Professional Documents

Culture Documents

Rmo 16-88 PDF

Rmo 16-88 PDF

Uploaded by

Peter Joshua Ortega0 ratings0% found this document useful (0 votes)

20 views1 pageOriginal Title

RMO 16-88.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageRmo 16-88 PDF

Rmo 16-88 PDF

Uploaded by

Peter Joshua OrtegaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

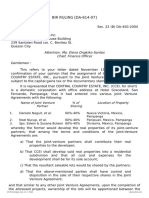

April 18, 1988

REVENUE MEMORANDUM ORDER NO. 16-88

SUBJECT : Amending Revenue Memorandum Order No. 29-86 Dated

September 3, 1986, Regarding Payment of Capital Gains Tax on

Extrajudicial Foreclosure Sale Initiated by Banks, Finance and

Insurance Companies

TO : All Internal Revenue Officers and Others Concerned

SECTION 1. In order to clarify the confusion brought about by the imposition of

the 5% capital gains tax, prescribed under Section 21(e) of the Tax Code, as amended,

on the purchase by banks, nance and insurance companies of real property classi ed

as capital asset from individuals thru mortgage foreclosure sale, paragraph 2.2 of

Revenue Memorandum Order No. 29-86 dated September 3, 1986 is hereby amended

to read as follows: cd i

"2.2 - The tax applies not only to ordinary sale transaction but also to pacto

de retro sales and other forms of conditional sales. This accordingly, includes

mortgage foreclosure sales, except extrajudicial foreclosure sale under Act No.

3135, as amended by Act No. 4118 wherein the tax shall become due only upon

the consolidation of title in the name of the nancial institution (banks, nance

and insurance company) concerned."

SECTION 2. Effectivity. — This Revenue Memorandum Order shall take effect

immediately. aisa dc

(SGD.) BIENVENIDO A. TAN, JR.

BIR Commissioner

CD Technologies Asia, Inc. © 2018 cdasiaonline.com

You might also like

- Chapter 189-The Stamp Duty Act PDFDocument92 pagesChapter 189-The Stamp Duty Act PDFEsther Maugo100% (1)

- 12 Songco v. NLRC (1990) (Ortega)Document2 pages12 Songco v. NLRC (1990) (Ortega)Peter Joshua Ortega100% (1)

- People V CabalquintoDocument2 pagesPeople V CabalquintoPeter Joshua OrtegaNo ratings yet

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaNo ratings yet

- 03 People v. Dalisay (2009)Document3 pages03 People v. Dalisay (2009)Peter Joshua OrtegaNo ratings yet

- Meralco V NLRC (Hipolito)Document3 pagesMeralco V NLRC (Hipolito)Peter Joshua Ortega100% (1)

- 03 Sps. Guanio v. Makati Shangri-La (2011) (Ortega)Document3 pages03 Sps. Guanio v. Makati Shangri-La (2011) (Ortega)Peter Joshua OrtegaNo ratings yet

- Case DigestDocument3 pagesCase DigestPeter Joshua OrtegaNo ratings yet

- UCPB General Insurance v. Masagana Telamart With Opinions (Yu)Document3 pagesUCPB General Insurance v. Masagana Telamart With Opinions (Yu)Peter Joshua OrtegaNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- 02 Director v. CA (Blando)Document2 pages02 Director v. CA (Blando)Peter Joshua Ortega100% (1)

- Manese V Jollibee (SUN)Document5 pagesManese V Jollibee (SUN)Peter Joshua OrtegaNo ratings yet

- Rmo 27-89 PDFDocument1 pageRmo 27-89 PDFPeter Joshua OrtegaNo ratings yet

- Rmo 27-89 PDFDocument1 pageRmo 27-89 PDFPeter Joshua OrtegaNo ratings yet

- Petitioner Vs Vs Respondent: Decision DecisionDocument32 pagesPetitioner Vs Vs Respondent: Decision DecisionLeulaDianneCantosNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDocument3 pages2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- G.R. No. 160756Document16 pagesG.R. No. 160756Meah BrusolaNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- Accenture, Inc. vs. CIR, GR No. 190102, 11 JULY 2012Document21 pagesAccenture, Inc. vs. CIR, GR No. 190102, 11 JULY 2012WAYNENo ratings yet

- Bid Document SALE OF SLUDGE CRT-005Document5 pagesBid Document SALE OF SLUDGE CRT-005Muhammad Asad FarooqiNo ratings yet

- DEUTSCHE BANK AG MANILA BRANCH V CIRDocument17 pagesDEUTSCHE BANK AG MANILA BRANCH V CIROlivia JaneNo ratings yet

- Revenue Memorandum Circular No. 13-85: SubjectDocument4 pagesRevenue Memorandum Circular No. 13-85: SubjectAemie JordanNo ratings yet

- Deutsche Bank Ag Manila Branch, Petitioner, vs. Commissioner of Internal Revenue, RespondentDocument15 pagesDeutsche Bank Ag Manila Branch, Petitioner, vs. Commissioner of Internal Revenue, RespondentSzia Darene MartinNo ratings yet

- RR 04-99 PDFDocument3 pagesRR 04-99 PDFPeter Joshua OrtegaNo ratings yet

- ISSUE: WON EO 273 Is Unconstitutional. NO. WON EO 273 Is in Violation of Art. VI, Sec. 28 (1) - NODocument22 pagesISSUE: WON EO 273 Is Unconstitutional. NO. WON EO 273 Is in Violation of Art. VI, Sec. 28 (1) - NODowie M. MatienzoNo ratings yet

- 5 - Accenture vs. CIRDocument21 pages5 - Accenture vs. CIRJeanne CalalinNo ratings yet

- Tax Rev CasesDocument54 pagesTax Rev CasesbrownieNo ratings yet

- BIRMDocument2 pagesBIRMboazmashimbaNo ratings yet

- 165465-2010-Calibre Traders Inc. v. Bayer Philippines20180918-5466-21lefzDocument18 pages165465-2010-Calibre Traders Inc. v. Bayer Philippines20180918-5466-21lefzAndrew NacitaNo ratings yet

- CREBA Vs RomuloDocument10 pagesCREBA Vs RomuloAndrea Peñas-ReyesNo ratings yet

- Maceda Vs MacaraigDocument17 pagesMaceda Vs MacaraigKenmar NoganNo ratings yet

- 34 - CREBA Vs RomuloDocument15 pages34 - CREBA Vs RomuloDazzle DuterteNo ratings yet

- Bir Ruling No. Ot-071-2023Document3 pagesBir Ruling No. Ot-071-2023Ren Mar CruzNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Adobe Scan Jan 26, 2023Document25 pagesAdobe Scan Jan 26, 2023Rafael AbedesNo ratings yet

- Maceda V MacaraigDocument45 pagesMaceda V MacaraigMarian ArcinasNo ratings yet

- US Internal Revenue Service: Irb00-06Document134 pagesUS Internal Revenue Service: Irb00-06IRSNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- XIII-XVI ReviewerDocument53 pagesXIII-XVI Reviewerjuna luz latigayNo ratings yet

- Xiii Xvi ReviewerDocument38 pagesXiii Xvi Reviewerjuna luz latigayNo ratings yet

- Maceda vs. Macaraig, JR (MR)Document32 pagesMaceda vs. Macaraig, JR (MR)Aaron CarinoNo ratings yet

- US Internal Revenue Service: Irb98-02Document44 pagesUS Internal Revenue Service: Irb98-02IRSNo ratings yet

- CIR V TMX SalesDocument12 pagesCIR V TMX SalesJolo RomanNo ratings yet

- Creba. v. Romulo. 614 Scra. 605Document18 pagesCreba. v. Romulo. 614 Scra. 605Joshua RodriguezNo ratings yet

- Petitioner Vs Vs Respondents: en BancDocument21 pagesPetitioner Vs Vs Respondents: en BancDaryl YuNo ratings yet

- G.R. No. 160756Document12 pagesG.R. No. 160756Jason BuenaNo ratings yet

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- G.R. No. 160756Document28 pagesG.R. No. 160756Mark Lord Morales BumagatNo ratings yet

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- Petitioner vs. vs. Respondents G E Aragones & Associates: Second DivisionDocument6 pagesPetitioner vs. vs. Respondents G E Aragones & Associates: Second DivisionPatricia BenildaNo ratings yet

- Bir 363-14Document5 pagesBir 363-14msdivergentNo ratings yet

- Cir Vs TMX SalesDocument10 pagesCir Vs TMX SalespjNo ratings yet

- E-Compendium of Tax Laws - Updated With Finance Act 2023Document841 pagesE-Compendium of Tax Laws - Updated With Finance Act 2023tgg56kcg55No ratings yet

- 5 CREBA Vs RomuloDocument50 pages5 CREBA Vs RomuloYour Public ProfileNo ratings yet

- CIR v. TMX Sales, Inc.Document4 pagesCIR v. TMX Sales, Inc.April ToledoNo ratings yet

- Yamane vs. BA LepantoDocument11 pagesYamane vs. BA LepantoJimi SolomonNo ratings yet

- Bill No. 22 of 2021 TNDocument2 pagesBill No. 22 of 2021 TNmlncoNo ratings yet

- Notes On Taxation 2 June 10 2021Document6 pagesNotes On Taxation 2 June 10 2021Diane JulianNo ratings yet

- SG ITAD Ruling No. 019-03Document4 pagesSG ITAD Ruling No. 019-03Paul Angelo TombocNo ratings yet

- BIR Ruling No. 296-14Document2 pagesBIR Ruling No. 296-14Godfrey TejadaNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- Duetsche Bank AG Manila Branch vs. Commissioner of Internal Revenue, 704 SCRA 216, G.R. No. 188550 August 28, 2013Document3 pagesDuetsche Bank AG Manila Branch vs. Commissioner of Internal Revenue, 704 SCRA 216, G.R. No. 188550 August 28, 2013Jin AghamNo ratings yet

- Deutsche Bank v. CIRDocument17 pagesDeutsche Bank v. CIRMlaNo ratings yet

- BIR Ruling No. 340-11 - E-BooksDocument5 pagesBIR Ruling No. 340-11 - E-BooksCkey ArNo ratings yet

- Upr - Em.e !court: 1'.tpublir of TBT Tlbilippints ManilaDocument24 pagesUpr - Em.e !court: 1'.tpublir of TBT Tlbilippints ManilaPhilip JameroNo ratings yet

- NEWCASURECOIIIDocument2 pagesNEWCASURECOIIIPeter Joshua OrtegaNo ratings yet

- ICL Developments CompilationDocument4 pagesICL Developments CompilationPeter Joshua OrtegaNo ratings yet

- (Compilation) (1) General ConceptsDocument16 pages(Compilation) (1) General ConceptsPeter Joshua OrtegaNo ratings yet

- RR 04-99 PDFDocument3 pagesRR 04-99 PDFPeter Joshua OrtegaNo ratings yet

- PDIC Charter 2022Document112 pagesPDIC Charter 2022Peter Joshua OrtegaNo ratings yet

- National Bank of Commerce Morgan, 92 So. 10 (Ala. 1921) : Supreme Court of AlabamaDocument8 pagesNational Bank of Commerce Morgan, 92 So. 10 (Ala. 1921) : Supreme Court of AlabamaPeter Joshua OrtegaNo ratings yet

- 1 CrimPro WarrantDocument2 pages1 CrimPro WarrantPeter Joshua OrtegaNo ratings yet

- (Compilation) (2) Organization of Administrative AgenciesDocument21 pages(Compilation) (2) Organization of Administrative AgenciesPeter Joshua OrtegaNo ratings yet

- (Compilation) (4) Power of Administrative AgenciesDocument15 pages(Compilation) (4) Power of Administrative AgenciesPeter Joshua OrtegaNo ratings yet

- (Compilation) (3) Power To ReorganizeDocument9 pages(Compilation) (3) Power To ReorganizePeter Joshua OrtegaNo ratings yet

- Vigilla V PH College of Criminology - Labor (JACINTO)Document3 pagesVigilla V PH College of Criminology - Labor (JACINTO)Peter Joshua OrtegaNo ratings yet

- Crim Pro - Arraignment - MTQ 1Document27 pagesCrim Pro - Arraignment - MTQ 1Peter Joshua OrtegaNo ratings yet

- Theis v. CA (Ortega)Document2 pagesTheis v. CA (Ortega)Peter Joshua OrtegaNo ratings yet

- Rellosa v. Gaw (Ortega)Document2 pagesRellosa v. Gaw (Ortega)Peter Joshua OrtegaNo ratings yet

- Universal Food Corp. v. Court of Appeals20181017-5466-Xjj5s6Document15 pagesUniversal Food Corp. v. Court of Appeals20181017-5466-Xjj5s6Peter Joshua OrtegaNo ratings yet