Professional Documents

Culture Documents

FA - II - Project Work 2020

Uploaded by

Yohanes DebeleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA - II - Project Work 2020

Uploaded by

Yohanes DebeleCopyright:

Available Formats

RIFT VALLEY UNIVERSITY

GADA CAMPUS

DEPARTMENT OF

ACCOUNTING AND FINANCE

Financial Accounting II- AcFn 312

Issue Date: June 19, 2020.

Submission Date: June 22, 2020.

Name_______________________________________ ID No.________________ Group________

Program/Division:

Regular Extension Add/Drop

Individual Project Work

Instruction: Dear students in doing your project work successful you have to:

(1) Devote time specifically to read the handouts (modules, or other references notes or books).

(2) Build individual accountability and do your project work thoroughly and copying from

others disqualifies results.

(3) You are expected to submit the project work in Hard Copy in to Four days after the date

you received to the Instructor’s.

(4) Don’t forget writing your full Name, Student Id No. and Group/Department.

Section to be filled by the Instructor:

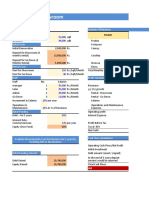

Project Wor k Weight in % Scored Result

Q# 1 8%

Q# 2 6%

Q# 3 14 %

Q# 4 12 %

Total 40 %

Financial Accounting – II AcFn - 312 Page 1

1. (Long-Term Debt) Awash Company issued $100,000 of 7% term bonds on January 1, 2019, due on

January 1, 2024. The market rate of interest for these bonds is 8%. Interest is payable annually on

December 31.

Required:

Assume that the company uses the effective-interest method of amortizing bond discount.

a) Calculate the amount of interest that is actually paid annually (2 point).

b) Compute the proceeds from issuance of the bonds and discount on bonds payable on January 1,

2019 (2 point).

c) Prepare a bond discount amortization schedule for 2019 - 2024 (2 point).

d) Prepare the journal entries to records the following transaction:

i) The issuance of bonds on January 1, 2019 (1 point).

ii) The payment of interest and the amortization of the discount on Dec. 31, 2019 (1 point).

2. (Capitalization of Interest) Haron Furniture Company started construction of a combination office and

warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2017. Haron

expected to complete the building by December 31, 2017. Haron has the following debt obligations

outstanding during the construction period.

Construction loan—12% interest, payable semiannually, issued

December 31, 2016 $ 2,000,000

Short-term loan—10% interest, payable monthly, and

Principal payable at maturity on May 30, 2018 1,400,000

Long-term loan—11% interest, payable on January 1 of each year.

Principal payable on January 1, 2021 1,000,000

Required:

(a) Assume that Haron completed the office and warehouse building on December 31, 2017, as

planned at a total cost of $5,200,000, and the weighted-average amount of accumulated

expenditures was $3,600,000. Compute the avoidable interest on this project (3 point).

(b) Compute the depreciation expense for the year ended December 31, 2018. Haron elected to

depreciate the building on a straight-line basis and determined that the asset has a useful life of

30 years and a salvage value of $300,000 (3 point).

Financial Accounting – II AcFn - 312 Page 2

3. (Retail Inventory Method) Presented below is information related to Sony Electronics Company.

Cost Retail

Beginning inventory, January 1 $ 58,000 $ 100,000

Purchases (net) 122,000 200,000

Markups, net -- 20,000

Markdowns, net -- 30,000

Sales -- 186,000

Required:

(a) Compute the ending inventory at retail (2 point).

(b) Compute a cost-to-retail percentage (ratio) under the following conditions (4 point):

1. Excluding both markups and markdowns.

2. Excluding markups but including markdowns.

3. Excluding markdowns but including markups.

4. Including both markdowns and markups.

(c) Which of the methods in (b) above (1, 2, 3, or 4) does the following? (2 point).

1. Provides the most conservative estimate of ending inventory and an approximation of LCNRV.

2. Is used in the conventional retail method.

(d) Compute ending inventory at LCNRV (2 point).

(e) Compute cost of goods sold based on (d) (2 point).

(f) Compute gross profit (margin) based on (d) (2 point).

4. (Depreciation Computations—Four Methods) Zebra Furniture Company purchased a new machine

for its assembly process on January 1, 2019. The cost of this machine was $880,000. The company

estimated that the machine would have a residual value of $80,000 at the end of its service life. Its life

is estimated at 4 years, and its working hours are estimated total activity level at 8,000,000 hours and

5,000,000 respectively. Activity rate 0.10 hours used and 0.16 units produced respectively. Year-end

is December 31.

Required:

Calculate the depreciation expense of each of the 4 years under the following methods:

(a) Activity (output production) assuming the following actual production:

(a)-1. Hours used 1,440,000, 2,000,000, 2,400,000, and 2,160,000 respectively (3 point).

(a)-2. Units produced 1,500,000, 2,000,000, 1,000,000, and 500,000, respectively (3 point).

(b) Straight line depreciation (2 point).

(c) Sum-of-the-years' digits (2 point).

(d) Double declining balance (2 point).

***************************//****************************

Financial Accounting – II AcFn - 312 Page 3

You might also like

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocument7 pagesMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Assignment #1 (With Answers)Document9 pagesAssignment #1 (With Answers)南玖No ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- Your Transunion Credit Report: Personal InformationDocument164 pagesYour Transunion Credit Report: Personal InformationRichard Griffin0% (1)

- Financial Accounting Act100 - Eosa Spring 2022 - OnlineDocument12 pagesFinancial Accounting Act100 - Eosa Spring 2022 - OnlineCarl DavisNo ratings yet

- 7001 Assignment #1Document6 pages7001 Assignment #1南玖No ratings yet

- Assignment 3 Calculation Questions - 151099758Document12 pagesAssignment 3 Calculation Questions - 151099758Pankaj KhannaNo ratings yet

- HaloCrypto Cumulative Case Tutorial QuestionsDocument6 pagesHaloCrypto Cumulative Case Tutorial QuestionsLim ShawnNo ratings yet

- Diy-Problems (Questionnaires)Document6 pagesDiy-Problems (Questionnaires)May RamosNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- Chapter 13Document8 pagesChapter 13ks1043210No ratings yet

- SOLUTION Midterm Exam Winter 2016 PDFDocument13 pagesSOLUTION Midterm Exam Winter 2016 PDFhfjffjNo ratings yet

- FAB Assignment 2020-2021 - UpdatedDocument7 pagesFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminNo ratings yet

- Diploma in Accountancy-March 2023 QaDocument233 pagesDiploma in Accountancy-March 2023 QaWalusungu A Lungu BandaNo ratings yet

- Accountancy and Auditing Papers 2017 - CSS Forums PDFDocument7 pagesAccountancy and Auditing Papers 2017 - CSS Forums PDFFawad ShahNo ratings yet

- Ita MockDocument8 pagesIta MockAyyan SheikhNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- Final - PDF - CSE - HUM 3115 - EDITED (Part A and B)Document6 pagesFinal - PDF - CSE - HUM 3115 - EDITED (Part A and B)ANIKNo ratings yet

- RISE All CAF Subjects Mock With Solutions Regards Saboor AhmadDocument139 pagesRISE All CAF Subjects Mock With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- IPE 481 - Term Final Question - January 2020Document6 pagesIPE 481 - Term Final Question - January 2020Shaumik RahmanNo ratings yet

- Zimbabwe School Examinations Council Accounting 6001/3Document8 pagesZimbabwe School Examinations Council Accounting 6001/3SaChibvuri JeremiahNo ratings yet

- AF2110 Exam QuestionsDocument10 pagesAF2110 Exam QuestionsHOYEE ZHANGNo ratings yet

- Quiz #4 - Intangibles and Investment PropertyDocument2 pagesQuiz #4 - Intangibles and Investment PropertyfbaabgfgbfdNo ratings yet

- Business Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial StatementsDocument21 pagesBusiness Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial Statementsjecille magalongNo ratings yet

- HKMU BAFS 2022 P2A Question EngDocument11 pagesHKMU BAFS 2022 P2A Question EngJaeeeNo ratings yet

- Accounting 201 FALL 2000 Exam 2Document11 pagesAccounting 201 FALL 2000 Exam 2Corey ArmstrongNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoNo ratings yet

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- CHRIST (Deemed To Be University), Bengaluru - 560 029: BIF431 - Page 1 of 9Document9 pagesCHRIST (Deemed To Be University), Bengaluru - 560 029: BIF431 - Page 1 of 9Arpit SharmaNo ratings yet

- 2023spring Intro Assign4solDocument5 pages2023spring Intro Assign4solHamayun KhanNo ratings yet

- Requirements. All Raw Materials Are Purchased On Account. 50% of A Quarter'sDocument4 pagesRequirements. All Raw Materials Are Purchased On Account. 50% of A Quarter'sairis nyanganoNo ratings yet

- 2022 BCTA July 2021 EOS Exam - Financial ReportingDocument9 pages2022 BCTA July 2021 EOS Exam - Financial ReportingsimbaNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- 101 Fac EngDocument23 pages101 Fac EngjamespotheadNo ratings yet

- Essay: Mid-Term Examination Akuntansi Biaya / Cost Accounting AKT 103 - AKT32-WDocument3 pagesEssay: Mid-Term Examination Akuntansi Biaya / Cost Accounting AKT 103 - AKT32-Wsangita indrianeNo ratings yet

- Management Accounting SundayDocument5 pagesManagement Accounting SundayAhsan MaqboolNo ratings yet

- Cost Accounting Midterm Exam AKT103-AKT32-WDocument3 pagesCost Accounting Midterm Exam AKT103-AKT32-Wsangita indrianeNo ratings yet

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- Seatwork 01 Statement of Income Answer KeyDocument3 pagesSeatwork 01 Statement of Income Answer KeyTshina Jill BranzuelaNo ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- Final Exam Paper 2020-2021Document7 pagesFinal Exam Paper 2020-2021pgpt8qhb4yNo ratings yet

- Section A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceDocument9 pagesSection A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceMagnolia KhineNo ratings yet

- Financial Accounting 3BDocument10 pagesFinancial Accounting 3BPRECIOUSNo ratings yet

- Management Accounting April2018Document21 pagesManagement Accounting April2018MJ39No ratings yet

- Modul 4 - Pengakuan Pendapatan-1Document3 pagesModul 4 - Pengakuan Pendapatan-1Anis RahmawatiNo ratings yet

- (Approved) Ugb163 Ia Mdist Ay2021-22Document4 pages(Approved) Ugb163 Ia Mdist Ay2021-22CannoniehNo ratings yet

- Accounting Dec 2007 Part1Document13 pagesAccounting Dec 2007 Part1AR SikdarNo ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- Cost Accounting - June 2010 Dec 2010 and June 2011Document71 pagesCost Accounting - June 2010 Dec 2010 and June 2011Mwila ChambaNo ratings yet

- Management AccountingDocument5 pagesManagement AccountingHamdan SheikhNo ratings yet

- ACCT6003 Assessment 2 T1 2020 Brief PDFDocument7 pagesACCT6003 Assessment 2 T1 2020 Brief PDFbhavikaNo ratings yet

- Financial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017Document4 pagesFinancial Accounting ACCT 201 Assignment 4: Last Date For Submission 16 December 2017jhie boterNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Chapter 1: Meaning, Characteristics and Rationales of Public EnterprisesDocument80 pagesChapter 1: Meaning, Characteristics and Rationales of Public EnterprisesYohanes DebeleNo ratings yet

- Public Chapter 4Document9 pagesPublic Chapter 4Yohanes DebeleNo ratings yet

- Financial MarketsDocument40 pagesFinancial MarketsYohanes DebeleNo ratings yet

- Social Media MarketingDocument4 pagesSocial Media MarketingYohanes DebeleNo ratings yet

- Linkedin S.marketingDocument6 pagesLinkedin S.marketingYohanes DebeleNo ratings yet

- Chapter-3 - Working Capital MGTDocument57 pagesChapter-3 - Working Capital MGTRaunak YadavNo ratings yet

- Accounting 10th Edition Hoggett Test BankDocument25 pagesAccounting 10th Edition Hoggett Test Bankformeretdoveshipx9yi8100% (29)

- CAF 05 FAR 1 Past Paper SC E Learning 1 PDFDocument223 pagesCAF 05 FAR 1 Past Paper SC E Learning 1 PDFaeman0% (1)

- (L) Chapter 13 Accounts For Limited CompanyDocument13 pages(L) Chapter 13 Accounts For Limited CompanyCHZE CHZI CHUAHNo ratings yet

- Cash Flow Analysis For Nestle India LTDDocument2 pagesCash Flow Analysis For Nestle India LTDVinayak Arun SahiNo ratings yet

- Balance Sheet Analysis:: Financial Accounting AssignmentDocument2 pagesBalance Sheet Analysis:: Financial Accounting AssignmentadirisinNo ratings yet

- Problem 1: Rizal Review CenterDocument6 pagesProblem 1: Rizal Review CenterrenoNo ratings yet

- Enquiry Details:: Bureau Name Response DetailsDocument4 pagesEnquiry Details:: Bureau Name Response DetailsRavinder singhNo ratings yet

- CHP 5Document72 pagesCHP 5Khaled A. M. El-sherifNo ratings yet

- Accounting Equation: Chapter TwoDocument8 pagesAccounting Equation: Chapter Twojohn adamNo ratings yet

- Time Value of Money Assignment A. GutierrezDocument6 pagesTime Value of Money Assignment A. GutierrezTPA TPANo ratings yet

- Review Material Secured Transactions Fall Semester 2021Document13 pagesReview Material Secured Transactions Fall Semester 2021OlavoNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- Types of Accounting ErrorsDocument8 pagesTypes of Accounting ErrorsHassleBustNo ratings yet

- Solution Manual For Financial and Managerial Accounting 8th by WildDocument45 pagesSolution Manual For Financial and Managerial Accounting 8th by WildTiffanyFowlercftzi100% (42)

- AnswerDocument3 pagesAnswerMoffat HarounNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- Weekly Exam 5Document9 pagesWeekly Exam 5Deyn EstoqueNo ratings yet

- Ashfaq Textile Mills LTD - 2001Document10 pagesAshfaq Textile Mills LTD - 2001Prince AdyNo ratings yet

- BST - FAQ On BNM - Moratorium 6 Months PDFDocument5 pagesBST - FAQ On BNM - Moratorium 6 Months PDFAin AdibahNo ratings yet

- Payment Installment AgreementDocument5 pagesPayment Installment AgreementRia KudoNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Statement of Cash FlowsDocument19 pagesStatement of Cash FlowsRiz NBNo ratings yet

- Payout Policy: © 2019 Pearson Education LTDDocument7 pagesPayout Policy: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Cash Book - AnswersDocument6 pagesCash Book - AnswersJoshNo ratings yet

- Exercises Intangible Assets Munich University Financial AccountingDocument3 pagesExercises Intangible Assets Munich University Financial AccountingNaresh SehdevNo ratings yet

- Chapter 4: Liquidation Based Valuation MC Problems 1 WW IncDocument153 pagesChapter 4: Liquidation Based Valuation MC Problems 1 WW IncKim BihagNo ratings yet

- Application For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenDocument2 pagesApplication For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenRAJENDRA BHANDARI50% (2)