Professional Documents

Culture Documents

At The Beginning of A Fiscal Year Flowers Company Buys: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

At The Beginning of A Fiscal Year Flowers Company Buys: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghCopyright:

Available Formats

At the beginning of a fiscal year Flowers Company buys

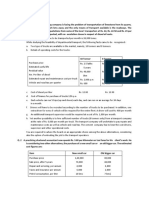

At the beginning of a fiscal year, Flowers Company buys a truck for $ 28,000. The truck’s

estimated life is five years, and its estimated salvage value is $ 3,000. Required Using the

following four methods, determine the annual depreciation of the truck for each of the estimated

five years of life, the accumulated depreciation at the end of each year, and the book value of

the truck at the end of each year. Round annual depreciation to whole dollars. a. Straight-line

method b. Double-declining-balance method c. Units-of-production method (Useful life is

100,000 miles. Year 1 use is 10,000 miles, Year 2 use is 20,000 miles, Year 3 use is 40,000

miles, Year 4 use is 18,000 miles, and Year 5 use is 12,000 miles.) Round depreciation per unit

to two decimal places. Year 5 depreciation should be rounded to balance. d. MACRS method

(Assume that the asset was purchased after 1986 and is five-year property.) Year 6

depreciation should be rounded to balance.View Solution: At the beginning of a fiscal year

Flowers Company buys

SOLUTION-- http://solutiondone.online/downloads/at-the-beginning-of-a-fiscal-year-flowers-

company-buys/

Unlock answers here solutiondone.online

You might also like

- At The Beginning of A Fiscal Year Alexander Company Buys: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of A Fiscal Year Alexander Company Buys: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Review Questions Volume 1 - Chapter 26Document1 pageReview Questions Volume 1 - Chapter 26YelenochkaNo ratings yet

- Thoma Cash FlowDocument2 pagesThoma Cash FlowflorentinaNo ratings yet

- Depreciation AssignmentDocument2 pagesDepreciation Assignmentyasir_mushtaq786No ratings yet

- Solutiondone 2-341Document1 pageSolutiondone 2-341trilocksp SinghNo ratings yet

- FM PaperDocument2 pagesFM Paperaftab20No ratings yet

- Prob SetDocument9 pagesProb SetVynz Higuit100% (1)

- Chapter 9 Depreciation LatestDocument2 pagesChapter 9 Depreciation LatestSiti Khadijatulrraadiah Roslan0% (1)

- MAT112 (Assignment) Business Mathematics September 2019 - January 2019Document2 pagesMAT112 (Assignment) Business Mathematics September 2019 - January 2019syafiqahNo ratings yet

- Assignment 4Document2 pagesAssignment 4Ahmed BeheryNo ratings yet

- ECON313 Engineering Economics Final ExamDocument2 pagesECON313 Engineering Economics Final ExamErickson CauyaoNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Tutorial 6 QsDocument6 pagesTutorial 6 QsDylan Rabin PereiraNo ratings yet

- Pertemuan 9 - Soal (English)Document2 pagesPertemuan 9 - Soal (English)Boby Kristanto ChandraNo ratings yet

- Millar Inc Purchased A Truck To Use For Deliveries andDocument1 pageMillar Inc Purchased A Truck To Use For Deliveries andtrilocksp SinghNo ratings yet

- EE Assignments 2016Document8 pagesEE Assignments 2016manojNo ratings yet

- New Tire Retreading Equipment Acquired at A Cost of 110 000: Unlock Answers Here Solutiondone - OnlineDocument1 pageNew Tire Retreading Equipment Acquired at A Cost of 110 000: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Eco ValuationDocument3 pagesEco ValuationAnonymous RbmGbYvNo ratings yet

- Turorial 9Document2 pagesTurorial 9FaezFarhatNo ratings yet

- Turorial 9: DepreciationDocument2 pagesTurorial 9: DepreciationFaezFarhatNo ratings yet

- FormulationDocument2 pagesFormulationawedsssssNo ratings yet

- Fall Semester - 2020 2021 Assignment IV - DepreciationDocument1 pageFall Semester - 2020 2021 Assignment IV - DepreciationJayagokul SaravananNo ratings yet

- Test#2 SampleDocument5 pagesTest#2 SamplelayanNo ratings yet

- Acctg at Udm: DepreciationDocument32 pagesAcctg at Udm: DepreciationBunbun 221No ratings yet

- EE Assignment 1-5 PDFDocument6 pagesEE Assignment 1-5 PDFShubhekshaJalanNo ratings yet

- Depreciation O Level NotesDocument5 pagesDepreciation O Level NotesBijoy SalahuddinNo ratings yet

- Chapter 8Document2 pagesChapter 8Gio RobakidzeNo ratings yet

- Solutiondone 2-337Document1 pageSolutiondone 2-337trilocksp SinghNo ratings yet

- Assignment 5Document2 pagesAssignment 5Chalermchai New KawinNo ratings yet

- Homework ExerciseDocument4 pagesHomework Exerciseazhar0% (1)

- Tugas Ektek 3Document2 pagesTugas Ektek 3Nahar MunNo ratings yet

- GEN292 - 2 Prod Assignment 4 2023Document2 pagesGEN292 - 2 Prod Assignment 4 2023Mohamed GamalNo ratings yet

- Review of Capital Budgeting Lecture 2 QuestionsDocument2 pagesReview of Capital Budgeting Lecture 2 QuestionsSalman AhmedNo ratings yet

- MAT112 - Past Year DepreciationDocument3 pagesMAT112 - Past Year DepreciationatiqahcantikNo ratings yet

- 0 EE IM Tutorial VDocument2 pages0 EE IM Tutorial VSivanesh KumarNo ratings yet

- 6a. Tutorial 6Document4 pages6a. Tutorial 6Siew Hui En A20A1947No ratings yet

- Depreciation MCQsDocument5 pagesDepreciation MCQsAsaduzzaman LimonNo ratings yet

- Depreciation Practice QuestionsDocument1 pageDepreciation Practice QuestionsM Hammad KothariNo ratings yet

- Chapter 3 - Economic Evaluation of AlternativesDocument21 pagesChapter 3 - Economic Evaluation of Alternativessam guptNo ratings yet

- 2 Prod Assignment 5Document2 pages2 Prod Assignment 5Mohamed GamalNo ratings yet

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- Test Bank 10Document9 pagesTest Bank 10mahmodsobhy121212No ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- Instructions: This Is A Take-Home Exam. Show Complete Solutions. Deadline ForDocument2 pagesInstructions: This Is A Take-Home Exam. Show Complete Solutions. Deadline ForYsmael Alongan B. MangorsiNo ratings yet

- Annual Equivalent MethodDocument14 pagesAnnual Equivalent MethodUsmanNo ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Exercises Service CostingDocument2 pagesExercises Service Costingashikin dzulNo ratings yet

- The Following Transactions Adjusting Entries and Closing Entries Were CompletedDocument1 pageThe Following Transactions Adjusting Entries and Closing Entries Were Completedtrilocksp SinghNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMikz PolzzNo ratings yet

- Depreciation Accounting-6Document19 pagesDepreciation Accounting-6rohitsf22 olypmNo ratings yet

- NYIF Accounting Module 8 Quiz With AnswersssDocument4 pagesNYIF Accounting Module 8 Quiz With AnswersssShahd OkashaNo ratings yet

- MEC210 Assignment#4 241Document3 pagesMEC210 Assignment#4 241Mohamed Gamal100% (1)

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Soal Ekotak Chapter 6 PDFDocument6 pagesSoal Ekotak Chapter 6 PDFSanti MarianaNo ratings yet

- New Tire Retreading Equipment Acquired at A Cost of 160 000Document1 pageNew Tire Retreading Equipment Acquired at A Cost of 160 000M Bilal SaleemNo ratings yet

- Examples and ProblemsDocument4 pagesExamples and ProblemsPaul AounNo ratings yet

- Financial Benefits of Converting A Fleet To Run On CNGDocument7 pagesFinancial Benefits of Converting A Fleet To Run On CNGapi-234260238No ratings yet

- Myanmar Transport Sector Policy NotesFrom EverandMyanmar Transport Sector Policy NotesRating: 3 out of 5 stars3/5 (1)

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet