Professional Documents

Culture Documents

Government of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & Restricted

Uploaded by

Mani Vannan JOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & Restricted

Uploaded by

Mani Vannan JCopyright:

Available Formats

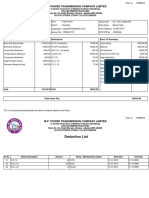

Government of TamilNadu

Treasury Bill for Salary (Employee)

Drawing Officer 2605|0016|HM GHS NEEDAMANGALAM, MANNARGUDI|- Treasury Reference Number 2605001620100002

(26050016)

Treasury/PAO ST NEEDAMANGALAM-(2605) Treasury Reference Date 22-10-2020

HOD Directorate of School Education-(04303)

Scheme Code Salary of Teachers and staff in Government Secondary and Higher Secondary Schools-(220202109AA)

Detail Head Pay-(30101)

Description Regular Salary Bill For HM PERMANENT For Oct-2020

Post Sanction GO 46 01-MAR-11

DEBIT CREDIT

220202109AA30101 Pay 86300 023560800AH22403 Family Benefit Fund 60

220202109AA30102 Medical Allowance 300 007500800BM22401 New Health Insurance Scheme- 180

Employees

220202109AA30106 House Rent Allowance 3200

803100102BL80102 Non Bearing Interest - Receipts 50

220202109AA30301 Dearness Allowance 14331

(Public Account)

865800102AG80102 Non Bearing Interest - Receipts 1094

(Public Account)

865800112AA80102 Non Bearing Interest - Receipts 12000

(Public Account)

800901101AA80102 Non Bearing Interest - Receipts 20000

(Public Account)

Tot. Gross: 104131 Tot. Deduction: 33384

NET : 70747

(Seventy Thousand Seven Hundred Fourty Seven Only)

Certificate Points :

LPC for the Transferees is required. SR 12 TR 16.

Page 1 of 2

Sensitivity: Internal & Restricted

Government of TamilNadu

Rate of joining time pay and allowances claimed are not correct. FR 107 (HRA / CCA should be preferred at the rate whichever is less)

Increment certificate is required . Art.75 of TNFC Vol-I & SR.13 TR 16.

Professional Tax is to be recovered from the salary bill for the month of August / January. G.O.No. 65 MAWS dt. 24.4.90, G.O.No. 249 MAWS dt. 28.12.98 & G.O.No. 11 MAWS dt.

12.1.99.

IT statement (in respect of Self Drawing Officers) for February salary claim / arrears claim upto 31st March to be attached. SR 2 (l) TR 16.

I.T., to be deducted SR 2 (l ) TR16.

Express Pay orders from Government is required for the claims of the newly formed office. Note to instruction 1 – TR 17.

HOD certificate has to be furnished for the claim of Temporary establishment beyond the expiry period of sanction upto three months. Note SR 7 TR 16.

The particulars of G.O. No. and date in the bill in which the Temporary Establishment was sanctioned, the period upto which sanctioned and last continued has to be furnished in the bill

SR 7 TR 16.

Separate bills are required for permanent / Temporary establishment noting the authority. SR 7 TR 16.

( CLAIM UNDER RUPEES 70748 /- )

( Rupees Seventy Thousand Seven Hundred Fourty Eight Only )

Dated Signature of DDO with seal.

Page 2 of 2

Sensitivity: Internal & Restricted

You might also like

- Explain Business Operations That Can Be Linked To DiversityDocument2 pagesExplain Business Operations That Can Be Linked To DiversitySushan Pradhan100% (1)

- BSBHRM525 Student Assessment Task 2Document33 pagesBSBHRM525 Student Assessment Task 2Qasim YousafNo ratings yet

- CASE Aggregate Planning at Green MillsDocument3 pagesCASE Aggregate Planning at Green Millshina firdousNo ratings yet

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & RestrictedDocument2 pagesGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & RestrictedMani Vannan JNo ratings yet

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberDocument2 pagesGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberMani Vannan JNo ratings yet

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberDocument2 pagesGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberMani Vannan JNo ratings yet

- 270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)yogarajanNo ratings yet

- Bill 1501013420110401Document3 pagesBill 1501013420110401prastacharNo ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet

- 1111Document2 pages1111Karan JangidNo ratings yet

- R K S Infra Computation 2022Document4 pagesR K S Infra Computation 2022birpal singhNo ratings yet

- Shree Khatu - Comp - Ay - 2021-22Document4 pagesShree Khatu - Comp - Ay - 2021-22Soumya SwainNo ratings yet

- COI AY 22-23 Narinder BhatiaDocument4 pagesCOI AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- Comp Anubhav Garg 23-24Document5 pagesComp Anubhav Garg 23-24prateek gangwaniNo ratings yet

- M.P. Power Transmission Company LimitedDocument2 pagesM.P. Power Transmission Company LimitedKanhaiya SharmaNo ratings yet

- Education SalaryDocument1 pageEducation Salaryankurrawat693No ratings yet

- Computation Fy 21-22Document4 pagesComputation Fy 21-22rakeshkaydalwarNo ratings yet

- Compu PDFDocument4 pagesCompu PDFMihir ThakkarNo ratings yet

- Compu TationDocument7 pagesCompu TationRaj KumarNo ratings yet

- Computation Anita SareeDocument3 pagesComputation Anita SareeSURYAKANT PATHAKNo ratings yet

- Computation Ramesh Singh RajpootDocument8 pagesComputation Ramesh Singh RajpootSHELESH GARGNo ratings yet

- RakeshDocument3 pagesRakeshASHISH BHONDENo ratings yet

- AY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationDocument4 pagesAY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationNarasimhamoorthy L RNo ratings yet

- Keshab Kaukhik Dutta ITDocument23 pagesKeshab Kaukhik Dutta ITAnup SahaNo ratings yet

- Documents 0Document3 pagesDocuments 0rajindermechNo ratings yet

- Please Send Me HackDocument3 pagesPlease Send Me Hackgaurav.verma17No ratings yet

- Scheme/CommittedDocument2 pagesScheme/CommittedShreyash JobworkNo ratings yet

- GgjdfhijfrbjcDocument3 pagesGgjdfhijfrbjcdmqktchxphNo ratings yet

- Computation 22-23 Buta SinghDocument2 pagesComputation 22-23 Buta SinghSharn RamgarhiaNo ratings yet

- Attendance Leave: Aslenah12 00days)Document2 pagesAttendance Leave: Aslenah12 00days)Vishnu DattNo ratings yet

- TSTC Form 47 Salary Bill: Government of TelanganaDocument9 pagesTSTC Form 47 Salary Bill: Government of TelanganaEENo ratings yet

- Bill 1503007424010010Document2 pagesBill 1503007424010010mechsathish63No ratings yet

- Compu TationDocument3 pagesCompu TationAbhilash M NairNo ratings yet

- Coi 21-22 TusharDocument4 pagesCoi 21-22 TusharKR FINANCIAL SERVICESNo ratings yet

- 1/Ct & Re (A2) 04-Jan-2010: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages1/Ct & Re (A2) 04-Jan-2010: Government of Tamilnadu Treasury Bill For Salary (Employee)PRAVEENKUMAR MNo ratings yet

- Com 2021Document6 pagesCom 2021devesh2408No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Attachment UnlockedDocument3 pagesAttachment Unlockedmbhalani1207No ratings yet

- Compu TationDocument5 pagesCompu Tationacme financialNo ratings yet

- Self-Occupied: Com Putati On of I Ncom E and Tax Pai DDocument5 pagesSelf-Occupied: Com Putati On of I Ncom E and Tax Pai DAnshika GoelNo ratings yet

- Amit Kumar Mudgal ComputationDocument4 pagesAmit Kumar Mudgal ComputationSHELESH GARGNo ratings yet

- Akshay Comp. 21-22Document3 pagesAkshay Comp. 21-22avishkar guptaNo ratings yet

- Akshay Comp. 21-22Document3 pagesAkshay Comp. 21-22avishkar guptaNo ratings yet

- Comp 21Document6 pagesComp 21aprna SharmaNo ratings yet

- Computation 2022-23Document2 pagesComputation 2022-23DKINGNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- ComputationDocument2 pagesComputationsameer prabhasNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Computation Khemchandra ShakyaDocument2 pagesComputation Khemchandra ShakyaSHELESH GARGNo ratings yet

- ViewpayslipDocument1 pageViewpayslipmkwalikar123No ratings yet

- Government of Tamilnadu Other ContingenciesDocument3 pagesGovernment of Tamilnadu Other ContingenciesprastacharNo ratings yet

- Gst-Challan - 2023-04-20T180356.843Document1 pageGst-Challan - 2023-04-20T180356.843Ashish GuptaNo ratings yet

- Computation Bhoopendra Ay 21-22Document2 pagesComputation Bhoopendra Ay 21-22SHELESH GARGNo ratings yet

- 1478316c PDFDocument9 pages1478316c PDFmurapakasrinivasNo ratings yet

- ITR Compilation 4u5346Document4 pagesITR Compilation 4u5346akhil kwatraNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Manorama Com 3Document2 pagesManorama Com 3nitin patidarNo ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- Suresh Naphade ComputationDocument2 pagesSuresh Naphade ComputationSAURABH KULKARNINo ratings yet

- Particulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानDocument3 pagesParticulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानDILLI BABUNo ratings yet

- Sensitivity: Internal & RestrictedDocument8 pagesSensitivity: Internal & RestrictedMani Vannan JNo ratings yet

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & RestrictedDocument2 pagesGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Sensitivity: Internal & RestrictedMani Vannan JNo ratings yet

- Headmaster, Govt High School, Kavarapattu 608 002Document1 pageHeadmaster, Govt High School, Kavarapattu 608 002Mani Vannan JNo ratings yet

- Presentation 1Document3 pagesPresentation 1Mani Vannan JNo ratings yet

- Gomery 1Document5 pagesGomery 1Mani Vannan JNo ratings yet

- It FormDocument13 pagesIt FormMani Vannan JNo ratings yet

- Phys 410II PDFDocument22 pagesPhys 410II PDFShweta SridharNo ratings yet

- Cantor SetDocument1 pageCantor SetMani Vannan JNo ratings yet

- LPC PDFDocument1 pageLPC PDFMani Vannan JNo ratings yet

- Latest LSC TT Asgn Submission J-2021Document2 pagesLatest LSC TT Asgn Submission J-2021rohitbanerjeeNo ratings yet

- чит. 10кл ІІDocument2 pagesчит. 10кл ІІДіана ГарникNo ratings yet

- OMG Employment ApplicationDocument3 pagesOMG Employment ApplicationjaniyaNo ratings yet

- Analysis - Code of Wages, 2019Document8 pagesAnalysis - Code of Wages, 2019Nikhil JainNo ratings yet

- HRM FinalDocument17 pagesHRM Finalpragya budhathokiNo ratings yet

- Position Paper Ronquillo vs. WheeltekDocument5 pagesPosition Paper Ronquillo vs. Wheeltekviolaine wycocoNo ratings yet

- Is The Fundamental Dimension of Man's Existence On Earth. The Pope Predicted That NewDocument2 pagesIs The Fundamental Dimension of Man's Existence On Earth. The Pope Predicted That NewKê MilanNo ratings yet

- China Education Is The Largest Education System in The WorldDocument14 pagesChina Education Is The Largest Education System in The WorldNita SilvanaNo ratings yet

- Herzberg's Motivation Theory - Two Factor TheoryDocument8 pagesHerzberg's Motivation Theory - Two Factor TheoryQasim Javaid BokhariNo ratings yet

- Coal India Executives Rules: Kavita Gupta Manager (Personnel)Document35 pagesCoal India Executives Rules: Kavita Gupta Manager (Personnel)Rajesh GummadiNo ratings yet

- CASE 11 McDonaldDocument2 pagesCASE 11 McDonaldSumndad JohayriaNo ratings yet

- CSHP COMPREHENSIVE Application FormDocument3 pagesCSHP COMPREHENSIVE Application FormNick Cajan100% (1)

- Employment Card (X-10) : Digitally Signed by Kapil Pandey Date: 2021.08.04 16:28:54 +05:30Document1 pageEmployment Card (X-10) : Digitally Signed by Kapil Pandey Date: 2021.08.04 16:28:54 +05:30bhuwan BishtNo ratings yet

- Bar Qs and As in Labor 2007 2017Document42 pagesBar Qs and As in Labor 2007 2017Rio LorraineNo ratings yet

- Cover Letter For College Instructor With No ExperienceDocument7 pagesCover Letter For College Instructor With No Experiencec2s1s8mr100% (1)

- Child Labour in Karachi - A Tip of An IcebergDocument20 pagesChild Labour in Karachi - A Tip of An IcebergMuhammad IsmailNo ratings yet

- Farm Worker: U.S. Department of Labor A. Job Offer InformationDocument14 pagesFarm Worker: U.S. Department of Labor A. Job Offer InformationJenny GarcíaNo ratings yet

- Siva Ganesan PDFDocument4 pagesSiva Ganesan PDFGopi S100% (2)

- Uber Drivers Sue Uber Over "Yes On Prop 22"Document92 pagesUber Drivers Sue Uber Over "Yes On Prop 22"GMG EditorialNo ratings yet

- How Exploitative Leadership Influences Employee Innovative Behavior: The Mediating Role of Relational Attachment and Moderating Role of High-Performance Work SystemsDocument16 pagesHow Exploitative Leadership Influences Employee Innovative Behavior: The Mediating Role of Relational Attachment and Moderating Role of High-Performance Work SystemsLejandra MNo ratings yet

- SHRM-Final NotesDocument21 pagesSHRM-Final NotesMuhammad Hasan SaeedNo ratings yet

- 12.02.20 The Starbucks ExperienceDocument5 pages12.02.20 The Starbucks ExperienceNiklaus MichaelsonNo ratings yet

- Handbook: #Think Digital Think IndiaDocument11 pagesHandbook: #Think Digital Think IndiaChirag TrivediNo ratings yet

- Module-1: Introduction To Talent ManagementDocument125 pagesModule-1: Introduction To Talent ManagementDr. Geetha RNo ratings yet

- Human Resource Management - AssignmentDocument16 pagesHuman Resource Management - AssignmentLazy FrogNo ratings yet

- Offerletter119891 PDFDocument4 pagesOfferletter119891 PDFJasmine fergusonNo ratings yet

- Kaileys Personal Learning PlanDocument8 pagesKaileys Personal Learning Planapi-543403848No ratings yet