Professional Documents

Culture Documents

Following Are The Benefits of Obtaining Udyam Registration

Uploaded by

Vinayak VagheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Following Are The Benefits of Obtaining Udyam Registration

Uploaded by

Vinayak VagheCopyright:

Available Formats

Following are the benefits of obtaining Udyam Registration:-

1. The business owner can avail octroi and tax concession in states laws as

applicable.

2. Claim stamp duty and registration fees waiver.

3. Exemption of 1% interest rate on Overdraft.

4. Can avail subsidy from NSIC and credit ratings & Eligible for IPS subsidy.

5. Reimbursement on the payment made for obtaining the ISO certificate.

6. Reservation of products for exclusive manufacturing by MSME and SSI.

7. Avail Excise Exemption Scheme.

8. Avail exemption while applying for government tenders.

9. Exemption under direct tax laws.

10. Enjoy easy bank mortgages and Bank Business Loans

11. Bank loans become cheaper as the interest rate is very low (Up to 1.5% lower

than interest on regular loans

12. Becomes easy to get licenses, approvals and registrations, irrespective of field of

business as business registered under Udyam are given higher preference for

government license and certification.

13. Registered Udyams gets tariff subsidies and tax and capital subsidies

14. Interest rate Subsidy on Bank loans

15. Protection against delayed payments, against material/services supplied

16. Ease of obtaining registrations, licenses, and approvals.

17. MSME Registered entity gets eligible for CLCSS (credit linked capital subsidy

scheme)

18. Subsidy is available for Patent registration

19. Industrial Promotion Subsidy (IPS) Subsidy Eligibility

20. One can avail 100% Collateral Free loans from all banks

21. Special consideration on International Trade fairs

22. Bar Code Registration Subsidy

23. Waiver in Security Deposit in Government Tenders and Departments

24. Concession in Electricity bills

You might also like

- Udy Am RegisterDocument12 pagesUdy Am Registerpassport sahayataNo ratings yet

- MSMEDocument1 pageMSMENagarNo ratings yet

- General MSME Frequently Asked QuestionsDocument46 pagesGeneral MSME Frequently Asked QuestionsABHISHEK SINGHNo ratings yet

- Benefits of Msme Registration in IndiaDocument2 pagesBenefits of Msme Registration in Indiaankit ayashkNo ratings yet

- Benefits For MSME RegistrationDocument3 pagesBenefits For MSME RegistrationAnkita SinghNo ratings yet

- Small and Medium Scale EnterprisesDocument5 pagesSmall and Medium Scale EnterprisesRao JeetuNo ratings yet

- Registration of Small Scale IndustriesDocument8 pagesRegistration of Small Scale IndustriesMohitraheja007No ratings yet

- Is Your Business Benefited? Are You An Msme?: Benefits of Msme RegistrationDocument2 pagesIs Your Business Benefited? Are You An Msme?: Benefits of Msme Registrationsubhamgupta7495No ratings yet

- Key Government Schemes - EBookDocument37 pagesKey Government Schemes - EBookNagaraja SNo ratings yet

- Be Sem 1 Unit 2 SsiDocument17 pagesBe Sem 1 Unit 2 SsiYash KeshkamatNo ratings yet

- Definition of Public DepositsDocument3 pagesDefinition of Public DepositsSriram SrinivasanNo ratings yet

- On REGISTRATION NOC FROM POLLUTION BOARDDocument14 pagesOn REGISTRATION NOC FROM POLLUTION BOARDankitabhardwaj3750% (1)

- Preferential TaxationDocument9 pagesPreferential TaxationMNo ratings yet

- Bridge EquityDocument8 pagesBridge EquityshahyashrNo ratings yet

- 1.) Who Are Eligible To Register As Bmbes?: AnswerDocument6 pages1.) Who Are Eligible To Register As Bmbes?: AnswerHazel Seguerra BicadaNo ratings yet

- Investment Manager - S Insurance (IMI) - Product BrochureDocument5 pagesInvestment Manager - S Insurance (IMI) - Product BrochureHARMAN SINGHNo ratings yet

- Small Sclae IndustriesDocument22 pagesSmall Sclae IndustriesDev kartik AgarwalNo ratings yet

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Errors and Omission Liability Insurance Policy: InsuredDocument60 pagesErrors and Omission Liability Insurance Policy: InsuredSwaroop KaruppiahNo ratings yet

- 2023-08-07 Sebi Faq RiaDocument19 pages2023-08-07 Sebi Faq Riacawojin576No ratings yet

- 2009 Investment Climate Statement - IndiaDocument23 pages2009 Investment Climate Statement - IndiaRukshana PraveenNo ratings yet

- Myanmar Investment LawDocument14 pagesMyanmar Investment Lawlaet yinwin88No ratings yet

- Business - 4: Legal Requirements and Financial Considerations GewargisDocument18 pagesBusiness - 4: Legal Requirements and Financial Considerations GewargislizNo ratings yet

- Gross IncomeDocument54 pagesGross IncomeErneylou RanayNo ratings yet

- Concept of Business Finance Ch7 BSTDocument7 pagesConcept of Business Finance Ch7 BSTRachit AgrawalNo ratings yet

- Confidential Private Offering Memorandum Final Version Second Offering 020514 Final PDF VersionDocument80 pagesConfidential Private Offering Memorandum Final Version Second Offering 020514 Final PDF Versionapi-243725106100% (1)

- OMWealth OldMutualWealthLifeWrappedInvestmentDocument2 pagesOMWealth OldMutualWealthLifeWrappedInvestmentJohn SmithNo ratings yet

- Startups India'Document5 pagesStartups India'kratika pathakNo ratings yet

- Banking Laws IVDocument19 pagesBanking Laws IVPatty JavierNo ratings yet

- What Is Outbound Investment Structuring?Document9 pagesWhat Is Outbound Investment Structuring?Paras MittalNo ratings yet

- Startup - Bareilly - Zari-BambooDocument6 pagesStartup - Bareilly - Zari-Bamboosaakshiis295No ratings yet

- Factors Affecting International Investment: 1. GovernmentDocument16 pagesFactors Affecting International Investment: 1. GovernmentDILMILEJBNo ratings yet

- Section 8 Micro Finance Company OverviewDocument6 pagesSection 8 Micro Finance Company OverviewAmar NalawadeNo ratings yet

- Sources OF BUSINESS FINANCEDocument28 pagesSources OF BUSINESS FINANCENeeraj BabbarNo ratings yet

- Business Law and Regulations Rhin FrancineDocument207 pagesBusiness Law and Regulations Rhin FrancineShiela MarieNo ratings yet

- Ign-Investment-Negative-List/: The Pros and Cons of Setting Up A One Person Corporation in The PhilippinesDocument7 pagesIgn-Investment-Negative-List/: The Pros and Cons of Setting Up A One Person Corporation in The PhilippinesEdgar EnriquezNo ratings yet

- AIF FAQsDocument4 pagesAIF FAQsBharat PatelNo ratings yet

- MSME (Micro, Small and Medium Enterprises)Document6 pagesMSME (Micro, Small and Medium Enterprises)ISU MITTALNo ratings yet

- Project ReportDocument28 pagesProject Reportsilkroute143No ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Normative Analyses of Investment Incentive in EthiopiaDocument6 pagesNormative Analyses of Investment Incentive in EthiopiaBelay MekuanintNo ratings yet

- BSD Frequently Asked Questions No 2 of 2020 eDocument17 pagesBSD Frequently Asked Questions No 2 of 2020 eAda DeranaNo ratings yet

- COVID-19 Paycheck Protection Program 4.7.20 - FINALDocument25 pagesCOVID-19 Paycheck Protection Program 4.7.20 - FINALJonathan FoxNo ratings yet

- Foreign InvestmentDocument12 pagesForeign InvestmentMahmudur RahmanNo ratings yet

- Establishing A Business in IndiaDocument45 pagesEstablishing A Business in IndiaAryaman SharmaNo ratings yet

- Formalities For Setting Up Small BusinessDocument37 pagesFormalities For Setting Up Small BusinessNitya GuptaNo ratings yet

- Benefits To Startups by Indian GovernmentDocument4 pagesBenefits To Startups by Indian GovernmenthridayNo ratings yet

- Repatriation of ProfitDocument3 pagesRepatriation of ProfitUmang KatochNo ratings yet

- P7Document6 pagesP7pardeshikanchan07No ratings yet

- Frequently Asked Questions: COVID-19 Economic Injury Disaster Loan (EIDL)Document11 pagesFrequently Asked Questions: COVID-19 Economic Injury Disaster Loan (EIDL)Jake BourqueNo ratings yet

- Chapter-7 (Interest)Document37 pagesChapter-7 (Interest)BoRO TriAngLENo ratings yet

- Professional Liability Insurance Policy Summary For Miscellaneous ProfessionalsDocument3 pagesProfessional Liability Insurance Policy Summary For Miscellaneous ProfessionalsQBE European OperationsNo ratings yet

- Module 3 - Preferential Taxation P1Document5 pagesModule 3 - Preferential Taxation P1Bella RonahNo ratings yet

- AbitDocument13 pagesAbitmesfinabera180No ratings yet

- Ruling On LendingDocument3 pagesRuling On LendingRheneir MoraNo ratings yet

- Policy Guidelines HDFCDocument3 pagesPolicy Guidelines HDFCkwangdidNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- Constitution of BusinessDocument18 pagesConstitution of BusinessGangadhar MamadapurNo ratings yet

- Group Assignment Business Law: Prof. M. C. GuptaDocument13 pagesGroup Assignment Business Law: Prof. M. C. GuptaNishit GarwasisNo ratings yet

- Quality ManagerDocument1 pageQuality ManagerVinayak VagheNo ratings yet

- Sample Self-Declaration Form: Patient InformationDocument1 pageSample Self-Declaration Form: Patient InformationDillip Kumar MahapatraNo ratings yet

- Tender Terms and ConditionsDocument8 pagesTender Terms and ConditionsVinayak VagheNo ratings yet

- Domain II Process-50%: Task 1 Execute Project With The Urgency Required To Deliver Business ValueDocument3 pagesDomain II Process-50%: Task 1 Execute Project With The Urgency Required To Deliver Business ValueVinayak VagheNo ratings yet

- Domain I People-42%: Task 1 Manage ConflictDocument3 pagesDomain I People-42%: Task 1 Manage ConflictVinayak VagheNo ratings yet

- Guia Certificado Medico BahamasDocument22 pagesGuia Certificado Medico BahamasRicardo AquinoNo ratings yet

- Saih Rawl Depletion Compression ProjectDocument4 pagesSaih Rawl Depletion Compression ProjectVinayak VagheNo ratings yet

- Design of StaircaseDocument4 pagesDesign of StaircaseahmedNo ratings yet

- Civil Engineering and Marine Works (CEM) Offshore Branch OfficeDocument41 pagesCivil Engineering and Marine Works (CEM) Offshore Branch OfficeVinayak VagheNo ratings yet

- View All Created Trainers List04 - 12 - 2020Document331 pagesView All Created Trainers List04 - 12 - 2020Vinayak VagheNo ratings yet

- Road Estimates SheetDocument11 pagesRoad Estimates SheetAmal PremachandranNo ratings yet

- Combined Footing DesignDocument14 pagesCombined Footing Designjoshua humirangNo ratings yet

- Steel ConnectionsDocument83 pagesSteel ConnectionsMEPNo ratings yet

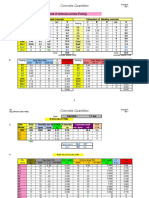

- CONCRETE QuantitiesDocument9 pagesCONCRETE QuantitiesdoxoNo ratings yet

- Column Desgin by RahulDocument4 pagesColumn Desgin by RahulpandianNo ratings yet

- Schedule of Values Construction TemplateDocument3 pagesSchedule of Values Construction TemplateVinayak VagheNo ratings yet

- Residential Construction Schedule: Click Here To Create in SmartsheetDocument14 pagesResidential Construction Schedule: Click Here To Create in SmartsheetVinayak VagheNo ratings yet

- Two Way Slab-ACI - Code - Good USED IN DESIGN - VerifiedDocument18 pagesTwo Way Slab-ACI - Code - Good USED IN DESIGN - VerifiedbiniamNo ratings yet

- Overview of The Checklist: U.S. Environmental Protection Agency SPCC Field Inspection and Plan Review ChecklistDocument29 pagesOverview of The Checklist: U.S. Environmental Protection Agency SPCC Field Inspection and Plan Review ChecklistVinayak VagheNo ratings yet

- Construction Work Schedule: MON Tues WED Thurs FRI SAT SUN Project Task CostDocument4 pagesConstruction Work Schedule: MON Tues WED Thurs FRI SAT SUN Project Task CostVinayak VagheNo ratings yet

- Schedule of Values Construction TemplateDocument3 pagesSchedule of Values Construction TemplateVinayak VagheNo ratings yet

- Residential Construction Schedule: Click Here To Create in SmartsheetDocument14 pagesResidential Construction Schedule: Click Here To Create in SmartsheetVinayak VagheNo ratings yet

- 2 Week Construction Schedule: Task Task Owner Location Su M T W R F Sa Su M T W R F Sa Start Date END DateDocument5 pages2 Week Construction Schedule: Task Task Owner Location Su M T W R F Sa Su M T W R F Sa Start Date END DateVinayak Vaghe100% (1)

- Construction Work Schedule: MON Tues WED Thurs FRI SAT SUN Project Task CostDocument4 pagesConstruction Work Schedule: MON Tues WED Thurs FRI SAT SUN Project Task CostVinayak VagheNo ratings yet

- Construction Daily Activity Schedule: SUN MON Tues WED Thurs FRI SATDocument5 pagesConstruction Daily Activity Schedule: SUN MON Tues WED Thurs FRI SATVinayak VagheNo ratings yet

- IC 3 Week Construction Schedule 10669Document5 pagesIC 3 Week Construction Schedule 10669Vinayak VagheNo ratings yet

- Engineering DictionaryDocument92 pagesEngineering DictionaryVinayak VagheNo ratings yet

- Engineering DictionaryDocument92 pagesEngineering DictionaryVinayak VagheNo ratings yet

- Precast ItemsDocument87 pagesPrecast ItemsVinayak VagheNo ratings yet