Professional Documents

Culture Documents

What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order Costing

Uploaded by

Danica ConcepcionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order Costing

Uploaded by

Danica ConcepcionCopyright:

Available Formats

1.

Maloe Company adds material at the begnning of

the process in Department A. Data concerning

materials used in the month of October production

are as follows:

2. Started during March 50,000 units

3. Completed and transferred 36,000 units

4. Normal spoilage 4,000 units

5. Work in process, March 31 10,000 units

6.

7. The equivalent units for materials are:

8. A. 50,000 B. 34,000

C. 40,000 D. 46,000

9. Kew had 3,000 units of work in process at April 1

which were 60% as to conversion cost. During

April, 10,000 units were completed. At April 30,

4,000 units remained in work in process which were

40% complete as to conversion cost. Direct

materials are added at the beginning of the process.

How many units were started during April?

A. 9,000 B. 9,800 C. 10,000 D. 11,000

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

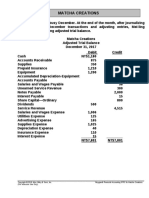

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added What is process

costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added What is process

costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

What is process costing?

Definition of Process Costing

Process costing is a term used in cost accounting to describe one method for collecting and

assigning manufacturing costs to the units produced. A processing cost system is used when

nearly identical units are mass produced. (Job costing or job order costing is a system used to

collect and assign manufacturing costs to units that vary from one another.)

Example of Process Costing

Let's assume that a company manufactures large quantities of an identical product. The product

requires several processing operations, each of which occurs in a separate department. In the first

department, the following processing costs were incurred during the month of June:

Direct materials of $150,000

Conversion costs of $225,000

If the equivalent of 100,000 units were processed in June, the per unit costs will be $1.50 for

direct materials and $2.25 for conversion costs. These costs will then be transferred to second

department where its processing costs will be added.

You might also like

- Chapter 6 Quiz and AssignmentDocument25 pagesChapter 6 Quiz and AssignmentSaeym SegoviaNo ratings yet

- Process Costing Exercise With AnswersDocument9 pagesProcess Costing Exercise With AnswersAubrey BlancasNo ratings yet

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- ACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsDocument8 pagesACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsNatasha DeclanNo ratings yet

- MSQ-01 - Cost Behavior & CVP AnalysisDocument10 pagesMSQ-01 - Cost Behavior & CVP AnalysisDanica Reyes QuintoNo ratings yet

- Comprehensive Topics With AnsDocument28 pagesComprehensive Topics With AnsHaru Lee60% (5)

- RFBT Reviewer:: TrueDocument3 pagesRFBT Reviewer:: TrueDanica ConcepcionNo ratings yet

- UGRD-MGT6147 Strategic Cost Management Midterm ExaminationDocument15 pagesUGRD-MGT6147 Strategic Cost Management Midterm Examinationjonathan anatNo ratings yet

- Msq01 Overview of The Ms Practice by The CpaDocument9 pagesMsq01 Overview of The Ms Practice by The CpaAnna Marie75% (8)

- Cloud - Security - Checklist - 221216 - 134458Document8 pagesCloud - Security - Checklist - 221216 - 134458Sumit ThatteNo ratings yet

- AFAR-16 (Process Costing)Document16 pagesAFAR-16 (Process Costing)Jamaica ManilaNo ratings yet

- Fringe Benefits Test BankDocument12 pagesFringe Benefits Test BankAB Cloyd100% (1)

- Process Costing Short QuizDocument5 pagesProcess Costing Short QuizGenithon PanisalesNo ratings yet

- Pt. Patco Elektronik Teknologi Standard Operating Procedure PurchasingDocument8 pagesPt. Patco Elektronik Teknologi Standard Operating Procedure Purchasingmochammad iqbal100% (1)

- ISO-TS 16949 Practice TestDocument18 pagesISO-TS 16949 Practice TestManan Bakshi100% (1)

- Process Costing ProblemDocument7 pagesProcess Costing ProblemAnonymous Ehv4lpsJ100% (1)

- Sample Problems - Donors TaxDocument3 pagesSample Problems - Donors TaxDidhane Martinez100% (2)

- e-StatementBRImo 585401009753509 Jul2023 20230731 081457Document2 pagese-StatementBRImo 585401009753509 Jul2023 20230731 08145709. BUNGA NUR YUNITA SARINo ratings yet

- AdfjsdfjksdfDocument12 pagesAdfjsdfjksdfJohn Carlo PeruNo ratings yet

- MSQ 02 Variable Absorption CostingDocument11 pagesMSQ 02 Variable Absorption CostingDanica ConcepcionNo ratings yet

- Ust Multiple Rework SpoilageDocument6 pagesUst Multiple Rework SpoilageJessica Shirl Vipinosa100% (1)

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDocument6 pagesWhat Is Process Costing?: Cost Accounting Manufacturing Costs Job Order CostingDanica ConcepcionNo ratings yet

- What Is Process Costing 7Document6 pagesWhat Is Process Costing 7Danica ConcepcionNo ratings yet

- Process Costing CompleteDocument84 pagesProcess Costing CompleteGian Carlo RamonesNo ratings yet

- Process Costing CompleteDocument85 pagesProcess Costing CompleteGian Carlo RamonesNo ratings yet

- What Is Process CostingDocument4 pagesWhat Is Process CostingDanica ConcepcionNo ratings yet

- Ch3 Process CostingDocument4 pagesCh3 Process CostingmahendrabpatelNo ratings yet

- EXERCISECHAPTER3Document5 pagesEXERCISECHAPTER3Bạch ThanhNo ratings yet

- Cost Accounting Manufacturing Costs Job Order Costing: Definition of Process CostingDocument1 pageCost Accounting Manufacturing Costs Job Order Costing: Definition of Process CostingTricia Mae FernandezNo ratings yet

- Process CostingDocument11 pagesProcess Costingliu.qtrangg11No ratings yet

- Quiz 5 7Document12 pagesQuiz 5 7Adeline DelveyNo ratings yet

- Assignment 3 Process CostingDocument9 pagesAssignment 3 Process CostingGie MagnayeNo ratings yet

- Additional Notes On Process CostingDocument4 pagesAdditional Notes On Process CostingShiv AchariNo ratings yet

- Description Process - VilloriaDocument4 pagesDescription Process - VilloriaDeocel May VilloriaNo ratings yet

- Process Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinDocument39 pagesProcess Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinFlorensia RestianNo ratings yet

- Ac102 ch4 PDFDocument16 pagesAc102 ch4 PDFmashhoodNo ratings yet

- Quizzes For Finals 1 Compilation Chap6,7,1,2Document35 pagesQuizzes For Finals 1 Compilation Chap6,7,1,2Saeym SegoviaNo ratings yet

- Chapter 16 FilI-In NotesDocument10 pagesChapter 16 FilI-In Noteslowell MooreNo ratings yet

- Practice Sheet 3 - CH4 - 4ADocument4 pagesPractice Sheet 3 - CH4 - 4AAhmed HyderNo ratings yet

- Process Costing - Lecture NotesDocument11 pagesProcess Costing - Lecture NotesOtenyo MeshackNo ratings yet

- Day 8 Chap 4 Rev. FI5 Ex PR PDFDocument6 pagesDay 8 Chap 4 Rev. FI5 Ex PR PDFDani GetachewNo ratings yet

- ACCT 102 Lecture Notes Chapter 16Document5 pagesACCT 102 Lecture Notes Chapter 16Trisha Bendaña ReyesNo ratings yet

- Examples 4 ChapterDocument6 pagesExamples 4 ChapterKutlu SaracNo ratings yet

- Chapter 4 .Doc Process CostingDocument13 pagesChapter 4 .Doc Process CostingMulumebet EshetuNo ratings yet

- Chapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingDocument12 pagesChapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingFear Part 2No ratings yet

- Pcost 5Document17 pagesPcost 5noowrieliinNo ratings yet

- Chapter 3 ACC 422Document19 pagesChapter 3 ACC 422Maria JosefaNo ratings yet

- InstructionsDocument2 pagesInstructionsMarkJoven BergantinNo ratings yet

- Process Costing: Questions For Writing and DiscussionDocument49 pagesProcess Costing: Questions For Writing and DiscussionKhoirul MubinNo ratings yet

- Chapter 17Document4 pagesChapter 17karam123No ratings yet

- Process CostingDocument43 pagesProcess CostingbortycanNo ratings yet

- ProblemsDocument1 pageProblemsGaia Sofia GirardiNo ratings yet

- 4.3 Tutorial Questions 3Document6 pages4.3 Tutorial Questions 3Lee XingNo ratings yet

- FINAL MODULE Mia PDFDocument31 pagesFINAL MODULE Mia PDFmEOW S100% (1)

- FINAL MODULE Mia PDFDocument31 pagesFINAL MODULE Mia PDFmEOW SNo ratings yet

- Process Costing Set B QuestionDocument4 pagesProcess Costing Set B QuestionTrixie HicaldeNo ratings yet

- Chapter 6 Practice QuestionsDocument9 pagesChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNo ratings yet

- Chap 004 Process CostingDocument116 pagesChap 004 Process CostingdhominicNo ratings yet

- AM 113 Chapter 4 ABCDocument36 pagesAM 113 Chapter 4 ABCswitbbgirlNo ratings yet

- Lecture 11 Process Costing - 2ndDocument35 pagesLecture 11 Process Costing - 2ndMahyy AdelNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Chapter 4 Cost and Management AcctDocument31 pagesChapter 4 Cost and Management AcctDebebe DanielNo ratings yet

- Introduction To Managerial AccountingDocument8 pagesIntroduction To Managerial AccountingWam OwnNo ratings yet

- Module 1 Purp Comm LectureDocument3 pagesModule 1 Purp Comm LectureLaineNo ratings yet

- Input and Output DevicesDocument2 pagesInput and Output DevicesDanica ConcepcionNo ratings yet

- Pointing Devices Are The Most Commonly Used Input Devices TodayDocument2 pagesPointing Devices Are The Most Commonly Used Input Devices TodayDanica ConcepcionNo ratings yet

- Input Is Really Important For The ComputerDocument2 pagesInput Is Really Important For The ComputerDanica ConcepcionNo ratings yet

- Reaction PaperDocument1 pageReaction PaperDanica ConcepcionNo ratings yet

- What Are The Input Devices of My ComputerDocument3 pagesWhat Are The Input Devices of My ComputerDanica ConcepcionNo ratings yet

- Fokine Went To The USADocument3 pagesFokine Went To The USADanica ConcepcionNo ratings yet

- Question 2Document3 pagesQuestion 2Danica ConcepcionNo ratings yet

- There Are 2 Types of MonitorsDocument2 pagesThere Are 2 Types of MonitorsDanica ConcepcionNo ratings yet

- Question 1Document3 pagesQuestion 1Danica ConcepcionNo ratings yet

- Input and Output DevicesDocument2 pagesInput and Output DevicesDanica ConcepcionNo ratings yet

- Reaction Paper - Gender and SocietyDocument1 pageReaction Paper - Gender and SocietyDanica ConcepcionNo ratings yet

- Origin and History of BalletDocument2 pagesOrigin and History of BalletDanica ConcepcionNo ratings yet

- In Renaissance Time in Italy Ballet Was The Type of Entertainment On Aristocratic WeddingsDocument3 pagesIn Renaissance Time in Italy Ballet Was The Type of Entertainment On Aristocratic WeddingsDanica ConcepcionNo ratings yet

- MAS - 1416 Profit Planning - CVP AnalysisDocument24 pagesMAS - 1416 Profit Planning - CVP AnalysisAzureBlazeNo ratings yet

- JshsbidisDocument2 pagesJshsbidisDanica ConcepcionNo ratings yet

- DevelopedDocument3 pagesDevelopedDanica ConcepcionNo ratings yet

- Net Revenues For The Third Quarter of Fiscal 2008 Increased by 11Document2 pagesNet Revenues For The Third Quarter of Fiscal 2008 Increased by 11Danica ConcepcionNo ratings yet

- NOTES Variable CostingDocument1 pageNOTES Variable CostingDanica ConcepcionNo ratings yet

- Social DaDocument2 pagesSocial DaDanica ConcepcionNo ratings yet

- Social DanDocument3 pagesSocial DanDanica ConcepcionNo ratings yet

- Social Dance Can Derive From or Be An Activity Within Many Different GenresDocument2 pagesSocial Dance Can Derive From or Be An Activity Within Many Different GenresDanica ConcepcionNo ratings yet

- Social DDocument2 pagesSocial DDanica ConcepcionNo ratings yet

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Research On Fastrack WatchesDocument23 pagesResearch On Fastrack Watcheskk_kamal40% (5)

- MID-TERM EXAM 1 Sem 1, 2023 24 - ValuationDocument2 pagesMID-TERM EXAM 1 Sem 1, 2023 24 - Valuationphamvi44552002No ratings yet

- Sue PisciottaDocument3 pagesSue PisciottaSubhadip Das SarmaNo ratings yet

- Working Capital Management (Bhavani)Document86 pagesWorking Capital Management (Bhavani)gangatulasiNo ratings yet

- Practice Question (Accounting Cycle) With Solution v2Document17 pagesPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorNo ratings yet

- "E20" Surface Mount Productivity Improvement Project - Phase 1Document51 pages"E20" Surface Mount Productivity Improvement Project - Phase 1JAYANT SINGHNo ratings yet

- Improving The Experience of Injured Workers FINAL REPORT - 0Document411 pagesImproving The Experience of Injured Workers FINAL REPORT - 0NeilNo ratings yet

- AGROVETDocument37 pagesAGROVETcaroprinters01No ratings yet

- Proposal - Manju (Formatted) (Final)Document16 pagesProposal - Manju (Formatted) (Final)How to TecH.No ratings yet

- Aspam Food Cold Storage Private Limited - Ad202008040853 PDFDocument8 pagesAspam Food Cold Storage Private Limited - Ad202008040853 PDFMukesh TodiNo ratings yet

- Pro Forma Balance Sheet and Income StatementDocument2 pagesPro Forma Balance Sheet and Income StatementMelinda AndrianiNo ratings yet

- A16z Comment Letter Final 1.4.21Document21 pagesA16z Comment Letter Final 1.4.21ForkLogNo ratings yet

- Fighting Food Waste Using The Circular Economy ReportDocument40 pagesFighting Food Waste Using The Circular Economy ReportCaroline Velenthio AmansyahNo ratings yet

- Food DayDocument15 pagesFood DaydigdagNo ratings yet

- QC Senior Compliance Attorney in Washington DC Resume Tina GreeneDocument2 pagesQC Senior Compliance Attorney in Washington DC Resume Tina GreeneTinaGreeneNo ratings yet

- Performance Guarantees: A. Guarantees Subject To Liquidated DamagesDocument3 pagesPerformance Guarantees: A. Guarantees Subject To Liquidated Damagesdeepdaman18891No ratings yet

- Approved Sponsorship LetterDocument2 pagesApproved Sponsorship LetterFelix Raphael MintuNo ratings yet

- Pacl ScamDocument24 pagesPacl ScamAindrila ChatterjeeNo ratings yet

- A Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Document22 pagesA Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Ryan29No ratings yet

- Topic 1 The Corporation and StakeholdersDocument3 pagesTopic 1 The Corporation and StakeholdersAprilNo ratings yet

- S. No. Date and Time Level Session Title Expert Name: 30 June 2021Document2 pagesS. No. Date and Time Level Session Title Expert Name: 30 June 2021Vinodh EwardsNo ratings yet

- Andhra Pradesh ShepDocument91 pagesAndhra Pradesh ShepKanagarajan UmapathiNo ratings yet

- The Challenges of Globalization On The Industrial Sector of BangladeshDocument18 pagesThe Challenges of Globalization On The Industrial Sector of Bangladeshsyed_sazidNo ratings yet

- Swarovski Proper Use GuidelinesDocument14 pagesSwarovski Proper Use Guidelinesasmiaty83No ratings yet