Professional Documents

Culture Documents

ACC13 Activity 7.1

Uploaded by

Jeva, Marrian Jane Nool0 ratings0% found this document useful (0 votes)

87 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

87 views2 pagesACC13 Activity 7.1

Uploaded by

Jeva, Marrian Jane NoolCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

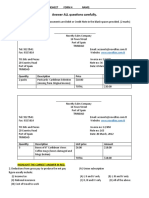

Activity 7.

1 Journal entries and trial balance

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted

trial balance on March 31, 2019, follows:

Elite Realty

Unadjusted Trial Balance

March 31, 2019

Account Debit Credit

No. Balances Balances

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 26,300

Accounts Receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 61,500

Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13 3,000

Office Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 1,800

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 —

Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 14,000

Unearned Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 —

Notes Payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 —

Lester Wagner, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 46,000

Lester Wagner, Drawing. . . . . . . . . . . . . . . . . . . . . . . . . . . 32 2,000

Fees Earned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41 240,000

Salary and Commission Expense. . . . . . . . . . . . . . . . . . . . . 51 148,200

Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52 30,000

Advertising Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 17,800

Automobile Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 5,500

Miscellaneous Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59 3,900 ______

300,000 300,000

The following business transactions were completed by Elite Realty during April 2019:

Apr. 1. Paid rent on office for month, ₱6,500.

2. Purchased office supplies on account, ₱2,300.

5. Paid insurance premiums, ₱6,000.

10. Received cash from clients on account, ₱52,300.

15. Purchased land for a future building site for ₱200,000, paying ₱30,000 in cash and giving a

note payable for the remainder.

17. Paid creditors on account, ₱6,450.

20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their

cost, ₱325.

23. Paid advertising expense, ₱4,300.

Enter the following transactions on Page 19 of the two-column journal:

27. Discovered an error in computing a commission; received cash from the sales-person for the

overpayment, ₱2,500.

28. Paid automobile expense (including rental charges for an automobile), ₱1,500.

29. Paid miscellaneous expenses, ₱1,400.

30. Recorded revenue earned and billed to clients during the month, ₱57,000.

30. Paid salaries and commissions for the month, ₱11,900.

30. Withdrew cash for personal use, ₱4,000.

30. Rented land purchased on April 15 to local merchants’ association for use as a parking lot in

May and June, during a street rebuilding program; received advance payment of ₱10,000.

Instructions

1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-

column account, write Balance in the item section, and place a check mark in the Posting

Reference column.

2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal

entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each

posting.

4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019.

You might also like

- Thames Water Bill (PDF Original)Document5 pagesThames Water Bill (PDF Original)robin sajid67% (3)

- Purposive Communication - Complete ModuleDocument153 pagesPurposive Communication - Complete ModuleAngel Joy Calisay89% (9)

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- DocxDocument5 pagesDocxSylvia Al-a'maNo ratings yet

- Adjusting Entries Questions and AnswersDocument28 pagesAdjusting Entries Questions and AnswersAnonymous 17L3cj75% (20)

- The Ultimate Beginners and Advanced Guide To Carding 20201Document107 pagesThe Ultimate Beginners and Advanced Guide To Carding 20201Ahmed Nafzaoui100% (6)

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Tugas 4 Dasar AkuntansiDocument20 pagesTugas 4 Dasar AkuntansiAji Surya Wijaya75% (4)

- Intermediate Accounting - MidtermsDocument9 pagesIntermediate Accounting - MidtermsKim Cristian MaañoNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Homework 2: Soal - 1Document3 pagesHomework 2: Soal - 1Rahadian ToramNo ratings yet

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- 151333-121838 20200331 PDFDocument8 pages151333-121838 20200331 PDFNizam ShamatNo ratings yet

- K S R T C - SomvarpetDocument2 pagesK S R T C - SomvarpetNaveen KannanNo ratings yet

- Statements 0322Document4 pagesStatements 0322Chris H. DabrovNo ratings yet

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- MK 2102-BAE2020 - Accounting For Merchandising ReDocument3 pagesMK 2102-BAE2020 - Accounting For Merchandising ReAngela Thrisananda0% (1)

- Delhi Public School, Nacharam Accountancy - Xi Practice Paper - 4Document4 pagesDelhi Public School, Nacharam Accountancy - Xi Practice Paper - 4lasyaNo ratings yet

- 2024.02.01FA ExerciseDocument2 pages2024.02.01FA ExerciseNgan Nguyen Ho KimNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Only For Students Who Have Problem With AbsencesDocument2 pagesOnly For Students Who Have Problem With Absencesusman akbarNo ratings yet

- Solutions To Exercises - Chap 3Document27 pagesSolutions To Exercises - Chap 3InciaNo ratings yet

- Chapter 18Document10 pagesChapter 18Ali Abu Al Saud100% (2)

- Practice Cash Flow ProblemDocument3 pagesPractice Cash Flow ProblemSid NairNo ratings yet

- FINAL MS5004 End Term Exam 2020Document2 pagesFINAL MS5004 End Term Exam 2020Biplav KumarNo ratings yet

- Acc.1 - HW Ch. 1+2+3 - 31-10-2023Document6 pagesAcc.1 - HW Ch. 1+2+3 - 31-10-2023samerghaith0No ratings yet

- Module 2 Homework Answer KeyDocument5 pagesModule 2 Homework Answer KeyMrinmay kunduNo ratings yet

- TUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Document24 pagesTUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Samuel PurbaNo ratings yet

- Final Term PaperDocument3 pagesFinal Term PaperUmerNo ratings yet

- Accounting Adjusting EntriesDocument42 pagesAccounting Adjusting EntriesDonnelly Keith MumarNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- 2 E Mabilis Trucking Service KP Golf Range HandoutsDocument3 pages2 E Mabilis Trucking Service KP Golf Range HandoutsJuan Dela Cruz0% (1)

- Cima c02 Mock-2Document13 pagesCima c02 Mock-2Samiuddin Bukhari100% (1)

- MIMIYUHHDocument2 pagesMIMIYUHHRogin Erica AdolfoNo ratings yet

- Math ProblemsDocument12 pagesMath ProblemsForhad Ahmad100% (1)

- Key Chapter 2Document11 pagesKey Chapter 2JinAe NaNo ratings yet

- Rental IncomeDocument3 pagesRental IncomeZhen WeiNo ratings yet

- 3 Spreadsheet PR 3.5ADocument2 pages3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNo ratings yet

- NKLT - PR1-3B-GR8Document1 pageNKLT - PR1-3B-GR8kimphuc3819No ratings yet

- Partnership Formation ReviewDocument3 pagesPartnership Formation ReviewRafael Capunpon VallejosNo ratings yet

- Chap 004Document35 pagesChap 0041sacNo ratings yet

- Exercise 18Document9 pagesExercise 18raihan aqilNo ratings yet

- CH # 4 Financial StatementsDocument4 pagesCH # 4 Financial StatementsAbubakar AliNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- The Following Selected Accounts Were Taken From The Financial RecordsDocument1 pageThe Following Selected Accounts Were Taken From The Financial Recordstrilocksp SinghNo ratings yet

- Additional Practical Problems-20Document16 pagesAdditional Practical Problems-20areet2701No ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Mid-Term - Financial Accounting For Managers July 2010...Document4 pagesMid-Term - Financial Accounting For Managers July 2010...ApoorvNo ratings yet

- Jawaban S 3-2Document4 pagesJawaban S 3-2Lamtiur LidiaqNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- QUIZ1 - Finacc3Document4 pagesQUIZ1 - Finacc3Jonnie RegalaNo ratings yet

- Assignment 1 - SolutionDocument10 pagesAssignment 1 - SolutionKhem Raj GyawaliNo ratings yet

- Exercise (10) - SolutionDocument4 pagesExercise (10) - Solutionmohamed.khayrtNo ratings yet

- Online Lecture Questions and SlidesDocument47 pagesOnline Lecture Questions and SlidesbongzNo ratings yet

- Financial MGTDocument2 pagesFinancial MGTSohail Liaqat AliNo ratings yet

- Cash Flow StatementDocument41 pagesCash Flow StatementMalar SrirengarajahNo ratings yet

- 5 Step Process Rev Rec Chapter Dayag SolmanDocument49 pages5 Step Process Rev Rec Chapter Dayag SolmanMichael Arevalo0% (1)

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- Chapter 1 TutorialDocument5 pagesChapter 1 TutorialAnisaNo ratings yet

- Additional Problem Chap 3 SolutionDocument6 pagesAdditional Problem Chap 3 SolutionominNo ratings yet

- Accounting For ManagersDocument9 pagesAccounting For ManagersAbdul Hadi SheikhNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Neith Is A TraderDocument8 pagesNeith Is A TraderGodfreyFrankMwakalingaNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Financial Accounting and Reporting AnswerDocument6 pagesFinancial Accounting and Reporting AnswerJeva, Marrian Jane NoolNo ratings yet

- Adjustments Are Journalized and Posted: Completing The Accounting CycleDocument4 pagesAdjustments Are Journalized and Posted: Completing The Accounting CycleJeva, Marrian Jane NoolNo ratings yet

- Lesson 1 - The Self From Various PerspectiveDocument6 pagesLesson 1 - The Self From Various PerspectivePaige PHNo ratings yet

- NSTP Module-1-4Document18 pagesNSTP Module-1-4Jeva, Marrian Jane Nool100% (1)

- Adjustments Are Journalized and Posted: Completing The Accounting CycleDocument4 pagesAdjustments Are Journalized and Posted: Completing The Accounting CycleJeva, Marrian Jane NoolNo ratings yet

- Arts AppreciationDocument3 pagesArts AppreciationJeva, Marrian Jane NoolNo ratings yet

- CHAPTER 1.accounting and Its EnvironmentDocument45 pagesCHAPTER 1.accounting and Its EnvironmentJeva, Marrian Jane NoolNo ratings yet

- Lesson 1 - The Self From Various PerspectiveDocument6 pagesLesson 1 - The Self From Various PerspectivePaige PHNo ratings yet

- CHAPTER 1 Accounting and Its EnvironmentDocument11 pagesCHAPTER 1 Accounting and Its EnvironmentJeva, Marrian Jane Nool100% (2)

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- CHAPTER 4 Worksheet and Financial StatementsDocument6 pagesCHAPTER 4 Worksheet and Financial StatementsJeva, Marrian Jane NoolNo ratings yet

- ACC13 Activity 7.1Document2 pagesACC13 Activity 7.1Jeva, Marrian Jane NoolNo ratings yet

- CHAPTER 3 Recording Business TransactionsDocument8 pagesCHAPTER 3 Recording Business TransactionsGabrielle Joshebed AbaricoNo ratings yet

- CHAPTER 1 Accounting and Its EnvironmentDocument11 pagesCHAPTER 1 Accounting and Its EnvironmentJeva, Marrian Jane Nool100% (2)

- Bank Reconciliation Statement NOTESDocument3 pagesBank Reconciliation Statement NOTESvarun rajNo ratings yet

- Rbi Guidelines On NRODocument6 pagesRbi Guidelines On NROGahininathJagannathGadeNo ratings yet

- 138 Cross QuestionDocument2 pages138 Cross Questionteam wisdomlegalNo ratings yet

- 005 Pantaleon v. American Express International, IncDocument2 pages005 Pantaleon v. American Express International, IncLoren Bea TulalianNo ratings yet

- BoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewDocument8 pagesBoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewThakur KdNo ratings yet

- Chap 3 Accounting Classification & Equation (Basic+Expended) - ClassDocument37 pagesChap 3 Accounting Classification & Equation (Basic+Expended) - Classnabkill100% (1)

- Fundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Document9 pagesFundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Joana Jean SuymanNo ratings yet

- Future Generali Motor-Od Claim FormDocument2 pagesFuture Generali Motor-Od Claim FormSABodyShop NagpurNo ratings yet

- Axis Bank: Corporate Salary Offering To InfosysDocument13 pagesAxis Bank: Corporate Salary Offering To InfosyssanjayNo ratings yet

- Language-For CrimeDocument6 pagesLanguage-For CrimeLisa CarpitelliNo ratings yet

- This Study Resource Was Shared Via: The Listening Part B QuestionDocument6 pagesThis Study Resource Was Shared Via: The Listening Part B QuestionGussrider EspNo ratings yet

- Incomplete Records 1Document7 pagesIncomplete Records 1Khadejai LairdNo ratings yet

- Oct Evolve and TrustDocument2 pagesOct Evolve and TrustSafeBit ProsNo ratings yet

- Updated & Revised Discount Sheet From 10 Oct 2021-KarachiDocument1 pageUpdated & Revised Discount Sheet From 10 Oct 2021-Karachisaadat aliNo ratings yet

- Hemlock Prepay Order InformationDocument2 pagesHemlock Prepay Order Informationapi-515368071No ratings yet

- Quiz 2Document9 pagesQuiz 2yuvita prasadNo ratings yet

- Only Banking Monthly Banking Awareness PDF MayDocument47 pagesOnly Banking Monthly Banking Awareness PDF Mayishky manoharNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- Explanatory Notes Before You Start: Data Form For InvestmentsDocument2 pagesExplanatory Notes Before You Start: Data Form For InvestmentsRajeshNo ratings yet

- Visa USA Interchange Reimbursement FeesDocument26 pagesVisa USA Interchange Reimbursement FeesMark Jasper DabuNo ratings yet

- ZFG Bahrain SS-PDF 592Document16 pagesZFG Bahrain SS-PDF 592ahmet aslanNo ratings yet

- Digital Payments PDFDocument16 pagesDigital Payments PDFmalvikabhansali300No ratings yet

- Flow Divider Valves ManualDocument10 pagesFlow Divider Valves ManualShirley Busto noNo ratings yet

- 010-Skeleton ArgumentDocument5 pages010-Skeleton ArgumentQamar KhaliqNo ratings yet

- MoneyDocument54 pagesMoneyTwinkle MehtaNo ratings yet