Professional Documents

Culture Documents

Certificate of Compensation Payment/Tax Withheld: (Present)

Uploaded by

Maria Cristina TuazonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Compensation Payment/Tax Withheld: (Present)

Uploaded by

Maria Cristina TuazonCopyright:

Available Formats

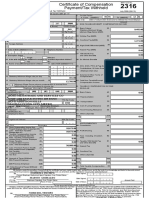

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENCS)

Payment/Tax Withheld

2316 01/18ENCS

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the Period

(YYYY) 2 0 2 0 From (MM/DD) 0 4 0 1 To (MM/DD) 1 2 3 1

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN

76 - 635 - 456 - 0 0 0 0 0 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

1 (Last Name, First Name, Middle Name)

4 Employee's Name 5 RDO Code 27 Basic Salary (including the exempt P250,000 & below)

or the Statutory Minimum Wage of the MWE 74 802.00

ISO, SHERILYN MAY ALBUEN 041

28 Holiday Pay (MWE) -

6 Registered Address 6A ZIP Code

Brgy. Domoit, Lucena City 29 Overtime Pay (MWE) -

6B Local Home Address 6C ZIP Code

30 Night Shift Differential (MWE) -

6D Foreign Address

31 Hazard Pay (MWE) -

N/A 32 13th Month Pay and Other Benefits

7 Date of Birth (MM/DD/YYYY) 8 Contact Number (maximum of P90,000) 7,488.87

07 03 1999 33 De Minimis Benefits

3,338.30

9 Statutory Minimum Wage rate per day 303.00 34 SSS, GSIS, PHIC & PAG-IBIG Contributions

and Union Dues (Employee share only) 5,873.40

10 Statutory Minimum Wage rate per month 7 903.25 35 Salaries and Other Forms of Compensation 0.00

Minimum Wage Earner (MWE) whose compensation is exempt from

11

X withholding tax and not subject to income tax 36 Total Non-Taxable/Exempt Compensation

Part II - Employer Information (Present) Income (Sum of Items 27 to 35) 91,502.57

12 TIN

001 - 668 - 428 - 0 0 0 00 B. TAXABLE COMPENSATION INCOME REGULAR

13 Employer's Name

37 Basic Salary

-

ACYATAN & CO., CPAS

38 Representation

14 Registered Address 14A ZIP Code -

Unit 123, 12th Flr. The Columbia Tower, Ortigas Avenue,

Mandaluyong City

155 0 39 Transportation

-

15 Type of Employer Main Employer Secondary Employer

x 40 Cost of Living Allowance (COLA)

Part III - Employer Information (Previous) -

16 TIN

139 - 584 - 275 - 0 0 0 0 0 41 Fixed Housing Allowance -

17 Employer's Name 42 Others (specify)

ARMINDA A. GUERRERO 42A

-

18 Registered Address 18A ZIP Code

42B -

Unit 123, 12th Flr. The Columbia Tower, Ortigas Avenue,

Mandaluyong City 1550 SUPPLEMENTARY

Part IVA - Summary

43 Commission

19 Gross Compensation Income from Present -

Employer (Sum of Items 36 and 50) 91,502.57

44 Profit Sharing

20 Less: Total Non-Taxable/Exempt Compensation -

Income from Present Employer (From Item 36) 91,502.57 45 Fees Including Director's Fees

21 Taxable Compensation Income from Present -

Employer (Item 19 Less Item 20) (From Item 50) - 46 Taxable 13th Month Benefits

22 Add: Taxable Compensation Income from -

Previous Employer, if applicable - 47 Hazard Pay

23 Gross Taxable Compensation Income -

(Sum of Items 21 and 22) - 48 Overtime Pay

24 Tax Due -

- 49 Others (specify)

25 Amount of Taxes Withheld

49A

25A Present Employer - -

25B Previous Employer, if applicable 49B

- -

26 Total Amount of Taxes Withheld as adjusted 50 Total Taxable Compensation Income

(Sum of Items 25A and 25B)

- (Sum of Items 37 to 49B) -

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our informati

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 ANTONINO A. ACYATAN Date Signed

Present Employer/Authorized Agent Signature over Printed Name

CONFORME:

52 SHERILYN MAY A. ISO Date Signed

Employee Signature over Printed Name Amount paid, if CTC

CTC/Valid ID No. Place of

Date Issued

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

reported under BIR Form No. 1604-C which has been filed with the Bureau of (BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

Internal Revenue. for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

ANTONINO A. ACYATAN Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

53 of Revenue Regulations (RR) No. 3-2002, as amended.

Present Employer/Authorized Agent Signature over Printed Name

(Head of Accounting/Human Resource or Authorized Representative) 54 SHERILYN MAY A. ISO

Employee Signature over Printed Name

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativegordon scottNo ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Maricar CoronelDocument1 pageCertificate of Compensation Payment/Tax Withheld: Maricar CoronelAmy P. DalidaNo ratings yet

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- Top 500 Taxpayers in The Philippines 2012Document8 pagesTop 500 Taxpayers in The Philippines 2012Mykiru IsyuseroNo ratings yet

- Tax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024Document2 pagesTax Case Digest: PB Com V. CIR (1999) : G.R. No. 112024RexNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)Document1 pageCertificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)jacotesaluna09No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDocument1 pageCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- Osea Aileen 2316Document1 pageOsea Aileen 2316Maricel PestañoNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJexterNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- GST BILL Highlights of Draft Model GST LawDocument6 pagesGST BILL Highlights of Draft Model GST LawS Sinha RayNo ratings yet

- The Following Transactions Occur Over The Remainder of The Year AugDocument2 pagesThe Following Transactions Occur Over The Remainder of The Year AugBube KachevskaNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- Almc - Cash Position - 11may2021Document246 pagesAlmc - Cash Position - 11may2021ACYATAN & CO., CPAs 2020No ratings yet

- Incometax Act 1961Document22 pagesIncometax Act 1961Mohd. Shadab khanNo ratings yet

- Departmental AccountingDocument21 pagesDepartmental AccountingFarhat Ullah KhanNo ratings yet

- Dec 2018Document1 pageDec 2018Bharat YadavNo ratings yet

- Tutorial 1 RSDocument2 pagesTutorial 1 RSateen rizalmanNo ratings yet

- One Nation, One Tax: Goods and Services Tax (GST)Document13 pagesOne Nation, One Tax: Goods and Services Tax (GST)Karan SharmaNo ratings yet

- Income Taxation of Employees in The PhilippinesDocument4 pagesIncome Taxation of Employees in The Philippinesjoan villacastinNo ratings yet

- DEUTSCHE BANK AG MANILA BRANCH Vs CIRDocument5 pagesDEUTSCHE BANK AG MANILA BRANCH Vs CIRBruno GalwatNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008Jaime II LustadoNo ratings yet

- Press Release Template 01Document2 pagesPress Release Template 01mkb07No ratings yet

- Tax3701 TL 102Document80 pagesTax3701 TL 102Jerome ChettyNo ratings yet

- Cagricultural Income: Meaning of Agricultural IncomeDocument5 pagesCagricultural Income: Meaning of Agricultural Incomerakshitha9reddy-1No ratings yet

- Income From House PropertyDocument40 pagesIncome From House PropertyDrPreeti JindalNo ratings yet

- 8.gang Rate Excel SheetDocument3 pages8.gang Rate Excel SheetRambhakt HanumanNo ratings yet

- Invoice Original 5873Document1 pageInvoice Original 5873Prakhar KesharNo ratings yet

- Filing of Returns and PaymentDocument10 pagesFiling of Returns and PaymentOmie Jehan Hadji-AzisNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- Business and Transfer Taxation Chapter 13A Discussion Questions AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13A Discussion Questions AnswerKarla Faye Lagang100% (1)

- PayslipsDocument63 pagesPayslipsPrem AahvaNo ratings yet

- Finance Act 2006Document4 pagesFinance Act 2006Tapia MelvinNo ratings yet

- Chapter 8 MCQDocument4 pagesChapter 8 MCQcik sitiNo ratings yet

- AttyGenl Brief 4.8.21Document42 pagesAttyGenl Brief 4.8.21The ForumNo ratings yet