Professional Documents

Culture Documents

Classifying Accounts Into Assets, Liabilities, Owners Equity, Revenue or Expense

Uploaded by

Saif Ali Khan0 ratings0% found this document useful (0 votes)

28 views1 pageOriginal Title

quizlet (3).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pageClassifying Accounts Into Assets, Liabilities, Owners Equity, Revenue or Expense

Uploaded by

Saif Ali KhanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Classifying Accounts into Assets, Liabilities, Owners Equity,

Revenue or Expense

Study online at quizlet.com/_r8i8l

1. Asset. Money owed by the customer to the Company. Accounts

Receivables

2. Asset. The most liquid form of Asset a company can hold. Cash

3. Asset. Goods or Material that is held by a company for the purpose of reselling for a profit. Inventory

4. Asset. When a business pays for goods and services that will be received in the near future Prepaid

Expenses

5. Asset. It's a Long-term Asset, a machine used for producing a product or service. It has a specific design and Equipment

purpose.

6. Asset. Real Property where a company's office buildings or manufacturing plants sit. Land

7. Assets. Any equity or debt instrument that it readily salable and can be converted into cash, or exchanged with Marketable

ease. Stocks, bonds, short-term commercial paper and certificates of deposit. (Investopedia) Securities

8. Liability. A formal written promise to pay. Example: Bank loans Notes

Payable

9. Liability. This is a current liability account that shows the amount a company owes for items or services purchased Accounts

on credit. This is often referred to as trade payables. Payable

10. Liability. Salaries earned by a company's employees, but have not been paid by the company Salaries

Payable

11. Liabilities. Money received by a company in advance of providing a service or delivering a product. Unearned

Revenues

12. Equity. Ownership shares in a company. Common

Stock

13. Equity. Capital received by a company for the sell of stock at a price greater than par value. Paid-in

Capital

14. Equity. Reports the net income of a corporation from its inception less the dividends paid/declared from its Retained

inception to the date of the balance sheet. Earnings

15. Revenue (Equity). Money earned for the sale of a product or service. Service

Revenues

16. Expense (Equity). Costs associated with generating sales. Found on the Income Statement Salaries

Expense

You might also like

- FABM Q3 M4 (Output No. 4 - Five Major Accounts)Document4 pagesFABM Q3 M4 (Output No. 4 - Five Major Accounts)Sophia MagdaraogNo ratings yet

- Las 3Document8 pagesLas 3Venus Abarico Banque-AbenionNo ratings yet

- Entreprenuership 2nd Sem Quiz QuestionsDocument2 pagesEntreprenuership 2nd Sem Quiz QuestionsHannah LegaspiNo ratings yet

- What Are The 5 Elements of AccountingDocument3 pagesWhat Are The 5 Elements of AccountingKatie MoreeNo ratings yet

- Reading Comprehension Activity "Introduction To The Financial Statements"Document4 pagesReading Comprehension Activity "Introduction To The Financial Statements"LAURA TELLEZNo ratings yet

- Chart of AccountsDocument2 pagesChart of AccountsBRIAN CORPUZ INCOGNITONo ratings yet

- 4types of Major Accounts-For Observation2Document13 pages4types of Major Accounts-For Observation2Marilyn Nelmida TamayoNo ratings yet

- Class Exercise 1 Identification of Accounting ElementsDocument2 pagesClass Exercise 1 Identification of Accounting ElementsSagar KansalNo ratings yet

- BanKoncepts - Equity and DebtsDocument3 pagesBanKoncepts - Equity and DebtsVenkat IyerNo ratings yet

- Five Accounting ElementsDocument2 pagesFive Accounting ElementsD AngelaNo ratings yet

- ABMFABM1 q3 Mod4 Types-of-Major-AccountsDocument14 pagesABMFABM1 q3 Mod4 Types-of-Major-AccountsEduardo john DolosoNo ratings yet

- Business CombinationsDocument44 pagesBusiness CombinationsHimanshu GaurNo ratings yet

- CHAPTER 4 Types of Major AccountsDocument4 pagesCHAPTER 4 Types of Major AccountsUnah Ysabelle ValdonNo ratings yet

- Review Page 4Document1 pageReview Page 4Flicker LoserNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionThea Gwyneth RodriguezNo ratings yet

- Capital Expenditure Revenue Expenditure: Internal Sources of FinanceDocument1 pageCapital Expenditure Revenue Expenditure: Internal Sources of Financeelena.mc666No ratings yet

- Topic 3 - Accounting Classification and Accounting Equation LatestDocument28 pagesTopic 3 - Accounting Classification and Accounting Equation LatestKhairul AkmalNo ratings yet

- 6 - ConceptsDocument8 pages6 - ConceptsAsma GaniNo ratings yet

- Acc1 Lesson Week7Document28 pagesAcc1 Lesson Week7KeiNo ratings yet

- FabmDocument5 pagesFabmJihane TanogNo ratings yet

- Financial Statements Analysis Formulae AnalysisDocument13 pagesFinancial Statements Analysis Formulae AnalysisChico ChanchanNo ratings yet

- THE Accounting Equation (Module 5, Camerino, D.)Document10 pagesTHE Accounting Equation (Module 5, Camerino, D.)Che AllejeNo ratings yet

- The Accounting Equation: Current Assets Are Assets That Can BeDocument3 pagesThe Accounting Equation: Current Assets Are Assets That Can BeKarysse Arielle Noel JalaoNo ratings yet

- Entrep ReviewerDocument2 pagesEntrep ReviewerIvymarian CantoyNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsAnthony DyNo ratings yet

- Current Vs Non-Current AssetsDocument3 pagesCurrent Vs Non-Current AssetsTrisha GarciaNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionCHARVIE KYLE RAMIREZNo ratings yet

- Accounting Concepts Assignment August 2022Document5 pagesAccounting Concepts Assignment August 2022SoiniNo ratings yet

- 1accounting Equation RevisedDocument4 pages1accounting Equation RevisedReniel MillarNo ratings yet

- Fabm 2Document5 pagesFabm 2lhoriereyes8No ratings yet

- EquityDocument10 pagesEquitygaurav4ektaNo ratings yet

- Chapter 2 - Financial StatementsDocument4 pagesChapter 2 - Financial StatementsMASSO CALINTAANNo ratings yet

- FINACC - Balance Sheet Terms - 011218 A1Document6 pagesFINACC - Balance Sheet Terms - 011218 A1ventus5thNo ratings yet

- Current Assets:: What Is The Statement of Financial PositionDocument4 pagesCurrent Assets:: What Is The Statement of Financial PositionEmar KimNo ratings yet

- Module 24 (Activity 1)Document4 pagesModule 24 (Activity 1)Mylene HeragaNo ratings yet

- Accounting NotesDocument6 pagesAccounting NotesD AngelaNo ratings yet

- Basic Accounts TermsDocument7 pagesBasic Accounts TermsJoanne CrysantherNo ratings yet

- Accounting Pre Ing ch1 ContentDocument3 pagesAccounting Pre Ing ch1 ContentDaksh JainNo ratings yet

- Accounting 2Document3 pagesAccounting 2sanshai sabadoNo ratings yet

- 1five Major AccountsDocument30 pages1five Major AccountsEaster LumangNo ratings yet

- Bonggang-Bonggang Reviewer in LawDocument5 pagesBonggang-Bonggang Reviewer in LawJM ArevaloNo ratings yet

- IGCSE Business Studies: Financial Information and Decisions: Study Online atDocument2 pagesIGCSE Business Studies: Financial Information and Decisions: Study Online atDefa RoseNo ratings yet

- Financial Accounting and Reporting (FAR) - Part 4Document3 pagesFinancial Accounting and Reporting (FAR) - Part 4Malcolm HolmesNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingAndrea Padilla MoralesNo ratings yet

- Itc LTD PDFDocument18 pagesItc LTD PDFKriti BansalNo ratings yet

- ACFAR Pre-Lectio Assignment IIDocument6 pagesACFAR Pre-Lectio Assignment IIJesa TanNo ratings yet

- Practice Assessment in Actg 1Document4 pagesPractice Assessment in Actg 1Roly Jr PadernaNo ratings yet

- L2 General Purpose Financial StatementsDocument10 pagesL2 General Purpose Financial StatementsRashid ZamanNo ratings yet

- ACCT105 Accounting For Non Accounting MajorsDocument31 pagesACCT105 Accounting For Non Accounting MajorsG JhaNo ratings yet

- Module 24 (Activity 1)Document4 pagesModule 24 (Activity 1)Mylene HeragaNo ratings yet

- Entrepreneurship Quarter 2 ReviewerDocument1 pageEntrepreneurship Quarter 2 ReviewerprcssrhNo ratings yet

- Chapters 1 and 2Document36 pagesChapters 1 and 2Qing ShiNo ratings yet

- Commonly Used Financial TermsDocument2 pagesCommonly Used Financial TermsMihai GeambasuNo ratings yet

- Basic Elements of AccountingDocument10 pagesBasic Elements of AccountingShaillyNo ratings yet

- 3 4 Final AccountsDocument6 pages3 4 Final AccountsKANAK KOKARENo ratings yet

- Uncalled CapitalDocument2 pagesUncalled CapitalLJBernardoNo ratings yet

- Quick Revision Points For CA Foundation AccountsDocument18 pagesQuick Revision Points For CA Foundation AccountsmahimaNo ratings yet

- 2) Accounting Is The Language of The BusinessDocument20 pages2) Accounting Is The Language of The BusinessMishalNo ratings yet

- The Shareholders Are General Agents of The Business. Pre-Emptive RightDocument20 pagesThe Shareholders Are General Agents of The Business. Pre-Emptive RightSaeym SegoviaNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- QuizletDocument150 pagesQuizletSaif Ali KhanNo ratings yet

- Accounting 200 - Chart of AccountsDocument3 pagesAccounting 200 - Chart of AccountsSaif Ali KhanNo ratings yet

- Quizlet PDFDocument1 pageQuizlet PDFSaif Ali KhanNo ratings yet

- Quizlet PDFDocument3 pagesQuizlet PDFSaif Ali KhanNo ratings yet

- Accounting 200 - Chart of AccountsDocument3 pagesAccounting 200 - Chart of AccountsSaif Ali KhanNo ratings yet

- Accounting 200 - Chart of AccountsDocument3 pagesAccounting 200 - Chart of AccountsSaif Ali KhanNo ratings yet

- Introduction To Financial Accounting Final Exam Lecture QuestionsDocument3 pagesIntroduction To Financial Accounting Final Exam Lecture QuestionsSaif Ali KhanNo ratings yet

- Introduction To Financial Accounting Final Exam Lecture QuestionsDocument2 pagesIntroduction To Financial Accounting Final Exam Lecture QuestionsSaif Ali KhanNo ratings yet

- The Seed 0.4 Walk-ThroughDocument5 pagesThe Seed 0.4 Walk-ThroughSaif Ali KhanNo ratings yet

- TW Walktrough Chapter 1 - 4Document20 pagesTW Walktrough Chapter 1 - 4Saif Ali KhanNo ratings yet

- Aes KeysDocument1 pageAes KeysPanas dalam133% (3)

- Super Street Fighter 4: 3D Edition (Disable FSAA v1.0) Citra - Enabled 08582D04 00000009Document1 pageSuper Street Fighter 4: 3D Edition (Disable FSAA v1.0) Citra - Enabled 08582D04 00000009Saif Ali KhanNo ratings yet

- Pokémon Fire Ash WalkthroughDocument307 pagesPokémon Fire Ash WalkthroughSaif Ali Khan75% (4)

- Pokémon Fire Ash RoutesDocument21 pagesPokémon Fire Ash RoutesSaif Ali KhanNo ratings yet

- Pokémon Fire Ash Evolution ChangesDocument1 pagePokémon Fire Ash Evolution ChangesSaif Ali Khan100% (5)

- Dorms em 1 Linear ProgrammingDocument37 pagesDorms em 1 Linear ProgrammingParamjeet Singh100% (1)

- Pokemon Fire Ash LocationsDocument22 pagesPokemon Fire Ash LocationsSaif Ali Khan67% (3)

- Automobileindustry 130214041016 Phpapp02Document35 pagesAutomobileindustry 130214041016 Phpapp02Saif Ali KhanNo ratings yet

- Mergers and Acquisitions Country Report PhilippinesDocument12 pagesMergers and Acquisitions Country Report PhilippinesErika PinedaNo ratings yet

- Practice Set 2 AbcDocument1 pagePractice Set 2 AbcDiana Rose BassigNo ratings yet

- Chapter 12 - Capital BudgetingDocument40 pagesChapter 12 - Capital BudgetingMarlinia QibthiyahNo ratings yet

- Investment Banking - Securities Dealing in The US Iexpert Report PDFDocument8 pagesInvestment Banking - Securities Dealing in The US Iexpert Report PDFJessyNo ratings yet

- Compu 1Document4 pagesCompu 1SK SchreaveNo ratings yet

- Module 2 - Partnership OperationsDocument10 pagesModule 2 - Partnership OperationsJhanella Faith FagarNo ratings yet

- Pas 12Document6 pagesPas 12AnneNo ratings yet

- Fourth Day Tally Contents (Journal Entry Part - 2)Document9 pagesFourth Day Tally Contents (Journal Entry Part - 2)Kamlesh Kumar100% (1)

- Investment Environment - I Investment Avenues: Prof. Mohinder SinghDocument19 pagesInvestment Environment - I Investment Avenues: Prof. Mohinder SinghranjuNo ratings yet

- Cheat Sheet For Final Summary PDFDocument2 pagesCheat Sheet For Final Summary PDFQuy TranNo ratings yet

- Topic 3.8 Quiz and Discussion Section 9 Consolidated and Separate Section 19 Business CombinationsDocument17 pagesTopic 3.8 Quiz and Discussion Section 9 Consolidated and Separate Section 19 Business CombinationsDavid OparindeNo ratings yet

- Receivables ExerciseDocument3 pagesReceivables ExerciseJERICKO LIAN DEL ROSARIONo ratings yet

- Financial Accounting McqsDocument3 pagesFinancial Accounting McqsMurad AliNo ratings yet

- Adjusting Trial BalanceDocument15 pagesAdjusting Trial BalancejepsyutNo ratings yet

- Case 28 - Aanalysis Guidance - Autozone, Inc PDFDocument1 pageCase 28 - Aanalysis Guidance - Autozone, Inc PDFVoramon PolkertNo ratings yet

- Adjusting The Accounts: Accounting Principles, 7 EditionDocument51 pagesAdjusting The Accounts: Accounting Principles, 7 EditionBader_86100% (1)

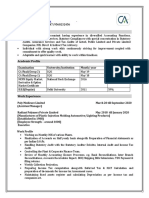

- CA Yogesh Kumar: Profile SynopsisDocument2 pagesCA Yogesh Kumar: Profile SynopsisThe Cultural CommitteeNo ratings yet

- Noh - The Effect of The Dependence On The Work of Other Auditors On Error in Analysts' Earnings Forecasts-DikonversiDocument27 pagesNoh - The Effect of The Dependence On The Work of Other Auditors On Error in Analysts' Earnings Forecasts-DikonversiNurfitrianiNo ratings yet

- Question and Answers About Corporation CodeDocument2 pagesQuestion and Answers About Corporation CodePrim Rose Vien100% (3)

- Strategic Business Reporting Class Notes: (International)Document259 pagesStrategic Business Reporting Class Notes: (International)Ramen ACCA100% (1)

- Lifting The Corporate VeilDocument3 pagesLifting The Corporate VeilRobin MathewNo ratings yet

- 1st Quiz-Partnership-rawDocument3 pages1st Quiz-Partnership-rawRey PerosaNo ratings yet

- Cost Accountancy: Bba - Ii Semester - IiiDocument19 pagesCost Accountancy: Bba - Ii Semester - IiiNishikant RayanadeNo ratings yet

- Chapman Department Store Is Located in Midtown Metropolis Durin PDFDocument1 pageChapman Department Store Is Located in Midtown Metropolis Durin PDFAnbu jaromiaNo ratings yet

- Business Laws and Regulations No. IiDocument131 pagesBusiness Laws and Regulations No. IiEdrian CabagueNo ratings yet

- PPE QuestionsDocument9 pagesPPE QuestionsMel BayhiNo ratings yet

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- Ssignment RiefDocument6 pagesSsignment RiefShah MuradNo ratings yet

- IR Committees-Roles ResponsibilitiesDocument2 pagesIR Committees-Roles ResponsibilitiesAbhijeet SarkarNo ratings yet

- Negotiations, Deal StructuringDocument30 pagesNegotiations, Deal StructuringVishakha PawarNo ratings yet