Professional Documents

Culture Documents

Difference Between Standard Costing and Budgetary Control

Uploaded by

Hassan Hadi KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference Between Standard Costing and Budgetary Control

Uploaded by

Hassan Hadi KhanCopyright:

Available Formats

Difference between Standard Costing and

Budgetary Control

Standard Costing

Standard Costing is an accounting technique that helps to calculate material

performance, labor, overheads and their variances, to take corrective action.

The variances are then analyzed in depth and re-established by comparing the

actual costs with the standard average production costs along with the

explanations for the same. There are two types of variances: favorable, when

the actual cost is less than the standard cost and adverse, actual costs exceed

standard costs.

These are the following steps taken to carry out Standard Costing:

Setting Standards

Determining Actual Costs

Comparing between actual and standard figures

Variance Analysis and Reporting

Taking corrective action for the disposition of variances

Standard costing is an instrument used to assess and manage costs. With this

technique, the organization can make the efficient use of available resources

possible. Additionally, by assessing the deviations, i.e. analyzing the difference

between actual performance and standard performance, the management can

keep a check on the organizational activities.

Budgetary Control

Budgetary Control is a management function that directs and regulates the

activities of an organization in such a way that they reach the desired

objectives. It is a methodological approach in which the operations are

planned in advance and then compared to the actual results to determine

whether or not the expected results are achieved. The following are the major

characteristics of this system:

The budgets are adjusted to policy criteria.

Constant comparisons to check the results are made between the actual

output and the budgeted targets.

Revisions are made if the existing circumstances change.

Where the desired outcomes are not obtained, necessary action will be

taken.

Here, the word budget means a written financial statement prepared in

advance for future periods that is expressed in monetary terms, containing

details of the organization’s financial activities.

The system of Budgetary Control allows management to correct the

obligations and organize the operations to produce the desired results. It helps

managers measure the overall performance of the organization. In addition, it

also assists management by reviewing current trends in formulating future

policies.

Similarity between Standard Costing and Budgetary Control

Fixed standards are used for both budgetary and standard cost controls.

Both strategies are targeted at pre-production cost determinations.

Both strategies presume that costs can be managed along fixed

accountability lines.

In the case of both the techniques, actual are compared with the pre-

determined standards.

Periodic reports of comparative costs for both are needed.

Both the techniques are intended to take corrective action in the case of

adverse variances.

Both aim to boost efficiency in performance.

Key Differences between Standard Costing and Budgetary Control

The following are the major differences between standard costing and

budgetary control:

Standard costing is a cost accounting method that calculates efficiency

by contrasting actual and standard costs. Budgetary Control is a control

system where actual and budgeted results are constantly compared in

order to achieve the desired outcome.

In Standard Costing, the distinction is made between actual cost and

expected production at standard cost. At the other hand, the contrast

between the actual and the budgeted output is made in Budgetary

Control.

Standard costing is limited to, cost data, but budgetary control is linked

to company's both cost concept and economic data.

Standard Costing has a narrow focus, restricted to production costs

only, while Budgetary Control has a comparatively broader view as it

covers all of the organization's operations.

In Standard Costing variances are disclosed and recorded in budgetary

control, but, because the control is simultaneously exercised, the

variances are not disclosed.

Due to short-term changes in the conditions, standard costs do not

change but budgeted costs can change.

Standard Costing is like a subset of Budgetary Control.

Standard Costing applies to manufacturing concerns. In contrast to

Budgetary Control, this applies to all the organizations.

Conclusion

Both Standard Costing and Budgetary Control are the methods that provide a

reference point for assessing performance and analyzing discrepancy between

actual and estimated figures.

But as Budgetary Control makes side-by side comparisons, the regular

changes are made in the budgets, and so it eliminates the need to mention the

variances. And this is what majorly missing from Standard Costing.

You might also like

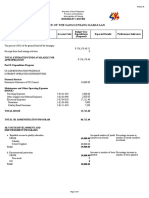

- SK Annual Budget 2023Document3 pagesSK Annual Budget 2023KENNETH ANINZO100% (5)

- Chapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Document106 pagesChapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Shravani Shrav50% (2)

- Difference Between Standard Costing and Budgetary ControlDocument3 pagesDifference Between Standard Costing and Budgetary ControlHassan Hadi KhanNo ratings yet

- Standard CostingDocument6 pagesStandard CostingAbinash NayakNo ratings yet

- 14 Advantages of Standard CostingDocument4 pages14 Advantages of Standard CostingThelma DancelNo ratings yet

- STANDARD COSTING (Learning Insights)Document1 pageSTANDARD COSTING (Learning Insights)Riel BerdigayNo ratings yet

- Management Accounting Standard Costing and Variance AnalysisDocument8 pagesManagement Accounting Standard Costing and Variance Analysismaha AkhtarNo ratings yet

- Standard CostingDocument12 pagesStandard CostingPîyûsh KôltêNo ratings yet

- Final Project of Standard CostingDocument16 pagesFinal Project of Standard CostingKishan Kudia60% (5)

- Arbaminch University: Colege of Business and EconomicsDocument13 pagesArbaminch University: Colege of Business and EconomicsHope KnockNo ratings yet

- Unit - 5: Objectives of Standard CostingDocument16 pagesUnit - 5: Objectives of Standard CostingThigilpandi07 YTNo ratings yet

- Standard Costing SystemDocument1 pageStandard Costing Systemdrin filesNo ratings yet

- Budgetary ControlDocument8 pagesBudgetary ControlRuhulAminNo ratings yet

- Ashish Rana 12538..Document3 pagesAshish Rana 12538..hiren4kachhadiyaNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- Standard Cost and Components and Variance AnalysisDocument7 pagesStandard Cost and Components and Variance AnalysisNaveen RajputNo ratings yet

- Controlling 1Document14 pagesControlling 1Rahela_FarooqiNo ratings yet

- Characteristics of Marginal CostingDocument2 pagesCharacteristics of Marginal CostingLJBernardoNo ratings yet

- Concept of Standard CostingDocument9 pagesConcept of Standard Costingdiyapaul100% (1)

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- Budget Variance Analysis: How To Monitor, Calculate, and AnalyzeDocument3 pagesBudget Variance Analysis: How To Monitor, Calculate, and AnalyzegreyNo ratings yet

- Chapter 12 Revision Notes: Budgetary ControlDocument4 pagesChapter 12 Revision Notes: Budgetary Controljugjitsingh355No ratings yet

- Budgetary Variance ModelDocument6 pagesBudgetary Variance ModelEvelyne WanguiNo ratings yet

- Standard Costing & Variance Analysis: Uses of Accounting InformationDocument34 pagesStandard Costing & Variance Analysis: Uses of Accounting InformationAngel JhamnaniNo ratings yet

- Objectives of Cost ControlDocument52 pagesObjectives of Cost Controlhailu tadeleNo ratings yet

- Budget ControlDocument7 pagesBudget ControlArnel CopinaNo ratings yet

- Cost Accounting BehaviorDocument3 pagesCost Accounting BehaviorJyasmine Aura V. AgustinNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- What Is Cost Accounting and DiferencesDocument6 pagesWhat Is Cost Accounting and Diferenceskasuntop99838No ratings yet

- AMA - Essay 4Document13 pagesAMA - Essay 4Deborah WilliamsNo ratings yet

- Order 1472Document15 pagesOrder 1472Zubair PirachaNo ratings yet

- Budgetary Control: Submitted by - Harsh Rawat, Ronish Jain and Sashwat GuptaDocument10 pagesBudgetary Control: Submitted by - Harsh Rawat, Ronish Jain and Sashwat GuptaHarsh RawatNo ratings yet

- Techniques of CostingDocument1 pageTechniques of CostingAlamin MohammadNo ratings yet

- Cost Accounting - Bcom - Module VDocument7 pagesCost Accounting - Bcom - Module Vmohammedarshad0021No ratings yet

- Cost Accounting ImportanceDocument1 pageCost Accounting ImportanceRegis, Julia Elyssa B.No ratings yet

- A Project Report On Budgetary Control SystemDocument81 pagesA Project Report On Budgetary Control SystemVirendra JhaNo ratings yet

- Lesson 1 Basic Concepts in Cost AccountingDocument3 pagesLesson 1 Basic Concepts in Cost AccountingBEA CATANEONo ratings yet

- Unit 5: Introduction To Standard CostingDocument15 pagesUnit 5: Introduction To Standard CostingAsim Hasan UsmaniNo ratings yet

- How To Control Cost of Manufacturing ConcernDocument18 pagesHow To Control Cost of Manufacturing ConcernkhurramNo ratings yet

- Management Accounting and BudgetingDocument5 pagesManagement Accounting and BudgetingDan Dem-WacykiewiczNo ratings yet

- Controlling Is A Primary Goal-Oriented Function of Management in AnDocument8 pagesControlling Is A Primary Goal-Oriented Function of Management in AnBrian Rey L. AbingNo ratings yet

- C Information Is Designed For Managers. Since Managers Are TakingDocument6 pagesC Information Is Designed For Managers. Since Managers Are Takingdrishti_bhushanNo ratings yet

- Managers Accounting (Unit 1,2,3,4)Document6 pagesManagers Accounting (Unit 1,2,3,4)Amit Vikram OjhaNo ratings yet

- Definition of Standard CostingDocument10 pagesDefinition of Standard CostingSandeep SinghNo ratings yet

- Accounts Question - WIP - v1Document14 pagesAccounts Question - WIP - v1Manish KumarNo ratings yet

- Standard CostDocument9 pagesStandard CostJohnNo ratings yet

- Cost Accounting ExerciseDocument4 pagesCost Accounting ExerciseAnanda RiskiNo ratings yet

- Costing Accounts AssignmentDocument7 pagesCosting Accounts AssignmentLionel MuchemwaNo ratings yet

- Cost Accounting and Cost Control - Discussion TranscriptDocument10 pagesCost Accounting and Cost Control - Discussion Transcriptkakimog738No ratings yet

- Financial Analysis and Control PDFDocument16 pagesFinancial Analysis and Control PDFShopno ChuraNo ratings yet

- Standard Cost and Variance AnalysisDocument22 pagesStandard Cost and Variance AnalysisAbbas Jan Bangash100% (1)

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- Controlling Is A Process of Measuring PerformanceDocument5 pagesControlling Is A Process of Measuring Performanceyukisenp4i11No ratings yet

- Standard CostingDocument13 pagesStandard CostingRia ChoithaniNo ratings yet

- Rp3 Acc213 Pelier 2Document2 pagesRp3 Acc213 Pelier 2m9kx6f7bq4No ratings yet

- Budget Control SystemsDocument77 pagesBudget Control SystemsPrasanna KumarNo ratings yet

- Reference Reading 6.3Document4 pagesReference Reading 6.3Deepak MahatoNo ratings yet

- 09 Calculating Standard Cost VariancesDocument1 page09 Calculating Standard Cost VariancesThelma DancelNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Ac16 601P Gabuat The Budget ProcessDocument5 pagesAc16 601P Gabuat The Budget ProcessRenelle HabacNo ratings yet

- Assessment of Local Fiscal PerformanceDocument2 pagesAssessment of Local Fiscal PerformanceKei SenpaiNo ratings yet

- Bureau of Local Government FinanceDocument8 pagesBureau of Local Government FinanceGerald BuslonNo ratings yet

- Modification Advice Form (Maf) No. 2020-Xx-Xxxx: DatedDocument2 pagesModification Advice Form (Maf) No. 2020-Xx-Xxxx: DatedJade Darping KarimNo ratings yet

- 2023 SK Annual Budget TimbaanDocument5 pages2023 SK Annual Budget TimbaanFrences RafaelNo ratings yet

- Budgeting in NigeriaDocument11 pagesBudgeting in NigeriaMonika br GintingNo ratings yet

- Benefits of BudgetingDocument2 pagesBenefits of BudgetingRoda Gayle RañadaNo ratings yet

- ECO104.16 AssignmentDocument5 pagesECO104.16 AssignmentRidwan AhmedNo ratings yet

- Financial OperationsDocument15 pagesFinancial OperationsmnmrznNo ratings yet

- Hanging Bridge at San MarcosDocument2 pagesHanging Bridge at San MarcosKap JPNo ratings yet

- TestsDocument5 pagesTestsDenzel GotoNo ratings yet

- Management Programme: Term-End Examination December, 2017 0 Ms-062: Sales ManagementDocument5 pagesManagement Programme: Term-End Examination December, 2017 0 Ms-062: Sales ManagementManoj NazareNo ratings yet

- My Written Report - FiscalDocument12 pagesMy Written Report - Fiscalfreezia xyz zinNo ratings yet

- Jan 23 2023 BOC Packet-Jail MillageDocument3 pagesJan 23 2023 BOC Packet-Jail MillageColin MerryNo ratings yet

- Sohn Investment Conference Presentation, June 9, 2022Document49 pagesSohn Investment Conference Presentation, June 9, 2022aitilopNo ratings yet

- Barangay Gender and Development Focal Point System (BGFPS)Document55 pagesBarangay Gender and Development Focal Point System (BGFPS)agustino marcelo100% (2)

- Kansas City Letter On KCPD Ballot MeasureDocument3 pagesKansas City Letter On KCPD Ballot MeasureThe Kansas City StarNo ratings yet

- Budget Operations ManualDocument115 pagesBudget Operations ManualFrank Udinabe SanjaNo ratings yet

- Fiscal Policy Statement FY 2023.24 - FinalDocument7 pagesFiscal Policy Statement FY 2023.24 - FinalAnubhav BhattaraiNo ratings yet

- The President's Budgetary Power by Emilia BoncodinDocument9 pagesThe President's Budgetary Power by Emilia BoncodinBlogWatchNo ratings yet

- Resolution No. 154 Series of 2020Document2 pagesResolution No. 154 Series of 2020Mary Grace MaribaoNo ratings yet

- CHAPTER 2 - Unified Accounts Code StructureDocument56 pagesCHAPTER 2 - Unified Accounts Code StructureRafael VictoriaNo ratings yet

- Araullo vs. Executive Secretary, G.R. No. 209287Document3 pagesAraullo vs. Executive Secretary, G.R. No. 209287Cheryl Fenol100% (2)

- Chapter 5Document6 pagesChapter 5Prince Justin SolanoNo ratings yet

- Zero Base BudgetingDocument3 pagesZero Base BudgetingAarti DivyaNo ratings yet

- Dav Public School,: Bseb Colony, PatnaDocument5 pagesDav Public School,: Bseb Colony, PatnaSaumya SaumyaNo ratings yet

- Government of Andhra PradeshDocument10 pagesGovernment of Andhra PradeshUddish Naik EslavathNo ratings yet

- Zero Based Budgeting (ZBB)Document11 pagesZero Based Budgeting (ZBB)sagarNo ratings yet

- Deakin Business Administration Accounting UnitDocument45 pagesDeakin Business Administration Accounting UnitYasiru MahindaratneNo ratings yet