Professional Documents

Culture Documents

Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVAS

Uploaded by

Kylene Edelle LeonardoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVAS

Uploaded by

Kylene Edelle LeonardoCopyright:

Available Formats

Assignment 5

Adjusting the accounts

Instruction: Prepare the answers in written form using a clean paper (e.g. Yellow pad, bond paper,

notebook etc.) and submit a snapshot in CANVAS.

M. Legend company’s annual accounting period ends on December 31, 2019. The following information

concerns the adjusting entries as of that date.

a. The office supplies account started the year with P5,000. During 2019, the company purchased

supplies for P15,000 which was added to the office supplies account. The inventory of supplies available

on December 31, 2019 totaled P3,000.

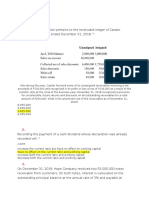

b. An analysis of the company’s insurance policies provided the following facts. The total premium for

each policy was paid in full (for all months) at the purchase date, and the Insurance expense account

was debited for the full cost.

POLICY DATE OF PURCHASE MOS. OF COVERAGE COST

A April 1, 2019 24 P50,000

B May 1, 2019 36 P100,000

C August 31, 2019 12 P20,000

c. On October 1, 2019 the company rented space to a tenant for P3,000 per month. The tenant paid five

months in advance on that date. The collection was recorded by the company to unearned rent revenue

account.

d. Since the company is not large enough to occupy the entire building it owns, it rented space to

another tenant starting November 1, 2019. The tenant paid in advance amounting to P60,000 for one

year rental. The collection was initially recorded by the company as income from rentals.

e. The company has a P10,000 bank loan on October 1, 2019 with 8% interest per annum. The company

will pay the interest and principal in cash after 6 months.

f. Wages expenses of P5,000 have been incurred but not paid as of December 31.

g. The company has earned P300 interest revenue from investments for the year ended December 31.

The interest revenue will be received on January 15 following the company’s year-end.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Illustrative Problem. Encina, Endrada, and Elina From BookDocument4 pagesIllustrative Problem. Encina, Endrada, and Elina From BookKylene Edelle Leonardo0% (1)

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- Chapter 2 (Logic)Document3 pagesChapter 2 (Logic)Kylene Edelle Leonardo0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- Far Quiz 2Document13 pagesFar Quiz 2Shiela Jane CrismundoNo ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- Competence and Impartiality in Telling The TruthDocument4 pagesCompetence and Impartiality in Telling The TruthKylene Edelle Leonardo100% (6)

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Auditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Document16 pagesAuditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Moira C. Vilog100% (1)

- Stock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!From EverandStock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!No ratings yet

- Accounting ProblemsDocument7 pagesAccounting ProblemsMarisolNo ratings yet

- Correction of ErrorsDocument15 pagesCorrection of ErrorsEliyah Jhonson100% (1)

- Contingent Liab Bonds PayableDocument11 pagesContingent Liab Bonds PayableKristine Lirose Bordeos100% (1)

- EXAM About INTANGIBLE ASSETS 4Document3 pagesEXAM About INTANGIBLE ASSETS 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- INTACC2 Liabilities Questions ARALJPIADocument3 pagesINTACC2 Liabilities Questions ARALJPIAKiba YuutoNo ratings yet

- AE-O-A - Quiz QuestionnaireDocument1 pageAE-O-A - Quiz QuestionnaireUSD 654No ratings yet

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDocument2 pagesRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNo ratings yet

- AJE Practice Problems - 2127759290Document2 pagesAJE Practice Problems - 2127759290Nichole Joy XielSera TanNo ratings yet

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- Borrowing CostsDocument1 pageBorrowing CostsJulliena BakersNo ratings yet

- Accounting ProcessDocument6 pagesAccounting ProcessJen NerNo ratings yet

- SynthesisDocument19 pagesSynthesisMej AgaoNo ratings yet

- Assignment 2Document1 pageAssignment 2mallarijhoana21No ratings yet

- ACCTG1 Activity 040224Document1 pageACCTG1 Activity 040224jerickolian.delrosarioNo ratings yet

- Test I Journalizing of Adjusting Entries (22 Points)Document4 pagesTest I Journalizing of Adjusting Entries (22 Points)Jonathan Dela CruzNo ratings yet

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsDocument7 pagesChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- CHAPTER 12: Events After Reporting Period: Problem 1Document3 pagesCHAPTER 12: Events After Reporting Period: Problem 1Mark IlanoNo ratings yet

- Basic Accounting Review Self Assessment TestDocument4 pagesBasic Accounting Review Self Assessment TestAether SkywardNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- Adjusting EntriesDocument8 pagesAdjusting EntriesYusra PangandamanNo ratings yet

- Accounting For Investments in Debt InstrumentsDocument4 pagesAccounting For Investments in Debt InstrumentsKeahlyn Boticario CapinaNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- 103 CompilationDocument12 pages103 CompilationLyn AbudaNo ratings yet

- Coactg1 Common Exam ReviewerDocument7 pagesCoactg1 Common Exam ReviewerIvy Rose BorasNo ratings yet

- Solutiondone 420Document1 pageSolutiondone 420trilocksp SinghNo ratings yet

- Quizzer 1Document4 pagesQuizzer 1Arvin John MasuelaNo ratings yet

- Diagnostic AssessmentDocument7 pagesDiagnostic AssessmentChristine JoyceNo ratings yet

- Bookkeeping Case ProblemDocument2 pagesBookkeeping Case ProblemNovelyn GamboaNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Far 103 - Accounting For Receivables and Notes ReceivableDocument4 pagesFar 103 - Accounting For Receivables and Notes ReceivablePatrishaNo ratings yet

- 10 31 Fabm QS 2Document10 pages10 31 Fabm QS 2Fat AjummaNo ratings yet

- Correction of Errors (Aug 31)Document2 pagesCorrection of Errors (Aug 31)Claire BarbaNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- FA - Adjusting EntriesDocument14 pagesFA - Adjusting EntriesaleezaNo ratings yet

- Financial LiabilitiesDocument4 pagesFinancial LiabilitiesNicah AcojonNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Assignment No. 2 Audit of ReceivablesDocument5 pagesAssignment No. 2 Audit of ReceivablesMa Tiffany Gura RobleNo ratings yet

- Seeds of The Nations Accounting Quiz ON Basic AccountingDocument25 pagesSeeds of The Nations Accounting Quiz ON Basic AccountingHershey GalvezNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Leonardo, Kylene Edelle L. - ASSESSMENTSDocument27 pagesLeonardo, Kylene Edelle L. - ASSESSMENTSKylene Edelle LeonardoNo ratings yet

- Leonardo, Kylene Edelle L. - Assignment Exercises 3-1 To 3-9Document11 pagesLeonardo, Kylene Edelle L. - Assignment Exercises 3-1 To 3-9Kylene Edelle LeonardoNo ratings yet

- Soln: 80,000 X 1/4Document4 pagesSoln: 80,000 X 1/4Kylene Edelle LeonardoNo ratings yet

- Christianity Protestantism: History and ConceptsDocument15 pagesChristianity Protestantism: History and ConceptsKylene Edelle Leonardo100% (1)

- Activity No. 1: Assessment 1. How Is Art and Philosophy Connected?Document2 pagesActivity No. 1: Assessment 1. How Is Art and Philosophy Connected?Kylene Edelle LeonardoNo ratings yet

- PrometheusBoundEssay - LEONARDO - KYLENE EDELLEDocument9 pagesPrometheusBoundEssay - LEONARDO - KYLENE EDELLEKylene Edelle LeonardoNo ratings yet

- Review of The Accounting CycleDocument35 pagesReview of The Accounting CycleKylene Edelle LeonardoNo ratings yet

- All About MyselfDocument1 pageAll About MyselfKylene Edelle LeonardoNo ratings yet

- Activity 6 (Chapter 3-Reflective Essay) Dated January 29, 2021Document2 pagesActivity 6 (Chapter 3-Reflective Essay) Dated January 29, 2021Kylene Edelle LeonardoNo ratings yet

- Activity 7 (Chap3-Knowledge Check) Dated January 29, 2021Document1 pageActivity 7 (Chap3-Knowledge Check) Dated January 29, 2021Kylene Edelle LeonardoNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet