Professional Documents

Culture Documents

Box Company Makes Shipping Containers The Trial Balance Section of

Uploaded by

Miroslav Gegoski0 ratings0% found this document useful (0 votes)

7 views1 pageBox Company Makes Shipping Containers the Trial Balance Section Of

Original Title

Box Company Makes Shipping Containers the Trial Balance Section Of

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBox Company Makes Shipping Containers the Trial Balance Section Of

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageBox Company Makes Shipping Containers The Trial Balance Section of

Uploaded by

Miroslav GegoskiBox Company Makes Shipping Containers the Trial Balance Section Of

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

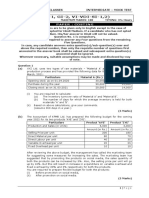

Box Company makes shipping containers The Trial

Balance section of #8012

Box Company makes shipping containers. The Trial Balance section of its worksheet and other

year-end data follow. INSTRUCTIONS1. Prepare a 12-column manufacturing worksheet for the

fiscal year ended December 31, 2016. Enter the trial balance in the first two columns.2. Using

the data given, enter the adjustments and complete the worksheet. Label all inventory

adjustments as (a).3. Prepare a statement of cost of goods manufactured.4. Prepare an income

statement.5. Prepare a statement of retained earnings. Additional data follows:a. Balance of

Retained Earnings, January 1, was $185,000.b. Dividends declared and paid on common stock

during the year were $10,000.6. Prepare a balance sheet as of December 31, 2016. Common

Stock, $1 par, was authorized for100,000 shares and 50,000 shares were outstanding.7.

Record the adjusting entries shown on the worksheet in general journal form. For each journal

entry, use the letter that identifies the adjustment on the worksheet. Make a separate entry for

each inventory adjustment. Do not give explanations.8. Prepare the closing entries for all

accounts involved in the cost of goods manufactured.9. Prepare the closing entries for all

revenue and expense accounts and the Manufacturing Summary account.10. Prepare the

closing entry to close the Income Summary account.11. Journalize the reversing entries. Date

the entries January 1, 2017.YEAR-END DATAa. Ending inventories: finished goods, $25,000;

work in process, $36,000; and raw materials, $21,000.b. Estimated uncollectible accounts:

increase Allowance for Uncollectible Accounts to 4 percent of Accounts Receivable.c. Expired

insurance, $2,000; debit the Insurance-Factory account for the amount of the necessary

adjustment.d. Factory supplies on hand, $1,000.e. Depreciation for the year: on factory building,

$15,000; on factory machinery, $5,000; and on office equipment, $2,000.f. Accrued factory

wages: direct labor, $1,800; indirect labor, $200.g. Accrued payroll taxes: social security, $124;

Medicare tax, $29.h. Total income tax expense for the year, $34,212.Analyze: Assume that the

industry standard for direct labor costs in its manufacturing industry is 31 percent of costs of

goods manufactured. How does this company compare to others in regard to this standard?

Explain.View Solution:

Box Company makes shipping containers The Trial Balance section of

ANSWER

http://paperinstant.com/downloads/box-company-makes-shipping-containers-the-trial-balance-

section-of/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Trial Balance of Save Mart Wholesale Company Contained The ADocument1 pageThe Trial Balance of Save Mart Wholesale Company Contained The AM Bilal SaleemNo ratings yet

- Acc312 Platt Spr07 Exam1 Solution PostedDocument13 pagesAcc312 Platt Spr07 Exam1 Solution Posted03322080738No ratings yet

- Ma. Acctng.Document7 pagesMa. Acctng.Kaname KuranNo ratings yet

- Sem 4Document6 pagesSem 4shioamn50% (2)

- Managerial Accouting TestDocument16 pagesManagerial Accouting TestBùi Yến NhiNo ratings yet

- Practice Problem Set 01Document7 pagesPractice Problem Set 01priya bhagwatNo ratings yet

- Tutorial 7Document4 pagesTutorial 7jasonNo ratings yet

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDocument9 pagesManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNo ratings yet

- BUSI 353 Assignment #6 General Instructions For All AssignmentsDocument4 pagesBUSI 353 Assignment #6 General Instructions For All AssignmentsTan0% (1)

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- P1 - Management Accounting - Performance EvaluationDocument24 pagesP1 - Management Accounting - Performance EvaluationSritijhaaNo ratings yet

- Assignment CH 2Document30 pagesAssignment CH 2Svetlana50% (2)

- ACC103 Assign Sem 1, 2020 PDFDocument9 pagesACC103 Assign Sem 1, 2020 PDFWSLee0% (1)

- Bertrand Manufacturing Uses A Job Order Cost System and Applies OverheadDocument2 pagesBertrand Manufacturing Uses A Job Order Cost System and Applies OverheadDoreenNo ratings yet

- Discussion - Job CostingDocument3 pagesDiscussion - Job CostingHannah Jane ToribioNo ratings yet

- Accounting Chapter 16 Brief Exercises and ExercisesDocument10 pagesAccounting Chapter 16 Brief Exercises and ExercisesAnonymous jrIMYSz9No ratings yet

- Asi Mba 162 4 Sma 140917Document6 pagesAsi Mba 162 4 Sma 140917Danah Dela RosaNo ratings yet

- ACC103 Assignment January 2019 IntakeDocument8 pagesACC103 Assignment January 2019 IntakeReina TrầnNo ratings yet

- Test Bank For Managerial Accounting 6th Edition Weygandt, Kimmel, KiesoDocument7 pagesTest Bank For Managerial Accounting 6th Edition Weygandt, Kimmel, Kiesoa131409420No ratings yet

- Day 06Document8 pagesDay 06Cy PenalosaNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- The Unadjusted Trial Balance of La Mesa Laundry at AugustDocument1 pageThe Unadjusted Trial Balance of La Mesa Laundry at AugustAmit PandeyNo ratings yet

- ACC 231 Pre TestDocument4 pagesACC 231 Pre TestM ANo ratings yet

- Accounting Textbook Solutions - 72Document19 pagesAccounting Textbook Solutions - 72acc-expertNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 2010-03-22 131208 Job CostingDocument6 pages2010-03-22 131208 Job CostingMiharu KimNo ratings yet

- SOLUTION Midterm Exam Winter 2016 PDFDocument13 pagesSOLUTION Midterm Exam Winter 2016 PDFhfjffjNo ratings yet

- Act Exam 1Document14 pagesAct Exam 1aman_nsu100% (1)

- Solved Heavenly Displays Inc Puts Together Large Scale Fireworks Displays Primarily For CanadaDocument2 pagesSolved Heavenly Displays Inc Puts Together Large Scale Fireworks Displays Primarily For CanadaDoreenNo ratings yet

- The Ledger and Trial Balance of Wizard Services Co AsDocument1 pageThe Ledger and Trial Balance of Wizard Services Co AsM Bilal Saleem100% (1)

- Exercise 1 - Cost Concepts-1Document7 pagesExercise 1 - Cost Concepts-1Vincent PanisalesNo ratings yet

- Job Order CostingDocument1 pageJob Order CostingVincent Pham100% (1)

- Omit The "$" Sign in Your Response.Document6 pagesOmit The "$" Sign in Your Response.Umer AhmadNo ratings yet

- Management Accounting Midterm Test (Time: 60') Name: Student ID: Class: - Part 1: Multiple Choice QuestionsDocument5 pagesManagement Accounting Midterm Test (Time: 60') Name: Student ID: Class: - Part 1: Multiple Choice QuestionsSơn HoàngNo ratings yet

- CIMA - Question Bank (Relevant For F2)Document12 pagesCIMA - Question Bank (Relevant For F2)bebebam100% (1)

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- Budgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The QuestionDocument17 pagesBudgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The Questionaldrin elsisuraNo ratings yet

- Practice Questions Chapter 5Document8 pagesPractice Questions Chapter 5Abdul Wajid Nazeer CheemaNo ratings yet

- Managerial Accounting ProjectDocument5 pagesManagerial Accounting ProjectAyaz AbroNo ratings yet

- Quiz 1 - Chapt 19-20-21Document7 pagesQuiz 1 - Chapt 19-20-21Giovanna CastilloNo ratings yet

- 02.02.2024 Accounting Cycle For A Manufacturing Company1Document34 pages02.02.2024 Accounting Cycle For A Manufacturing Company1Dennis N. IndigNo ratings yet

- Assignment 1Document8 pagesAssignment 1Gerson GloreNo ratings yet

- FR - Final Mock Exam - Dec 2021Document20 pagesFR - Final Mock Exam - Dec 2021ibrahimNo ratings yet

- ACT 202 AssignmentDocument3 pagesACT 202 AssignmentFahim AnjumNo ratings yet

- NtantDocument6 pagesNtantmahedreNo ratings yet

- FA - II - Project Work 2020Document3 pagesFA - II - Project Work 2020Yohanes DebeleNo ratings yet

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- This Unadjusted Trial Balance Is For Challenger Construction at TheDocument1 pageThis Unadjusted Trial Balance Is For Challenger Construction at TheFreelance WorkerNo ratings yet

- Homework AssignmentDocument11 pagesHomework AssignmentHenny DeWillisNo ratings yet

- The Unadjusted Trial Balance of Fix It Co at December 31 PDFDocument1 pageThe Unadjusted Trial Balance of Fix It Co at December 31 PDFTaimur TechnologistNo ratings yet

- Practice Question 2,3,5,6Document10 pagesPractice Question 2,3,5,6student.devyankgosainNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Math PracticeDocument3 pagesMath Practiceakmal_07No ratings yet

- 06.paper 06 - Mix MCQDocument9 pages06.paper 06 - Mix MCQHashan DasanayakaNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Chapter 4 In-Class ExercisesDocument9 pagesChapter 4 In-Class ExercisesNguyễn Thị Thanh ThúyNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Suppose That People Consume Only Three Goods As Shown inDocument1 pageSuppose That People Consume Only Three Goods As Shown inMiroslav Gegoski0% (1)

- Suppose That As An Owner of A Federally Insured S LDocument1 pageSuppose That As An Owner of A Federally Insured S LMiroslav GegoskiNo ratings yet

- Suppose That in A Year An American Worker Can ProduceDocument1 pageSuppose That in A Year An American Worker Can ProduceMiroslav GegoskiNo ratings yet

- Suppose That A Market Is Described by The Following SupplyDocument1 pageSuppose That A Market Is Described by The Following SupplyMiroslav GegoskiNo ratings yet

- Suppose That Congress Passes A Law Requiring Employers To ProvidDocument1 pageSuppose That Congress Passes A Law Requiring Employers To ProvidMiroslav GegoskiNo ratings yet

- Suppose That Fixed Costs For A Firm in The AutomobileDocument1 pageSuppose That Fixed Costs For A Firm in The AutomobileMiroslav GegoskiNo ratings yet

- Suppose That Congress Imposes A Tariff On Imported Autos ToDocument1 pageSuppose That Congress Imposes A Tariff On Imported Autos ToMiroslav GegoskiNo ratings yet

- Suppose That A Perfectly Competitive Firm Has The Following TotaDocument1 pageSuppose That A Perfectly Competitive Firm Has The Following TotaMiroslav GegoskiNo ratings yet

- Suppose That Pattys Pool Has The Demand DataDocument1 pageSuppose That Pattys Pool Has The Demand DataMiroslav GegoskiNo ratings yet

- Suppose That A Paper Mill Feeds A Downstream Box MillDocument1 pageSuppose That A Paper Mill Feeds A Downstream Box MillMiroslav GegoskiNo ratings yet

- Suppose That One Day Gilligan The Castaway Eats A MagicalDocument1 pageSuppose That One Day Gilligan The Castaway Eats A MagicalMiroslav GegoskiNo ratings yet

- Suppose That Pattys Pool Has The Demand Data Given in TableDocument1 pageSuppose That Pattys Pool Has The Demand Data Given in TableMiroslav GegoskiNo ratings yet

- Suppose That Every Driver Faces A 1 Probability of AnDocument1 pageSuppose That Every Driver Faces A 1 Probability of AnMiroslav GegoskiNo ratings yet

- Suppose That There Are 10 Million Workers in Canada andDocument1 pageSuppose That There Are 10 Million Workers in Canada andMiroslav GegoskiNo ratings yet

- Sung Sam Inc Is Currently DesigningDocument1 pageSung Sam Inc Is Currently DesigningMiroslav GegoskiNo ratings yet

- Suppose That A Firm S Production Function Is Given by TheDocument1 pageSuppose That A Firm S Production Function Is Given by TheMiroslav GegoskiNo ratings yet

- Suppose That The Marshall Islands Does Not Trade With TheDocument1 pageSuppose That The Marshall Islands Does Not Trade With TheMiroslav GegoskiNo ratings yet

- Suppose That The Equation Were y 5 XDocument1 pageSuppose That The Equation Were y 5 XMiroslav GegoskiNo ratings yet

- Suppose As in The Previous Problem You Buy A HomeDocument1 pageSuppose As in The Previous Problem You Buy A HomeMiroslav GegoskiNo ratings yet

- Suppose That The Owner of Boyer Construction Is Feeling TheDocument1 pageSuppose That The Owner of Boyer Construction Is Feeling TheMiroslav GegoskiNo ratings yet

- Suppose That Prior To The Passage of The Truth inDocument1 pageSuppose That Prior To The Passage of The Truth inMiroslav GegoskiNo ratings yet

- Structural Unemployment Is Sometimes Said To Result From A MismaDocument1 pageStructural Unemployment Is Sometimes Said To Result From A MismaMiroslav GegoskiNo ratings yet

- Suppose Douglas and Ziffel Have Properties That Adjoin The FarmDocument1 pageSuppose Douglas and Ziffel Have Properties That Adjoin The FarmMiroslav GegoskiNo ratings yet

- Suppose Consumption and Investment Are Described by The FollowinDocument1 pageSuppose Consumption and Investment Are Described by The FollowinMiroslav GegoskiNo ratings yet

- Suppose An Economy Is in Long Run Equilibrium A Use TheDocument1 pageSuppose An Economy Is in Long Run Equilibrium A Use TheMiroslav GegoskiNo ratings yet

- Suppose A Computer Virus Disables The Nation S Automatic TellerDocument1 pageSuppose A Computer Virus Disables The Nation S Automatic TellerMiroslav GegoskiNo ratings yet

- Suppose As in The Previous Problem You Buy A Home ForDocument1 pageSuppose As in The Previous Problem You Buy A Home ForMiroslav GegoskiNo ratings yet

- Suppose A Technological Advance Reduces The Cost of Making CompuDocument1 pageSuppose A Technological Advance Reduces The Cost of Making CompuMiroslav GegoskiNo ratings yet

- Suppose An Appliance Manufacturer Is Doing A Regression AnalysisDocument1 pageSuppose An Appliance Manufacturer Is Doing A Regression AnalysisMiroslav GegoskiNo ratings yet

- Suppose Firms Become Very Optimistic About Future Business CondiDocument1 pageSuppose Firms Become Very Optimistic About Future Business CondiMiroslav GegoskiNo ratings yet

- Costing English Question-01.09.2022Document5 pagesCosting English Question-01.09.2022Planet ZoomNo ratings yet

- Labour Law-II Second WeekDocument28 pagesLabour Law-II Second WeekAkanksha BohraNo ratings yet

- Art. 130. Nightwork ProhibitionDocument11 pagesArt. 130. Nightwork ProhibitionVance AgumNo ratings yet

- Montor - Labor DigestDocument7 pagesMontor - Labor DigestShericka Jade MontorNo ratings yet

- Ncm-120-Week-12-Topic 8 (A-B.2) - 0CT 25 To 30, 2021Document37 pagesNcm-120-Week-12-Topic 8 (A-B.2) - 0CT 25 To 30, 2021Shaf Abubakar100% (1)

- Legal Forms Cases 2Document60 pagesLegal Forms Cases 2Marvi Blaise CochingNo ratings yet

- BAP - Application - Feed Mill Issue 2.1 - Rev. 3 - 23-May-2017 - Pt. 2Document8 pagesBAP - Application - Feed Mill Issue 2.1 - Rev. 3 - 23-May-2017 - Pt. 2choth mal jangirNo ratings yet

- Vice President Human Resources in Louisville KY Resume Christopher LitrasDocument3 pagesVice President Human Resources in Louisville KY Resume Christopher LitrasChristopher LitrasNo ratings yet

- Labor Law and Social Legislations 2005 Bar Examination Questions and AnswersDocument21 pagesLabor Law and Social Legislations 2005 Bar Examination Questions and AnswersRodolfo DiazNo ratings yet

- RMC 39-2007 (Agency Fee)Document6 pagesRMC 39-2007 (Agency Fee)rmdelmandoNo ratings yet

- Exclusions From Gross Income: (13 Month Pay, de Minimis Benefits, GSIS, SSS, MEDICARE, and Other Contribution)Document12 pagesExclusions From Gross Income: (13 Month Pay, de Minimis Benefits, GSIS, SSS, MEDICARE, and Other Contribution)KathNo ratings yet

- Mabeza vs. NLRCDocument5 pagesMabeza vs. NLRCIrish Joi TapalesNo ratings yet

- Letter - SampleDocument12 pagesLetter - Samplenuwul2003No ratings yet

- Historian InterpretationDocument1 pageHistorian InterpretationchelseaNo ratings yet

- Lec 04 - Managerial Accounting (Concepts & Principles)Document36 pagesLec 04 - Managerial Accounting (Concepts & Principles)Sakib RafeeNo ratings yet

- OB Project On AdidasDocument31 pagesOB Project On AdidasvichuicsNo ratings yet

- Towards Sustainable Labour Costing in The Global Apparel IndustryDocument20 pagesTowards Sustainable Labour Costing in The Global Apparel IndustryShaaban NoamanNo ratings yet

- Relevant Costing ConceptsDocument7 pagesRelevant Costing ConceptsAngel Lilly100% (1)

- Jurisprudence On Labor LawDocument99 pagesJurisprudence On Labor LawKerth50% (2)

- Libanon Close Out Report2Document17 pagesLibanon Close Out Report2Michael BenhuraNo ratings yet

- Management of Human Resources MS 02 Dr. Onkar NathDocument124 pagesManagement of Human Resources MS 02 Dr. Onkar NathJapjiv SinghNo ratings yet

- Chapter 9 Student NotesDocument6 pagesChapter 9 Student Noteskiranliaquat60No ratings yet

- An ITF Guide For Seafarers To The ILO Maritime Labour Convention, 2006Document81 pagesAn ITF Guide For Seafarers To The ILO Maritime Labour Convention, 2006Mark Lourence TiuNo ratings yet

- Final Term Paper RMG Industry of BangladeshDocument15 pagesFinal Term Paper RMG Industry of BangladeshtaijulshadinNo ratings yet

- Echo 2000 Commercial CorporationDocument2 pagesEcho 2000 Commercial Corporationangelsu04No ratings yet

- Atributos Empleados Data SourceDocument3 pagesAtributos Empleados Data SourceJulio Rafael Olivos PuenteNo ratings yet

- Asian Transmission Corp V CADocument2 pagesAsian Transmission Corp V CAFayda Cariaga88% (8)

- Full Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5Th Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Accounting Tools For Business Decision Making Kimmel Weygandt Kieso 5Th Edition PDF Docx Full Chapter Chapterbraidscanty8unib100% (20)

- Final Report MOU ContractDocument50 pagesFinal Report MOU Contractsumanshailendra0% (1)

- Related Coverage: Middle Class Shrinks Further As More Fall Out Instead of Climbing Upjan. 25, 2015Document2 pagesRelated Coverage: Middle Class Shrinks Further As More Fall Out Instead of Climbing Upjan. 25, 2015Mirza Yanuar RizkyNo ratings yet