Professional Documents

Culture Documents

Financial Summary: Annual Report 2076/77

Uploaded by

Panchakanya SaccosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Summary: Annual Report 2076/77

Uploaded by

Panchakanya SaccosCopyright:

Available Formats

Annual Report 2076/77

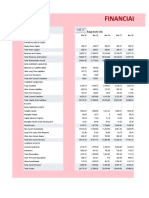

FINANCIAL SUMMARY

Statement of Financial Position (Figure in Crore)

Assets FY 2076/77 FY 2075/76 FY 2074/75 FY 2073/74 FY 2072/73

Cash and cash equivalent 824.34 1,048.02 880.35 396.18 377.33

Due from Nepal Rastra Bank 930.94 564.73 731.30 642.80 466.24

Placement with Bank and Financial Institutions - - 1,036.16 1,328.66 553.05

Derivative financial instruments 12.29 - - - -

Other trading assets 2.38 2.04 2.30 2.48 1.84

Loan and advances to B/FIs 425.84 287.22 229.85 152.39 119.14

Loans and advances to customers 8,438.63 7,236.37 6,182.20 4,547.50 3,868.89

Investment securities 926.98 873.50 783.71 615.13 385.18

Current tax assets 26.17 21.95 17.18 11.74 3.80

Investment in subsidiaries 18.89 18.89 10.00 10.00 -

Investment in associates - - - - -

Investment property - - - - -

Property and equipment 94.10 84.40 73.95 62.25 62.04

Goodwill and Intangible assets 0.39 0.45 0.20 - -

Deferred tax assets 31.51 23.62 9.73 3.41 12.88

Other assets 98.96 92.67 38.15 101.64 80.01

Total Assets(A) 11,831.42 10,253.87 9,995.09 7,874.19 5,930.40

Liabilities and equity

Due to Bank and Financial Institutions 227.00 270.96 615.54 418.47 -

Due to Nepal Rastra Bank 76.14 - - - -

Derivative financial instruments - 0.68 - - -

Deposits from customers 9,792.44 8,426.92 8,081.88 6,521.35 5,162.82

Borrowing - - - - -

Current tax liabilities - - - - -

Provisions - - - - -

Deferred tax liabilities - - - - -

Other liabilities 220.39 175.19 143.69 116.39 97.27

Debt securities issued 100.00 100.00 100.00 100.00 100.00

Subordinated liabilities - - - - -

Total liabilities(B) 10,415.98 8,973.76 8,941.11 7,156.21 5,360.09

Shareholder's Fund(A-B)

Share capital 844.93 804.69 692.49 388.37 305.81

Share premium - 38.18 - - 7.92

Retained earnings 185.37 121.88 114.50 122.50 82.54

Reserves 385.15 315.37 246.99 207.11 174.04

Total equity attributable to equity holders 1,415.44 1,280.11 1,053.97 717.98 570.31

Statement of Profit and Loss (Figure in Crore)

Particulars FY 2076/77 FY 2075/76 FY 2074/75 FY 2073/74 FY 2072/73

Interest income 1,127.68 906.98 599.17 400.74 384.97

Interest expense 657.17 492.48 299.45 156.52 177.38

Net interest income 470.51 414.50 299.72 244.23 207.59

Fee and commission income 99.36 91.29 85.03 75.05 56.12

Fee and commission expense 8.99 8.47 7.3 - -

Net fee and commission income 90.37 82.82 77.64 75.05 56.12

Net interest, fee and commission income 560.88 497.32 377.36 319.28 263.71

Net trading income 30.63 23.35 20.28 13.64 11.95

Other operating income 1.93 4.29 2.19 1.00 3.07

Total operating income 593.44 524.96 399.82 333.91 278.73

Impairment charge/(reversal) for loans and other losses 14.66 27.23 12.95 3.89 8.44

Net operating income 578.77 497.73 386.87 330.02 270.29

Operating expense

Personnel expenses 161.86 137.54 95.76 81.48 69.75

Other operating expenses 88.07 70.31 57.73 52.36 41.22

Depreciation & amortization 16.45 13.71 11.40 10.70 11.67

Operating Profit 312.39 276.17 221.99 185.48 147.66

Non-operating income 19.61 3.89 2.09 0.61 -

Non-operating expense 0.38 - - - 0.65

Profit before income tax 331.62 280.05 224.08 186.09 147.01

Income tax expense - - - - -

Current Tax 107.22 94.21 68.70 59.31 52.69

Deferred Tax Income/ (Expenses) 4.85 16.50 1.09 (1.41) 3.09

Profit for the period 229.25 202.35 156.47 125.37 97.41

You might also like

- Assets FY 2075/76 FY 2074/75 FY 2073/74 FY 2072/73 FY 2071/72Document1 pageAssets FY 2075/76 FY 2074/75 FY 2073/74 FY 2072/73 FY 2071/72Girja AutomotiveNo ratings yet

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaNo ratings yet

- Gujarat Narmada Valley Fertilizers & ChemicalsDocument14 pagesGujarat Narmada Valley Fertilizers & ChemicalsPrashant TiwariNo ratings yet

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDocument4 pagesWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNo ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

- Ashok Leyland Ltd.Document9 pagesAshok Leyland Ltd.Debanjan MukherjeeNo ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- JL22PG002 NMDCDocument35 pagesJL22PG002 NMDCHemendra GuptaNo ratings yet

- Annual Results in BriefDocument8 pagesAnnual Results in BriefPrashanthDalawaiNo ratings yet

- Guj AlkaliDocument8 pagesGuj AlkalirotiNo ratings yet

- Balance Sheet of Gujarat Alkalies and ChemicalsDocument8 pagesBalance Sheet of Gujarat Alkalies and ChemicalsrotiNo ratings yet

- Guj AlkaliDocument8 pagesGuj AlkalirotiNo ratings yet

- Acc LTD Balance Sheet: Sources of FundsDocument75 pagesAcc LTD Balance Sheet: Sources of FundsSaad YousufNo ratings yet

- Idbi Financial In4mationDocument9 pagesIdbi Financial In4mationKishor PatelNo ratings yet

- 5 Year Comparative NTPCDocument11 pages5 Year Comparative NTPCShivanshi SharmaNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- Mutual Fund Selector Buy? Sell? Hold?: Sep ' 13 Sep ' 12 Sep ' 11 Sep ' 10 Sep ' 09Document3 pagesMutual Fund Selector Buy? Sell? Hold?: Sep ' 13 Sep ' 12 Sep ' 11 Sep ' 10 Sep ' 09Anit Jacob PhilipNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- Report Card: Attribute Value DateDocument20 pagesReport Card: Attribute Value DateMp SunilNo ratings yet

- IndiaMart P&L and BS 2022-23 - UpdatedDocument22 pagesIndiaMart P&L and BS 2022-23 - UpdatedAman LambaNo ratings yet

- Accltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument59 pagesAccltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Jubilant FoodworksDocument6 pagesJubilant FoodworksManan GuptaNo ratings yet

- LIC Housing Finance Ltd. - Research Center: Balance SheetDocument3 pagesLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345No ratings yet

- Analysis of Adani PortsDocument63 pagesAnalysis of Adani PortsHarsh JaswalNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Bav ModelDocument10 pagesBav Modeltanishamahajan06No ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- DCF - Mega Webinar - Pranav - 22.08Document80 pagesDCF - Mega Webinar - Pranav - 22.08zorem axoneNo ratings yet

- Dalmia Cement (Bharat) LTDDocument8 pagesDalmia Cement (Bharat) LTDRemonNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Data To Use - Detail InformationDocument44 pagesData To Use - Detail InformationAninda DuttaNo ratings yet

- TVS Income StatementDocument9 pagesTVS Income StatementBobNo ratings yet

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARNo ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Financial Statement of Bharti Airtel LTD.: Balance SheetDocument3 pagesFinancial Statement of Bharti Airtel LTD.: Balance SheetGaurav KalraNo ratings yet

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- Names of Team Members Roll No Criteria For Selection of Main CompanyDocument31 pagesNames of Team Members Roll No Criteria For Selection of Main CompanyGaurav SharmaNo ratings yet

- Marico Combined FinalDocument9 pagesMarico Combined FinalAbhay Kumar SinghNo ratings yet

- Balance Sheet SAB: of Which: Interest Expenses - 35.24 - 37.37 - 63.68Document13 pagesBalance Sheet SAB: of Which: Interest Expenses - 35.24 - 37.37 - 63.68Hoàng Ngọc OanhNo ratings yet

- Standalone Bal SheetDocument2 pagesStandalone Bal SheetvaidyaaadiNo ratings yet

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNo ratings yet

- Financial ReportDocument60 pagesFinancial ReportAastha GuptaNo ratings yet

- Syndicate BankDocument5 pagesSyndicate BankpratikNo ratings yet

- Britannia X Ls XDocument15 pagesBritannia X Ls Xshubham9308No ratings yet

- Financial Analysis (HAL) FinalDocument22 pagesFinancial Analysis (HAL) FinalAbhishek SoniNo ratings yet

- Group 10 - Apollo Tyre ModelDocument34 pagesGroup 10 - Apollo Tyre ModelJAY SANTOSH KHORENo ratings yet

- 4808 Rishab Bansal Excel 39919 1194528774Document27 pages4808 Rishab Bansal Excel 39919 1194528774Rishab BansalNo ratings yet

- Ratio AnalysisDocument10 pagesRatio Analysisbikash_kediaNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Annex B Feb 23 FinancialsDocument8 pagesAnnex B Feb 23 FinancialsMeeting Sarala DevelopmentNo ratings yet

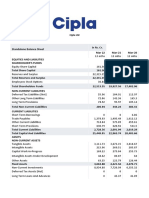

- Cipla LTDDocument6 pagesCipla LTDscribd sogawNo ratings yet

- Directors Report 2014 PDFDocument14 pagesDirectors Report 2014 PDFgalacticwormNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Financial+Statement+Analysis SolvedDocument5 pagesFinancial+Statement+Analysis SolvedMary JoyNo ratings yet

- Procter & Gamble Hygiene & Healthcare Ltd. - Research CenterDocument6 pagesProcter & Gamble Hygiene & Healthcare Ltd. - Research Centersaket14No ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Cyber Crime Cyber Security and Cyber LawsDocument23 pagesCyber Crime Cyber Security and Cyber LawsVijay SinghNo ratings yet

- Corporate Governance in IndiaDocument29 pagesCorporate Governance in IndiaMH PHOTO CREATIVENo ratings yet

- Revised KP Law 2Document75 pagesRevised KP Law 2BARANGAY MOLINO IINo ratings yet

- Admin Case and CrimDocument4 pagesAdmin Case and CrimIris Camille GabrielNo ratings yet

- Garcia, Et Al. v. People - 318 SCRA 434Document5 pagesGarcia, Et Al. v. People - 318 SCRA 434Khenz MistalNo ratings yet

- OFFICIAL STATEMENT of Ms. Ileto-Luyon, Dr. Henson, Ms. Soriano and Mr. BobisDocument2 pagesOFFICIAL STATEMENT of Ms. Ileto-Luyon, Dr. Henson, Ms. Soriano and Mr. Bobisjayar medicoNo ratings yet

- Contempt-Kinds and Constitutional ValidityDocument22 pagesContempt-Kinds and Constitutional ValidityShrutiNo ratings yet

- List of Proclaimed Protected Areas in Region 8Document4 pagesList of Proclaimed Protected Areas in Region 8Kerwin Leonida100% (3)

- Nature of CrimeDocument105 pagesNature of CrimeRajatNo ratings yet

- LBP Vs TapuladoDocument3 pagesLBP Vs Tapuladojun junNo ratings yet

- Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesRevision Notes Chapter-1 Introduction To Accountingyash siwachNo ratings yet

- Animal Health and Livestock Services Act 2055 NepalDocument13 pagesAnimal Health and Livestock Services Act 2055 NepalSuraj SubediNo ratings yet

- If Single Shipment Check Box Below: Cod Amount: $Document1 pageIf Single Shipment Check Box Below: Cod Amount: $ABC DewiohtNo ratings yet

- McLemore Press Release Dec 6 2023Document2 pagesMcLemore Press Release Dec 6 2023Indiana Public Media NewsNo ratings yet

- Web List BBBDocument58 pagesWeb List BBBAvijitSinharoyNo ratings yet

- Gaw Guy V IgnacioDocument10 pagesGaw Guy V IgnacioEunicqa Althea SantosNo ratings yet

- Ahmed Fine Weaving LTDDocument5 pagesAhmed Fine Weaving LTDHamza AsifNo ratings yet

- HamstersDocument1,547 pagesHamstersCourtney RatliffNo ratings yet

- RefugeDocument101 pagesRefugesusanooo001No ratings yet

- Microsoft Paper License QuoteDocument1 pageMicrosoft Paper License QuotePushpendra Singh SisodiaNo ratings yet

- Shubham Singh BhadoriyaDocument3 pagesShubham Singh BhadoriyaThe Cultural CommitteeNo ratings yet

- Snohomish County Medical ExaminerDocument8 pagesSnohomish County Medical ExaminerEvan Buxbaum, CircaNo ratings yet

- BIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATEDocument2 pagesBIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATERoy RitagaNo ratings yet

- Sample Philippine Legal Forms 2015Document971 pagesSample Philippine Legal Forms 2015Francis Laurence Jake Amodia100% (7)

- NRI BankingDocument33 pagesNRI BankingKrinal Shah0% (1)

- United States v. Hadley, 10th Cir. (2003)Document3 pagesUnited States v. Hadley, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Prof. John Mark H. VillanuevaDocument16 pagesProf. John Mark H. VillanuevaPrincess Marie JuanNo ratings yet

- Metropolis 1927: Peter GrahamDocument34 pagesMetropolis 1927: Peter GrahamDeacha SuthaseeNo ratings yet

- Transaction Details Report PDFDocument25 pagesTransaction Details Report PDFShakhir MohunNo ratings yet