Professional Documents

Culture Documents

© This Is A Licensed Product of Ken Research and Should Not Be Copied

Uploaded by

Sagar BhagdevOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

© This Is A Licensed Product of Ken Research and Should Not Be Copied

Uploaded by

Sagar BhagdevCopyright:

Available Formats

1

© This is a licensed product of Ken Research and should not be copied

TABLE OF CONTENTS

1. India Eyewear Industry Introduction

2. India Eyewear Industry Market Size, FY’2007-FY’2013

3. India Eyewear Market Segmentation

3.1. By Type of Products, FY’2007-FY’2013

3.2. By Branded and Unbranded Products, FY’2013

3.3. By Organized And Unorganized Sector, FY’2013

4. India Spectacle Lenses Market Introduction and Size

5. India Spectacle Lenses Market Segmentation

5.1. By Geography, FY’2013

5.2. By Organized and Unorganized Sector, FY’2013

6. Market Share of Major Players in the Organized Spectacle Lens Market in India, FY’2013

7. India Spectacle Lens Market Future Outlook and Projections, FY’2014 - FY’2018

8. India Sunglasses Market Introduction and Size

9. India Sunglasses Market Segmentation

9.1. By Geography, FY’2013

9.2. By Designer and Non-Designer Sunglasses, FY’2013

10. India Sunglasses Market Competitve Landscape, FY’2013

11. India Sunglasses Market Future Outlook and Projections

12. India Contact Lens Market Introduction and Size

13. India Contact Lens Market Segmentation

13.1. By Types of Contact Lense Users, FY’2013

14. Market Share of Major Players in India Contact Lens Market, FY’2013

15. India Contact Lens Market Future Outlook and Projections

16. India Eyewear Exports, FY’2007 – FY’2013

17. India Eyewear Imports, FY’2007 – FY’2013

2

© This is a licensed product of Ken Research and should not be copied

18. India Eyewear Industry Trends and Developments

Eyewear as a Fashion Accessory

Transition from Unorganized to Organized Retail

Focus on Tier II and Tier III Cities

Innovative Lens Offerings

The Advent of New Surgical Technologies

The arrival of Online Eyewear

The trend of Multiple Ownership

19. India Eyewear Industry Future Outlook and Projections, FY’2014 – FY’2018

19.1. Cause and Effect Relationship Analysis of the India Eyewear Industry

20. India Online Eyewear Market Introduction and Size

21. India Online Eyewear Market Segmentation

21.1. By Type of Products, FY’2013

22. India Online Eyewear Market Customer Profile

23. Market Share of Major Players in India Online Eyewear Market, FY’2013

24. India Online Eyewear Market Future Outlook and Projections, FY’2014 – FY’2018

24.1. Cause and Effect Relationship Analysis of the India Online Eyewear Market

25. Company Profile of Major Players in India Online Eywear Market

25.1. Lenskart

25.1.1. Business Overview

25.1.1.1. Lenskart’s Operational Value Chain

25.1.2. Business Strategies

Focus on Increasing Offline Presence

Focus on In-House Brands

Home Try-on Strategy

Focus on Technology and Promotion

© This is a licensed product of Ken Research and should not be copied

25.2. GKB Online

25.2.1. Business Overview

25.2.2. Business Strategies

Leveraging Offline Infrastructure

26. India Eyewear Industry Company Profiles

27. Macroeconomic and Industry Factors: Historical and Projections

27.1. Urban Population in India, FY’2007-FY’2018

27.2. Consumer Expenditure on Medical Care and Health Services, FY’2007-FY’2018

27.3. Broadband Subscribers in India, FY’2007-FY’2018

27.4. Debit Card Payments in India, FY’2007-FY’2018

27.5. Private Equity Investments in E-Commerce In India, FY2007-FY’2018

27.6. Smartphone Shipments in India, FY’2009-FY’2018

28. Appendix

28.1. Market Definitions

28.2. Abbreviations

28.3. Research Methodology

Data Collection Methods

Approach

Variables (Dependent and Independent)

Final Conclusion

28.4. Disclaimer

© This is a licensed product of Ken Research and should not be copied

LIST OF FIGURES

Figure 1: India Eyewear Industry Market Size on the Basis of Revenues in USD Million,

FY’2007-FY’2013

Figure 2: Number of Cataract Surgeries Performed in India in Million, FY’2008-FY’2012

Figure 3: India Eyewear Market Segmentation on the Basis of Revenues from Different Types of

Products in USD Million in Percentage, FY’2007-FY’2013

Figure 4: India Eyewear Market Segmentation on the Basis of Revenues from Branded and

Unbranded Products in Percentage, FY’2013

Figure 5: India Eyewear Market Segmentation on the Basis of Revenues from the Organized and

Unorganized Sector in Percentage, FY’2013

Figure 6: India Spectacle Lenses Market Size on the Basis of Revenues in USD Million,

FY’2007-FY’2013

Figure 7: India Spectacle Lenses Market Segmentation on the Basis of Demand from Different

Geographical Regions in Percentage, FY’2013

Figure 8: India Spectacle Lenses Market Segmentation on the Basis of Revenues from Organized

and Unorganized Sector in Percentage, FY’2013

Figure 9: Market Shares of Major Players in the India Spectacle Lens Market on the Basis of

Revenues in USD Million in Percentage, FY’2013

Figure 10: India Spectacle Lens Market Future Projections on the Basis of Revenues in USD

Million, FY’2014-FY’2018

Figure 11: India Sunglasses Market Size on the Basis of Revenues in USD Million, FY’2007-

FY’2013

Figure 12: India Sunglasses Market Segmentation on the Basis of Demand from Different

Geographical Regions in Percentage, FY’2013

Figure 13: India Sunglasses Market Segmentation on the Basis of Revenues from Designer and

Non-Designer Sunglasses in Percentage, FY’2013

Figure 14: India Sunglasses Market Future Projections on the Basis of Revenues in USD Million,

FY’2014-FY’2018

Figure 15: India Contact Lens Market Size on the Basis of Revenues in USD Million, FY’2007-

FY’2013

© This is a licensed product of Ken Research and should not be copied

Figure 16: India Contact Lens Market Segmentation on the Basis of Number of Conventional

Contact Lens and Daily Disposable Contact Lens Users in Percentage, FY’2013

Figure 17: Market Shares of Major Players in the India Contact Lens Market, FY’2013

Figure 18: India Contact Lens Market Future Projections on the Basis of Revenues in USD

Million, FY’2014-FY’2018

Figure 19: Exports of Eyewear Products from India on the Basis of Value in USD Million,

FY’2007-FY’2013

Figure 20: Imports of Eyewear Products in India on the Basis of Value in USD Million,

FY’2007-FY’2013

Figure 21: India Eyewear Industry Future and Projections on the Basis of Revenues in USD

Million, FY’2014-FY’2018

Figure 22: India Online Eyewear Market Size on the Basis of Revenues in USD Million,

FY’2011-FY’2013

Figure 23: India Online Eyewear Market Segmentation on the Basis of Revenues from Different

Products in USD Million in Percentage, FY’2013

Figure 24: Distribution of Online Eyewear Buyers in India on the Basis of Gender in Percentage,

FY’2013

Figure 25: Distribution of Online Eyewear Buyers in India on the Basis of Age in Percentage,

FY’2013

Figure 26: Market Share of major Players in the India Online Eyewear Market on the Basis of

Revenues in USD Million in Percentage, FY’2013

Figure 27: India Online Eyewear Market Future Projections on the Basis of Revenues in USD

Million, FY’2014-FY’2018

Figure 28: Lenskart’s Operational Value Chain

Figure 29: Lenskart’s Revenues Breakdown on the Basis of Sale of In-House Brands and Other

Brands in USD Million in Percentage, FY’2013

Figure 30: Urban Population in India in Million, FY’2007-FY’2018

Figure 31: Consumer Expenditure on Medical Care and Health Services in USD Million,

FY’2007-FY’2018

Figure 32: Broadband Subscribers in India, FY’2007-FY’2018

Figure 33: Number of Debit Card Payments in India in Million, FY’2007-FY’2018

6

© This is a licensed product of Ken Research and should not be copied

Figure 34: Private Equity Investments in E-Commerce in India in USD Million, FY’2007-

FY’2018

Figure 35: Smartphone Shipments in India, FY’2009-FY’2018

© This is a licensed product of Ken Research and should not be copied

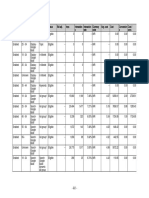

LIST OF TABLES

Table 1: Units of Sunglasses Sold by Top Ten Manufacturers in India in Thousand, FY’2013

Table 2: Imports of Eyewear Products in India from Different Countries on the Basis of Value in

USD Million, FY’2007-FY’2013

Table 3: Cause and Effect Relationship Analysis between Industry Factors and Expected

Eyewear Industry Prospects

Table 4: Profile of Online Eyewear Buying Population in India

Table 5: Competitive Landscape of the India Online Eyewear Market, FY’2013

Table 6: Cause and Effect Relationship Analysis between Industry Factors and Expected Online

Eyewear Market Prospects in India

Table 7: List of a Few Eyewear Brands Offered By Lenskart

Table 8: List of a Few Eyewear Brands Offered by GKB Online

Table 9: Company Profiles of Major Players in the India Eyewear Industry

Table 10: Correlation Matrix of the India Eyewear Industry

Table 11: Regression Coefficients Output

© This is a licensed product of Ken Research and should not be copied

INDIA EYEWEAR INDUSTRY MARKET SIZE, FY’2007-

FY’2013

Over FY’2007-FY’2013, the eyewear market in India has grown at a CAGR of 27.4%. There has

been a significant shift in the adoption trend of eyewear products in India, as the consumers have

transitioned from being health conscious towards being more fashion conscious. This has spurred

the demand of branded and luxury products, playing a vital part in the overall revenue growth in

the last five fiscal years.

Spectacle lenses comprise of a major chunk of revenues from the eyewear industry in India. The

market has grown from USD 490.2 million in FY’2007 to USD ~ million in FY’2013. Major

share of the revenues from spectacle lenses market have been accounted for by the unorganized

segment. Market for frames has been the second largest in terms of contribution to the overall

eyewear revenues.

Figure: India Eyewear Industry Market Size on the Basis of Revenues in USD Million,

FY’2007-FY’2013

6,000.0

5,000.0

4,000.0

USD Million

3,000.0

2,252.5

2,000.0

1,000.0

0.0

FY'2007 FY'2008 FY'2009 FY'2010 FY'2011 FY'2012 FY'2013

© This is a licensed product of Ken Research and should not be copied

INDIA EYEWEAR MARKET SEGMENTATION

BY TYPE OF PRODUCTS, FY’2007-FY’2013

The eyewear market in India is largely comprised of four types of products including spectacle

lenses, frames, sunglasses, contact lens, while a minor segment also includes intraocular lens

(IOLs), Lasik and lens cleaning solutions. Historically, the

Historically, the spectacle spectacle lens segment has dominated the market for eyewear

lens segment has dominated

in India in terms of revenues.

the market for eyewear in

India in terms of revenues Sunglasses market has been one of the fastest growing

segments in the India eyewear industry. Revenues from sales

of sunglasses in India accounted for a 12.8% share in the eyewear industry in India in FY’2013.

Easy access to international brands such as Ray-Ban, Maui Jim, Oakley, Vintage and Vogue and

fashion driven purchases have stimulated the revenue growth in the sunglasses segment.

Figure: India Eyewear Market Segmentation on the Basis of Revenues from Different

Types of Products in USD Million in Percentage, FY’2007-FY’2013

100.0%

90.0%

80.0%

12.8%

70.0%

Percentage(%)

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

FY'2007 FY'2008 FY'2009 FY'2010 FY'2011 FY'2012 FY'2013

Spectacle Lenses Frames Sunglasses Lenses Others

10

© This is a licensed product of Ken Research and should not be copied

MARKET SHARE OF MAJOR PLAYERS IN THE

ORGANIZED SPECTACLE LENS MARKET IN INDIA,

FY’2013

Essilor was the leading manufacturer and marketer of spectacles in the Indian spectacle lens

sector in FY’2013, so has been the case for the past many years. The company has witnessed

tremendous growth in its business over the period of past five fiscal years, surpassing all the

immediate competing companies in the India spectacle lens space. Operating in the premium end

segment of lenses in the market, the company has leveraged on the strong increase in demand for

high-value prescription spectacle lenses in India, which in turn has reflected in the company’s

revenues over the years.

Figure: Market Shares of Major Players in the India Spectacle Lens Market on the Basis of

Revenues in USD Million in Percentage, FY’2013

Essilor

Vision Rx

GKB High Tech

Carl Zeiss

Hoya

Others

11

© This is a licensed product of Ken Research and should not be copied

INDIA SUNGLASSES MARKET SEGMENTATION

BY GEOGRAPHY, FY’2013

Demand of sunglasses from the Northern region was ~ of the total demand of sunglasses in India

in the fiscal year 2013. Delhi, in particular accounted for a major portion of the total demand for

branded sunglasses owing to a higher proportion of fashion driven customers with relatively

higher disposable incomes.

Figure: India Sunglasses Market Segmentation on the Basis of Demand from Different

Geographical Regions in Percentage, FY’2013

North

West

South

East

12

© This is a licensed product of Ken Research and should not be copied

INDIA CONTACT LENS MARKET FUTURE OUTLOOK

AND PROJECTIONS

Though spectacles are the most vigorously selling eyewear products in India, sales of contact

lenses are expected to grow rapidly. The contact lens market in India is expected to grow at a

CAGR of 22.7%, registering revenues of USD 653.7 million in FY’2018. The increase in the

disposable incomes and inclining number of youths and working population in India are

expected to exert a positive influence on the contact lenses sector. Additionally, the availability

of contact lenses is projected to increase in India owing to an increase in the number of

retail/chained outlets, consequently boosting the sales of contact lenses over the next few years.

Figure 1: India Contact Lens Market Future Projections on the Basis of Revenues in USD

Million, FY’2014-FY’2018

700.0 653.7

600.0

500.0

USD Million

400.0

300.0

200.0

100.0

0.0

FY'2014 FY'2015 FY'2016 FY'2017 FY'2018

13

© This is a licensed product of Ken Research and should not be copied

INDIA ONLINE EYEWEAR MARKET INTRODUCTION

AND SIZE

In the past two years, the eyewear industry in India has

Online ordering of products

such as expanded its presence to e-commerce websites. Online

spectacles,

sunglasses, frames and

ordering of products such as spectacles, sunglasses, frames

contact lenses has been and contact lenses has been gaining massive traction as

gaining massive traction consumers have been increasingly progressing towards

product purchase on the internet, with the presence of a whole host of varieties. The advent of

websites offering eyewear online has been driven by a number of factors. The penetration of the

internet and broadband, increasing sales of mobile devices such as smartphones as well as the

growth of plastic card payments have all contributed to the growth of online retailing and

ultimately the online eyewear market.

Total number of people that shopped for eyewear products on the online channel amounted to

approximately 7-8 lakh in FY’2013. Market revenues from sales of eyewear products through the

online channel have grown at a CAGR of 247.6% over FY’2011-FY’2013.

Figure: India Online Eyewear Market Size on the Basis of Revenues in USD Million,

FY’2011-FY’2013

9.0

8.0

7.0

6.0

USD Million

5.0

4.0

3.0

2.0

1.0

0.0

FY'2011 FY'2012 FY'2013

14

© This is a licensed product of Ken Research and should not be copied

.

DISCLAIMER

The research reports provided by Ken Research are for the personal information of the

authorized recipient and is not for public distribution and should not be reproduced or

redistributed without prior permission. You are permitted to print or download extracts from this

material for your personal use only. None of this material may be used for any commercial or

public use.

The information provided in the research documents is from publicly available data and other

sources, which are reliable. Efforts are made to try and ensure accuracy of data. With respect to

documents available, neither the company nor any of its employees makes any warranty, express

or implied, including the warranties of merchantability and fitness for a particular purpose, or

assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any

information, apparatus, product, or process disclosed, or represents that its use will not infringe

privately owned rights.

The report also includes analysis and views expressed by our research team. The research reports

are purely for information purposes. The opinions expressed are our current opinions as of the

date appearing in the material and may be subject to change from time to time without notice.

Investors should not solely rely on the information contained in the research documents and must

make investment decisions based on their own investment objectives, risk profile and financial

position. The recipients of this material should take their own professional advice before acting

on this information.

Ken Research will not accept returns of reports once dispatched due to the confidentiality of

information provided in our reports. In case, a report qualify for return, we will issue a credit,

minus shipping charges, of equal value to the original purchase price, toward a future purchase—

no refunds. The decision about whether the product return can be accepted or not is solely at our

discretion. Any dispute will be subject to the laws of India and exclusive jurisdiction of Indian

Courts.

No part of this manual or any material appearing may be reproduced, stored in or transmitted

on any other Web site without written permission of Ken Research and any payments of a

specified fee. Requests to republish any material may be sent to us.

15

© This is a licensed product of Ken Research and should not be copied

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Normal Focus: Iris CorneaDocument5 pagesNormal Focus: Iris CorneaerajkhanNo ratings yet

- Franchise Proposal - Pink & Blue KidsDocument5 pagesFranchise Proposal - Pink & Blue KidsSagar BhagdevNo ratings yet

- Clinical Case in Contact Lenses, 1e - 2001Document205 pagesClinical Case in Contact Lenses, 1e - 2001Miguel PalaciosNo ratings yet

- Check My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesDocument42 pagesCheck My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesNurse UtopiaNo ratings yet

- Module 4 Case Study HUbble Contact Lense V9Document15 pagesModule 4 Case Study HUbble Contact Lense V9KAVYA MAHESHWARI100% (1)

- Indian Eyewear Industry ReportDocument8 pagesIndian Eyewear Industry ReportNishant RatheeNo ratings yet

- Ark 760 ADocument125 pagesArk 760 AMax Oliveira0% (1)

- Science Laboratory ManualDocument14 pagesScience Laboratory ManualSir Josh100% (2)

- Optometrist Business PlanDocument49 pagesOptometrist Business PlanJoseph QuillNo ratings yet

- Eyewear Market Size PDFDocument3 pagesEyewear Market Size PDFSagar BhagdevNo ratings yet

- FQE Student Presentation (Miranda Richardson)Document41 pagesFQE Student Presentation (Miranda Richardson)Bradley Walker100% (1)

- Eyesight Self Correction Instructions 2Document19 pagesEyesight Self Correction Instructions 2Brad YantzerNo ratings yet

- 5cb90b1616ec990556f0ae1f - Cease and Desist MagnetDocument4 pages5cb90b1616ec990556f0ae1f - Cease and Desist MagnetSagar BhagdevNo ratings yet

- New Franchise AgreementDocument41 pagesNew Franchise AgreementSagar BhagdevNo ratings yet

- Moengage Covid Report FinalDocument50 pagesMoengage Covid Report FinalSagar BhagdevNo ratings yet

- Ningshing& QuantumDocument27 pagesNingshing& QuantumSagar BhagdevNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountSagar BhagdevNo ratings yet

- En KashDocument1 pageEn KashSagar BhagdevNo ratings yet

- Al SunglassesDocument2 pagesAl SunglassesSagar BhagdevNo ratings yet

- TME Reel To Real Showroom - IndiaDocument38 pagesTME Reel To Real Showroom - IndiaSagar BhagdevNo ratings yet

- Scoopearth - Deck .NWDocument9 pagesScoopearth - Deck .NWSagar BhagdevNo ratings yet

- 4961 Internet Marketing Words and Phrases That Sell Like Crazy!Document92 pages4961 Internet Marketing Words and Phrases That Sell Like Crazy!Sagar BhagdevNo ratings yet

- Eye Wear Insurance - DeckDocument11 pagesEye Wear Insurance - DeckSagar BhagdevNo ratings yet

- Age ReportDocument8 pagesAge ReportSagar BhagdevNo ratings yet

- Gender Report: September 11, 2019 - September 28, 2019Document2 pagesGender Report: September 11, 2019 - September 28, 2019Sagar BhagdevNo ratings yet

- Your Name: Education QualificationDocument1 pageYour Name: Education QualificationSagar BhagdevNo ratings yet

- Revision: Wish - Unreal PastDocument7 pagesRevision: Wish - Unreal PastNguyễn Thu HàNo ratings yet

- AaaDocument6 pagesAaalovembulNo ratings yet

- Opthcs 2Document24 pagesOpthcs 2Asma Sukar100% (1)

- Lasik GuidelinesDocument4 pagesLasik GuidelinesIlmiahdmobgyn MaretmeiNo ratings yet

- Covered in This SOP: Customer Trading Manager (CTM) General Store Manager (GSM)Document6 pagesCovered in This SOP: Customer Trading Manager (CTM) General Store Manager (GSM)nazboxer97No ratings yet

- You CAN See Without Your GlassesDocument1 pageYou CAN See Without Your GlassesShyle Valerie HilisNo ratings yet

- Eye Mistakes You Might Be MakingDocument3 pagesEye Mistakes You Might Be MakingRatnaPrasadNalamNo ratings yet

- Scleral Lens GuideDocument8 pagesScleral Lens Guideadidao111No ratings yet

- Allied Health Staff IDocument188 pagesAllied Health Staff IEl Min ForoNo ratings yet

- Muna Tuet - Science Essay AstigmatismDocument2 pagesMuna Tuet - Science Essay Astigmatismapi-361589971No ratings yet

- NNVJHDocument94 pagesNNVJHAnda AlexandraNo ratings yet

- Eye Drops LeafletDocument2 pagesEye Drops LeafletlianayudoNo ratings yet

- New-DLP Phase1 Assignment-2 Module-A Final-9.8.18Document6 pagesNew-DLP Phase1 Assignment-2 Module-A Final-9.8.18PNo ratings yet

- Contact Lenses and Associated AnteriorDocument13 pagesContact Lenses and Associated AnteriorJose Antonio Fuentes VegaNo ratings yet

- Sydney Sandone ResumeDocument2 pagesSydney Sandone ResumeSydney SandoneNo ratings yet

- Ophthalmology Lectures PDFDocument88 pagesOphthalmology Lectures PDFsharenNo ratings yet

- Interojo Catalog PDFDocument20 pagesInterojo Catalog PDFAnys Miguel ValléeNo ratings yet

- Ingles Semana - 8Document6 pagesIngles Semana - 8Hernandez FranciscoNo ratings yet

- Iacle 5 CMDocument222 pagesIacle 5 CMchakkithyaNo ratings yet

- Preservatives Used in Eye Drops: Paytaxt Private Institute Pharmacy Department 1 StageDocument7 pagesPreservatives Used in Eye Drops: Paytaxt Private Institute Pharmacy Department 1 StageShakar Ezaddin AbdullahNo ratings yet

- Lid Wiper EpitheliopathyDocument1 pageLid Wiper EpitheliopathyNurmawati AtNo ratings yet