Professional Documents

Culture Documents

Chanakya National Law University: End Semester Examinations - December, 2020 7 Semester

Uploaded by

shreyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chanakya National Law University: End Semester Examinations - December, 2020 7 Semester

Uploaded by

shreyaCopyright:

Available Formats

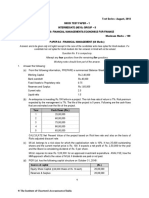

CHANAKYA NATIONAL LAW UNIVERSITY

NYAYA NAGAR, MITHAPUR, PATNA- 800001

End Semester Examinations - December, 2020

7th Semester

TAXATION LAWS-I

Total Time: 3 hrs. Maximum Marks: 60

Answer all Questions. Roll No. - _______

Figures in the brackets indicate full marks.

INSTRUCTION: SUPPORT YOUR ANSWERS WITH STATUTORY PROVISIONS AND

JUDICIAL PRECEDENTS.

Group A: Each answer should not exceed 300 words (5x6= 30 Marks)

Write critical notes on the following.

1. Exclusions from the term “Permanent Establishment” under Article 5(3) of the Double Taxation

Avoidance Agreement.

2. Set off of loss from one head against income from another head. (Inter head set off).

3. Deduction u/s 57 (iii) of the Income Tax Act, 1961.

4. Capital Gains Article of the OECD Model.

5. Meaning of the term “Substantial Interest” under Section 64 of the Income Tax Act, 1961.

Group B: Each answer should not exceed 400 words [2x10=20 Marks]

6. The assessee is a partner in the partnership firm, holding ten per cent share in the firm. He created a

trust by a deed of settlement assigning fifty per cent out of his ten per cent right, title and interest, as

a partner in the firm. In the relevant assessment year, he claimed that as fifty per cent of the income

attributable to his share from the firm, stood transferred to the trust resulting in diversion of income

at source, the same could not be included in his total income for the purpose of his assessment.

Decide.

7. Company A Co. is a sourcing entity, for an Indian multinational group, incorporated in a foreign

country, X. Company A is 100% subsidiary of Company B, which is an Indian Company. The assets

of Company A comprise of warehouses and stock in them and are located in country X and 40% of

its total income is passive in nature. Company A has a total of 50 employees. 47 employees,

managing the warehouse, storekeeping and accounts of the company, are located in country X. The

Managing Director (MD), Chief Executive Officer (CEO) and sales head are resident in India. The

total annual payroll expenditure on these 50 employees is of Rs. 5 crore. However the annual payroll

expenditure in respect of MD, CEO and Sales head, who are residents in India is of Rs. 3crore. Decide

whether Company A is engaged in active business outside India clearly explaining the meaning of

expressions “Passive Income”, “Assets of the Company”, “Payroll Expenditure” and “Number of

Employees”.

Group C: Answer should not exceed 600 words [10 Marks]

8. A subsidiary company and its parent company are totally distinct tax payers. The entities subject to

income-tax are taxed on profits derived by them on standalone basis, irrespective of their actual

degree of economic independence and regardless of whether profits are reserved or distributed to the

shareholders. Discuss.

You might also like

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Open Book: Financial Statement Analysis AKT304-MNJ62Document3 pagesOpen Book: Financial Statement Analysis AKT304-MNJ62Riska IinNo ratings yet

- Long Question of Financial AcDocument20 pagesLong Question of Financial AcQasim AliNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- Pid6012 MBMDocument4 pagesPid6012 MBMSukumar ManiNo ratings yet

- 71475exam57501 p6f 2Document37 pages71475exam57501 p6f 2Anagha ReddyNo ratings yet

- Law Mock TestDocument8 pagesLaw Mock TestHemant AherNo ratings yet

- Test Finance and AccountingDocument5 pagesTest Finance and AccountingKarachi Tuitions GroupNo ratings yet

- Financial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFDocument5 pagesFinancial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFani2sysNo ratings yet

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- IAS Mains Commerce 1979Document4 pagesIAS Mains Commerce 1979SONALI DHARNo ratings yet

- HRM 221 NOTES pdf-1-2Document104 pagesHRM 221 NOTES pdf-1-2Kevin NdabambiNo ratings yet

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocument2 pagesHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916No ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Midlands State University Faculty of CommerceDocument9 pagesMidlands State University Faculty of CommerceOscar MakonoNo ratings yet

- FR (Old) MTP Compiler Past 8Document122 pagesFR (Old) MTP Compiler Past 8Pooja GuptaNo ratings yet

- FM PP 1 PDFDocument3 pagesFM PP 1 PDFRavichandraNo ratings yet

- MCSDocument20 pagesMCSMilind KaleNo ratings yet

- Typology of QuestionsDocument15 pagesTypology of QuestionsMageswaran PitchaiahNo ratings yet

- Taxation Direct and IndirectDocument6 pagesTaxation Direct and Indirectdivyakashyapbharat1No ratings yet

- 05 s601 SFM - 3 PDFDocument4 pages05 s601 SFM - 3 PDFMuhammad Zahid FaridNo ratings yet

- Gujarat Technological University: InstructionsDocument3 pagesGujarat Technological University: InstructionssanketchauhanNo ratings yet

- Management Programme Term-End Examination December, 2009Document4 pagesManagement Programme Term-End Examination December, 2009Anonymous pKsr5vNo ratings yet

- Corporate Tax ProblemsDocument21 pagesCorporate Tax Problemsnavtej02No ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- Financial Management 14 JuneDocument3 pagesFinancial Management 14 JunerajNo ratings yet

- SA PCC-Group-I May 2010Document99 pagesSA PCC-Group-I May 2010NagarajuNeeliNo ratings yet

- Extra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Document4 pagesExtra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Dj BravoNo ratings yet

- Revised BDM - Sample Q&A SolveDocument13 pagesRevised BDM - Sample Q&A SolveSonam Dema DorjiNo ratings yet

- Tally Assignment AfrozDocument17 pagesTally Assignment AfrozAfrozNo ratings yet

- CBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeDocument39 pagesCBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeSuman PaswanNo ratings yet

- Business Law 1Document9 pagesBusiness Law 1Shashi Bhushan Sonbhadra0% (1)

- Accounting For Share CapitalDocument26 pagesAccounting For Share CapitalShivam VeerNo ratings yet

- Test 7 - IND AS 102, 19 - QuestionsDocument3 pagesTest 7 - IND AS 102, 19 - QuestionskrishbafanaNo ratings yet

- Law Chapter 9 QPDocument8 pagesLaw Chapter 9 QPlostworld2005777No ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- Itc Subsidiaries 2011 CompleteDocument199 pagesItc Subsidiaries 2011 Completevisheshkotha3009No ratings yet

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterDocument12 pagesINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterRenalyn ParasNo ratings yet

- IBF FINAL Exam SP 2020 ONLINE BDocument4 pagesIBF FINAL Exam SP 2020 ONLINE BSYED MANSOOR ALI SHAHNo ratings yet

- Ipo Analysis V1Document19 pagesIpo Analysis V1AayanRoy0% (1)

- CH 8 and CH 7Document3 pagesCH 8 and CH 7Saurabh GuptaNo ratings yet

- Shanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015Document7 pagesShanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015SharmaNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- Starting and Managing An Industry 1. The Ambition To Be An IndustrialistDocument24 pagesStarting and Managing An Industry 1. The Ambition To Be An IndustrialistAshok BalajiNo ratings yet

- 67 1 Accountancy 1Document16 pages67 1 Accountancy 1nikita kumariNo ratings yet

- BSBFIN601 Task 1 V0357Document5 pagesBSBFIN601 Task 1 V0357Catalina Devia CastiblancoNo ratings yet

- Screenshot 2023-02-14 at 7.42.01 PM PDFDocument11 pagesScreenshot 2023-02-14 at 7.42.01 PM PDFpalak sanghviNo ratings yet

- CA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsDocument4 pagesCA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsNakul GoyalNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Syazliana KasimNo ratings yet

- Data 0001Document50 pagesData 0001Deepak SindhuNo ratings yet

- Guideline Answers: Executive ProgrammeDocument94 pagesGuideline Answers: Executive Programmeblack horseNo ratings yet

- Guideline Answers: Executive ProgrammeDocument94 pagesGuideline Answers: Executive Programmeblack horseNo ratings yet

- Ch.3 Accounting of Employee Stock Option PlansDocument4 pagesCh.3 Accounting of Employee Stock Option PlansDeepthi R TejurNo ratings yet

- Methodsof Estimationof Working Capital RequirementDocument10 pagesMethodsof Estimationof Working Capital Requirementanindita sahooNo ratings yet

- Question 262122Document3 pagesQuestion 262122groverpankaj04No ratings yet

- Class - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Document9 pagesClass - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Rishav BhattNo ratings yet

- Class 12 - Quarterly Examination Q FINALDocument11 pagesClass 12 - Quarterly Examination Q FINALsubbuNo ratings yet

- Investment Banking - 02092021Document4 pagesInvestment Banking - 02092021rishabh jainNo ratings yet

- Economics Pa 1 Class IXDocument2 pagesEconomics Pa 1 Class IXidealNo ratings yet

- Fire InsuranceDocument9 pagesFire InsuranceshreyaNo ratings yet

- AD Hiring Legal ConsultantsDocument6 pagesAD Hiring Legal ConsultantsshreyaNo ratings yet

- Insurance - Concept, Function and ImportanceDocument8 pagesInsurance - Concept, Function and ImportanceshreyaNo ratings yet

- Principle of Utmost Good FaithDocument7 pagesPrinciple of Utmost Good FaithshreyaNo ratings yet

- Principle of Insurable InterestDocument5 pagesPrinciple of Insurable InterestshreyaNo ratings yet

- Drafting, Pleading and ConveyancingDocument1 pageDrafting, Pleading and ConveyancingshreyaNo ratings yet

- Rapid Antibody Test of India: Person DetailsDocument1 pageRapid Antibody Test of India: Person DetailsshreyaNo ratings yet

- Non Performing Assets: Chanakya National Law UniversityDocument4 pagesNon Performing Assets: Chanakya National Law UniversityshreyaNo ratings yet

- The Timely Delivery of Radical Radiotherapy: Guidelines For The Management of Unscheduled Treatment InterruptionsDocument39 pagesThe Timely Delivery of Radical Radiotherapy: Guidelines For The Management of Unscheduled Treatment InterruptionsshreyaNo ratings yet

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument90 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceshreyaNo ratings yet

- Insurance Law FDDocument13 pagesInsurance Law FDshreyaNo ratings yet

- 2015 Don C. Benjamin - Social World of Deuteronomy A New Feminist CommentaryDocument108 pages2015 Don C. Benjamin - Social World of Deuteronomy A New Feminist CommentaryPedro RamirezNo ratings yet

- Team Building Breakout ScriptDocument12 pagesTeam Building Breakout ScriptMelanie PajaronNo ratings yet

- Interview Feedback FormDocument4 pagesInterview Feedback FormRohit HNo ratings yet

- Application of Aging Theories To NursingDocument3 pagesApplication of Aging Theories To NursingArvin LabradaNo ratings yet

- Clase 1-Fisiopatología de La Artritis ReumatoideaDocument45 pagesClase 1-Fisiopatología de La Artritis ReumatoideaPercy Williams Mendoza EscobarNo ratings yet

- Bachelor Series 7 His TemptressDocument275 pagesBachelor Series 7 His Temptresscam UyangurenNo ratings yet

- Car 1Document8 pagesCar 1SAKET RATHI IPS Academy IndoreNo ratings yet

- Reception in EnglandDocument16 pagesReception in EnglandMason OBrienNo ratings yet

- Negotiation and Diplomacy Term PaperDocument37 pagesNegotiation and Diplomacy Term PaperManifa OsmanNo ratings yet

- mwr218 13Document8 pagesmwr218 13Andrei SmeuNo ratings yet

- Clinical Outcome of Tolosa-Hunt Syndrome After Intravenous Steroid Therapy (Case Report)Document1 pageClinical Outcome of Tolosa-Hunt Syndrome After Intravenous Steroid Therapy (Case Report)JumrainiTammasseNo ratings yet

- Field Strength MeterDocument9 pagesField Strength MeterVinod JagdaleNo ratings yet

- Stages of LaborDocument3 pagesStages of Laborkatzuhmee leeNo ratings yet

- AIP Chapter FiveDocument113 pagesAIP Chapter Fivetekalegn barekuNo ratings yet

- Sciencedoze: Science, Education and Technology: Biodegradable Polymers: de Nition, Examples, Properties and ApplicationsDocument5 pagesSciencedoze: Science, Education and Technology: Biodegradable Polymers: de Nition, Examples, Properties and Applicationssantosh chikkamathNo ratings yet

- Chickens Come Home To Roost (Genesis 32: 1 - 36: 43)Document13 pagesChickens Come Home To Roost (Genesis 32: 1 - 36: 43)logosbiblestudy100% (1)

- Microbiology Best Laboratory PracticesDocument47 pagesMicrobiology Best Laboratory PracticesQAV_CRS100% (1)

- Is The Legend of Oedipus A FolktaleDocument12 pagesIs The Legend of Oedipus A FolktaleLuciano CabralNo ratings yet

- Human Medicinal Agents From PlantsDocument358 pagesHuman Medicinal Agents From Plantsamino12451100% (1)

- Ielts Cracker: LeapscholarDocument10 pagesIelts Cracker: LeapscholarmobileNo ratings yet

- Is Understanding Factive - Catherine Z. Elgin PDFDocument16 pagesIs Understanding Factive - Catherine Z. Elgin PDFonlineyykNo ratings yet

- Sap Sas DocumentDocument4 pagesSap Sas DocumentbrcraoNo ratings yet

- A Naturalistic Interpretation of The Yoruba Concept of Ori PDFDocument13 pagesA Naturalistic Interpretation of The Yoruba Concept of Ori PDFCaetano RochaNo ratings yet

- An Action Research On The Effectiveness of Differentiated Instruction in Teaching English For Grade 4 ClassesDocument10 pagesAn Action Research On The Effectiveness of Differentiated Instruction in Teaching English For Grade 4 ClassesKi KoNo ratings yet

- Backgrounder 4 (Ahmad & Tank 2021) - Sharia Law and Women's RightsDocument6 pagesBackgrounder 4 (Ahmad & Tank 2021) - Sharia Law and Women's RightsaminNo ratings yet

- RPH Midterm ExamDocument6 pagesRPH Midterm ExamNicole LaderasNo ratings yet

- BG3 Artbook High ResDocument97 pagesBG3 Artbook High ResCallum D100% (11)

- ABB REC670 1MRK511232-BEN D en Product Guide REC670 1.2 Pre-ConfiguredDocument93 pagesABB REC670 1MRK511232-BEN D en Product Guide REC670 1.2 Pre-Configuredjoakim_ÖgrenNo ratings yet

- Sets&StatisticsDocument6 pagesSets&StatisticsFarah AghaverdiyevaNo ratings yet

- Days of Prayer and FastingDocument40 pagesDays of Prayer and FastingVictor saintNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfFrom EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet