Professional Documents

Culture Documents

Chapter Two Current Liabilities and Contingencies

Uploaded by

Black boxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter Two Current Liabilities and Contingencies

Uploaded by

Black boxCopyright:

Available Formats

Chapter Two

Current Liabilities and Contingencies

Liabilities

Def. are probable future sacrifices of economic benefits arising from present obligations of a

particular entity to transfer assets or provide services to other entities in the future as a result of

past transactions or events.

Recorded when obligations are incurred, and are measured at the amounts to be paid or at the

present value of these amounts.

Current liabilities versus Long – Term liabilities

The distinction between current liabilities and long-term liabilities is important because it enables

to assess the business enterprise’s ability to settle its maturing debt.

Current liabilities: are obligations for which payment will require

1. The use of current assets, or In one year or one operating cycle,

2. The creation of other current liabilities whichever is longer

Current liabilities include payables to suppliers and employees; accruals for taxes, rents; advance

collection from customers; obligation that are payable on demand within one year even though the

liquidation may not be expected within that period.

* Current liabilities do not include those obligation not settled within one operating cycle;

* Obligations that will be liquidated by the issuance of shares of capital stock; are included in

stockholders’ equity in the balance sheet not current liabilities.

* The relationship between current assets and current liabilities, and the relationship between

cash balance and current liabilities is important because it shows the solvency of the business

(i.e. the ability to pay debts as they mature).

Recognition and valuation of current liabilities

In theory, the measure of any liability at the time it is incurred is the present value of the required

future cash out flow. In practice, however, most current liabilities are recorded at face amount. The

difference between the present value of a current liability and the amount that will be paid at maturity

usually is not material because of the short time period involved.

The recognition of liabilities poses two conditions,

(i) Liabilities include future cash outflow that result from past transactions and events, and

(ii) Measured with reasonable accuracy.

With regard to liabilities two questions always are going to be asked

(1) Does the liability exist?

(2) If it exists, what is the amount of the obligation?

Degree of uncertainty is a major factor for the measurement of current liabilities, in this chapter we

will discussed in three basic headings;

1. Definitely measurable liabilities

2. Liabilities dependent on operating results

3. Contingencies

1. Definitely measurable liabilities

The amount of an obligation and its due date are known with reasonable certainty because they result

from contracts or the operation of statutes. Let’s give specific examples with their respective

explanations.

A. Trade Accounts Payable

Trade accounts payable resulted from purchases of goods and services on account. There are two

ways of recording trade accounts payable,

Financial Accounting –II Page 1

(1) Gross Method: -

Trade accounts payable are recorded at face amount.

The purchases discounts ledger account is credited for discounts taken, and

A material amount of discounts available to be taken at the end of an accounting period is accrued

by a debit to Allowance for Purchases Discounts (a contra-liability ledger account).

The balance of the purchase discount is deducted from purchases to give net purchases.

(2) Net Method: -

Purchase is recorded net of discounts at the time of purchases.

For discounts not taken the Purchases Discounts Lost account is debited.

In the income statement, the amount of Purchases Discounts Lost is reported under other

Expenses.

Exercise 1

Assume that the following information is taken from Alpha Plc. For year 6:

A) Purchases Br. 1, 000, 000 of merchandise on terms 2/10, n/30

B) Paid invoices for purchases of Br. 500, 000 within the discount period and for

purchases of Br. 200, 000 after the discount period

C) Estimated at the end of year 6 that 80% of Br. 300, 000 outstanding trade accounts

payable would be paid within the discount period.

Required-

Required- Give journal entries and balance sheet presentation related to trade accounts payable using

gross method

Solution-

Solution- (a) Purchases 1, 000,000

Trade Accounts payable 1, 000, 000

(b) Trade Accounts Payable (500, 000 + 200, 000) 700, 000

Purchased Discounts (500, 000 x 0.02) 10, 000

Cash 690, 000

(c) Allowance for Purchased Discounts (300, 000 x 0.08 x 0.02) 4, 800

Purchases Discounts 4, 800

Excerpt from balance sheet – End of year 6

Trade Accounts Payable (1, 000, 000 – 700, 000) 300, 000

Less: Allowance for purchases Discounts 4, 800

Carrying Amount 295, 200

B. Loan obligations and Refinancing of short-term Debt

Includes

Short term promissory notes

Any portion of long-term debt due within one year

Excludes Long-term debt currently maturing expected to be retired from;

Sinking fund

Proceeds of new long-term debt, or

Through conversion to common stock

Note; short-term debt that is expected to be refinanced on a long term-term basis may be excluded

from current liabilities.

Promissory notes

The accounting for promissory notes payable resembles that of accounting for promissory

notes receivable. In this section we concentrate on short-term promissory notes payable.

When a promissory note bears a current fair rate of interest, its face amount is equal to its

present value at the time of issuance

When a promissory note bears no interest or an unreasonably low rate of interest, the present

value of the note payable is less than its face amount. The discount of the note is converted to

interest expense over the term of the note.

Financial Accounting –II Page 2

Exercise 2

Assume that in November 1, year 9, unity Co. uses a one-year noninterest bearing note as a

consideration for the acquisition of furniture. The face amount of the note is Br. 240, 000 and the

current fair rate of interest on the note is 12% compounded monthly (i.e. see the appropriate present

value table for 1% (12%/12 months) per period for three decimal places).

Required (i) The journal entries for the month of November and December

(ii) The presentation of the note in unity balance sheet on Dec. 31, year 9, the end of the

fiscal period

Journal Entries;

Solution (i) – Nov. 1 Furniture (240, 000 x p12% = 240, 000 x 0.887) 212, 880

Discount on Notes payable 27, 120

Notes payable 240, 000

Nov. 30 Interest Expenses (240, 000 – 27, 120 x 0.12 x 1/12) 2, 129

Discount on Notes payable 2, 129

Dec. 31 Interest Expense (240, 000 – 27, 120 + 2, 129) x 0.12 x 1/12) 2, 150

Discount on Notes payable 2, 150

(ii) Excerpt from the balance sheet

Notes payable Br. 240, 000

Less: Discount on Notes payable (27, 120 – 2129 – 2150) 22, 841

Carrying Amount of the note Br. 217, 159

C. Refinancing of Short –Term Debt

Refinancing means replacing short-term debt with either long-term debt or equity securities, or

renewing, extending, or replacing the short-term debt with other short-term debt for more than one

operating cycle from the date of the balance sheet

Accounting standard requires that a short term debt be classified as current liabilities unless;

1. the enterprise intends to refinance the debt on a long term basis

2. its ability to carry out the refinancing

Ability to refinance on long-term basis must be demonstrated either by

(a) actually issuing long-term debt or equity securities to replace short-term debt, or

(b) Entered into a contract to replace short term debt at maturity.

When a short term debt is classified as other than a current liability, the reason for such classification

should have to be disclosed in the note to the financial statements. The specific disclosures required

include the description of the refinancing contract, the terms of any new debt incurred, and the terms

of any new equity securities issued.(see page 503)

D. Cash Dividends

When board of directors declares a cash dividend, the corporation incurs a legal obligation to pay the

dividend on a specified date. Because of short-duration between cash dividend declaration and

payment, it is a current liability.

Dividends in arrears on cumulative preferred stock are declared by the board, they are not liabilities

but disclosed in the note to the financial statements.

An undistributed stock dividend is reported in the stockholders’ equity section, not as current liability

because no cash outlay is required (i.e. specifically on stock dividends to be distributed ledger

account).

E. Advance from Customers

A liability that is created when a business enterprise receives payments in advance from its

customers

Sometimes referred as deferred revenue or deferred credit

The organization obligated to perform by delivery of goods or service

When performance takes place the amount of liability diminishes and is transferred to revenue

Financial Accounting –II Page 3

Examples include

o Deposits on sales order

o Magazine subscription received in advance

o Billings in excess of cost incurred on construction-type contracts

F. Accrued Liabilities

Accrued liabilities /accrued expenses are obligations that come into existence as a result of past

contractual commitments. To explain this topic, let’s discuss accrued salary and property taxes.

Accrued Salary – a liability that is related to payrolls expenses of the organizations. There are

various deductions to calculate the liability for net pay. Some of the deductions include pension

contribution, income taxes withhold, contribution for labor union, penalties, etc. Here simply to give

hypothetical journal entry.

Salaries Expenses xxx

Payroll Taxes Expenses xxx

Taxes payable xxx

Liability for income Taxes withhold xxx

Accrued payroll xxx

Property Taxes

are sources of revenue for the government

Based on the assessed value of real and personal property.

There are two accounting issues which arise relating to property taxes:

(1) When should the liability for property taxes be recorded?

a) On the lien date, when the legal liability for property tax arises

b) Accrual property of taxes during the fiscal year of the taxing unit.

Note; the second method is supported by the AICPA

(2) To which accounting period does the tax expense relate?

Because property taxes are expenses associated with the use of property during the fiscal year of the

taxing units, it seems reasonable to expense the property taxes during that period (instead of

expensing it all on the lien date)

Exercise 3

Bob Company’s plant assets are subject to property taxes by local taxing units. The fiscal year of the

local taxing units cover the period from July 1 to June 30. Property taxes of $72,000 are assessed on

March 15, Year 1, covering the fiscal year starting on July 1, year 1. The lien date is July 1, Year 1,

and taxes are payable with two installments of $36,000 each on December 10, Year 1, and on April

10, Year 2.

July 1, Year 1. Liability of $72,000 comes into existence on July 1, Year 1, the lien date.

Journal Entries

(No Journal Entries)

At the end of July, August, September, October, and November, Year 1, to record Monthly property

taxes expenses.

Journal Entries

Property Taxes Expense ($ 72,000 / 12) 6,000

Property Taxes Payable 6,000

December 10, Year 1. (To record payment of first installment of property tax bill.

Property Tax Payable ($ 6,000 @ 5) 30,000

Prepaid Property Taxes 6,000

Cash 36,000

December 31, Year 1(To record monthly property taxes expense)

Property Tax Payable 6,000

Prepaid Property Taxes 6,000

Financial Accounting –II Page 4

At the end of January, February, and March, Year 2, to record monthly property taxes expense

Property Taxes Expense 6,000

Property Tax Payable 6,000

April 10, Year 2. (To record payment of second installment of property tax bill.

Property Tax Payable ($ 6,000 @ 3) 18,000

Prepaid Property Taxes 18,000

Cash 36,000

At end of April, May, and June, Year 2, to record monthly property taxes expense

Property Tax Expense 6,000

Prepaid Property Taxes 6,000

G. An accrued loss on a firm purchase commitment

To assure a steady supply of merchandise or material, a business enterprise may enter into a contract

for the future delivery of goods a fixed price for the ordered goods. If the contract is not subject to

cancellation, regardless of changes in the market price, if the price of the goods at the end of an

accounting period less than the contract price and the loss is recognized in the accounting records.

A sustained loss is recognized in the accounting period in which the price decline occurs, and the

value of the goods under contract is reduced as though these goods were on hand.

Entries are;

Loss on firm purchase commitment XX

Liability arising from firm purchase commitment XX

Exercise 4

Kacha manufacturing company makes an agreement with General Trading company in order to have

uninterrupted operations due to shortage of raw materials. On February 27, year 6, Kacha Company

contracted to purchase 10,000 tons of materials in year 7at a fixed price of $200 per ton. The contract

was not subject to cancellation. On December 31, year 6, the replacement cost the material was $ 180

per ton.

Journal entries;

Dec. 31 Year 6

Loss on firm purchase commitment ($200-$180)@10,000 $200,000

Liability arising from firm purchase commitment $200,000

2. Liabilities Dependent on operating Results

Certain obligations are computed, by their nature, based on operating results. At the end of the year

the operating results are known, therefore, there is no problem of determining such liabilities. The

problem arises in determining such obligation for interim reporting purposes. Obligations dependent

on operating results include bonuses, income taxes, royalties, etc.

Income Taxes

Business enterprises based on the number of owners, are classified into single proprietorship,

partnerships and corporations. The first two, namely single proprietorship and partnership, are not

taxable entities and therefore do not report income tax liabilities in their balance sheets. However,

corporation is a taxable entity and income tax liabilities appear in the balance sheet of such entities.

Corporations usually are required to make payments of their estimated tax liabilities in advance. The

remaining tax not covered by the estimated payment is payable by the due date of the income tax

return.

The journal entries for tax payment advance are;

Prepaid income taxes xxx

Cash xxx

When it expires

Income taxes expense xxx

Prepaid income taxes xxx

Financial Accounting –II Page 5

The journal entries, if the income tax is accrued

Adjustment for the accrued tax

Income taxes expense xxx

Income Taxes payable xxx

At the time of paying the debt

Income taxes payable xxx

Cash xxx

Bonus and profit sharing results

Contract covering rents, royalties, or employee compensation sometimes call for conditional

payments in an amount dependent on revenue/sale or income for an accounting period. Bonus used to

describe conditional payment of this type.

For example,

royalties payment which is 20% of sales;

rents which is composed of a fixed Br. 2,000 a month and 1% of sales;

employee compensation based on 10% income in excess of Br. 500,000

When a bonus plan is based on income, there is a difficulty of determining which expenses are going

to be deducted. There could be three different assumptions, applying the bonus percentage on:

(1) Income before income taxes and bonus

(2) Income after bonus but before income taxes

(3) Net income (i.e. income after bonus and income taxes)

Exercise 5

Assume that Promise Insurance share co. has a bonus plan under which employees are entitled to

share among themselves 15% of income over birr 60,000 earned by their respective branches. Income

for a given branch is Birr 180,000 before bonus and income tax. Income tax rate is 35% of pretax

income.

Required

Determine the amount of bonus if the bonus contract calls for a bonus on income in excess of Birr

60,000:

(a) Before income tax and bonus

(b) Before income tax but after bonus

(c) Net income in excess of Br 60,000.

Plan a: Bonus is based on income in excess of Birr 60,000 before deduction of bonus and the income

taxes;

Bonus = .15 (Birr 180,000 – Birr 60,000)

Bonus = Birr 18,000

Plan b: Bonus is based on income excess of Birr 60,000 after deduction of the bonus but before

deduction of taxes

Bonus = .15 (Birr 180,000 – Birr 60,000 – Bonus)

= Birr 18000 - .15 Bonus

1.15 Bonus = Birr 18,000

Bonus = Birr 15,652

Plan c: Bonus is based on net income in excess of Birr 60,000 after deduction of both the bonus and

income tax

Bonus = .15 (Birr 180,000 – Birr 60,000 – Bonus - Tax)

= Birr 18,000 – .15B – .15T) ---------------------------- (1)

Tax = .35 (Birr 180,000 – Bonus)

= Br. 63,000 - .35B---------------------------------------- (2)

Financial Accounting –II Page 6

Substituting (2) in (1)

Bonus = Birr 18,000 - .15B- .15(Birr 18,000 – .35B)

Bonus = Birr 18,000 - .15B - Birr 9,450 - .0525 Bonus

= Birr 18,000 - 9,450 - .0975B

= Birr 8,550 - .0975B

1.0975 Bonus = Birr 8,550

Bonus = 7,790

Journal entry to record bonus

Bonus Expense 7,790

Bonus Payable 7,790

3. Contingencies

Contingent liabilities

Contingency is uncertainty as to possible gain (gain contingency) or loss (loss contingency) to a

business enterprise that ultimately will be resolved when a future event occurs or fails to occur. When

uncertainty surrounding a gain contingency resolved, it may result in an acquisition of an asset or the

reduction of liability. When uncertainty surrounding a lose contingency is resolved, it may result in

reduction of an asset or the incurrence of a liability.

The likelihood that the future event(s) will confirm the loss may be

Probable - likely to occur

Reasonably possible – more than remote but less than likely

Remote – slight chance of occurring

The preparation of financial statements requires estimates for many business activities, and the use of

estimates does not necessarily mean that a contingency exists. As an example, computing

depreciation of plant assets is certain, what is the uncertain is the periodic amounts of depreciation

expense (these may require use of estimates). To be loss contingency, it should have to be uncertain

as to even its existence not merely its amounts. Therefore, not all uncertainties inherent in the

accounting process give rise to contingencies.

Loss Contingencies

There is uncertainty as to the existence and amounts of loss to be incurred. Examples include

1. Collectability of receivable (i.e. loss as a result of failing to collect)

2. Liabilities for product warranties

3. Risk of damage to property by fire

4. Pending or threatened litigation

5. Threat of expropriation of assets

6. Selling of receivable or other assets through recourse

To explain their accounting treatment, scrutinize the following table:

Probability that Contingency can be Contingency cannot be

contingency exists reasonably estimated reasonably estimated

(1) Probable Accrued & included in the Not accrued but reported in a note

financial statements to the financial statements

(2) Reasonably

Possible Not accrued, but reported in a Not accrued, but reported in a

note to the financial statements note to the financial statements

(3) Remote Not accrued, a note to the Not accrued, a note to the

financial statements is financial statements is permitted

permitted but not required but not required

Financial Accounting –II Page 7

Accrual of loss contingencies

As can be seen and implied from the above table, a loss contingency is accrued

1. Only when it is probable that an asset has been impaired or a liability incurred

2. The amount of the loss can be reasonably estimated, and

3. It must be probable that a future event will confirm the existence of the loss

You should have to note that a mere exposure to risk does not require accrual of a loss. For

example, the possibility that injury claims will be made against a business enterprise doesn’t indicate

that an asset has been impaired or that a liability has been incurred, therefore, it is not going to be

accrued.

In some instances it is difficult to give single amount estimate for the loss contingency. Instead a

range of loss can be reasonable estimated. Within the range no single amount appears to be a better

estimate than any other amount. The minimum account in the range should be accrued, and any

additional possible loss is disclosed in the note to the financial statements.

Exercise 6

Moran has been sued for industrial espionage, and the damage sought by the plaintiff amount of

$200,000. Morgan’s outside counsel and management are of the opinion that the suit has merit and

that the amount of the damages may range from a minimum of $25,000 to a maximum of $75,000.

No amount in this range is a better estimate than any other amount.

Entry to record such transactions

Litigation loss 25,000

Liability from litigation 25,000

Loss contingencies that are not accrued

Loss contingencies that do not meet the criteria for accrual, but which are at least reasonably

possible as to their existence, are disclosed in the note to the financial statements. The disclosure

should indicate the nature of the contingency and provide an estimate of possible loss, or state that

such all estimates cannot be made. An example of such a loss contingency is a legal action whose

unfavorable outcome is reasonably possible, but a reasonable estimate of loss cannot be made.

Disclosure may not be required for a loss contingency involving law suits not yet filed, unless it

appears probable that the lawsuit will be filed and that an unfavorable outcome is reasonably possible.

For loss contingency, which are remote as to their existence, disclosure may still be permitted, but not

required. Such contingencies include guarantees of indebtedness of others and agreements to

reacquire receivables that had been sold.

Gain Contingencies

Contingencies that might result in gains are not recorded until the gains are realized or realizable.

Examples of gain contingencies include probable favorable outcome of plaintiff litigation and

potential future income tax benefits of operating loss carry forwards.

Probability that Contingency can be reasonably

contingency exists estimated Contingency cannot be reasonably estimated

(1) Probable

Not accrued, except in unusual Not accrued but disclosed in a note to the

situations; disclosure in a note to financial statements in a manner that does not

the financial statements is required give an impression gain is likely

Not accrued, but reported in a note

(2) Reasonably to the financial statements in a

Possible manner that does not give an Not accrued, but reported in a note to the

impression that realization of gain financial statements in a manner that doesn’t

is likely give an impression realization of gain is likely

(3) Remote No disclosure required No disclosure required

Accounting for Loss Contingencies When Liability Has Been Incurred

Financial Accounting –II Page 8

The accrual of loss contingencies requires

A debit to a loss or expense ledger account

A credit to either an asset or an estimated liability account

The term estimated liability

1. Used to describe an obligation that definitely exists but is uncertain as the amount and due

date

Examples include;

a) Product warranties

Most business enterprises give warranties to replace or repair a product if it proves unsatisfactory

during some specified time period. The liabilities arise at the time of sale and may be recorded;

i. At the time of sale

ii. At the end of accounting periods

Recording it at the time of sale

Estimated liability at the time of sale

Product warranty expense xxx

Liability under product warranty xxx

Recording actual costs of servicing customer claims

Liability under product warranty xxx

Cash (or Accounts payable, inventories, etc) xxx

Recording at the end of accounting period

Estimated liability at the time of sale

No entry

Recording actual costs of servicing customer claims

Product warranty expense xxx

Cash (or Accts payable, inventories, etc) xxx

Potential claims outstanding are recorded at the end of the accounting period

Product warranty expense xxx

Liability under product warranty xxx

Exercise 7

Eve Company sold a Sony TV on credit in January year 7 for $2,400, along with a one-year warranty.

Maintenance on each TV sold during the warranty period averages $200. During year 7 Eve

Company incurred cash expenditure of $180 to service the TV.

Required:

Prepare journal entries for Eve Company to record assuming that product warranty expense at the

time of sale

1. Sale of the TV

2. warranty expense

3. Expenditure made of maintenance.

b) Gift certificates

Sold by retail stores to provide merchandise on some later date.

The amount of liability is equal to the amount advanced by customers.

As redemptions are made, the liability ledger account is debited and a revenue account is credited.

Examples; coupons issued by garage and gasoline station

Tickets issued by transportation enterprise

The organization may offer obligations;

o Expired after stated period, estimating the amount of forfeits claims is simple.

o Indefinite duration – necessary to estimate potential claims that will not be redeemed and

transfer from liability ledger to a revenue account.

c) Service contracts

Financial Accounting –II Page 9

Household appliances like refrigerator, TV, etc. are sold with their associated servicing contracts for a

specified period of time. The amounts received for such service contracts constitute unearned revenue

that will be earned by performance over the term of the contract. The actual costs of servicing will be

recognized as expenses.

Exercise 8

Millennium enterprise sells television service contracts for $250 each, agreeing to service customers’

sets for one year. In January year 5, 2000 such service contracts are sold. The past experience shows

that 35% of the calls tend to be made in the first month, 15% in the second month, and 5% each of the

10 subsequent months. In January and February millennium enterprise service contract cost incurred

$95,000 and 32,500 respectively.

Required:

1. Journalize sale of service contracts

2. Journalize revenue realized and cost incurred in January and February year 5.

d) Coupons and trading stamps

Coupons – for promotional purposes, coupon is issued which is exchangeable for prizes such as cash

or merchandise. The liability for the issuer is the cost of the prizes that are expected to be claimed by

customers.

Exercise 9

In year 1 Melat Company issued coupons that may be redeemed for prizes costing $5,000 if all the

coupons are presented for redemption. The past experience indicates that only 75% of the coupons

issued are presented for redemption. The company purchased $5,600 prize merchandise to be given

to customers in year 1.The Lena Company’s customers coupons during year 1 in exchange of prize

merchandise costing $3,000.

Required

1. Journalize purchase of prizes

2. Journalize redemption of coupons for prizes

3. Journalize adjusting entry to record the liability

e) Operating reserves

Debit an expense ledger account and credit an operating reserve for costs

Used for repairs or maintenance that has not yet been incurred.

Estimated future payments for deferred compensation, restoration of leased properties, plant

closing and relocation costs and disposal of an industry segment sometimes are reported as

current liabilities

Disclosure of contingencies not accrued

If a loss does not the two criteria for accrual the likely of the loss is reasonably possible or remote, the

loss contingency is disclosed in a note to the financial statements.

Examples include:

Guarantee of indebtedness of others

Pending or threatened litigation

Actual or possible claims and assessments

Presentation of liabilities in balance sheet

Current liabilities may be reported in the order of maturity or

according to amounts (largest to smallest).

*********//***********

Financial Accounting –II Page 10

You might also like

- Accounts ReceivableDocument11 pagesAccounts Receivablesarahbee89% (9)

- CONTROL ACCOUNT NotesDocument2 pagesCONTROL ACCOUNT Notesndumiso100% (2)

- Operations Management 2Nd Edition by Peter Jones Full ChapterDocument41 pagesOperations Management 2Nd Edition by Peter Jones Full Chapterpatrick.hamm229100% (24)

- Unit - TWO EdtdDocument14 pagesUnit - TWO EdtdHaileNo ratings yet

- Unit 3Document23 pagesUnit 3Nigussie BerhanuNo ratings yet

- Unit 5: Current Liabilities and ContingenciesDocument21 pagesUnit 5: Current Liabilities and Contingenciessamuel kebedeNo ratings yet

- AttachmentDocument11 pagesAttachmentRegasa GutemaNo ratings yet

- Unit 3: Current Liabilities and ContingenciesDocument22 pagesUnit 3: Current Liabilities and Contingenciesyebegashet100% (1)

- Unit A 1Document12 pagesUnit A 1Karl Lincoln TemporosaNo ratings yet

- Intermediate FA II Chapter 1 Edtd FFDocument13 pagesIntermediate FA II Chapter 1 Edtd FFአንተነህ የእናቱNo ratings yet

- Lecture Slides LiabilitiesDocument104 pagesLecture Slides LiabilitiesHuiru ChuaNo ratings yet

- Intermediate CH 1Document15 pagesIntermediate CH 1Abdi MohamedNo ratings yet

- Present ObligationDocument6 pagesPresent ObligationArgem Jay PorioNo ratings yet

- 1 Introduction To LiabilitiesDocument18 pages1 Introduction To LiabilitiesLhea VillanuevaNo ratings yet

- Module 1-LIABILITIES and PREMIUM LIABILITYDocument10 pagesModule 1-LIABILITIES and PREMIUM LIABILITYKathleen SalesNo ratings yet

- Module 001 Accounting For Liabilities-Current Part 2Document7 pagesModule 001 Accounting For Liabilities-Current Part 2Gab BautroNo ratings yet

- LiabilitiesDocument14 pagesLiabilitiesKaye Choraine NadumaNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Chapter 1 Current LiabilitiesDocument48 pagesChapter 1 Current LiabilitiesNeighvest100% (1)

- LiabilitiesDocument4 pagesLiabilitiesarkishaNo ratings yet

- Integrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesDocument10 pagesIntegrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesKamyll VidadNo ratings yet

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Current Liabilities - Revised (Warranties)Document14 pagesCurrent Liabilities - Revised (Warranties)Jerome_JadeNo ratings yet

- Week 04 - 01 - Module 09 - Accounting For Receivables (Part 4)Document10 pagesWeek 04 - 01 - Module 09 - Accounting For Receivables (Part 4)지마리No ratings yet

- FINMNN1 Chapter 4 Short Term Financial PlanningDocument16 pagesFINMNN1 Chapter 4 Short Term Financial Planningkissmoon732No ratings yet

- C1 LiabilitiesDocument20 pagesC1 LiabilitiesJomar MarananNo ratings yet

- Reporting and Analyzing Receivables Answers To QuestionsDocument57 pagesReporting and Analyzing Receivables Answers To Questionsislandguy19100% (3)

- Chapter 8 PayablesDocument46 pagesChapter 8 PayablesLEE WEI LONGNo ratings yet

- Receivable Financing PDFDocument3 pagesReceivable Financing PDFPatawaran, Janelle S.No ratings yet

- Forms of Receivable FinancingDocument3 pagesForms of Receivable FinancingVillaruz Shereen MaeNo ratings yet

- Module 001 Accounting For Liabilities-Current Part 1Document6 pagesModule 001 Accounting For Liabilities-Current Part 1Gab BautroNo ratings yet

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- The Balance Sheet, L+EDocument13 pagesThe Balance Sheet, L+EPao VuochneaNo ratings yet

- Module 1Document31 pagesModule 1Jiane SanicoNo ratings yet

- Test Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, WarfieldDocument12 pagesTest Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, Warfielda384600180No ratings yet

- Chapter1 Current Liab, Prov & ContengeciesDocument51 pagesChapter1 Current Liab, Prov & Contengeciessamuel hailuNo ratings yet

- Auditing ProblemsDocument12 pagesAuditing ProblemsTricia Nicole DimaanoNo ratings yet

- Liabilities in Accounting Examples & Formulas - How To Calculate Total Liabilities - Video & Lesson TranscriptDocument6 pagesLiabilities in Accounting Examples & Formulas - How To Calculate Total Liabilities - Video & Lesson Transcriptmike tanNo ratings yet

- BA 114.1 - Quiz 2 SamplexDocument8 pagesBA 114.1 - Quiz 2 SamplexPamela May NavarreteNo ratings yet

- Intermediate AccountingDocument36 pagesIntermediate AccountingJerome SarmientoNo ratings yet

- Intention To Acquire Goods in The FutureDocument21 pagesIntention To Acquire Goods in The Futurecynthia reyesNo ratings yet

- Solution Manual For Cornerstones of Financial and Managerial Accounting 2nd Edition by RichDocument56 pagesSolution Manual For Cornerstones of Financial and Managerial Accounting 2nd Edition by RichAlejandraVaughanxqbtNo ratings yet

- Diy-Exercises (Questionnaires)Document31 pagesDiy-Exercises (Questionnaires)May RamosNo ratings yet

- Receivables - AccountingDocument11 pagesReceivables - AccountingDairymple MendeNo ratings yet

- Audit Receivables Part 1 ProgramDocument19 pagesAudit Receivables Part 1 ProgramErika PanganNo ratings yet

- Financial and Non-Financial LiabilitiesDocument24 pagesFinancial and Non-Financial LiabilitiesBarredo, Joanna M.No ratings yet

- Liabilities: Lecture NotesDocument10 pagesLiabilities: Lecture NotesJimbo ManalastasNo ratings yet

- Module 1 Accounting ReportDocument12 pagesModule 1 Accounting ReportLovely Joy SantiagoNo ratings yet

- Intermediate Accounting Volume 2 by Robles and Empleo 2017 (book) chapterDocument13 pagesIntermediate Accounting Volume 2 by Robles and Empleo 2017 (book) chapterAbraham ChinNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- Midterm NotesDocument11 pagesMidterm NotesLauNo ratings yet

- Acc 124Document5 pagesAcc 124KISSEY ESTRELLANo ratings yet

- Accounts ReceivableDocument43 pagesAccounts ReceivableZee 24No ratings yet

- Unang Pahina Far LiabilitiesDocument41 pagesUnang Pahina Far LiabilitiesNadin Olga SemiraNo ratings yet

- Problem 1 Write The Letter As Well As The Entire AnswersDocument4 pagesProblem 1 Write The Letter As Well As The Entire Answerslirva cantonaNo ratings yet

- Hock CMA P1 2019 (Sections A, B & C) AnswersDocument17 pagesHock CMA P1 2019 (Sections A, B & C) AnswersNathan DrakeNo ratings yet

- CH09Document28 pagesCH09Will TrầnNo ratings yet

- CH 2Document46 pagesCH 2Sarose ThapaNo ratings yet

- PRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerDocument21 pagesPRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerShiena ApasNo ratings yet

- Chapter 3Document8 pagesChapter 3yosef mechalNo ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Chapter Five: Market Structure 5.1 Perfectly Competition Market StructureDocument27 pagesChapter Five: Market Structure 5.1 Perfectly Competition Market StructureBlack boxNo ratings yet

- Theory of CostDocument9 pagesTheory of CostBlack boxNo ratings yet

- Chapter One: Basic Concepts of EconomicsDocument19 pagesChapter One: Basic Concepts of EconomicsBlack boxNo ratings yet

- 2.CH 02 Econ 201Document9 pages2.CH 02 Econ 201Black boxNo ratings yet

- Understanding Long-Term Debt FinancingDocument22 pagesUnderstanding Long-Term Debt FinancingBlack boxNo ratings yet

- Unit 4 FA-IIDocument20 pagesUnit 4 FA-IIBlack boxNo ratings yet

- General Concepts What Is Public Finance?Document13 pagesGeneral Concepts What Is Public Finance?Black boxNo ratings yet

- Unit 3 FA-IIDocument19 pagesUnit 3 FA-IIBlack boxNo ratings yet

- GDSN Trade Item Implementation GuideDocument459 pagesGDSN Trade Item Implementation Guideqiaohongzedingtalk.comNo ratings yet

- Guideline of Qaqc For Minor Project Under Local AuthoritiesDocument63 pagesGuideline of Qaqc For Minor Project Under Local AuthoritiesNurul AfiqahNo ratings yet

- Vendor Master Form - v2 (IDX)Document1 pageVendor Master Form - v2 (IDX)jaguar proNo ratings yet

- FH Method Statement For Procurement ServicesDocument5 pagesFH Method Statement For Procurement Servicesjovana samNo ratings yet

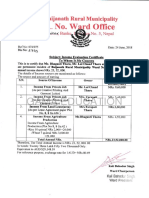

- Income Sources and Annual Earnings of Baijanath ResidentsDocument15 pagesIncome Sources and Annual Earnings of Baijanath Residentsriwaj_ghimireNo ratings yet

- Department of Education: Masbate Apollo General MerchandiseDocument2 pagesDepartment of Education: Masbate Apollo General MerchandiseAřčhäńgël KäśtïelNo ratings yet

- Improvement of Construction Procurement System ProcessesDocument121 pagesImprovement of Construction Procurement System ProcessesBeauty SairaNo ratings yet

- I. POS System of StarbucksDocument8 pagesI. POS System of StarbucksKyra Mae Asis TreceñeNo ratings yet

- Chapt 6 - Financial Ratio Analysis - CabreraDocument35 pagesChapt 6 - Financial Ratio Analysis - CabreraLancerAce22No ratings yet

- PGP 1 Group M2 Improves Maya SalesDocument4 pagesPGP 1 Group M2 Improves Maya SalesApoorva SharmaNo ratings yet

- Assignment: EntrepreneushipDocument10 pagesAssignment: EntrepreneushipRajesh KumarNo ratings yet

- Para ImprimirDocument2 pagesPara ImprimirZymafayNo ratings yet

- CSP Mine PDFDocument7 pagesCSP Mine PDFAlex HedarNo ratings yet

- SUS H101 Aspen HYSYS CCS ACU Study GuideDocument3 pagesSUS H101 Aspen HYSYS CCS ACU Study GuideOttors kebin philipNo ratings yet

- Unit 5. Lecture 2 Public Finance of SportsDocument50 pagesUnit 5. Lecture 2 Public Finance of SportsKayla FrancisNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Professional CV ResumeDocument1 pageProfessional CV ResumenetoameNo ratings yet

- Certificate of Incorporation-20190704Document1 pageCertificate of Incorporation-20190704Pinky KumariNo ratings yet

- Exercise Case 6 7 AnswerDocument1 pageExercise Case 6 7 AnswerMinle HengNo ratings yet

- HINDUSTAN UNILEVER LTD HulDocument41 pagesHINDUSTAN UNILEVER LTD Hulviveknegandhi100% (2)

- Oracle® Iprocurement: Implementation and Administration Guide Release 12.2Document290 pagesOracle® Iprocurement: Implementation and Administration Guide Release 12.2Indumathi KumarNo ratings yet

- Yamuna Express AuthorityDocument14 pagesYamuna Express Authoritydeepagautam1907No ratings yet

- FAO Project ProfileDocument3 pagesFAO Project ProfileAbubakarr SesayNo ratings yet

- Lead Generation Using AIDocument57 pagesLead Generation Using AIparitosh kalbhor100% (1)

- 7 Final Accounts of CompaniesDocument15 pages7 Final Accounts of CompaniesAakshi SharmaNo ratings yet

- Forex Business Plan.01Document8 pagesForex Business Plan.01Kelvin Tafara SamboNo ratings yet

- Design Thinking IntroductionDocument26 pagesDesign Thinking IntroductionEduardo MucajiNo ratings yet

- Eco Clothesline Query AssignmentDocument2 pagesEco Clothesline Query AssignmentthetechbossNo ratings yet