Professional Documents

Culture Documents

The Game Place Is A Retail Store That Sells Computer: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Game Place Is A Retail Store That Sells Computer: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghCopyright:

Available Formats

The Game Place is a retail store that sells computer

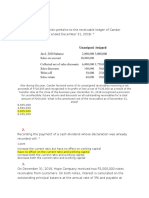

The Game Place is a retail store that sells computer games, owned by Matt Huffman. On

December 31, 2019, the firm's general ledger contained the accounts and balances below. All

account balances are normal.Cash .........................................................$ 34,465Accounts

Receivable ..........................................1,669Prepaid Advertising

.............................................480Supplies ...........................................................425Merchandise

Inventory .....................................18,500Store Equipment

.............................................30,000Accumulated Depreciation-Store Equipment

...........3,000Office Equipment .............................................4,800Accumulated Depreciation-

Office Equipment .........1,500Notes Payable, due 2020 ...................................22,500Accounts

Payable .............................................5,725Wages PayableSocial Security Tax PayableMedicare

Tax PayableUnearned Seminar Fees .....................................7,500Interest PayableMatt

Huffman, Capital ....................................43,000Matt Huffman, Drawing

..................................18,000Income SummarySales

.........................................................163,660Sales Discounts

.................................................180Seminar Fee IncomePurchases

....................................................92,500Purchases Returns and Allowances

..........................770Freight In ........................................................275Rent Expense

................................................26,400Wages Expense

.............................................18,000Payroll Taxes Expense

.......................................1,811Depreciation Expense-Store EquipmentDepreciation Expense-

Office EquipmentAdvertising ExpenseSupplies ExpenseInterest Expense

..............................................150INSTRUCTIONS1. Prepare the Trial Balance section of a

10-column worksheet. The worksheet covers the year ended December 31, 2019.2. Enter the

adjustments below in the Adjustments section of the worksheet. Identify each adjustment with

the appropriate letter.3. Complete the worksheet.ADJUSTMENTSa.-b. Merchandise inventory at

December 31, 2019, was counted and determined to be $21,200.c. The amount recorded as

prepaid advertising represents $480 paid on September 1, 2019, for six months of advertising.d.

The amount of supplies on hand at December 31 was $125.e. Depreciation on store equipment

was $4,500 for 2019.f. Depreciation on office equipment was $1,500 for 2019.g. Unearned

seminar fees represent $7,500 received on November 1, 2019, for five seminars. AtDecember

31, three of these seminars had been conducted.h. Wages owed but not paid at December 31

were $800.i. On December 31, 2019, the firm owed the employer's social security tax ($49.60)

andMedicare tax ($11.60).j. The note payable bears interest at 8 percent per annum. One

month's interest is owed atDecember 31, 2016.Analyze: How did the balance of merchandise

inventory change during the year ended December 31, 2019?View Solution: The Game Place is

a retail store that sells computer

SOLUTION-- http://solutiondone.online/downloads/the-game-place-is-a-retail-store-that-sells-

computer/

Unlock answers here solutiondone.online

You might also like

- Term ProjectDocument4 pagesTerm ProjectArslan QadirNo ratings yet

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- ACCT215 Principles of Accounting I - First Exam Part II QuestionsDocument4 pagesACCT215 Principles of Accounting I - First Exam Part II QuestionsshigekaNo ratings yet

- Chapter 18Document10 pagesChapter 18Ali Abu Al Saud100% (2)

- 104Document8 pages104Magdy Kamel100% (1)

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- The Artisan Wines Is A Retail Store Selling Vintage Wines: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Artisan Wines Is A Retail Store Selling Vintage Wines: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Fun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - OnlineDocument1 pageFun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Programs Plus Is A Retail Firm That Sells Computer Programs: Unlock Answers Here Solutiondone - OnlineDocument1 pagePrograms Plus Is A Retail Firm That Sells Computer Programs: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Whatnots Is A Retail Seller of Cards Novelty Items And: Unlock Answers Here Solutiondone - OnlineDocument1 pageWhatnots Is A Retail Seller of Cards Novelty Items And: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- The Green Thumb Gardener Is A Retail Store That Sells: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Green Thumb Gardener Is A Retail Store That Sells: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Solutiondone 420Document1 pageSolutiondone 420trilocksp SinghNo ratings yet

- The Post Closing Trial Balance of Storey Corporation at December 31Document1 pageThe Post Closing Trial Balance of Storey Corporation at December 31trilocksp SinghNo ratings yet

- Exercise 18Document9 pagesExercise 18raihan aqilNo ratings yet

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- Pamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2Document4 pagesPamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2suruth242No ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- AUD PROB Activity May 18Document2 pagesAUD PROB Activity May 18Kent Judehilee BacalNo ratings yet

- Mojakoe Ak2 Uts 2018 PDFDocument17 pagesMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNo ratings yet

- Audit of Prepayments and Intangible AssetsDocument8 pagesAudit of Prepayments and Intangible AssetsVip BigbangNo ratings yet

- ENT503M MidtermQuestionnaireDocument7 pagesENT503M MidtermQuestionnaireNevan NovaNo ratings yet

- IA 1 and 2 - Midterm Quiz - Student FileDocument21 pagesIA 1 and 2 - Midterm Quiz - Student FileDaniella Mae ElipNo ratings yet

- Cima c02 Mock-2Document13 pagesCima c02 Mock-2Samiuddin Bukhari100% (1)

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaNo ratings yet

- Healthy Eating Foods Company Is A Distributor of Nutritious SnackDocument1 pageHealthy Eating Foods Company Is A Distributor of Nutritious Snacktrilocksp SinghNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Accounting Adjusting EntriesDocument42 pagesAccounting Adjusting EntriesDonnelly Keith MumarNo ratings yet

- Master Budget Case: Toyworks Ltd. (A)Document4 pagesMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- Solutiondone 429Document1 pageSolutiondone 429trilocksp SinghNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International General Certificate of Secondary Educationbipin jainNo ratings yet

- Quiz 2Document1 pageQuiz 2Panda ErarNo ratings yet

- You Have Been Asked by A Client To Review The PDFDocument3 pagesYou Have Been Asked by A Client To Review The PDFHassan JanNo ratings yet

- MIMIYUHHDocument2 pagesMIMIYUHHRogin Erica AdolfoNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- ACC13 Activity 7.1Document2 pagesACC13 Activity 7.1Jeva, Marrian Jane NoolNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- AccountingDocument2 pagesAccountingMonica MonicaNo ratings yet

- On December 31 2009 Matt Morgan Completed The First YearDocument1 pageOn December 31 2009 Matt Morgan Completed The First YearMuhammad ShahidNo ratings yet

- CE1 Acctg MidYear2018 Paper1 QDocument10 pagesCE1 Acctg MidYear2018 Paper1 QnadineNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Connect Accounting Homework AnswersDocument9 pagesConnect Accounting Homework AnswerscuatmshjfNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- The Following Selected Accounts Were Taken From The Financial RecordsDocument1 pageThe Following Selected Accounts Were Taken From The Financial Recordstrilocksp SinghNo ratings yet

- Quiz # 4 Cash & InventoryDocument1 pageQuiz # 4 Cash & InventoryChristine CarmonaNo ratings yet

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- Premiums and WarrantyDocument2 pagesPremiums and WarrantyAJ Gaspar100% (1)

- D) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDocument5 pagesD) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDaniella Mae ElipNo ratings yet

- The Following Selected Accounts Are Taken From Crandle Corporation S DecemberDocument1 pageThe Following Selected Accounts Are Taken From Crandle Corporation S DecemberTaimur TechnologistNo ratings yet

- Final Exam Cfas WoDocument11 pagesFinal Exam Cfas WoAndrei GoNo ratings yet

- ACC 301 CH 9 NO AnswersDocument6 pagesACC 301 CH 9 NO AnswersCarl Angelo0% (1)

- 06 Correction of Errors PDFDocument5 pages06 Correction of Errors PDFRoxanneNo ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- Answer Key - Exercise Problems Investment in Debt SecuritiesDocument5 pagesAnswer Key - Exercise Problems Investment in Debt SecuritiesApply Ako Work EhNo ratings yet

- ACCT 301B - CH 13 In-Class ExercisesDocument10 pagesACCT 301B - CH 13 In-Class ExercisesJudith Garcia0% (1)

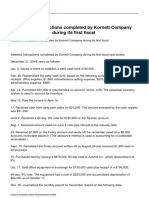

- Selected Transactions Completed by Kornett Company During Its First FiscalDocument4 pagesSelected Transactions Completed by Kornett Company During Its First FiscalAmit PandeyNo ratings yet

- QUIZ1 - Finacc3Document4 pagesQUIZ1 - Finacc3Jonnie RegalaNo ratings yet

- Job Order Costing QuizDocument5 pagesJob Order Costing Quizxenoyew100% (1)

- Homework Week7Document3 pagesHomework Week7Arista Yuliana SariNo ratings yet

- Solved Lundquist Company Received A 60 Day 9 Note For 28 000 DatedDocument1 pageSolved Lundquist Company Received A 60 Day 9 Note For 28 000 DatedAnbu jaromiaNo ratings yet

- Commercial Real Estate Investing in Canada: The Complete Reference for Real Estate ProfessionalsFrom EverandCommercial Real Estate Investing in Canada: The Complete Reference for Real Estate ProfessionalsNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet