Professional Documents

Culture Documents

Business Math - W3 - Gross and Net Earnings

Uploaded by

cjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Math - W3 - Gross and Net Earnings

Uploaded by

cjCopyright:

Available Formats

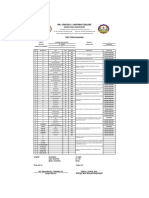

Dumaguete City National High School

Dumaguete City Division

BUSINESS MATHEMATICS

Prepared by: MISS CLAREEN JUNE E. DAGOY

Quarter 2 - Week 3

Gross and Net Earnings

Content Standard:

The learners demonstrate an understanding of the fundamental operations of mathematics as

applied in salaries and wages.

Performance Standard:

The learners are able to apply appropriate mathematical operation in computing salaries and

wages.

Most Essential Learning Competencies (MELC):

Define salary, wage, income, benefits

Compute gross and net earnings

Concept:

Gross and Net Earnings

Prepared by Miss Clareen June E. Dagoy

Gross earning is the amount earned by any person before subtracting the taxes, benefits, loans,

and other possible deductions.

Net earnings is the amount earned by any person less the total deductions.

Deduction is the amount held by any authority as a form of payment for some necessary dues

like taxes, loans, etc.

Salary is a fixed regular payment, typically paid on a monthly or biweekly basis but often

expressed as an annual sum, made by an employer to an employee.

Now let;

E = is the total earnings D = is the total deduction N = is the monthly net

The equation: E=D+N

Example A:

1. Ellaine has a monthly net amounting to P 10, 568.23. If he receives a total deduction

of P 14, 235.18, then how much will she receive as her total earning?

Solution: E = D + N

= P 4, 235.18 + P 10, 568.23

= P 14, 803. 41 is the total earning of Ellaine

2. Jill has a total earnings amounting to P 20, 524.17. If he receives a total deduction

of P 3, 826.21, then how much will he receive as her net earning?

Solution: N= E + D

= P 20, 524.17 + P 3, 826.21

= P 16, 697.96 is the total net earning of Jill

Prepared by Miss Clareen June E. Dagoy

3. April receives the total earnings worth of P 22, 271.16. If it happens, that he has the

monthly net worth of P 11, 721.30, what is the value of her total deduction?

Solution: D= E + N

= P 22, 271.16 - P 11, 721.30

= P 10, 549.86 is the total deduction of April

CHECK WHAT YOU KNOW

A. Identify if each statement is True or False. (2 pts. each)

_____1. Gross earning is sometimes greater than net income.

_____2. Net earning can be greater than the gross earning.

_____3. The total deduction is always equal to the net earning.

Prepared by Miss Clareen June E. Dagoy

_____4. Gross + Net earning is equal to Deduction plus twice the Net Earning.

_____5. If the deduction is 0, then Gross earning = Net Earning.

_____6. Overtime pay is the part of the deduction.

_____7. Taxes are added in the deduction.

_____8. Other benefits and Payment of Loans are deducted from the Net Earning.

_____9. Net Earning is part of Gross Earning.

_____10. If the deduction is more than the net earning, then the net earning is more than half

of the gross earning.

B. Solve the value in following problems: (5 pts. Each and show your solution)

1. If D = P 2, 122.00 and N = P 17, 517.29, what is the value of E?

2. If E = P 72, 130. 22 and D = P 28, 875.21, what is the value of N?

3. If E = P 28, 091.16 and N = 11, 213.00, what is the value of D?

4. If D = P 17, 122. 05 and N = 21, 318.29, what is the value of E?

Prepared by Miss Clareen June E. Dagoy

5. John earns an annual income of P100,000 from his financial management consultancy

work. John also earns P70,000 in rental income from his real estate properties, P10,000 in

dividends from shares he owns at Company XYZ, and $5,000 in interest income from his

savings account. When calculating all of his expenses, it reached up to P15,222.00. What

is John’s gross income?

Prepared by Miss Clareen June E. Dagoy

You might also like

- Sales: 4.1 Gross and Net EarningsDocument16 pagesSales: 4.1 Gross and Net EarningsJohn Philip Reyes100% (2)

- Business Math - W1 - InterestDocument4 pagesBusiness Math - W1 - Interestcj100% (1)

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocument11 pagesABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- Business Mathematics Gross and Net EarningsDocument7 pagesBusiness Mathematics Gross and Net EarningsZeus MalicdemNo ratings yet

- Business Math - W4 - W5 - Wage EarnersDocument7 pagesBusiness Math - W4 - W5 - Wage Earnerscj100% (4)

- Las Bussmath q2 Week 3 4 .11pagesDocument11 pagesLas Bussmath q2 Week 3 4 .11pagesAndrea GalangNo ratings yet

- ABM11 BussMath Q2 Wk3 Benefits-Of-Wage-EarnersDocument11 pagesABM11 BussMath Q2 Wk3 Benefits-Of-Wage-EarnersArchimedes Arvie GarciaNo ratings yet

- Math 11-ABM BM-Q1-Week-7Document26 pagesMath 11-ABM BM-Q1-Week-7Jessa Cuanan Calo100% (1)

- Business Math11 12 q2 Clas6 Spreadsheet For Computation and Presentation v1 1 Joseph AurelloDocument12 pagesBusiness Math11 12 q2 Clas6 Spreadsheet For Computation and Presentation v1 1 Joseph AurelloKim Yessamin Madarcos100% (3)

- Salaries and Wages: Taxable vs. Nontaxable BenefitsDocument6 pagesSalaries and Wages: Taxable vs. Nontaxable BenefitsAj Gomez100% (1)

- Math 11 Abm BM q1 Week 5Document20 pagesMath 11 Abm BM q1 Week 5Flordilyn Dichon100% (1)

- Introduction To Salaries, Wages, Income and Benefits Self Learning Worksheet in Business MathematicsDocument14 pagesIntroduction To Salaries, Wages, Income and Benefits Self Learning Worksheet in Business MathematicsErwin AllijohNo ratings yet

- Business Math - W2 - CommissionDocument5 pagesBusiness Math - W2 - Commissioncj100% (3)

- Business Math Lesson1 Week 3Document6 pagesBusiness Math Lesson1 Week 3REBECCA BRIONES0% (1)

- Business Mathematics 2nd Quarter 1st Week Lesson Key Concepts of CommissionsDocument11 pagesBusiness Mathematics 2nd Quarter 1st Week Lesson Key Concepts of CommissionsDearla BitoonNo ratings yet

- Learning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionDocument10 pagesLearning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionArchimedes Arvie GarciaNo ratings yet

- FABM2 Module 05 (Q1-W6)Document12 pagesFABM2 Module 05 (Q1-W6)Christian ZebuaNo ratings yet

- q1 Business Math Module 7Document20 pagesq1 Business Math Module 7Reigi May50% (2)

- Business Math Week 5-6Document18 pagesBusiness Math Week 5-6Clareen June DagoyNo ratings yet

- Bus Math11 Slo QTR2-WK 1 - 2Document5 pagesBus Math11 Slo QTR2-WK 1 - 2Alma Dimaranan-Acuña100% (1)

- Single Trade Discounts and Discount SeriesDocument11 pagesSingle Trade Discounts and Discount SeriesAxl Fitzgerald Bulawan75% (4)

- Business Math Module 15-16-17 18Document48 pagesBusiness Math Module 15-16-17 18Jodin Masiba100% (1)

- Business Math: Quarter 1 - Module 7: Mark-On, Markdown, and Mark-Up of A Given ProductDocument20 pagesBusiness Math: Quarter 1 - Module 7: Mark-On, Markdown, and Mark-Up of A Given Productsfdvs sdgfsd100% (1)

- Abm11 - q1 - Mod3 - Solving Problems With Fractions, Decimals and Percentage - v3 - R.OlegarioDocument24 pagesAbm11 - q1 - Mod3 - Solving Problems With Fractions, Decimals and Percentage - v3 - R.OlegarioTecno Lougie67% (3)

- Simple Interest + Mortgages + Commissions and OverridesDocument20 pagesSimple Interest + Mortgages + Commissions and Overridesrommel legaspi100% (2)

- Business Mathematics 2nd Quarter 7th Week Lesson Presentation and Analysis of Business DataDocument23 pagesBusiness Mathematics 2nd Quarter 7th Week Lesson Presentation and Analysis of Business DataDearla Bitoon67% (3)

- Business Finance: Financial Institutions, Markets, and InstrumentsDocument14 pagesBusiness Finance: Financial Institutions, Markets, and InstrumentsAngelica Paras100% (1)

- Business Math: Quarter 1 - Module 9: Gross Margin On SalesDocument20 pagesBusiness Math: Quarter 1 - Module 9: Gross Margin On Salessfdvs sdgfsdNo ratings yet

- Types of CommissionDocument5 pagesTypes of CommissionArnelson DerechoNo ratings yet

- Math 11-ABM Business Math-Q2-Week-1Document16 pagesMath 11-ABM Business Math-Q2-Week-1Flordilyn DichonNo ratings yet

- Module 4 Mark On Mark Down and Mark UpDocument46 pagesModule 4 Mark On Mark Down and Mark UpStacey VillanuevaNo ratings yet

- Business Math: Quarter 1 - Module 4: Identifying The Different Kinds of ProportionDocument24 pagesBusiness Math: Quarter 1 - Module 4: Identifying The Different Kinds of ProportionYan Fajota67% (3)

- ABM11 BussMath Q1 Wk3 ProportionsDocument12 pagesABM11 BussMath Q1 Wk3 ProportionsArchimedes Arvie Garcia100% (1)

- Module in Payroll, Commissions and TaxesDocument10 pagesModule in Payroll, Commissions and TaxesAvigail Beltran75% (4)

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Business Mathematics Module 7 Profit and LossDocument16 pagesBusiness Mathematics Module 7 Profit and LossDavid DueNo ratings yet

- CALCULATE TRADE AND CASH DISCOUNTSDocument13 pagesCALCULATE TRADE AND CASH DISCOUNTSrommel legaspi71% (7)

- Business Mathematics Discount SeriesDocument4 pagesBusiness Mathematics Discount SeriesMiguel MerandillaNo ratings yet

- Business Mathematics: Quarter 1, Week 7-Module 11 Differentiate Profit From Loss - ABM - BM11BS-Ii-6Document11 pagesBusiness Mathematics: Quarter 1, Week 7-Module 11 Differentiate Profit From Loss - ABM - BM11BS-Ii-6Dave Sulam100% (1)

- Business Mathematics: Quarter 1, Week 6 - Module 9 Describing How Gross Margin Is Used in Sales - ABM - BM11BS-Ih-4Document14 pagesBusiness Mathematics: Quarter 1, Week 6 - Module 9 Describing How Gross Margin Is Used in Sales - ABM - BM11BS-Ih-4Dave Sulam100% (2)

- BUS - MATH 11 Q1 Module 9 PDFDocument21 pagesBUS - MATH 11 Q1 Module 9 PDFKrisha FernandezNo ratings yet

- Business Math: Quarter 1 - Module 8: Differentiating Mark-Up From MarginsDocument20 pagesBusiness Math: Quarter 1 - Module 8: Differentiating Mark-Up From Marginssfdvs sdgfsdNo ratings yet

- ABM11 Business-Mathematics Q1 W5 5Document12 pagesABM11 Business-Mathematics Q1 W5 5Archimedes Arvie GarciaNo ratings yet

- Business Finance: Loan AmortizationDocument13 pagesBusiness Finance: Loan AmortizationAngelica Paras100% (2)

- LM Busmath q2 Module 2 Wk2 CasillaDocument30 pagesLM Busmath q2 Module 2 Wk2 CasillaDonna CasillaNo ratings yet

- HdowisdbDocument28 pagesHdowisdbHsiosnc0% (1)

- Business Math Qtr1 Week 5Document6 pagesBusiness Math Qtr1 Week 5Joan BalmesNo ratings yet

- Most Essential Learning Competency: National Capital Region SchoolsdivisionofficeoflaspiñascityDocument3 pagesMost Essential Learning Competency: National Capital Region SchoolsdivisionofficeoflaspiñascityJessel CarilloNo ratings yet

- LM Business Finance Q3 W6 8 Module 8Document17 pagesLM Business Finance Q3 W6 8 Module 8Minimi LovelyNo ratings yet

- Business Math Qtr1 Week 6Document2 pagesBusiness Math Qtr1 Week 6Joan BalmesNo ratings yet

- BUS - MATH 11 Q1 Module 7 W3Document28 pagesBUS - MATH 11 Q1 Module 7 W3joshua calmaNo ratings yet

- Business Mathematics: Quarter 1, Week 6 - Module 8 Differentiating Mark-Up From Margins-ABM - BM11BS-Ih-3Document11 pagesBusiness Mathematics: Quarter 1, Week 6 - Module 8 Differentiating Mark-Up From Margins-ABM - BM11BS-Ih-3Dave Sulam100% (2)

- Salary, Wage and Income Definitions (39Document12 pagesSalary, Wage and Income Definitions (39Ronald AlmagroNo ratings yet

- Business Mathematics: Senior High School (ABM)Document12 pagesBusiness Mathematics: Senior High School (ABM)Clareen JuneNo ratings yet

- Business Math - Lesson 7Document7 pagesBusiness Math - Lesson 7wilhelmina roman100% (2)

- Math 11-ABM Business Math-Q2-Week-4Document26 pagesMath 11-ABM Business Math-Q2-Week-4Flordilyn DichonNo ratings yet

- ABM-BM Module 3Document20 pagesABM-BM Module 3Necilyn Balatibat AngelesNo ratings yet

- Business Finance: Flow of Funds Within The OrganizationDocument11 pagesBusiness Finance: Flow of Funds Within The OrganizationAngelica Paras100% (1)

- ABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Document4 pagesABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Emmanuel Villeja LaysonNo ratings yet

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocument9 pagesABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- Business Finance Week 3 - 4Document8 pagesBusiness Finance Week 3 - 4cj100% (5)

- Business Finance Week 6 - 8Document14 pagesBusiness Finance Week 6 - 8cj89% (9)

- Dumaguete City National High School compares bank and non-bank loan requirementsDocument5 pagesDumaguete City National High School compares bank and non-bank loan requirementscjNo ratings yet

- Business Finance Week 2Document7 pagesBusiness Finance Week 2cjNo ratings yet

- Business Finance Week 1Document6 pagesBusiness Finance Week 1cjNo ratings yet

- Personal Development Summative TestDocument1 pagePersonal Development Summative TestMichelle Iris82% (22)

- Multiple Choice.: Physical Education 12Document4 pagesMultiple Choice.: Physical Education 12cjNo ratings yet

- Fixed Rate Mortgage Homework ProblemsDocument2 pagesFixed Rate Mortgage Homework ProblemscjNo ratings yet

- Personality DevelopmentDocument7 pagesPersonality DevelopmentJerson EspinileNo ratings yet

- SHS Applied - Entrepreneurship CG PDFDocument7 pagesSHS Applied - Entrepreneurship CG PDFPat Che Sabaldana88% (8)

- ABM Strand Subject Scheduling for Grades 11-12Document1 pageABM Strand Subject Scheduling for Grades 11-12Levi Manigo Buencamino100% (1)

- 1st Grading Exam Perdev With TOSDocument4 pages1st Grading Exam Perdev With TOSRAPPY R.PEJO90% (178)

- SHS E Class Record 2016Document27 pagesSHS E Class Record 2016Cristina Rocas-BisqueraNo ratings yet

- Personal DevelopmentDocument12 pagesPersonal Developmentcj100% (2)

- Entrepreneurship DLLDocument8 pagesEntrepreneurship DLLcj0% (1)

- Accounting Cycle of a Service BusinessDocument46 pagesAccounting Cycle of a Service BusinesscjNo ratings yet

- Personal DevelopmentDocument12 pagesPersonal Developmentcj100% (2)

- YT - Share - Item AnalysisDocument2 pagesYT - Share - Item AnalysiscjNo ratings yet

- Item Analysis Version 3.0 - (40 Items)Document7 pagesItem Analysis Version 3.0 - (40 Items)cj100% (2)

- Dr. Carlos S. Lanting College Test Item AnalysisDocument1 pageDr. Carlos S. Lanting College Test Item AnalysisEdna Grace Abrera TerragoNo ratings yet

- Most Essential Learning Competencies Matrix Latest Rmay 21 PDFDocument735 pagesMost Essential Learning Competencies Matrix Latest Rmay 21 PDFJOSEPHINE B. TEJANO100% (1)

- Business Math - W2 - CommissionDocument5 pagesBusiness Math - W2 - Commissioncj100% (3)

- EXPERIENTIAL EXERCISE 2 (HBOIA1) Cyrus Valerio (BSMA-3B)Document2 pagesEXPERIENTIAL EXERCISE 2 (HBOIA1) Cyrus Valerio (BSMA-3B)DSAW VALERIONo ratings yet

- Review Lecture Notes Chapter 1Document4 pagesReview Lecture Notes Chapter 1- OriNo ratings yet

- Chapter 6 Supply, Demand, and Government PoliciesDocument35 pagesChapter 6 Supply, Demand, and Government Policiesjhohan freestyleNo ratings yet

- Policy Paper On Majulah Universal Basic IncomeDocument13 pagesPolicy Paper On Majulah Universal Basic IncomeNicole LeeNo ratings yet

- Recent Final CBB of Hot and Coldspring An AssestmentDocument31 pagesRecent Final CBB of Hot and Coldspring An AssestmentMaela Pollen Elumba Yema0% (1)

- Chapter 3Document55 pagesChapter 3Ahmed hassanNo ratings yet

- Twice THE Profit: Locals, Choose Local!Document1 pageTwice THE Profit: Locals, Choose Local!CheskaNo ratings yet

- Organizational Behavior: Motivation: From Concepts To ApplicationsDocument23 pagesOrganizational Behavior: Motivation: From Concepts To ApplicationsArham BajwaNo ratings yet

- THREE CHANNELS OF DEVELOPMENT ASSISTANCEDocument4 pagesTHREE CHANNELS OF DEVELOPMENT ASSISTANCEAallhiex EscartaNo ratings yet

- Economics Notes 2Document3 pagesEconomics Notes 2Andrea Nicole CachoNo ratings yet

- Rent Minimum Wage Taxes Economic Icon: Mariah Shakira Eviza October 2021Document15 pagesRent Minimum Wage Taxes Economic Icon: Mariah Shakira Eviza October 2021Mariah Shakira EvizaNo ratings yet

- Case Study Community OrganizationDocument17 pagesCase Study Community OrganizationJelyza Jade BiolNo ratings yet

- Employment Flexibility at Pushkar HotelsDocument9 pagesEmployment Flexibility at Pushkar Hotelstanishqa joganiNo ratings yet

- CF - Compensation - Benefits - Template (Reviewed)Document7 pagesCF - Compensation - Benefits - Template (Reviewed)Djefferson MoraisNo ratings yet

- Cut Your Council Tax 2020Document4 pagesCut Your Council Tax 2020AlpamisNo ratings yet

- Annex I Contract of Service Between The Dole Regional Office and Tupad WorkersDocument4 pagesAnnex I Contract of Service Between The Dole Regional Office and Tupad WorkersArcelin LabuguinNo ratings yet

- NSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 10 Factors of ProductionDocument17 pagesNSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 10 Factors of ProductiondizzelNo ratings yet

- Retirement Benefits Under Labor CodeDocument14 pagesRetirement Benefits Under Labor CodeSam ConcepcionNo ratings yet

- IR 204 - ReviewerDocument27 pagesIR 204 - ReviewerDebielyn ClamosaNo ratings yet

- Employment legislation overviewDocument2 pagesEmployment legislation overviewNurizzati MohamadNo ratings yet

- Policies For Reducing UnemploymentDocument14 pagesPolicies For Reducing UnemploymentAnushkaa DattaNo ratings yet

- Solved Currently All The National Central Banks in The Euro SystemDocument1 pageSolved Currently All The National Central Banks in The Euro SystemM Bilal SaleemNo ratings yet

- Chapter 2. PITDocument77 pagesChapter 2. PITKhuất Thanh HuếNo ratings yet

- Fundamentals of Human Resource Management: Ninth EditionDocument30 pagesFundamentals of Human Resource Management: Ninth Editionkingshukb100% (1)

- What Is Industrial RelationDocument26 pagesWhat Is Industrial RelationRaju PantaNo ratings yet

- CH 1Document23 pagesCH 1Jaylan A ElwailyNo ratings yet

- March 2016 (v2) MS - Paper 2 CIE Economics IGCSEDocument10 pagesMarch 2016 (v2) MS - Paper 2 CIE Economics IGCSEfarahNo ratings yet

- Labour Law AssignmentDocument23 pagesLabour Law AssignmentArchana AgrawalNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- TH Prefers A World Where All Land Was Help in Government Trust and Leased Out On Limited-Term ContractsDocument1 pageTH Prefers A World Where All Land Was Help in Government Trust and Leased Out On Limited-Term ContractsMilena BaljakNo ratings yet

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerFrom EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerRating: 5 out of 5 stars5/5 (49)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningFrom EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningRating: 5 out of 5 stars5/5 (3)

- The Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesFrom EverandThe Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesNo ratings yet

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldFrom EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldRating: 3.5 out of 5 stars3.5/5 (129)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emRating: 4 out of 5 stars4/5 (64)

- POKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)From EverandPOKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)No ratings yet

- The Everything Card Tricks Book: Over 100 Amazing Tricks to Impress Your Friends And Family!From EverandThe Everything Card Tricks Book: Over 100 Amazing Tricks to Impress Your Friends And Family!No ratings yet

- Phil Gordon's Little Gold Book: Advanced Lessons for Mastering Poker 2.0From EverandPhil Gordon's Little Gold Book: Advanced Lessons for Mastering Poker 2.0Rating: 3.5 out of 5 stars3.5/5 (6)

- Poker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsFrom EverandPoker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsRating: 4 out of 5 stars4/5 (7)

- Mental Floss: Genius Instruction ManualFrom EverandMental Floss: Genius Instruction ManualRating: 4 out of 5 stars4/5 (27)

- Target: JackAce - Outsmart and Outplay the JackAce in No-Limit HoldemFrom EverandTarget: JackAce - Outsmart and Outplay the JackAce in No-Limit HoldemNo ratings yet

- How to Be a Poker Player: The Philosophy of PokerFrom EverandHow to Be a Poker Player: The Philosophy of PokerRating: 4.5 out of 5 stars4.5/5 (4)

- Straight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How It All Came Crashing Down . . .From EverandStraight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How It All Came Crashing Down . . .Rating: 3.5 out of 5 stars3.5/5 (22)

- Steampunk Tarot Ebook: Wisdom from the Gods of the MachineFrom EverandSteampunk Tarot Ebook: Wisdom from the Gods of the MachineRating: 4 out of 5 stars4/5 (2)