Professional Documents

Culture Documents

Solutiondone 2-147

Solutiondone 2-147

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutiondone 2-147

Solutiondone 2-147

Uploaded by

trilocksp SinghCopyright:

Available Formats

Percy University a government university had no

endowments prior to

Percy University, a government university, had no endowments prior to September 1, 20X7. The

following transactions took place during the fiscal year ended August 31, 20X8:1. At the

beginning of the year, a cash donation of $900,000 was received to establish Endowment X,

and another donation of $600,000, also in cash, was received for the purpose of establishing

Endowment Y. The income from these endowments is restricted for specific purposes. It was

decided to invest this money immediately; to pool the investments of both endowments; and to

share earnings, including any gains or losses on sales of investments, at the end of the year

based on the ratio of the original contributions of each endowment.2. Securities with a par value

of $1,000,000 were purchased at a premium of $10,000.3. Securities with a par value of

$191,500 were acquired at a discount of $2,000; accrued interest at date of purchase amounted

to $500.4. The university trustees voted to pool the investments of a new endowment,

Endowment Z, with the investments of Endowments X and Y under the same conditions as

applied to the latter two endowments. The investments of Endowment Z at the date it joined the

pool at midyear amounted to $290,000 at book value and $300,000 at market value. (Hereafter,

the investment pool earnings are to be shared 9:6:3.)5. Cash dividends received from the

pooled investments during the year amounted to $70,000, and interest receipts were $5,500.6.

Premiums of $500 and discounts of $100 were amortized.7. Securities carried at $30,000 were

sold at a gain of $2,400.8. Each endowment was credited with its share of the investment

earnings for the year (see transactions 1 and 4).9. A provision of Endowment Y is that a

minimum of $75,000 each year, whether from earnings or principal or both, is to be made

available for unrestricted uses.10. An apartment complex comprising land, buildings, and

equipment valued at $800,000 was donated to the university, distributed as follows: land,

$80,000; buildings, $500,000; equipment, $220,000. The donor stipulated that an endowment

(designated as Endowment N) should be established and that the income therefrom should be

used for a restricted operating purpose.11. Unrestricted resources of $150,000 were set aside

by the board as a quasi-endowment (or fund functioning as an endowment) and was designated

Endowment O.12. A trust fund in the amount of $350,000 (cash) was set up by a donor with the

stipulation that the income was to go to the university to be used for general purposes. This

fund was designated Endowment P.Requireda. Prepare the necessary journal entries for Percy

University for the 20X7–20X8fiscal year.b. Explain how each transaction affects the net position

classifications.View Solution: Percy University a government university had no endowments

prior to

SOLUTION-- http://solutiondone.online/downloads/percy-university-a-government-university-

had-no-endowments-prior-to/

Unlock answers here solutiondone.online

You might also like

- Xiaomi Challenges Global Smartphone Leaders. Case Study: XiaomiDocument5 pagesXiaomi Challenges Global Smartphone Leaders. Case Study: XiaomiYvonne MbuguaNo ratings yet

- Starbuck's Case - CRM - Jonas KocherDocument3 pagesStarbuck's Case - CRM - Jonas Kocherleni thNo ratings yet

- Café Management System Full and Final ReportDocument18 pagesCafé Management System Full and Final ReportMuhammad Xalman Xhaw100% (3)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting II-Review Chapters12,13,14 (8thed)Document10 pagesAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889No ratings yet

- NFP AssDocument9 pagesNFP AssAbdii Dhufeera100% (2)

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Chapter 11 Problems - 2Document7 pagesChapter 11 Problems - 2salehin1969No ratings yet

- The Trial Balance of Farley College A Government University AsDocument1 pageThe Trial Balance of Farley College A Government University Astrilocksp SinghNo ratings yet

- Govt ch3Document21 pagesGovt ch3Belay MekonenNo ratings yet

- The City of Phoenix Arizona Has A Variety of General: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City of Phoenix Arizona Has A Variety of General: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Using The Format at The End of This Exercise Indicate: Unlock Answers Here Solutiondone - OnlineDocument1 pageUsing The Format at The End of This Exercise Indicate: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Solutiondone 2-283Document1 pageSolutiondone 2-283trilocksp SinghNo ratings yet

- The State Government Administers A Special Revenue FundDocument2 pagesThe State Government Administers A Special Revenue FundGETAHUN ASSEFA ALEMUNo ratings yet

- Funds and Other Investment ActivitiesDocument7 pagesFunds and Other Investment Activitiesjoong wanNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDFDocument6 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDFSpencerMoorenbds100% (38)

- Fundamental - I WorksheetDocument3 pagesFundamental - I WorksheetuuuNo ratings yet

- Solutiondone 2-218Document1 pageSolutiondone 2-218trilocksp SinghNo ratings yet

- On May 1 Steele Recreation Corporation Issued 4 500 000 WorthDocument1 pageOn May 1 Steele Recreation Corporation Issued 4 500 000 Worthtrilocksp SinghNo ratings yet

- HW On Sinking Fund CDocument2 pagesHW On Sinking Fund CCha PampolinaNo ratings yet

- MBA Review Questions CH 8 & CH 10 Princ. Acc. IIDocument5 pagesMBA Review Questions CH 8 & CH 10 Princ. Acc. IIMirna Kassar100% (1)

- Solutiondone 2-281Document1 pageSolutiondone 2-281trilocksp SinghNo ratings yet

- Chapter 17 HomeworkDocument3 pagesChapter 17 HomeworkTracy LeeNo ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- Sak LM, A2 Topik 4: Financial Instrument: Tugas IndividuDocument2 pagesSak LM, A2 Topik 4: Financial Instrument: Tugas IndividuCita Setia RahmiNo ratings yet

- Joe Thyme Opened Thyme Company A Veterinary Business in NeoshoDocument1 pageJoe Thyme Opened Thyme Company A Veterinary Business in Neoshotrilocksp SinghNo ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Latihan Accounting EquationDocument1 pageLatihan Accounting EquationemiNo ratings yet

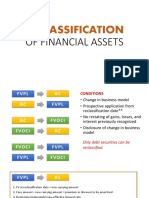

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Mock Test (Final Exam) Time: 60 Minutes: InstructionsDocument1 pageMock Test (Final Exam) Time: 60 Minutes: InstructionsVương AnhNo ratings yet

- FA2PDocument3 pagesFA2PdainokaiNo ratings yet

- Les Stanley Established An Insurance Agency On July 1 20y5Document1 pageLes Stanley Established An Insurance Agency On July 1 20y5Miroslav GegoskiNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Solutiondone 2-148Document1 pageSolutiondone 2-148trilocksp SinghNo ratings yet

- 1 ST Quiz NGODocument5 pages1 ST Quiz NGOfrancesNo ratings yet

- Exerciseon Principles of AccountingDocument1 pageExerciseon Principles of AccountingBedri M AhmeduNo ratings yet

- Solutiondone 2-219Document1 pageSolutiondone 2-219trilocksp SinghNo ratings yet

- AFAR-non ProfitDocument21 pagesAFAR-non ProfitJessica Pama EstandarteNo ratings yet

- StudentDocument21 pagesStudentasem shabanNo ratings yet

- Sample FinalDocument18 pagesSample FinalDavid MendietaNo ratings yet

- Assignment AFA IDocument4 pagesAssignment AFA IAbebeNo ratings yet

- S.E.C. Civil Complaint Against SJK Investment ManagementDocument30 pagesS.E.C. Civil Complaint Against SJK Investment ManagementDealBookNo ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- Ias 40 - ExerciseDocument3 pagesIas 40 - ExerciseQuỳnh AnhNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Test 1 W AnswersDocument8 pagesTest 1 W AnswersVaniamarie VasquezNo ratings yet

- FOA II 2nd AssignmentDocument5 pagesFOA II 2nd Assignmentshekaibsa38No ratings yet

- Tutorial - Corporation Stock - StudentsDocument3 pagesTutorial - Corporation Stock - StudentsBerwyn GazaliNo ratings yet

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentNo ratings yet

- Topic 1 - Financial Assets and Investment in Equity SecuritiesDocument7 pagesTopic 1 - Financial Assets and Investment in Equity SecuritiesRey Handumon100% (1)

- Multiple Choice Questions Indicate The Best Answer For Each ofDocument1 pageMultiple Choice Questions Indicate The Best Answer For Each oftrilocksp SinghNo ratings yet

- The July 1 20X5 Trial Balance For The Bond Redemption: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe July 1 20X5 Trial Balance For The Bond Redemption: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Reliance Mutual FundDocument32 pagesReliance Mutual FundJitesh AroraNo ratings yet

- Fund 2Document5 pagesFund 2prey kunNo ratings yet

- Shareholder's EquityDocument10 pagesShareholder's EquityNicole Gole CruzNo ratings yet

- Prepare The Journal Entries For Boegner University Problem Assuming ThatDocument1 pagePrepare The Journal Entries For Boegner University Problem Assuming Thattrilocksp SinghNo ratings yet

- ACC 3003 - Final Exam RevisionDocument19 pagesACC 3003 - Final Exam Revisionfalnuaimi001100% (1)

- Fund FinalDocument3 pagesFund FinalAbdi Mucee TubeNo ratings yet

- Homework On Sinking Fund: Problem 1Document2 pagesHomework On Sinking Fund: Problem 1Rose DumadaugNo ratings yet

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- BDM (End Term)Document112 pagesBDM (End Term)Raam Sai BharadwajNo ratings yet

- Bangladesh Association of Construction Industry (BACI)Document3 pagesBangladesh Association of Construction Industry (BACI)saimunNo ratings yet

- RA 1405 Law On Bank Secrecy of Bank DepositsDocument24 pagesRA 1405 Law On Bank Secrecy of Bank DepositsJetJuárezNo ratings yet

- ME 1 Skill India (PMKVY)Document19 pagesME 1 Skill India (PMKVY)Kishan Kumar RNo ratings yet

- SSPTE Service Report 1Document1 pageSSPTE Service Report 1JEET ARUMUGAMNo ratings yet

- Nairobi Bottlers Limited - Sales Agreement Contract 2023Document14 pagesNairobi Bottlers Limited - Sales Agreement Contract 2023copymaxenterpriseNo ratings yet

- Sabah: Development CorridorDocument24 pagesSabah: Development CorridorHilarionSabitangNo ratings yet

- International Financial Management 13th Edition Madura Test BankDocument25 pagesInternational Financial Management 13th Edition Madura Test BankMichaelSmithspqn100% (53)

- One Wave Soldering Machine-Interbras PDFDocument4 pagesOne Wave Soldering Machine-Interbras PDFUserSMTNo ratings yet

- Etr401 FullDocument145 pagesEtr401 FullTrung NguyenNo ratings yet

- Radiomuseum Radio Craftsmen c400 10 Watt Audio Amplifier 474127Document2 pagesRadiomuseum Radio Craftsmen c400 10 Watt Audio Amplifier 474127ditgh ditghNo ratings yet

- Automatic Mail Notification Process ChainDocument7 pagesAutomatic Mail Notification Process Chainghaz_khan0% (1)

- Kaizen Philosophy A Manner of Continuous Improvement of Processes and ProductsDocument7 pagesKaizen Philosophy A Manner of Continuous Improvement of Processes and ProductsadeebNo ratings yet

- DocDocument2 pagesDocAbhijeet ChaudharyNo ratings yet

- COVID Tracker App: Help Us Reduce The Spread of COVID-19 in IrelandDocument4 pagesCOVID Tracker App: Help Us Reduce The Spread of COVID-19 in IrelandmanuelNo ratings yet

- Presentation On Kingfisher AirlinesDocument19 pagesPresentation On Kingfisher Airlinesshiv shankarNo ratings yet

- Peoples Bank Annual Report 2022 1Document376 pagesPeoples Bank Annual Report 2022 1Manasa SelamuthuNo ratings yet

- Sap VS Oracle PDFDocument11 pagesSap VS Oracle PDFdexter.dy4238No ratings yet

- Iso 9001 (FFC Uk) - FlowserveDocument4 pagesIso 9001 (FFC Uk) - FlowserveBRUNONo ratings yet

- HSA5177 - Assignment 2 - Answers A. Multiple Choices (Each Item Below 2 Points, 60 Points Total. Only One Correct Answer To Each Question)Document19 pagesHSA5177 - Assignment 2 - Answers A. Multiple Choices (Each Item Below 2 Points, 60 Points Total. Only One Correct Answer To Each Question)KateNo ratings yet

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelNo ratings yet

- Impact of Rera On Real State in EldicoDocument94 pagesImpact of Rera On Real State in EldicosalmanNo ratings yet

- 24 - Tent Pole Report by VK VermaDocument46 pages24 - Tent Pole Report by VK VermaSrinivasa NNo ratings yet

- The Effect of E-Procurement On Supply Chain Management at Teachers' Service CommissionDocument69 pagesThe Effect of E-Procurement On Supply Chain Management at Teachers' Service CommissionNaina SoniNo ratings yet

- I. Executive Summary: Oil India Limited (OIL)Document5 pagesI. Executive Summary: Oil India Limited (OIL)pawan995470No ratings yet

- Masotta Marcelo Bruno 11 de Semptiembre 530 1653 Buenos Aires ArgentinienDocument1 pageMasotta Marcelo Bruno 11 de Semptiembre 530 1653 Buenos Aires ArgentinienAntonela MasottaNo ratings yet

- 04 NG Vs PeopleDocument2 pages04 NG Vs PeopleCleinJonTiuNo ratings yet