Professional Documents

Culture Documents

Case Study On STRSAR PDF

Uploaded by

A M Faisal0 ratings0% found this document useful (0 votes)

15 views11 pagesOriginal Title

Case Study on STRSAR.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views11 pagesCase Study On STRSAR PDF

Uploaded by

A M FaisalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

CASE STUDY ON STR/SAR

Mr. X, a company director and shareholder of a local

sports club currently in administration, has held both

personal and business accounts with the bank for a

considerable number of years. Mr. X is well known to staff

and is something of a local celebrity. On the same day that

a credit of BDT18,50,000 was received in his personal

account, Mr. X approached the bank to request a

withdrawal of BDT 1500,000 in cash, and issued two

cheques in a total sum of BDT 350,000 to his business

partner Mr. Y. Mr. X was advised that such an amount of

cash would need to be ordered, but that it could be made

available in two working days.

CASE STUDY ON STR/SAR ( CONT.)

The teller suggested to Mr. X that this sum of

money could be transferred by more secure

methods than cash withdrawal. Cash Officer also

gone through his TP and found that cash

withdrawal data was absent in his TP and only

contains Fund Transfer through RGTS & EFT.

Mr. X declined this suggestion, stating that he did

require the sum in cash, and advised that the

money had come from his sports club. Finally,

manager of the branch refrained from such

transactions.

CASE STUDY ON STR/SAR

Issues:

What was the basis for suspicion, if any?

Should a SAR/STR has been submitted?

Was the Cash Officer being asked to conduct a prohibited act

or circular?

If a report were to have been submitted, how may this have

impacted upon the bank?

What were the risk factors?

How could the bank/reporter have mitigated against any

risks?

CASE STUDY ON STR/SAR

Ms. Roksana held a bank account which had seen

sporadic use throughout her five year relationship

with the Gulistan bank Ltd. When in use, the pattern

had been that of multiple cash deposits, on the same

day, which were paid in through a number of local

branches. However in a three month period the

account had received heavier use than normal,

receiving deposits totalling BDT 50,00,000 in cash

and BDT 60,00,000 in cheques, a number of which

were for BDT 10,00,000 – BDT15,00,000 at a time.

CASE STUDY ON STR/SAR

These funds had then been withdrawn by

cheque and direct debit payments. Initial

funds credited to Ms. Farida’s account, in the

sum of BDT 25,00,000, which she had advised

bank staff were the proceeds of a property sale,

had been subsequently transferred to an

account she had recently opened in the name

of Company Y.

CASE STUDY ON STR/SAR ( CONT.)

When asked if a cash transaction of BDT 25,00,000

could be paid directly into the account of Company Y,

Ms. Roksna was adamant that the funds should be first

processed through her personal account. Two bankers’

cheques had been debited from Company Y’s account,

one in the sum of BDT15,00,000 to a solicitors firm and

the other for BDT 10,00,000 to a development company.

On the other hand , TP does not contain above

mentioned Transactions under any circumstances. It is

publicly available information that client has a good

relation with IP and Govt high officials.

CASE STUDY ON STR/SAR

Issues:

What was the basis for suspicion?

Should a SAR/STR have been submitted?

What were the risk factors?

How could the bank/reporter have mitigated

against any risks?

CASE STUDY ON STR/SAR

Amin & Co. Ltd in accordance with the data available

at “Bank Gulshan Ltd " is a retailer of jewelry and

precious metal. Based on the bank's observation, this

company has a slow growth. Usual transfer to and

from the account of Amin & Co. Ltd from a number of

individuals is a multiple amount of BDT 1.00 lac and

ranges from BDT 10.00 lac to BDT 50.00 lac. Transfer

out is also conducted in a routine manner to two

"company executives" of Amin & Co. Ltd in a

relatively enormous amount namely ranges from BDT

20.00 lac to BDT 80.00 lac. Cash withdrawing is also

performed frequently by the employees of Amin & Co.

Ltd and the amount reaches of 5.00 Crore BDT in a

month. The aforementioned mutation pattern draws

the attention of “Bank Gulshan Ltd” officials.

SUSPICIOUS INDICATORS

Customer's account activity is inconsistent with the fact that

customer's business grows slowly.

Transaction patterns as reflected by transaction amount and

frequency involving some persons do not comply with customer's

business characteristics.

Routine transfer to two "company executives" of Amin & Co. Ltd in

a large amount has unclear relation with customer's business.

Cash withdrawing in a relatively large amount frequently having

unclear relation with customer's business often occurs.

CASE STUDY ON STR/SAR

Bank Gulistan Ltd, in November 2017, opened saving

accounts for 10 new customers most of whom work as

private entrepreneurs with the average income of

BDT 25,000.00 to BDT 50,000.00 per month. Within a

month, the ten accounts simultaneously receive Tk.

5.00 lac each time through RTGS from a senior

regional official through various banks. Each of

account holders withdrew some cash through ATM in

a several phases within a relatively short period and

they left only thousand BDT in their accounts.

Officials of Bank Gulistan Ltd checked the addresses

of the account holders and it found that they provided

false addresses. There is information that one of the

ten account holders has been arrested by the DMP

due to fraud cases.

CASE STUDY ON SAR/STR

Suspicious Indicators

Accounts were opened for the purpose of receiving funds

in several phases and the funds were withdrawn in a

relatively short period.

Transactions were conducted without clear reasons.

Transactions amount and frequency does not comply with

customer's income profile.

The withdrawal was conducted in cash through ATM in a

reasonable high frequency and maximum amount so that

the balance is almost gone

One of the customers was arrested by the Police due to

fraud cases.

The customers provided fake addresses.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- CHASE PRIVATE CLIENT CHECKING Statement For Account Ending in 5229 DaDocument4 pagesCHASE PRIVATE CLIENT CHECKING Statement For Account Ending in 5229 Darocky fletcher100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bank Account Closing LetterDocument13 pagesBank Account Closing LetterSantosh ShresthaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AKeiver jimenezNo ratings yet

- The Correct Answer Is: P105,000Document5 pagesThe Correct Answer Is: P105,000cindy100% (2)

- Sample of Bank Comfort LetterDocument2 pagesSample of Bank Comfort LetterShakeshakes90% (10)

- Wells Fargo Preferred CheckingDocument3 pagesWells Fargo Preferred CheckingAarón CantúNo ratings yet

- Sales ContractDocument3 pagesSales ContractA M FaisalNo ratings yet

- Mutasi Mar 2023Document1 pageMutasi Mar 2023Imam Fidyansyah100% (1)

- Kii We WeDocument6 pagesKii We WeA M FaisalNo ratings yet

- Financial Affidavit With Ali FillableDocument2 pagesFinancial Affidavit With Ali FillableA M FaisalNo ratings yet

- Techno LabDocument3 pagesTechno LabA M FaisalNo ratings yet

- UntitledDocument1 pageUntitledA M FaisalNo ratings yet

- South Asia TechDocument6 pagesSouth Asia TechA M FaisalNo ratings yet

- South Asia TechDocument6 pagesSouth Asia TechA M FaisalNo ratings yet

- Story of UzayerDocument2 pagesStory of UzayerA M FaisalNo ratings yet

- Bamlco PDFDocument4 pagesBamlco PDFA M FaisalNo ratings yet

- UntitledDocument1 pageUntitledA M FaisalNo ratings yet

- Guideline - TBML 12 2019 PDFDocument94 pagesGuideline - TBML 12 2019 PDFA M FaisalNo ratings yet

- Attention: Branch Anti Money Laundering Compliance Officers (Bamlcos), All BranchesDocument3 pagesAttention: Branch Anti Money Laundering Compliance Officers (Bamlcos), All BranchesA M FaisalNo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Seller KYC 2Document1 pageSeller KYC 2MN Builders & DevelopersNo ratings yet

- Atanasio Monserrate KundliDocument19 pagesAtanasio Monserrate KundliMohan RadiyaNo ratings yet

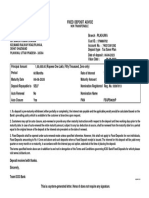

- Fixed Deposit AdviceDocument1 pageFixed Deposit Advicemac martinNo ratings yet

- Balance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Document1 pageBalance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Ali Khan AKNo ratings yet

- ZZZ CZ 1110 GR 004J enDocument2 pagesZZZ CZ 1110 GR 004J enNataliiaNo ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- SBI Life Branch GRO Grievance Redressal Officer DetailsDocument42 pagesSBI Life Branch GRO Grievance Redressal Officer DetailsDebmalya GhoshNo ratings yet

- Account Closure FormDocument1 pageAccount Closure FormDineshya GNo ratings yet

- UntitledDocument36 pagesUntitledbaniNo ratings yet

- C300 PDFDocument8 pagesC300 PDFAngelaNo ratings yet

- PROFIL SINGKAT PERUSAHAAN Yang Isinya Meliputi:: Tugas IiDocument8 pagesPROFIL SINGKAT PERUSAHAAN Yang Isinya Meliputi:: Tugas Iisupaijho watiNo ratings yet

- Accounting & Excel Assignment - ExperiencedDocument21 pagesAccounting & Excel Assignment - Experienceddivyaparashar10No ratings yet

- For How Long You Are Part of SBI Bank? Response No. of Customer %age of CustomerDocument4 pagesFor How Long You Are Part of SBI Bank? Response No. of Customer %age of CustomersanjuNo ratings yet

- WWW CBN Gov NG 419 Samples InheritanceProposal HTMDocument2 pagesWWW CBN Gov NG 419 Samples InheritanceProposal HTMEric HazzardNo ratings yet

- Branch ListDocument24 pagesBranch ListRAJARAJESHWARI M GNo ratings yet

- Indorsement Letter For The Incoming School Head: AnnexDocument2 pagesIndorsement Letter For The Incoming School Head: AnnexJohn Caleb Axalan CabugNo ratings yet

- Exercise ProjectDocument3 pagesExercise ProjectHassenNo ratings yet

- List of All Fees For Primary Card Brightwell Visa Prepaid Card All Fees Amount DetailsDocument3 pagesList of All Fees For Primary Card Brightwell Visa Prepaid Card All Fees Amount DetailsIvan MilosavljevicNo ratings yet

- Credit Transaction Digest 1Document1 pageCredit Transaction Digest 1Michelle Jude TinioNo ratings yet

- DirectionsDocument2 pagesDirectionsbbbobbboNo ratings yet

- Poster Infographic PDFDocument1 pagePoster Infographic PDFSyarifah ErniNo ratings yet

- Bba 2 Year Morning 4TH Merit ListDocument2 pagesBba 2 Year Morning 4TH Merit ListHassan MuneebNo ratings yet