Professional Documents

Culture Documents

Pune Residential Market Analysis Reveals Investment Demand at 31

Uploaded by

SNEHA DEVARAJUOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pune Residential Market Analysis Reveals Investment Demand at 31

Uploaded by

SNEHA DEVARAJUCopyright:

Available Formats

PUNE RESIDENTIAL MARKET ANALYSIS

* Graph depicts demand and supply of

residential inventory across budget

segments in top eight metro cities in the

studied quarter

BUDGET-WISE

DEMAND SUPPLY

City wise growth DEMAND & SUPPLY

Capital Rental

Across the country, most of the markets have exhibited similar trends,

except Pune. Pune is emerging as one of the most sought after

DYNAMICS

investment destinations, driven by the IT/ITES hub in Hinjewadi and

automotive industry belt in Chakan. 31% of unit sales in Pune this

quarter are intended for investment, while in other cities, investments Baner Wagholi Hinjewadi Undri Hadapsar Kharadi Waked Pimple Kothrud Bavdhan

are in the range of 22-25%. Saudagar

Over view

•Pune witnessed about 40 percent dip in the residential enquiries,

QoQ. Close to 1,800 units were sold in Apr-Jun 2020 as against

5,000 properties in Jan-Mar 2020.

•While yearly rentals grew by four percent, average ‘asks’ did not

post any hike amid the distressed sentiment.

•Bavdhan, Hinjewadi, Balewadi and Kharadi Annexe remained

popular amid homebuyers for configurations priced within Rs 45-

65 lakh.

•A mere 16 new projects were launched in this quarter, denoting

a 65 percent fall, QoQ. While technologically equipped and

financially well-placed Grade A developers leveraged the digital

Demand Supply

platforms, Grade B and C developers took a backseat.

•Unsold residential stock in Pune remained unchanged at 96,000 NAME:SNEHA DEVARAJU

units as construction-linked challenges kept the sceptical buyers USN:1IE18AT030

at bay. SUBJECT:SOCIOLOGY

You might also like

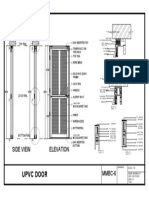

- Wooden Sliding Folding Door: MMBC-6Document1 pageWooden Sliding Folding Door: MMBC-6SNEHA DEVARAJU100% (1)

- Steel Frame Sliding Door Assembly DetailsDocument1 pageSteel Frame Sliding Door Assembly DetailsSNEHA DEVARAJUNo ratings yet

- Upvc Door: Side View ElevationDocument1 pageUpvc Door: Side View ElevationSNEHA DEVARAJU100% (1)

- Not Your Fathers Supply ChainDocument4 pagesNot Your Fathers Supply Chainkhadden999No ratings yet

- PDF Solution Manual For Supply Chain Management 4 e Sunil Chopra Peter MeindlDocument22 pagesPDF Solution Manual For Supply Chain Management 4 e Sunil Chopra Peter MeindlsivaNo ratings yet

- Inventory Management PresentationDocument15 pagesInventory Management PresentationAsif Ahmed KhanNo ratings yet

- Assignment CH 4Document17 pagesAssignment CH 4Svetlana100% (2)

- HOUSING MARKET SURVEY - Sneha (1IE18AT030)Document1 pageHOUSING MARKET SURVEY - Sneha (1IE18AT030)SNEHA DEVARAJUNo ratings yet

- Insite: Mumbai Residential Market UpdateDocument14 pagesInsite: Mumbai Residential Market UpdateDivyesh BhayaniNo ratings yet

- India Pune Residential Q1 2019Document2 pagesIndia Pune Residential Q1 2019Viren BhuptaniNo ratings yet

- PuneDocument2 pagesPuneJimmy JonesNo ratings yet

- Real Estate Market Outlook: CambodiaDocument23 pagesReal Estate Market Outlook: CambodiaJay YuanNo ratings yet

- KEC K-Blitz IIMKozhikodeDocument12 pagesKEC K-Blitz IIMKozhikodeMegha BepariNo ratings yet

- HIA Land Monitor Report 2018Document28 pagesHIA Land Monitor Report 2018Toby VueNo ratings yet

- January - June 2019 - Status of The Built Environment PDFDocument11 pagesJanuary - June 2019 - Status of The Built Environment PDFMichael LangatNo ratings yet

- Condominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Document6 pagesCondominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Jay YuanNo ratings yet

- CB Richard Ellis Report - India Office Market View - q3, 2010 - FinalDocument12 pagesCB Richard Ellis Report - India Office Market View - q3, 2010 - FinalMayank19mNo ratings yet

- Collier QuarterlyDocument7 pagesCollier QuarterlysitiNo ratings yet

- JLLM Report The Transforming Landscape of Indian Warehousing 1Document11 pagesJLLM Report The Transforming Landscape of Indian Warehousing 1Anjum Karmali100% (1)

- Cairo: The Real Estate MarketDocument5 pagesCairo: The Real Estate MarketGamal SalemNo ratings yet

- India Delhi NCR Residential Q1 2021Document2 pagesIndia Delhi NCR Residential Q1 2021Ramkrishnan MuduliNo ratings yet

- Mapping Consumer GenomeDocument10 pagesMapping Consumer Genomeapi-26164262No ratings yet

- India Betting On Warehousing BoomDocument10 pagesIndia Betting On Warehousing BoomSajiNo ratings yet

- Colliers India Global Capability Center Report Feb 2024Document11 pagesColliers India Global Capability Center Report Feb 2024Bitan SahaNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- India Chennai Residential Q1 2021Document2 pagesIndia Chennai Residential Q1 2021Ayshwarya AyshuNo ratings yet

- Colliers Iloilo H1 2021 ResidentialDocument4 pagesColliers Iloilo H1 2021 ResidentialKrisha Mae MarconNo ratings yet

- Stockifi - Prestige Estates Projects - ICDocument16 pagesStockifi - Prestige Estates Projects - ICsudhansumail102No ratings yet

- Integrated Smart City Framework PlanDocument16 pagesIntegrated Smart City Framework PlanSansriti VardhanNo ratings yet

- Real Estate IBEF PresentationDocument31 pagesReal Estate IBEF PresentationGurava MaruriNo ratings yet

- Economic Times - 2010 - 6 - 14 - Coal ReportDocument28 pagesEconomic Times - 2010 - 6 - 14 - Coal ReportbassmaloneNo ratings yet

- India Mumbai Residential Q1 2021 v2Document2 pagesIndia Mumbai Residential Q1 2021 v2San JayNo ratings yet

- 01 - Foo Gee JenDocument14 pages01 - Foo Gee JenHafiz FadzilNo ratings yet

- Real Estate: December 2016 December 2016Document46 pagesReal Estate: December 2016 December 2016Sahil Gupta0% (1)

- Philippine Construction Industry RoadmapDocument22 pagesPhilippine Construction Industry RoadmapAdrian RuizNo ratings yet

- Colliers Manila H2 2022 Industrial v1Document4 pagesColliers Manila H2 2022 Industrial v1slingNo ratings yet

- The Four Horsemen - ShubhamDocument14 pagesThe Four Horsemen - ShubhamAnonymous PVFheu0QvNo ratings yet

- Sunteck Realty Fact SheetDocument4 pagesSunteck Realty Fact SheetJagannath DNo ratings yet

- Real Estate March 2017Document46 pagesReal Estate March 2017Anonymous P1dMzVxNo ratings yet

- Singapore Market Outlook 2017Document36 pagesSingapore Market Outlook 2017rennieNo ratings yet

- Colliers Q4 2019 Metro Manila Residential CondoDocument4 pagesColliers Q4 2019 Metro Manila Residential CondoChristian OcampoNo ratings yet

- Cement: For Updated Information, Please VisitDocument6 pagesCement: For Updated Information, Please Visitpratyush thakurNo ratings yet

- Colliers Manila 2019 Outlook FinalDocument10 pagesColliers Manila 2019 Outlook FinalATS Design StudiosNo ratings yet

- KnightFrank - India Real Estate H2 2020Document150 pagesKnightFrank - India Real Estate H2 2020Swanand KulkarniNo ratings yet

- Colliers Quarterly Manila Q4 2018 ResidentialDocument5 pagesColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNo ratings yet

- Analysis of Infrastructure Sector and DLF GroupDocument55 pagesAnalysis of Infrastructure Sector and DLF GrouparjunvigNo ratings yet

- Australia Real Estate Market Outlook 2019 AojgDocument39 pagesAustralia Real Estate Market Outlook 2019 AojgAbhishek KallaNo ratings yet

- Residential Traction at GlanceDocument6 pagesResidential Traction at GlanceVASUNo ratings yet

- Codename QUAD - E-BookDocument12 pagesCodename QUAD - E-BookAmiya ArnavNo ratings yet

- Egypt Green Building Market Intelligence EXPORTDocument12 pagesEgypt Green Building Market Intelligence EXPORTMohamed El ZayatNo ratings yet

- Colliers Myanmar Condo Quarterly Q2 2019Document4 pagesColliers Myanmar Condo Quarterly Q2 2019Eingel LinnNo ratings yet

- Resilience of Hyderabad Residential Market During COVID-19Document5 pagesResilience of Hyderabad Residential Market During COVID-19Celestine DcruzNo ratings yet

- Affordable Housing in India 24072012Document20 pagesAffordable Housing in India 24072012Arjun GunasekaranNo ratings yet

- Ksa Cost Benchmarking q1 2020Document1 pageKsa Cost Benchmarking q1 2020Ty BorjaNo ratings yet

- Colliers - Market Overview BiH - 00202Document19 pagesColliers - Market Overview BiH - 00202Dražen ŠNo ratings yet

- 2Q19 Washington DC Local Apartment ReportDocument4 pages2Q19 Washington DC Local Apartment ReportWilliam HarrisNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22017Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22017Anonymous Feglbx5No ratings yet

- Namrata Kushwaha 221510000681 Industry CellDocument6 pagesNamrata Kushwaha 221510000681 Industry Cellhallid25No ratings yet

- Mr Mehta’s Conundrum: Where Next? Real Estate Growth DriversDocument15 pagesMr Mehta’s Conundrum: Where Next? Real Estate Growth DriversASDASNo ratings yet

- High Growth in Gross Absorption: Summary & RecommendationsDocument4 pagesHigh Growth in Gross Absorption: Summary & RecommendationsbiswasjpNo ratings yet

- 3Q19 Atlanta Local Apartment ReportDocument4 pages3Q19 Atlanta Local Apartment ReportAnonymous amHficr9RNo ratings yet

- Is Nifty Over ValuedDocument6 pagesIs Nifty Over ValuedBalakrishna MaturNo ratings yet

- Chennai Off 2q19Document2 pagesChennai Off 2q19Harsh SawhneyNo ratings yet

- Visit Note: Ansal Properties and Infrastructure Limited (APIL)Document5 pagesVisit Note: Ansal Properties and Infrastructure Limited (APIL)royrakeshNo ratings yet

- Nairobi Metropolitan Area Residential Report 2023 Full ReportDocument30 pagesNairobi Metropolitan Area Residential Report 2023 Full Reportj.mcleanjackNo ratings yet

- Article 33856Document12 pagesArticle 33856SNEHA DEVARAJUNo ratings yet

- 34 TH Surajkund International Crafts Mela - 2020Document1 page34 TH Surajkund International Crafts Mela - 2020SNEHA DEVARAJUNo ratings yet

- Kevin Lynch Mapping MethodDocument38 pagesKevin Lynch Mapping MethodNéstor De LeónNo ratings yet

- Aavarna 2Document13 pagesAavarna 2SNEHA DEVARAJU100% (1)

- Pragati MaidanDocument3 pagesPragati MaidanSNEHA DEVARAJUNo ratings yet

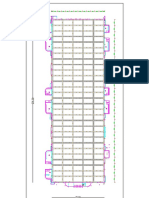

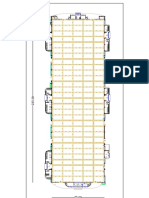

- Hall 5Document1 pageHall 5SNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-WsDocument1 pageMMBC Portfolio-WsSNEHA DEVARAJUNo ratings yet

- Good City Form-Kevin Lynch: Topic: SenseDocument9 pagesGood City Form-Kevin Lynch: Topic: SenseSNEHA DEVARAJUNo ratings yet

- Case Study Dayananda Sagar Dental CollegeDocument21 pagesCase Study Dayananda Sagar Dental CollegeSNEHA DEVARAJUNo ratings yet

- WindowsDocument8 pagesWindowsSNEHA DEVARAJUNo ratings yet

- Bangalore International Exhibition Centre Hall 4 GROSS AREA: 17500 SQ.MDocument1 pageBangalore International Exhibition Centre Hall 4 GROSS AREA: 17500 SQ.MSNEHA DEVARAJUNo ratings yet

- Griha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuDocument5 pagesGriha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuSNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-UwDocument1 pageMMBC Portfolio-UwSNEHA DEVARAJUNo ratings yet

- MMBC Glass Group 3Document16 pagesMMBC Glass Group 3SNEHA DEVARAJUNo ratings yet

- Detailed Design Program (Area Statements and Requirements) - Ad5Document1 pageDetailed Design Program (Area Statements and Requirements) - Ad5SNEHA DEVARAJUNo ratings yet

- Practical Strategies: HotelsDocument15 pagesPractical Strategies: HotelsSNEHA DEVARAJUNo ratings yet

- Green Building Ratings - SnehaDocument13 pagesGreen Building Ratings - SnehaSNEHA DEVARAJUNo ratings yet

- COMMUNITIES: ORIGINS, GROWTH AND CHARACTERISTICSDocument21 pagesCOMMUNITIES: ORIGINS, GROWTH AND CHARACTERISTICSSNEHA DEVARAJUNo ratings yet

- Business Hotel Layout and DesignDocument56 pagesBusiness Hotel Layout and DesignSNEHA DEVARAJUNo ratings yet

- Water Henri Snel UKDocument3 pagesWater Henri Snel UKSNEHA DEVARAJUNo ratings yet

- Bengaluru BDA RMP 2031 Volume - 4 - PlanningDistrictReport PDFDocument376 pagesBengaluru BDA RMP 2031 Volume - 4 - PlanningDistrictReport PDFyvenkatakrishna100% (1)

- 166268510Document63 pages166268510DevoRoyNo ratings yet

- Qutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020Document12 pagesQutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020SNEHA DEVARAJUNo ratings yet

- The Mysore Palace: An Architectural OverviewDocument40 pagesThe Mysore Palace: An Architectural OverviewSNEHA DEVARAJU100% (1)

- History of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniDocument13 pagesHistory of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniSNEHA DEVARAJUNo ratings yet

- Chopra3 PPT ch10Document29 pagesChopra3 PPT ch10Sharoz SheikhNo ratings yet

- The Goal Book ReviewDocument6 pagesThe Goal Book ReviewRakesh SkaiNo ratings yet

- Lecture OutlineDocument55 pagesLecture OutlineShweta ChaudharyNo ratings yet

- Journal Entry For Correction of Errors and CounterbalancingDocument9 pagesJournal Entry For Correction of Errors and CounterbalancingsharbularsNo ratings yet

- FSN Analysis For Inventory Management - Case Study of Sponge Iron PlantDocument5 pagesFSN Analysis For Inventory Management - Case Study of Sponge Iron PlantJanani JayaprakasanNo ratings yet

- 10th Step Daily Review WorksheetDocument2 pages10th Step Daily Review WorksheetAj StrangNo ratings yet

- Overall and Spares Inventory Over Last Five Years (Whole NTPC)Document16 pagesOverall and Spares Inventory Over Last Five Years (Whole NTPC)SamNo ratings yet

- Inventory ManagementDocument2 pagesInventory Managementpranay639No ratings yet

- Notes - Chapter 5 Jan 14 KeyDocument9 pagesNotes - Chapter 5 Jan 14 Keyman7895bouy79745No ratings yet

- Audit Cash ExercisesDocument2 pagesAudit Cash ExercisesjhevesNo ratings yet

- Luxury Motor Home Sales & CostsDocument6 pagesLuxury Motor Home Sales & CostsUmer AhmadNo ratings yet

- Ch. 24 Inventory ManagementDocument5 pagesCh. 24 Inventory ManagementRosina KaneNo ratings yet

- Accounting for spoilage, reworks, and scrap materialsDocument4 pagesAccounting for spoilage, reworks, and scrap materialsGianJoshuaDayritNo ratings yet

- Codification and Standardisationof The MaterialsDocument13 pagesCodification and Standardisationof The MaterialsCojanu CozminNo ratings yet

- Introduction to S.G. Iron Casting IndustryDocument30 pagesIntroduction to S.G. Iron Casting Industryavnishchauhan8_46499100% (1)

- Inventory Formula Excel TemplateDocument4 pagesInventory Formula Excel TemplateMustafa Ricky Pramana SeNo ratings yet

- This Study Resource Was: Example 1Document1 pageThis Study Resource Was: Example 1Sharifah AmizaNo ratings yet

- Senior Buyer Purchasing in Boston MA Resume Anthony BarrassoDocument2 pagesSenior Buyer Purchasing in Boston MA Resume Anthony BarrassoAnthonyBarrassoNo ratings yet

- SCM 0Document49 pagesSCM 0Jonathan EscamillanNo ratings yet

- Managerial Accounting and Cost ConceptsDocument67 pagesManagerial Accounting and Cost ConceptsTristan AdrianNo ratings yet

- Orquia, Anndhrea S. BSA-22Document2 pagesOrquia, Anndhrea S. BSA-22Clint RoblesNo ratings yet

- Ch. 6 Study Guide SolutionsDocument24 pagesCh. 6 Study Guide SolutionsOlufifehanmi OsikoyaNo ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet

- On January 1 2013 Lessard Acquired 80 of The Share PDFDocument1 pageOn January 1 2013 Lessard Acquired 80 of The Share PDFhassan taimourNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlShweta Dixit100% (1)

- Study Text Cma Caf 3Document606 pagesStudy Text Cma Caf 3Muhammad KashifNo ratings yet