Professional Documents

Culture Documents

Brian LTD Starts Selling Footballs in 20x2 Although Each Ball

Uploaded by

Miroslav GegoskiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brian LTD Starts Selling Footballs in 20x2 Although Each Ball

Uploaded by

Miroslav GegoskiCopyright:

Available Formats

Brian Ltd starts selling footballs in 20X2 Although each

ball #8237

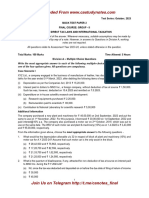

Brian Ltd starts selling footballs in 20X2. Although each ball looks the same, the unit cost of

manufacture (which is done in batches) has fluctuated during the period. Details of the costs are

as follows:Details of sales are as follows:The closing inventory was counted on 30 June and

found to be 70 units.Requireda. Calculate the cost of sales for the year ended 30 June 20X3

and detail the value of the closing inventory using the FIFO, LIFO and weighted average

inventory valuation cost flow methods (inventory movement sheets are required).b. Prepare

extracts from the statement of profit and loss for the year ended 30 June 20X3 based on the

three valuation methods - explain why a different profit is reported under each method.c. What

inventory valuation method is not permitted under IAS 2?d. Explain in which circumstances (if

any) it would be appropriate to use the following cost flow assumptions:i. First in first out (LIFO)

assumption;ii. Last in, first out (LIFO) assumption;iii. Specific identification assumption;iv.

Weighted average cost assumption?View Solution:

Brian Ltd starts selling footballs in 20X2 Although each ball

ANSWER

http://paperinstant.com/downloads/brian-ltd-starts-selling-footballs-in-20x2-although-each-ball/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- MSU Acc408 Inclass Test 1 211022Document3 pagesMSU Acc408 Inclass Test 1 211022Kudzaishe chigwaNo ratings yet

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsFrom EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsNo ratings yet

- Quiz 2Document2 pagesQuiz 2I.E. Business SchoolNo ratings yet

- Accountancy & Auditing-II 2023Document2 pagesAccountancy & Auditing-II 2023rabia khanNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Mba104 - Cost and Management Accounting PDFDocument3 pagesMba104 - Cost and Management Accounting PDFAnurag VarmaNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Managerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Document5 pagesManagerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Nodeh Deh SpartaNo ratings yet

- DIP1.ACC - UNIT30.your NAME - IDDocument10 pagesDIP1.ACC - UNIT30.your NAME - IDAbdo Salem9090No ratings yet

- Bugs Bunny A Wholesale Dealer in Ready Made Menswear Achieves ADocument1 pageBugs Bunny A Wholesale Dealer in Ready Made Menswear Achieves AMiroslav GegoskiNo ratings yet

- Past Year Exam Paper Folder SLDocument50 pagesPast Year Exam Paper Folder SLAdouko Jean-Eudes E AssiriNo ratings yet

- MBG-206 2019-20Document4 pagesMBG-206 2019-20senthil.jpin8830No ratings yet

- 26th JULY 2017 BUS 3313cost Accounting RoyDocument4 pages26th JULY 2017 BUS 3313cost Accounting RoyVinsmoke KaidoNo ratings yet

- Accounting Principles: 11 Edition - US GAAPDocument73 pagesAccounting Principles: 11 Edition - US GAAPPutu Deny WijayaNo ratings yet

- BM Paper 2 - MarkschemeDocument12 pagesBM Paper 2 - MarkschemeSonam ThakkarNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- MSC Practice QuestsDocument2 pagesMSC Practice Questsmuyi kunleNo ratings yet

- (BUSINESS ADMINISTRATION) Company Law and Secretarial PracticeDocument5 pages(BUSINESS ADMINISTRATION) Company Law and Secretarial PracticeGuruKPONo ratings yet

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaNo ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDocument7 pagesACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldNo ratings yet

- Last Year PaperDocument7 pagesLast Year PaperVivek ChauhanNo ratings yet

- Business Management Standard Level Paper 2: Instructions To CandidatesDocument7 pagesBusiness Management Standard Level Paper 2: Instructions To CandidatesjinLNo ratings yet

- Topic 2 - PPE - Eng - ExerciseDocument4 pagesTopic 2 - PPE - Eng - Exercisehuynhgiade1805No ratings yet

- Set: A: Instructions For CandidatesDocument10 pagesSet: A: Instructions For CandidatessaurabhNo ratings yet

- December 2003 ACCA Paper 2.5 QuestionsDocument10 pagesDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Assignment #1 Questions ONLY (ISpace)Document4 pagesAssignment #1 Questions ONLY (ISpace)ziqingyeNo ratings yet

- Break Even TutorialDocument4 pagesBreak Even Tutorialleeroybradley7No ratings yet

- Exercises P Class3-2022Document6 pagesExercises P Class3-2022Angel MéndezNo ratings yet

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- Tutorial Topic2 Questions-1Document4 pagesTutorial Topic2 Questions-1Aliyana SmolderhalderNo ratings yet

- Gambit Corporation Purchased A New Plant Asset On April 1Document1 pageGambit Corporation Purchased A New Plant Asset On April 1Freelance WorkerNo ratings yet

- Final Exam Prep Exam 2 CFIDocument7 pagesFinal Exam Prep Exam 2 CFIdereck memeNo ratings yet

- KL Management Information May Jun 2017Document3 pagesKL Management Information May Jun 2017Laskar REAZNo ratings yet

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarNo ratings yet

- SBR Specemin 2Document26 pagesSBR Specemin 2Leamarie LimNo ratings yet

- Department of Mechanical Engineering: Question BankDocument22 pagesDepartment of Mechanical Engineering: Question Bankpasrinivasan_1997352No ratings yet

- MCQs SQ - 12 - July - 2019Document4 pagesMCQs SQ - 12 - July - 2019omerogolddNo ratings yet

- Topic 1: Conceptual FrameworkDocument16 pagesTopic 1: Conceptual FrameworkHuỳnh Như PhạmNo ratings yet

- Ktqte1-N2 - 2 9-3 3Document6 pagesKtqte1-N2 - 2 9-3 3Trần Thanh SơnNo ratings yet

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

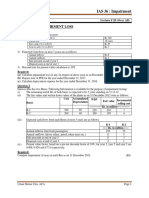

- 20 - 24 Lecture Notes (1-4) IAS-36 (Impairment)Document4 pages20 - 24 Lecture Notes (1-4) IAS-36 (Impairment)manadish nawaz100% (1)

- FORM 24. Return of Allotment of Shares. (COMPANIES REGULATIONS, 1966 - P.U. 173 - 66)Document4 pagesFORM 24. Return of Allotment of Shares. (COMPANIES REGULATIONS, 1966 - P.U. 173 - 66)auni fildzahNo ratings yet

- Short Term Planning Illustrations QuestionsDocument3 pagesShort Term Planning Illustrations Questionsfrancis MagobaNo ratings yet

- Principles of Accounts IIDocument10 pagesPrinciples of Accounts IIMohamed MubarakNo ratings yet

- Use The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternDocument6 pagesUse The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternPRESCIOUS JOY CERALDENo ratings yet

- Tutorial AccountingDocument5 pagesTutorial AccountingMevika MerchantNo ratings yet

- 54540bos43716 p3q PDFDocument6 pages54540bos43716 p3q PDFPul pehlad pur 14 BadarpurNo ratings yet

- Quantitative Techniques Comprehensive Mock ExaminationsDocument15 pagesQuantitative Techniques Comprehensive Mock ExaminationsLuke ShawNo ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- Marginal Cost Questions - Past ExamDocument3 pagesMarginal Cost Questions - Past ExamLouisa HasfordNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- CVP & Alternate Costing Questions Baf Ii Mu-MainDocument10 pagesCVP & Alternate Costing Questions Baf Ii Mu-MainChristopher LoisulieNo ratings yet

- MG6863 EngineeringEconomicsquestionbank 2Document20 pagesMG6863 EngineeringEconomicsquestionbank 2Dhamotharan SivasubramaniamNo ratings yet

- BBF201 - 05-Jan 2024 - Assignment 1 (Question)Document4 pagesBBF201 - 05-Jan 2024 - Assignment 1 (Question)elamathey.sagadavanNo ratings yet

- TC9QD16Document6 pagesTC9QD16kalowekamoNo ratings yet

- Be CFFDocument6 pagesBe CFFisheikhNo ratings yet

- Suppose That People Consume Only Three Goods As Shown inDocument1 pageSuppose That People Consume Only Three Goods As Shown inMiroslav Gegoski0% (1)

- Suppose That Congress Imposes A Tariff On Imported Autos ToDocument1 pageSuppose That Congress Imposes A Tariff On Imported Autos ToMiroslav GegoskiNo ratings yet

- Suppose That Fixed Costs For A Firm in The AutomobileDocument1 pageSuppose That Fixed Costs For A Firm in The AutomobileMiroslav GegoskiNo ratings yet

- Suppose That A Perfectly Competitive Firm Has The Following TotaDocument1 pageSuppose That A Perfectly Competitive Firm Has The Following TotaMiroslav GegoskiNo ratings yet

- Suppose That Congress Passes A Law Requiring Employers To ProvidDocument1 pageSuppose That Congress Passes A Law Requiring Employers To ProvidMiroslav GegoskiNo ratings yet

- Suppose That in A Year An American Worker Can ProduceDocument1 pageSuppose That in A Year An American Worker Can ProduceMiroslav GegoskiNo ratings yet

- Suppose That A Market Is Described by The Following SupplyDocument1 pageSuppose That A Market Is Described by The Following SupplyMiroslav GegoskiNo ratings yet

- Suppose That A Firm S Production Function Is Given by TheDocument1 pageSuppose That A Firm S Production Function Is Given by TheMiroslav GegoskiNo ratings yet

- Suppose That Prior To The Passage of The Truth inDocument1 pageSuppose That Prior To The Passage of The Truth inMiroslav GegoskiNo ratings yet

- Suppose That Every Driver Faces A 1 Probability of AnDocument1 pageSuppose That Every Driver Faces A 1 Probability of AnMiroslav GegoskiNo ratings yet

- Suppose That There Are 10 Million Workers in Canada andDocument1 pageSuppose That There Are 10 Million Workers in Canada andMiroslav GegoskiNo ratings yet

- Suppose Douglas and Ziffel Have Properties That Adjoin The FarmDocument1 pageSuppose Douglas and Ziffel Have Properties That Adjoin The FarmMiroslav GegoskiNo ratings yet

- Suppose That The Owner of Boyer Construction Is Feeling TheDocument1 pageSuppose That The Owner of Boyer Construction Is Feeling TheMiroslav GegoskiNo ratings yet

- Suppose That A Paper Mill Feeds A Downstream Box MillDocument1 pageSuppose That A Paper Mill Feeds A Downstream Box MillMiroslav GegoskiNo ratings yet

- Suppose One of Your Clients Is Four Years Away FromDocument1 pageSuppose One of Your Clients Is Four Years Away FromMiroslav GegoskiNo ratings yet

- Sung Sam Inc Is Currently DesigningDocument1 pageSung Sam Inc Is Currently DesigningMiroslav GegoskiNo ratings yet

- Suppose A Technological Advance Reduces The Cost of Making CompuDocument1 pageSuppose A Technological Advance Reduces The Cost of Making CompuMiroslav GegoskiNo ratings yet

- Suppose That The Marshall Islands Does Not Trade With TheDocument1 pageSuppose That The Marshall Islands Does Not Trade With TheMiroslav GegoskiNo ratings yet

- Structural Unemployment Is Sometimes Said To Result From A MismaDocument1 pageStructural Unemployment Is Sometimes Said To Result From A MismaMiroslav GegoskiNo ratings yet

- Stowe Automotive Is Considering An Offer From Indula To BuildDocument1 pageStowe Automotive Is Considering An Offer From Indula To BuildMiroslav GegoskiNo ratings yet

- Suppose Firms Become Very Optimistic About Future Business CondiDocument1 pageSuppose Firms Become Very Optimistic About Future Business CondiMiroslav GegoskiNo ratings yet

- Suppose A Computer Virus Disables The Nation S Automatic TellerDocument1 pageSuppose A Computer Virus Disables The Nation S Automatic TellerMiroslav GegoskiNo ratings yet

- Suppose An Appliance Manufacturer Is Doing A Regression AnalysisDocument1 pageSuppose An Appliance Manufacturer Is Doing A Regression AnalysisMiroslav GegoskiNo ratings yet

- Suppose That A Fall in Consumer Spending Causes A RecessionDocument1 pageSuppose That A Fall in Consumer Spending Causes A RecessionMiroslav GegoskiNo ratings yet

- Suppose An Economy Is in Long Run Equilibrium A Use TheDocument1 pageSuppose An Economy Is in Long Run Equilibrium A Use TheMiroslav GegoskiNo ratings yet

- Suppose That A Ceo S Goal Is To Increase Profitability andDocument1 pageSuppose That A Ceo S Goal Is To Increase Profitability andMiroslav GegoskiNo ratings yet

- Stamp Collecting Has Become An IncreasinglyDocument1 pageStamp Collecting Has Become An IncreasinglyMiroslav GegoskiNo ratings yet

- Suppose An Enhanced Effectiveness of Cooperative Advertising OccDocument1 pageSuppose An Enhanced Effectiveness of Cooperative Advertising OccMiroslav GegoskiNo ratings yet

- Refer To Table in This Chapter and Answer The FollowingDocument1 pageRefer To Table in This Chapter and Answer The FollowingMiroslav GegoskiNo ratings yet

- Royersford Knitting Mills LTD Sells A Line of Women S KnitDocument1 pageRoyersford Knitting Mills LTD Sells A Line of Women S KnitMiroslav GegoskiNo ratings yet

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (94)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4.5 out of 5 stars4.5/5 (3)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachFrom EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachRating: 3.5 out of 5 stars3.5/5 (6)

- Summary: Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant by W. Chan Kim & Renee Mauborgne: Key Takeaways, Summary & AnalysisFrom EverandSummary: Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant by W. Chan Kim & Renee Mauborgne: Key Takeaways, Summary & AnalysisRating: 5 out of 5 stars5/5 (4)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Having It All: Achieving Your Life's Goals and DreamsFrom EverandHaving It All: Achieving Your Life's Goals and DreamsRating: 4.5 out of 5 stars4.5/5 (65)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (365)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Vusi: Business & Life Lessons from a Black DragonFrom EverandVusi: Business & Life Lessons from a Black DragonRating: 4.5 out of 5 stars4.5/5 (44)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (31)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderFrom EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderRating: 4.5 out of 5 stars4.5/5 (62)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Summary of The 33 Strategies of War by Robert GreeneFrom EverandSummary of The 33 Strategies of War by Robert GreeneRating: 3.5 out of 5 stars3.5/5 (21)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberFrom EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberRating: 5 out of 5 stars5/5 (39)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeFrom EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeRating: 4 out of 5 stars4/5 (49)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- Every Tool's a Hammer: Life Is What You Make ItFrom EverandEvery Tool's a Hammer: Life Is What You Make ItRating: 4.5 out of 5 stars4.5/5 (249)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (25)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Your AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsFrom EverandYour AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsNo ratings yet

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeFrom EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeRating: 5 out of 5 stars5/5 (25)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)