Professional Documents

Culture Documents

Compliance Points 2020 PDF

Compliance Points 2020 PDF

Uploaded by

mk73rcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compliance Points 2020 PDF

Compliance Points 2020 PDF

Uploaded by

mk73rcCopyright:

Available Formats

Reference Compliance Requirement Remarks

bank statement or agreement for sale or

leave and license agreement or

acknowledged copy of Income Tax return.

Comm. 2211 PAN card of the corporate entity.

dated 22nd AMC Pool accounts should be opened in the

December, same name that is mentioned by the Stock

2010 Exchanges in their correspondence intimating

the CMID.

Operating FIIs

Instruction 2.3.8 Certified True Copy of certificate of

registration with SEBI, certified by

Managing Director / Company Secretary.

Certified true copy of the Board

Resolution, duly certified by Managing

Director / Company Secretary authorizing

persons to open and operate the account

and specifying the manner of operation of

the account.

Names of the authorised signatories,

designation, photograph and their

specimen signatures duly certified by the

Managing Director / Company Secretary.

Memorandum and Articles of Association

of the Company, if any.

Operating OCBs

Instruction 2.3.9 Copy of RBI Registration Certificate.

Certified true copy of the Board

Resolution, certified by Managing Director

/ Company Secretary, authorizing persons

to open and operate the account and

specifying the manner of operation of the

account.

Names of the authorised signatories,

designation, photograph and their

specimen signatures duly verified by the

Managing Director / Company Secretary.

Memorandum and Articles of Association

of the Company.

Declaration from the OCB that it meets

with guidelines issued by RBI / Ministry of

finance

Compliance Manual for DPs Page 21 of 165

Reference Compliance Requirement Remarks

Certificate from overseas auditors in form

OAC or OAC – 1, as may be applicable.

Statement of A/C from the bank.

Operating Registered Societies

Instruction Copy of Certificate of Registration under

2.3.10 the Societies Registration Act, 1860.

List of Managing Committee members.

Certified true copy of Resolution of the

Managing Committee for persons

authorised to open and operate the

account and specifying the manner of

operation of the account.

Names of the Authorised signatories,

designation, photograph (with signatures

across the face of the photograph) and

their specimen signatures.

Copy of Society’s Rules and Bye Laws

duly certified by the Chairman / Secretary.

Proof of address evidenced by documents

registered with registering authority or

bank statement or agreement for sale or

leave and license agreement or

acknowledged copy of income tax return

Unregistered Society

Operating

Instruction The account should be opened in the

2.3.10 names of the members under “Individual”

category (maximum three persons).

All the documents as applicable for

account opening under individual category

should be obtained.

SEBI circular The proof of address / identity documents

09/06 dated of the individual members should be

July 20, 2006 obtained for account opening.

PAN card of society

Operating Public Trust / Charitable Trust and Trust

Instruction capable of holding property in its name:

2.3.11.1 Account to be opened in the name of the

Trust.

Trust Deed and Rules.

Compliance Manual for DPs Page 22 of 165

Reference Compliance Requirement Remarks

List of Members on the Board of Trustees.

Certificate of Registration of Trust under

the Societies Registration Act, 1860 /

Bombay Public Trust Act, 1950 / Public

Trust Act, of relevant State.

Certified true copy of Board Resolution to

open the Demat account and specifying

the persons authorised by the Board to act

as Authorised Signatory(ies) to operate the

demat account.

Names of the Authorised Signatories,

Designation, photograph (with their

signatures across the face of the

photograph) and their specimen signatures

duly verified by the Managing Trustee.

PAN card of the trust

Proof of registered office address

evidenced by documents registered with

registering authority or bank statement or

agreement for sale or leave and license

agreement or acknowledged copy of

income tax return

Operating

Instruction Private Trust

2.3.11.2 Account should be opened in the names of

individual trustees (maximum three), under

“Individual” category.

The board of trustees shall specify the

names of the trustees who shall hold /

operate the demat account.

The proof of address and proof of identity

documents of the trustees should be

obtained for account opening.

PAN card of the Trust

Operating “Recognised” Funds/ Trusts/ Other Similar

Instruction Entities:

2.3.11.3

(i) The Funds/ Trusts/ Entities presently

included under this category are as follows:

(a) Employees Provident Fund, which have

been recognized by the Provident Fund

Compliance Manual for DPs Page 23 of 165

Reference Compliance Requirement Remarks

Commissioner under Employee’s

Provident Funds & Miscellaneous

Provisions Act, 1952.

(b) Employees Gratuity Fund, which are

formed under Payment of Gratuity Act,

1972.

(c) Superannuation Fund which are formed

under the guidelines issued by Income

Tax Department.

(d) Venture Capital Funds which are

registered by SEBI.

(e) ESOP Trust formed pursuant to the

guidelines issued by SEBI).

(ii) Accounts of the above Funds/ Trusts/

Entities should be opened in the name of

above Funds/ Trusts/ Entities as they are

recognized either under the Income Tax Act or

Securities & Exchange Board of India, etc.

(iii) Documents to be furnished by the above

Funds/ Trusts/ Entities and other Funds/

Trusts/ Entities which are similarly placed are:

1) Certificate of Registration, if any, issued by

the authority recognizing the Fund/ Trust/

Entity as such;

2) Trust Deed and Rules and/or any

document or charter defining their

constitution and providing for management

thereof;

3) List of Members on the Board of

Trustees/Governing Body;

4) Certified true copy of the Resolution

passed by the Board of

Trustees/Governing Body to open the

demat account and specifying the persons

authorized by the Board to act as

Authorized signatory(ies) to operate the

demat account;

5) Names of the authorized signatories,

designation, and their specimen signatures

duly verified by the Managing Trustee;

6) One passport-size photograph of each of

Compliance Manual for DPs Page 24 of 165

Reference Compliance Requirement Remarks

the authorized signatory(ies) with their

signatures across the face of the

photograph;

7) PAN cards issued to such

Fund/Trust/Entity;

8) Proof of registered office address

evidenced by document registered with

registering authority or bank statement or

agreement for sale or leave-and-license

agreement or acknowledged copy of

Income Tax Return.

Operating Banks

Instruction Certified true copy of Board Resolution.

2.3.12 OR

Letter on the letterhead of the bank,

signed by the Chairman / Managing

Director authorizing the persons to open

and operate the account.

Names of the authorised signatories,

designation, photograph and their

specimen signatures duly verified by the

Chairman / Managing Director.

Memorandum and Articles of Association&

Certificate of Incorporation or copy of RBI

registration in case of Scheduled/Co-

operative banks.

Proof of address evidenced by documents

registered with registering authority or

agreement for sale or leave and license

agreement or acknowledged copy of

income tax return or Telephone bills (Bill

date not more than two months old) or

Electricity bills (Bill date not more than two

months old).

Operating Foreign Nationals

Instruction Copy of passport or certificate from the

2.3.13 bank.

The foreign address containing Post Office

Box Number (P.O. Box No.) may be

accepted, as valid address provided such

Compliance Manual for DPs Page 25 of 165

You might also like

- Republic of The Philippines) ) S.S.Document4 pagesRepublic of The Philippines) ) S.S.Kikz Gusi100% (3)

- Banker AcceptanceDocument2 pagesBanker Acceptancecktee77100% (1)

- AMWELSH79Document3 pagesAMWELSH79nspanoliosNo ratings yet

- Merchant OnboardingDocument16 pagesMerchant Onboardingsheetal.kamthewadNo ratings yet

- LTD Company Account Mandate-EnglishDocument2 pagesLTD Company Account Mandate-EnglishvasanthawNo ratings yet

- Zerodha CDocument18 pagesZerodha CJaved HakimNo ratings yet

- Lipa Na Mpesa Paybill RequirementsDocument16 pagesLipa Na Mpesa Paybill Requirementscatholic HymnsNo ratings yet

- Enyuata Kenya Limited 2021Document7 pagesEnyuata Kenya Limited 2021nic amanyaNo ratings yet

- ENYUATA KENYA LIMITED 2021 CorrectionsDocument7 pagesENYUATA KENYA LIMITED 2021 Correctionsnic amanyaNo ratings yet

- Paybill RequirementsDocument6 pagesPaybill Requirementssharif sayyid al mahdalyNo ratings yet

- Coaljunction: New Registration Checklist & InstructionsDocument8 pagesCoaljunction: New Registration Checklist & Instructionsanujtomar31No ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormAshok KumarNo ratings yet

- Current Account RulesDocument10 pagesCurrent Account RulesJags EesanNo ratings yet

- NT Opening NT Openingf: H.G Markets (PVT) Limited H.G Markets (PVT) Limited H.G Markets (PVT) LimitedDocument11 pagesNT Opening NT Openingf: H.G Markets (PVT) Limited H.G Markets (PVT) Limited H.G Markets (PVT) LimitedMuhammad Azhar SaleemNo ratings yet

- Memorandum of Association, Prospectus, Statement in Lieu of ProspectusDocument14 pagesMemorandum of Association, Prospectus, Statement in Lieu of ProspectusSahil AggarwalNo ratings yet

- CA External Auditor 2023Document3 pagesCA External Auditor 2023subhrajit KuanrNo ratings yet

- Checklist For In-Principle-Public Issue of Debentures (Existing Listed Issuers)Document1 pageChecklist For In-Principle-Public Issue of Debentures (Existing Listed Issuers)Hemlata LodhaNo ratings yet

- Client On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsDocument39 pagesClient On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsJan Paolo CruzNo ratings yet

- Detailed Procedure For Listing of Privately Placed DebenturesDocument11 pagesDetailed Procedure For Listing of Privately Placed Debenturesaniket guptaNo ratings yet

- Checklist Capital ConversionDocument1 pageChecklist Capital ConversionCarl Los100% (1)

- 2019 Updated Kyc RequirementsDocument11 pages2019 Updated Kyc RequirementsRoy K NjokaNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument15 pagesInstructions / Checklist For Filling KYC FormAdarsh SinghNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument13 pagesInstructions / Checklist For Filling KYC Formsuraj rautNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument28 pagesInstructions / Checklist For Filling KYC Formvishnu ksNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument27 pagesInstructions / Checklist For Filling KYC FormMayank KumarNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument35 pagesInstructions / Checklist For Filling KYC FormAjay Kumar MattupalliNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument15 pagesInstructions / Checklist For Filling KYC FormMohmmad ShahnawazNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument21 pagesInstructions / Checklist For Filling KYC FormdhritimohanNo ratings yet

- Ach Form-13Document2 pagesAch Form-13anjiNo ratings yet

- Annexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Document3 pagesAnnexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Consultant NowFoundationNo ratings yet

- Ach FormDocument2 pagesAch FormPamu PungleNo ratings yet

- Commodity SegmentDocument12 pagesCommodity Segmenthbk.khbdNo ratings yet

- Welcome ToDocument25 pagesWelcome ToAbdulAhadNo ratings yet

- State Bank of Pakistan Banking Policy Department Karachi: I. I. Chundrigar Road, Post Box No. 4456Document4 pagesState Bank of Pakistan Banking Policy Department Karachi: I. I. Chundrigar Road, Post Box No. 4456Hafiz NoumanNo ratings yet

- Ach - Form - 2023-06-09T205028.461Document2 pagesAch - Form - 2023-06-09T205028.461Flex ClipNo ratings yet

- Zerodha CDocument13 pagesZerodha CGopagani DharshanNo ratings yet

- SEC 17-C - Results of Board Meeting - January 30, 2023Document5 pagesSEC 17-C - Results of Board Meeting - January 30, 2023anne anneNo ratings yet

- Bdo Sec Cert CompleteDocument4 pagesBdo Sec Cert CompleteMartin Michael HatolNo ratings yet

- Corporate AccountDocument4 pagesCorporate AccountEdwardNo ratings yet

- Ach FormDocument2 pagesAch Formashishsahu78No ratings yet

- Boc e Pay Application Form enDocument7 pagesBoc e Pay Application Form enYapaNo ratings yet

- Axa China Bank ADA Enrollment Form PDFDocument1 pageAxa China Bank ADA Enrollment Form PDFAna A OverlyNo ratings yet

- Ach FormDocument2 pagesAch FormDhiraj PaikNo ratings yet

- List of Officially Valid Kyc Documents: Resident IndividualsDocument8 pagesList of Officially Valid Kyc Documents: Resident Individualsmail24x71125No ratings yet

- Ach FormDocument2 pagesAch FormRishabh MakkarNo ratings yet

- Standard Chartered Pakistan 2008 Annual ReportDocument200 pagesStandard Chartered Pakistan 2008 Annual ReportMoiz Sheikh100% (2)

- Ach FormDocument2 pagesAch FormFlex ClipNo ratings yet

- BR FormatDocument2 pagesBR Formatarvindan ram hariNo ratings yet

- Notice of 26th Annual General MeetingDocument12 pagesNotice of 26th Annual General MeetingLaxmikant RathiNo ratings yet

- Secretary Certificate TemplateDocument2 pagesSecretary Certificate TemplateChristian John Tomas100% (1)

- Revised AMFI GuidlinesDocument5 pagesRevised AMFI GuidlinesPreparation StudioNo ratings yet

- CoaljunctionDocument3 pagesCoaljunctionuttamksrNo ratings yet

- Form of Resolutions of A Sole Director To Approve Entry Into T.C. Ziraat Bankasi A.S. London Branch Account MandateDocument4 pagesForm of Resolutions of A Sole Director To Approve Entry Into T.C. Ziraat Bankasi A.S. London Branch Account MandateАлена МихееваNo ratings yet

- Solicitor ATR Checklist For SME Banking v2017Document10 pagesSolicitor ATR Checklist For SME Banking v2017Tan KhaiNo ratings yet

- Minutes of Board MeetingDocument5 pagesMinutes of Board MeetingMaricel Mendoza Capulong100% (1)

- Ach FormDocument2 pagesAch FormSyed Tanveer Hasan HasanNo ratings yet

- Increase of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionDocument3 pagesIncrease of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionsejinmaNo ratings yet

- Ach FormDocument2 pagesAch FormFlex ClipNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Compliance Manual For Dps Page 6 of 165Document5 pagesCompliance Manual For Dps Page 6 of 165mk73rcNo ratings yet

- Compliance Manual 1Document5 pagesCompliance Manual 1mk73rcNo ratings yet

- Compliance Manual For Dps Page 11 of 165Document5 pagesCompliance Manual For Dps Page 11 of 165mk73rcNo ratings yet

- Service Level Agreement CIP Computer ConsultancyDocument8 pagesService Level Agreement CIP Computer Consultancymk73rcNo ratings yet

- Murali Mohan Reddy-Anekal-metric-201020-AREA STATEMENT-2Document2 pagesMurali Mohan Reddy-Anekal-metric-201020-AREA STATEMENT-2mk73rcNo ratings yet

- Hr365 Asset ManagementDocument1 pageHr365 Asset Managementmk73rcNo ratings yet

- HR 365 - Timesheet Plus, TIme Off Manager, Employee DirectoryDocument1 pageHR 365 - Timesheet Plus, TIme Off Manager, Employee Directorymk73rcNo ratings yet

- Ipo RHP IndigoDocument404 pagesIpo RHP IndigoKuperajahNo ratings yet

- International Business Law - Chapter 6Document34 pagesInternational Business Law - Chapter 6hnhNo ratings yet

- HT115 Parts ManualDocument151 pagesHT115 Parts ManualSergii wolfNo ratings yet

- Republic of The Philippines Eulogio "Amang" Rodriguez Institute of Science and Technology Nagtahan, Sampaloc, ManilaDocument3 pagesRepublic of The Philippines Eulogio "Amang" Rodriguez Institute of Science and Technology Nagtahan, Sampaloc, ManilaWendell MalarastaNo ratings yet

- Remedies Under The LGC - Movido OutlineDocument20 pagesRemedies Under The LGC - Movido Outlinecmv mendoza100% (1)

- PSA Birth CertDocument1 pagePSA Birth CertThomasNo ratings yet

- Butterfly Damper InstallationDocument5 pagesButterfly Damper InstallationRepl microsoft, PuneNo ratings yet

- Account StatementDocument2 pagesAccount StatementAshwin RiffelNo ratings yet

- 10 de Borja vs. Vda. de de BorjaDocument11 pages10 de Borja vs. Vda. de de BorjaSimeon TutaanNo ratings yet

- Deputy Assistant DirectorDocument5 pagesDeputy Assistant DirectorDanish RazaNo ratings yet

- Consolidation ProcedureDocument11 pagesConsolidation ProcedureShamim SarwarNo ratings yet

- Sbiepay Sbiepay: Neft Challan (No RTGS) Neft Challan (No RTGS)Document1 pageSbiepay Sbiepay: Neft Challan (No RTGS) Neft Challan (No RTGS)VedanthNo ratings yet

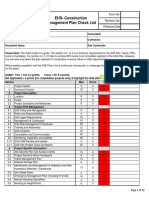

- EHS-Construction Management Plan Check List: Form No. Revision No. Effective DateDocument10 pagesEHS-Construction Management Plan Check List: Form No. Revision No. Effective DateshahnawazNo ratings yet

- Samson Vs Corrales TanDocument3 pagesSamson Vs Corrales TanMargarita SisonNo ratings yet

- Petrie SeasonDocument122 pagesPetrie Seasonblueingrey100% (1)

- Oracle Upgrade From 11.2.0.1 To 11.2.0.4Document41 pagesOracle Upgrade From 11.2.0.1 To 11.2.0.4Pradeep SNo ratings yet

- Encinas Vs Natl Book S To Negros OccidentalDocument8 pagesEncinas Vs Natl Book S To Negros OccidentalQueenie PeliscoNo ratings yet

- IPCR-Lawyer - AS Urbina - July-December 2020Document2 pagesIPCR-Lawyer - AS Urbina - July-December 2020Christian UrbinaNo ratings yet

- Conventions Provide The Flesh Which Clothes The Dry Bones of The LawDocument5 pagesConventions Provide The Flesh Which Clothes The Dry Bones of The LawAlia ZaheeraNo ratings yet

- Arranger AgreementDocument5 pagesArranger AgreementNadym Gulam RasulNo ratings yet

- CBPM 2021 Form B 14 PO Package 5Document2 pagesCBPM 2021 Form B 14 PO Package 5Jane brigoli TagayongNo ratings yet

- Concept MapDocument1 pageConcept MapBryantNo ratings yet

- Corporate EUtopia FinalDocument16 pagesCorporate EUtopia FinalKatarina PeovićNo ratings yet

- History of Compilation of The Quran-1-1Document2 pagesHistory of Compilation of The Quran-1-1Hamza HashmiNo ratings yet

- Petitioners Response To Respondents' and Intervener's Motions For Summary JudgmentDocument6 pagesPetitioners Response To Respondents' and Intervener's Motions For Summary JudgmentstevenamedinaNo ratings yet

- The Blood Brothers: Mircea II Vlad IV Călugărul Radu IIIDocument4 pagesThe Blood Brothers: Mircea II Vlad IV Călugărul Radu IIIahussin_3No ratings yet

- Home Sellers GuideDocument10 pagesHome Sellers GuidehenryvargaNo ratings yet

- Property - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Document2 pagesProperty - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Lewrej De PerioNo ratings yet

- 4 5868387638146240346 PDFDocument87 pages4 5868387638146240346 PDFalgi hajarNo ratings yet