Professional Documents

Culture Documents

The Following Are Selected Transactions That May Affect Shareholders Equity PDF

Uploaded by

Freelance Worker0 ratings0% found this document useful (0 votes)

32 views1 pageThe document lists 12 transactions that may affect shareholders' equity and instructs the reader to indicate the effect of each transaction on various financial statement elements under IFRS. It asks if the effects would change under private enterprise GAAP. The transactions include recording accrued interest, declaring and paying dividends, conducting a stock split, recording insurance expiration, changes in investment fair value, declaring and distributing property and stock dividends, and repurchasing shares.

Original Description:

Original Title

the-following-are-selected-transactions-that-may-affect-shareholders-equity.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists 12 transactions that may affect shareholders' equity and instructs the reader to indicate the effect of each transaction on various financial statement elements under IFRS. It asks if the effects would change under private enterprise GAAP. The transactions include recording accrued interest, declaring and paying dividends, conducting a stock split, recording insurance expiration, changes in investment fair value, declaring and distributing property and stock dividends, and repurchasing shares.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views1 pageThe Following Are Selected Transactions That May Affect Shareholders Equity PDF

Uploaded by

Freelance WorkerThe document lists 12 transactions that may affect shareholders' equity and instructs the reader to indicate the effect of each transaction on various financial statement elements under IFRS. It asks if the effects would change under private enterprise GAAP. The transactions include recording accrued interest, declaring and paying dividends, conducting a stock split, recording insurance expiration, changes in investment fair value, declaring and distributing property and stock dividends, and repurchasing shares.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

The following are selected transactions that may affect

shareholders equity #1275

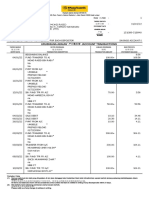

The following are selected transactions that may affect shareholders’ equity. 1. Recorded

accrued interest earned on a note receivable. 2. Declared a cash dividend. 3. Effected a stock

split. 4. Recorded the expiration of insurance coverage that was previously recorded as prepaid

insurance. 5. Paid the cash dividend declared in item 2 above. 6. Recorded accrued interest

expense on a note payable. 7. Recorded an increase in the fair value of an investment

accounted for using fair value through other comprehensive income (FV-OCI) that will be

distributed as a property dividend. The carrying amount of the FV-OCI investment was greater

than its cost. The shares are traded in an active market. 8. Declared a property dividend (see

item 7 above). 9. Distributed the investment to shareholders (see items 7 and 8 above). 10.

Declared a stock dividend. 11. Distributed the stock dividend declared in item 10. 12.

Repurchased common shares for less than their initial issue price. Instructions(a). In the table

below, assuming the company follows IFRS, indicate the effect that each of the 12 transactions

has on the financial statement elements that are listed. Use the following codes: increase (I),

decrease (D), and no effect (NE). (b). Would the effect of any of the above items change if the

company were to follow private enterprise GAAP?View Solution:

The following are selected transactions that may affect shareholders equity

ANSWER

http://paperinstant.com/downloads/the-following-are-selected-transactions-that-may-affect-

shareholders-equity/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- BMO Bank of Montreal Online Banking NovDocument4 pagesBMO Bank of Montreal Online Banking NovHarold KumarNo ratings yet

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceFrom EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNo ratings yet

- Series Seed Term Sheet (v2)Document2 pagesSeries Seed Term Sheet (v2)zazenNo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Investment DecisionDocument26 pagesInvestment DecisionToyin Gabriel AyelemiNo ratings yet

- Finman Final Exam ProblemDocument10 pagesFinman Final Exam ProblemJayaAntolinAyusteNo ratings yet

- Shareholders Agreement: ©hitechlaw Group LLCDocument12 pagesShareholders Agreement: ©hitechlaw Group LLCScott Mercer100% (2)

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- Frs Assignment 2Document15 pagesFrs Assignment 2Sharmila Devi100% (1)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- FinalCadburyLetter121807 PDFDocument14 pagesFinalCadburyLetter121807 PDFbillroberts981No ratings yet

- During 2010 Jester Corporation Had The Following Transactions A PDFDocument1 pageDuring 2010 Jester Corporation Had The Following Transactions A PDFAnbu jaromiaNo ratings yet

- Dunrobin Industries LTD Which Uses Ifrs Had The Following Transactions PDFDocument1 pageDunrobin Industries LTD Which Uses Ifrs Had The Following Transactions PDFTaimur TechnologistNo ratings yet

- Assume That Masters Enterprises Uses The Following Headings On I PDFDocument1 pageAssume That Masters Enterprises Uses The Following Headings On I PDFAnbu jaromiaNo ratings yet

- MAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !Document3 pagesMAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !srushti thoratNo ratings yet

- IAS 21, IfRS 11, IAS 28 (For Consolidation)Document1 pageIAS 21, IfRS 11, IAS 28 (For Consolidation)dominicNo ratings yet

- A Company Enters Into The Following Transactions A Interest Is PaidDocument1 pageA Company Enters Into The Following Transactions A Interest Is Paidhassan taimourNo ratings yet

- Milford Corporation Had The Following Transactions and Events 1 Issued PreferredDocument1 pageMilford Corporation Had The Following Transactions and Events 1 Issued PreferredMiroslav GegoskiNo ratings yet

- AFTM3 Chp10 OutlineDocument9 pagesAFTM3 Chp10 OutlinechazmalcolmharrisNo ratings yet

- 1 Which of The Following Is Not A Distinguishing CharacteristicDocument1 page1 Which of The Following Is Not A Distinguishing Characteristichassan taimourNo ratings yet

- Presented Below Are The Captions of Nikos Company S Balance Shee PDFDocument1 pagePresented Below Are The Captions of Nikos Company S Balance Shee PDFAnbu jaromiaNo ratings yet

- Six Events Pertaining To Financial Assets Are Described As FollowsDocument1 pageSix Events Pertaining To Financial Assets Are Described As FollowsAmit PandeyNo ratings yet

- M9.1 Analysis of The Equity Statement..Document14 pagesM9.1 Analysis of The Equity Statement..Gopi nathNo ratings yet

- Several Statement of Financial Position Accounts of Greenspoon Inc Follow 1 PDFDocument1 pageSeveral Statement of Financial Position Accounts of Greenspoon Inc Follow 1 PDFLet's Talk With HassanNo ratings yet

- Manual of Accounting Policies (MAP) : Shareholders EquityDocument10 pagesManual of Accounting Policies (MAP) : Shareholders EquityMiruna RaduNo ratings yet

- The Following Events Were Experienced by Abbot Inc 1 IssuedDocument1 pageThe Following Events Were Experienced by Abbot Inc 1 IssuedM Bilal SaleemNo ratings yet

- 2009 F-7 Class NotesDocument3 pages2009 F-7 Class NotesChris Tian FlorendoNo ratings yet

- 1 Which of The Following Are Attributes of A LiabilityDocument1 page1 Which of The Following Are Attributes of A LiabilityM Bilal SaleemNo ratings yet

- Q12 KeyDocument3 pagesQ12 KeyMuhammad AbdullahNo ratings yet

- Assignment II - Quiz 2Document5 pagesAssignment II - Quiz 2tawfikNo ratings yet

- Financial Reporting and Analysis Q-1Document16 pagesFinancial Reporting and Analysis Q-1Xiaoyuan, Penny ZhengNo ratings yet

- Solutions To End-Of-Chapter MaterialDocument11 pagesSolutions To End-Of-Chapter MaterialSunil JaiswalNo ratings yet

- Chapter-02 Statement of Cash FlowsDocument16 pagesChapter-02 Statement of Cash Flowsmd. hasanuzzamanNo ratings yet

- Auditing&Assurance-Audit Of-Investment Divinagracia, Khyla A.Document10 pagesAuditing&Assurance-Audit Of-Investment Divinagracia, Khyla A.Khyla DivinagraciaNo ratings yet

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Accounting:: Recording, Analysing and SummarisingDocument37 pagesAccounting:: Recording, Analysing and SummarisingNguyen Ngoc MaiNo ratings yet

- CH 11Document4 pagesCH 11pablozhang1226No ratings yet

- Chapter 7 - Homework & Solution: Answers To QuestionsDocument15 pagesChapter 7 - Homework & Solution: Answers To QuestionsSumera SarwarNo ratings yet

- Long-Lived Assets: Revsine/Collins/Johnson/Mittelstaedt: Chapter 10Document18 pagesLong-Lived Assets: Revsine/Collins/Johnson/Mittelstaedt: Chapter 10NileshAgarwalNo ratings yet

- Review Materials Financial ManagementDocument9 pagesReview Materials Financial ManagementTOBIT JEHAZIEL SILVESTRENo ratings yet

- Dwnload Full Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manual PDFDocument36 pagesDwnload Full Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manual PDFphumilorlyna100% (12)

- Chapter-02-Cash Flow SatementDocument21 pagesChapter-02-Cash Flow SatementSafeen LabibNo ratings yet

- CorpF ReviseDocument5 pagesCorpF ReviseTrang DangNo ratings yet

- Solution Manual For Interpreting and Analyzing Financial Statements 6Th Edition Schoenebeck and Holtzman 0132746247 9780132746243 Full Chapter PDFDocument36 pagesSolution Manual For Interpreting and Analyzing Financial Statements 6Th Edition Schoenebeck and Holtzman 0132746247 9780132746243 Full Chapter PDFalex.orick428100% (10)

- Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions ManualDocument36 pagesInterpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manualbobsilvaka0el100% (24)

- A Balance Sheet:: More On Financial Statements ChapterDocument25 pagesA Balance Sheet:: More On Financial Statements ChapterCNo ratings yet

- Financial Management - Exam 1Document7 pagesFinancial Management - Exam 1jozetteypilNo ratings yet

- Accounts of Joint Stock Company - Issue of Shares & Debentures, & Schedule ViDocument13 pagesAccounts of Joint Stock Company - Issue of Shares & Debentures, & Schedule VibasithrahmanNo ratings yet

- Solution Manual For Core Concepts of Accounting Raiborn 2nd EditionDocument18 pagesSolution Manual For Core Concepts of Accounting Raiborn 2nd EditionJacquelineFrancisfpgs100% (36)

- Dissolution of FirmDocument16 pagesDissolution of FirmPrathamNo ratings yet

- Addison Manufacturing Holds A Large Portfolio of Debt Securities As PDFDocument1 pageAddison Manufacturing Holds A Large Portfolio of Debt Securities As PDFHassan JanNo ratings yet

- FA1 Exercises 2022Document19 pagesFA1 Exercises 2022baothi298No ratings yet

- Ind As - 33Document13 pagesInd As - 33RaghavanNo ratings yet

- National Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPDocument10 pagesNational Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPEshetieNo ratings yet

- CFAB Accounting Chapter 11. Company Financial StatementsDocument43 pagesCFAB Accounting Chapter 11. Company Financial StatementsHuy NguyenNo ratings yet

- Accountancy 7Document65 pagesAccountancy 7Arif ShaikhNo ratings yet

- Rps Bahan Ajar 9Document62 pagesRps Bahan Ajar 9GundamSeedNo ratings yet

- Balance Sheet Vs Fund Flow StatementDocument19 pagesBalance Sheet Vs Fund Flow StatementsuasiveNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Fifteen Transactions or Events Affecting Computer Specialists Inc Are AsDocument1 pageFifteen Transactions or Events Affecting Computer Specialists Inc Are Astrilocksp SinghNo ratings yet

- The Following Is A List of Possible Transactions 1 Purchased Inventory PDFDocument2 pagesThe Following Is A List of Possible Transactions 1 Purchased Inventory PDFTaimur TechnologistNo ratings yet

- Full Download Foundations of Financial Management Canadian 9th Edition Hirt Solutions ManualDocument15 pagesFull Download Foundations of Financial Management Canadian 9th Edition Hirt Solutions Manualyoreoakling.9vtk0y100% (40)

- Lesson 7Document46 pagesLesson 7Quyen Thanh NguyenNo ratings yet

- Week 04 Risk ManagementDocument16 pagesWeek 04 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Sources of Capital: Owners' Equity: Mcgraw-Hill/IrwinDocument29 pagesSources of Capital: Owners' Equity: Mcgraw-Hill/IrwinKumarRohitNo ratings yet

- Fin 531 Exam 1Document19 pagesFin 531 Exam 1Gaurav SonkeshariyaNo ratings yet

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Using The Information in Problem 3b Complete The Requirements AssumingDocument1 pageUsing The Information in Problem 3b Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- Use The Data From Problem 6 5a and Do The QuestionDocument1 pageUse The Data From Problem 6 5a and Do The QuestionFreelance WorkerNo ratings yet

- Ubs Ag Is A Global Provider of Financial Services ToDocument1 pageUbs Ag Is A Global Provider of Financial Services ToFreelance WorkerNo ratings yet

- Using The Following Independent Situations Answer The Following Questions SituationDocument1 pageUsing The Following Independent Situations Answer The Following Questions SituationFreelance WorkerNo ratings yet

- Two Alternative Machines Are Being Considered For A Cost Reduction ProjectDocument1 pageTwo Alternative Machines Are Being Considered For A Cost Reduction ProjectFreelance WorkerNo ratings yet

- Accounting 101 - Reviewer (TEST QUIZ)Document18 pagesAccounting 101 - Reviewer (TEST QUIZ)AuroraNo ratings yet

- SBR Specimen Exam Illustrative Answers PDFDocument14 pagesSBR Specimen Exam Illustrative Answers PDFmi_owextoNo ratings yet

- PRC 5 ST ApqDocument104 pagesPRC 5 ST Apqmeki ustadNo ratings yet

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomNo ratings yet

- M1 - Risk & Return - Graded Quiz - Answer KeyDocument4 pagesM1 - Risk & Return - Graded Quiz - Answer KeykhaledNo ratings yet

- Facebook IPODocument4 pagesFacebook IPOvaibhavNo ratings yet

- WTB - Applied AuditingDocument24 pagesWTB - Applied AuditingWaye EdnilaoNo ratings yet

- Ibs Tangkak 1 31/03/22Document2 pagesIbs Tangkak 1 31/03/22NABIL HAKIMNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- BMAN21011 Exam Paper 19-20Document3 pagesBMAN21011 Exam Paper 19-20Xinwei LinNo ratings yet

- Revenue Recognition Over TimeDocument11 pagesRevenue Recognition Over TimeFAEETNo ratings yet

- Questions: Answers Answer To Q 14.1 Parts (A) and (B) Are Provided in The Excel File Titled "Q 14.1 Excel Solutions - XLS"Document1 pageQuestions: Answers Answer To Q 14.1 Parts (A) and (B) Are Provided in The Excel File Titled "Q 14.1 Excel Solutions - XLS"Nga BuiNo ratings yet

- AMAUR Export PlanDocument27 pagesAMAUR Export Planhezron ackNo ratings yet

- Islami Bank Bangladesh Limited: Annual Report 2015Document143 pagesIslami Bank Bangladesh Limited: Annual Report 2015MD. ISRAFIL PALASHNo ratings yet

- 0.2 Investment Appraisal Part 2Document28 pages0.2 Investment Appraisal Part 2সৈকত হাবীবNo ratings yet

- Format of Financial StatementsDocument11 pagesFormat of Financial StatementssarlagroverNo ratings yet

- Strategy - Derivatives and Risk Management - StulzDocument10 pagesStrategy - Derivatives and Risk Management - StulzradhicalNo ratings yet

- Synergy Webinar 6.0 Project Finance Structuring A DealDocument36 pagesSynergy Webinar 6.0 Project Finance Structuring A DealMoulik DhawanNo ratings yet

- Portfolio Management Handout 2 - QuestionsDocument6 pagesPortfolio Management Handout 2 - QuestionsPriyankaNo ratings yet

- F3 FfaDocument3 pagesF3 FfaStpmTutorialClass100% (1)

- Friendship CoDocument3 pagesFriendship CoKeahlyn BoticarioNo ratings yet

- CHAPTER 9 Ans PDFDocument3 pagesCHAPTER 9 Ans PDFKiSu KimNo ratings yet

- (Final) Financial Management Alevel Ent TwoDocument117 pages(Final) Financial Management Alevel Ent Twoojokdanniel77No ratings yet

- EFim 05 Ed 2Document18 pagesEFim 05 Ed 2Hira Masood100% (1)