Professional Documents

Culture Documents

The Toys "R" Us Lbo & Freeport-Mcmoran: Financing An Acquisition & Avago

Uploaded by

Damla YılmazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Toys "R" Us Lbo & Freeport-Mcmoran: Financing An Acquisition & Avago

Uploaded by

Damla YılmazCopyright:

Available Formats

Damla YILMAZ

MBA 588

CAPITAL MARKETS AND INSTITUTIONS

Case Analysis

The Toys “R” US LBO & Freeport-McMoRan: Financing an Acquisition & Avago

Case 1: The Toys “R” US LBO

This case investigates the experience of a private equity investor evaluating a potential

investment, trends and participants in the private equity industry. To understand how private

equity firms analyze investment opportunities through application of an LBO model that

summarizes returns and risks. Also, to review private equity participation in club deals, large

(and early) dividends, and IPOs.

The Company’s worldwide toy business was highly seasonal (especially including the all-

important holiday sales of November and December). After 2003 holiday season, the

company retained Credit Suisse First Boston (CSFB) as its financial advisor. The Company

and CSFB initially decided to separate the US toy retailing business and Babies “R” Us by

running a thorough sale process for its toy retailing business. However, this was rejected and

instead to sell the portfolio of businesses together. In 2005, the company sold the entire

worldwide operations to the consortium of KKR, Bain Capital, and Vornado Realty Trust for

$26.75 per share in a $6.7billion transaction. The consortium assumed the Company’s

existing debt and cash not used in the transaction. There are some risks and merits of the

transaction. Consequently, the company became more leveraged with the transaction.

Risks:

It is a very competitive industry.

It is a highly volatile ande xpanding market (Walmart, Target, etc.).

Specialty stores already ousted.

Big changes could lead to big fall-out

Merits:

Changing industry could allow consortium to make dramatic changes to Toys "R" Us.

In the global toy market, target company is the main leader.

There is a lot of capital within the consortium.

Although sales are decreasing, they have eye-catching cash flows.

The potential exit alternatives for this investment:

IPO at the time of acquisition (Toys”R”Us was not a public company).

Selling to a strategic buyer which is their competitor.

Selling to a financial buyer. (able to resell the company to another PE firm)

Damla YILMAZ

Case 2: Freeport-McMoRan: Financing an Acquisition

Case 3: Avago

You might also like

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Sears Holdings CorpDocument7 pagesSears Holdings CorpKristine Angelie100% (1)

- Finance Director in Boston MA Resume James ReynoldsDocument2 pagesFinance Director in Boston MA Resume James ReynoldsJamesReynolds2No ratings yet

- Corp RestructDocument7 pagesCorp RestructConcepts TreeNo ratings yet

- Kohler Group 5Document6 pagesKohler Group 5Prateek PatraNo ratings yet

- Creating Value from Mergers and AcquisitionsDocument7 pagesCreating Value from Mergers and Acquisitionsredaek0% (1)

- FADMDocument27 pagesFADMManju TripathiNo ratings yet

- Restructuring Marriott Corp with Project ChariotDocument6 pagesRestructuring Marriott Corp with Project Chariotswati_0211No ratings yet

- Lessons From 200 LBO DefaultsDocument10 pagesLessons From 200 LBO DefaultsforbesadminNo ratings yet

- What Is Leveraged Buyout and How Does It Works?Document4 pagesWhat Is Leveraged Buyout and How Does It Works?Keval ShahNo ratings yet

- Organizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyDocument37 pagesOrganizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyPriyanka SinghNo ratings yet

- Toy Horse Conjoint Experiment: Case AssignmentDocument23 pagesToy Horse Conjoint Experiment: Case AssignmentwillowNo ratings yet

- Should The General Manager Be FiredDocument10 pagesShould The General Manager Be FiredAbdul MohidNo ratings yet

- Ducati OrgnCritiqueDocument28 pagesDucati OrgnCritiquecherikokNo ratings yet

- Marriot CorporationDocument3 pagesMarriot CorporationEddie KruleNo ratings yet

- Goldman Sachs Capital PartnersDocument4 pagesGoldman Sachs Capital PartnersCarl CordNo ratings yet

- Corporate India's Global Ambitions May Weaken Credit Risk ProfilesDocument6 pagesCorporate India's Global Ambitions May Weaken Credit Risk ProfileschengadNo ratings yet

- The Effects of Leveraged Buyouts On ProdDocument55 pagesThe Effects of Leveraged Buyouts On ProdsayyedtarannumNo ratings yet

- Director Financial Planning Analysis in Boston MA Resume Melissa SalernoDocument2 pagesDirector Financial Planning Analysis in Boston MA Resume Melissa SalernoMelissaSalernoNo ratings yet

- Analyzing Toys R Us Supply Chain ManagementDocument8 pagesAnalyzing Toys R Us Supply Chain ManagementCharles Bishop OgollaNo ratings yet

- Report On Marvel's Restructuring Dilemma: Financial ManagementDocument19 pagesReport On Marvel's Restructuring Dilemma: Financial Managementebi ayatNo ratings yet

- Leverage Buyout and Junk KbondsDocument31 pagesLeverage Buyout and Junk KbondsChetan VenuNo ratings yet

- MarriottDocument7 pagesMarriottHaritha PanyaramNo ratings yet

- Financial Planning Analysis Director in Dallas TX Resume Sanjay NaraDocument3 pagesFinancial Planning Analysis Director in Dallas TX Resume Sanjay NaraSanjayNaraNo ratings yet

- Reshuffling The Debt: The Credit Implications of The New Wave of LbosDocument10 pagesReshuffling The Debt: The Credit Implications of The New Wave of LbosDavid TollNo ratings yet

- Leveraged Buyout Bankrupties, The Problem of HindsightDocument104 pagesLeveraged Buyout Bankrupties, The Problem of Hindsight83jjmackNo ratings yet

- Leveraged Buyout (LBO) AnalysisDocument4 pagesLeveraged Buyout (LBO) AnalysisAtibAhmedNo ratings yet

- Case Study Week 2 LegoDocument3 pagesCase Study Week 2 LegoLinh HoangNo ratings yet

- In A Turnaround or Transformation Situation, Making Adjustments To The Business Model Is More Important Than Managing The People IssuesDocument6 pagesIn A Turnaround or Transformation Situation, Making Adjustments To The Business Model Is More Important Than Managing The People IssuesgreffenstetteNo ratings yet

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- JPM Software Technology 2013-07-12 1161609Document24 pagesJPM Software Technology 2013-07-12 1161609Dinesh MahajanNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Employee Buyout - A Compelling Exit StrategyDocument5 pagesEmployee Buyout - A Compelling Exit StrategyheenaieibsNo ratings yet

- Valuation of Early Stage StartupsDocument2 pagesValuation of Early Stage StartupsPaulo Timothy AguilaNo ratings yet

- SearsvswalmartDocument7 pagesSearsvswalmartXie KeyangNo ratings yet

- Iridium LLC Group ProjectDocument20 pagesIridium LLC Group ProjectScarlet JohnsonNo ratings yet

- Return On Invested Capital (ROIC)Document4 pagesReturn On Invested Capital (ROIC)VinodSinghNo ratings yet

- Co OpetitionDocument17 pagesCo OpetitionRizal Udin Firman HidayatNo ratings yet

- Practical Guide to Calculating Deferred Tax in Business CombinationsDocument15 pagesPractical Guide to Calculating Deferred Tax in Business CombinationsdirehitNo ratings yet

- JPMCDocument320 pagesJPMCtiwariparveshNo ratings yet

- Cleveland Research Company Stock Pitch 2016 EntryDocument24 pagesCleveland Research Company Stock Pitch 2016 EntryNguyen D. Nguyen100% (1)

- ID: 8819428 Laveen Kumar Jayabalan ID:8945037 HU HUANG ID:8988274 HO KUANLIN ID:9081408 KAI GAO ID:8850764 HAMZA FARIDDocument11 pagesID: 8819428 Laveen Kumar Jayabalan ID:8945037 HU HUANG ID:8988274 HO KUANLIN ID:9081408 KAI GAO ID:8850764 HAMZA FARIDOnyango VictorNo ratings yet

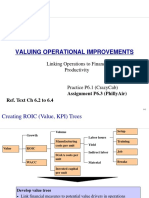

- 2 Linking Operations To Finance and ProductivityDocument14 pages2 Linking Operations To Finance and ProductivityAidan HonnoldNo ratings yet

- The Role of Chief Financial Officers in Managing InnovationDocument10 pagesThe Role of Chief Financial Officers in Managing InnovationNestaNo ratings yet

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- Dear Chairman - Boardroom Battles and The Rise of Shareholder Acti-2Document5 pagesDear Chairman - Boardroom Battles and The Rise of Shareholder Acti-2Vala Srihitha RaoNo ratings yet

- 12 Corporate Restructuring and BankruptcyDocument5 pages12 Corporate Restructuring and BankruptcyMohammad DwidarNo ratings yet

- FACD Project - Allergan-Pfizer DealDocument5 pagesFACD Project - Allergan-Pfizer DealSaksham SinhaNo ratings yet

- Distressed Debt Investment Strategy: Ashok BanerjeeDocument14 pagesDistressed Debt Investment Strategy: Ashok BanerjeeAKSHAY PANWARNo ratings yet

- Damodaran - Financial Services ValuationDocument4 pagesDamodaran - Financial Services ValuationBogdan TudoseNo ratings yet

- Investment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerDocument17 pagesInvestment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerStudy FreakNo ratings yet

- Forces Driving Industry Competition & Key Factors Affecting FirmsDocument2 pagesForces Driving Industry Competition & Key Factors Affecting FirmsMohammad SarifudinNo ratings yet

- Business Valuation: Economic ConditionsDocument10 pagesBusiness Valuation: Economic ConditionscuteheenaNo ratings yet

- Real Options Analysis of Cox CommunicationsDocument1 pageReal Options Analysis of Cox CommunicationsLibayTeaNo ratings yet

- Marvel Case QuestionsDocument1 pageMarvel Case QuestionsJorge Duran AgamaNo ratings yet

- Ipo Guide 2016Document88 pagesIpo Guide 2016Rupali GuravNo ratings yet

- Lbo Model Long FormDocument5 pagesLbo Model Long FormGabriella RicardoNo ratings yet

- CRBV Kohler Case - Group 6Document14 pagesCRBV Kohler Case - Group 6amitsuchi100% (4)

- Research Final DraftDocument10 pagesResearch Final Draftcharlie raithNo ratings yet