Professional Documents

Culture Documents

Chapter 2 Fin PDF

Uploaded by

saraf masu0 ratings0% found this document useful (0 votes)

12 views6 pagesThe document summarizes some fundamental prohibitions in Islamic finance:

1) Interest (Al-Riba) is prohibited as it refers to predetermined return on money and includes two types - Riba al Nasiah involves interest on loans while Riba al Fadl involves unequal exchange.

2) Uncertainty (Al-Gharar) is prohibited if it involves major risks, like trading an object not in possession. It is permitted if it involves minor risks like variability in demand, prices, or costs.

3) Gambling (Al-Maisir) aims to obtain undeserved money and is prohibited as it causes harm to individuals and society.

Original Description:

Original Title

Chapter 2 fin.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes some fundamental prohibitions in Islamic finance:

1) Interest (Al-Riba) is prohibited as it refers to predetermined return on money and includes two types - Riba al Nasiah involves interest on loans while Riba al Fadl involves unequal exchange.

2) Uncertainty (Al-Gharar) is prohibited if it involves major risks, like trading an object not in possession. It is permitted if it involves minor risks like variability in demand, prices, or costs.

3) Gambling (Al-Maisir) aims to obtain undeserved money and is prohibited as it causes harm to individuals and society.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views6 pagesChapter 2 Fin PDF

Uploaded by

saraf masuThe document summarizes some fundamental prohibitions in Islamic finance:

1) Interest (Al-Riba) is prohibited as it refers to predetermined return on money and includes two types - Riba al Nasiah involves interest on loans while Riba al Fadl involves unequal exchange.

2) Uncertainty (Al-Gharar) is prohibited if it involves major risks, like trading an object not in possession. It is permitted if it involves minor risks like variability in demand, prices, or costs.

3) Gambling (Al-Maisir) aims to obtain undeserved money and is prohibited as it causes harm to individuals and society.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Chapter – 02: Fundamental Prohibitions in Islamic Finance

Basic Prohibited Elements:

• Interest (Al-Riba) :

• Gambling(Al-Maisir) :

• Uncertainty (Al-Gharar)

1)Interest (Al-Riba) :

• The word used by the Quran concerning ‘interest’ is Riba. The literal meaning of Riba

are money increase, increase of anything or increment of anything from its original

amount.

• In the Shariah, Riba technically refers to the premium that must be paid by the

borrower to the lender along with the principal amount as a condition for the loan or

for an extension in its maturity. In other words, Riba is the predetermined return on

the use of money.

Al-Riba /Interest Basic Characteristics are:

• It must be related to loan;

• A prefixed amount of money to be paid when due;

• A time is fixed for the repayment; and

All these elements for repayment are taken as conditions for loan;

There are two types of Riba.

1. Riba al Nasiah 2. Riba al Fadl

1. Riba al Nasiah: The term nasi'ah means to postpone, defer, or wait and refers to the

time that is allowed for the borrower to repay the loan in return for the addition or the

premium. Hence Riba al-Nasi'ah refers to the interest on the loan. Here the increase or

growth is due to postponement. It can be specified in the beginning of transaction or on

maturity of debt. If the debtor is not able to pay back the debt on maturity and the creditor

gives him some more time in return for an additional amount it is termed Riba al Nasiah.

Characteristics of Riba al Nasiah

There are three types of Riba al Nasiah :

i. Deferred payment: Article is sold on deferred payment basis. Time of payment is fixed.

Inability to pay on the stipulated time attracts extra amount and the payment date is

extended.

ii. Pre determined: A sum is lent and it is determined at the beginning that the borrower

would return an extra amount in addition to the amount loaned within a stipulated time.

iii. Fixed as well as variable rate of interest: A sum is lent at a fixed rate of interest for a

stipulated time period. If the borrower fails to pay within the time, the rate of interest

would increase.

2. Riba al Fadl : The increase is independent of postponement or maturity of debt. It

happens when two same things are exchanged unequally. For example a kilo of wheat

being exchanged for 1.5 kilos of wheat. This transaction was termed as Riba by the Holy

Prophet (PBUH). Therefore, it was called as 'Riba al-fadl’ or Riba-al-sunnah’.

Characteristics of Riba al Fadl

• The increase is independent of postponement or maturity of debt;

• Two same things are exchanged unequally;

• It was called as 'Riba al-fadl’ or Riba-al-sunnah’;

Prohibition of Riba in Qur’an:

The prohibition of Riba appears in the Quran in four different revelations.

The first of these in Makkah, emphasized that while interest deprived wealth of Allah’s

blessings, charity raised it manifold (30:39).

The second revelation in Madina threatening of severe punishment to those who took Riba

in juxtaposition with those who wrongfully appropriated other people’s property (4:160-

161).

The third revelation, around the second and third year after Hijra, enjoined Muslims to

keep away from Riba if they desired their own welfare (3:130).

The fourth revelation near the completion of the Prophet’s mission, severely censured

those who take Riba, established a clear distinction between trade and Riba, and required

Muslims to all outstanding Riba, instructing them to take only the principal amount, and

forgo even this in case of the borrowers’ hardship (2:275-280).

Prohibition of Riba in Hadith

Jabir b. Abdullah reports that the Prophet (PBUH) cursed the receiver of interest and the

payer thereof, the one who records it and the two witnesses thereof. He said:"They are all

alike in guilt."

It is reported from Abu Sa‘eed al-Khudari, he said: the Messenger of Allah said: “Exchange

gold with gold, silver with silver, wheat with wheat, barley with barley, dates with dates,

salt with salt in equal quantities and spot. Anyone who increases the quantity or asks for

increase indulges in riba. The receiver and payer are equal in this.”

Impact of interest:

A. Economic Impact

B. Social and moral impact

C. Political Impact

D. International Impact

A. Economic Impact

1. Impact on capital formation and investment

2. Impact on production

3. Impact on Distribution

4. Impact on Economic Stability

1. Impact on capital formation and investment

i. Interest not only retards capital formation but also reduces the rate of capital

growth. It is the rate of interest, which sets limits to the rate of growth of real capital.

ii. Interest encourages keeping capital idle. On the other, the capitalists will be bound to

invest their funds for earning profit in absence of interest.

iii. Interest reduces the rate of investment especially in risky capital intensive projects.

iv. Interest leads investment to unproductive speculative sector.

v. Interest retards the efficient sanction of bank funds. Banks and financial institutions

emphasize on credit worthiness of the loanees while granting loan. They do not

consider the productivity of the loanees projects and this is because of fixed and

predetermined interest income they desire to drive.

vi. Interest reduces the rate of investment in social welfare projects.

vii. Interest encourages creating idleness amongst the depositors; since it is obtained

without any risk and labor on the part of the depositors.

viii. Interest tends to lead the capitalists towards exploitative behavior and attitude.

2. Impact on production

i. Interest tends to reduce the rate of production since it retards capital formation.

ii. Interest tends to increase the price of commodities and services.

iii. Interest tends to reduce the purchasing power of the people.

iv. Interest tends to reduce the demand of the commodities because of low purchasing

power of the people.

v. Interest compels to destroy the manufactured commodities because of prevalence of

depression in the economy.

3. Impact on Distribution

i. Interest tends to increase the rate of unemployment in a country.

ii. Interest helps reducing the rate of wages.

iii. Interest helps creating economic disparity in the society.

iv. Interest tends to impose tax burden on the general mass of a country.

4. Impact on Economic Stability

i. Interest helps creating inflation in an economy.

ii. Interest helps creating depressions in the economy.

iii. Interest tends to create instability in the economy.

iv. Interest gives rise to speculative business in the stock market.

v. Interest encourages speculative business in commodity market.

vi. The rate of interest tends to make the monetary policy of a country ineffective .

vii. Interest tends to make the exchange rate unstable.

viii. Interest retards the economic growth of a country.

B. Social and moral impact

i. Interest creates greediness and misery amongst the individuals. It includes

the habit of miseries, selfishness, cruelty, love of money, greediness for

accumulation of wealth etc. amongst the individuals.

ii. Interest creates hatred and jealousy in the society.

iii. Interest helps destroying the morality of the people.

iv. Interest helps making the borrowers heavily indebted.

v. Interest tends to reduce the working capacity of the indebted poor.

C. Political Impact

i. Interest helps creating political unrest in the country.

ii. Interest creates obstruction for the Government in performing social

welfare activities.

iii. Interest compels the Government to take resort to loans at the time of

emergency like wars, floods, cyclones etc, because interest-free loans are

not available at the time of emergency of a country.

D. International Impact

i. Interest creates problems in payment of foreign loans.

ii. Interest helps increasing foreign dependence.

iii. Interest serves the interest of the donor countries and not that of

borrowing countries.

iv. Interest tends to create economic disparity between the donor and

borrowing countries

v. Interest helps worsening peace in the world.

2. Uncertainty (Al-Gharar):

The Arabic word Gharar is a fairly broad concept that literally means deceit, risk, fraud,

uncertainty or hazard that might lead to destruction or loss. Gharar in Islam refers to any

transaction of probable objects whose existence or description are not certain, due to lack

of information and knowledge of the ultimate outcome of the contract or the nature and

quality of the subject matter of it.

Types of Uncertainty /Al-Gharar

There are two types of Gharar:

1.Minor Gharar: In Islam dealing with minor Gharar is permissible. e.g demand

variability, sales price variability, input cost variability, all are different types of

minor Gharar or uncertainty.

2.Major/Substantial Gharar: In Islam dealing with major Gharar is prohibited.

e.g trading of an object which is not in possession can not be traded.

Difference among Interest,Profit and Rent

3. Gambling (Al-Maisir)

Gambling is a way of obtaining undeserved money which makes man forget his Creator,

prevents him from performing prayers, leads him to laziness, eliminates his strength to

work and causes grudge and enmity among people. All kinds of gambling, which causes

irreparable wounds in individual and social life, are haram in the religion of Islam.

Prohibition of Gambling in Qur’an

• They/People ask thee/you concerning wine and gambling. Say: "In them is great sin,

and some profit, for men; but the sin is greater than the profit." They ask thee how

much they are to spend; Say: "What is beyond your needs." Thus doth Allah Make

clear to you His Signs: In order that ye may consider”-( 2:219).

• you who believe! Intoxicants (all kinds of alcoholic drinks), and gambling, and Al-

Ansab , and Al-Azlam (arrows for seeking luck or decision) are an abomination of

Shaitan’s (Satan) handiwork. So avoid (strictly all) that (abomination) in order that

you may be successful. Shaitan (Satan) wants only to excite enmity and hatred

between you with intoxicants (alcoholic drinks) and gambling, and hinder you from

the remembrance of Allah and from As-Salat (the prayer). So, will you not then

abstain?- (5:90-91)

Criticism of Conventional Financial System from Islamic View point

• It is based on interest

• It aims at maximization of profit disregarding individual or social welfare

• It leads to social injustice and inequitable distribution of income

• It is unethical, exploitative, unfair and non-transparent

• It leads to wastage of resources and wealth

• It leads to violate and conflict

• It leads to socio-political instability, corruption and mismanagement

• It promotes selfishness

• It ignores religious values

You might also like

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- Topic 1 Development of CreditDocument3 pagesTopic 1 Development of CreditPhilip Jayson CarengNo ratings yet

- Economics 3Document56 pagesEconomics 3ananth9367No ratings yet

- Shadman Haider, Islamiyat, BS 2B PDFDocument4 pagesShadman Haider, Islamiyat, BS 2B PDFShaista KhattakNo ratings yet

- Assignment Pair WorkDocument5 pagesAssignment Pair Workhusniyah nadiahNo ratings yet

- Islamic Finance in Nigeria Issues and ChallengesDocument16 pagesIslamic Finance in Nigeria Issues and ChallengesBashir Aliyu UmarNo ratings yet

- TUTORIAL 10 Sugegsted AnswerDocument5 pagesTUTORIAL 10 Sugegsted AnswerJason T. NathanNo ratings yet

- Islamic Banking MidDocument24 pagesIslamic Banking MidRomeshaNo ratings yet

- Definition of 'Credit': Joana Rey P. Palabyab Credit and Collection BSBM - Fm3A Ms. Luisita MarzanDocument3 pagesDefinition of 'Credit': Joana Rey P. Palabyab Credit and Collection BSBM - Fm3A Ms. Luisita MarzanJoana Rey PalabyabNo ratings yet

- Questions On RibaDocument4 pagesQuestions On RibaSyed NazhefNo ratings yet

- Macro EconomicsDocument46 pagesMacro EconomicsHarshita SarinNo ratings yet

- Lesson 1Document3 pagesLesson 1nawel mezighecheNo ratings yet

- Evolution To International BankingDocument28 pagesEvolution To International BankingSupriya Pawar100% (7)

- Development of CreditDocument3 pagesDevelopment of CreditMonica GunnacaoNo ratings yet

- Questions On RibaDocument4 pagesQuestions On RibaSyed NazhefNo ratings yet

- Islamic Financial SystemDocument13 pagesIslamic Financial SystemMushood AmjadNo ratings yet

- The Prohibition of Riba (Usury) : Dr. Mohammed Alwosabi BANK 411Document15 pagesThe Prohibition of Riba (Usury) : Dr. Mohammed Alwosabi BANK 411rajinraj2No ratings yet

- IB - A New Era of FinancingDocument22 pagesIB - A New Era of FinancingMoNa AlamgirNo ratings yet

- Financial Accountant Journal - Sept. 13 ExtractDocument4 pagesFinancial Accountant Journal - Sept. 13 ExtractSaleem Uddin FaisalNo ratings yet

- Islamic & Conventional Banking: Islamic Banking Is An Ethical Banking System, and Its Practices Are Based OnDocument17 pagesIslamic & Conventional Banking: Islamic Banking Is An Ethical Banking System, and Its Practices Are Based OnSoban MamoonNo ratings yet

- F 408 AssignmentDocument22 pagesF 408 AssignmentTamzid Ahmed LikhonNo ratings yet

- Concept of Outreach in Microfinance Institutions:: Indicator of Success of MfisDocument6 pagesConcept of Outreach in Microfinance Institutions:: Indicator of Success of MfisRiyadNo ratings yet

- Mubashir Ameenudeen IFDocument6 pagesMubashir Ameenudeen IFLebbe PuthaNo ratings yet

- RibaDocument50 pagesRibafarhan israrNo ratings yet

- Group 1A - Reasons of Riba ProhibitionDocument11 pagesGroup 1A - Reasons of Riba ProhibitionNur Allieya Aini Binti AzaharNo ratings yet

- Islamic Finance PPTs 1Document16 pagesIslamic Finance PPTs 1Ehsan Ehsan100% (1)

- EconomicsDocument5 pagesEconomicspb_vgslNo ratings yet

- IF Internals 1Document11 pagesIF Internals 1Amith AlphaNo ratings yet

- Riba. Hassan Durrani, BBA, Group-B, 5thDocument7 pagesRiba. Hassan Durrani, BBA, Group-B, 5thLebbe PuthaNo ratings yet

- Hassan Basarally1120020 FQH 606Document4 pagesHassan Basarally1120020 FQH 606Hassan BasarallyNo ratings yet

- Submission Number: 1 Group Number: 34 Group Members: Non-Contributing Member (X)Document5 pagesSubmission Number: 1 Group Number: 34 Group Members: Non-Contributing Member (X)Darshna JhaNo ratings yet

- Finance Assignment 2: Financial Crisis of 2008: Housing Market in USADocument2 pagesFinance Assignment 2: Financial Crisis of 2008: Housing Market in USADipankar BasumataryNo ratings yet

- Financial Stability: How To Save EffectivelyDocument3 pagesFinancial Stability: How To Save EffectivelyKahayag 00No ratings yet

- Park SM ch23 PDFDocument14 pagesPark SM ch23 PDFIlyas SadvokassovNo ratings yet

- Concept PaperDocument5 pagesConcept PaperRyan Bianet CosicolNo ratings yet

- Topic I Introduction To CreditDocument4 pagesTopic I Introduction To CreditLemon OwNo ratings yet

- Riba Definition Characteristics Social ImpactDocument5 pagesRiba Definition Characteristics Social ImpactMD. ANWAR UL HAQUE100% (3)

- Lesson 6 Chapter 9 - Solutions To Homework ProblemsDocument6 pagesLesson 6 Chapter 9 - Solutions To Homework Problemsstephanie.rcNo ratings yet

- Group 8 RibaDocument30 pagesGroup 8 RibaArif Suhaimi AripozzNo ratings yet

- Golobal Financial Crisis: Reasons and Islamic SolutionsDocument44 pagesGolobal Financial Crisis: Reasons and Islamic SolutionsabulaasNo ratings yet

- Islamic Economic SystemDocument5 pagesIslamic Economic SystemAli HassanNo ratings yet

- The Cost of Money: Production Opportunities Time Preferences For Consumption Risk InflationDocument5 pagesThe Cost of Money: Production Opportunities Time Preferences For Consumption Risk InflationAina AguirreNo ratings yet

- Financial InstitutionsDocument17 pagesFinancial InstitutionsNikolaiNo ratings yet

- Money and CreditDocument7 pagesMoney and Creditraimaali220077No ratings yet

- Introduction Islamic FinanceDocument28 pagesIntroduction Islamic FinanceMaryam KhaliqNo ratings yet

- Macro II Chap 4-7 EdittedDocument50 pagesMacro II Chap 4-7 Editteddagne momNo ratings yet

- What Is A 'Financial Crisis?'Document3 pagesWhat Is A 'Financial Crisis?'Abdul Ahad SheikhNo ratings yet

- Theory of Riba (Differences Between Conventional Personal Financing and Islamic Personal Financing)Document20 pagesTheory of Riba (Differences Between Conventional Personal Financing and Islamic Personal Financing)millimilNo ratings yet

- Financial Markets & Institutions 1. Definition of Financial SystemDocument4 pagesFinancial Markets & Institutions 1. Definition of Financial SystempragyaNo ratings yet

- ECO3933 Study GuideDocument7 pagesECO3933 Study GuidekmeloNo ratings yet

- Negative Elements in TransactionsDocument8 pagesNegative Elements in TransactionsManfadawi Fadawi0% (1)

- Islamic Modes of Financing A4Document6 pagesIslamic Modes of Financing A4Moeez ShahNo ratings yet

- Agri Chap 6Document11 pagesAgri Chap 6ኤደን DagneNo ratings yet

- Derivatives Regulation Lecture Daniele 2024Document58 pagesDerivatives Regulation Lecture Daniele 2024ashabaman98No ratings yet

- Undamentals OF Inance: Office of The Expanded Tertiary Education Equivalency and Accreditation ProgramDocument73 pagesUndamentals OF Inance: Office of The Expanded Tertiary Education Equivalency and Accreditation ProgrambriogeliqueNo ratings yet

- Lim Yew Joon B19080668 FMI Tutorial 5Document4 pagesLim Yew Joon B19080668 FMI Tutorial 5Jing HangNo ratings yet

- Alasdair Macleod Sound Money 555Document5 pagesAlasdair Macleod Sound Money 555Kevin CreaseyNo ratings yet

- Islamic Financial SystemDocument15 pagesIslamic Financial SystemFarfoosh Farfoosh FarfooshNo ratings yet

- ECONOMICS ASSIGNMENT B & FDocument5 pagesECONOMICS ASSIGNMENT B & FAbdulrauf AmeenNo ratings yet

- Principles of Islamic FinanceDocument5 pagesPrinciples of Islamic Financemr basitNo ratings yet

- Standard Operating Procedure SOP For AccDocument7 pagesStandard Operating Procedure SOP For AccOsman ZaheerNo ratings yet

- Analysis of Financial StatementDocument7 pagesAnalysis of Financial StatementMohsin QayyumNo ratings yet

- Refresher Exam Paper 2 - QP - UnlockedDocument9 pagesRefresher Exam Paper 2 - QP - UnlockedAnoop SreedharNo ratings yet

- Sample of Counter AffidavitDocument4 pagesSample of Counter Affidavitmanny monesNo ratings yet

- Fact Sheet Fha 203bDocument10 pagesFact Sheet Fha 203bmptacly9152No ratings yet

- Loan Application Form: CIN: L65922DL1988PLC033856Document10 pagesLoan Application Form: CIN: L65922DL1988PLC033856Lucky SinghNo ratings yet

- Uptown School Dubai, UAE - School FeesDocument3 pagesUptown School Dubai, UAE - School FeesfarraheshamNo ratings yet

- Accounting Standards AS1 AS2 and Their InetrconnectionsDocument5 pagesAccounting Standards AS1 AS2 and Their InetrconnectionsSaif KasmaniNo ratings yet

- Listing Agreement - BseDocument7 pagesListing Agreement - BseBhavyesh JainNo ratings yet

- Banking ReviewerDocument41 pagesBanking ReviewerCindy-chan DelfinNo ratings yet

- UTP Bulletins 300 3Document52 pagesUTP Bulletins 300 3Lucho Dom100% (1)

- Cash Receipts and Cash Payment JournalDocument4 pagesCash Receipts and Cash Payment Journalapi-434210060No ratings yet

- Ap Muktamad Triple Zest Trading Supliers SDN Bhd. 2 Lagi (As of 20.10.23) @001Document25 pagesAp Muktamad Triple Zest Trading Supliers SDN Bhd. 2 Lagi (As of 20.10.23) @001ldshukriNo ratings yet

- SARFAESI Act For NBFCsDocument22 pagesSARFAESI Act For NBFCsdeba3589No ratings yet

- JARAVATA Vs SandiganbayanDocument38 pagesJARAVATA Vs SandiganbayanJosie Jones BercesNo ratings yet

- IFM CHDocument53 pagesIFM CHMarIam AnsariNo ratings yet

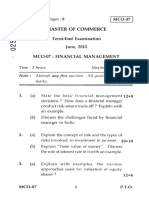

- MCO-7 June12Document7 pagesMCO-7 June12BinayKPNo ratings yet

- The Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Document7 pagesThe Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Christen CaliboNo ratings yet

- Advanced-Accounting-Part 1-Dayag-2015-Chapter-7Document33 pagesAdvanced-Accounting-Part 1-Dayag-2015-Chapter-7trisha sacramentoNo ratings yet

- COMMERCE 4FP3 at McMaster U, Cheatsheet For FinalDocument6 pagesCOMMERCE 4FP3 at McMaster U, Cheatsheet For Finalstargaze_night_42No ratings yet

- Long Question of Financial AcDocument20 pagesLong Question of Financial AcQasim AliNo ratings yet

- The Rise and Fall of NationsDocument9 pagesThe Rise and Fall of Nationskohinoor_roy5447No ratings yet

- Wings Ebiz - Payroll ProDocument23 pagesWings Ebiz - Payroll ProRoshan naiduNo ratings yet

- Working Capital Management: Navana Furniture LimitedDocument18 pagesWorking Capital Management: Navana Furniture Limitedbalal_hossain_1No ratings yet

- Luzon Development Bank vs. Angeles Catherine EnriquezDocument1 pageLuzon Development Bank vs. Angeles Catherine EnriquezJeliza ManaligodNo ratings yet

- Subject: Reducing/eliminating Printouts in Customs Clearance - RegardingDocument2 pagesSubject: Reducing/eliminating Printouts in Customs Clearance - RegardingMohamed GaniNo ratings yet

- 4 Current Liabilities MGMTDocument4 pages4 Current Liabilities MGMTWinter SummerNo ratings yet

- Principles of AccountingDocument6 pagesPrinciples of AccountingGian Karlo PagariganNo ratings yet

- Obligations and Contracts Notes - Atty Gravador PDFDocument36 pagesObligations and Contracts Notes - Atty Gravador PDFMichael Roberts100% (1)

- A Guide To UK Banks: The Banking System in The UKDocument9 pagesA Guide To UK Banks: The Banking System in The UKCassiane OgliariNo ratings yet