Professional Documents

Culture Documents

In September 2016 Manson Paint Corporation Began Operations in A

Uploaded by

Muhammad ShahidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In September 2016 Manson Paint Corporation Began Operations in A

Uploaded by

Muhammad ShahidCopyright:

Available Formats

In September 2016 Manson Paint Corporation began

operations in a #6867

In September 2016, Manson Paint Corporation began operations in a state that requires new

employers of one or more individuals to pay a state unemployment tax of 3.5% of the first

$7,000 of wages paid each employee. An analysis of the company's payroll for the year shows

total wages paid of $177,610. The salaries of the president and the vice president of the

company were $20,000 and $15,000, respectively, for the four-month period, but there were no

other employees who received wages in excess of $7,000 for the four months. Included in the

total wages were $900 paid to a director who only attended director meetings during the year,

$6,300 paid to the factory superintendent, and $2,000 in employee contributions to a cafeteria

plan made on a pretax basis-for both federal and state. In addition to the total wages of

$177,610, a payment of $2,430 was made to Andersen Accounting Company for an audit it

performed on the company's books in December 2016. Compute:a. Net FUTA tax

............................................................... $________b. SUTA tax

...................................................................... $________View Solution:

In September 2016 Manson Paint Corporation began operations in a

ANSWER

http://paperinstant.com/downloads/in-september-2016-manson-paint-corporation-began-

operations-in-a/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- IBA Suggested Solution First MidTerm Taxation 12072016Document9 pagesIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanNo ratings yet

- As The Accountant For Runson Moving Company You Are PreparingDocument1 pageAs The Accountant For Runson Moving Company You Are PreparingMuhammad ShahidNo ratings yet

- Quiz 5 ProblemsDocument5 pagesQuiz 5 ProblemsElizabeth100% (1)

- Prashant'S Commerce Academy Fundamentals of PartnershipDocument3 pagesPrashant'S Commerce Academy Fundamentals of PartnershipMuskan TilokaniNo ratings yet

- Budget MemoDocument2 pagesBudget Memoapi-468699368No ratings yet

- You Have Been Asked by A Client To Review The PDFDocument3 pagesYou Have Been Asked by A Client To Review The PDFHassan JanNo ratings yet

- Technical Note: DisclaimerDocument13 pagesTechnical Note: DisclaimerNicquainCTNo ratings yet

- Assume The Following Facts For Munoz Company in 2016 Munoz PDFDocument1 pageAssume The Following Facts For Munoz Company in 2016 Munoz PDFHassan JanNo ratings yet

- Risk & Return AnalysisDocument13 pagesRisk & Return AnalysisTaleya FatimaNo ratings yet

- AF4S31 Assessment 1 - R1502D658467Document16 pagesAF4S31 Assessment 1 - R1502D658467Tafadzwa Muza100% (4)

- The Following Selected Accounts Are Taken From Crandle Corporation S DecemberDocument1 pageThe Following Selected Accounts Are Taken From Crandle Corporation S DecemberTaimur TechnologistNo ratings yet

- Payroll Accounting 2016 2nd Edition Landin Solutions ManualDocument43 pagesPayroll Accounting 2016 2nd Edition Landin Solutions Manualphongtuanfhep4u100% (30)

- On January 1 2016 Mitta Corporation Acquires A 60 InterestDocument1 pageOn January 1 2016 Mitta Corporation Acquires A 60 InterestMuhammad ShahidNo ratings yet

- Karlson Software Company Is Located in State H Which EnablesDocument1 pageKarlson Software Company Is Located in State H Which EnablesMuhammad ShahidNo ratings yet

- Taxation of Income of Partnership FirmDocument8 pagesTaxation of Income of Partnership FirmVipul DohleNo ratings yet

- Following Your Retirement As Senior Vice President of Finance ForDocument1 pageFollowing Your Retirement As Senior Vice President of Finance Fortrilocksp SinghNo ratings yet

- Byers Company Presents The Following Condensed Income Statement For 2016Document1 pageByers Company Presents The Following Condensed Income Statement For 2016Taimur TechnologistNo ratings yet

- The Following Information Is Available For Lumberton Co For TheDocument1 pageThe Following Information Is Available For Lumberton Co For Thetrilocksp SinghNo ratings yet

- Soal Advanced 2 Mid 2018 2019Document2 pagesSoal Advanced 2 Mid 2018 2019dwi davisNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetkeshav madamNo ratings yet

- Taxation of Income of Partnership FirmDocument8 pagesTaxation of Income of Partnership FirmMsharathteja ManthaNo ratings yet

- On January 1 2014 Paxton Company Purchased A 70 InterestDocument1 pageOn January 1 2014 Paxton Company Purchased A 70 InterestMuhammad ShahidNo ratings yet

- IFRS - 2016 - Solved QPDocument14 pagesIFRS - 2016 - Solved QPSharan ReddyNo ratings yet

- At The End of 2017 While Auditing Sandlin Company S BooksDocument1 pageAt The End of 2017 While Auditing Sandlin Company S BooksTaimur TechnologistNo ratings yet

- During July 2016 The First Month of The 2017 FiscalDocument1 pageDuring July 2016 The First Month of The 2017 FiscalMuhammad ShahidNo ratings yet

- Pinson Company and Estes Company Are Two Proprietorships That AreDocument1 pagePinson Company and Estes Company Are Two Proprietorships That Aretrilocksp SinghNo ratings yet

- Okay From This OnwardsDocument4 pagesOkay From This Onwardsjerald cimafrancaNo ratings yet

- On January 1 2015 James Company Purchases 70 of TheDocument1 pageOn January 1 2015 James Company Purchases 70 of TheMuhammad ShahidNo ratings yet

- To: From: CC: Date: ReDocument11 pagesTo: From: CC: Date: ReBrad TabkeNo ratings yet

- It Is The End of 2016 and You Are AnDocument1 pageIt Is The End of 2016 and You Are AnDoreenNo ratings yet

- In Fisk Company S Negotiations With Its Employees Union On JanuaryDocument1 pageIn Fisk Company S Negotiations With Its Employees Union On JanuaryLet's Talk With HassanNo ratings yet

- Lesson 9.4 Adjusting EntriesDocument36 pagesLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Chapter 2 Interest On CapitalDocument9 pagesChapter 2 Interest On CapitalAparna PNo ratings yet

- 494 SCS HomeworkDocument3 pages494 SCS HomeworkborokawNo ratings yet

- BondsDocument2 pagesBondsJuly LumantasNo ratings yet

- MWBE ReportDocument28 pagesMWBE ReportSarahNo ratings yet

- Laporan Negara AmerikaDocument15 pagesLaporan Negara AmerikaRiyanti AjengNo ratings yet

- Laporan Keuangan Negara AmerikaDocument15 pagesLaporan Keuangan Negara AmerikaRiyanti AjengNo ratings yet

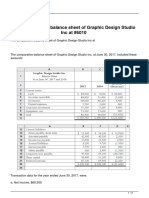

- The Comparative Balance Sheet of Graphic Design Studio Inc atDocument2 pagesThe Comparative Balance Sheet of Graphic Design Studio Inc atMuhammad ShahidNo ratings yet

- Group 4 - MANAC Report - DraftDocument11 pagesGroup 4 - MANAC Report - DraftviewpawanNo ratings yet

- FGL Distribution 2016 Asset Management PlanDocument195 pagesFGL Distribution 2016 Asset Management PlanAbhishek Ranjan SinghNo ratings yet

- Solutiondone 429Document1 pageSolutiondone 429trilocksp SinghNo ratings yet

- City of Busselton - Adopted Budget 2016-2017Document314 pagesCity of Busselton - Adopted Budget 2016-2017NeenNo ratings yet

- Cost On January 1 2016 Baznik Company Adopted A DefinedDocument1 pageCost On January 1 2016 Baznik Company Adopted A DefinedTaimur TechnologistNo ratings yet

- On January 1 2016 Peanut Corporation Acquires An 80 InterestDocument1 pageOn January 1 2016 Peanut Corporation Acquires An 80 InterestMuhammad ShahidNo ratings yet

- Stevens Textile Corporation S 2016 Financial Statements Are Shown Below Balance SheetDocument2 pagesStevens Textile Corporation S 2016 Financial Statements Are Shown Below Balance SheetAmit PandeyNo ratings yet

- Cpar AfarDocument21 pagesCpar AfarFrancheska NadurataNo ratings yet

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (45)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document32 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1markcamachoyrpbjxgeft100% (21)

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFemma.ingram210100% (11)

- The Following Unadjusted Trial Balance Is For Power Demolition CompanyDocument1 pageThe Following Unadjusted Trial Balance Is For Power Demolition Companytrilocksp SinghNo ratings yet

- Seaforth International Wrote Off The Following Accounts Receivable As UncollectibleDocument1 pageSeaforth International Wrote Off The Following Accounts Receivable As UncollectibleAmit PandeyNo ratings yet

- Analysis AppleDocument18 pagesAnalysis AppleAdhira VenkatNo ratings yet

- Business Partners Channel DevelopmentDocument25 pagesBusiness Partners Channel DevelopmentAnonymous Fe49rBLNo ratings yet

- Damon Manufacturing Is Preparing Its Master Budget For The FirstDocument3 pagesDamon Manufacturing Is Preparing Its Master Budget For The FirstAmit PandeyNo ratings yet

- Proxy Statement: and Notice of Annual Meeting of ShareholdersDocument80 pagesProxy Statement: and Notice of Annual Meeting of ShareholdersGayathri MurugesanNo ratings yet

- Correction of Errors: Assets Liabilities Equity ProfitDocument4 pagesCorrection of Errors: Assets Liabilities Equity ProfitCharithea NaboNo ratings yet

- Mexico KAP Business Plan Finalplandenegocios - UploadDocument6 pagesMexico KAP Business Plan Finalplandenegocios - Uploadxbdrsk6fbgNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- You Have Been Asked To Evaluate Two Companies As PossibleDocument2 pagesYou Have Been Asked To Evaluate Two Companies As PossibleMuhammad ShahidNo ratings yet

- You Can Find A Spreadsheet Containing The Historic Returns PresentedDocument1 pageYou Can Find A Spreadsheet Containing The Historic Returns PresentedMuhammad ShahidNo ratings yet

- You Have Been Named As Investment Adviser To A FoundationDocument1 pageYou Have Been Named As Investment Adviser To A FoundationMuhammad ShahidNo ratings yet

- Zeus Industries Manufactures Two Types of Electrical Power Units CustomDocument1 pageZeus Industries Manufactures Two Types of Electrical Power Units CustomMuhammad ShahidNo ratings yet

- You Are The Controller of Small Toys Inc Marta JohnsDocument1 pageYou Are The Controller of Small Toys Inc Marta JohnsMuhammad ShahidNo ratings yet

- Your Supervisor Has Asked You To Research A Potential TaxDocument1 pageYour Supervisor Has Asked You To Research A Potential TaxMuhammad ShahidNo ratings yet

- You Are Considering Making A Contribution To The Conservation FundDocument1 pageYou Are Considering Making A Contribution To The Conservation FundMuhammad ShahidNo ratings yet

- Wireless Communications Inc Is Preparing Its Cash Budget For 2014Document1 pageWireless Communications Inc Is Preparing Its Cash Budget For 2014Muhammad ShahidNo ratings yet

- You Decide Which Method Is Better The Direct Write Off Method orDocument1 pageYou Decide Which Method Is Better The Direct Write Off Method orMuhammad ShahidNo ratings yet

- You Are Being Interviewed For A Job As A PortfolioDocument1 pageYou Are Being Interviewed For A Job As A PortfolioMuhammad ShahidNo ratings yet

- You Are Reviewing The Financial Statements of Rising Yeast CoDocument1 pageYou Are Reviewing The Financial Statements of Rising Yeast CoMuhammad ShahidNo ratings yet

- You Are P J Walter Cfa A Managing Partner ofDocument1 pageYou Are P J Walter Cfa A Managing Partner ofMuhammad ShahidNo ratings yet

- You Are A Portfolio Manager and Senior Executive Vice PresidentDocument1 pageYou Are A Portfolio Manager and Senior Executive Vice PresidentMuhammad ShahidNo ratings yet

- West Texas Exploration Co Was Established On October 15 2016Document2 pagesWest Texas Exploration Co Was Established On October 15 2016Muhammad ShahidNo ratings yet

- World Mosaic Furniture Gallery Inc Provided The Following Data FromDocument2 pagesWorld Mosaic Furniture Gallery Inc Provided The Following Data FromMuhammad ShahidNo ratings yet

- You Are Given The Following Price of The Stock 18 PriceDocument1 pageYou Are Given The Following Price of The Stock 18 PriceMuhammad ShahidNo ratings yet

- You Are Given The Following Information Expected Return On Stock ADocument1 pageYou Are Given The Following Information Expected Return On Stock AMuhammad ShahidNo ratings yet

- Winnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atDocument2 pagesWinnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atMuhammad ShahidNo ratings yet

- Wimberley Glass Inc Has Shops in The Shopping Malls ofDocument1 pageWimberley Glass Inc Has Shops in The Shopping Malls ofMuhammad ShahidNo ratings yet

- Wilma Company Must Decide Whether To Make or Buy SomeDocument1 pageWilma Company Must Decide Whether To Make or Buy SomeMuhammad ShahidNo ratings yet

- When Sandra Costello S Father Died Suddenly Sandra Had Just CompletedDocument1 pageWhen Sandra Costello S Father Died Suddenly Sandra Had Just CompletedMuhammad ShahidNo ratings yet

- You Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresDocument1 pageYou Are Maintaining A Subsidiary Ledger Account For Firefighter Training ExpendituresMuhammad ShahidNo ratings yet

- Waypine Enterprises Reported A Pretax Operating Loss of 84 000 inDocument1 pageWaypine Enterprises Reported A Pretax Operating Loss of 84 000 inMuhammad ShahidNo ratings yet

- Walter Liu Has Owned and Operated LW Media Inc SinceDocument2 pagesWalter Liu Has Owned and Operated LW Media Inc SinceMuhammad ShahidNo ratings yet

- Western Agriculture Industries LTD Is Authorized by The Province ofDocument1 pageWestern Agriculture Industries LTD Is Authorized by The Province ofMuhammad ShahidNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- Washington City Created An Information Technology Department in 2013 To PDFDocument1 pageWashington City Created An Information Technology Department in 2013 To PDFMuhammad ShahidNo ratings yet

- Webmasters Com Has Developed A Powerful New Server That Would BeDocument1 pageWebmasters Com Has Developed A Powerful New Server That Would BeMuhammad ShahidNo ratings yet

- Using The Data Below Compute Net Income Accounts PayableDocument1 pageUsing The Data Below Compute Net Income Accounts PayableMuhammad ShahidNo ratings yet

- Web Marketing Services Inc Completed These Transactions During The FirstDocument2 pagesWeb Marketing Services Inc Completed These Transactions During The FirstMuhammad ShahidNo ratings yet