Professional Documents

Culture Documents

Essay Agency Theory, Stewardhips Theory, Stakeholders Theory and Corporate Governance

Uploaded by

Afira Arif BizvaganzaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Essay Agency Theory, Stewardhips Theory, Stakeholders Theory and Corporate Governance

Uploaded by

Afira Arif BizvaganzaCopyright:

Available Formats

SHAHIRAH BINTI MUKHTAR

M172004514

MPW 3023 BUSINESS ETHICS AND CORPORATE GOVERNANCE

ESSAY

AGENCY THEORY, STEWARDHIPS THEORY, STAKEHOLDERS THEORY AND

CORPORATE GOVERNANCE

Agency theory is about understanding the relationships between agents and principals.

The agent represent the principal in a particular business transaction and is expected to represent

the best interests of the principal without regard for self-interest. Corporate governance can be

used to change the rules under which the agent operates and restore the principal's interests. The

principal, by employing the agent to represent the principal's interests, must overcome a lack of

information about the agent's performance of the task. Agents must have incentives encouraging

them to act in unison with the principal's interests. Agency theory may be used to design these

incentives appropriately by considering what interests motivate the agent to act. Incentives

encouraging the wrong behavior must be removed, and rules discouraging moral hazard must be

in place. Understanding the mechanisms that create problems helps businesses develop better

corporate policy. Agency loss drops when the following situations occur such as the agent and

principal both hold similar interests of achieving the identical income and the principal is

mindful of the agent’s activities, so the principal has a keen knowledge of the level of service he

is receiving.

The steward theory states that a steward protects and maximises shareholders wealth

through firm performance. Stewards are company executives and managers working for the

shareholders, protects and make profits for the shareholders. The stewards are satisfied and

motivated when organizational success is attained. It so stressing on the position of employees or

executives to act more autonomously so that the shareholders’ returns are maximized. The

employees take ownership of their jobs and work at them diligently. Stewardship models may

include environmental concerns, where a company believes it should operate with as little

impact as possible on the earth. Other companies may champion human or animal rights,

refraining from using products that are made in sweatshops or tested on live subjects. Still

others may honor the owner’s religious beliefs that show themselves in the form of servant

leadership. These models tend to be subjective, with management determining the boundary

between socially responsible or irresponsible behavior. These is can give a few effects such as

effects on business and effects on employees.

The stakeholder theory of corporate governance focuses on the effect

of corporate activity on all identifiable stakeholders of the corporation. This theory positions

that corporate managers (officers and directors) should take into consideration the interests of

each stakeholder in its governance process. The idea of the stakeholder as a factor in corporate

governance is quite new. Most of us were educated with conservative economist Milton

Friedman’s view that the only purpose of a business is to make money for its shareholders. But,

in 1963, a group of economists at the Stanford Research Institute in California coined the idea

that a business is actually responsible to a larger group: its stakeholders, including “employees,

customers, suppliers, creditors and even the wider community and competitors”, according to

British economist Andrew Gamble, who took up the concept. Everyone who has a “stake” in the

future of the business, as the Oxford English Dictionary defines the term ‘stakeholder’, is

included.

You might also like

- Stakeholder and Shareholder Theory AssignmntDocument9 pagesStakeholder and Shareholder Theory AssignmntMarlvern Panashe ZifambaNo ratings yet

- Theories of Corporate GovernanceDocument5 pagesTheories of Corporate GovernanceRishabh DuttaNo ratings yet

- Theories of Corporate GovernanceDocument6 pagesTheories of Corporate GovernanceBasheer AcNo ratings yet

- 03 Activity 2 (Part 2)Document3 pages03 Activity 2 (Part 2)Ralph Louise PoncianoNo ratings yet

- Theories of Corporate GovernanceDocument4 pagesTheories of Corporate GovernanceAmit Grover100% (1)

- Corporate Social Responsibility and Business Ethics1Document15 pagesCorporate Social Responsibility and Business Ethics1Eve Muli MueniNo ratings yet

- Theories of Corporate GovernanceDocument5 pagesTheories of Corporate GovernanceSyeda HudaNo ratings yet

- Theories of Corporate Governance: Agency TheoryDocument3 pagesTheories of Corporate Governance: Agency TheoryKatrinaDelaCruz100% (1)

- Lesson 2Document8 pagesLesson 2Aramella VaronaNo ratings yet

- Lesson 2 - Handouts (BACC 6)Document6 pagesLesson 2 - Handouts (BACC 6)Judil BanastaoNo ratings yet

- Corporate Governace - TheoriesDocument4 pagesCorporate Governace - TheoriesMillat Afridi100% (1)

- Theories of Corporate Governance (Unit II)Document3 pagesTheories of Corporate Governance (Unit II)ShoaibNo ratings yet

- Corporate GovernanceDocument12 pagesCorporate GovernanceArtNo ratings yet

- Amity Law School: Corporate GovernanceDocument8 pagesAmity Law School: Corporate GovernancetanyaNo ratings yet

- NotesDocument3 pagesNotesnikiNo ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentSwarnajeet GaekwadNo ratings yet

- Uganda Management Institute (Umi) : CourseDocument13 pagesUganda Management Institute (Umi) : CourseMwembi perezNo ratings yet

- Business Ethics NotesDocument10 pagesBusiness Ethics NotesLUMU EMMANo ratings yet

- CGE Short NotesDocument23 pagesCGE Short NotesMd ImranNo ratings yet

- 9 Ijm May12Document6 pages9 Ijm May12Fitriyeni OktaviaNo ratings yet

- What Are TheDocument5 pagesWhat Are Theyonassheleme1122No ratings yet

- Business Ethics (Also Corporate Ethics) Is A Form of Applied Ethics or ProfessionalDocument21 pagesBusiness Ethics (Also Corporate Ethics) Is A Form of Applied Ethics or ProfessionalSanket Jadhav100% (1)

- Agency TheoryDocument5 pagesAgency TheoryalfritschavezNo ratings yet

- Freeman's Stakeholder TheoryDocument2 pagesFreeman's Stakeholder Theoryshrikant raiNo ratings yet

- Agency Theory Final INfoDocument9 pagesAgency Theory Final INfoalfritschavezNo ratings yet

- Theories of Coroporate GovernanceDocument3 pagesTheories of Coroporate GovernanceMohankumar0205No ratings yet

- Unit 5 INTRODUCTION TO CORPORATEDocument10 pagesUnit 5 INTRODUCTION TO CORPORATEbhargav.bhut112007No ratings yet

- Assignment - 1 2018 SpringDocument33 pagesAssignment - 1 2018 SpringNikhil AcharyaNo ratings yet

- TOPIC 2: Corporate Governance: Definitions and TheoriesDocument17 pagesTOPIC 2: Corporate Governance: Definitions and TheoriesJhamszGabianaNo ratings yet

- Corporate Social Responsibility: Shareholders StakeholdersDocument3 pagesCorporate Social Responsibility: Shareholders StakeholdersNishant SoodNo ratings yet

- Corporate GovernanceDocument9 pagesCorporate GovernanceVanita SanghaviNo ratings yet

- Business Ethics: Dr. D.Y.Patiluniversity Department of Business ManagemntDocument4 pagesBusiness Ethics: Dr. D.Y.Patiluniversity Department of Business ManagemntAvishkarzNo ratings yet

- Research Paper On Agency TheoryDocument4 pagesResearch Paper On Agency Theorygz7p29p0100% (1)

- HRM Ethics Assignment: Submitted by Abhinandan Choudhury Hanish Dhume Nishita Tibrewal Prathmesh Joshi Rajat VarshneyDocument4 pagesHRM Ethics Assignment: Submitted by Abhinandan Choudhury Hanish Dhume Nishita Tibrewal Prathmesh Joshi Rajat VarshneyAbhinandan ChoudhuryNo ratings yet

- 1 Running Head:: Business EthicsDocument4 pages1 Running Head:: Business Ethicssamuel waweruNo ratings yet

- Course Synthesis GaringDocument7 pagesCourse Synthesis GaringMary ClareNo ratings yet

- Fundamental and Ethical Theories On Corporate GovernanceDocument6 pagesFundamental and Ethical Theories On Corporate GovernanceVincent John Agustin AlipioNo ratings yet

- Midlands State University: Topic/Question: Discuss The Implications of Stakeholder Theory and ShareholderDocument6 pagesMidlands State University: Topic/Question: Discuss The Implications of Stakeholder Theory and ShareholderMarlvern Panashe ZifambaNo ratings yet

- BACC 501 Corporate Governance Concepts and Theories 2Document2 pagesBACC 501 Corporate Governance Concepts and Theories 2abel tizonNo ratings yet

- MGT TH Ch2Document8 pagesMGT TH Ch2Ismael KasimNo ratings yet

- Ethical Dilemma, Sources and Their Resolutions: Dr. Anita SinghDocument53 pagesEthical Dilemma, Sources and Their Resolutions: Dr. Anita SinghSRK HONEY100% (1)

- BECG MaterialDocument12 pagesBECG MaterialC Rani100% (2)

- Busines Ethics Chapter FiveDocument7 pagesBusines Ethics Chapter Fivedro landNo ratings yet

- Corporate Finance for CFA level 1: CFA level 1, #1From EverandCorporate Finance for CFA level 1: CFA level 1, #1Rating: 3.5 out of 5 stars3.5/5 (3)

- Academic Script PDFDocument11 pagesAcademic Script PDFShihab ChiyaNo ratings yet

- Business Ethics Unit 1Document29 pagesBusiness Ethics Unit 1Rakshit SharmaNo ratings yet

- Management Strategies in Educational InstitutionsDocument16 pagesManagement Strategies in Educational InstitutionsGhulam ShabbirNo ratings yet

- Jamshaid 59 4438 2 BE Session 2Document44 pagesJamshaid 59 4438 2 BE Session 2Mahnoor BalochNo ratings yet

- Corporate Governance and EthicsDocument28 pagesCorporate Governance and EthicsAndrea PalomeraNo ratings yet

- Stake Hold eDocument1 pageStake Hold eandresraroca17No ratings yet

- Business Ethics Class 2 - Module 1Document42 pagesBusiness Ethics Class 2 - Module 1archit.chatterjee05No ratings yet

- The Agency ConceptDocument2 pagesThe Agency ConceptFianne RamalesNo ratings yet

- Maasai Mara University School of Business and EconomicsDocument12 pagesMaasai Mara University School of Business and Economicsjohn wambuaNo ratings yet

- Business Ethics - Some Basic ConceptsDocument20 pagesBusiness Ethics - Some Basic ConceptsZara PatelNo ratings yet

- Instruction: Answer The Following Questions. Refer To The Given Rubric For Scoring. (50 Points)Document3 pagesInstruction: Answer The Following Questions. Refer To The Given Rubric For Scoring. (50 Points)Maj MarticioNo ratings yet

- Ethical and Social Responsibility of EntrepreneuDocument2 pagesEthical and Social Responsibility of EntrepreneuZainab YousufNo ratings yet

- Assignment On Ethics in Bangladesh: Ethics Business Ethics MoralityDocument2 pagesAssignment On Ethics in Bangladesh: Ethics Business Ethics MoralityArafatNo ratings yet

- Rahma Putri Hapsari - 29120450 - Task 1Document2 pagesRahma Putri Hapsari - 29120450 - Task 1Rahma Putri HapsariNo ratings yet

- Value Ethics Module 2Document7 pagesValue Ethics Module 2Mayal SheikhNo ratings yet

- And Ethical Issues: Assignment of SocialDocument17 pagesAnd Ethical Issues: Assignment of Socialbhumika nagiNo ratings yet

- What Is InflationDocument222 pagesWhat Is InflationAhim Raj JoshiNo ratings yet

- INA CBGs Dan PPK7.ppt (Compatibility Mode)Document65 pagesINA CBGs Dan PPK7.ppt (Compatibility Mode)Casemix rsudwaledNo ratings yet

- Cement Industry Analysis Model 2Document5 pagesCement Industry Analysis Model 2shadyNo ratings yet

- Adobe Scan 02-Jul-2022Document4 pagesAdobe Scan 02-Jul-2022Akshita SethiNo ratings yet

- Math #21Document4 pagesMath #21Pdf FilesNo ratings yet

- 2 TsgraphicsDocument107 pages2 TsgraphicsjuanivazquezNo ratings yet

- Chapter 23 IaDocument4 pagesChapter 23 IaKiminosunoo LelNo ratings yet

- Finshing BOQ - RevDocument14 pagesFinshing BOQ - RevAmmar HattabNo ratings yet

- Turning Great Strategy Into Great PerformanceDocument22 pagesTurning Great Strategy Into Great PerformanceCathy Jeny Jeny Catherine100% (2)

- Customer Service Case StudiesDocument4 pagesCustomer Service Case Studiessameer maddubaigari80% (5)

- Eco 3 28.4 PDFDocument329 pagesEco 3 28.4 PDFDean Wood0% (1)

- VISUALS IN ECONOMICS (Deped)Document4 pagesVISUALS IN ECONOMICS (Deped)Ceres B. LuzarragaNo ratings yet

- Worksheet 5-PopulationDocument6 pagesWorksheet 5-PopulationrizNo ratings yet

- Tariff Order 2010-11Document187 pagesTariff Order 2010-11Nannapaneni P. ChowdaryNo ratings yet

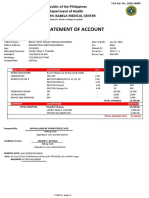

- Statement of Account: Republic of The Philippines Department of Health Southern Isabela Medical CenterDocument1 pageStatement of Account: Republic of The Philippines Department of Health Southern Isabela Medical CenterNHUJBETH INTERNET CAFENo ratings yet

- The Latte FactorDocument10 pagesThe Latte FactorКыр Сосичка100% (1)

- CVC GuidelinesDocument23 pagesCVC Guidelinespritish mandalNo ratings yet

- Was Milton Friedman A Socialist? Yes.: MEST Journal January 2013Document17 pagesWas Milton Friedman A Socialist? Yes.: MEST Journal January 2013Raphaël FromEverNo ratings yet

- Chemistry 1 Tutor - Vol 2 - Worksheet 10 - Limiting Reactants - Part 1Document12 pagesChemistry 1 Tutor - Vol 2 - Worksheet 10 - Limiting Reactants - Part 1lightningpj1234No ratings yet

- List of HRERA Agents 692017Document10 pagesList of HRERA Agents 692017sharad159No ratings yet

- Department of Education: Republic of The PhilippinesDocument5 pagesDepartment of Education: Republic of The PhilippinesJoelmarMondonedo100% (7)

- Case QuestionDocument3 pagesCase QuestionNguyên Kim100% (4)

- JSRRDA - PMU - 16 JMF Observations PalamuDocument2 pagesJSRRDA - PMU - 16 JMF Observations Palamuprathuri sumanthNo ratings yet

- UiTM SHAH ALAM PUBLIC TRANSPORT SERVICE (LATEST)Document4 pagesUiTM SHAH ALAM PUBLIC TRANSPORT SERVICE (LATEST)Khairul AnazNo ratings yet

- NS ES 0048 Steam Generator - ALLDocument2 pagesNS ES 0048 Steam Generator - ALLbartney chenNo ratings yet

- PS Review Chapter 4Document8 pagesPS Review Chapter 4Thai Quoc Toan (K15 HCM)No ratings yet

- Ies TomDocument42 pagesIes TomLidiaCojocaruNo ratings yet

- Fixed Date Claim Form - 2022110208441500Document18 pagesFixed Date Claim Form - 2022110208441500Lynton OrrettNo ratings yet

- Brosur ARIN PARTITIONDocument12 pagesBrosur ARIN PARTITIONMomo mwsNo ratings yet

- Hussen Field ReportDocument17 pagesHussen Field ReportHussein Makame100% (1)