0% found this document useful (0 votes)

421 views1 pageTypes of Risk 1

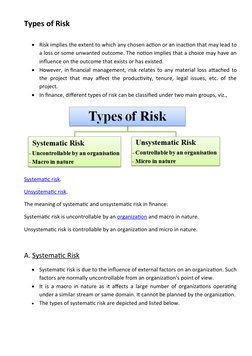

The document discusses different types of risk. It defines risk as the potential for loss or unwanted outcomes from actions or inactions. In finance, risk refers to losses that could impact a project's productivity, tenure, or legal issues. Risks are classified as either systematic or unsystematic. Systematic risk stems from uncontrollable macro-level external factors that affect many organizations, while unsystematic risk is micro-level and controllable by an individual organization.

Uploaded by

gaurav112011Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

421 views1 pageTypes of Risk 1

The document discusses different types of risk. It defines risk as the potential for loss or unwanted outcomes from actions or inactions. In finance, risk refers to losses that could impact a project's productivity, tenure, or legal issues. Risks are classified as either systematic or unsystematic. Systematic risk stems from uncontrollable macro-level external factors that affect many organizations, while unsystematic risk is micro-level and controllable by an individual organization.

Uploaded by

gaurav112011Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Types of Risk