Professional Documents

Culture Documents

Goring Dairy Leases Its Milking Equipment From King Finance PDF

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goring Dairy Leases Its Milking Equipment From King Finance PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

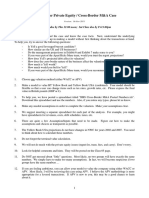

Goring Dairy leases its milking equipment from King

Finance

Goring Dairy leases its milking equipment from King Finance Company under the following

lease terms.1. The lease term is 10 years, non-cancelable, and requires equal rental payments

of $30,300 due at the beginning of each year starting January 1, 2011.2. The equipment has a

fair value and cost at the inception of the lease (January 1, 2011) of $220,404, an estimated

economic life of 10 years, and a residual value (which is guaranteed by Goring Dairy) of

$20,000.3. The lease contains no renewable options, and the equipment reverts to King

Finance Company upon termination of the lease.4. Goring Dairy’s incremental borrowing rate is

9% per year. The implicit rate is also 9%.5. Goring Dairy depreciates similar equipment that it

owns on a straight-line basis.6. Collectibility of the payments is reasonably predictable, and

there are no important uncertainties surrounding the costs yet to be incurred by the lessor.(a)

Evaluate the criteria for classification of the lease, and describe the nature of the lease. In

general, discuss how the lessee and lessor should account for the lease transaction.(b) Prepare

the journal entries for the lessee and lessor at January 1, 2011, and December 31, 2011 (the

lessee’s and lessors year-end). Assume no reversing entries.(c) What would have been the

amount capitalized by the lessee upon the inception of the lease if:(1) The residual value of

$20,000 had been guaranteed by a third party, not the lessee?(2) The residual value of $20,000

had not been guaranteed at all?(d) On the lessor’s books, what would be the amount recorded

as the Net Investment (LeaseReceivable) at the inception of the lease, assuming:(1) The

residual value of $20,000 had been guaranteed by a third party?(2) The residual value of

$20,000 had not been guaranteed at all?(e) Suppose the useful life of the milking equipment is

20 years. How large would the residual value have to be at the end of 10 years in order for the

lessee to qualify for the operating method? (Assume that the residual value would be

guaranteed by a third party.) (Hint: The lessee’s annual payments will be appropriately reduced

as the residual value increases.)View Solution:

Goring Dairy leases its milking equipment from King Finance

SOLUTION-- http://accountinginn.online/downloads/goring-dairy-leases-its-milking-equipment-

from-king-finance/

For Solutions Visit accountinginn.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Bowne VentureCapital GuidebookDocument152 pagesBowne VentureCapital GuidebookVipul Desai100% (2)

- FAQsDocument34 pagesFAQsFredPahssenNo ratings yet

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- Session 1 - Bond Valuation and RisksDocument69 pagesSession 1 - Bond Valuation and RisksManuel TapiaNo ratings yet

- How To Make A Fortune With Icharity Club Membership WebsiteDocument21 pagesHow To Make A Fortune With Icharity Club Membership WebsiteSylvesterNo ratings yet

- Chapter 8 - Leases Part 2Document5 pagesChapter 8 - Leases Part 2JEFFERSON CUTE100% (1)

- Florida Real Estate Exam Prep: Everything You Need to Know to PassFrom EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNo ratings yet

- Session 2 Discounted Cash Flow ValuationDocument39 pagesSession 2 Discounted Cash Flow ValuationSiddharth Shankar BebartaNo ratings yet

- LeasesDocument5 pagesLeasesElla Montefalco50% (2)

- 23232424Document15 pages23232424JV De Vera100% (1)

- Non State InstitutionsDocument21 pagesNon State InstitutionsYza Velle100% (1)

- A Project Feasibility Study On Sweet PotDocument35 pagesA Project Feasibility Study On Sweet PotYvonne Dale V. DaceraNo ratings yet

- Compromise Agreement: of The Philippines vs. - "Document3 pagesCompromise Agreement: of The Philippines vs. - "alaricelyang100% (1)

- The Development and Financing of Future FLNG ProjectsDocument12 pagesThe Development and Financing of Future FLNG ProjectsDaniel Ismail100% (1)

- This Study Resource Was: Fellowship Baptist College College of Business and AccountancyDocument5 pagesThis Study Resource Was: Fellowship Baptist College College of Business and AccountancyNah HamzaNo ratings yet

- Comparative Study of Financial Report of Three Indian Banks (IIMT) Project FileDocument95 pagesComparative Study of Financial Report of Three Indian Banks (IIMT) Project Filedeepak GuptaNo ratings yet

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Security Bank and Trust Company vs. GanDocument2 pagesSecurity Bank and Trust Company vs. GanElaine HonradeNo ratings yet

- Special Liabilities San Carlos CollegeDocument23 pagesSpecial Liabilities San Carlos CollegeRowbby Gwyn100% (1)

- CH 21Document6 pagesCH 21Saleh RaoufNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- Morgan Marie Leasing Company Signs An Agreement On January 1Document1 pageMorgan Marie Leasing Company Signs An Agreement On January 1M Bilal SaleemNo ratings yet

- Sales&leasebackDocument15 pagesSales&leasebackeulhiemae arong0% (1)

- Soal Latihan LeasingDocument2 pagesSoal Latihan LeasingMuhamad NizarNo ratings yet

- Assignment 3Document3 pagesAssignment 3Esther LiuNo ratings yet

- Quiz Chapter 7 Leases Part 1 2021Document2 pagesQuiz Chapter 7 Leases Part 1 2021Jennifer Reloso100% (1)

- Synergetics Inc Leased A New Crane To Gumowski Construction Under PDFDocument1 pageSynergetics Inc Leased A New Crane To Gumowski Construction Under PDFFreelance WorkerNo ratings yet

- Lease Practice QuestionsDocument4 pagesLease Practice QuestionsAbdul SamiNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- Seal Container Corporation Signed A Lease Agreement On JanuaryDocument1 pageSeal Container Corporation Signed A Lease Agreement On JanuaryTaimour HassanNo ratings yet

- Activity Debt Restructuring LeaseDocument2 pagesActivity Debt Restructuring LeaseLory Dela PeñaNo ratings yet

- Lessee - Capital Lease Lessor - Direct Financing LeaseDocument4 pagesLessee - Capital Lease Lessor - Direct Financing LeaseFeruz Sha RakinNo ratings yet

- Intermediate Accounting Volume 2 7Th Edition Beechy Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting Volume 2 7Th Edition Beechy Test Bank Full Chapter PDFDianeWhiteicyf100% (8)

- Fieval Leasing Company Signs An Agreement On January 1 2010 PDFDocument1 pageFieval Leasing Company Signs An Agreement On January 1 2010 PDFAnbu jaromiaNo ratings yet

- Grady Leasing Company Signs An Agreement On January 1 2010 PDFDocument1 pageGrady Leasing Company Signs An Agreement On January 1 2010 PDFAnbu jaromiaNo ratings yet

- Homework 7 - Leases (Lessor - S Books)Document1 pageHomework 7 - Leases (Lessor - S Books)alvarezxpatriciaNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Basic Lessee Accounting With Difficult PV Calculation in 2009 PDFDocument1 pageBasic Lessee Accounting With Difficult PV Calculation in 2009 PDFAnbu jaromiaNo ratings yet

- Finals - SeatWorkDocument1 pageFinals - SeatWorkDan RyanNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- ACCT 202 Pre-Quiz Number Two (Ch. 15)Document7 pagesACCT 202 Pre-Quiz Number Two (Ch. 15)Gabrielle Gamble0% (1)

- ACC226 Lease AccountingDocument18 pagesACC226 Lease AccountingJaneth Barrete100% (2)

- Lease PART 1 and 2Document6 pagesLease PART 1 and 2shadowlord468No ratings yet

- Tutorial 11 (Exercise)Document2 pagesTutorial 11 (Exercise)Vidya IntaniNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- 1Document12 pages1lee jong suk100% (1)

- Lecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTDocument3 pagesLecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTBee jayNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- This Study Resource Was: Operating Lease Treatment by LessorsDocument8 pagesThis Study Resource Was: Operating Lease Treatment by LessorsYasir ArafatNo ratings yet

- Accounting 8 - ReviewerDocument4 pagesAccounting 8 - ReviewerAshley David AligonsaNo ratings yet

- Assignment 3Document3 pagesAssignment 3Nate LoNo ratings yet

- Ross12e Chapter21 TBDocument11 pagesRoss12e Chapter21 TBhi babyNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- Theories LeasesDocument11 pagesTheories LeasesMinie KimNo ratings yet

- Only US$2.99/monthDocument3 pagesOnly US$2.99/monthKath LeynesNo ratings yet

- Unit 4 - LeasesDocument6 pagesUnit 4 - LeasesJean Pierre IsipNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- Orca Share Media1575043628730Document4 pagesOrca Share Media1575043628730Jayr BV100% (1)

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- Leases ExercisessDocument6 pagesLeases ExercisessdorothyannvillamoraaNo ratings yet

- Synergetics Inc Leased A New Crane To M K GumowskiDocument1 pageSynergetics Inc Leased A New Crane To M K GumowskiM Bilal SaleemNo ratings yet

- IA2 AssignmentDocument2 pagesIA2 AssignmentJobelle Marie MahNo ratings yet

- Week 1 Tutorial QuestionsDocument3 pagesWeek 1 Tutorial QuestionsPardeep Ramesh AgarvalNo ratings yet

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- 21 Finance Lease LesseeDocument3 pages21 Finance Lease LesseeTinNo ratings yet

- EA EA2 SU3 OutlineDocument9 pagesEA EA2 SU3 OutlineAdil AliNo ratings yet

- Oakridge Leasing Corporation Which Uses Private Enterprise Gaap Signs An PDFDocument1 pageOakridge Leasing Corporation Which Uses Private Enterprise Gaap Signs An PDFLet's Talk With HassanNo ratings yet

- Leases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesFrom EverandLeases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Speech by Minister Otuoma During Launch of New Products and Flagging Off Motor BikesDocument3 pagesSpeech by Minister Otuoma During Launch of New Products and Flagging Off Motor BikesWellWisherNo ratings yet

- RM Questionnaire For Bank Customer Satisfaction - Pranotee WorlikarDocument5 pagesRM Questionnaire For Bank Customer Satisfaction - Pranotee WorlikarSasha SGNo ratings yet

- Actuarial MathematicsDocument10 pagesActuarial MathematicsEti GoldbergNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesAnh TramNo ratings yet

- Opr 0004 YDocument1 pageOpr 0004 YsrgaurNo ratings yet

- Assurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonDocument30 pagesAssurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonGilang AnggoroNo ratings yet

- C MMM MMDocument8 pagesC MMM MMHaroon ArshadNo ratings yet

- 3rd Sem Finance True and False - pdf112958630Document28 pages3rd Sem Finance True and False - pdf112958630Lee So Min100% (2)

- Retirement of A PartnerDocument6 pagesRetirement of A Partnershrey narulaNo ratings yet

- AIS (Chapter 5 - MC) Flashcards - QuizletDocument4 pagesAIS (Chapter 5 - MC) Flashcards - QuizletJohn Carlo D MedallaNo ratings yet

- MT PS With Solutions PDFDocument11 pagesMT PS With Solutions PDFWilmar AbriolNo ratings yet

- Tutorial6 AnswersDocument3 pagesTutorial6 AnswersTosin OjoNo ratings yet

- February 23, 2018 Strathmore TimesDocument23 pagesFebruary 23, 2018 Strathmore TimesStrathmore TimesNo ratings yet

- Grade 11 Sample Performance Task 478946 7Document13 pagesGrade 11 Sample Performance Task 478946 7api-235457167No ratings yet

- Boracay Foundation Inc Vs Province of AklanDocument52 pagesBoracay Foundation Inc Vs Province of AklanKevinPRNo ratings yet

- Questions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmDocument2 pagesQuestions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmvencentNo ratings yet

- (218399336) Article What Is Opportunity CostDocument5 pages(218399336) Article What Is Opportunity CostJatin AroraNo ratings yet

- Comparatie IFRS HGB PDFDocument5 pagesComparatie IFRS HGB PDFslisNo ratings yet

- Fitch Ratings Definitions and ScalesDocument58 pagesFitch Ratings Definitions and ScalesThomasJacobsNo ratings yet