Professional Documents

Culture Documents

Papc QP 3

Uploaded by

ಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್0 ratings0% found this document useful (0 votes)

52 views2 pagesTHIRD INTERNALS PAPC

Original Title

PAPC-QP-3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTHIRD INTERNALS PAPC

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

52 views2 pagesPapc QP 3

Uploaded by

ಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್THIRD INTERNALS PAPC

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Dept.

of Management Studies

JNNCE, Shimoga

III Semester MBA

III CIE Test

Course: Project Appraisal, Planning & Control Course Code: 18MBAFM306

Date: 07-01-2021 Max. Marks: 50 Max. Time: 90 Minutes

Instructions

1. Fill-up the details on the front sheet of your answer book.

2. Answer all the questions.

3. Write your answers with black-ink ball-point pen only.

4. Indicate the Q.Nos. and Page Nos. clearly and prominently.

5. Preserve the answer scripts safely and submit to the Dept. when advised.

6. Submit neatly scanned answer scripts (within 15 minutes from the close of the test) to:

papc2020tests@gmail.com

-------------------------------------------------------------------------------------------------------------------------------

Q. No. Question CO BTL Marks

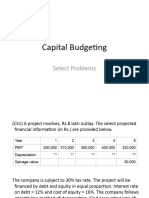

1 a Explain: (i) Post-audit (ii) Abandonment Analysis 3 3 3

An equipment costs Rs.1,000,000 and lasts for 6 years. What

should be the minimum annual cash inflow to justify the

1 b purchase of the equipment ? Assume that the cost of capital is 4 4 7

12 percent.

Megatronics Limited is evaluating a project whose expected

cash flows are as follows:

Year Cash flow

0 -500,000

1 100,000

1 c 4 4 10

2 200,000

3 300,000

4 100,000

What is the NPV of the project if the cost of capital is 10

percent?

2 a Mention any three measures of calculating ARR? 4 2 3

2 b Explain prerequisites for successful project implementation 3 3 7

2 c A project has begun on 1st July 200X and is expected 4 4 10

to be completed by 31st December 200X. The project is being

reviewed on 30th September 200X when the following

information has been developed:

Budgeted cost for work scheduled (BCWS) : Rs 8,000,000

Budgeted cost for work performed (BCWP) :Rs 4,600,000

Actual cost of work performed (ACWP) Rs 4,100,000

Budgeted cost for total work (BCTW) Rs 11,000,000

Additional cost for completion (ACC) :Rs 6,000,000

Determine the following: (i) cost variance, (ii) schedule

variance in cost terms, (iii) cost

Jawahar Industries has identified that the following factors,

with their respective expected values, have a bearing on the

NPV of their new project.

Initial investment 10,000

Cost of capital 11 %

Quantity manufactured and sold annually 1,000

Price per unit 20

Variable cost per unit 15

Fixed costs 1,000

Depreciation 1,000

Tax rate 20 %

3 - Life of the project 7years 4 4 10

Net salvage value Nil

Assume that the following underlying variables can take

the values as shown below:

Underlying variable Pessimistic Optimistic

Quantity manufactured and sold 700 1,400

Price per unit 18 23

Variable cost per unit 16 14

Perform scenario analysis

***

* indicative

You might also like

- Tutorial Questions - Capital Budgeting 2023-1Document16 pagesTutorial Questions - Capital Budgeting 2023-1Richie Ric JuniorNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Kohat University Mid Term Exam Questions on Managerial AccountingDocument2 pagesKohat University Mid Term Exam Questions on Managerial Accountingilyas muhammadNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- Project Finance and Appraisal TutorialDocument3 pagesProject Finance and Appraisal TutorialAjay MeenaNo ratings yet

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument2 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarkssushilNo ratings yet

- Tutorial 1Document2 pagesTutorial 1Theresia RobertNo ratings yet

- Proj Fin Q BankDocument29 pagesProj Fin Q BankkIkiNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document14 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Tutorial Question 2 NPV AnalysisDocument8 pagesTutorial Question 2 NPV AnalysisTheva LetchumananNo ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Project Assignment IIDocument3 pagesProject Assignment IILidya AberaNo ratings yet

- Campusexpress - Co.in: Set No. 1Document8 pagesCampusexpress - Co.in: Set No. 1skssushNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Dba 302 Financial Management Supplementary TestDocument3 pagesDba 302 Financial Management Supplementary Testmulenga lubembaNo ratings yet

- Ce 8 Sem Construction Economics and Finance Jun 2017Document4 pagesCe 8 Sem Construction Economics and Finance Jun 2017Panna KurmiNo ratings yet

- Engineering Economics Project Analysis & Decision MakingDocument32 pagesEngineering Economics Project Analysis & Decision MakingbibekNo ratings yet

- NIT Rourkela Mid-Semester Exam for SPPQMDocument11 pagesNIT Rourkela Mid-Semester Exam for SPPQM36rajnee kantNo ratings yet

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Investment Appraisal Questions 2-1Document8 pagesInvestment Appraisal Questions 2-1Olajumoke SanusiNo ratings yet

- University of Zimbabwe: Professional and Industrial StudiesDocument7 pagesUniversity of Zimbabwe: Professional and Industrial StudiesBrightwell InvestmentsNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- Cost ManagemnetDocument45 pagesCost ManagemnetGowri Shaji0% (1)

- Acc3204 - Jan2018Document5 pagesAcc3204 - Jan2018natlyhNo ratings yet

- Universiti Teknologi MaraDocument5 pagesUniversiti Teknologi Mararaihana abdulkarimNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Postal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueDocument22 pagesPostal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueGajju ChautalaNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- Advanced Financial Management Elective PaperDocument3 pagesAdvanced Financial Management Elective PaperRamakrishna NagarajaNo ratings yet

- Cost Accounting 2 Question PaperDocument6 pagesCost Accounting 2 Question PaperSajithaNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- CPA Review: Advanced Financial Accounting SelftestDocument7 pagesCPA Review: Advanced Financial Accounting SelftestJennifer RueloNo ratings yet

- FMP (2nd) May2016Document1 pageFMP (2nd) May2016Vandana AhujaNo ratings yet

- Practice 6 - QuestionsDocument4 pagesPractice 6 - QuestionsantialonsoNo ratings yet

- Chemical Plant Design & Economics Exam QuestionsDocument2 pagesChemical Plant Design & Economics Exam QuestionsrahulNo ratings yet

- Problems On Capital BudgetingDocument2 pagesProblems On Capital BudgetingDeepakNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Cost Mock Test Paper 2Document7 pagesCost Mock Test Paper 2Soul of honeyNo ratings yet

- Quiz No. 2 IntAcc1&2 With AnswersDocument4 pagesQuiz No. 2 IntAcc1&2 With AnswersFrancis AsisNo ratings yet

- 53 Elective1 Advanced Financial Management Fresh CBCS 2016 17 and OnwardsDocument3 pages53 Elective1 Advanced Financial Management Fresh CBCS 2016 17 and OnwardsLaya NeeleshNo ratings yet

- B.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015Document15 pagesB.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015MD SHAKIL AHMEDNo ratings yet

- NPV and IRR - Lesson 1Document4 pagesNPV and IRR - Lesson 1Barack MikeNo ratings yet

- Additional Review QNSDocument2 pagesAdditional Review QNSchabeNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Sri Sairam Institute of Management Studies Chennai - 44Document4 pagesSri Sairam Institute of Management Studies Chennai - 44Anbarasu KrishnanNo ratings yet

- Diploma in Accountancy-March 2023 QaDocument233 pagesDiploma in Accountancy-March 2023 QaWalusungu A Lungu BandaNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Tutorials Fin 310 2023Document3 pagesTutorials Fin 310 2023SimonNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Mas CeggDocument20 pagesMas CeggMaurice AgbayaniNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Quiz ConstructionDocument1 pageQuiz ConstructionErjohn PapaNo ratings yet

- D. E. I. Technical College, Dayalbagh, AgraDocument6 pagesD. E. I. Technical College, Dayalbagh, AgraPreetam MehtaNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Names of Planet in IndiaDocument1 pageNames of Planet in Indiaಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- J N N College of Engineering: Shivamogga, KarnatakaDocument1 pageJ N N College of Engineering: Shivamogga, Karnatakaಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- VinuuDocument1 pageVinuuಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- JNN College of Engineering: Department of Management StudiesDocument1 pageJNN College of Engineering: Department of Management Studiesಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Financial Accounting, Management and Analysis PaperDocument3 pagesFinancial Accounting, Management and Analysis Paperಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Dhanya - Final ReadytoprintDocument86 pagesDhanya - Final Readytoprintಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Primary distribution summary cost apportionmentDocument6 pagesPrimary distribution summary cost apportionmentಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- PAPC Case StudyDocument1 pagePAPC Case Studyಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- FA - 1 Question Paper RavishDocument5 pagesFA - 1 Question Paper Ravishಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Sugar Industry Is The Largest AgroDocument2 pagesSugar Industry Is The Largest Agroಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- I. Capital & ReservesDocument4 pagesI. Capital & Reservesಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- History of NumbersDocument1 pageHistory of Numbersಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- SalaryDocument19 pagesSalaryಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Chapters For ProjectDocument1 pageChapters For Projectಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Stone 'S ModelDocument1 pageStone 'S ModelMohammed ImranNo ratings yet

- DividendDocument15 pagesDividendಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Sugar Industry Is The Largest AgroDocument2 pagesSugar Industry Is The Largest Agroಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Project Report On Indian Banking SystemDocument61 pagesProject Report On Indian Banking Systemhjghjghj75% (172)

- Random Numbers For StatisticsDocument1 pageRandom Numbers For Statisticsಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- To Test The Significance of The Mean of A Random Sample. in Determining Whether TheDocument8 pagesTo Test The Significance of The Mean of A Random Sample. in Determining Whether Theಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- FM TheoryDocument66 pagesFM Theoryಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Litrerature Review of AlphbetsDocument1 pageLitrerature Review of Alphbetsಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- VTU MBA Syllabus 2010Document149 pagesVTU MBA Syllabus 2010jysuraj100% (3)

- Chapter 3Document7 pagesChapter 3Srinivasa MurthyNo ratings yet

- 3 Ratio AnalysisDocument9 pages3 Ratio Analysisಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Financial Slack and Mergers BibliographyDocument4 pagesFinancial Slack and Mergers Bibliographyಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- VTU EDUSAT Program Explains 8 Ways IT Can Provide Strategic AdvantageDocument19 pagesVTU EDUSAT Program Explains 8 Ways IT Can Provide Strategic Advantageಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- 08oct MotivationDocument21 pages08oct Motivationಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- APA Format Bibliography GuideDocument4 pagesAPA Format Bibliography GuideMat EyNo ratings yet

- Cis Bin Haider GRP LTD - HSBC BankDocument5 pagesCis Bin Haider GRP LTD - HSBC BankEllerNo ratings yet

- Samahan NG Manggagawa NG Hanjin Vs BLRDocument11 pagesSamahan NG Manggagawa NG Hanjin Vs BLRPhrexilyn PajarilloNo ratings yet

- 20-Sdms-02 (Overhead Line Accessories) Rev01Document15 pages20-Sdms-02 (Overhead Line Accessories) Rev01Haytham BafoNo ratings yet

- AfghanistanLML OnlinDocument117 pagesAfghanistanLML Onlinعارف حسینNo ratings yet

- Andrija Kacic Miosic - Razgovor Ugodni Naroda Slovinskoga (1862)Document472 pagesAndrija Kacic Miosic - Razgovor Ugodni Naroda Slovinskoga (1862)paravelloNo ratings yet

- Dhi-Ehs-Hsm-028 Work Over Water Rev0Document5 pagesDhi-Ehs-Hsm-028 Work Over Water Rev0Phạm Đình NghĩaNo ratings yet

- VespaDocument5 pagesVespaAmirul AimanNo ratings yet

- Project Feasibility Study For The Establishment of Footwear and Other AccessoriesDocument12 pagesProject Feasibility Study For The Establishment of Footwear and Other Accessoriesregata4No ratings yet

- BUSINESS TALE - A Story of Ethics, Choices, Success - and A Very Large Rabbit - Theme of Ethics Code or Code of Business Con - EditedDocument16 pagesBUSINESS TALE - A Story of Ethics, Choices, Success - and A Very Large Rabbit - Theme of Ethics Code or Code of Business Con - EditedBRIAN WAMBUINo ratings yet

- Document - University Admission SystemDocument100 pagesDocument - University Admission SystemNaresh SharmaNo ratings yet

- Rate of Grease Penetration of Flexible Barrier Materials (Rapid Method)Document3 pagesRate of Grease Penetration of Flexible Barrier Materials (Rapid Method)DanZel Dan100% (1)

- TU20Document6 pagesTU20Manikumar KNo ratings yet

- 4 - ASR9K XR Intro Routing and RPL PDFDocument42 pages4 - ASR9K XR Intro Routing and RPL PDFhem777No ratings yet

- COURSE Strucure - M.tech (S.E) I & II Sem (Autonomous)Document40 pagesCOURSE Strucure - M.tech (S.E) I & II Sem (Autonomous)Fresherjobs IndiaNo ratings yet

- Altracs: A Superior Thread-Former For Light AlloysDocument8 pagesAltracs: A Superior Thread-Former For Light AlloysSquidwardNo ratings yet

- Automatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElDocument212 pagesAutomatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElVIDAL ALEJANDRO GARCIAVARGASNo ratings yet

- Writing References for StudentsDocument4 pagesWriting References for StudentsRyan OktafiandiNo ratings yet

- How To Recover An XP Encrypted FileDocument2 pagesHow To Recover An XP Encrypted FileratnajitorgNo ratings yet

- Materials Storage and BuildingDocument3 pagesMaterials Storage and BuildingAmit GoyalNo ratings yet

- Natural Fibres For Composites in EthiopiaDocument12 pagesNatural Fibres For Composites in EthiopiaTolera AderieNo ratings yet

- Sample Administrative Disicplinary CasesDocument13 pagesSample Administrative Disicplinary CasesWen DyNo ratings yet

- RELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEDocument5 pagesRELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEReiBañez100% (2)

- IsotopesDocument35 pagesIsotopesAddisu Amare Zena 18BML0104No ratings yet

- F404-15 Standard Consumer Safety Specification For High ChairsDocument19 pagesF404-15 Standard Consumer Safety Specification For High ChairsAhmed AlzubaidiNo ratings yet

- Fusion Accounting Hub 304046 PDFDocument14 pagesFusion Accounting Hub 304046 PDFrpgudlaNo ratings yet

- Agni Free PDF - 2 For Sbi Clerk Mains 2024Document18 pagesAgni Free PDF - 2 For Sbi Clerk Mains 2024supriyo248650No ratings yet

- Prison Architect Calculator (V2.0)Document11 pagesPrison Architect Calculator (V2.0)freakman89No ratings yet

- Tinas Resturant AnalysisDocument19 pagesTinas Resturant Analysisapi-388014325100% (2)

- CRAPAC Monthly JanDocument4 pagesCRAPAC Monthly JanJasonMortonNo ratings yet

- One SheetDocument1 pageOne Sheetadeel ghouseNo ratings yet