Professional Documents

Culture Documents

Artifact 5 - Employee Pension Scheme Form 10 C

Uploaded by

Siva chowdaryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Artifact 5 - Employee Pension Scheme Form 10 C

Uploaded by

Siva chowdaryCopyright:

Available Formats

Serial No:

For Office Use Only

In Words No.

Form No. 10 C (E.P.S)

__________________________________________________________________________________________

EMPLOYEES’ PENSION SCHEME, 1995

FORM TO BE USED BY A MEMBER OF THE EMPLOYEES’ PENSION SCHEME,

1995 FOR CLAIMING WITHDRAWAL BENEFIT/SCHEME CERTIFICATE

(Read the instructions before filling up this form)

__________________________________________________________________________________________

6. 1.Reasona)forName

leaving

of the

services

member :- _____________________________

_____________________________________

( In Block Letters)

& Dateb)of Name

leaving

of the claimant (s) _____________________________

_____________________________________

2. Date Of Birth

3. a) Father’s Name _____________________________

b) Husband’s Name _____________________________

(If applicable)

4. Name & Address of the Establishment Tata Consultancy Services Limited

in which, the member was last employed 10th Floor, Air India Building,

Nariman Point, Mumbai – 400021.

5. Code No. & Account No. MH/BAN/48475/

7. Full Postal Address :-

(In Block Letters) _____________________________________

Sh/Smt./Km _____________________________________

S/o, W/o, D/o _____________________________________

____________________PIN______________

Email Id:

Mob. No.

8. Are you willing to accept Scheme (a) (b)

Certificate in lieu of withdrawal benefits Yes No

9. Particulars of Family (Spouse & Children & Nominee)

Name Date of Birth Relationship with Member Name of the guardan of minor

(a) Family

Members

(b) Nominee

(b)

Note: 1. If opting for Scheme Certificate they should provide age proof of nominees and family members.

2. Withdrawal benefits are not payable if opted for Scheme Certificate.

10. In case of death of member after attaining the age of 58 years without filling the claim:- (to be filled up

by the family member or relative of the employee for claiming the withdrawal benefit in case of the

death of the member )

(a) Date of death of the member:

(b) Name of the Claimant(s) / and relationship with the members :

11. MODE FOR REMITTANCE [PUT A TIC IN THE BOX AGAINST THE ONE OPTED]

(a) By postal money order at my cost to address given against item No. 7

(c) Account payee cheque sent direct for credit to my Savings Bank A/c (Scheduled Bank) under

intimation to me

Savings Bank Account No. _______________________________________________

Name of the Bank _______________________________________________

(in block letters) _______________________________________________

Branch _______________________________________________

(in block letters) _______________________________________________

Full Address Of the Branch _______________________________________________

12. Are your availing pension under EPS-95? (As of now keep it blank)

If so indicate : PPO NO.________________By Whom issued________________

__________________________________________________________________________

Certified THAT THE PARTICULARS ARE TRUE TO THE BEST OF MY KNOWLEDGE.

Date:

Signature or left hand thumb

Impression of the member/claimant

ADVANCE STAMPED RECEIPT

[To be furnished only in case of (b) above]

Received a sum of Rs……………..(Rupees………………………………………………………………..)

Only from Regional Provident Fund Commissioner / Officer-in charge of Sub-Regional

Office ____________________

By deposit in my saving Bank A/c towards the settlement of my Pension Fund Accounts.

(The Space should be left blank which shall be filled by Regional Provident Fund Commissioner /Officer-

in-Charge)

Rs 1/-

Signature & left hand thumb impression of the member on the stamp Revenue

Stamp

Affix revenue stamp

_________________________________________________

Certified that the particulars of the member given are correct and the member has signed/thumb impressed

before me.

The details of wages and period of non-contributory service of the member are as under:-

Form 3A/7 (EPS) enclosed for the period for which it was not sent to employee’s Provident Fund Office)

Wages (Basic + D.A) as on 15.11.95(if applicable)

Wages as on the date of exit

Period of non contributory Service

Year/Month No. of days

Stamp of the establishment and

Authorized Signatory

(FOR THE USE OF COMMISSIONER’S OFFICE)

(Under Rs…………………………………………………………………………………………………...

P.I. No. ……………………………………………………M.O./Cheque

Passed for payment for Rs. ………………………….(in words)…………………..

………………………………………………………………………………………………………………

M.O. Commission (if any) ……………………..net amount to be paid by M.O. …………………………

D.H. S.S. A.A.O

____________________________________________________________________________________

(FOR USE IN CASH SECTION)

Paid by inclusion in cheque No……………………Dt…………………..vide cash Book (Bank) Account

No. 10 Debit item No. ……………………………….

D.H S.S AC(A/cs)

____________________________________________________________________________________

For issue if S.S;. IDS is enclosed.

D.H. S.S. A.A.O/APFC(A/cs)

____________________________________________________________________________________

(FOR USE IN PENSION SECTION)

Scheme Certificate bearing the control No……………………………..Issued on……………………and

entered in the scheme Certificate Control Register-

D.H. S.S A.A.O

APFC (PENSION)

You might also like

- PF Pension Settlement Form-TCSDocument4 pagesPF Pension Settlement Form-TCSSridhara Krishna BodavulaNo ratings yet

- Esic ChallanDocument7 pagesEsic Challanrgsr2008No ratings yet

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNo ratings yet

- RegistrationDocument15 pagesRegistrationpratikdhond100% (3)

- Contract Labour RegisterDocument34 pagesContract Labour Registerravinder.singh19853857No ratings yet

- Online Registration of Establishment With DSC: User ManualDocument39 pagesOnline Registration of Establishment With DSC: User ManualroseNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- Calculate income tax liability under old and new tax regimesDocument6 pagesCalculate income tax liability under old and new tax regimesJigeesha BhargaviNo ratings yet

- Form of Pension Proposals FormDocument14 pagesForm of Pension Proposals Formlakshmi naryanaNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

- ESIC e-Pehchan Card BenefitsDocument3 pagesESIC e-Pehchan Card BenefitsGoutam HotaNo ratings yet

- CCENT Notes Part-3Document63 pagesCCENT Notes Part-3Anil JunagalNo ratings yet

- CTS Marriage Loan PolicyDocument5 pagesCTS Marriage Loan PolicyshaannivasNo ratings yet

- Kar Shops Commercial Forms FormatDocument16 pagesKar Shops Commercial Forms FormatbelvaisudheerNo ratings yet

- Salary AdministrationDocument17 pagesSalary AdministrationMae Ann GonzalesNo ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Statutory ComplianceDocument2 pagesStatutory Compliancemax997No ratings yet

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraDocument8 pagesWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiNo ratings yet

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureDocument6 pagesSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeNo ratings yet

- INCOME UNDER SALARIESDocument44 pagesINCOME UNDER SALARIEShny0910No ratings yet

- Offer Letter Business Development Associate SalesDocument1 pageOffer Letter Business Development Associate SalespraveenNo ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- Cheklist For Employers: Statutory Deposits & ReturnsDocument4 pagesCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaNo ratings yet

- Overtime Allowance Eligibility and RatesDocument3 pagesOvertime Allowance Eligibility and RatesKumudha Devi100% (1)

- International J. Seed Spices Growth RatesDocument4 pagesInternational J. Seed Spices Growth Ratesmohan rathoreNo ratings yet

- USSP User Manual v1.0Document18 pagesUSSP User Manual v1.0Siva ChNo ratings yet

- Major Spice State Wise Area Production Web 2015 PDFDocument3 pagesMajor Spice State Wise Area Production Web 2015 PDFbharatheeeyuduNo ratings yet

- Karnataka Shops and Commercial Establishments Act, 1961Document44 pagesKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamNo ratings yet

- Attendance Register FormatDocument1 pageAttendance Register Formatvishal_mtoNo ratings yet

- Compliance PDFDocument20 pagesCompliance PDFSUBHANKAR PALNo ratings yet

- PF TransferDocument11 pagesPF TransfersinniNo ratings yet

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitDocument4 pagesBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghNo ratings yet

- YTD Statement-1326013854886Document108 pagesYTD Statement-1326013854886deepson800No ratings yet

- EPF CalenderDocument1 pageEPF CalenderAmitav TalukdarNo ratings yet

- Web2Rise Solutions Pvt. LTD.: (HR Manager)Document1 pageWeb2Rise Solutions Pvt. LTD.: (HR Manager)Er Kapil GuptaNo ratings yet

- MCSE PracticalsDocument88 pagesMCSE PracticalsMayur UkandeNo ratings yet

- YTD Statement 2017 - 2018Document1 pageYTD Statement 2017 - 2018HanumanthNo ratings yet

- EPF Provident Fund CalculatorDocument6 pagesEPF Provident Fund CalculatorUtkal SolankiNo ratings yet

- Employee Pension SchemeDocument6 pagesEmployee Pension SchemeAarthi PadmanabhanNo ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Spice Growing States of IndiaDocument1 pageSpice Growing States of IndiahemachalNo ratings yet

- National Pension Scheme (NPS) Guidelines FY 2019-20Document21 pagesNational Pension Scheme (NPS) Guidelines FY 2019-20harrishNo ratings yet

- All Forms Under Factories Act 1948Document2 pagesAll Forms Under Factories Act 1948jagshishNo ratings yet

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADocument25 pagesSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Sbi Service Rules 2015Document25 pagesSbi Service Rules 2015Jeeban MishraNo ratings yet

- Annexure II Details of AllowancesDocument4 pagesAnnexure II Details of AllowancesPravin Balasaheb GunjalNo ratings yet

- Annexure - Flexible Benefit PlanDocument3 pagesAnnexure - Flexible Benefit PlanpvkmanoharNo ratings yet

- 0064 - Form L - Annual Return of Indian Trade Union ActDocument4 pages0064 - Form L - Annual Return of Indian Trade Union ActSreedharanPN63% (8)

- Family Pension SchemeDocument15 pagesFamily Pension SchemeJitu Choudhary100% (1)

- CCNA Cisco Routing Protocols and Concepts Final Exam-PracticeDocument22 pagesCCNA Cisco Routing Protocols and Concepts Final Exam-Practicesabriel69100% (1)

- 10 CformDocument4 pages10 CformGurmukhSingh100% (2)

- EPF Form No 10 CDocument4 pagesEPF Form No 10 Capi-370495693% (14)

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- Form 10c Form 19 Word Format Doc Form 10cDocument6 pagesForm 10c Form 19 Word Format Doc Form 10cshaikali1980No ratings yet

- EPS 10C Scheme Certificate FormDocument3 pagesEPS 10C Scheme Certificate Formytduyyuli yufyufNo ratings yet

- Employees' Pension Scheme, 1995Document5 pagesEmployees' Pension Scheme, 1995surencaNo ratings yet

- Guidelines For Form 10 C Withdrawal of PensionDocument4 pagesGuidelines For Form 10 C Withdrawal of PensionDeepakKumarPanda100% (1)

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)aasifimamNo ratings yet

- Staff Settlement Form - NewDocument9 pagesStaff Settlement Form - NewBaban GaigoleNo ratings yet

- Artifact 2 - Superannuation FormDocument9 pagesArtifact 2 - Superannuation FormSiva chowdaryNo ratings yet

- Artifact 6 - Guidelines For Filling The Pension FormDocument2 pagesArtifact 6 - Guidelines For Filling The Pension FormSiva chowdaryNo ratings yet

- Artifact 3 - Instructions For Filling PF Withdrawal FormDocument1 pageArtifact 3 - Instructions For Filling PF Withdrawal FormSiva chowdaryNo ratings yet

- Artifact 4 - PF Withdrawal FormDocument1 pageArtifact 4 - PF Withdrawal FormSiva chowdaryNo ratings yet

- 1TCS India Separation Kit PDFDocument18 pages1TCS India Separation Kit PDFSiva chowdaryNo ratings yet

- Skill Certificate FormatDocument1 pageSkill Certificate FormatKunal SinghNo ratings yet

- Vlsi1 Slides PDFDocument186 pagesVlsi1 Slides PDFSiva chowdaryNo ratings yet

- 06 VLSI Design StylesDocument57 pages06 VLSI Design StylesboppanamuralikrishnaNo ratings yet

- Writing Successful Description in VerilogDocument43 pagesWriting Successful Description in VerilogNahyan Chowdhury TamalNo ratings yet

- Layouts Ds PDFDocument96 pagesLayouts Ds PDFVenkateswara ReddyNo ratings yet

- Layout RuleswithReasonDocument16 pagesLayout RuleswithReasonVishnu Vardhan ReddyNo ratings yet

- Fundamentals of CMOS VLSI 10EC56Document214 pagesFundamentals of CMOS VLSI 10EC56Santhos KumarNo ratings yet

- RTL Verilog Navabi PDFDocument294 pagesRTL Verilog Navabi PDFSiva chowdaryNo ratings yet

- Newspaper - Polity, IR - Sept CompilationDocument85 pagesNewspaper - Polity, IR - Sept CompilationSiva chowdaryNo ratings yet

- Ethics Personal NotesDocument18 pagesEthics Personal NotesSiva chowdaryNo ratings yet

- Ce40 CPR1Document7 pagesCe40 CPR1Abigail VNo ratings yet

- Rtiu Postal Service Introduction-3Document43 pagesRtiu Postal Service Introduction-3samy7541No ratings yet

- Michigan LLC Articles of OrganizationDocument3 pagesMichigan LLC Articles of OrganizationRocketLawyer100% (2)

- Castleknock Courses Spring 2022 SINGLE 2Document6 pagesCastleknock Courses Spring 2022 SINGLE 2Omar AglanNo ratings yet

- Mahsa Application FormDocument5 pagesMahsa Application FormDaphney Nicholas singNo ratings yet

- Wizznotes-Docx 1Document90 pagesWizznotes-Docx 1SashNo ratings yet

- 9 Voluntary Payment Form1Document2 pages9 Voluntary Payment Form1Vosarogo SeraNo ratings yet

- Application of Gratuity by An EmployeeDocument2 pagesApplication of Gratuity by An EmployeeDr. Muhammed KhanNo ratings yet

- Swatantrata Sainik Samman Pension Scheme 1980Document20 pagesSwatantrata Sainik Samman Pension Scheme 1980Latest Laws TeamNo ratings yet

- Anti-Money Laundering and Terrorist Financing Working Group: Final Report On The Model RulesDocument50 pagesAnti-Money Laundering and Terrorist Financing Working Group: Final Report On The Model RulesMark FalkenbergNo ratings yet

- Case Digest Compilation Nego Nov 21Document32 pagesCase Digest Compilation Nego Nov 21AaliyahNo ratings yet

- BQSM registration guidelines for quantity surveyorsDocument30 pagesBQSM registration guidelines for quantity surveyorsKhairul HazwanNo ratings yet

- Federal Treasury Rules SummaryDocument21 pagesFederal Treasury Rules SummaryKhurram Sheraz50% (2)

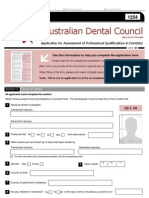

- ADC Assessment ApplicationDocument5 pagesADC Assessment ApplicationDileep SharmaNo ratings yet

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDocument4 pagesUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerNo ratings yet

- SSS Employer Contributions FormDocument2 pagesSSS Employer Contributions FormUncle Cheffy - MalateNo ratings yet

- Receipt - Payment Rules - Point WiseDocument11 pagesReceipt - Payment Rules - Point WiseRAKESHNo ratings yet

- Catalog Piese TeatruDocument68 pagesCatalog Piese TeatruÁndi Gherghe100% (1)

- Criminal Complaint Against Kevin Ford and OthersDocument43 pagesCriminal Complaint Against Kevin Ford and OthersSteve Warmbir50% (2)

- Unedited Digests Sec 02 10Document9 pagesUnedited Digests Sec 02 10Andrea RioNo ratings yet

- Rule 58 and 59 of Insurance Rules 1939Document10 pagesRule 58 and 59 of Insurance Rules 1939WatsManNo ratings yet

- TOEFL Ibt Score Review Request FormDocument1 pageTOEFL Ibt Score Review Request Formtourifael1No ratings yet

- NIL CasesDocument51 pagesNIL CasesLope Nam-iNo ratings yet

- Lifetime UPAA Member - UP Alumni AssociationDocument2 pagesLifetime UPAA Member - UP Alumni AssociationNexBengsonNo ratings yet

- United States v. Michael Mandilakis, 23 F.3d 278, 10th Cir. (1994)Document6 pagesUnited States v. Michael Mandilakis, 23 F.3d 278, 10th Cir. (1994)Scribd Government DocsNo ratings yet

- F 1040 VDocument2 pagesF 1040 VNotarys To Go0% (1)

- Donation Receipt - Cash DonationDocument1 pageDonation Receipt - Cash DonationifyjoslynNo ratings yet

- Website Subpoena Instructions 11.1.2019Document2 pagesWebsite Subpoena Instructions 11.1.2019Mark RiveraNo ratings yet

- San Diego County Sheriff's Detention Service Policy and Procedure ManualDocument640 pagesSan Diego County Sheriff's Detention Service Policy and Procedure Manualsilverbull8No ratings yet

- Notification WBSSC LDC Assistant PostsDocument14 pagesNotification WBSSC LDC Assistant PostsJaya SinhaNo ratings yet