Professional Documents

Culture Documents

At The Beginning of A Fiscal Year Alexander Company Buys: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

At The Beginning of A Fiscal Year Alexander Company Buys: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghCopyright:

Available Formats

At the beginning of a fiscal year Alexander Company buys

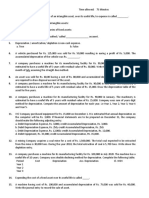

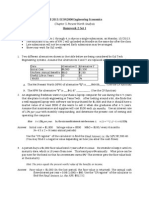

At the beginning of a fiscal year, Alexander Company buys a machine for $ 48,000. The

machine has an estimated life of five years and an estimated salvage value of $ 4,000.

Required Using the following four methods, determine the annual depreciation of the machine

for each of the estimated five years of its life, the accumulated depreciation at the end of each

year, and the book value of the machine at the end of each year. Round annual depreciation to

whole dollars. a. Straight-line method b. Double-declining-balance method c. Units-of-production

method (Useful life is 420,000 units. Year 1 use is 120,000 units, Year 2 use is 100,000 units,

Year 3 use is 90,000 units, Year 4 use is 60,000 units, and Year 5 use is 50,000 units.) Round

calculations to 3 decimal places. Year 5 depreciation should be rounded to balance. d. MACRS

method (Assume that the asset was purchased after 1986 and is seven-year property.) Year 8

depreciation should be rounded to balance.View Solution: At the beginning of a fiscal year

Alexander Company buys

SOLUTION-- http://solutiondone.online/downloads/at-the-beginning-of-a-fiscal-year-alexander-

company-buys/

Unlock answers here solutiondone.online

You might also like

- NYIF Accounting Module 8 Quiz With AnswersssDocument4 pagesNYIF Accounting Module 8 Quiz With AnswersssShahd OkashaNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsMark De Jesus0% (1)

- Capital BudgetingDocument3 pagesCapital BudgetingMikz PolzzNo ratings yet

- 6 Comparing AlternativesDocument49 pages6 Comparing AlternativesTrimar DagandanNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- At The Beginning of A Fiscal Year Flowers Company Buys: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of A Fiscal Year Flowers Company Buys: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- PROBLEM SET Final TermDocument2 pagesPROBLEM SET Final TermjianNo ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- DepreciationDocument17 pagesDepreciationZAID BIN TAHIRNo ratings yet

- Depreciation AccountingDocument14 pagesDepreciation AccountingsheebaNo ratings yet

- AnswerDocument15 pagesAnswerBIRHANU GEMECHUNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- REPLACEMENT1Document51 pagesREPLACEMENT1Ramees KpNo ratings yet

- Faculty of Mechanical and Industrial Engineering Industrial Chemistry Program Industrial Management and Engineering EconomicsDocument2 pagesFaculty of Mechanical and Industrial Engineering Industrial Chemistry Program Industrial Management and Engineering EconomicsAdisu ButaNo ratings yet

- Math3 sf.q1Document2 pagesMath3 sf.q1ExequielCamisaCrusperoNo ratings yet

- Eco ValuationDocument3 pagesEco ValuationAnonymous RbmGbYvNo ratings yet

- Capacity Problem1Document3 pagesCapacity Problem1Ahmed ZamanNo ratings yet

- Engineering Economy by Group ActivityDocument1 pageEngineering Economy by Group ActivityMj MallongaNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Assigned Task Capital BudgetingDocument1 pageAssigned Task Capital Budgetingjennyrose.navajaNo ratings yet

- Depreciation, Determining CostsDocument13 pagesDepreciation, Determining CostsKHAWAJA MUHAMMAD HUZAIFA100% (1)

- Sample Problems On DepreciationDocument1 pageSample Problems On DepreciationrobNo ratings yet

- Topic: Depreciation (Cost of Machine) Made by Sir Hyder AliDocument4 pagesTopic: Depreciation (Cost of Machine) Made by Sir Hyder AliHaroon KhatriNo ratings yet

- Problems Theme 4 FIXED ASSETSDocument5 pagesProblems Theme 4 FIXED ASSETSMihaelaNo ratings yet

- New Tire Retreading Equipment Acquired at A Cost of 110 000: Unlock Answers Here Solutiondone - OnlineDocument1 pageNew Tire Retreading Equipment Acquired at A Cost of 110 000: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- GEN292 - 2 Prod Assignment 4 2023Document2 pagesGEN292 - 2 Prod Assignment 4 2023Mohamed GamalNo ratings yet

- Working Hours Method WHM and UnitDocument11 pagesWorking Hours Method WHM and UnitSharryne Pador ManabatNo ratings yet

- Depreciation Accounting-6Document19 pagesDepreciation Accounting-6rohitsf22 olypmNo ratings yet

- Aqa Acc7 W QP Jun08Document8 pagesAqa Acc7 W QP Jun08Aimal FaezNo ratings yet

- Tut 9-11Document3 pagesTut 9-11Riya khungerNo ratings yet

- New Tire Retreading Equipment Acquired at A Cost of 160 000Document1 pageNew Tire Retreading Equipment Acquired at A Cost of 160 000M Bilal SaleemNo ratings yet

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- MAT112 (Assignment) Business Mathematics September 2019 - January 2019Document2 pagesMAT112 (Assignment) Business Mathematics September 2019 - January 2019syafiqahNo ratings yet

- 2 Prod Assignment 5Document2 pages2 Prod Assignment 5Mohamed GamalNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- 7 Problems On Investment Analysis V 1646203039086Document1 page7 Problems On Investment Analysis V 1646203039086Risshi AgrawalNo ratings yet

- 1231231Document5 pages1231231joshua espirituNo ratings yet

- Question Bank - Economics For EngineersDocument3 pagesQuestion Bank - Economics For EngineersAnurag AnandNo ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- MEC210 Assignment#4 241Document3 pagesMEC210 Assignment#4 241Mohamed Gamal100% (1)

- EE Assignments 2016Document8 pagesEE Assignments 2016manojNo ratings yet

- Practice Exam For Financial Management FALL 2020Document2 pagesPractice Exam For Financial Management FALL 2020Yasir Ahmed SiddiquiNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Financial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsDocument55 pagesFinancial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsmukul3087_305865623No ratings yet

- Depreciation Depreciation: by S KrugonDocument15 pagesDepreciation Depreciation: by S KrugonBRAHMAIAH NAKKANo ratings yet

- Cash Flows IIDocument16 pagesCash Flows IIChristian EstebanNo ratings yet

- Chapter 3 DEPRECIATION SEMIDocument16 pagesChapter 3 DEPRECIATION SEMIJames EscribaNo ratings yet

- Economic Exam 2019Document3 pagesEconomic Exam 2019Abuzeid Ahmed AliNo ratings yet

- Determining Relevant Cash Flows Basic Capital Budgeting Rockyford Company MustDocument1 pageDetermining Relevant Cash Flows Basic Capital Budgeting Rockyford Company MustAWDwaNo ratings yet

- Assignment 4Document2 pagesAssignment 4Ahmed BeheryNo ratings yet

- Chapter 8Document2 pagesChapter 8Gio RobakidzeNo ratings yet

- Cash Flows-Capbud PDFDocument2 pagesCash Flows-Capbud PDFErjohn PapaNo ratings yet

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- Fall Semester - 2020 2021 Assignment IV - DepreciationDocument1 pageFall Semester - 2020 2021 Assignment IV - DepreciationJayagokul SaravananNo ratings yet

- Chapter 5 - Replacement AnalysisDocument29 pagesChapter 5 - Replacement AnalysisUpendra ReddyNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet