Professional Documents

Culture Documents

Session - DM - Customer Profitability - Make or Buy

Uploaded by

Navya AgrawalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session - DM - Customer Profitability - Make or Buy

Uploaded by

Navya AgrawalCopyright:

Available Formats

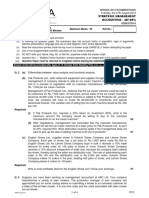

SESSION– PROBLEM – DECISION MAKING AND RELEVANT COSTS

Customer Profitability

Allied West, the West zone sales office of Allied Furniture, a wholesaler of specialized furniture, supplies

furniture to three local retailers: Vijay, Amit and Ankush. Expected Revenues and costs of Allied West by

customer for the upcoming year using ABC costing is given below:

Particulars Activity Driver Customer

Vijay Amit Ankush Total

Revenues 50,00,000 30,00,000 40,00,000 1,20,00,000

COGS 37,00,000 22,00,000 33,00,000 92,00,000

Furniture handling Number of units 4,10,000 1,80,000 3,30,000 9,20,000

labor shipped

Furniture handling Assume customer level 1,20,000 40,000 90,000 2,50,000

equip (dep) costs

Rent Warehouse sq. ft space 1,40,000 80,000 1,40,000 3,60,000

reserved

Marketing support Number of sales visits 1,10,000 90,000 1,00,000 3,00,000

Sales order Number of sales orders 1,30,000 70,000 1,20,000 3,20,000

Gen Admin Customer revenue basis 2,00,000 1,20,000 1,60,000 4,80,000

Corp office Customer revenue basis 1,00,000 60,000 80,000 2,40,000

Total costs 49,10,000 28,40,000 43,20,000 1,20,70,000

Op Income 90,000 1,60,000 (3,20,000) (70,000)

Let’s discuss:

1. Should Allied West drop the Ankush account? Analyze the costs in Ankush’s account? What

influence will it have on other costs? What is your decision with respect to Ankush’s account?

2. Should it add a fourth customer Anurag? Imagine Anurag has a customer profile much like

Ankush’s. Allied West’s managers predict revenues and costs of doing business with Anurag to

be the same as the revenues and costs described for Ankush. They have to acquire furniture

handling equipment for the Anurag account costing INR 90,000, with a one-year useful life and

zero disposal value. What influence will it have on other costs?

3. Why do you think depreciation was ignored when considering dropping Ankush’s account and

taken into account while considering adding Anurag’s account?

Prof Divya Aggarwal Management Account Term II

SESSION– PROBLEM – DECISION MAKING AND RELEVANT COSTS

Make or Buy Decision: Harsh, a management accountant with the Maruti Udyog, is evaluating whether

a component MTR.2000 should continue to be manufactured by Maruti or purchased from Outside

Vendor Company. Outside Vendor has submitted a bid to manufacture and supply the 32,000 units of

MTR.2000 that Maruti Udyog will need for 2019 at a selling price of INR 173. Harsh has gathered the

following information regarding Maruti’s costs to manufacture 30,000 units of MTR-2000 in 2018.

Particulars INR

Direct Materials 19,50,000

Direct Manufacturing Labor 12,00,000

Plant space rental 8,40,000

Equipment Leasing 3,60,000

Other manufacturing overhead 22,50,000

Total manufacturing costs 66,00,000

Harsh has also collected the following information related to manufacturing MTR 2000:

a) Prices of direct materials used in the production of MTR.2000 are expected to increase by 8% in

2019

b) Maruti Udyog’s direct manufacturing labor contract calls for a 5% increase in 2019

c) Maruti Udyog can withdraw from the plant space rental agreement without any penalty. Maruti

Udyog will have no need for this space if MTR.2000 is not manufactured.

d) The equipment lease can be terminated by paying INR 60,000

e) 40% of the other manufacturing overhead is considered variable. Variable overhead changes

proportionately with the number of units produced. The fixed component of other

manufacturing overhead costs is expected to remain the same whether or not MTR.2000 is

manufactured.

Pradeep, plant manager at Maruti Udyog, indicates to Harsh that the current performance of the plant

can be significantly improved and that the cost increases he is assuming are unlikely to occur. Hence, the

analysis should be done assuming costs will be considerably below current levels. Harsh knows that

Pradeep is concerned about outsourcing MTR.2000 because it will mean that some of his close friends

will be laid off.

Harsh believes that it is unlikely that the plant will achieve the lower costs as Pradeep describes. He is

very confident about the accuracy of the information he has collected, but he is also unhappy about

laying off employees.

1. Based on the financial information Harsh has obtained, should Maruti Udyog make MTR.2000 or

buy it in 2019? Show your calculations.

2. What other factors should Maruti Udyog consider before deciding?

3. What should Harsh do in response to Pradeep’s comments?

Prof Divya Aggarwal Management Account Term II

You might also like

- Southwest Airlines Possible Solution-HBR CaseDocument17 pagesSouthwest Airlines Possible Solution-HBR Casekowshik yakkala100% (19)

- Procedure For MV Cable Termination and TestingDocument8 pagesProcedure For MV Cable Termination and TestingAtlas Dammam100% (1)

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- MPT History Part 1Document3 pagesMPT History Part 1orbisrobeNo ratings yet

- Selling Building Partnerships 10th Edition Castleberry Solutions ManualDocument30 pagesSelling Building Partnerships 10th Edition Castleberry Solutions Manualforewordhatable.mtbc0m100% (15)

- Managerial Accounting - Mid Term Exam PDFDocument4 pagesManagerial Accounting - Mid Term Exam PDFNavya AgrawalNo ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- Assignment ProblemDocument7 pagesAssignment ProblemAnantha KrishnaNo ratings yet

- Screenshot 2023-08-27 at 11.56.55 AMDocument34 pagesScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNo ratings yet

- Cost Sheet CaseDocument4 pagesCost Sheet CasetanishaNo ratings yet

- Job CostingDocument4 pagesJob CostingZoya RehmanNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Skans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1Document4 pagesSkans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1maryNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Kuis Paralel AML - UTSDocument4 pagesKuis Paralel AML - UTSGrace EsterMNo ratings yet

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- MTE - Spring 2020, Managerial AccountingDocument6 pagesMTE - Spring 2020, Managerial AccountingUTTAM KOIRALANo ratings yet

- Managerial Accounting Assignment - Edited 2Document3 pagesManagerial Accounting Assignment - Edited 2maximillan njagiNo ratings yet

- 6104 - Accounting For Managers MBA FT 2021Document4 pages6104 - Accounting For Managers MBA FT 2021akshitapaul19No ratings yet

- Cost and Management Accounting IpcnDocument20 pagesCost and Management Accounting IpcnlahotishreyanshNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- Cost & Management Accounting - MGT402 Paper PDFDocument42 pagesCost & Management Accounting - MGT402 Paper PDFArslan QamarNo ratings yet

- CMAC Section A, B Mid-Term Q.PaperDocument5 pagesCMAC Section A, B Mid-Term Q.PaperWaseim khan Barik zaiNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingMaithili SUBRAMANIANNo ratings yet

- RTP Year Wise Compiliation ICANDocument2,993 pagesRTP Year Wise Compiliation ICANMichael AdhikariNo ratings yet

- CAP-II RTPs June2023 Group-IDocument81 pagesCAP-II RTPs June2023 Group-IPrashant Sagar GautamNo ratings yet

- Samsoe - Ma - Costing - Set ADocument1 pageSamsoe - Ma - Costing - Set Akapil soniNo ratings yet

- Cost Management Accounting AM1 STDocument5 pagesCost Management Accounting AM1 STAash RedmiNo ratings yet

- Cost Management Accounting DEC 2023Document4 pagesCost Management Accounting DEC 2023Aash RedmiNo ratings yet

- 16 Af 601 Sma - 3Document4 pages16 Af 601 Sma - 3umargee123No ratings yet

- Mcom Sem 4 PricingDocument2 pagesMcom Sem 4 PricingVishal VasaNo ratings yet

- Abacus India Ltd.Document3 pagesAbacus India Ltd.Minto MathewNo ratings yet

- Tutorial 2 Traditional OverheadsDocument3 pagesTutorial 2 Traditional OverheadsSyafiqNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- Costing English Question 14.07.2020Document7 pagesCosting English Question 14.07.2020Prathmesh JambhulkarNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Over Head Part 1Document3 pagesOver Head Part 1binuNo ratings yet

- 1 Cost Sheet TexbookDocument6 pages1 Cost Sheet TexbookVishal Kumar 5504No ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- Accounting - 11Document9 pagesAccounting - 11kaveeshaNo ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Financial and Managerial ExercisesDocument5 pagesFinancial and Managerial ExercisesBedri M Ahmedu50% (2)

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- D12 Cac PDFDocument6 pagesD12 Cac PDFsecret studentNo ratings yet

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainNo ratings yet

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument30 pagesPaper - 3: Cost and Management Accounting Questions Material CostADITYA JAINNo ratings yet

- Pakistan: Extra Reading Time: 15 Minutes Writing Time: 02 Hours 45 Minutes Maximum Marks: 90 Roll No.Document4 pagesPakistan: Extra Reading Time: 15 Minutes Writing Time: 02 Hours 45 Minutes Maximum Marks: 90 Roll No.Abdul BasitNo ratings yet

- 59 IpcccostingDocument5 pages59 Ipcccostingapi-206947225No ratings yet

- Final CMAC (SOL) Midterm Q.Paper Aut-23Document4 pagesFinal CMAC (SOL) Midterm Q.Paper Aut-23Anmoul ZahraNo ratings yet

- Date: February 26, 2024 Maximum Points: 40 Marks Duration: 120 MinutesDocument4 pagesDate: February 26, 2024 Maximum Points: 40 Marks Duration: 120 Minutesasmitamittal1998No ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Assignment AMA PDFDocument2 pagesAssignment AMA PDFPritesh Ranjan Sahoo100% (1)

- Accounting and FinanceDocument14 pagesAccounting and FinanceJapjiv SinghNo ratings yet

- CA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesDocument17 pagesCA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesAyush ThÃkkarNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- Part - 1 Costing - 27095855 PDFDocument4 pagesPart - 1 Costing - 27095855 PDFMaharajan GomuNo ratings yet

- Merton Truck Case AnalysisDocument5 pagesMerton Truck Case AnalysisChandan BhartiNo ratings yet

- JHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketDocument1 pageJHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketNavya AgrawalNo ratings yet

- Cultural Committee - InductionDocument10 pagesCultural Committee - InductionNavya AgrawalNo ratings yet

- Student Guide: Presented byDocument19 pagesStudent Guide: Presented byNavya AgrawalNo ratings yet

- Talking About Whether Planet Volkswagen Was Successful or NotDocument1 pageTalking About Whether Planet Volkswagen Was Successful or NotNavya AgrawalNo ratings yet

- Blazers - Tata Power RiseDocument8 pagesBlazers - Tata Power RiseNavya AgrawalNo ratings yet

- Accept Fine Printing Proposal Differential Cash Flow Approach If P&D Is ClosedDocument4 pagesAccept Fine Printing Proposal Differential Cash Flow Approach If P&D Is ClosedNavya AgrawalNo ratings yet

- Blazers - Tata Power RiseDocument8 pagesBlazers - Tata Power RiseNavya AgrawalNo ratings yet

- Nestle India Q3 2020 PDFDocument4 pagesNestle India Q3 2020 PDFNavya AgrawalNo ratings yet

- Accept Fine Printing Proposal Differential Cash Flow Approach If P&D Is ClosedDocument4 pagesAccept Fine Printing Proposal Differential Cash Flow Approach If P&D Is ClosedNavya AgrawalNo ratings yet

- IIM R - Case Study Submission - Harappa EducationDocument1 pageIIM R - Case Study Submission - Harappa EducationNavya AgrawalNo ratings yet

- 4Document1 page4Navya AgrawalNo ratings yet

- Indian Institute of Management R: Post-Graduate Programme in ManagementDocument3 pagesIndian Institute of Management R: Post-Graduate Programme in ManagementNavya AgrawalNo ratings yet

- Finsight October 2020 PDFDocument11 pagesFinsight October 2020 PDFNavya AgrawalNo ratings yet

- Updated Operation Management Syllabus (IIM R) - AASCB-2020-21Document4 pagesUpdated Operation Management Syllabus (IIM R) - AASCB-2020-21Navya AgrawalNo ratings yet

- Khushiyaan Chun Chun Ke (Responses)Document24 pagesKhushiyaan Chun Chun Ke (Responses)Navya AgrawalNo ratings yet

- FRA End TermDocument15 pagesFRA End TermNavya AgrawalNo ratings yet

- Finsight: Standoff Between The Holy Trinity of Oil-Opec, Mexico and RussiaDocument12 pagesFinsight: Standoff Between The Holy Trinity of Oil-Opec, Mexico and RussiaNavya AgrawalNo ratings yet

- 176 - QP - Mid Term - Microeconomics - Mba 2020-22Document2 pages176 - QP - Mid Term - Microeconomics - Mba 2020-22Navya AgrawalNo ratings yet

- 176 - QP - Mid Term - Microeconomics - Mba 2020-22Document2 pages176 - QP - Mid Term - Microeconomics - Mba 2020-22Navya AgrawalNo ratings yet

- Nestle India Q3 2020 PDFDocument4 pagesNestle India Q3 2020 PDFNavya AgrawalNo ratings yet

- FRCM - Group 7Document15 pagesFRCM - Group 7Navya Agrawal100% (1)

- Rice News 5 April 2022Document102 pagesRice News 5 April 2022Mujahid AliNo ratings yet

- Online Supply Chain PracticesDocument2 pagesOnline Supply Chain PracticesKëërtäñ SubramaniamNo ratings yet

- Evaluating The Effects of Advertising and Sales Promotion CampaignsDocument12 pagesEvaluating The Effects of Advertising and Sales Promotion CampaignsGulderay IklassovaNo ratings yet

- Chapter 8Document44 pagesChapter 8Victoria Damsleth-AalrudNo ratings yet

- The Great Eastern Life Insurance Co. vs. Hongkong & Shanghai Banking Corp.Document2 pagesThe Great Eastern Life Insurance Co. vs. Hongkong & Shanghai Banking Corp.Lenie SanchezNo ratings yet

- Rev 2 - Change of Details EmailedDocument5 pagesRev 2 - Change of Details EmailedMunodawafa ChimhamhiwaNo ratings yet

- Investment Management-Equity Research Group 1 Fundamental and Technical AnalysisDocument18 pagesInvestment Management-Equity Research Group 1 Fundamental and Technical AnalysisRuchikaNo ratings yet

- Principles of Mktng-Q3-Module-6Document16 pagesPrinciples of Mktng-Q3-Module-6Maristela RamosNo ratings yet

- Aws A5.3 1999Document26 pagesAws A5.3 1999Marco VeraNo ratings yet

- 12.economic ApplicationsDocument3 pages12.economic ApplicationsDevansh KumarNo ratings yet

- Deeksha Jaitly: Work ExperienceDocument4 pagesDeeksha Jaitly: Work ExperienceNitin MahawarNo ratings yet

- CCC2023 028Document7 pagesCCC2023 028majed sawanNo ratings yet

- David v. MacasiaoDocument2 pagesDavid v. MacasiaoChristine Gel MadrilejoNo ratings yet

- Chapter 2 Research Rrs UpdateDocument6 pagesChapter 2 Research Rrs UpdateCherry Anne AtilloNo ratings yet

- 1 Macro-Perspective-Of-Tourism-And-Hospitality-PrelimDocument23 pages1 Macro-Perspective-Of-Tourism-And-Hospitality-Prelimbarbara palaganasNo ratings yet

- Jan 13Document32 pagesJan 13Ashwan KumarNo ratings yet

- 2.15. Risk ScheduleDocument33 pages2.15. Risk ScheduleJohnNo ratings yet

- BUS309 SBC Questions JohnsonDrugCompanyDocument3 pagesBUS309 SBC Questions JohnsonDrugCompanyDom RohanNo ratings yet

- TATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaDocument1 pageTATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaTejas Talole0% (1)

- 5D2 S4CLD2302 BPD en UsDocument39 pages5D2 S4CLD2302 BPD en UsMarieTeeNo ratings yet

- Expression of Interest For Setting Up of Bio Refinery (Ethanol/Bio Fuel) Units in ChhattisgarhDocument23 pagesExpression of Interest For Setting Up of Bio Refinery (Ethanol/Bio Fuel) Units in ChhattisgarhaadeNo ratings yet

- Multiple Choice Questions: Introduction To Business ProcessesDocument10 pagesMultiple Choice Questions: Introduction To Business ProcessesTiên Nguyễn ThủyNo ratings yet

- Bpi-Family Savings Bank vs. CADocument1 pageBpi-Family Savings Bank vs. CARaquel Doquenia100% (1)

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- MIS17 - CH11 - Case2 - Alfresco Sem3Document3 pagesMIS17 - CH11 - Case2 - Alfresco Sem3Ardina Rasti WidianiNo ratings yet

- Varsha PandlaDocument2 pagesVarsha Pandlashandhin.malviya07No ratings yet