Professional Documents

Culture Documents

MC6 Matcha Creations: Instructions

Uploaded by

Reza eka Putra0 ratings0% found this document useful (0 votes)

112 views2 pagesOriginal Title

ch06-1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

112 views2 pagesMC6 Matcha Creations: Instructions

Uploaded by

Reza eka PutraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

MC6 MATCHA CREATIONS

Mei-ling is busy establishing both divisions of her business (cookie classes

and mixer sales) and completing her business degree. Her goals for the next

11 months are to sell one mixer per month and to give two to three classes

per week.

The cost of the fine European mixers is expected to increase. Mei-ling

has just negotiated new terms with Kzinski that include shipping costs in the

negotiated purchase price (mixers will be shipped FOB destination). Assume

that Mei-ling has decided to use a periodic inventory system and now must

choose a cost flow assumption for her mixer inventory.

The following transactions occur in February to May 2018.

Feb. 2 Mei-ling buys two deluxe mixers on account from Kzinski

Supply Co. for NT$1,200 (NT$600 each), FOB destination,

terms n/30.

16 She sells one deluxe mixer for NT$1,150 cash.

25 She pays the amount owed to Kzinski.

Mar. 2 She buys one deluxe mixer on account from Kzinski Supply

Co. for NT$618, FOB destination, terms n/30.

30 Mei-ling sells two deluxe mixers for a total of NT$2,300 cash.

31 She pays the amount owed to Kzinski.

Apr. 1 She buys two deluxe mixers on account from Kzinski Supply

Co. for N T $1,224 (NT$612 each), FOB destination, terms n/30.

13 She sells three deluxe mixers for a total of NT$3,450 cash.

30 Mei-ling pays the amounts owed to Kzinski.

May 4 She buys three deluxe mixers on account from Kzinski

Supply Co. for NT$1,875 (NT$625 each), FOB destination,

terms n/30.

27 She sells one deluxe mixer for NT$1,150 cash.

Instructions

(a) Determine the cost of goods available for sale. Recall from Chapter 5

that at the end of January, Cookie Creations had three mixers on hand

at a cost of NT$595 each.

(b) (i) Calculate the ending inventory under the FIFO average cost, and

LIFO methods.

(ii) Calculate the cost of goods sold under the FIFO, average cost, and

LIFO methods.

(iii) Calculate the gross profit under the FIFO, average cost, and

LIFOmethods.

(iv) Calculate the gross profit rate under the FIFO, average cost, and

______________________________________________________________________________

Copyright © 2016 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 3e Matcha Creations

(For Instructor Use Only)

LIFO, methods.

______________________________________________________________________________

Copyright © 2016 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 3e Matcha Creations

(For Instructor Use Only)

You might also like

- Group Assigment CA MATCHA CREATIONSDocument8 pagesGroup Assigment CA MATCHA CREATIONSHoàng Hải Quyên100% (1)

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkNo ratings yet

- Assessment Test - Accounting and Tax PDFDocument1 pageAssessment Test - Accounting and Tax PDFqonitahusnaNo ratings yet

- What Is Happening To World MarketsDocument2 pagesWhat Is Happening To World MarketsJohana ApriliaNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- Lecture 8 - Exercises - QuestionDocument3 pagesLecture 8 - Exercises - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- Working 3Document6 pagesWorking 3Hà Lê DuyNo ratings yet

- MC3 Matcha Creations: (For Instructor Use Only)Document2 pagesMC3 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Tugas Pert.3Document7 pagesTugas Pert.3Hari YantoNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- Tugas 4 AKM - Kelompok 5 - 142200278Document13 pagesTugas 4 AKM - Kelompok 5 - 142200278muhammad alfariziNo ratings yet

- CH 06Document1 pageCH 06kidNo ratings yet

- COVID-19 and Flu Vaccination Walgreens Immunization ServicesDocument1 pageCOVID-19 and Flu Vaccination Walgreens Immunization ServicesAitana MaldonadoNo ratings yet

- Hassellhouf Company Unrecorded Transactions and Financial Statements CP9Document3 pagesHassellhouf Company Unrecorded Transactions and Financial Statements CP9Rahul100% (1)

- Variance Analysi1Document2 pagesVariance Analysi1Elliot RichardNo ratings yet

- Tugas Ifrs Chapter 7.2Document4 pagesTugas Ifrs Chapter 7.2Nabilla salsaNo ratings yet

- FM-BINUS-AA-FPU-78/V2R0 Audit CaseDocument4 pagesFM-BINUS-AA-FPU-78/V2R0 Audit CaseIkhsan Uiandra Putra SitorusNo ratings yet

- Soal Asis 3 - Jordy - AJPDocument1 pageSoal Asis 3 - Jordy - AJPJordy TangNo ratings yet

- Pale Company transfers assets to newly created subsidiary SightDocument6 pagesPale Company transfers assets to newly created subsidiary SightKristilyn CartaNo ratings yet

- Financial accounting journal entriesDocument3 pagesFinancial accounting journal entriesAlfiyanNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Wiley - Chapter 12: Intangible AssetsDocument20 pagesWiley - Chapter 12: Intangible AssetsIvan BliminseNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Calculus Company Makes Calculators For StudentsDocument2 pagesCalculus Company Makes Calculators For StudentsElliot RichardNo ratings yet

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDocument2 pagesKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNo ratings yet

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Chapter 17 Solution To Difficult ProblemDocument2 pagesChapter 17 Solution To Difficult Problembennetta24100% (2)

- Chapter 21 Latihan SoalDocument10 pagesChapter 21 Latihan SoalJulyaniNo ratings yet

- ch11 DepriciationDocument19 pagesch11 DepriciationKatie Vo50% (2)

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- ACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineDocument16 pagesACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineGaidon HercNo ratings yet

- Tutorial 1 (For Student)Document2 pagesTutorial 1 (For Student)dee davyanNo ratings yet

- Record Sales Gross and NetDocument3 pagesRecord Sales Gross and NetrahmawNo ratings yet

- Tugas AKL P1-3Document14 pagesTugas AKL P1-3bagong kussetNo ratings yet

- The Richter Company A Technology Company Has Been Growing RapidlyDocument1 pageThe Richter Company A Technology Company Has Been Growing RapidlyHassan JanNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Review Analisis Kinerja Keuangan Di PT Phapros. TBKDocument15 pagesReview Analisis Kinerja Keuangan Di PT Phapros. TBKMutia HidayatillahNo ratings yet

- Body EmailDocument2 pagesBody Emailferry firmannaNo ratings yet

- Udah Bener'Document4 pagesUdah Bener'Shafa AzahraNo ratings yet

- Calculate Pension ExpensesDocument2 pagesCalculate Pension ExpensesPeachyNo ratings yet

- Chapter 11-Part 1 Share Transaction Soal 1Document2 pagesChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- Module 9 Problems - MrnakDocument9 pagesModule 9 Problems - MrnakJenny MrnakNo ratings yet

- Gao Vs IiaDocument4 pagesGao Vs Iiaapi-266966345No ratings yet

- KELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditDocument39 pagesKELOMPOK 04 PPT AUDIT Siklus Perolehan Dan Pembayaran EditAkuntansi 6511No ratings yet

- Bank Reconciliation and Adjusting Entries for Aglife GeneticsDocument9 pagesBank Reconciliation and Adjusting Entries for Aglife GeneticsDetha Prasetio KumaraNo ratings yet

- Soal 2Document2 pagesSoal 2putriNo ratings yet

- Preliminary computations and consolidation of Piero SAADocument3 pagesPreliminary computations and consolidation of Piero SAAMuhammad SyukurNo ratings yet

- Chapter 2Document26 pagesChapter 2IstikharohNo ratings yet

- Taufik Rahman Audit Practicum ModulesDocument136 pagesTaufik Rahman Audit Practicum ModulesMiftaNo ratings yet

- Tugas PA 2Document2 pagesTugas PA 2Fadhilah HazimahNo ratings yet

- The Following Data For Coca Cola Ticker Symbol Ko AreDocument1 pageThe Following Data For Coca Cola Ticker Symbol Ko AreTaimur TechnologistNo ratings yet

- Presented Here Are Selected Transactions For Norlan Inc During SeptemberDocument2 pagesPresented Here Are Selected Transactions For Norlan Inc During SeptemberMiroslav GegoskiNo ratings yet

- CH 06Document1 pageCH 06kidNo ratings yet

- MC5 Matcha Creations: (For Instructor Use Only)Document3 pagesMC5 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Matcha Creations perpetual inventory systemDocument3 pagesMatcha Creations perpetual inventory systemMahlatse MalatjiNo ratings yet

- Guidelines For Selecting Materials For Downhole Completions Equipment (Jewellery)Document32 pagesGuidelines For Selecting Materials For Downhole Completions Equipment (Jewellery)Slim.BNo ratings yet

- Database AwsDocument15 pagesDatabase AwsHareesha N GNo ratings yet

- Economics of Power GenerationDocument32 pagesEconomics of Power GenerationKimberly Jade VillaganasNo ratings yet

- 5G Antenna Talk TWDocument48 pages5G Antenna Talk TWRohit MathurNo ratings yet

- PDI 14 Asthma Admission RateDocument2 pagesPDI 14 Asthma Admission RatejrmyfngNo ratings yet

- MKTM028 FathimathDocument23 pagesMKTM028 FathimathShyamly DeepuNo ratings yet

- Bee WareDocument49 pagesBee WareJayNo ratings yet

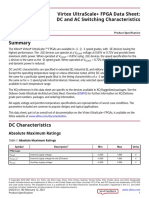

- ds923 Virtex Ultrascale PlusDocument81 pagesds923 Virtex Ultrascale Plusismail topcuNo ratings yet

- XII Class Assignment Programs 2023-24Document8 pagesXII Class Assignment Programs 2023-24Sudhir KumarNo ratings yet

- Instant Download Ebook PDF Building Construction Handbook 11th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Building Construction Handbook 11th Edition PDF Scribdthomas.bilal255100% (38)

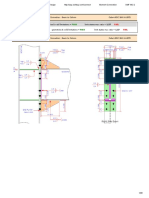

- Result Summary - Overall: Moment Connection - Beam To Column Code AISC 360-16 LRFDDocument29 pagesResult Summary - Overall: Moment Connection - Beam To Column Code AISC 360-16 LRFDYash Suthar100% (2)

- Julia Henzler - Resume 2 27Document1 pageJulia Henzler - Resume 2 27api-491391730No ratings yet

- Cooler Ok El8sDocument11 pagesCooler Ok El8sIBRAHIM ALMANLANo ratings yet

- How To VOR WorksDocument23 pagesHow To VOR WorksHai AuNo ratings yet

- MPMC All Questions and AnswerDocument6 pagesMPMC All Questions and AnswerMODERN TELUGAMMAYINo ratings yet

- Islamic Center Design With Islamic ArchiDocument11 pagesIslamic Center Design With Islamic ArchiMuhammad Sufiyan SharafudeenNo ratings yet

- T2-1 MS PDFDocument27 pagesT2-1 MS PDFManav NairNo ratings yet

- Automation of Banking Service - EBL & EXIM BankDocument32 pagesAutomation of Banking Service - EBL & EXIM BankShaffyNo ratings yet

- Boston Globe Article - Jonnie Williams & Frank O'DonnellDocument3 pagesBoston Globe Article - Jonnie Williams & Frank O'DonnellFuzzy PandaNo ratings yet

- Bomba de Vacio Part ListDocument2 pagesBomba de Vacio Part ListNayeli Zarate MNo ratings yet

- Integrated Marketing Communication PlanDocument5 pagesIntegrated Marketing Communication Planprojectwork185No ratings yet

- Timetable 1Document1 pageTimetable 1sunilbijlaniNo ratings yet

- Samruddhi ComplexDocument7 pagesSamruddhi ComplexNews Side Effects.No ratings yet

- Data Structures and Algorithms in Java ™: Sixth EditionDocument8 pagesData Structures and Algorithms in Java ™: Sixth EditionIván Bartulin Ortiz0% (1)

- STAR GLASS - D66f5e - PDFDocument126 pagesSTAR GLASS - D66f5e - PDFJessie O.BechaydaNo ratings yet

- The Greatest Showman PDFDocument22 pagesThe Greatest Showman PDFMJ RecordNo ratings yet

- Articulos 2022-2Document11 pagesArticulos 2022-2Nilser Enrique Valle HernandezNo ratings yet

- Computer Organization and Assembly Language: Lecture 1 - Basic ConceptsDocument13 pagesComputer Organization and Assembly Language: Lecture 1 - Basic ConceptsNosreffejDelRosarioNo ratings yet

- Development PlanningDocument15 pagesDevelopment PlanningSamuelNo ratings yet