Professional Documents

Culture Documents

2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujm

Uploaded by

rian.lee.b.tiangco0 ratings0% found this document useful (0 votes)

31 views4 pagesOriginal Title

35732-2012-ITAD_BIR_Ruling_No._092-1220210505-11-1ig3ujm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujm

Uploaded by

rian.lee.b.tiangcoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

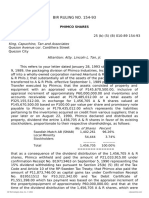

February 16, 2012

ITAD BIR RULING NO. 092-12

Isla Lipana & Co.

29th Floor, Philamlife Tower

8767 Paseo de Roxas, Makati City

Attention: Alexander B. Cabrera

Managing Partner

Tax Services

Gentlemen :

This refers to your Tax Treaty Relief Application ("TTRA") filed on

December 28, 2007 requesting confirmation that service fees paid by STEAG

Aktiengesellschaft-Philippine Regional Operating Headquarters ("STEAG

ROHQ") to One TÜV BV Technische Inspektions GmbH ("One TÜV") are

exempt from income tax pursuant to the Agreement between the Republic of

the Philippines and the Federal Republic of Germany for the Avoidance of

Double Taxation with Respect to Taxes on Income and Capital.

One TÜV is a corporation organized and existing under the laws of

Germany and is a resident thereof based on the Confirmation of Registration

issued by the Inland Revenue Office of Essen-North/East in Germany on May

7, 2008. One TÜV is situated at Langemarckstr. 20, 45141 Essen, Germany.

One TÜV is not registered as a corporation or partnership in the Philippines

based on the Certification of Non-Registration issued by the Securities and

Exchange Commission on October 1, 2007. On the other hand, STEAG ROHQ

is the regional operating headquarters in the Philippines of STEAG

Aktiengesellschaft, is situated at Barangay Balacanas, Misamis Oriental,

Philippines.

On October 7, 2005, One TÜV a n d STEAG ROHQ entered into a

Consultancy Agreement where One TÜV agreed to provide consultancy and

advisory services to STEAG ROHQ relating to, among others, the supervision

of boiler pressure tests as specified in the Mindanao Project Contracts,

especially with regard to the application of all ASME regulations as requested

in the Superior Technical Specification and Power Purchase Agreement as

amended, at the construction site of the Mindanao Power Project. In

consideration, STEAG ROHQ will pay service fees to One TÜV amounting to

US$7,000.00 for services rendered for the first 10 days and US$700.00 for

each succeeding day. The service fees will be paid within 30 days from the

date of receipt of the invoice by STEAG ROHQ. The Agreement took effect on

October 7, 2005, and remained in effect up to December 31, 2006. cDIaAS

Based on the Affidavit issued by the Resident Agent and Manager of

STEAG ROHQ on October 5, 2007, One TÜV has only sent one personnel to

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

the Philippines to provide services to STEAG ROHQ in the person of Mr.

Surachai Burasothicul. He provided these services for 21 days in 2005

(October 12-19, 28-31 and December 7-10, 21-25) and for 9 days in 2006

(January 11-12, 31, February 1-3 and July 18-20).

Relative thereto, please be informed that under Section III (2) of

Revenue Memorandum Order No. 1-00 (Procedures for Processing Tax Treaty

Relief Application) ("RMO 1-2000") , any availment of tax treaty relief

(exemption from income tax or reduction of tax) shall be preceded by an

application filed at the International Tax Affairs Division ("ITAD") of this

Bureau at least 15 days before the intended transaction or payment of

income, to wit:

"III. Policies:

In order to achieve the above-mentioned objectives, the following

policies shall be observed:

xxx xxx xxx

2. Any availment of the tax treaty relief shall be preceded by an

application by filing BIR Form No. 0901 (Application for Relief from

Double Taxation) with ITAD at least 15 days before the transaction i.e.,

payment of dividends, royalties, etc., accompanied by supporting

documents justifying the relief. . ." (Emphasis ours)

This condition was emphasized by the Court of Tax Appeals in Mirant

(Philippines) Operations Corporation vs. Commissioner of Internal Revenue

(C.T.A. Case No. 6382 dated June 7, 2005) where it ruled:

"However, it must be remembered that a foreign corporation

wishing to avail of the benefits of the tax treaty should invoke the

provisions of the tax treaty and prove that indeed the provisions of the

tax treaty applies to it, before the benefits may be extended to such

corporation. In other words, a resident or non-resident foreign

corporation shall be taxed according to the provisions of the National

Internal Revenue Code, unless it is shown that the treaty provisions

apply to the said corporation, and that, in cases the same are

applicable, the option to avail of the tax benefits under the tax treaty

has been successfully invoked. cCaATD

Under Revenue Memorandum Order 01-2000 of the Bureau of

Internal Revenue, it is provided that the availment of a tax treaty

provision must be preceded by an application for a tax treaty relief

with its International Tax Affairs Division (ITAD). This is to prevent any

erroneous interpretation and/or application of the treaty provisions

with which the Philippines is a signatory to. The implementation of the

said Revenue Memorandum Order is in harmony with the objectives of

the contracting state to ensure that the granting of the benefits under

the tax treaties are enjoyed by the persons or corporations duly

entitled to the same.

The Court notes that nowhere in the records of the case was it

shown that petitioner indeed took the liberty of properly observing the

provisions of the said order. Petitioner quotes various BIR, as well as

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

ITAD, Rulings issued to several foreign corporations seeking for a tax

relief from the office of the respondent. However, not any one of these

rulings pertains to the petitioner. It must be stressed that BIR rulings

are issued based on the facts and circumstances surrounding particular

issue/issues in question and are resolved on a case-to-case basis. It

would be thus erroneous to invoke the ruling of the respondent in

specific cases, which have no bearing to the case of petitioner."

(Emphasis ours)

This decision was upheld by the Supreme Court in a Resolution (G.R.

No. 168531) dated February 18, 2008.

Furthermore, this requirement in RMO 1-2000 is reiterated in

subsequent rulings of the Court of Tax Appeals: Deutsche Bank AG Manila

Branch vs. Commissioner of Internal Revenue (C.T.A. Case No. 456 dated

May 29, 2009), CBK Power Company Ltd. vs. Commissioner of Internal

Revenue (C.T.A. Case Nos. 6699, 6844 and 7166 dated March 29, 2010) and

Manila North Tollways Corporation vs. Commissioner of Internal Revenue

(C.T.A. Case No. 7864 dated April 12, 2011).

In view of the foregoing, since One TÜV rendered the above-mentioned

services in the Philippines in October and December 2005 and in January,

February and July 2006 , and the service fees therefor were paid within 30

days from the date of receipt of the invoice by STEAG ROHQ, which could be

the month following the month when the services were rendered, but since

the subject TTRA was filed on December 28, 2007, this Office hereby DENIES

relief on these paid by STEAG ROHQ to One TÜV for having been filed

beyond the fifteen-day period required in RMO 1-2000. Accordingly, said fees

shall be subject to income tax at the rate of 35 percent under Section 28 (B)

(1) of the National Internal Revenue Code of 1997, as amended, to wit: DTIaHE

"SEC. 28. Rates of Income Tax on Foreign Corporations. —

xxx xxx xxx

(B) Tax on Nonresident Foreign Corporation. —

(1) In General. — Except as otherwise provided in this

Code, a foreign corporation not engaged in trade or business in

the Philippines shall pay a tax equal to thirty-five percent (35%)

of the gross income received during each taxable year from all

sources within the Philippines, such as interests, dividends, rents,

royalties, salaries, premiums (except reinsurance premiums),

annuities, emoluments or other fixed or determinable annual,

periodic or casual gains, profits and income, and capital gains,

except capital gains subject to tax under subparagraph 5(c) and

(d) above: Provided, That effective January 1, 2009, the rate of

income tax shall be thirty percent (30%)."

Please be guided accordingly.

Very truly yours,

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDocument3 pages2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNo ratings yet

- Philippines-Netherlands Tax Treaty Dividend RulingDocument3 pagesPhilippines-Netherlands Tax Treaty Dividend Rulingnathalie velasquezNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- Taxation Case Digest (Batch 2) Case #1Document7 pagesTaxation Case Digest (Batch 2) Case #1Na AbdurahimNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- CIR v. Commonwealth Management & Services CorporationDocument9 pagesCIR v. Commonwealth Management & Services CorporationHazel SegoviaNo ratings yet

- Republic vs. Heirs of JalandoniDocument18 pagesRepublic vs. Heirs of JalandoniJose Emmanuel DolorNo ratings yet

- BIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Document5 pagesBIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Archie Guevarra100% (3)

- 2020 Tax Updates: Key SC and CTA Rulings on Income Tax and VATDocument12 pages2020 Tax Updates: Key SC and CTA Rulings on Income Tax and VATCarlota VillaromanNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- Jurisprudence-Pacta Sunt ServandaDocument3 pagesJurisprudence-Pacta Sunt ServandaMavisJamesNo ratings yet

- Petitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueDocument7 pagesPetitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueKing ForondaNo ratings yet

- TtraDocument3 pagesTtralance757No ratings yet

- Glorilyn M. Montejo 8-14 Cases On Double or Tax Exemption CIR vs. CA G.R. No. 95022 207 March 23, 1992 SCRA 487 Tax Exemption FactsDocument10 pagesGlorilyn M. Montejo 8-14 Cases On Double or Tax Exemption CIR vs. CA G.R. No. 95022 207 March 23, 1992 SCRA 487 Tax Exemption FactsAna leah Orbeta-mamburamNo ratings yet

- Deutsche Bank Ag Manila Branch VS CirDocument4 pagesDeutsche Bank Ag Manila Branch VS CirJen DeeNo ratings yet

- BIR Ruling ECCP 068-08Document4 pagesBIR Ruling ECCP 068-08Kendra Miranda LorinNo ratings yet

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationDocument3 pagesJustice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationNicco AcaylarNo ratings yet

- Pawnshop, Airline Taxation Issues Analyzed by Supreme CourtDocument68 pagesPawnshop, Airline Taxation Issues Analyzed by Supreme CourtWilliam DS M ClaverNo ratings yet

- Duetsche Bank AG Manila Branch vs. Commissioner of Internal Revenue, 704 SCRA 216, G.R. No. 188550 August 28, 2013Document3 pagesDuetsche Bank AG Manila Branch vs. Commissioner of Internal Revenue, 704 SCRA 216, G.R. No. 188550 August 28, 2013Jin AghamNo ratings yet

- Streamlining Treaty ReliefDocument3 pagesStreamlining Treaty ReliefAlea MalabananNo ratings yet

- Rmo No. 14 2021Document13 pagesRmo No. 14 2021Christine Fe BuencaminoNo ratings yet

- 2006 ITAD Rulings - Delegated AuthorityDocument537 pages2006 ITAD Rulings - Delegated AuthorityJerwin DaveNo ratings yet

- Bir Ruling 2021 - DST On Loan Exemption by PezaDocument5 pagesBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaNo ratings yet

- Bir Ruling (Da - (C-005) 023-08)Document4 pagesBir Ruling (Da - (C-005) 023-08)Marlene TongsonNo ratings yet

- Tax CasesDocument67 pagesTax CasesRichardEnriquezNo ratings yet

- Deutsche Bank vs CIR tax treaty reliefDocument4 pagesDeutsche Bank vs CIR tax treaty reliefTinersNo ratings yet

- Tax 2Document99 pagesTax 2Francis PunoNo ratings yet

- 1999 ITAD RulingsDocument97 pages1999 ITAD RulingsJerwin DaveNo ratings yet

- BIR Ruling DA - C-018 075-10Document2 pagesBIR Ruling DA - C-018 075-10Mark Lord Morales BumagatNo ratings yet

- 8 CIR v. American ExpressDocument21 pages8 CIR v. American ExpressHannah MedNo ratings yet

- Problem Exercises in TaxationDocument38 pagesProblem Exercises in TaxationSHeena MaRie ErAsmoNo ratings yet

- Deutsche Vs CIR - RamirezDocument2 pagesDeutsche Vs CIR - RamirezTats YumulNo ratings yet

- CIR Vs CADocument7 pagesCIR Vs CAChrissyNo ratings yet

- Taxation 2015 CasesDocument21 pagesTaxation 2015 CasesErika Mae GumabolNo ratings yet

- First Division: DecisionDocument17 pagesFirst Division: Decisiondom0202No ratings yet

- Facts:: 1 CIR vs. Seagate Technology (Philippines) G.R. NO. 153866, February 11, 2005Document5 pagesFacts:: 1 CIR vs. Seagate Technology (Philippines) G.R. NO. 153866, February 11, 2005JV PagunuranNo ratings yet

- 201743-2016-ING Bank N.V. v. Commissioner of Internal20210505-12-K23ebnDocument12 pages201743-2016-ING Bank N.V. v. Commissioner of Internal20210505-12-K23ebnRJ YuNo ratings yet

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachNo ratings yet

- SGV Ey Tax BulletinDocument15 pagesSGV Ey Tax BulletinJEWELNo ratings yet

- (CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000Document3 pages(CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000j guevarraNo ratings yet

- G.R. No. 160756Document16 pagesG.R. No. 160756Meah BrusolaNo ratings yet

- G.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentDocument16 pagesG.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentSamuel John CahimatNo ratings yet

- Commissioner of Internal Revenue vs. Court of AppealsDocument7 pagesCommissioner of Internal Revenue vs. Court of Appealsvince005No ratings yet

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document28 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Abbey Agno PerezNo ratings yet

- May 2018 SGV SDGSDDocument26 pagesMay 2018 SGV SDGSDBien Bowie A. CortezNo ratings yet

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : Scope and Limitations of Taxation (Constitutional Limitations)Document4 pagesJustice Teresita Leonardo-De Castro Cases (2008-2015) : Scope and Limitations of Taxation (Constitutional Limitations)jimNo ratings yet

- RMC No. 77-2021Document38 pagesRMC No. 77-2021Mike Ferdinand SantosNo ratings yet

- Cir vs. Isabela Cultural Corporation (Icc) : Issue/SDocument5 pagesCir vs. Isabela Cultural Corporation (Icc) : Issue/SMary AnneNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- Petitioner Respondent: First DivisionDocument10 pagesPetitioner Respondent: First DivisionJuan Miguel Suerte FelipeNo ratings yet

- Petitioner vs. vs. Respondents Melquiades C Gutierrez The Solicitor GeneralDocument9 pagesPetitioner vs. vs. Respondents Melquiades C Gutierrez The Solicitor Generalthirdy demaisipNo ratings yet

- Creba. v. Romulo. 614 Scra. 605Document18 pagesCreba. v. Romulo. 614 Scra. 605Joshua RodriguezNo ratings yet

- CIR vs. Bank of Commerce (2005)Document16 pagesCIR vs. Bank of Commerce (2005)BenNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- Case List: Value Added TaxDocument7 pagesCase List: Value Added TaxAnne Marieline BuenaventuraNo ratings yet

- Tax Treaty Benefits Prevail Over RMO No. 1-2000Document7 pagesTax Treaty Benefits Prevail Over RMO No. 1-2000Jihan LlamesNo ratings yet

- Petitioner RespondentDocument4 pagesPetitioner Respondentrian.lee.b.tiangcoNo ratings yet

- BIR Ruling SB - 056 827-09 20210505Document3 pagesBIR Ruling SB - 056 827-09 20210505rian.lee.b.tiangcoNo ratings yet

- Amending Section 21 of City Tax Ordinance No.20210505-12Document3 pagesAmending Section 21 of City Tax Ordinance No.20210505-12rian.lee.b.tiangcoNo ratings yet

- Tax Consequences of The Transfer of AssetsDocument5 pagesTax Consequences of The Transfer of Assetsrian.lee.b.tiangcoNo ratings yet

- Naga City 2022 Revised Revenue CodeDocument30 pagesNaga City 2022 Revised Revenue Coderian.lee.b.tiangcoNo ratings yet

- Davao City Upholds Tax on Investment FirmDocument4 pagesDavao City Upholds Tax on Investment Firmrian.lee.b.tiangcoNo ratings yet

- Petitioner RespondentsDocument15 pagesPetitioner Respondentsrian.lee.b.tiangcoNo ratings yet

- Petitioners RespondentDocument18 pagesPetitioners Respondentrian.lee.b.tiangcoNo ratings yet

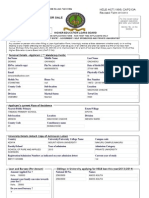

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDocument2 pagesBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoNo ratings yet

- Revenue Memorandum Circular No. 116-19: October 18, 2019Document2 pagesRevenue Memorandum Circular No. 116-19: October 18, 2019rian.lee.b.tiangcoNo ratings yet

- Petitioner Respondent: Bpi Capital Corporation, Commissioner of Internal RevenueDocument16 pagesPetitioner Respondent: Bpi Capital Corporation, Commissioner of Internal Revenuerian.lee.b.tiangcoNo ratings yet

- Revenue Regulations No. 25-20: September 30, 2020Document3 pagesRevenue Regulations No. 25-20: September 30, 2020rian.lee.b.tiangcoNo ratings yet

- Republic Act No. 8756: Definition of Terms Multinational CompanyDocument11 pagesRepublic Act No. 8756: Definition of Terms Multinational Companyrian.lee.b.tiangcoNo ratings yet

- 986 2005 ITAD - Ruling - No. - 016 0520210505 12 1rwd8efDocument7 pages986 2005 ITAD - Ruling - No. - 016 0520210505 12 1rwd8efrian.lee.b.tiangcoNo ratings yet

- 2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6Document4 pages2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6rian.lee.b.tiangcoNo ratings yet

- BIR RULING (DA-521-05) : SGV & CoDocument2 pagesBIR RULING (DA-521-05) : SGV & Corian.lee.b.tiangcoNo ratings yet

- Itad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law OfficeDocument5 pagesItad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law Officerian.lee.b.tiangcoNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- How To Use KEATDocument5 pagesHow To Use KEATAamir KhanNo ratings yet

- CMA Exam Review - Strategic Planning ToolsDocument67 pagesCMA Exam Review - Strategic Planning ToolsLe BlancNo ratings yet

- Functional Definition of Insurance: MeaningDocument6 pagesFunctional Definition of Insurance: MeaningShubham DhimaanNo ratings yet

- DEPOSITORY RECEIPT-A NoteDocument1 pageDEPOSITORY RECEIPT-A NoteFathimaNo ratings yet

- Part III Money Market (Revised For 2e)Document31 pagesPart III Money Market (Revised For 2e)Harun MusaNo ratings yet

- EuroHedge Summit Brochure - April 2011Document12 pagesEuroHedge Summit Brochure - April 2011Absolute ReturnNo ratings yet

- Payment Receipt: Urban Administration and Development DepartmentDocument2 pagesPayment Receipt: Urban Administration and Development Departmentaadarsh vermaNo ratings yet

- Metropolis Town Villa Cost SheetDocument1 pageMetropolis Town Villa Cost SheetpreanandNo ratings yet

- ISO 20022 Data Source Schemes (DSS)Document15 pagesISO 20022 Data Source Schemes (DSS)aNo ratings yet

- JhunjhunwalaDocument12 pagesJhunjhunwalapercysearchNo ratings yet

- MIT18 S096F13 Lecnote14Document34 pagesMIT18 S096F13 Lecnote14eni100% (1)

- Build income statement and debt assumptions modelDocument19 pagesBuild income statement and debt assumptions modelzzduble1100% (1)

- Problem #7: Recording Transactions in A Financial Transaction WorksheetDocument17 pagesProblem #7: Recording Transactions in A Financial Transaction Worksheetfabyunaaa100% (1)

- Idx Monthly Oct 2023Document154 pagesIdx Monthly Oct 2023ikhsan AdiNo ratings yet

- Mock Exam 1 AnsDocument110 pagesMock Exam 1 Ansteeravac vac100% (3)

- v1nChuHABHUWjH4tt5dcaP PDFDocument416 pagesv1nChuHABHUWjH4tt5dcaP PDFashaduzzamanNo ratings yet

- Technics Oil & Gas: Initiation of CoverageDocument15 pagesTechnics Oil & Gas: Initiation of Coveragecentaurus553587No ratings yet

- Master Budget Case: Toyworks Ltd. (A)Document4 pagesMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- Accounting Equation & Major AccountsDocument19 pagesAccounting Equation & Major AccountsAldeguer Joy PenetranteNo ratings yet

- Facing A Challenging Financial FutureDocument8 pagesFacing A Challenging Financial FutureCommunity and Voluntary ServiceNo ratings yet

- Business Valuation TemplateDocument2 pagesBusiness Valuation TemplateAkshay MathurNo ratings yet

- Moving Average Guide Handout FinalDocument9 pagesMoving Average Guide Handout FinalSaurabh Jain100% (1)

- Ans: AnsDocument7 pagesAns: AnsRomelie M. NopreNo ratings yet

- Iasb Employee BenDocument3 pagesIasb Employee BenRommel CruzNo ratings yet

- Helb DennisDocument6 pagesHelb DennisDennis Onchieku OnyandoNo ratings yet

- Cooper 2015 - Shadow Money and The Shadow WorkforceDocument30 pagesCooper 2015 - Shadow Money and The Shadow Workforceanton.de.rotaNo ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet

- LendIt PDFDocument4 pagesLendIt PDFLuis GNo ratings yet

- Mortgage Loan Case StudiesDocument8 pagesMortgage Loan Case StudiesFurkhan SyedNo ratings yet

- Chapter 21: The Simplest Short-Run Macro Model: Desired Aggregate ExpenditureDocument8 pagesChapter 21: The Simplest Short-Run Macro Model: Desired Aggregate ExpenditureSaaki GaneshNo ratings yet