Professional Documents

Culture Documents

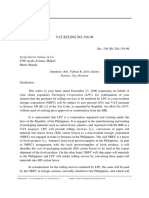

Revenue Memorandum Circular No. 116-19: October 18, 2019

Uploaded by

rian.lee.b.tiangcoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Memorandum Circular No. 116-19: October 18, 2019

Uploaded by

rian.lee.b.tiangcoCopyright:

Available Formats

October 18, 2019

REVENUE MEMORANDUM CIRCULAR NO. 116-19

SUBJECT : Clarifications on the Treatment of Alien Individuals

Employed in the Philippines by Regional or Area

Headquarters and Regional Operating Headquarters of

Multinational Companies, Offshore Banking Units and

Petroleum Service Contractors and Subcontractors

Pursuant to Section 4.C of Revenue Regulations No. 8-

2018

To : All Internal Revenue Officials, Employees and Others

Concerned

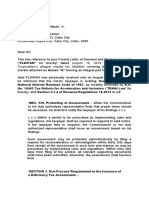

I. BACKGROUND

The pertinent provisions of Republic Act No. 10963, otherwise known

as the "Tax Reform for Acceleration and Inclusion (TRAIN) Law" introduced

the new tax treatment on the income earned by alien individuals from

certain entities in the Philippines, which were, however, vetoed by the

President. Its implementing provisions under Section 4.C of Revenue

Regulations (RR) No. 8-2018 provide that:

"The preferential income tax rate under Subsection (C), (D) and (E) of

Section 25 of the Tax Code, as amended, shall no longer be applicable

without prejudice to the application of preferential tax rates under

existing international tax treaties, if warranted. Thus, all concerned

employees of regional or area headquarters and regional operating

headquarters of multinational companies, offshore banking units and

petroleum service contractor and subcontractor shall be subject to

the regular tax rate under Sec. 24(A)(2)(a) of the Tax Code, as

amended."

II. CLARIFICATIONS

The respective incomes of the alien individuals employed by the

above-stated entities are now similarly taxed as income of regular

employees of locally established entities. Accordingly, these alien individuals

are subject to the same administrative requirements of this Bureau being

imposed on other regular employees, such as the substituted filing, issuance

of BIR Form No. 2316, inclusion in the monthly withholding tax remittance on

compensation, as well as in the prescribed alphalists, etc. HTcADC

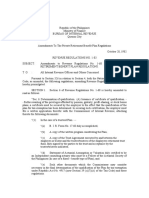

With respect to those alien individuals who are employed by foreign

principals and who are assigned to render services exclusively to these local

entities, otherwise known as "seconded employees or secondees," they are

likewise subject to the regular income tax rates. It is grounded on the

principle of situs of taxation considering that the services rendered by these

alien individuals are being performed within the Philippines, regardless of

whether their salaries are being paid by the foreign principals or advanced

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

by these local entities.

For this purpose, the local entities, to whom the "seconded employees"

render their services, shall comply the same administrative requirements,

except for substituted filing, imposed by this Bureau for regular employees.

In addition to these prescribed requirements, the following procedures shall

be complied by all concerned:

(a) A separate employment status and description for "seconded

employees" shall be provided in the "Current Employment

Status" of the Alphabetical List of Employees/Payees from Whom

Taxes Were Withheld under BIR Form No. 1604C, as well as in the

Alphalist Data Entry and Validation Module version 6.1.

(b) These "seconded employees" shall file their annual income tax

return and pay the income tax due, if applicable, on or before the

prescribed deadline of April 15 of each year, together with the

attached BIR Form No. 2316 duly issued by the local entities.

(c) In all copies of BIR Form No. 2316 to be issued to these

employees, the phrase "For Seconded Employee" shall be typed

or printed in bold capital letters enclosed in open and close

parenthesis immediately under the form's title "Certificate of

Compensation Payment/Tax Withheld."

(d) In case of termination of their services before the end of the

taxable year, the local entities shall ensure that the withholding

tax on their last salaries shall be computed using the annualized

withholding tax method, pursuant to the provisions of Sec. 2.29

(B) (5) (b) of RR No. 2-98, as amended.

All internal revenue officers and employees are hereby enjoined to give

this Circular as wide a publicity as possible.

(SGD.) CAESAR R. DULAY

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- DRAFT RR-Implementing EOPT - For Public ConsultationDocument4 pagesDRAFT RR-Implementing EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- RR 3-02Document6 pagesRR 3-02matinikkiNo ratings yet

- RMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.Document3 pagesRMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.KC AtinonNo ratings yet

- RMC 1-80Document1,167 pagesRMC 1-80Ramon Augusto Melad LacambraNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- RR No. 12-2021Document3 pagesRR No. 12-2021eric yuulNo ratings yet

- RR 12-01Document6 pagesRR 12-01matinikkiNo ratings yet

- Revenue Regulations No. 2-2011Document3 pagesRevenue Regulations No. 2-2011Jose IbarraNo ratings yet

- Revenue Memorandum Circular No. 028-19Document2 pagesRevenue Memorandum Circular No. 028-19Alvin AgullanaNo ratings yet

- XYZ Water Inc. FAN ProtestDocument16 pagesXYZ Water Inc. FAN ProtestRalf Arthur SilverioNo ratings yet

- TDS On Salaries - Income Tax Department, INDIADocument112 pagesTDS On Salaries - Income Tax Department, INDIAArnav MendirattaNo ratings yet

- RMC 42-99Document4 pagesRMC 42-99fatmaaleahNo ratings yet

- Tax Alert - 2007 - MarDocument10 pagesTax Alert - 2007 - MarKeats QuindozaNo ratings yet

- RMC No 16-2013Document3 pagesRMC No 16-2013Eric DykimchingNo ratings yet

- RMC 42-99 VAT On OECFDocument4 pagesRMC 42-99 VAT On OECFLeizlyn Ann De OcampoNo ratings yet

- Bir Ruling No. Ot-0339-2020Document5 pagesBir Ruling No. Ot-0339-2020Ren Mar CruzNo ratings yet

- Tax Alert (April 2020) FinalDocument30 pagesTax Alert (April 2020) FinalRheneir MoraNo ratings yet

- RMC 41-09Document4 pagesRMC 41-09fatmaaleahNo ratings yet

- RR 09-99Document1 pageRR 09-99saintkarriNo ratings yet

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaNo ratings yet

- BIR RulingDocument3 pagesBIR RulingyakyakxxNo ratings yet

- BIR Ruling DA-143-06Document4 pagesBIR Ruling DA-143-06joefieNo ratings yet

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Document2 pagesAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArNo ratings yet

- 244877-2019-Clarifications On The Inclusion of Taxpayers20220328-11-5qiv23Document2 pages244877-2019-Clarifications On The Inclusion of Taxpayers20220328-11-5qiv23Vence EugalcaNo ratings yet

- CIR V BurmeisterDocument3 pagesCIR V BurmeisterGenevieve Kristine Manalac100% (1)

- Department of Finance v. Asia United BankDocument19 pagesDepartment of Finance v. Asia United BankMarj BaquialNo ratings yet

- TRAIN (Changes) ???? Pages 2, 5 - 7Document4 pagesTRAIN (Changes) ???? Pages 2, 5 - 7blackmail1No ratings yet

- May 2018 SGV SDGSDDocument26 pagesMay 2018 SGV SDGSDBien Bowie A. CortezNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- Revenue Regulations (RR) No 10-08Document0 pagesRevenue Regulations (RR) No 10-08sj_adenipNo ratings yet

- Module 10 Business Taxation Required ReadingDocument17 pagesModule 10 Business Taxation Required Readingfranz mallariNo ratings yet

- VAT Ruling No. 16-09Document4 pagesVAT Ruling No. 16-09Rieland CuevasNo ratings yet

- CIR v. AmEx (Digest)Document3 pagesCIR v. AmEx (Digest)Tini GuanioNo ratings yet

- TRAIN (Changes) ???? Pages 1, 3, 7Document3 pagesTRAIN (Changes) ???? Pages 1, 3, 7blackmail1No ratings yet

- RR 7-2012Document38 pagesRR 7-2012Andrea ANo ratings yet

- Nov 2019Document39 pagesNov 2019amitha g.sNo ratings yet

- Bir Ruling (Da-117-03)Document5 pagesBir Ruling (Da-117-03)Marlene TongsonNo ratings yet

- SECTION 2.58. Returns and Payment of Taxes Withheld at SourceDocument5 pagesSECTION 2.58. Returns and Payment of Taxes Withheld at SourceStevenkyNo ratings yet

- Budget 2020-21 PointersDocument19 pagesBudget 2020-21 PointersJaved MushtaqNo ratings yet

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Revenue Regulations 10-2008Document43 pagesRevenue Regulations 10-2008mary lou100% (29)

- RR No. 10-2008Document37 pagesRR No. 10-2008Kristan John ZernaNo ratings yet

- Ey TB Nov 2019 ApacDocument10 pagesEy TB Nov 2019 ApacAlvin Lozares CasajeNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayNo ratings yet

- RR 7-12Document53 pagesRR 7-12jankriezlNo ratings yet

- Revenue Regulations No. 34-2020Document3 pagesRevenue Regulations No. 34-2020zelayneNo ratings yet

- Revenue Memorandum Order No. 42-03: October 23, 2003Document11 pagesRevenue Memorandum Order No. 42-03: October 23, 2003nathalie velasquezNo ratings yet

- Rmo 19-2007Document22 pagesRmo 19-2007ACVGNo ratings yet

- 26120RR 17-2005Document10 pages26120RR 17-2005Sy HimNo ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- RevenueRegulations1 83Document4 pagesRevenueRegulations1 83Ansherina Francisco100% (1)

- Employee Benefits and Retirement PlanningDocument20 pagesEmployee Benefits and Retirement PlanningchiposityNo ratings yet

- BIR Updates Issue No. 2Document2 pagesBIR Updates Issue No. 2Jy GoNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- BIR Ruling SB - 056 827-09 20210505Document3 pagesBIR Ruling SB - 056 827-09 20210505rian.lee.b.tiangcoNo ratings yet

- Naga City 2022 Revised Revenue CodeDocument30 pagesNaga City 2022 Revised Revenue Coderian.lee.b.tiangcoNo ratings yet

- Petitioners RespondentDocument18 pagesPetitioners Respondentrian.lee.b.tiangcoNo ratings yet

- Petitioner RespondentDocument4 pagesPetitioner Respondentrian.lee.b.tiangcoNo ratings yet

- Amending Section 21 of City Tax Ordinance No.20210505-12Document3 pagesAmending Section 21 of City Tax Ordinance No.20210505-12rian.lee.b.tiangcoNo ratings yet

- Tax Consequences of The Transfer of AssetsDocument5 pagesTax Consequences of The Transfer of Assetsrian.lee.b.tiangcoNo ratings yet

- Soriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao CityDocument4 pagesSoriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao Cityrian.lee.b.tiangcoNo ratings yet

- Petitioner RespondentsDocument15 pagesPetitioner Respondentsrian.lee.b.tiangcoNo ratings yet

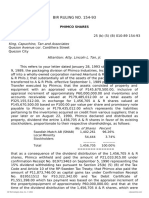

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDocument2 pagesBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoNo ratings yet

- Revenue Regulations No. 25-20: September 30, 2020Document3 pagesRevenue Regulations No. 25-20: September 30, 2020rian.lee.b.tiangcoNo ratings yet

- Petitioner Respondent: Bpi Capital Corporation, Commissioner of Internal RevenueDocument16 pagesPetitioner Respondent: Bpi Capital Corporation, Commissioner of Internal Revenuerian.lee.b.tiangcoNo ratings yet

- BIR RULING (DA-521-05) : SGV & CoDocument2 pagesBIR RULING (DA-521-05) : SGV & Corian.lee.b.tiangcoNo ratings yet

- Republic Act No. 8756: Definition of Terms Multinational CompanyDocument11 pagesRepublic Act No. 8756: Definition of Terms Multinational Companyrian.lee.b.tiangcoNo ratings yet

- 986 2005 ITAD - Ruling - No. - 016 0520210505 12 1rwd8efDocument7 pages986 2005 ITAD - Ruling - No. - 016 0520210505 12 1rwd8efrian.lee.b.tiangcoNo ratings yet

- 2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6Document4 pages2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6rian.lee.b.tiangcoNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- Itad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law OfficeDocument5 pagesItad Bir Ruling No. 029-18: Puyat Jacinto and Santos Law Officerian.lee.b.tiangcoNo ratings yet

- Subscription Agreement: No. 10, J.P. Laurel Avenue, Bajada, Poblacion, Davao City, Davao Del Sur, Philippines 8000Document4 pagesSubscription Agreement: No. 10, J.P. Laurel Avenue, Bajada, Poblacion, Davao City, Davao Del Sur, Philippines 8000Vikki Amorio100% (1)

- Kenya Energy SituationDocument162 pagesKenya Energy SituationArudo Elly OkaraNo ratings yet

- LeanIX - Poster - Best Practices To Define Business Capability Maps - DE - OcredDocument1 pageLeanIX - Poster - Best Practices To Define Business Capability Maps - DE - OcredAlbert MutelNo ratings yet

- Description Freight/Risk More Details EXW: Buyer Buyer BuyerDocument1 pageDescription Freight/Risk More Details EXW: Buyer Buyer BuyerZainal AbidinNo ratings yet

- Profile - Teledipity 2Document1 pageProfile - Teledipity 2Nayara TeodoroNo ratings yet

- Kaizen Sheet - Tamil & EngDocument6 pagesKaizen Sheet - Tamil & EngkrixotNo ratings yet

- SimhaDocument14 pagesSimhaArunachalam ANo ratings yet

- Marketing Intelligence & Planning: Article InformationDocument22 pagesMarketing Intelligence & Planning: Article InformationStef SoonsNo ratings yet

- Passion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, VisitDocument42 pagesPassion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, Visitaurelia450No ratings yet

- Chemical and Petrochemical Industry PDFDocument139 pagesChemical and Petrochemical Industry PDFMiguel MartinezNo ratings yet

- Application For Registration Private Education Institution Part Time 2019Document10 pagesApplication For Registration Private Education Institution Part Time 2019Btwins123No ratings yet

- Human Resource ManagementDocument11 pagesHuman Resource ManagementShakhawath HosenNo ratings yet

- Jawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanDocument12 pagesJawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanY AjaNo ratings yet

- Mgt400 Group Assignment 1 FinalDocument19 pagesMgt400 Group Assignment 1 FinalJoshua NicholsonNo ratings yet

- Topic 12 Evaluating HRM Towards The Future BX2051Document33 pagesTopic 12 Evaluating HRM Towards The Future BX2051JunNo ratings yet

- Load Balancing in Microsoft AzureDocument40 pagesLoad Balancing in Microsoft Azurekumara030350% (2)

- 1 - SR Duck Annual Situation Report - SignedDocument35 pages1 - SR Duck Annual Situation Report - SignedJoanalyn LataNo ratings yet

- Mathematics For Economics and Business 8th Edition Jacques Solutions ManualDocument36 pagesMathematics For Economics and Business 8th Edition Jacques Solutions Manualduckingsiddow9rmb1100% (21)

- Audit Work Program TemplateDocument64 pagesAudit Work Program TemplateleonciongNo ratings yet

- Problems Theme 4 FIXED ASSETSDocument5 pagesProblems Theme 4 FIXED ASSETSMihaelaNo ratings yet

- Managerial Eco - AssugnmentDocument14 pagesManagerial Eco - AssugnmentAbdullah NomanNo ratings yet

- SECOMET PresentationDocument12 pagesSECOMET PresentationABDELKADER BENABDALLAHNo ratings yet

- Bastida vs. Menzi & Co., 58 Phil. 188, March 31, 1933Document29 pagesBastida vs. Menzi & Co., 58 Phil. 188, March 31, 1933VoxDeiVoxNo ratings yet

- Priciples of Commerce Short Long Questions I YearDocument4 pagesPriciples of Commerce Short Long Questions I YearMuhammad MuneebNo ratings yet

- Active Agency September 2022Document8 pagesActive Agency September 2022Karthik ShankarNo ratings yet

- Vebsar: Specific Gravity PorousDocument2 pagesVebsar: Specific Gravity Porousrahul srivastavaNo ratings yet

- Big Data KPMGDocument4 pagesBig Data KPMGTim Van den WijngaertNo ratings yet

- CRM BCBLDocument60 pagesCRM BCBLHasnat ShakirNo ratings yet

- HIRAC Program PristineDocument16 pagesHIRAC Program PristineRigor La Pieta VicencioNo ratings yet

- Allocative Efficiency Vs X EfficiencyDocument25 pagesAllocative Efficiency Vs X EfficiencyaasdNo ratings yet