Revised Rules of CourtRenard EnrileNo ratings yet

- Indirect TaxDocument4 pagesIndirect TaxAbhijeet SinghNo ratings yet

- Business Math Q4 M3Document28 pagesBusiness Math Q4 M3irishmaelacaba05No ratings yet

- Passive Income To Final TaxDocument3 pagesPassive Income To Final TaxAngela 18 PhotosNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- 1392-Monthly Fiscal Bulletin 5Document16 pages1392-Monthly Fiscal Bulletin 5Macro Fiscal PerformanceNo ratings yet

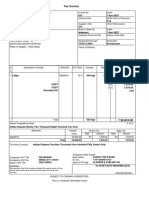

- Invoice FromDocument1 pageInvoice FromVladislavs RužanskisNo ratings yet

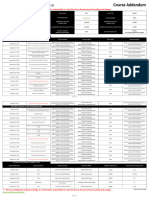

- Fall 2023 ACC400 NKK Course AddendumDocument2 pagesFall 2023 ACC400 NKK Course AddendumGKNo ratings yet

- TRAIN Slides RR 8-2018 PDFDocument183 pagesTRAIN Slides RR 8-2018 PDFpaulinoemersonpNo ratings yet

- Test Bank For South Western Federal Taxation 2021 Individual Income Taxes 44th Edition James C Young Annette Nellen William A Raabe William H Hoffman JR David M Maloney 2Document37 pagesTest Bank For South Western Federal Taxation 2021 Individual Income Taxes 44th Edition James C Young Annette Nellen William A Raabe William H Hoffman JR David M Maloney 2sierraenarmedgj2n100% (31)

- Credit Note: Dobrinescu F. Ioan-Cristinel Str. Moldovan Micu Ioan, Nr. 1 Voluntari, Pipera, 077190Document1 pageCredit Note: Dobrinescu F. Ioan-Cristinel Str. Moldovan Micu Ioan, Nr. 1 Voluntari, Pipera, 077190Dob CrisNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- ONPSLIP UN 1011202311555 8025192RcsDocument1 pageONPSLIP UN 1011202311555 8025192RcsjohnsonmarielouiseNo ratings yet

- Chapter-1 Introduction & Basics of Income TaxDocument21 pagesChapter-1 Introduction & Basics of Income TaxsumitNo ratings yet

- Chapter 1 Introduction of GSTDocument4 pagesChapter 1 Introduction of GSTjhjhNo ratings yet

- RCM On Residential DwellingDocument5 pagesRCM On Residential Dwellingashok babuNo ratings yet

- Grindly Gases Petrochemicals PVT LTD - 270 - 11!09!2021Document2 pagesGrindly Gases Petrochemicals PVT LTD - 270 - 11!09!2021Pragnesh PrajapatiNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- Redcell 3Document2 pagesRedcell 3Ajish joNo ratings yet

- CIR vs. Phoenix (TAX)Document2 pagesCIR vs. Phoenix (TAX)Teff Quibod100% (3)

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- Principles of Taxation Sir Azeem New 2021Document1 pagePrinciples of Taxation Sir Azeem New 2021Bilal ShaikhNo ratings yet

- WithholdingTaxTable RatesDocument3 pagesWithholdingTaxTable Ratesafzallodhi736No ratings yet

- Vijay Kumar GSTDocument1 pageVijay Kumar GSTKarthick KrishnaNo ratings yet

- TicketDocument1 pageTicketRavi VarmaNo ratings yet

- Basics On Income Tax PDFDocument10 pagesBasics On Income Tax PDFHannan Mahmood TonmoyNo ratings yet

- Foreign Investment Real Property Tax Act (FIRPTA)Document1 pageForeign Investment Real Property Tax Act (FIRPTA)book15wormNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- PIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityDocument1 pagePIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue Authorityseres jakoNo ratings yet

- Sin TiruloDocument1 pageSin TiruloAlvaro RomeroNo ratings yet