Professional Documents

Culture Documents

Cost Accounting Midterm Exam AKT103-AKT32-W

Uploaded by

sangita indrianeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting Midterm Exam AKT103-AKT32-W

Uploaded by

sangita indrianeCopyright:

Available Formats

ESSAY

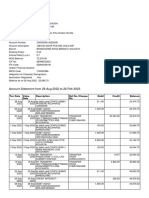

MID-TERM EXAMINATION

AKUNTANSI BIAYA / COST ACCOUNTING

AKT 103 – AKT32-W-

Session: Semester 3 – AY 2021/2022 Date: 28 Oktober 2021

Faculty: Economics and Social Sciences Duration: 10:15 – 12:45 (150 minutes)

Study Program: Accounting Permitted Materials: Open Book

Level of Study: Undergraduate (S1)

INSTRUCTIONS TO CANDIDATES:

1. Check the following exam paper information:

Exam paper:

Total number of pages: 3 (including this page)

Attached materials: ---

Total number of sections: 4

Total number of questions: 18

Instructions:

You are required to answer all questions. The total number of marks

you can be awarded is 100 marks. For specific instructions, please refer

to the appropriate sections.

2. Please write your name and student ID on the exam paper and answer sheets.

Student Name ……………………………………………..

Student ID ……………………………………………..

3. Candidates may use this exam paper to write notes as necessary but should not remove

it from the examination venue for any reason.

4. Any form of cheating or attempt to cheat is a serious offence leading to dismissal.

MID - Term Examination – Semester 3/ AY 2021/2022

Problem 1 (25%)

Baba Black Sheep Corporation manufacturing costing system uses a three-part classification

of direct materials, direct manufacturing labor, and manufacturing overhead costs. The

following items pertain to Baba Black Sheep Corporation:

Revenues $ 18,000,000

Marketing, distribution, and customer-service costs 1,860,000

General and administrative costs 1,020,000

Plant insurance 60,000

Plant utilities 360,000

Repairs and maintenance—plant 240,000

Equipment leasing costs 960,000

Depreciation—plant, building, and equipment 630,000

Direct materials purchased 3,840,000

Direct manufacturing labor 3,180,000

Indirect manufacturing labor 1,440,000

Indirect materials 420,000

Direct materials inventory, Jan. 1, 2020 1,950,000

Direct materials inventory, Dec. 31, 2020 1,020,000

Finished goods inventory, Jan. 1, 2020 3,690,000

Finished goods inventory, Dec. 31, 2020 3,060,000

Work-in-process inventory, Jan. 1, 2020 2,490,000

Work-in-process inventory, Dec. 31, 2020 2,160,000

Required:

1. Prepare a schedule for the cost of goods manufactured for 2020. (10%)

2. Prepare the income statement for 2020. (5%)

3. Compute the prime cost and conversion cost to production. (5%)

4. Would the sales manager’s salary (included in marketing, distribution, and customer-

service costs) be accounted for any difference if the Baba Black Sheep Corporation were

a merchandising-sector company instead of a manufacturing-sector company (5%)

Problem 2 (25%)

Black Pink Company prints custom training material for corporations. The business was

started January 1, 2020. The company uses a normal-costing system. It has two direct cost

pools: materials and labor, and one indirect cost pool: overhead. Overhead is charged to

printing jobs on the basis of direct labor cost. There were two jobs in process on December

31, 2020: Job 101 and Job 102. The information is available for 2020: Budgeted direct labor

costs $450,000; Budgeted overhead costs $540,000; Costs of actual material used

$379,500; Actual direct labor costs $446,250; and Actual overhead costs $528,000. Black

Widow Company has no finished goods inventories because all printing jobs are transferred

to cost of goods sold when completed. Costs added to each job as of December 31, 2020

are as follows:

Job 101 Job 102

Direct material costs $10,860 $20,490

Direct labor costs $13,500 $21,750

Required:

1. Compute the overhead allocation rate. (5%)

2. Calculate the balance in ending work in process and cost of goods sold before any

adjustments for under-allocated or over-allocated overhead. (5%)

3. Calculate under-allocated or over-allocated overhead. (5%)

4. Calculate the ending balances in work in process and cost of goods sold if the under-

allocated or over-allocated overhead amount is as prorated based on overhead

allocation in 2020 (before proration). (10%)

Cost Accounting Page 2 of 3

MID - Term Examination – Semester 3/ AY 2021/2022

Problem 3 (30%)

Byford Company manufactures car seats in its San Fransisco plant. Each car seat passes

through the assembly department and the testing department. This problem focuses on the

testing department. Direct materials are added when the testing department process is 90%

complete. Conversion costs are added evenly during the testing department’s process. As work

in assembly is completed, each unit is immediately transferred to testing. As each unit is

completed in testing, it is immediately transferred to Finished Goods. Comfort Company uses

the weighted-average method of process costing. Data for the testing department for October

2021 are as follows:

Physical Transferred- Direct Conversion

Units In Costs Materials Costs

a

Work in process, October 1 2,500 $ 977,500 $ 0 $ 278,490

Transferred in during October 2021 7,500

Completed during October 2021 8,800

Work in process, October 31b 1,200

Total costs added during October 2021 $2,572,500 $3,234,900 $ 1,318,600

a

Degree of completion: transferred-in costs, 100%; direct materials, 0%; conversion costs, 70%

b

Degree of completion: transferred-in costs, 100%; direct materials, 0%; conversion costs, 60%

Requires

1. Summarize the flow of physical units of output (step 1). 5%

2. Compute the equivalent units for direct material and conversion cost (step 2). 5%

3. Summarize the total costs to account for direct material and conversion costs (step 3). 5%

4. Compute the cost per equivalent unit for direct material and conversion cost (step 4). 5%

5. Assign costs to the units completed and units ending work-in-process inventory for direct

material and conversion costs (step 5). 5%

6. Prepare journal entries for October, transfers from the assembly department to the testing

department and from the testing department to Finished Goods. (5%)

Problem 4 (20%)

Mediterranean Furniture is a manufacturer of furniture products for Asian customers. The

plant manager of Mediterranean Furniture, Willy Joo, obtains the following information for

Job #007 in September 2021. Fifty-five units were started, and five spoiled units were

detected and rejected at final inspection, yielding 50 good units. The spoiled units were

considered to be normal spoilage. Costs assigned before the inspection point are $5,500 per

unit. The current disposal price of the spoiled units is $220 per unit. When the spoilage is

detected, the spoiled goods are inventoried at $220 per unit. Assume that the five spoiled

units of Mediterranean Furniture’s Job #007 can be reworked for a total cost of $7,500. A

total cost of $25,000 associated with these units has already been assigned to Job #007

before the rework. Assume that Job #007 of Mediterranean Furniture generates normal

scrap with a total sales value of $500 (it is assumed that the scrap returned to the storeroom

is sold quickly).

Required:

1. Compute the normal spoilage rate? (5%)

2. Prepare the journal entries to record the normal spoilage if the spoilage is related to a

common all jobs. (5%)

3. Prepare the journal entries for the rework if the rework is considered to be a specific job.

(5%)

4. Prepare the journal entries if the value of scrap is material, and scrap is recognized as

inventory at the time of production and is recorded at its net realizable value. (5%)

---------- end of exam paper ---------

Cost Accounting Page 3 of 3

You might also like

- Mid-Term Exam Cost Accounting EssayDocument3 pagesMid-Term Exam Cost Accounting Essaysangita indrianeNo ratings yet

- ACTG360 - Cost Accounting - Midterm Exam - 01Document3 pagesACTG360 - Cost Accounting - Midterm Exam - 01Nguyễn Thị Thanh ThúyNo ratings yet

- VIRGEN MILAGROSA UNIVERSITY COST ACCOUNTING QUIZDocument4 pagesVIRGEN MILAGROSA UNIVERSITY COST ACCOUNTING QUIZMary Joanne Tapia33% (3)

- Comprehensive Exam A: Cost Accounting SolutionsDocument30 pagesComprehensive Exam A: Cost Accounting Solutionsakeila3100% (1)

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- COMPREHENSIVE EXAMINATION A REVIEWDocument28 pagesCOMPREHENSIVE EXAMINATION A REVIEWJoshua GibsonNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Tugas Individual 345Document7 pagesTugas Individual 345Mochamad PutraNo ratings yet

- Comp ExamsDocument28 pagesComp ExamsTomoko KatoNo ratings yet

- CA Tutorial - Week 2 - QuestionsDocument3 pagesCA Tutorial - Week 2 - QuestionsAndhika YogaraksaNo ratings yet

- SCM Assignment Activity Sept 20 2020 Answer Key PDF FreeDocument5 pagesSCM Assignment Activity Sept 20 2020 Answer Key PDF FreeChizu ChizuNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Chapter Review: 6-8j ProblemsDocument18 pagesChapter Review: 6-8j ProblemsfauziahezzyNo ratings yet

- I.U. Faculty of Political Science Take Home Midterm Exam Cost and Managerial Accounting 2020-2021 Spring Assoc - Prof.Dr - İpek TürkerDocument3 pagesI.U. Faculty of Political Science Take Home Midterm Exam Cost and Managerial Accounting 2020-2021 Spring Assoc - Prof.Dr - İpek Türkerİsmail KorkmazNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- Iqra University Cost Accounting PaperDocument5 pagesIqra University Cost Accounting PaperHaris KhanNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- Midterm-Exam Managerial Accounting - Fall - 2020-1Document9 pagesMidterm-Exam Managerial Accounting - Fall - 2020-1Emna NegrichiNo ratings yet

- Question - Parallel Quiz - Final Term - Cost Accounting 22 - 23Document6 pagesQuestion - Parallel Quiz - Final Term - Cost Accounting 22 - 23Gistima Putra JavandaNo ratings yet

- JOB ORDER COSTING Practice SetDocument5 pagesJOB ORDER COSTING Practice SetGoogle UserNo ratings yet

- 05.16.2023 ASSIGNMENT Activity Problem With Theories-Process Costing and JOB Order Costing - With ANSWER KEYDocument11 pages05.16.2023 ASSIGNMENT Activity Problem With Theories-Process Costing and JOB Order Costing - With ANSWER KEYAngel Cil RuleteNo ratings yet

- LMSDocument4 pagesLMSJohn Carlo LorenzoNo ratings yet

- Mid Exam For COST I - Its Cost Lecture NoteDocument3 pagesMid Exam For COST I - Its Cost Lecture Notehatenon1415No ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Practice Questions - Class Excercises 2Document12 pagesPractice Questions - Class Excercises 2Chris With LuvNo ratings yet

- ACC103 Assign Sem 1, 2020 PDFDocument9 pagesACC103 Assign Sem 1, 2020 PDFWSLee0% (1)

- PGP 2019 CM Exam Question Paper SharedDocument19 pagesPGP 2019 CM Exam Question Paper SharedAMARJEET KUMARNo ratings yet

- JIT CostingDocument2 pagesJIT CostinghellokittysaranghaeNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Marketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentDocument8 pagesMarketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentReina TrầnNo ratings yet

- Cost Compiled Past Papers UpdatedDocument364 pagesCost Compiled Past Papers UpdatedAbubakar PalhNo ratings yet

- Sem 1, 2009 AnnotatedDocument6 pagesSem 1, 2009 Annotatedmoksiuwai100% (2)

- Job Costing Chapter 4 Key ConceptsDocument8 pagesJob Costing Chapter 4 Key Conceptsangelbear2577100% (1)

- Remedial 2Document6 pagesRemedial 2Jelwin Enchong BautistaNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDocument9 pagesManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNo ratings yet

- Cost and Management Accounting 01 _ Class Notes (1)Document114 pagesCost and Management Accounting 01 _ Class Notes (1)saurabhNo ratings yet

- Comprehensive Exam A: Cost Accounting ProblemsDocument13 pagesComprehensive Exam A: Cost Accounting ProblemsKeith Joanne SantiagoNo ratings yet

- Acct1003 Midsemester Exam08-09 SOLUTIONSDocument7 pagesAcct1003 Midsemester Exam08-09 SOLUTIONSKimberly KangalooNo ratings yet

- ACCT 2022 - FS First-Exam-ADocument6 pagesACCT 2022 - FS First-Exam-AMr MDRKHMNo ratings yet

- DEPA Cost Acctng.Document39 pagesDEPA Cost Acctng.Maria DyNo ratings yet

- Practice Exam 22-23 EBC2164 Without Solutions-1-1Document14 pagesPractice Exam 22-23 EBC2164 Without Solutions-1-1sjirandrien01No ratings yet

- Cost 1st Summative AssessmentDocument13 pagesCost 1st Summative AssessmentApas Pel Joshua M.No ratings yet

- Process-CostingDocument3 pagesProcess-Costingallain.jeremy13No ratings yet

- Cost Quiz 2Document5 pagesCost Quiz 2alexissosing.cpaNo ratings yet

- Practice Sheet 3 - CH4 - 4ADocument4 pagesPractice Sheet 3 - CH4 - 4AAhmed HyderNo ratings yet

- Costing analysis helps electronics firm's "make or buyDocument8 pagesCosting analysis helps electronics firm's "make or buyVenessa YongNo ratings yet

- Ma As2Document6 pagesMa As2Omar AbidNo ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- Final ExamDocument4 pagesFinal ExamJojo EstebanNo ratings yet

- Cost Accounting - June 2010 Dec 2010 and June 2011Document71 pagesCost Accounting - June 2010 Dec 2010 and June 2011Mwila ChambaNo ratings yet

- Answer Sheet: Academic Year:2012 EC, Year: 2Document4 pagesAnswer Sheet: Academic Year:2012 EC, Year: 2samuel debebe100% (1)

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- Tutorial 6Document4 pagesTutorial 6NurSyazwaniRosliNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Construction Quantity Surveying: A Practical Guide for the Contractor's QSFrom EverandConstruction Quantity Surveying: A Practical Guide for the Contractor's QSRating: 5 out of 5 stars5/5 (2)

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Company Profile: Inside Look at Leading Jacket ManufacturerDocument41 pagesCompany Profile: Inside Look at Leading Jacket ManufacturerVanika SharmaNo ratings yet

- English Khmer Glossary of Accounting and Auditing Terminology (2009) PDFDocument365 pagesEnglish Khmer Glossary of Accounting and Auditing Terminology (2009) PDFHum Chamroeun100% (2)

- MANGILIMAN, Neil Francel Domingo (Sep 28)Document8 pagesMANGILIMAN, Neil Francel Domingo (Sep 28)Neil Francel D. MangilimanNo ratings yet

- Accounting InformationDocument3 pagesAccounting Informationnenette cruzNo ratings yet

- Derivatives FundamentalsDocument1 pageDerivatives FundamentalsShailaja RaghavendraNo ratings yet

- A Study On Consumer Buying Behavior of Young Adults Towards Coffee BrandDocument13 pagesA Study On Consumer Buying Behavior of Young Adults Towards Coffee BrandRomeo ChuaNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- Social Support For Expatriates Through Virtual Platforms: Exploring The Role of Online and Offline ParticipationDocument33 pagesSocial Support For Expatriates Through Virtual Platforms: Exploring The Role of Online and Offline ParticipationAniss AitallaNo ratings yet

- DLL FABM Week17Document3 pagesDLL FABM Week17sweetzelNo ratings yet

- Principles of Engineering EconomyDocument14 pagesPrinciples of Engineering Economyabhilash gowdaNo ratings yet

- Chapter 4 SlideDocument45 pagesChapter 4 Slidekhanhly2k41107No ratings yet

- Class 7 - Spring 2021 - TopostDocument24 pagesClass 7 - Spring 2021 - TopostMahin AliNo ratings yet

- Increase Google Reviews Using G Popcard and Must Know The BenefitsDocument3 pagesIncrease Google Reviews Using G Popcard and Must Know The Benefitsgpopcard.seoNo ratings yet

- Parfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandDocument21 pagesParfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandrheaNo ratings yet

- Tyco fraud investigation timelineDocument12 pagesTyco fraud investigation timelineSumit Sharma100% (1)

- Mobile App Development & Digital Marketing SolutionsDocument15 pagesMobile App Development & Digital Marketing SolutionsAru KNo ratings yet

- Final Exam Theories ValuationDocument6 pagesFinal Exam Theories ValuationBLN-Hulo- Ronaldo M. Valdez SRNo ratings yet

- Business Management - Study and Revision Guide - Paul Hoang - Hodder 2016Document194 pagesBusiness Management - Study and Revision Guide - Paul Hoang - Hodder 2016Cecy Vallejo LeónNo ratings yet

- About Us Page SEO SummaryDocument19 pagesAbout Us Page SEO Summarymajor raveendraNo ratings yet

- Extracting Value From Municipal Solid Waste For Greener Cities: The Case of The Republic of KoreaDocument5 pagesExtracting Value From Municipal Solid Waste For Greener Cities: The Case of The Republic of KoreajakariaNo ratings yet

- Booking Invoice - M06AI23I17058515 - LTADocument1 pageBooking Invoice - M06AI23I17058515 - LTANishant DuggalNo ratings yet

- Shrimp Farming in Pakistan Urdu GuideDocument17 pagesShrimp Farming in Pakistan Urdu GuidesohailauhNo ratings yet

- The Application of Machine Learning and Deep LearnDocument20 pagesThe Application of Machine Learning and Deep LearnFran MoralesNo ratings yet

- Irrevocable Letter of CreditDocument1 pageIrrevocable Letter of CreditJunvy AbordoNo ratings yet

- Home Credit India Welcome Script Provides Guidance for New Loan CustomersDocument5 pagesHome Credit India Welcome Script Provides Guidance for New Loan CustomersPranali ThombeNo ratings yet

- Firming Up Inequality: How Rising Between-Firm Dispersion Contributed to Rising U.S. Earnings InequalityDocument50 pagesFirming Up Inequality: How Rising Between-Firm Dispersion Contributed to Rising U.S. Earnings InequalitySiti Nur AqilahNo ratings yet

- Bank StatementDocument5 pagesBank StatementSANJIB GHOSHNo ratings yet

- EContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Document23 pagesEContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Tom CruiseNo ratings yet

- PR Week 5 CVPDocument3 pagesPR Week 5 CVPAyhuNo ratings yet

- Digitalgyanweb20 Blogspot Com PDFDocument8 pagesDigitalgyanweb20 Blogspot Com PDFNirmaan SinghNo ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)