Professional Documents

Culture Documents

Annex B Feb 23 Financials

Uploaded by

Meeting Sarala DevelopmentCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex B Feb 23 Financials

Uploaded by

Meeting Sarala DevelopmentCopyright:

Available Formats

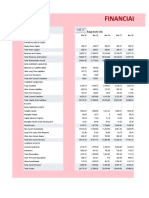

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

CIN: U65910WB1992PTC055152

Provisional Balance Sheet as at …

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Particulars Notes

Unaudited Unaudited Audited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

I. Equity and liabilities

Shareholders' funds

Share capital 3 144,009.36 144,009.36 144,009.36 144,009.36

Reserves and surplus 4 293,732.39 316,405.40 313,282.46 300,955.23

437,741.75 460,414.76 457,291.82 444,964.59

Non-current liabilities

Long-term borrowings 5 376,013.67 591,664.69 404,823.09 580,647.92

376,013.67 591,664.69 404,823.09 580,647.92

Current liabilities

Short-term borrowings 7 255,582.68 582,357.14 416,410.23 550,186.64

Other current liabilities 8 27,856.39 17,312.68 41,051.39 60,220.92

Short-term provisions 6 131,731.19 122,736.76 106,163.50 111,798.72

415,170.26 722,406.58 563,625.12 722,206.28

Total 1,228,925.69 1,774,486.03 1,425,740.02 1,747,818.78

II. Assets

Non-current assets

Property plant & equipment and Intangible assets

Property plant & equipment 9A 4,679.88 6,313.11 4,612.42 5,231.83

Intangible assets 9B 114.35 114.35 87.51 114.35

Deferred tax assets (net) 10 20,549.26 23,418.80 20,549.26 21,517.72

Long term loans and advances 11 639,727.44 394,921.84 671,641.23 482,205.55

Other non-current assets 12 78.44 70.86 3,296.63 2,781.63

665,149.37 424,838.96 700,187.05 511,851.07

Current assets

Cash and bank balances 13 114,700.57 172,376.16 126,201.16 157,106.99

Short-term loans and advances 11 365,031.90 1,132,925.30 564,213.67 1,058,686.86

Other current assets 12 84,043.85 44,345.61 35,138.14 20,173.87

563,776.32 1,349,647.07 725,552.97 1,235,967.71

Total 1,228,925.69 1,774,486.03 1,425,740.02 1,747,818.78

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

CIN:U65910WB1992PTC055152

Statement of Profit and Loss for the period ended …

Comparative Half Year

Period ended Year ended

Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Particulars Notes Feb 28, 2022 2022

Unaudited Unaudited Audited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

I. Income

Revenue from operations 14 258,326.21 264,623.27 155,852.69 359,798.74

Other income 15 46,994.81 12,233.75 23,848.57 24,896.52

Total income 305,321.03 276,857.02 179,701.26 384,695.26

II. Expenses

Employee benefit expenses 16 79,143.50 81,270.47 45,061.80 96,735.61

Finance costs 17 93,256.30 127,960.99 57,068.35 140,007.15

Other expenses 18 35,625.76 30,296.33 20,678.31 37,306.84

Depreciation and amortization expenses 19 928.10 985.51 928.10 1,971.01

Provisions and write offs 20 108,546.31 10,296.88 42,669.01 96,176.86

Total expenses 317,499.97 250,810.17 166,405.57 372,197.48

Profit before Tax (12,178.95) 26,046.86 13,295.69 12,497.78

Tax expense

- Current tax - - -

- Deferred tax credit 968.46 1,901,087 968.46 3,802.17

Total tax expenses 968.46 1,901,087 968.46 3,802.17

Profit for the year (13,147.40) 24,145.77 12,327.24 8,695.60

Earning per equity share (EPS)

Basic and Diluted (Rs.) 21 -0.91 1.68 0.48 0.48

Nominal value of share (Rs.) 10.00 10.00 10.00 10.00

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

Notes to the Financial Statements as at and for the year ended March 31, 2022

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

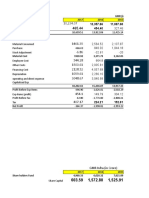

3 Share capital

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Authorized Shares

15,000,000 equity shares of Rs.10/- each 150,000.00 150,000.00 150,000.00 150,000.00

5,000,000 redeemable preference shares of Rs.10/-each 50,000.00 50,000.00 50,000.00 50,000.00

200,000.00 200,000.00 200,000.00 200,000.00

Issued, subscribed and fully paid-up shares

14,400,936 equity shares of Rs.10/- each 144,009.36 144,009.36 144,009.36 144,009.36

Total issued, subscribed and fully paid-up share capital 144,009.36 144,009.36 144,009.36 144,009.36

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

4 Reserves and surplus

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Securities premium account

Balance as at the beginning of the year 42,510.81 42,510.81 42,510.81 42,510.81

Add: Addition during the year - - - -

Balance as at the end of the year 42,510.81 42,510.81 42,510.81 42,510.81

B. Statutory reserve u/s 45-IC of Reserve Bank of India Act, 1934

Balance as at the beginning of the year 51,688.88 49,949.76 51,688.88 49,949.76

Add: Amount transferred from surplus balance in the statement of profit & loss during the year (2,629.48) - 2,465.45 1,739.12

Balance as at the end of the year 49,059.40 49,949.76 54,154.33 51,688.88

C. Surplus in the statement of profit and loss

Balance as at the beginning of the year 206,755.53 199,799.05 206,755.53 199,799.05

Profit for the year (13,147.40) 24,145.77 12,327.23 8,695.60

Less: Appropriations (5,924.56)

Transferred to Statutory reserve (2,629.48) - 2,465.45 1,739.12

Total Appropriations (8,554.04) 2,465.45 1,739.12

Net surplus in the statement of profit and loss 202,162.17 223,944.82 216,617.32 206,755.53

Total 293,732.39 316,405.40 313,282.46 300,955.23

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

Notes to the Financial Statements as at and for the year ended March 31, 2022

As at As at As at As at

Long-term borrowings

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

5

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Term Borrowings

Secured*

- from banks 476,089.08 785,798.73 600,018.31 775,939.23

- from financial institutions 22,498.87 91,536.17 49,582.21 88,344.46

- from non banking financial companies 33,008.40 196,686.93 71,632.79 166,550.86

B. Unsecured

- from banks (subordinated) 100,000.00 100,000.00 100,000.00 100,000.00

Total 631,596.35 1,174,021.83 821,233.31 1,130,834.56

Current maturities of term borrowings

- from banks (210,967.94) (348,208.65) (295,195.23) (343,839.64)

- from financial institutions (16,769.03) (68,224.45) (49,582.21) (65,845.58)

- from non-banking finance companies (27,845.71) (165,924.04) (71,632.79) (140,501.42)

Amount disclosed under the head ''Short-term borrowings'' (Refer Note 7) (255,582.68) (582,357.14) (416,410.23) (550,186.64)

Total 376,013.67 591,664.69 404,823.09 580,647.92

*(i) Term loan from banks and others are secured by way of hypothecation of the outstanding loan portfolio, in addition to the fixed deposits being held as collateral security.

(ii) Term loans from banks are also guaranteed by promoter directors of the Company.

6 Provisions

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Provision for portfolio loans

On standard assets 2,172.13 113,584.97 2,855.08 31,176.37

On non performing assets 108,659.67 - 74,922.22 50,541.93

110,831.81 113,584.97 77,777.31 81,718.30

B. Provision for employee benefits

Provision for gratuity (250.69) - (50.60) 1,381.75

Provision for leave 2,898.00 1,917.32 2,898.00 1,392.70

Provision for employee benefits payable (86.60) - 1,656.37 4,254.87

2,560.72 1,917.32 4,503.77 7,029.31

C. Others

Provision for Taxes - 7,234.47 18,378.34 6,315.84

Provision for managed portfolio loans 18,338.67 - 5,504.09 16,735.27

18,338.67 7,234.47 23,882.43 23,051.11

Total 131,731.19 122,736.76 106,163.50 111,798.72

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

7 Short-term borrowings

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Secured

Cash Credit from a bank - - - -

Current maturities of term borrowings (Refer Note 5)

- from banks 210,967.94 348,208.65 295,195.23 343,839.64

- from financial institutions 16,769.03 68,224.45 49,582.21 65,845.58

- from non-banking finance companies 27,845.71 165,924.04 71,632.79 140,501.42

Total 255,582.68 582,357.14 416,410.23 550,186.64

As at As at As at As at

8 Other current liabilities Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Interest accrued but not due on borrowings 428.10 - 853.71 555.00

Statutory dues payable 1,623.57 2,047.78 2,174.22 3,830.61

Payable towards Insurance premium and Commission on Cash collection 3,661.07 1,853.83 2,543.60 5,247.24

Payable to BankS/Partners against business correspondence arrangements * 16,604.68 - 29,280.23 42,181.02

Security deposits 3,320.98 4,530.54 4,058.72 4,488.54

Other payables 2,217.99 8,880.52 2,140.92 3,918.52

Total 27,856.39 17,312.68 41,051.39 60,220.92

* Payable to Banks/NBFCs against BC arrangement represents amount collected from customers for loans disbursed on behalf of Banks/NBFCs.

As at As at As at As at

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

10 Deferred tax assets/(Liabilities) (net)

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Deferred tax assets

Impact of provision for standard, non-performing assets, managed loans and other receivables 20,549.26 23,418.80 20,549.26 21,517.72

Net deferred tax assets 20,549.26 23,418.80 20,549.26 21,517.72

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

Notes to the Financial Statements as at and for the year ended March 31, 2022

11 Loans and advances Non-Current Portion Current Portion

As at As at As at As at As at As at As at As at

(Unsecured, considered good unless stated otherwise)

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022 Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Unaudited Unaudited Unaudited Audited Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Portfolio loans

Considered good 365,908.51 188,584.22 521,517.83 380,349.59 362,631.51 1,112,154.23 558,402.91 1,041,711.59

Considered doubtful 271,701.86 197,580.62 147,608.23 100,344.65 - - - -

637,610.37 386,164.85 669,126.06 480,694.23 362,631.51 1,112,154.23 558,402.91 1,041,711.59

B. Home repair loans

Considered good - - - - 1,276.30 2,441.91 401.72 452.59

Considered doubtful 641.80 - 1,791.51 641.80 - 1,306.34

641.80 - 1,791.51 641.80 1,276.30 2,441.91 401.72 1,758.93

C. Others

Prepaid expenses - - - - - 9.00 238.47 1,269.03

Loan to staff 1,472.16 2,066.06 696.29 457.90 1,069.10 786.79 1,939.31 994.09

Margin money with non-banking financial companies and financial institutions# - - - - - 17,313.75 2,500.00 10,713.75

Other receivables 3.11 6,690.93 27.37 411.61 55.00 219.62 731.26 2,239.48

1,475.27 8,756.99 723.66 869.51 1,124.10 18,329.15 5,409.04 15,216.35

Total 639,727.44 394,921.84 671,641.23 482,205.55 365,031.90 1,132,925.30 564,213.67 1,058,686.86

# Includes deposit certificates marked as lien towards term loans availed from financial institutions and non banking financial companies.

12 Other assets Non-Current Portion Current Portion

As at As at As at As at As at As at As at As at

(Unsecured, considered good unless stated otherwise)

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022 Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Unaudited Unaudited Unaudited Audited Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Security Deposit

Considered good 78.44 70.86 78.44 74.51 - - - -

78.44 70.86 78.44 74.51 - - - -

B. Others

Interest accrued on Portfolio Loan - - - - 24,500.00 3,917.66 26,162.83 9,539.07

Interest accrued on Home repair Loans - 19.06 101.78 19.06 24.53

Interest accrued but not due on deposits placed with banks and financial institutions 3,218.19 2,707.12 5,705.82 13,917.32 3,954.24 5,125.46

Service fee and other income receivable - - - - 44,504.87 30,742.62 3,806.57 5,055.34

Other assets - 9,314.09 (4,333.77) 1,195.46 429.47

- - 3,218.19 2,707.12 84,043.85 44,345.61 35,138.14 20,173.87

Total 78.44 70.86 3,296.63 2,781.63 84,043.85 44,345.61 35,138.14 20,173.87

13 As at As at As at As at

Cash and bank balances

Feb 28, 2023 Feb 28, 2022 Sep 30, 2022 Mar 31, 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Cash and cash equivalents

Balances with banks

-on current accounts 5,557.70 15,686.73 4,462.21 6,485.60

- deposits with original maturity within 3 months -

Cash at Branches 1,779.50 558.07

Cash in hand Head Office 188.70 241.10 34.45 27.38

5,746.40 15,927.83 6,276.16 7,071.05

Other bank balances

Deposit with original maturity for more than 3 months but less than 12 months

42,515.16 61,047.92 20,425.00 42,112.83

(*) (^)

Margin money Deposit with original maturity for more than 12 months (*) (^) 66,439.01 95,400.41 99,500.00 107,923.11

108,954.17 156,448.34 119,925.00 150,035.94

Total 114,700.57 172,376.16 126,201.16 157,106.99

Note:

Comparative

Period ended Half Year ended Year ended Mar

14 Revenue from operations Period ended

Feb 28, 2023 Sep 30, 2022 31, 2022

Feb 28, 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Interest income

Interest income on portfolio loans 200,378.11 219,985.02 125,165.58 305,173.79

Interest income on Home repair loans 209.84 257.59 143.64 211.50

Interest income on margin money deposits (*) 5,734.21 6,536.19 3,423.50 8,829.23

Interest Income on fixed deposits with banks and others - 289.39 - 289.39

B. Income from other financial services

Service fee and stationery income from business correspondence arrangements 43,261.96 23,113.50 21,074.51 26,328.88

Processing fee on portfolio loans 8,742.11 14,441.59 6,045.47 18,965.95

Total 258,326.21 264,623.27 155,852.69 359,798.74

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

Notes to the Financial Statements as at and for the year ended March 31, 2022

* Includes interest on margin money deposits marked as lien towards term loans availed from banks and financial institutions and on deposits marked as cash collateral placed in connection with business correspondent

arrangements entered with a bank.

Comparative Half Year

Period ended Year ended

15 Other income Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Other interest 1.51 0.44 1.51 1,528.44

Bad debt recovery 38,242.79 6,142.67 17,909.95 16,621.07

Net gain / loss on sale of investments 184.59 53.02 184.59 91.13

Miscellaneous income 8,565.92 6,037.62 5,752.52 6,655.87

Total 46,994.81 12,233.75 23,848.57 24,896.52

Comparative Half Year

Period ended Year ended

16 Employee benefit expenses Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Salaries 65,927.02 66,165.33 34,465.74 78,755.43

Incentive & bonus 3,147.40 5,788.42 4,757.42 4,254.87

Contributions to provident fund and others (Refer Note - 25) 6,280.28 5,893.28 3,800.48 8,911.39

Staff welfare expenses 3,788.80 3,423.43 2,038.17 4,813.93

Total 79,143.50 81,270.47 45,061.80 96,735.61

Comparative Half Year

Period ended Year ended

17 Finance costs Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Interest expense 91,749.32 122,690.80 56,033.81 134,202.83

Other borrowing costs* 1,506.98 5,270.19 1,034.53 5,804.32

Total 93,256.30 127,960.99 57,068.35 140,007.15

* Includes loan processing and arranger/facilitation fees `

Comparative Half Year

Period ended Year ended

18 Other expenses Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Rent 9,645.79 9,284.15 5,319.36 10,473.57

Rates and taxes 1,337.38 1,354.89 792.49 1,742.94

Repairs & maintenance

- Office Equipment, Furniture 822.71 783.52 536.70 861.10

Office Expenses 1,358.18 1,258.06 848.17 1,468.30

Director sitting fees 652.50 417.50 270.00 537.50

Travelling and conveyance 6,358.12 4,516.87 3,659.11 5,370.14

Communication expenses 1,129.11 945.29 652.63 1,182.35

Printing & stationery 1,613.51 1,226.89 808.11 1,411.22

Legal and professional fees 5,468.51 3,692.94 3,028.60 4,504.72

Payment to auditors 200.00 211.00 200.00 811.00

Training & meeting expenses 830.28 453.76 368.80 523.38

Electricity Expenses 1,111.17 1,078.13 718.14 1,206.91

Bank charges 1,152.75 1,771.58 780.02 2,166.49

Insurance Premium 467.68 365.94 249.53 277.60

Corporate social responsibility expenses 1,122.74 1,311.00 822.74 1,311.00

Cash Collection Service 1,293.76 50.45 - -

Software Maintenance expenses 633.27 468.88 468.75 557.45

Miscellaneous expenses 428.30 1,105.47 1,155.17 2,901.17

Total 35,625.76 30,296.33 20,678.31 37,306.84

Comparative Half Year

Period ended Year ended

19 Depreciation and amortisation expense Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

Depreciation on tangible assets 901.27 960.53 901.27 1,921.05

Amortisation of intangible assets 26.84 24.98 26.84 49.96

928.10 985.51 928.10 1,971.01

Comparative Half Year

Period ended Year ended

20 Provisions and write offs Period ended ended Sep 30,

Feb 28, 2023 Mar 31, 2022

Feb 28, 2022 2022

Unaudited Unaudited Unaudited Audited

(Rs. in '000) (Rs. in '000) (Rs. in '000) (Rs. in '000)

A. Provisions

Provision against standard assets (29,004.24) - (28,321.19) (113,584.97)

Provision for non-performing assets 58,117.75 - 24,380.20 81,718.29

Provision for loss on managed portfolio 1,603.39 - 1,643.06 16,735.27

Provision for receivables (insurance claims) - - - 254.37

B. Write offs

Managed portfolio loans written off 7,477.62 1,591.75 6,099.28 80,538.46

Portfolio loan written-off 70,351.78 8,705.13 38,867.66 30,515.43

108,546.31 10,296.88 42,669.01 96,176.86

SARALA DEVELOPMENT & MICROFINANCE PRIVATE LIMITED

Notes to the Financial Statements as at and for the year ended March 31, 2022

Half Year Comparative Increase/ Increase/

Period ended

Note Indirect Expenses Increase/Decrease ended Sep 30, Period ended (Decrease) over (Decrease) over

Feb 28, 2023

2022 Feb 28, 2022 Half year Comparative PY

Unaudited Unaudited Unaudited

% %

(Rs. in '000) (Rs. in '000) (Rs. in '000)

Insurance Premium Paid 467.68 249.53 365.94 2% Inc 28% Inc

Payment To Directors 652.50 270.00 417.50 32% Inc 56% Inc

Postage & Courier Charges 22.39 17.57 3.65 -30% Dec 513% Inc

Rates & Taxes 215.63 192.53 156.15 -39% Dec 38% Inc

Rent Paid For Office 9,645.79 5,319.36 9,284.15 -1% Dec 4% Inc

Repair & Maintenence 822.71 536.70 783.52 -16% Dec 5% Inc

Telephone & Postage 636.18 372.68 513.78 -7% Dec 24% Inc

Audit Fees 200.00 200.00 211.00 -45% Dec -5% Dec

Bank Charges 1,152.75 780.02 1,771.58 -19% Dec -35% Dec

Cash Collection Service 1,293.76 841.39 50.45 -16% Dec 2,464% Inc

Communication Expenses 470.54 279.95 427.85 -8% Dec 10% Inc

Computer Running Expenses 633.27 468.75 468.88 -26% Dec 35% Inc

Conveyance Expenses 3,878.91 2,451.79 2,600.49 -14% Dec 49% Inc

Electricity Charges 1,111.17 718.14 1,078.13 -16% Dec 3% Inc

Filing Fees 8.50 3.70 22.20 25% Inc -62% Dec

Gst - Paid 1,110.75 593.75 1,174.05 2% Inc -5% Dec

Legal Expenses 33.59 5.22 25.30 251% Inc 33% Inc

Membership Fees Paid 721.27 699.47 438.95 -44% Dec 64% Inc

Office Expenses 1,358.18 848.17 1,258.06 -13% Dec 8% Inc

Printing & Stationery Expenses 1,613.51 808.11 1,226.89 9% Inc 32% Inc

Professional Caharges 4,705.90 2,316.16 3,222.61 11% Inc 46% Inc

PROFESSIONAL TAX (COMPANY) 2.50 2.50 2.50 -45% Dec 0% Inc

Social Expenses 1,122.74 822.74 1,311.00 -26% Dec -14% Dec

Stamp Duty Charges 7.75 7.75 6.08 -45% Dec 27% Inc

Trainee Fees 12.00 12.00 - -45% Dec 0% Inc

Training & Meeting Expenses 652.60 356.80 453.76 -0% Dec 44% Inc

Travelling & Conveyance Expenses 2,479.20 1,207.31 1,916.39 12% Inc 29% Inc

Training Expenses 165.68 - - 0% Inc 0% Inc

- - 0% Inc 0% Inc

- - 0% Inc 0% Inc

- - 0% Inc 0% Inc

- - 0% Inc 0% Inc

- - 0% Inc 0% Inc

Miscellaneous Expenses 0% Inc 0% Inc

Abnormal Loss 15.30 15.30 - -45% Dec 0% Inc

Advertisement Expenses 2.55 1.70 3.71 -18% Dec -31% Dec

COMPENSATION TO DEATH BORROWER 73.23 49.19 141.28 -19% Dec -48% Dec

Donation & Subscription Expenses 90.02 49.34 68.52 -0% Dec 31% Inc

Miscellaneous Expenses 186.32 119.82 891.97 -15% Dec -79% Dec

Sundry Balance Written Off 60.88 60.88 - -45% Dec 0% Inc

- - 0% Inc 0% Inc

- - 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

- 0% Inc 0% Inc

Total 35,625.76 20,678.31 30,296.33 -6% Dec 18% Inc

Check 0.00 0.01 (0.00)

Loan Loss Provision Long Term Short Term Total

Own Portfolio

Doubtfull Advances overdue Principal

More Than 180 Days 84,135,011 84,135,011

More than 90 Less Than 180 46,837,050 46,837,050

Standard 868,853,296 868,853,296

999,825,357

Provision on Doubtfull Advances

More Than 180 Days @ 100% 100.00% 84,135,011 84,135,011

More than 90 Less Than 180 @ 50.00% 23,418,525 23,418,525

Standard @ 0.25% 2,172,133 2,172,133

109,725,669 109,725,669

1% Minimum 9,998,254

Closing Provision 109,725,669 109,725,669

Non Qualifying Portfolio

Doubtfull Advances overdue Principal

Loss Assets - -

Doubtful 2,212,277 2,212,277

Substandard - -

2,212,277

Provision on Doubtfull Advances

Loss Assets Days @ 100.00% - -

Doubtful @ 50.00% 1,106,139 1,106,139

Substandard @ 10.00% - -

1,106,139 1,106,139

Closing Provision 1,106,139 1,106,139

Additional Provision on

Restructurred Portfolio

Doubtfull Advances overdue Principal

More Than 180 Days 100.00% - -

More than 90 Less Than 180 100.00% - -

Standard @ 1.00% - -

Provision on Doubtfull Advances

More Than 180 Days @ 100% 100.00% - -

More than 90 Less Than 180 @ 100.00% - -

Standard @ 0.00% - -

- -

Closing Provision own Portfolio 110,831,807 109,725,669

Break up & Reco

Gross Closing Provision Requirement 110,831,807 110,831,807

Gross Closing NPA Provision Requirement 108,659,674

Gross Closing Standard Provision 2,172,133

Less Opening 81,718,295 81,718,295

Less Opening NPA Provision 50,541,926

Less Opening Standard Provision 31,176,369

Charged During This Year 29,113,512 29,113,512

BC Portfolio

Doubtfull Advances overdue Principal

More Than 180 Days 17,266,932 17,266,932

More than 90 Less Than 180 2,143,471 2,143,471

Standard 466,127,624 466,127,624

485,538,027

Provision on Doubtfull Advances

More Than 180 Days @ 100% 100.00% 17,266,932 17,266,932

More than 90 Less Than 180 @ 50.00% 1,071,736 1,071,736

Standard @ 0.00% -

18,338,668 18,338,668

Closing Provision 18,338,668 18,338,668

Less Opening 16,735,275 16,735,275

Charged During This Year 1,603,393 1,603,393

Total Charge 30,716,905 30,716,905

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Finance Project On ITC (Statement Analysis)Document2 pagesFinance Project On ITC (Statement Analysis)jigar jainNo ratings yet

- Mahinda Last Five Years Balance SheetDocument2 pagesMahinda Last Five Years Balance SheetSuman Sarkar100% (1)

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDivya PandeyNo ratings yet

- Hindalco Industries Balance Sheet AnalysisDocument3 pagesHindalco Industries Balance Sheet AnalysisSharon T100% (1)

- Tata SteelDocument14 pagesTata Steeldevansh kakkarNo ratings yet

- Money ControlDocument2 pagesMoney ControlsuryaaNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- Steel Authority of India Balance Sheet and Profit & Loss AnalysisDocument12 pagesSteel Authority of India Balance Sheet and Profit & Loss AnalysisPadmavathi shivaNo ratings yet

- AbhimanyuDocument46 pagesAbhimanyuMaurya KNo ratings yet

- CA2 (1)Document22 pagesCA2 (1)aryanvaish64No ratings yet

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocument5 pagesFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaNo ratings yet

- Tatasteel Inclass DiscusionDocument6 pagesTatasteel Inclass DiscusionADAMYA VARSHNEYNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- CMA CIA 3 YateeDocument38 pagesCMA CIA 3 YateeYATEE TRIVEDI 21111660No ratings yet

- Graphite P&L and Balance Sheet AnalysisDocument22 pagesGraphite P&L and Balance Sheet AnalysisAbhishek SoniNo ratings yet

- 5 Year Comparative NTPCDocument11 pages5 Year Comparative NTPCShivanshi SharmaNo ratings yet

- Tata Motors - Strategy - DataDocument17 pagesTata Motors - Strategy - DataSarvesh SmartNo ratings yet

- Tata Steel Valuation by BKMNDocument12 pagesTata Steel Valuation by BKMNKp PatelNo ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsArun BineshNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetprathamesh tawareNo ratings yet

- Housing Development Finance Corporation: PrintDocument2 pagesHousing Development Finance Corporation: PrintAbdul Khaliq ChoudharyNo ratings yet

- Group 10 - Apollo Tyre ModelDocument34 pagesGroup 10 - Apollo Tyre ModelJAY SANTOSH KHORENo ratings yet

- Rajesh Export Limited Balance Sheet and Profit & Loss StatementDocument6 pagesRajesh Export Limited Balance Sheet and Profit & Loss StatementKshitij MaheshwaryNo ratings yet

- JL22PG002 NMDCDocument35 pagesJL22PG002 NMDCHemendra GuptaNo ratings yet

- Analysis of Adani PortsDocument63 pagesAnalysis of Adani PortsHarsh JaswalNo ratings yet

- Tata SteelDocument10 pagesTata SteelSakshi ShahNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Ratio AnalysisDocument10 pagesRatio Analysisbikash_kediaNo ratings yet

- GMR and Larsen & Turbo financial data comparisonDocument20 pagesGMR and Larsen & Turbo financial data comparisonShashank PatelNo ratings yet

- Name Enrollment Number Project On Section Submitted To DateDocument16 pagesName Enrollment Number Project On Section Submitted To DateL1588AshishNo ratings yet

- Cipla Limited Balance Sheet and Financial AnalysisDocument6 pagesCipla Limited Balance Sheet and Financial Analysisscribd sogawNo ratings yet

- AK Sun Pharma UM21321Document4 pagesAK Sun Pharma UM21321akarshika raiNo ratings yet

- Tata Motors Last 5years Balance SheetDocument2 pagesTata Motors Last 5years Balance SheetSuman Sarkar100% (1)

- Financial ManagementDocument14 pagesFinancial ManagementPrapti KilleNo ratings yet

- Tata Motors: 83.41 - 307.55 Profit/Loss Before Tax - 1,640.05 - 2,274.72Document38 pagesTata Motors: 83.41 - 307.55 Profit/Loss Before Tax - 1,640.05 - 2,274.72Vanisha GuptaNo ratings yet

- HindalcoDocument13 pagesHindalcosanjana jainNo ratings yet

- Cipla Balance SheetDocument2 pagesCipla Balance SheetNEHA LAL100% (1)

- Xiamen C&D Inc. Consolidated Balance Sheet: December 31, 2017 January 1,2017 Current AssetsDocument5 pagesXiamen C&D Inc. Consolidated Balance Sheet: December 31, 2017 January 1,2017 Current AssetsanithjayarajNo ratings yet

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- Tata Power Balance SheetDocument2 pagesTata Power Balance Sheetakankshakhushi12No ratings yet

- Adani Power Balance Sheet Data for 5 YearsDocument2 pagesAdani Power Balance Sheet Data for 5 YearsPriyankar RaiNo ratings yet

- Financial Analysis of Sun PharmaDocument7 pagesFinancial Analysis of Sun PharmahemanshaNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- Bharat Petroleum Corporation Limited: Company's ProfileDocument7 pagesBharat Petroleum Corporation Limited: Company's ProfileTanushree LamareNo ratings yet

- Asian Paints BsDocument2 pagesAsian Paints BsPriyalNo ratings yet

- STD Balance Sheet 3Document2 pagesSTD Balance Sheet 3AbhijeetBhiseNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- SHREE Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesSHREE Moneycontrol - Com - Company Info - Print FinancialsMohammad DishanNo ratings yet

- MBA06070 VinayJaju AsianPaintsDocument15 pagesMBA06070 VinayJaju AsianPaintsVinay JajuNo ratings yet

- Vodafone Idea Limited: PrintDocument2 pagesVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Financial Statements: Consolidated Balance SheetDocument10 pagesFinancial Statements: Consolidated Balance SheetDrNaveed Ul HaqNo ratings yet

- ABB India Standalone Balance SheetDocument2 pagesABB India Standalone Balance SheetAbhay Kumar SinghNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFSumit KalelkarNo ratings yet

- Ratios of HDFC BankDocument50 pagesRatios of HDFC BankrupaliNo ratings yet

- Verb TenseDocument12 pagesVerb TenseVuiNo ratings yet

- General Motors CEO Mary BarraDocument12 pagesGeneral Motors CEO Mary BarraSeyed Adeeb100% (1)

- 10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsADocument12 pages10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsAHumbertNo ratings yet

- Company Profile 1Document6 pagesCompany Profile 1MangeshNo ratings yet

- Wise v. MeerDocument2 pagesWise v. MeerSosthenes Arnold MierNo ratings yet

- Introduction To Enterprise SystemsDocument51 pagesIntroduction To Enterprise Systemsvarsha bansodeNo ratings yet

- Binmaley School of FisheriesDocument5 pagesBinmaley School of FisheriesNathan SorianoNo ratings yet

- Synergo Intro DeckDocument14 pagesSynergo Intro DeckAri titikNo ratings yet

- Aon UK Stewardship CodeDocument143 pagesAon UK Stewardship CodevladshevtsovNo ratings yet

- Three Factors Impacting Gillette's Business and Value Chain AnalysisDocument15 pagesThree Factors Impacting Gillette's Business and Value Chain AnalysisNur Dina AbsbNo ratings yet

- Ey Personal Tax Immigration Guide 05 April 2023Document1,751 pagesEy Personal Tax Immigration Guide 05 April 2023ashish poddarNo ratings yet

- Patterson 1999Document18 pagesPatterson 1999Teodora Maria DeseagaNo ratings yet

- ABITRIA Online Assignment Chapter 11 and 12 1Document1 pageABITRIA Online Assignment Chapter 11 and 12 1Ian LamayoNo ratings yet

- Laporan Keuangan Tahunan Tahun 2020Document113 pagesLaporan Keuangan Tahunan Tahun 2020Rinal AldiansyahNo ratings yet

- CHAPTER 1 Introduction To AccountingDocument12 pagesCHAPTER 1 Introduction To Accountingrosendophil7No ratings yet

- FPT ShopDocument25 pagesFPT ShopNhư MaiNo ratings yet

- Essay About Doing Business in JapanDocument5 pagesEssay About Doing Business in JapanSabariah Mohd DaudNo ratings yet

- HWAWELLTEX 2021-2022 Annual PDFDocument146 pagesHWAWELLTEX 2021-2022 Annual PDFCAL ResearchNo ratings yet

- Chapter 1 Introductio1Document27 pagesChapter 1 Introductio1Aryan BagdekarNo ratings yet

- IQ OQ PQ Validation Guideline DocumentsDocument2 pagesIQ OQ PQ Validation Guideline DocumentsBIMO KUKUHNo ratings yet

- JP Morgan Industrials ConferenceDocument19 pagesJP Morgan Industrials ConferenceJames BrianNo ratings yet

- Sereneo vs. Schering Plough, Corp G.R. No. 142506 - February 17, 2005Document4 pagesSereneo vs. Schering Plough, Corp G.R. No. 142506 - February 17, 2005ELMER T. SARABIANo ratings yet

- IMSLP320605-PMLP518792-opus 33 Ave SantissimaDocument1 pageIMSLP320605-PMLP518792-opus 33 Ave SantissimaoloqornoNo ratings yet

- Tesco's international expansion strategyDocument59 pagesTesco's international expansion strategyJenniNo ratings yet

- Enterprise ArchitectureDocument8 pagesEnterprise ArchitectureRahul BadaikNo ratings yet

- 01 32 16 - Construction Progress ScheduleDocument4 pages01 32 16 - Construction Progress ScheduleSteve LezamaNo ratings yet

- 03 - SAP - Order To CashDocument25 pages03 - SAP - Order To CashkeimmaNo ratings yet

- Name: Tooba Khalid Roll No: Bafm-18-17 Submitted To: DR - Asif Yaseen Subject: Bs (Accounting and Finance) Semester: 4Document10 pagesName: Tooba Khalid Roll No: Bafm-18-17 Submitted To: DR - Asif Yaseen Subject: Bs (Accounting and Finance) Semester: 4Ayyan MalikNo ratings yet

- Unit 4 High Rise BuildingsDocument22 pagesUnit 4 High Rise BuildingsInfanta mary100% (3)

- BSP Notice Letter o of Delay - EditedDocument43 pagesBSP Notice Letter o of Delay - EditedBoalan OfficeNo ratings yet